Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Clearwater Paper Corp | a51443096ex99_1.htm |

| 8-K - CLEARWATER PAPER CORPORATION 8-K - Clearwater Paper Corp | a51443096.htm |

Exhibit 99.2

Clearwater Paper Corporationthird quarter 2016Supplemental Information Linda Massman President, Chief Executive Officer and DirectorJohn HertzSenior Vice President Finance and Chief Financial Officer 10/20/16

Forward-Looking Statements This presentation of supplemental information contains, in addition to historical information, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding financial models; the costs, timing and benefits associated with strategic capital investments and operational improvements; segment, corporate and consolidated outlook for Q4 2016; production; revenue; product volumes shipped; product pricing and sales mix; pulp and wood fiber costs and supply; chemical costs; operational and packaging supply costs; transportation costs; energy costs; cost and timing of major maintenance and repairs; cost of wages and benefits; selling, general, and administrative expenses; corporate expenses; estimated Q4 2016 EBITDA and adjusted EBITDA. These forward-looking statements are based on management’s current expectations, estimates, assumptions and projections that are subject to change. Our actual results of operations may differ materially from those expressed or implied by the forward-looking statements contained in this presentation. Important factors that could cause or contribute to such differences include the risks and uncertainties described from time to time in the company's public filings with the Securities and Exchange Commission, as well as the following: competitive pricing pressures for our products, including as a result of increased capacity as additional manufacturing facilities are operated by our competitors in North America and abroad;changes in the U.S. and international economies and in general economic conditions in the regions and industries in which we operate;changes in customer product preferences and competitors' product offerings;the loss of or changes in prices in regards to a significant customer;cyclical industry conditions;changes in the cost and availability of wood fiber and wood pulp;inability to successfully implement our operational efficiencies and expansion strategies;changes in transportation costs and disruptions in transportation services;customer acceptance, timing and quantity of purchases of our tissue products;changes in costs for and availability of packaging supplies, chemicals, energy and maintenance and repairs;environmental liabilities or expenditures;labor disruptions;manufacturing or operating disruptions, including IT system and IT system implementation failures, equipment malfunction and damage to our manufacturing facilities;changes in expenses and required contributions associated with our pension plans;reliance on a limited number of third-party suppliers for raw materials;inability to fund our debt obligations;restrictions on our business from debt covenants and terms; andchanges in laws, regulations or industry standards affecting our business.Forward-looking statements contained in this presentation present management’s views only as of the date of this presentation. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. 1

third Quarter financial highlights $435 million net sales, flat VS. Q2’16, $9 million gaap operating income$34 million adjusted EBitda1, at higher end of outlook of $30 to $35 millionHighest tissue shipments and net sales since sale of specialty mills in Q4’14Completed major maintenance at our Idaho paperboard facility, $18 million costReturned $52 million to shareholders year to date as part of $100 million share buyback program at average price of $46.91 per share$12 million of operating income and $13 million of adjusted ebitda1 benefit contribution from strategic capital and operational efficiency initiatives in q3’16, $39 million total operating income and $41 million total adjusted ebitda1 since q1’15 2 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure.

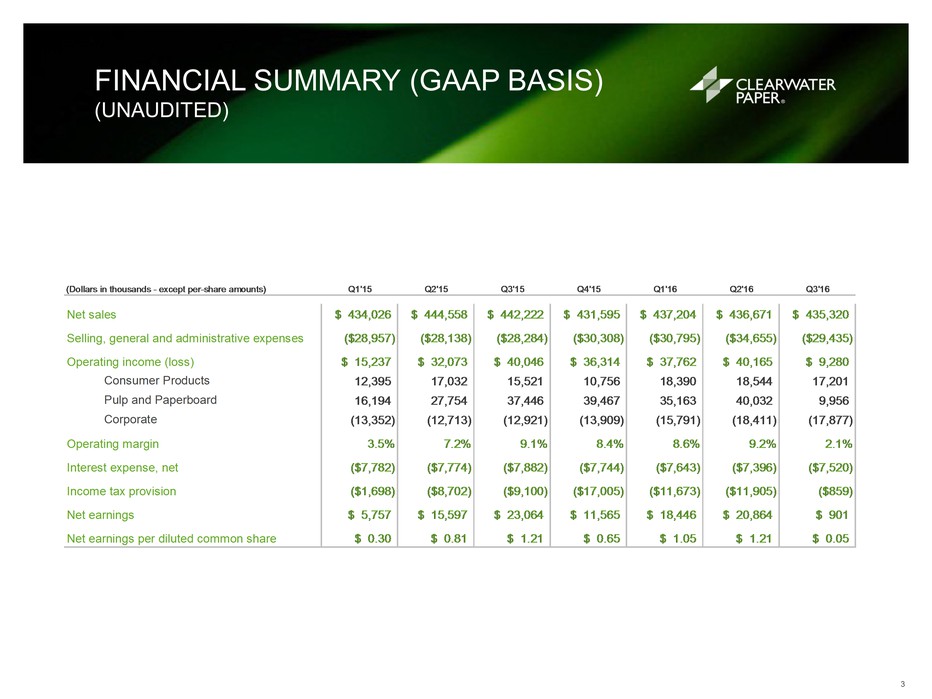

Financial Summary (GAAP basis)(Unaudited) 3

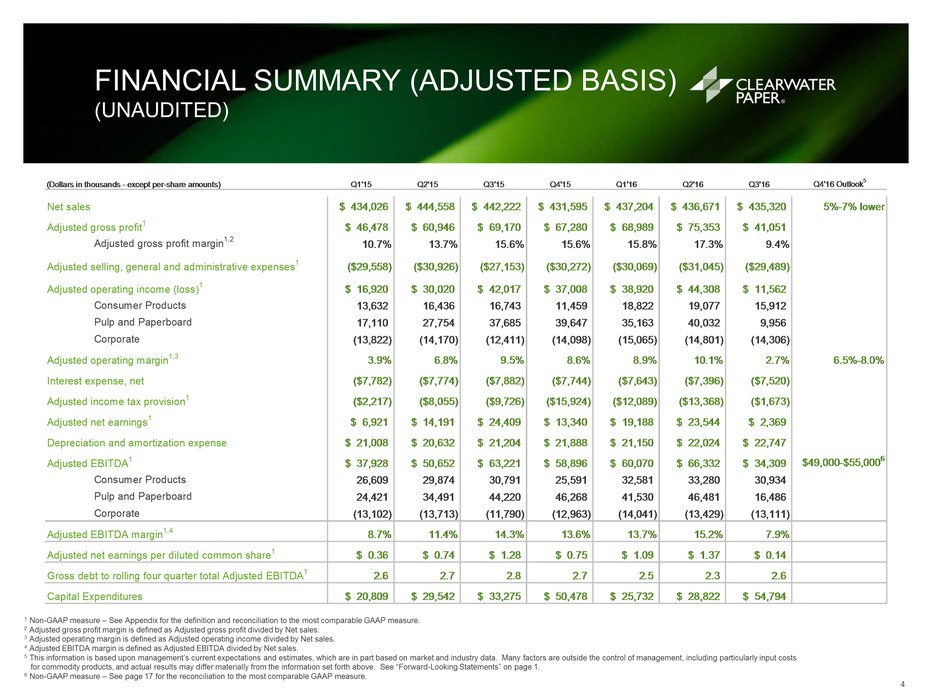

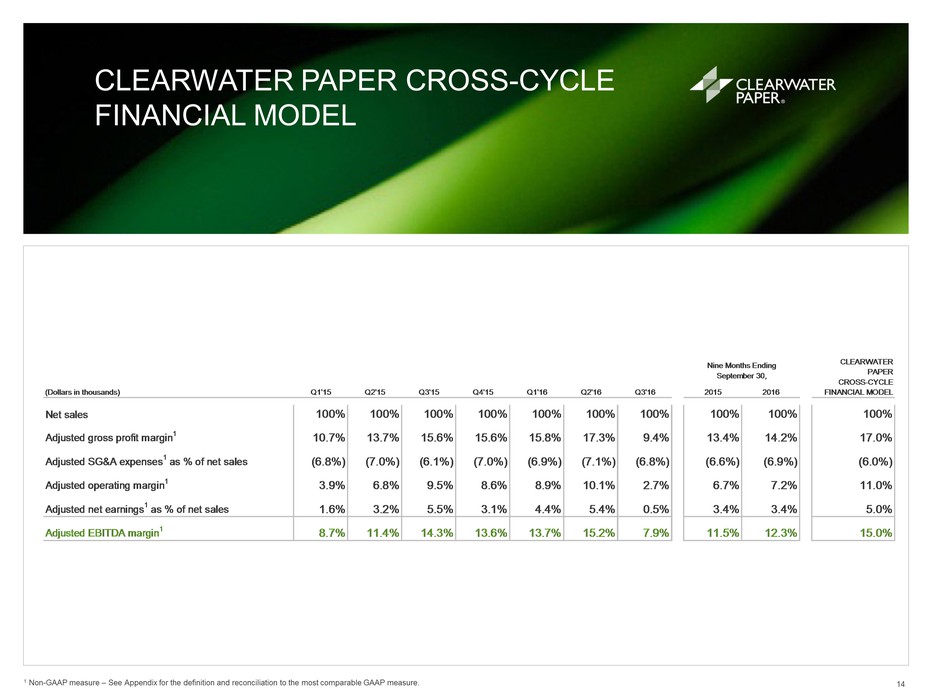

Financial Summary (adjusted basis)(Unaudited) 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure.2 Adjusted gross profit margin is defined as Adjusted gross profit divided by Net sales.3 Adjusted operating margin is defined as Adjusted operating income divided by Net sales.4 Adjusted EBITDA margin is defined as Adjusted EBITDA divided by Net sales.5 This information is based upon management’s current expectations and estimates, which are in part based on market and industry data. Many factors are outside the control of management, including particularly input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.6 Non-GAAP measure – See page 17 for the reconciliation to the most comparable GAAP measure... 4

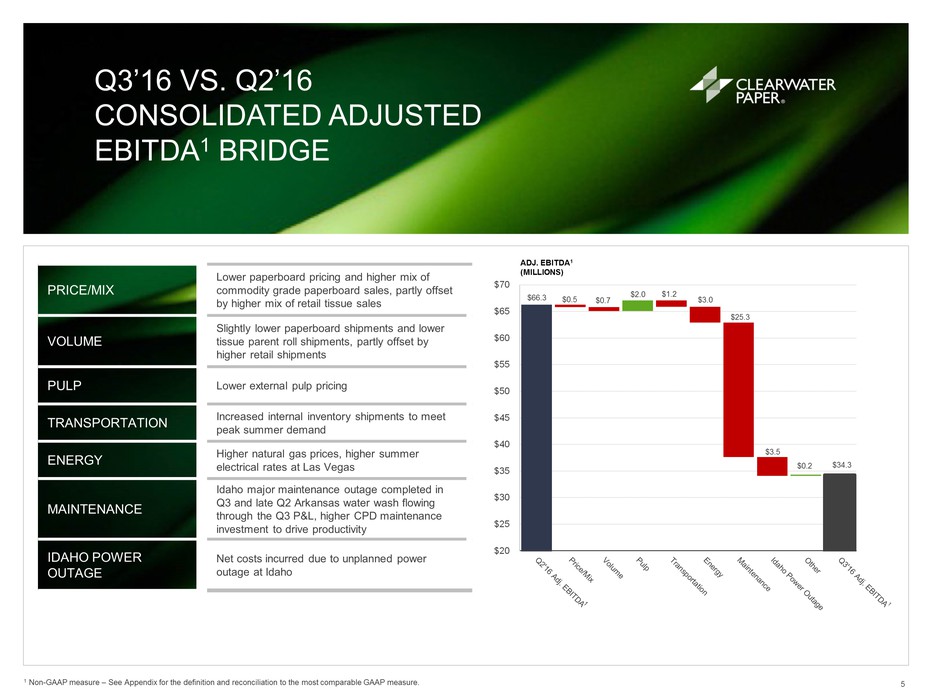

Q3’16 vs. Q2’16Consolidated Adjusted EBITDA1 Bridge 5 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure. Price/mix Lower paperboard pricing, partly offset by higher mix of retail tissue sales volume Slightly lower paperboard shipments and lower tissue parent roll shipments, partly offset by higher retail shipments Pulp Lower external pulp pricing transportation Increased internal inventory shipments to meet peak summer demand energy Higher natural gas prices, higher summer electrical rates at Las Vegas maintenance Idaho major maintenance outage completed in Q3 and late Q2 Arkansas water wash flowing through the Q3 P&L, higher CPD maintenance investment to drive productivity Idaho power outage Net costs incurred due to unplanned power outage at Idaho

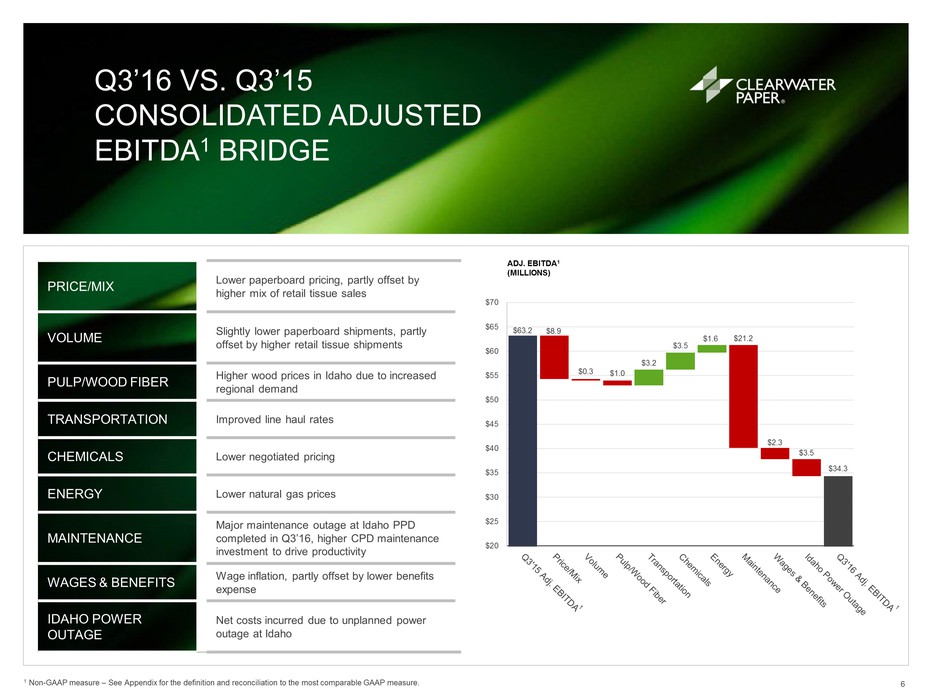

Q3’16 vs. Q3’15Consolidated Adjusted EBITDA1 Bridge 6 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure. Price/Mix Lower paperboard pricing, partly offset by higher mix of retail tissue sales Volume Slightly lower paperboard shipments, partly offset by higher retail tissue shipments Pulp/wood fiber Higher wood prices in Idaho due to increased regional demand transportation Improved line haul rates chemicals Lower negotiated pricing energy Lower natural gas prices Maintenance Major maintenance outage at Idaho PPD completed in Q3’16, higher CPD maintenance investment to drive productivity Wages & Benefits Wage inflation, partly offset by lower benefits expense Idaho power outage Net costs incurred due to unplanned power outage at Idaho

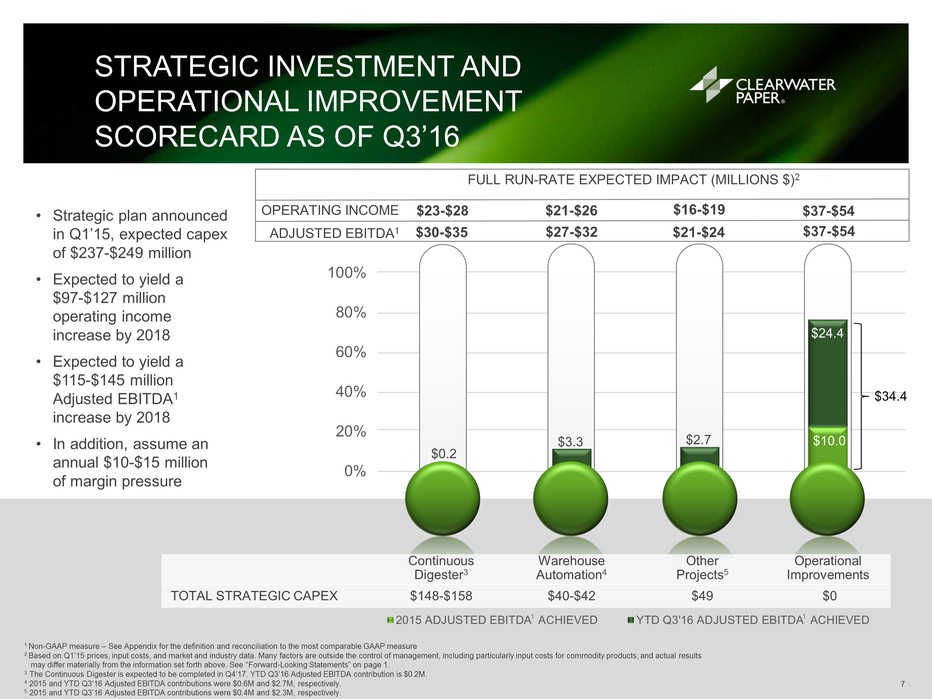

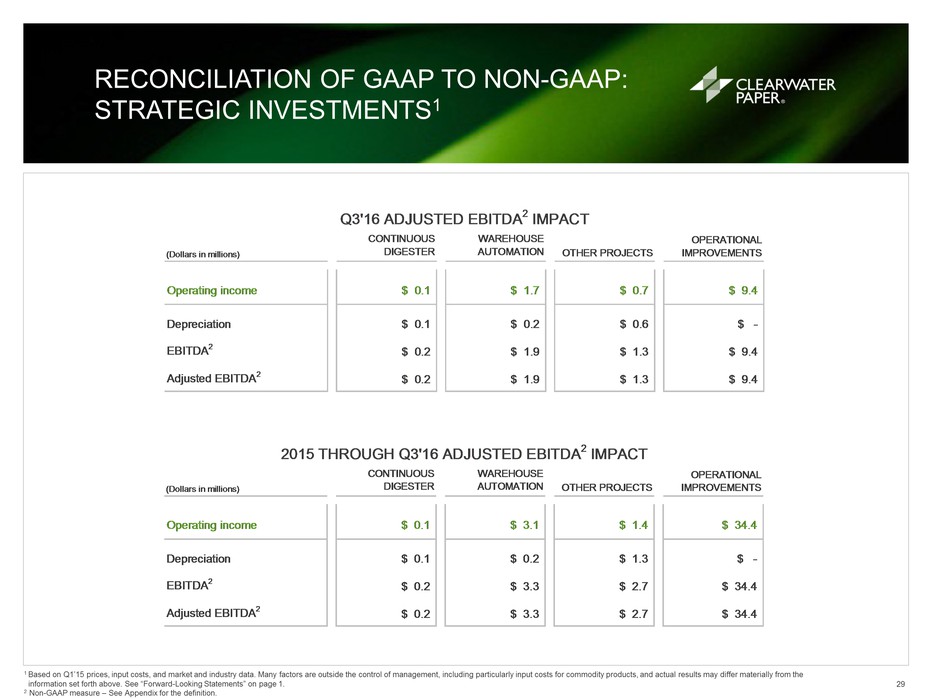

Strategic investment and operational improvement scorecard as of Q3’16 7 Strategic plan announced in Q1’15, expected capex of $237-$249 millionExpected to yield a $97-$127 million operating income increase by 2018Expected to yield a $115-$145 million Adjusted EBITDA1 increase by 2018In addition, assume an annual $10-$15 million of margin pressure Continuous Digester3 Warehouse Automation4 Other Projects5 Operational Improvements TOTAL STRATEGIC CAPEX $148-$158 $40-$42 $49 $0 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure2 Based on Q1’15 prices, input costs, and market and industry data. Many factors are outside the control of management, including particularly input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.3 The Continuous Digester is expected to be completed in Q4’17. YTD Q3’16 Adjusted EBITDA contribution is $0.2M.4 2015 and YTD Q3’16 Adjusted EBITDA contributions were $0.6M and $2.7M, respectively.5 2015 and YTD Q3’16 Adjusted EBITDA contributions were $0.4M and $2.3M, respectively.. 1 1 FULL RUN-RATE EXPECTED IMPACT (MILLIONS $)2 ADJUSTED EBITDA1 $23-$28 OPERATING INCOME $21-$26 $34.4

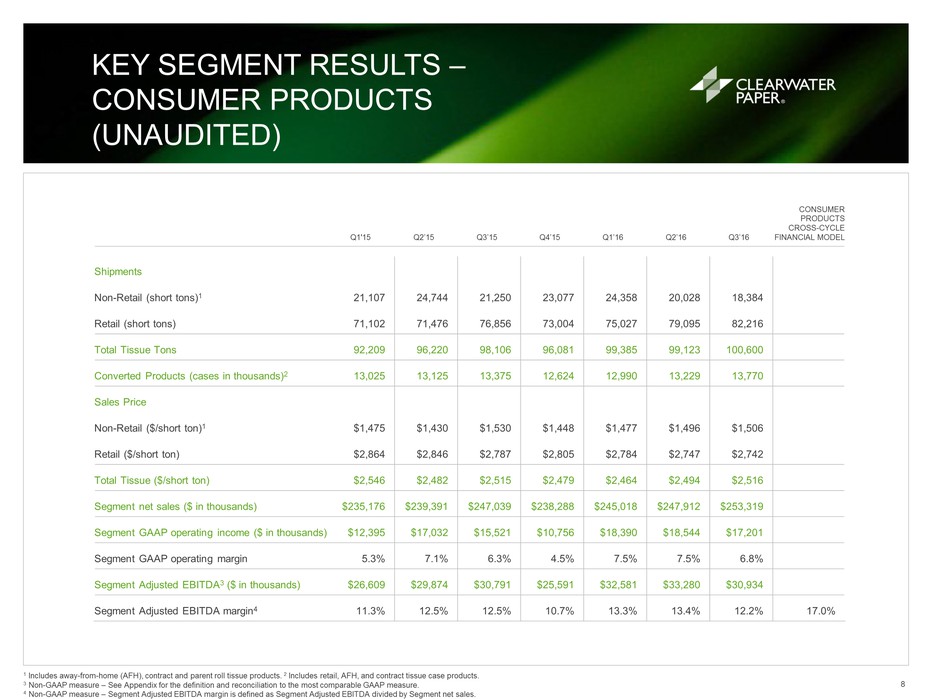

Key Segment Results – Consumer Products (Unaudited) 8 1 Includes away-from-home (AFH), contract and parent roll tissue products. 2 Includes retail, AFH, and contract tissue case products. 3 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure. 4 Non-GAAP measure – Segment Adjusted EBITDA margin is defined as Segment Adjusted EBITDA divided by Segment net sales. Q1'15 Q2’15 Q3’15 Q4’15 Q1’16 Q2’16 Q3’16 Consumer Products Cross-Cycle Financial Model Shipments Non-Retail (short tons)1 21,107 24,744 21,250 23,077 24,358 20,028 18,384 Retail (short tons) 71,102 71,476 76,856 73,004 75,027 79,095 82,216 Total Tissue Tons 92,209 96,220 98,106 96,081 99,385 99,123 100,600 Converted Products (cases in thousands)2 13,025 13,125 13,375 12,624 12,990 13,229 13,770 Sales Price Non-Retail ($/short ton)1 $1,475 $1,430 $1,530 $1,448 $1,477 $1,496 $1,506 Retail ($/short ton) $2,864 $2,846 $2,787 $2,805 $2,784 $2,747 $2,742 Total Tissue ($/short ton) $2,546 $2,482 $2,515 $2,479 $2,464 $2,494 $2,516 Segment net sales ($ in thousands) $235,176 $239,391 $247,039 $238,288 $245,018 $247,912 $253,319 Segment GAAP operating income ($ in thousands) $12,395 $17,032 $15,521 $10,756 $18,390 $18,544 $17,201 Segment GAAP operating margin 5.3% 7.1% 6.3% 4.5% 7.5% 7.5% 6.8% Segment Adjusted EBITDA3 ($ in thousands) $26,609 $29,874 $30,791 $25,591 $32,581 $33,280 $30,934 Segment Adjusted EBITDA margin4 11.3% 12.5% 12.5% 10.7% 13.3% 13.4% 12.2% 17.0%

Clearwater Paper Tissue Shipmentsand U.S. Retail Tissue Market 9 U.S. Retail Tissue Market ($) (MultiOutlet)1 Category Private Label BRANDS Total Total RetailTissue Share ($) 25% 75% 100% % ChangeQ3’16 vs. Q2’16 0.1% (0.1)% -% 1 Data Source: IRI Worldwide data through September 11, 2016.

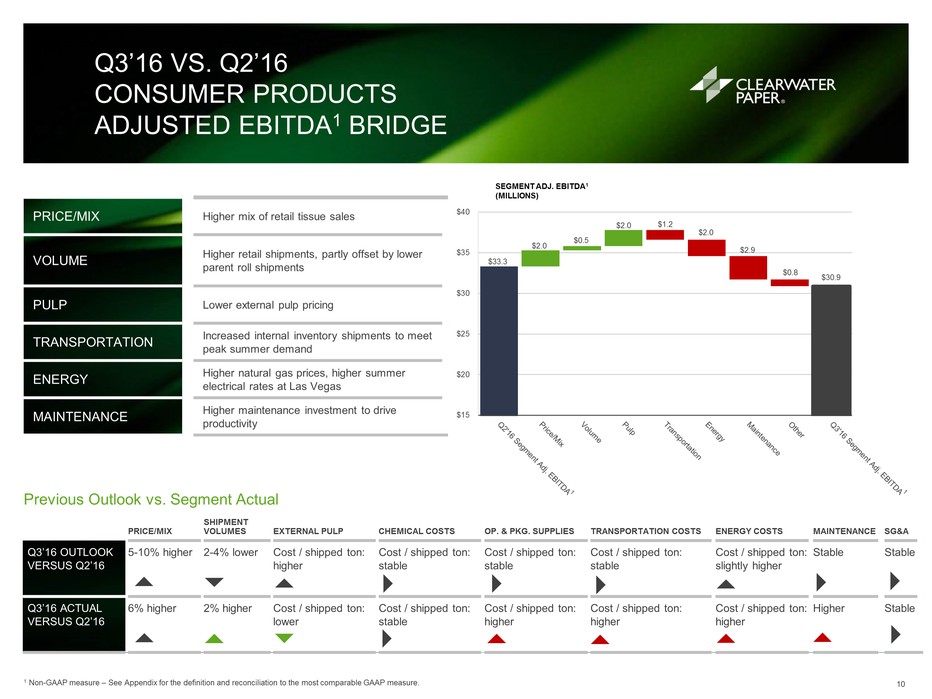

Price/Mix Shipment volumes External Pulp Chemical costs Op. & Pkg. Supplies Transportation costs Energy costs Maintenance SG&A Q3’16 OutlookVersus Q2’16 5-10% higher 2-4% lower Cost / shipped ton: higher Cost / shipped ton: stable Cost / shipped ton: stable Cost / shipped ton: stable Cost / shipped ton: slightly higher Stable Stable Q3’16 ActualVersus Q2’16 6% higher 2% higher Cost / shipped ton: lower Cost / shipped ton: stable Cost / shipped ton: higher Cost / shipped ton: higher Cost / shipped ton: higher Higher Stable Price/mix Higher mix of retail tissue sales volume Higher retail shipments, partly offset by lower parent roll shipments Pulp Lower external pulp pricing Transportation Increased internal inventory shipments to meet peak summer demand Energy Higher natural gas prices, higher summer electrical rates at Las Vegas maintenance Higher maintenance investment to drive productivity Q3’16 vs. Q2’16Consumer Products Adjusted EBITDA1 Bridge 10 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure. Previous Outlook vs. Segment Actual 1

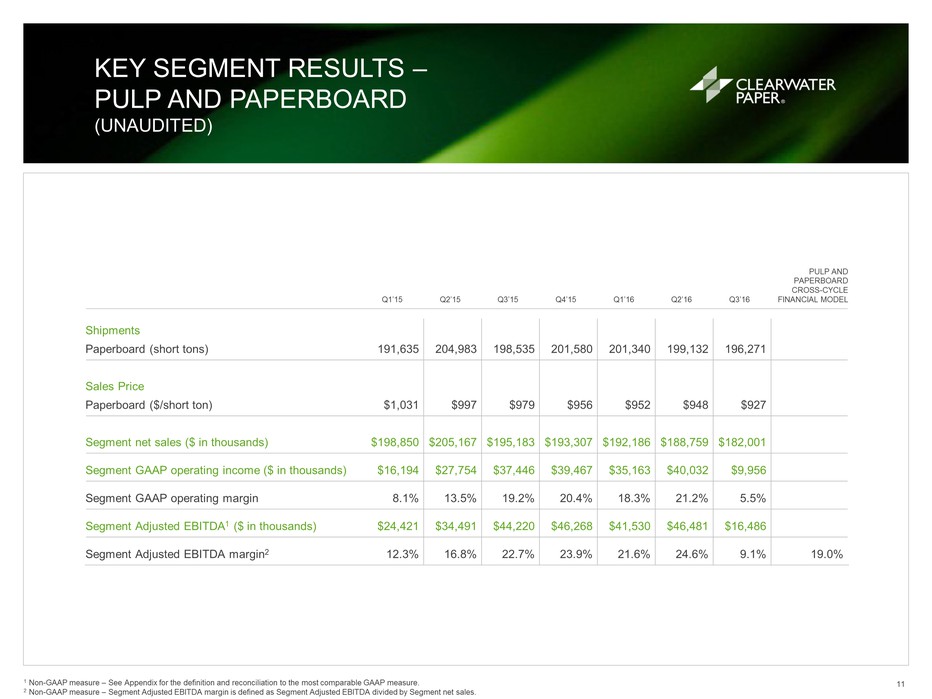

Key Segment Results – Pulp and Paperboard(Unaudited) 11 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure.2 Non-GAAP measure – Segment Adjusted EBITDA margin is defined as Segment Adjusted EBITDA divided by Segment net sales. Pulp and PaperboardCross-Cycle Financial Model Q1’15 Q2’15 Q3’15 Q4’15 Q1’16 Q2’16 Q3’16 Shipments Paperboard (short tons) 191,635 204,983 198,535 201,580 201,340 199,132 196,271 Sales Price Paperboard ($/short ton) $1,031 $997 $979 $956 $952 $948 $927 Segment net sales ($ in thousands) $198,850 $205,167 $195,183 $193,307 $192,186 $188,759 $182,001 Segment GAAP operating income ($ in thousands) $16,194 $27,754 $37,446 $39,467 $35,163 $40,032 $9,956 Segment GAAP operating margin 8.1% 13.5% 19.2% 20.4% 18.3% 21.2% 5.5% Segment Adjusted EBITDA1 ($ in thousands) $24,421 $34,491 $44,220 $46,268 $41,530 $46,481 $16,486 Segment Adjusted EBITDA margin2 12.3% 16.8% 22.7% 23.9% 21.6% 24.6% 9.1% 19.0%

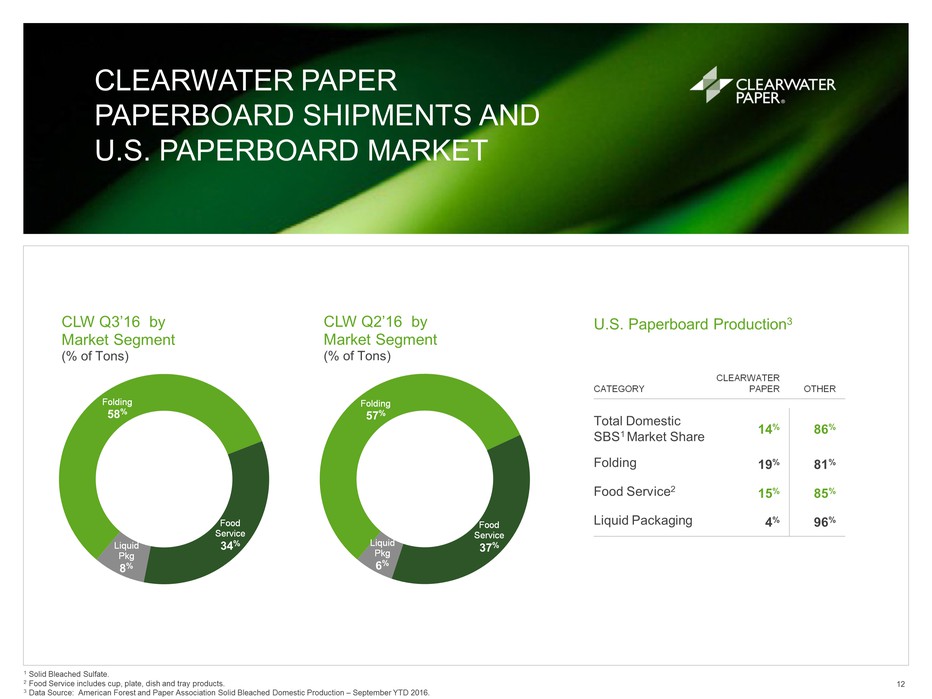

Clearwater Paper Paperboard Shipments and U.S. Paperboard Market 12 U.S. Paperboard Production3 Category Clearwater Paper Other Total Domestic SBS1 Market Share 14% 86% Folding 19% 81% Food Service2 15% 85% Liquid Packaging 4% 96% 1 Solid Bleached Sulfate.2 Food Service includes cup, plate, dish and tray products.3 Data Source: American Forest and Paper Association Solid Bleached Domestic Production – September YTD 2016.

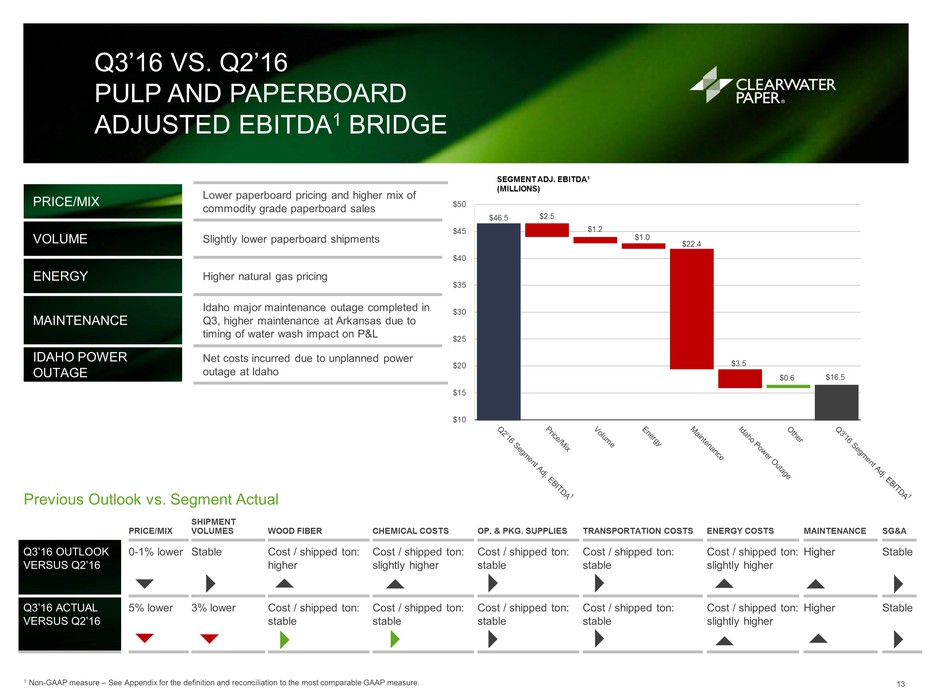

Price/Mix Shipment volumes Wood Fiber Chemical costs Op. & Pkg. Supplies Transportation costs Energy costs Maintenance SG&A Q3’16 OutlookVersus Q2’16 0-1% lower Stable Cost / shipped ton: higher Cost / shipped ton: slightly higher Cost / shipped ton: stable Cost / shipped ton: stable Cost / shipped ton: slightly higher Higher Stable Q3’16 ActualVersus Q2’16 5% lower 3% lower Cost / shipped ton: stable Cost / shipped ton: stable Cost / shipped ton: stable Cost / shipped ton: stable Cost / shipped ton: slightly higher Higher Stable Price/mix Lower paperboard pricing volume Slightly lower paperboard shipments Energy Higher natural gas pricing Maintenance Idaho major maintenance outage completed in Q3, higher maintenance at Arkansas due to timing of water wash impact on P&L Idaho power outage Net costs incurred due to unplanned power outage at Idaho Q3’16 vs. Q2’16 Pulp and Paperboard Adjusted EBITDA1 Bridge 13 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure. Previous Outlook vs. Segment Actual 1 1

Clearwater Paper Cross-Cycle Financial Model 14 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure.

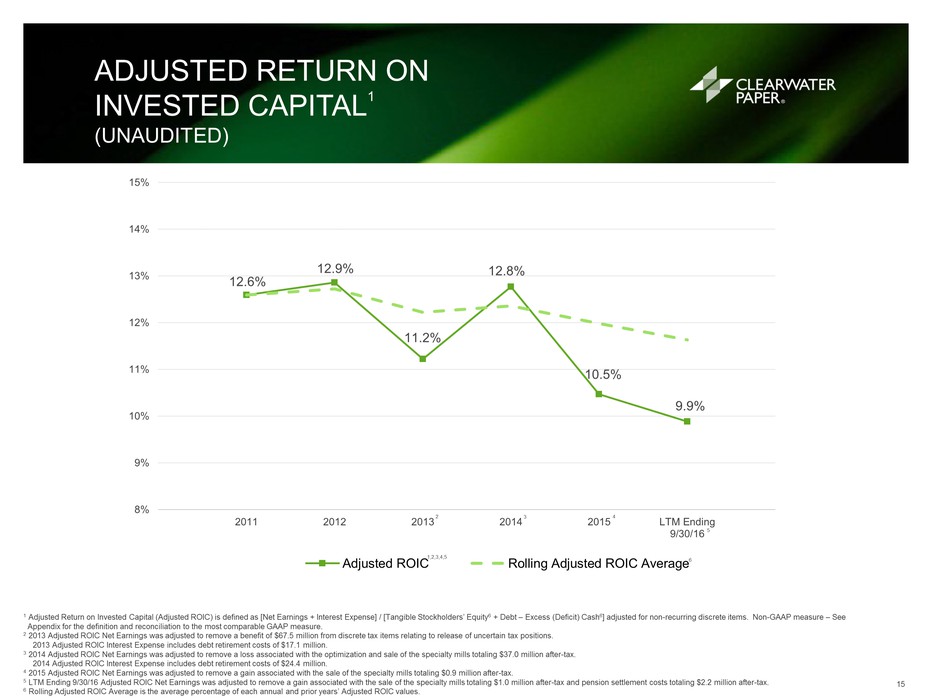

Adjusted Return on Invested Capital1(Unaudited) 15 1 Adjusted Return on Invested Capital (Adjusted ROIC) is defined as [Net Earnings + Interest Expense] / [Tangible Stockholders’ Equity6 + Debt – Excess (Deficit) Cash6] adjusted for non-recurring discrete items. Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure.2 2013 Adjusted ROIC Net Earnings was adjusted to remove a benefit of $67.5 million from discrete tax items relating to release of uncertain tax positions.2013 Adjusted ROIC Interest Expense includes debt retirement costs of $17.1 million.3 2014 Adjusted ROIC Net Earnings was adjusted to remove a loss associated with the optimization and sale of the specialty mills totaling $37.0 million after-tax.2014 Adjusted ROIC Interest Expense includes debt retirement costs of $24.4 million. 4 2015 Adjusted ROIC Net Earnings was adjusted to remove a gain associated with the sale of the specialty mills totaling $0.9 million after-tax.5 LTM Ending 9/30/16 Adjusted ROIC Net Earnings was adjusted to remove a gain associated with the sale of the specialty mills totaling $1.0 million after-tax and pension settlement costs totaling $2.2 million after-tax.6 Rolling Adjusted ROIC Average is the average percentage of each annual and prior years’ Adjusted ROIC values.

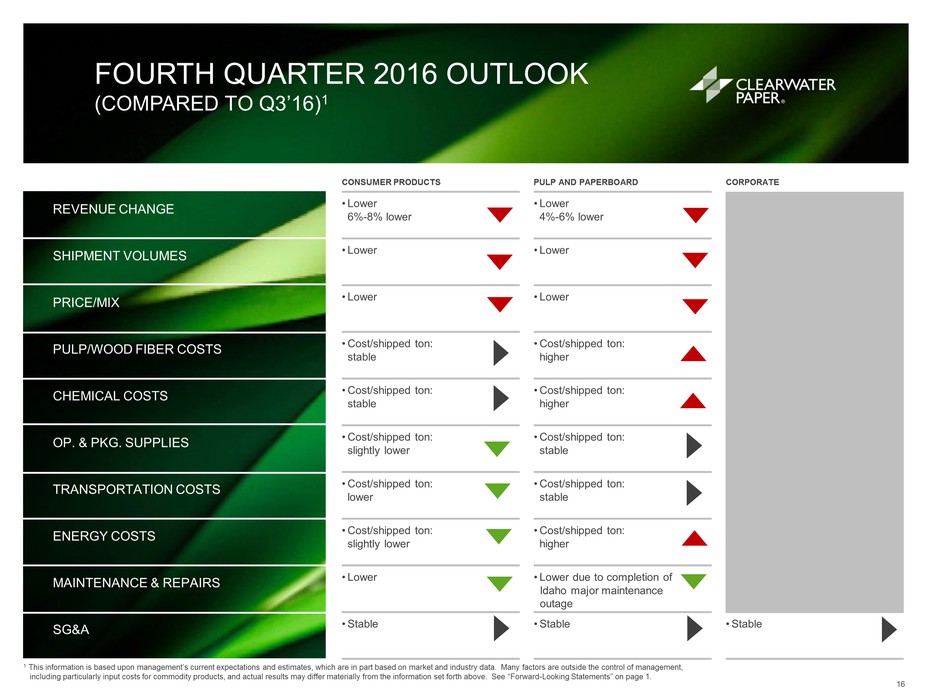

fourth quarter 2016 Outlook(Compared to Q3’16)1 16 Consumer products Pulp and Paperboard Corporate Revenue change Lower6%-8% lower Lower4%-6% lower Shipment volumes Lower Lower Price/mix Lower Lower Pulp/Wood Fiber Costs Cost/shipped ton:stable Cost/shipped ton:higher Chemical Costs Cost/shipped ton:stable Cost/shipped ton:higher Op. & Pkg. Supplies Cost/shipped ton:slightly lower Cost/shipped ton:stable Transportation Costs Cost/shipped ton:lower Cost/shipped ton:stable Energy Costs Cost/shipped ton:slightly lower Cost/shipped ton:higher Maintenance & Repairs Lower Lower due to completion of Idaho major maintenance outage SG&A Stable Stable Stable 1 This information is based upon management’s current expectations and estimates, which are in part based on market and industry data. Many factors are outside the control of management, including particularly input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.

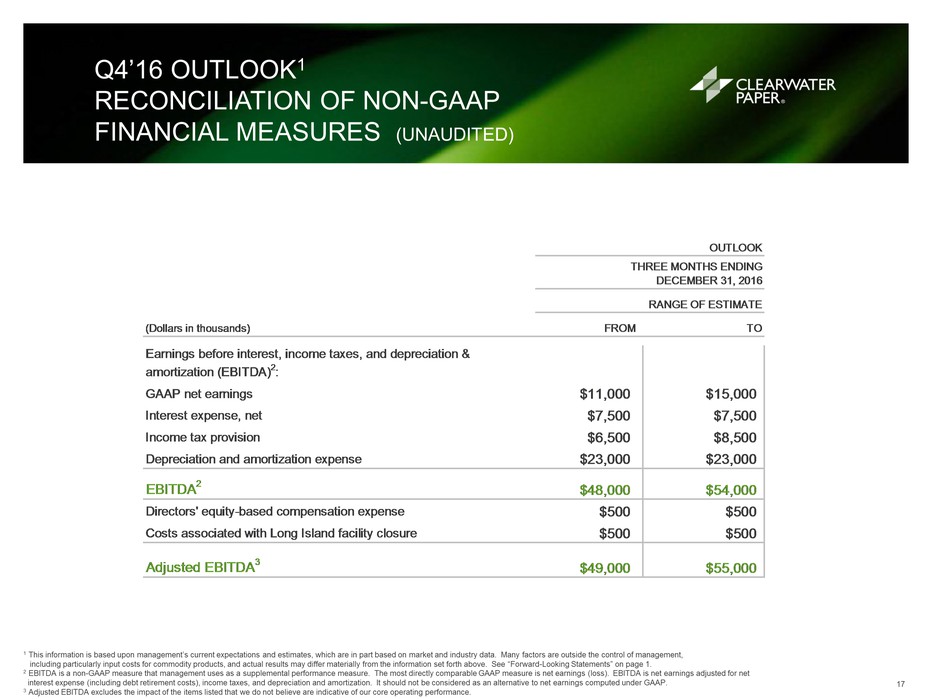

Q4’16 Outlook1Reconciliation of Non-GAAP Financial Measures (Unaudited) 17 1 This information is based upon management’s current expectations and estimates, which are in part based on market and industry data. Many factors are outside the control of management, including particularly input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.2 EBITDA is a non-GAAP measure that management uses as a supplemental performance measure. The most directly comparable GAAP measure is net earnings (loss). EBITDA is net earnings adjusted for net interest expense (including debt retirement costs), income taxes, and depreciation and amortization. It should not be considered as an alternative to net earnings computed under GAAP.3 Adjusted EBITDA excludes the impact of the items listed that we do not believe are indicative of our core operating performance.

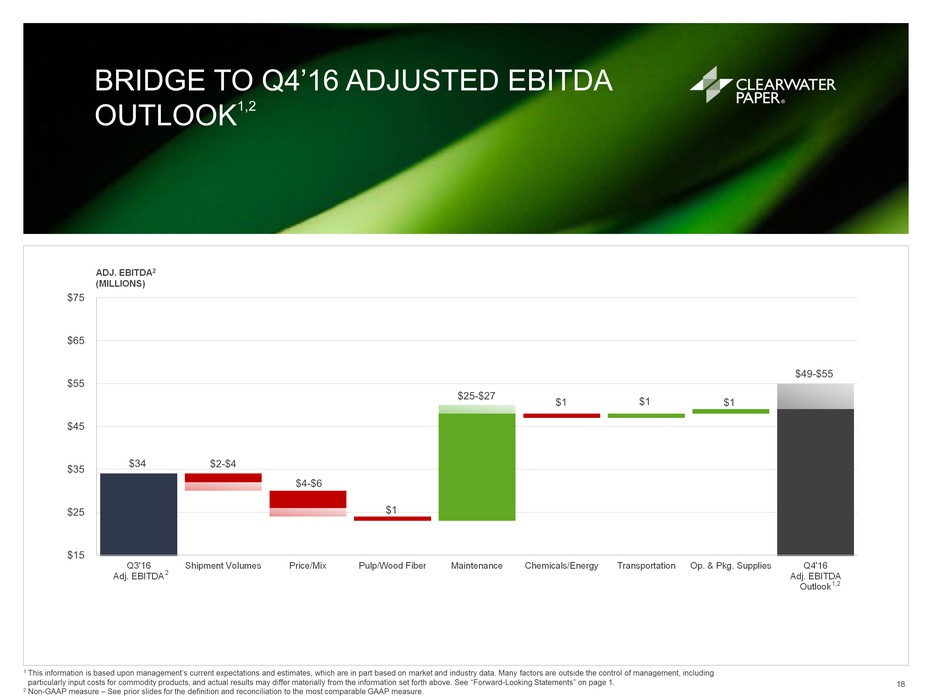

BRIDGE TO Q4’16 ADJUSTED EBITDA OUTLOOK1,2 18 1 This information is based upon management’s current expectations and estimates, which are in part based on market and industry data. Many factors are outside the control of management, including particularly input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.2 Non-GAAP measure – See prior slides for the definition and reconciliation to the most comparable GAAP measure.

Appendix 19

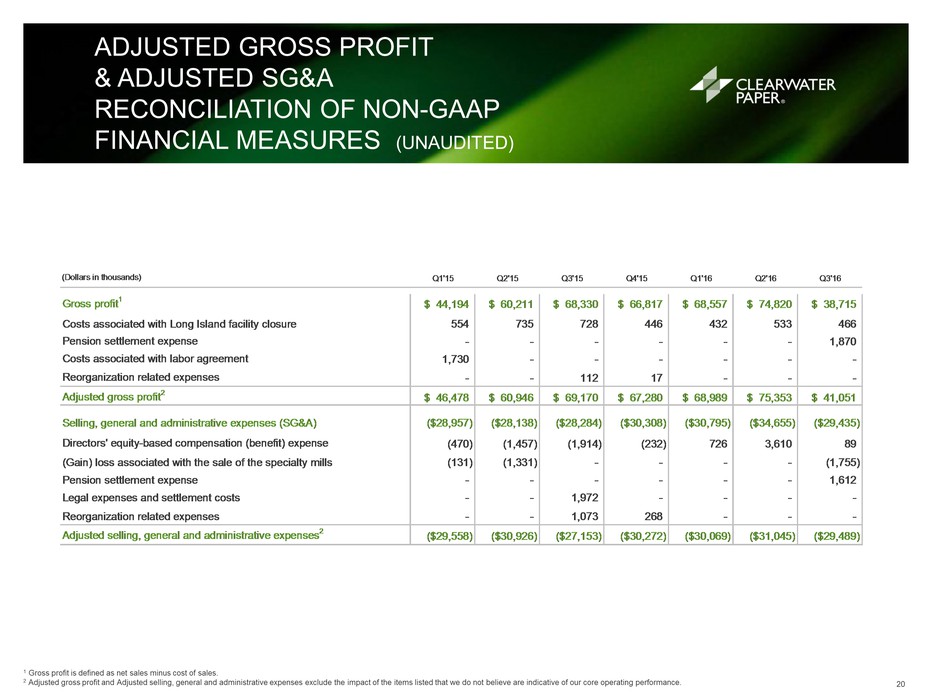

Adjusted Gross Profit& Adjusted SG&AReconciliation of Non-GAAP Financial Measures (Unaudited) 20 1 Gross profit is defined as net sales minus cost of sales.2 Adjusted gross profit and Adjusted selling, general and administrative expenses exclude the impact of the items listed that we do not believe are indicative of our core operating performance.

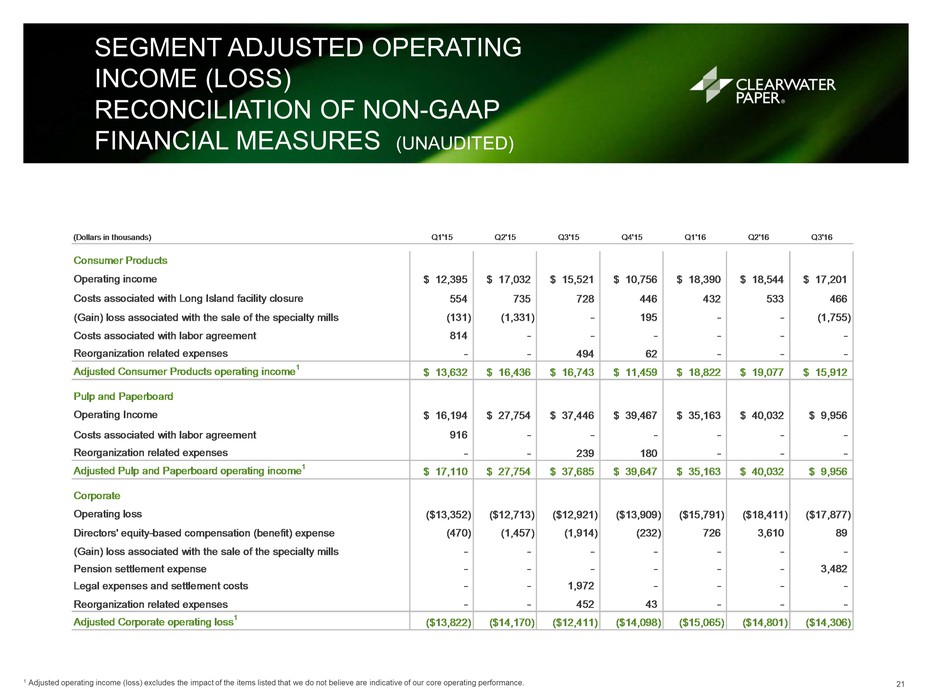

Segment Adjusted Operating Income (Loss)Reconciliation of Non-GAAP Financial Measures (Unaudited) 21 1 Adjusted operating income (loss) excludes the impact of the items listed that we do not believe are indicative of our core operating performance.

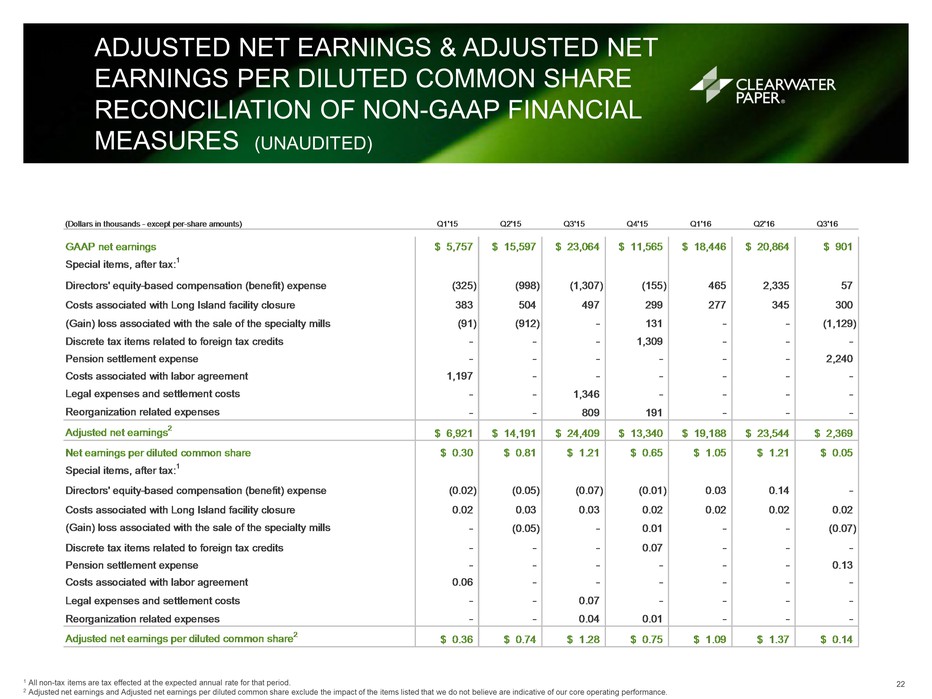

Adjusted Net Earnings & Adjusted Net Earnings per Diluted common shareReconciliation of Non-GAAP Financial Measures (Unaudited) 22 1 All non-tax items are tax effected at the expected annual rate for that period.2 Adjusted net earnings and Adjusted net earnings per diluted common share exclude the impact of the items listed that we do not believe are indicative of our core operating performance.

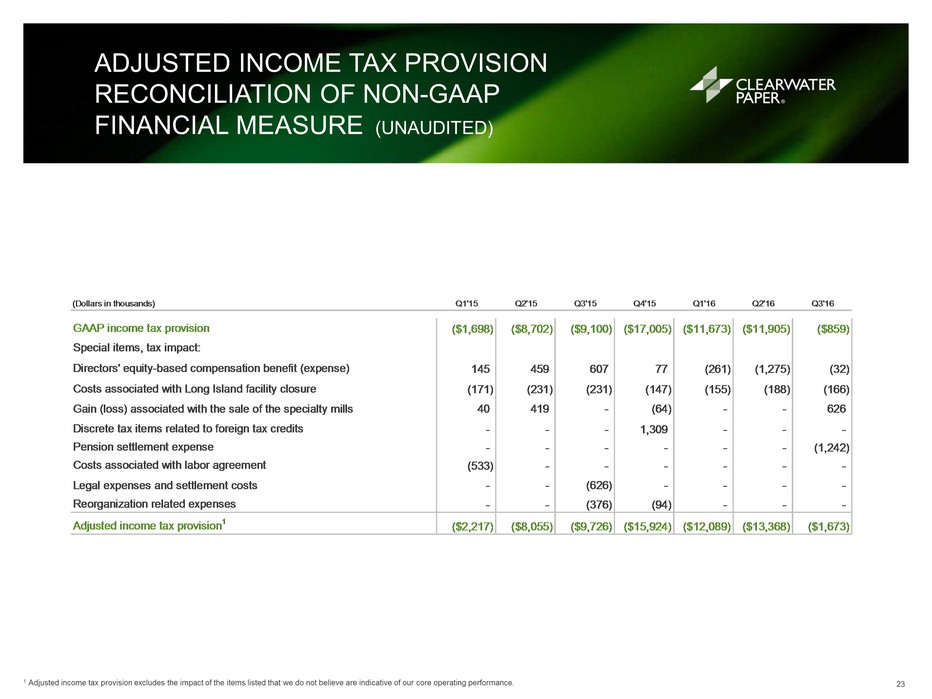

Adjusted Income Tax ProvisionReconciliation of Non-GAAP Financial Measure (Unaudited) 23 1 Adjusted income tax provision excludes the impact of the items listed that we do not believe are indicative of our core operating performance.

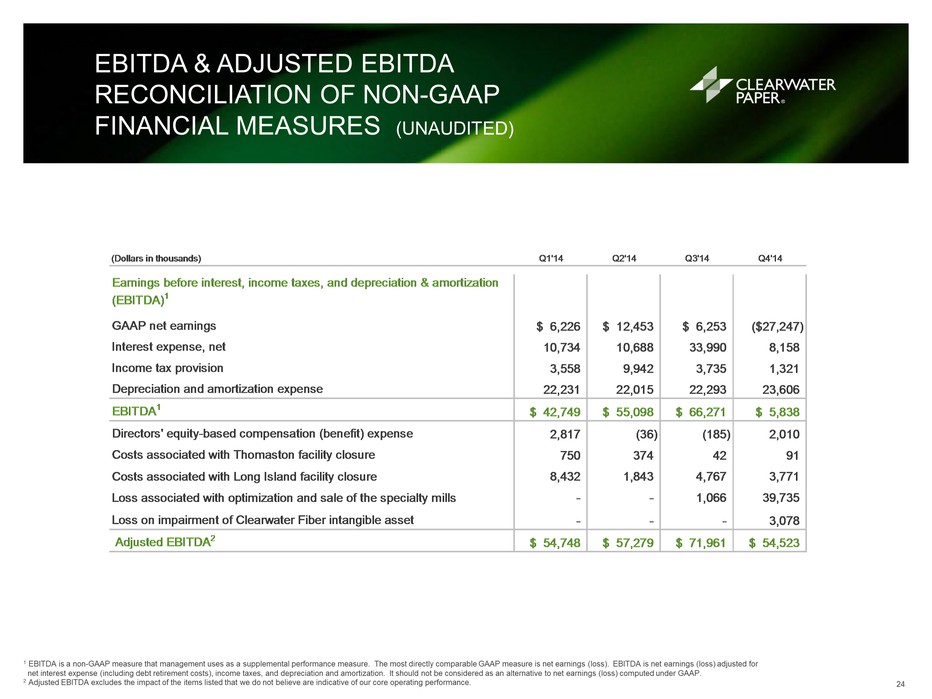

EBITDA & Adjusted EBITDA Reconciliation of Non-GAAP Financial Measures (Unaudited) 24 1 EBITDA is a non-GAAP measure that management uses as a supplemental performance measure. The most directly comparable GAAP measure is net earnings (loss). EBITDA is net earnings (loss) adjusted for net interest expense (including debt retirement costs), income taxes, and depreciation and amortization. It should not be considered as an alternative to net earnings (loss) computed under GAAP.2 Adjusted EBITDA excludes the impact of the items listed that we do not believe are indicative of our core operating performance.

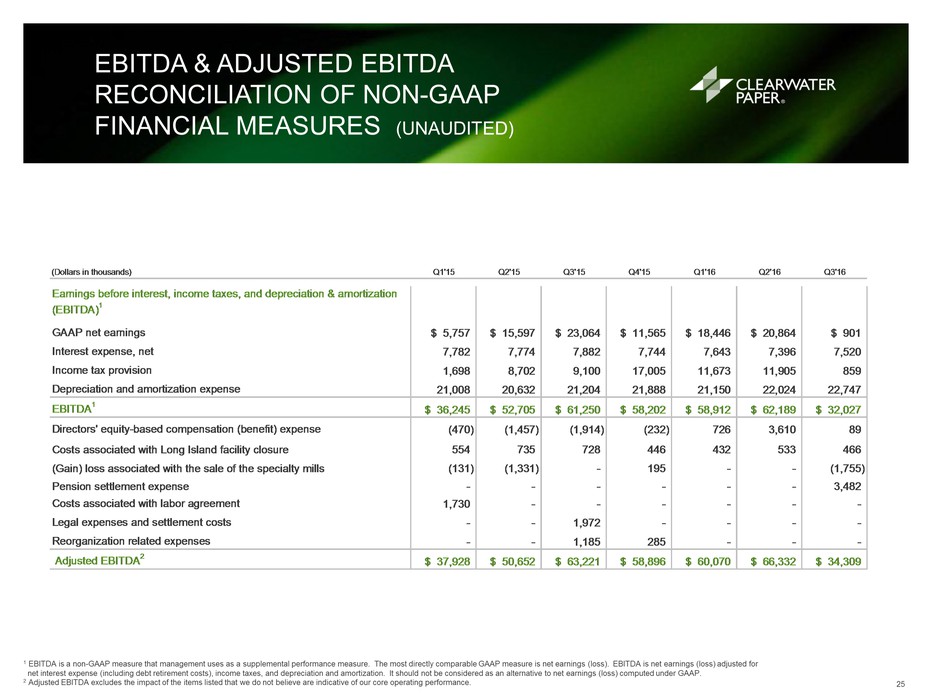

EBITDA & Adjusted EBITDA Reconciliation of Non-GAAP Financial Measures (Unaudited) 25 1 EBITDA is a non-GAAP measure that management uses as a supplemental performance measure. The most directly comparable GAAP measure is net earnings (loss). EBITDA is net earnings (loss) adjusted for net interest expense (including debt retirement costs), income taxes, and depreciation and amortization. It should not be considered as an alternative to net earnings (loss) computed under GAAP.2 Adjusted EBITDA excludes the impact of the items listed that we do not believe are indicative of our core operating performance.

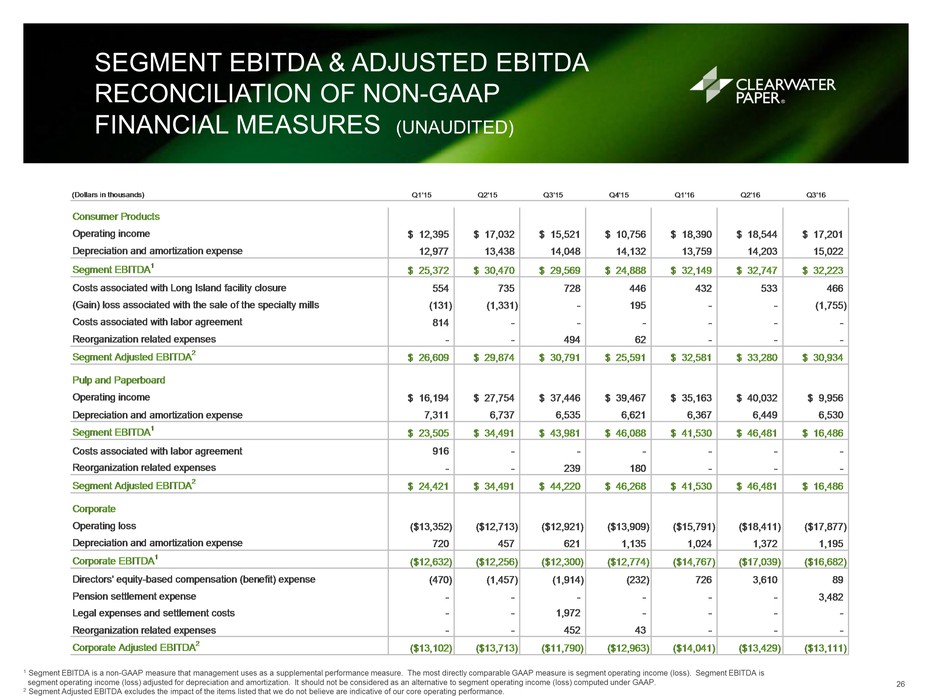

Segment EBITDA & Adjusted EBITDA Reconciliation of Non-GAAPFinancial Measures (Unaudited) 26 1 Segment EBITDA is a non-GAAP measure that management uses as a supplemental performance measure. The most directly comparable GAAP measure is segment operating income (loss). Segment EBITDA is segment operating income (loss) adjusted for depreciation and amortization. It should not be considered as an alternative to segment operating income (loss) computed under GAAP. 2 Segment Adjusted EBITDA excludes the impact of the items listed that we do not believe are indicative of our core operating performance.

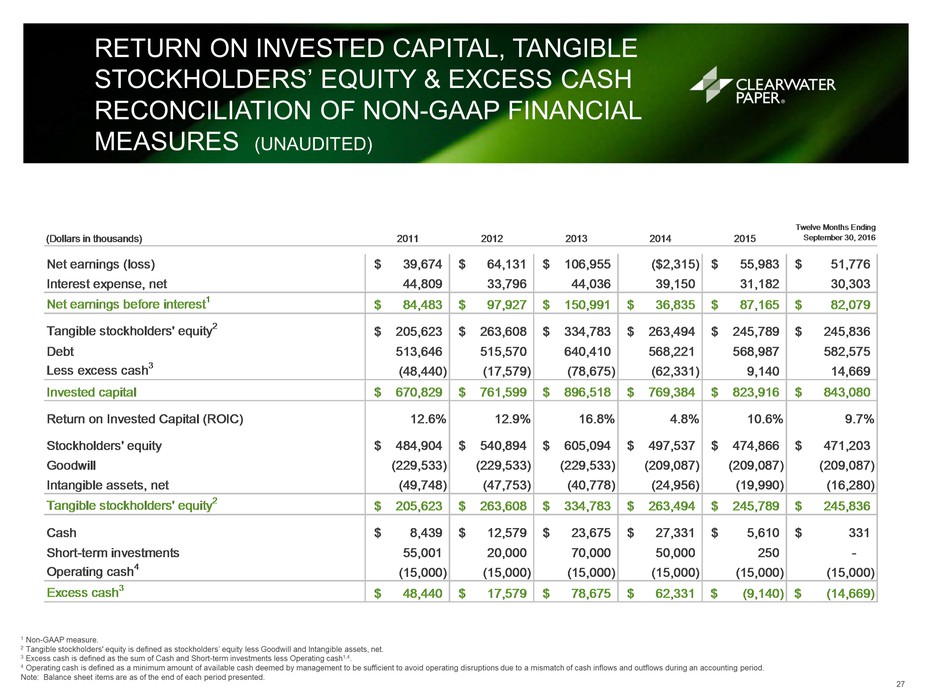

Return on Invested Capital, Tangible Stockholders’ Equity & Excess Cash Reconciliation of Non-GAAP Financial Measures (Unaudited) 27 1 Non-GAAP measure.2 Tangible stockholders' equity is defined as stockholders’ equity less Goodwill and Intangible assets, net.3 Excess cash is defined as the sum of Cash and Short-term investments less Operating cash1,4.4 Operating cash is defined as a minimum amount of available cash deemed by management to be sufficient to avoid operating disruptions due to a mismatch of cash inflows and outflows during an accounting period.Note: Balance sheet items are as of the end of each period presented.

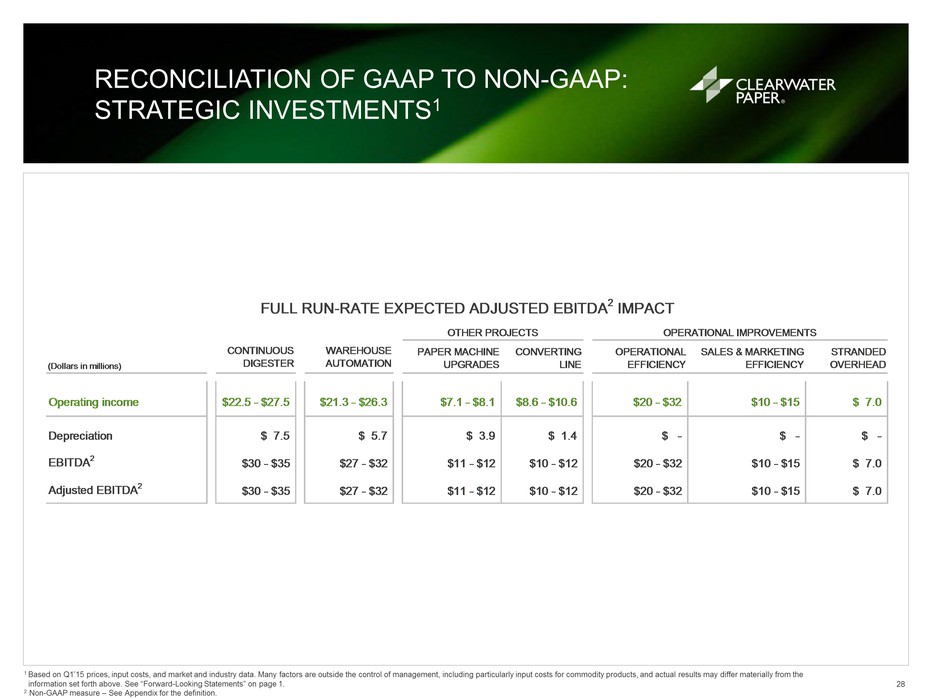

Reconciliation of GAAP to Non-GAAP: Strategic investments1 28 1 Based on Q1’15 prices, input costs, and market and industry data. Many factors are outside the control of management, including particularly input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.2 Non-GAAP measure – See Appendix for the definition.

Reconciliation of GAAP to Non-GAAP: Strategic investments1 29 1 Based on Q1’15 prices, input costs, and market and industry data. Many factors are outside the control of management, including particularly input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.2 Non-GAAP measure – See Appendix for the definition.

For more information:www.clearwaterpaper.com 30