Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTERPOINT ENERGY INC | d449186d8k.htm |

CenterPoint Energy September 28, 2016 Wolfe Research Power and Gas Leaders Conference Exhibit 99.1

Cautionary Statement This presentation and the oral statements made in connection herewith contain statements concerning our expectations, beliefs, plans, objectives, goals, strategies, future operations, events, financial position, earnings, growth, costs, prospects capital investments or performance or underlying assumptions (including future regulatory filings and recovery, liquidity, capital resources, balance sheet, cash flow, capital investments and management, financing costs, and rate base or customer growth) and other statements that are not historical facts. These statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” ”target,” “will,” or other similar words. The absence of these words, however, does not mean that the statements are not forward-looking. Examples of forward-looking statements in this presentation (including, but not limited to, the information presented on slide 7) include statements about our Continuum acquisition, including statements about future financial performance, margin and operating income and growth, guidance, including earnings and dividend growth, future financing plans and expectation for liquidity and capital resources, tax rates and interest rates and expense, among other statements. We have based our forward-looking statements on our management's beliefs and assumptions based on information currently available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Some of the factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include but are not limited to the timing and impact of future regulatory, legislative and IRS decisions, financial market conditions, future market conditions, economic and employment conditions, customer growth, Enable Midstream’s performance and ability to pay distributions, and other factors described in CenterPoint Energy, Inc.’s Form 10-K for the period ended December 31, 2015 and Form 10-Q for the period ended June 30, 2016 under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Certain Factors Affecting Future Earnings” and in other filings with the SEC by CenterPoint Energy, which can be found at www.centerpointenergy.com on the Investor Relations page or on the SEC’s website at www.sec.gov. This presentation contains time sensitive information that is accurate as of the date hereof. Some of the information in this presentation is unaudited and may be subject to change. We undertake no obligation to update the information presented herein except as required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investor Relations page of our website. In the future, we will continue to use these channels to distribute material information about the Company and to communicate important information about the Company, key personnel, corporate initiatives, regulatory updates and other matters. Information that we post on our website could be deemed material; therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to review the information we post on our website. Use of Non-GAAP Financial Measures In addition to presenting its financial results in accordance with generally accepted accounting principles (GAAP), including presentation of net income and diluted earnings per share, CenterPoint Energy also provides guidance based on adjusted net income and adjusted diluted earnings per share, which are non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance that excludes or includes amounts that are not normally excluded or included in the most directly comparable GAAP financial measure. CenterPoint Energy’s adjusted net income and adjusted diluted earnings per share calculation excludes from net income and diluted earnings per share, respectively, the impact of ZENS and related securities and mark-to-market gains or losses resulting from the company’s Energy Services business. CenterPoint Energy is unable to present a quantitative reconciliation of forward-looking adjusted net income and adjusted diluted earnings per share because changes in the value of ZENS and related securities and mark-to-market gains or losses resulting from the company’s Energy Services business are not estimable. Management evaluates the company’s financial performance in part based on adjusted net income and adjusted diluted earnings per share. We believe that presenting these non-GAAP financial measures enhances an investor’s understanding of CenterPoint Energy’s overall financial performance by providing them with an additional meaningful and relevant comparison of current and anticipated future results across periods. The adjustments made in these non-GAAP financial measures exclude items that Management believes do not most accurately reflect the company’s fundamental business performance. CenterPoint Energy’s adjusted net income and adjusted diluted earnings per share non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, net income and diluted earnings per share, which respectively are the most directly comparable GAAP financial measures. These non-GAAP financial measures also may be different than non-GAAP financial measures used by other companies.

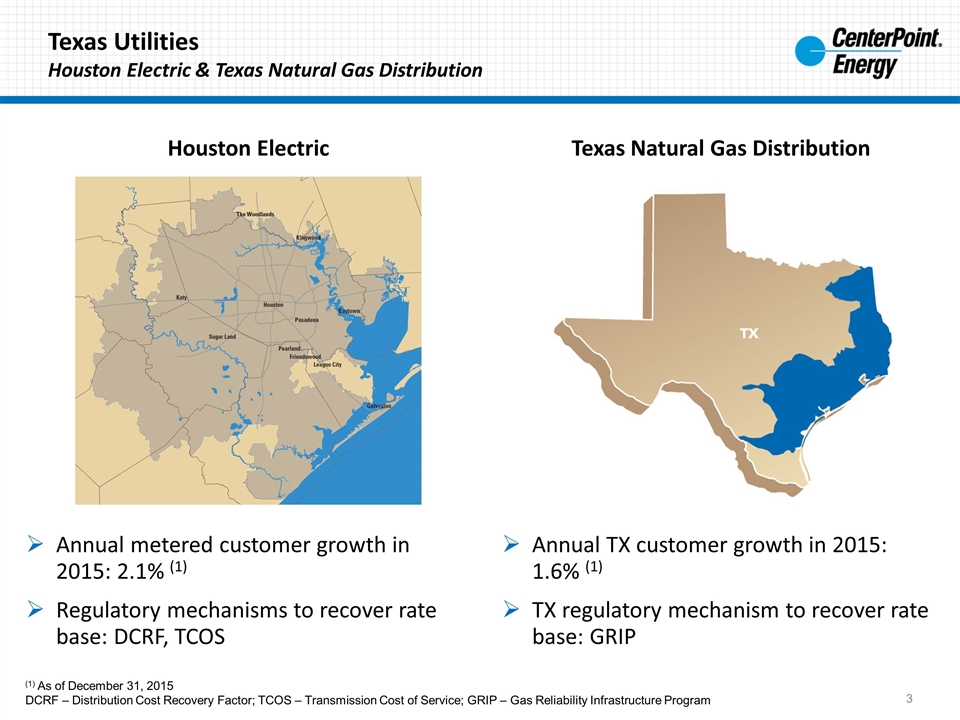

Texas Utilities Houston Electric & Texas Natural Gas Distribution Annual metered customer growth in 2015: 2.1% (1) Regulatory mechanisms to recover rate base: DCRF, TCOS Houston Electric Texas Natural Gas Distribution (1) As of December 31, 2015 DCRF – Distribution Cost Recovery Factor; TCOS – Transmission Cost of Service; GRIP – Gas Reliability Infrastructure Program Annual TX customer growth in 2015: 1.6% (1) TX regulatory mechanism to recover rate base: GRIP

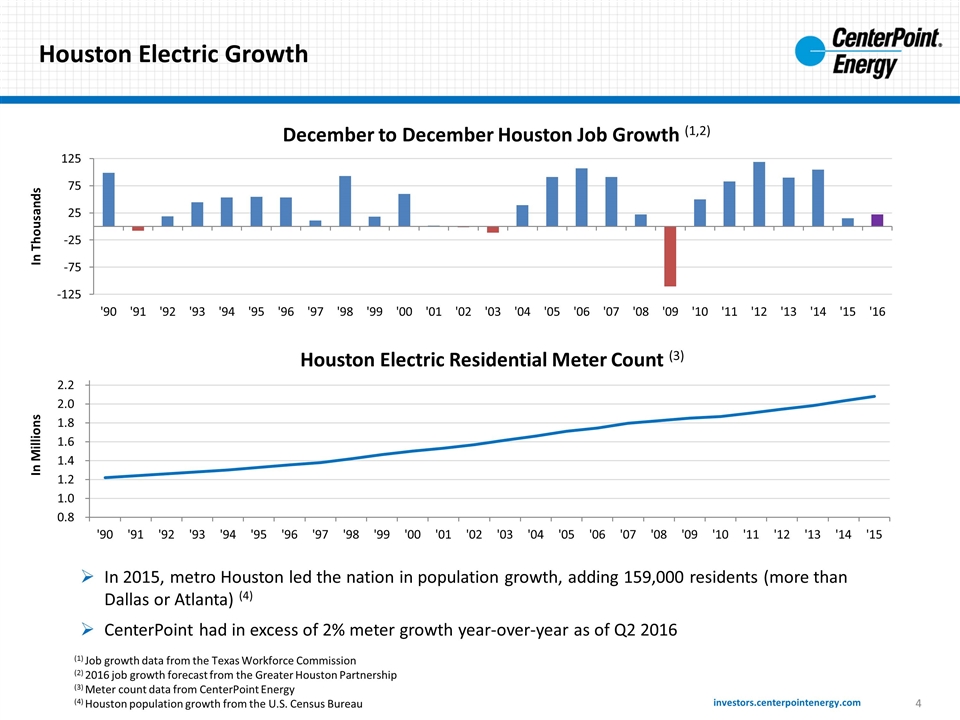

Houston Electric Residential Meter Count (3) Houston Electric Growth December to December Houston Job Growth (1,2) In Thousands In Millions (1) Job growth data from the Texas Workforce Commission (2) 2016 job growth forecast from the Greater Houston Partnership (3) Meter count data from CenterPoint Energy (4) Houston population growth from the U.S. Census Bureau In 2015, metro Houston led the nation in population growth, adding 159,000 residents (more than Dallas or Atlanta) (4) CenterPoint had in excess of 2% meter growth year-over-year as of Q2 2016

Houston Economy A Diverse and Growing Economy Source: Greater Houston Partnership Q3 2016 www.houston.org Source: Port of Houston www.portofhouston.com Source: Houston Airport System www.fly2houston.com

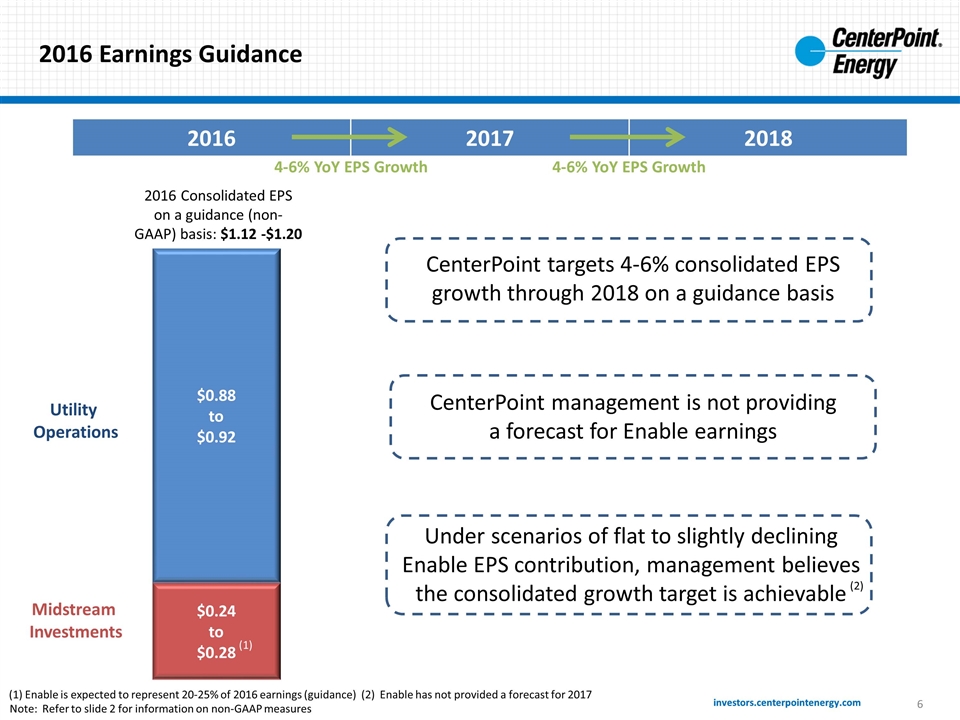

2016 Earnings Guidance Midstream Investments Utility Operations 2016 Consolidated EPS on a guidance (non-GAAP) basis: $1.12 -$1.20 2016 2017 2018 $0.88 to $0.92 $0.24 to $0.28 Note: Refer to slide 2 for information on non-GAAP measures 4-6% YoY EPS Growth 4-6% YoY EPS Growth CenterPoint management is not providing a forecast for Enable earnings Under scenarios of flat to slightly declining Enable EPS contribution, management believes the consolidated growth target is achievable CenterPoint targets 4-6% consolidated EPS growth through 2018 on a guidance basis (1) Enable is expected to represent 20-25% of 2016 earnings (guidance) (2) Enable has not provided a forecast for 2017 (1) (2)

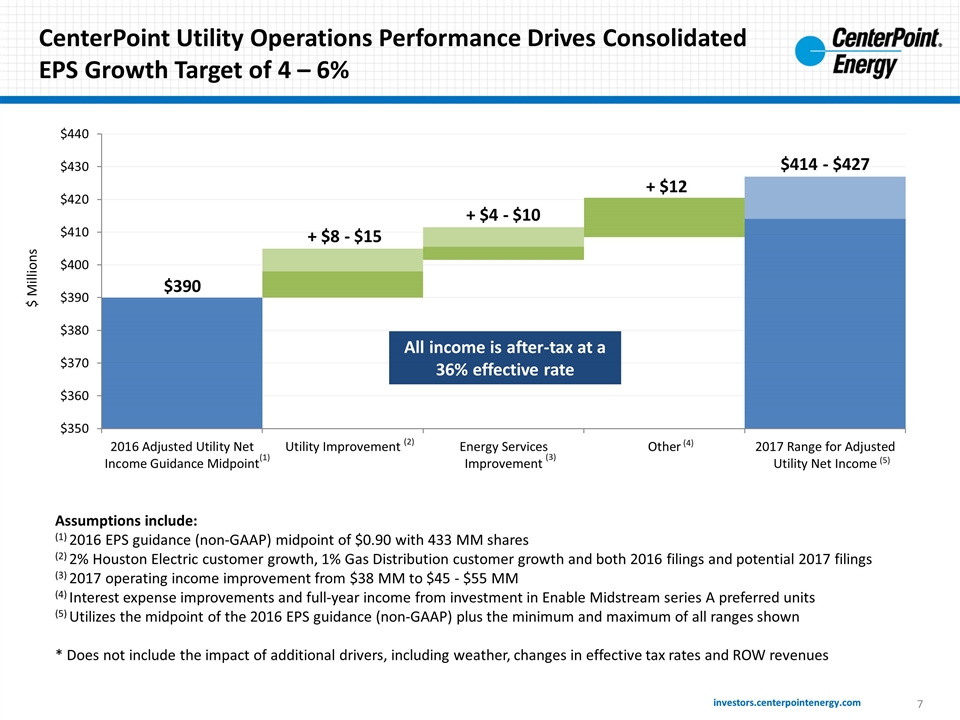

7 CenterPoint Utility Operations Performance Drives Consolidated EPS Growth Target of 4 – 6% Assumptions include: (1) 2016 EPS guidance (non-GAAP) midpoint of $0.90 with 433 MM shares (2) 2% Houston Electric customer growth, 1% Gas Distribution customer growth and both 2016 filings and potential 2017 filings (3) 2017 operating income improvement from $38 MM to $45 - $55 MM (4) Interest expense improvements and full-year income from investment in Enable Midstream series A preferred units (5) Utilizes the midpoint of the 2016 EPS guidance (non-GAAP) plus the minimum and maximum of all ranges shown * Does not include the impact of additional drivers, including weather, changes in effective tax rates and ROW revenues $ Millions (1) (2) (3) (4) $390 + $8 - $15 + $12 + $4 - $10 $414 - $427 (5) All income is after-tax at a 36% effective rate

CenterPoint Energy’s Value Proposition Expect to continue delivering long-term value… Targeting 4 – 6% year-over-year EPS growth through 2018 with dividends to follow Annualized 2016 dividend of $1.03 per share would provide a yield of 4.3% (1) Solid historical dividend growth expected to continue Competitive P/E multiple given CNP’s risk profile as a result of strong fundamentals. Strong operating cash flow and balance sheet Capital investment in transmission and distribution assets expected to sustain earnings momentum Capital recovery mechanisms at electric and natural gas utilities help reduce regulatory lag Expanded Energy Services business expected to provide earnings growth Lack of generation assets reduces the environmental risks generally associated with a fully-integrated utility Low commodity prices and the competitive retail electric market help keep customer bills low (1) As of market close on September 22, 2016