Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - US ENERGY CORP | s104166_ex99-4.htm |

| EX-99.2 - EXHIBIT 99.2 - US ENERGY CORP | s104166_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - US ENERGY CORP | s104166_ex99-1.htm |

| 8-K - 8-K - US ENERGY CORP | s104166_8k.htm |

Exhibit 99.3

U.S. ENERGY CORP. The Oil & Gas Conference® August 17, 2016

NASDAQ: USEG WWW.USNRG.COM 2 A Legacy of Success & Longevity Celebrating Over 50 Years - Established 1966 - 2016

NASDAQ: USEG WWW.USNRG.COM 3 Safe Harbor Disclosure Carefully read the following disclaimer: The information discussed in this Presentation includes “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 (the “Securities Act”) and Section 21 E of the Securities Exchange Act of 1934 (the “Exchange Act”) . All statements made in or in conjunction with this Presentation, other than statements of historical fact, are forward - looking statements . Examples of such statements in this Presentation may relate to planned capital expenditures for oil and gas exploration and development projects ; cash expected to be available for continued work programs with all our industry partners, and for those projects as to which we do not presently have industry partners ; recovered volumes and values of oil and gas approximating third - party estimates of oil and gas reserves ; projected increases in oil and gas production ; current and anticipated drilling and completion activities ; anticipated production and price differentials and decline rates from initial production rates, over time, of the daily volume of oil and natural gas produced from wells completed in the Williston Basin and elsewhere ; the relationship of national oil and gas natural prices to prices paid for such production in the Williston Basin and other areas in which we operate ; expected well spacing for wells to be drilled ; future cash flows and borrowings ; pursuit of potential acquisition opportunities ; our expected financial position ; our business strategy ; and other plans and objectives for future operations . These forward - looking statements are typically identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “project,” “plan,” “believe,” “intend,” “achievable,” “anticipate,” “will,” “continue,” “potential,” “should,” “could,” and similar terms and phrases . Though we believe that the expectations reflected in these statements are reasonable, they do involve certain assumptions, risks and uncertainties . Results could differ materially from those anticipated in these statements as a result of numerous factors . Our future results will depend upon various other risks and uncertainties, including, but not limited to, those detailed in the section entitled “Risk Factors” in our Annual Report on Form 10 - K, our Quarterly Reports on Form 10 - Q, and other filings we make with the Securities and Exchange Commission, all of which are incorporated by reference in this Presentation . All forward - looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements made above, elsewhere in this Presentation and as incorporated from our public filings . All of such forward - looking statements are made as of the date of this Presentation, and except as otherwise required under securities laws, we do not assume a duty to update any forward - looking statement, whether as a result of new information, subsequent events or circumstances, changes in expectations or otherwise . Actual timing of drilling and completing wells, well performance and the anticipated number of gross and net wells could vary in each of these cases . Amounts budgeted for each regional drilling program are also subject to change based on a number of factors including, but not limited to, timing, well costs, drilling and completion success, availability of capital and weather - related issues . Anticipated well performance could also vary significantly from those modeled internally . Furthermore, funds allocated for specific drilling programs under the 2015 CAPEX budget may be re - allocated to other drilling programs if initial results are below expectations . IP rates, test results and similar data from exploration and development activities are not necessarily reflective of the production, reserves or cash flow that may ultimately be generated from the well in question . Our ability, or the ability of the relevant operator, to maintain expected levels of production from a well is subject to numerous risks and uncertainties, including those discussed and referenced above .

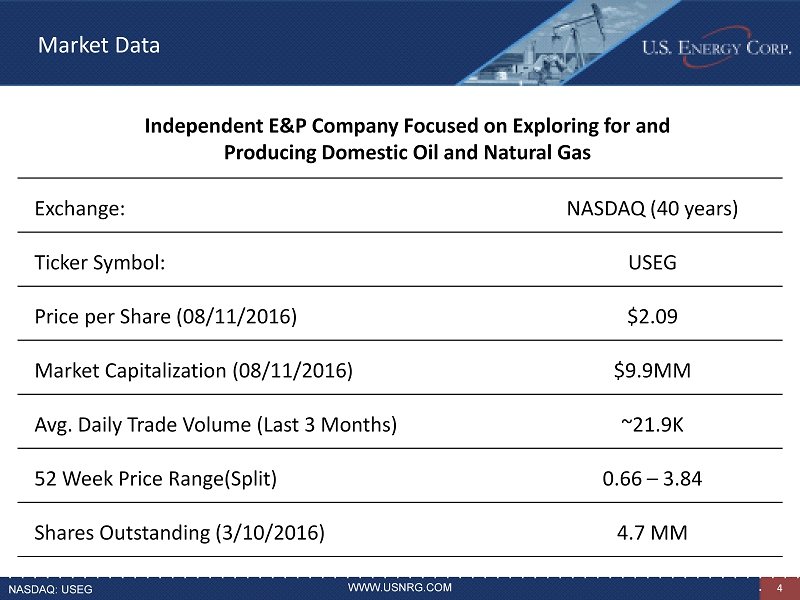

NASDAQ: USEG WWW.USNRG.COM 4 Independent E&P Company Focused on Exploring for and Producing Domestic Oil and Natural Gas Exchange: NASDAQ (40 years) Ticker Symbol: USEG Price per Share (08/11/2016) $2.09 Market Capitalization (08/11/2016) $9.9MM Avg. Daily Trade Volume (Last 3 Months) ~21.9K 52 Week Price Range(Split) 0.66 – 3.84 Shares Outstanding (3/10/2016) 4.7 MM Market Data

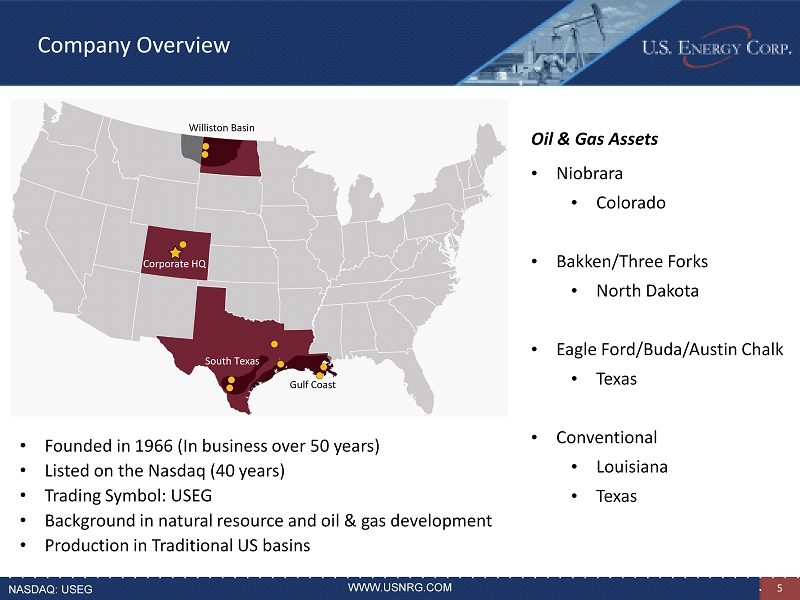

NASDAQ: USEG WWW.USNRG.COM 5 Oil & Gas Assets • Niobrara • Colorado • Bakken/Three Forks • North Dakota • Eagle Ford/Buda/Austin Chalk • Texas • Conventional • Louisiana • Texas • Founded in 1966 (In business over 50 years) • Listed on the Nasdaq (40 years) • Trading Symbol: USEG • Background in natural resource and oil & gas development • Production in Traditional US basins Company Overview Williston Basin Corporate HQ South Texas Gulf Coast

NASDAQ: USEG WWW.USNRG.COM 6 Corporate Overview - Operations • Interest in approximately 6,068 net acres primarily located in South Texas and the Williston Basin in North Dakota • Participate in 159 gross (21 net) producing wells in North Dakota / Texas / Louisiana (August 2016) • 2 nd Quarter 2016 Average Daily Production 772 BOE/D (60% oil) • Proved Reserves (2 nd Quarter 2016) 1.68 MMBOE • Wattenberg Development is adding 0.745 MMBOE

NASDAQ: USEG WWW.USNRG.COM 7 2016 CAPEX The Company’s capital focus will be on: • Funding our drilling obligation in the Wattenberg Development • Acquiring additional interests in the wells we currently are invested in • Acquisition of producing properties

NASDAQ: USEG WWW.USNRG.COM 8 U.S. ENERGY CORP. E&P Assets

NASDAQ: USEG WWW.USNRG.COM 9 Williston Basin Operations & Drilling Programs Bakken / Three Forks Formations Producing Operations in Williams, McKenzie and Mountrail Counties, North Dakota • Interests in 58 participated drilling units (HBP) (majority 1,280 acre spacing) • 66,00 Gross & 2,514 Net participated acres ( 43% to 0.1%) • Overall potential for 342* gross drilling locations • ~10* - 15** net wells on a going forward basis which would nearly double our well count • Second quarter 2016 Net production was 501 BOEPD in North Dakota • Actively seeking Williston Basin acquisitions of producing properties and consolidation of current assets • Transition to operations to use our experience and skill sets • Acquisition Opportunities will be available due to low commodity prices • Looking to consolidate and high grade our working interest position and will propose to operate • Qualified and Experienced in the Williston Basin to operate profitably at current commodity prices

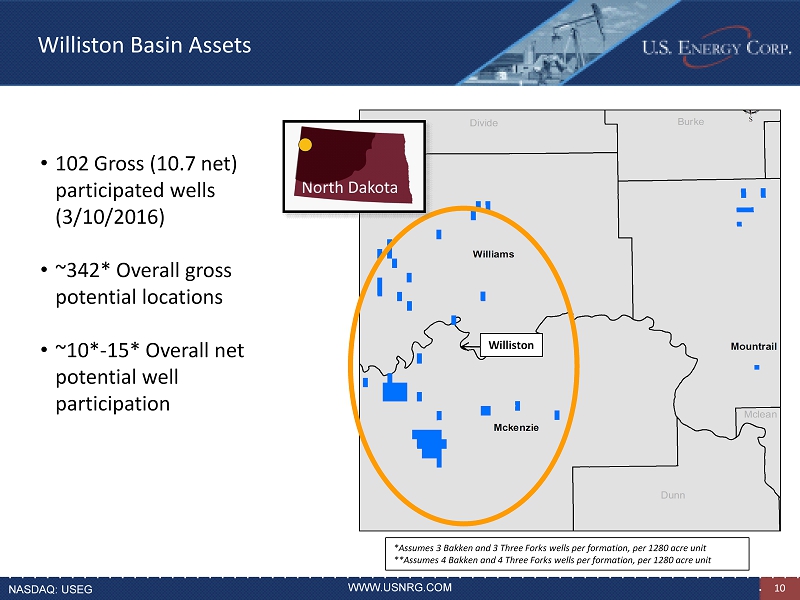

NASDAQ: USEG WWW.USNRG.COM 10 • 102 Gross (10.7 net) participated wells (3/10/2016) • ~342* Overall gross potential locations • ~10* - 15* Overall net potential well participation *Assumes 3 Bakken and 3 Three Forks wells per formation, per 1280 acre unit **Assumes 4 Bakken and 4 Three Forks wells per formation, per 1280 acre unit Williston Williston Basin Assets

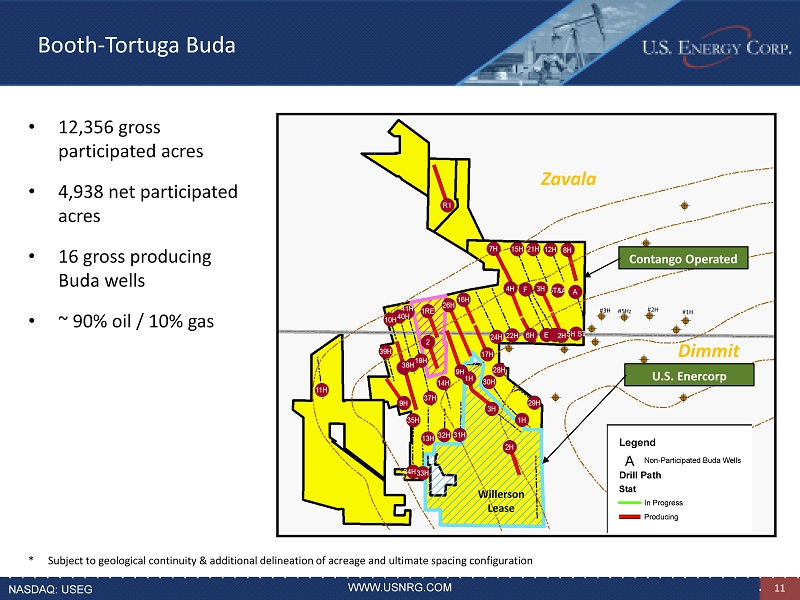

NASDAQ: USEG WWW.USNRG.COM 11 • 12,356 gross participated acres • 4,938 net participated acres • 16 gross producing Buda wells • ~ 90% oil / 10% gas * Subject to geological continuity & additional delineation of acreage and ultimate spacing configuration #3H #5Hz #2H #1H Dimmit Zavala Willerson Lease Contango Operated U.S. Enercorp Legend ! A Non-Participated Buda Wells Drill Path Stat In Progress Producing Booth - Tortuga Buda

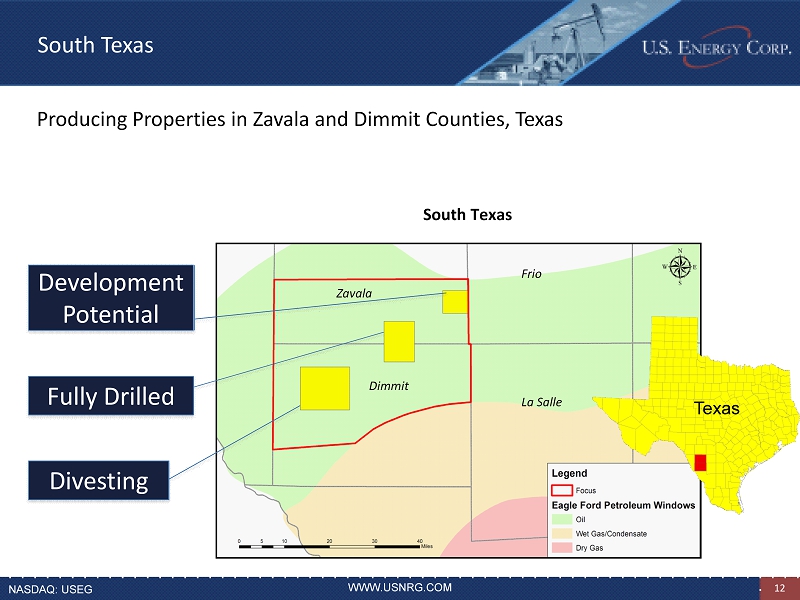

NASDAQ: USEG WWW.USNRG.COM 12 Producing Properties in Zavala and Dimmit Counties, Texas La Salle Frio Dimmit Zavala Texas South Texas South Texas Divesting Fully Drilled Development Potential

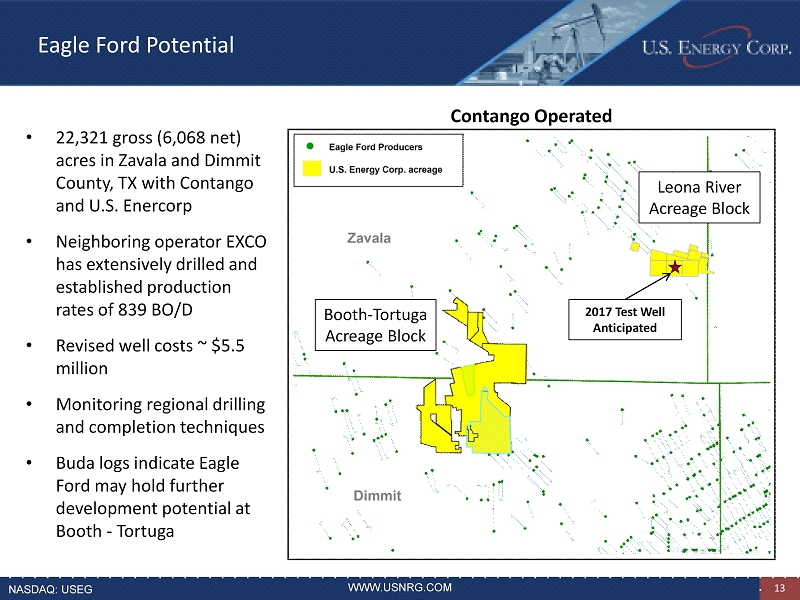

NASDAQ: USEG WWW.USNRG.COM 13 Contango Operated • 22,321 gross (6,068 net) acres in Zavala and Dimmit County, TX with Contango and U.S. Enercorp • Neighboring operator EXCO has extensively drilled and established production rates of 839 BO/D • Revised well costs ~ $5.5 million • Monitoring regional drilling and completion techniques • Buda logs indicate Eagle Ford may hold further development potential at Booth - Tortuga 2017 Test Well Anticipated Booth - Tortuga Acreage Block Leona River Acreage Block Eagle Ford Potential

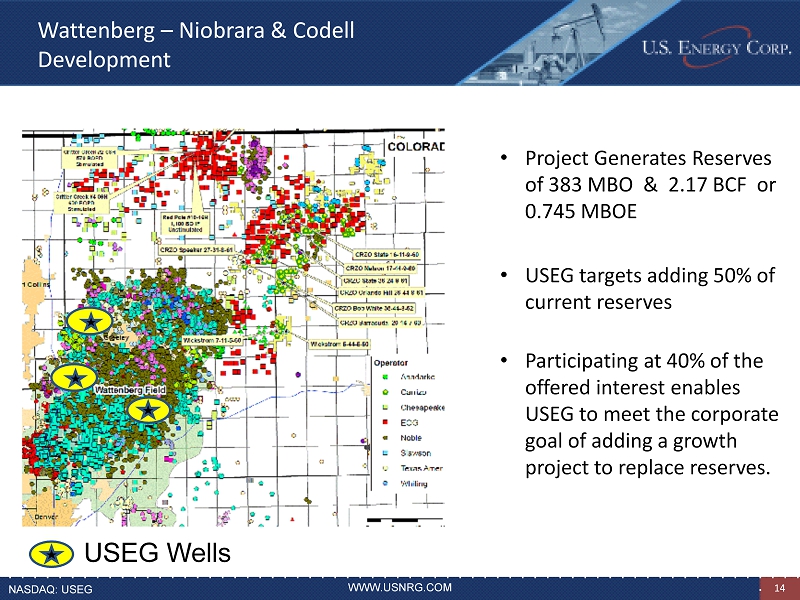

NASDAQ: USEG WWW.USNRG.COM 14 • Project Generates Reserves of 383 MBO & 2.17 BCF or 0.745 MBOE • USEG targets adding 50% of current reserves • Participating at 40% of the offered interest enables USEG to meet the corporate goal of adding a growth project to replace reserves. USEG Wells Wattenberg – Niobrara & Codell Development

NASDAQ: USEG WWW.USNRG.COM 15 • Drilling and Completion Costs down 55% • $3.0 1.0 mile • $4.0 1.5 mile • $4.5 2.0 mile • More efficient design cuts days • Monobore Design • Infrastructure in place • Operating Costs are established • Different techniques and economic drivers for different operators DJ Basin Development Drilling Opportunity

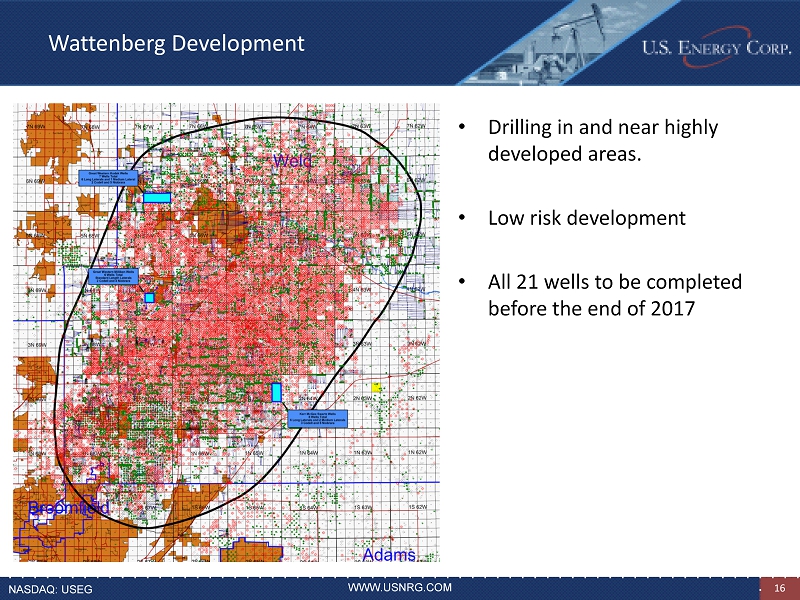

NASDAQ: USEG WWW.USNRG.COM 16 Wattenberg Development • Drilling in and near highly developed areas. • Low risk development • All 21 wells to be completed before the end of 2017

NASDAQ: USEG WWW.USNRG.COM 17 Leveraging Other Operator’s Experience

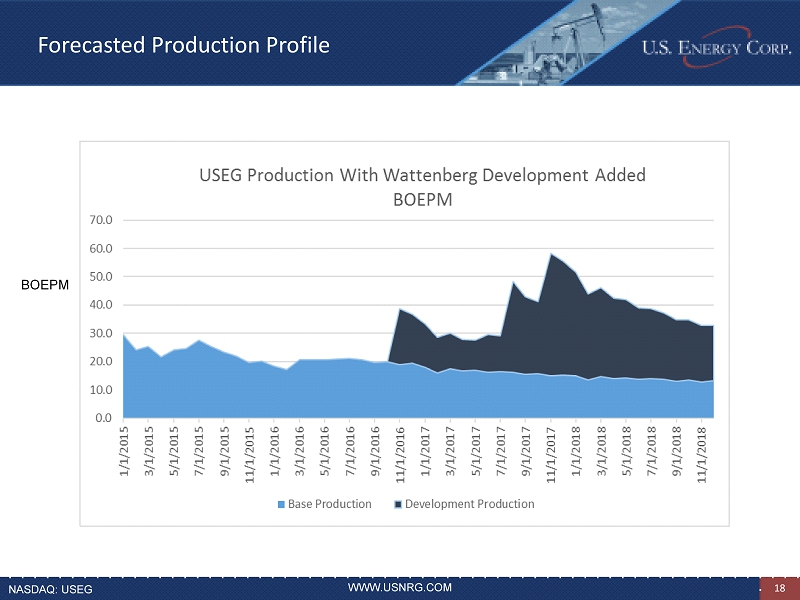

NASDAQ: USEG WWW.USNRG.COM 18 Forecasted Production Profile BOEPM

NASDAQ: USEG WWW.USNRG.COM 19 U.S. ENERGY CORP. Financials

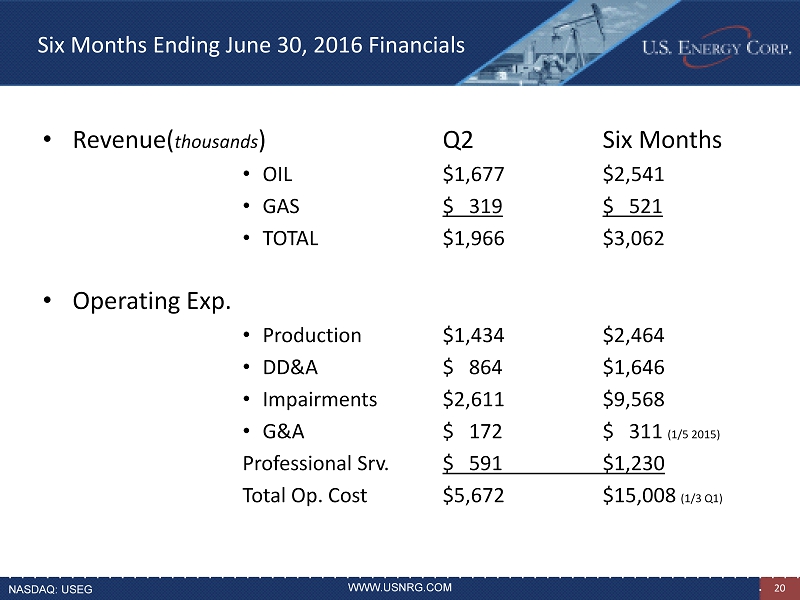

NASDAQ: USEG WWW.USNRG.COM 20 Six Months Ending June 30, 2016 Financials • Revenue( thousands ) Q2 Six Months • OIL $1,677 $2,541 • GAS $ 319 $ 521 • TOTAL $1,966 $3,062 • Operating Exp. • Production $1,434 $2,464 • DD&A $ 864 $1,646 • Impairments $2,611 $9,568 • G&A $ 172 $ 311 (1/5 2015) Professional Srv . $ 591 $1,230 Total Op. Cost $5,672 $15,008 (1/3 Q1)

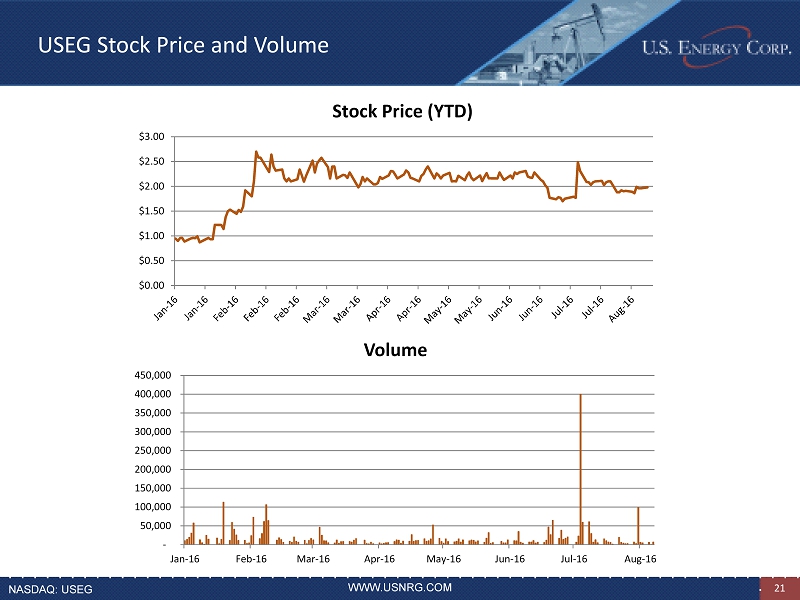

NASDAQ: USEG WWW.USNRG.COM 21 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 Stock Price (YTD) - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Volume USEG Stock Price and Volume

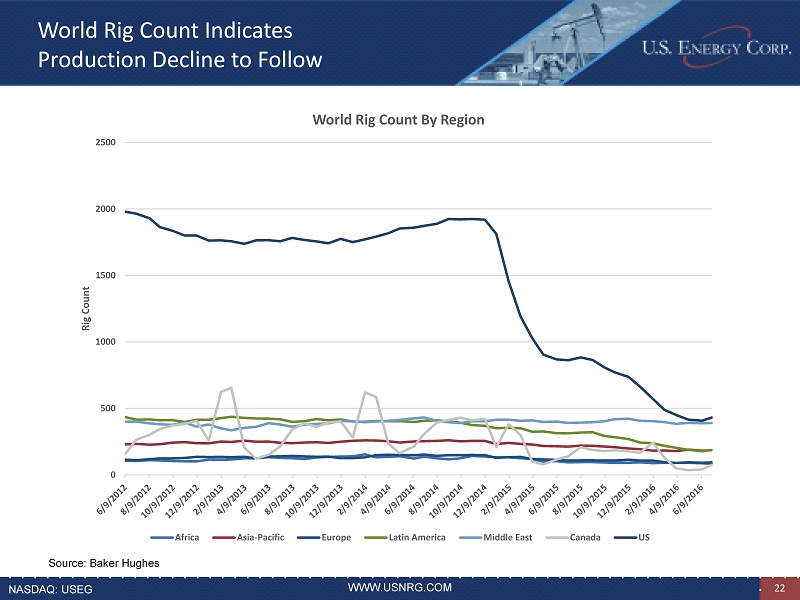

NASDAQ: USEG WWW.USNRG.COM 22 0 500 1000 1500 2000 2500 Rig Count World Rig Count By Region Africa Asia-Pacific Europe Latin America Middle East Canada US Source: Baker Hughes World Rig Count Indicates Production Decline to Follow

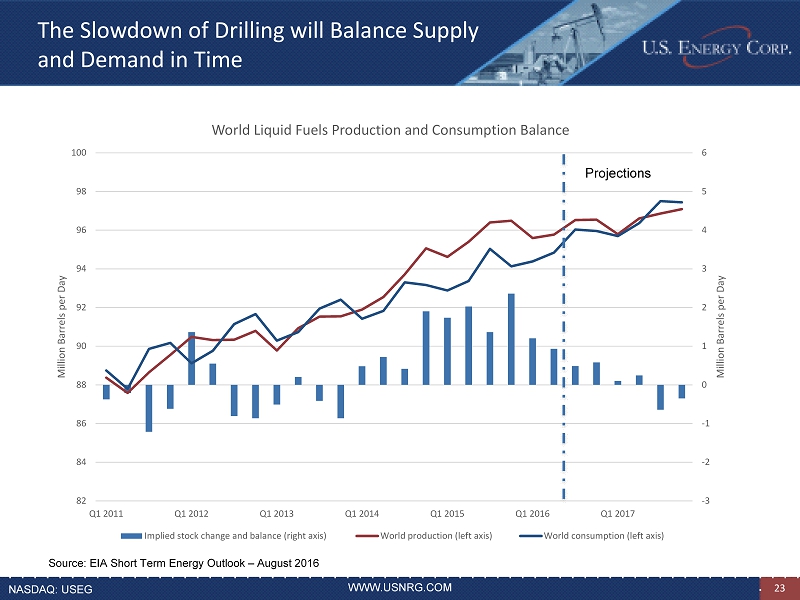

NASDAQ: USEG WWW.USNRG.COM 23 -3 -2 -1 0 1 2 3 4 5 6 82 84 86 88 90 92 94 96 98 100 Q1 2011 Q1 2012 Q1 2013 Q1 2014 Q1 2015 Q1 2016 Q1 2017 Million Barrels per Day Million Barrels per Day World Liquid Fuels Production and Consumption Balance Implied stock change and balance (right axis) World production (left axis) World consumption (left axis) Projections Source: EIA Short Term Energy Outlook – August 2016 The Slowdown of Drilling will Balance Supply and Demand in Time

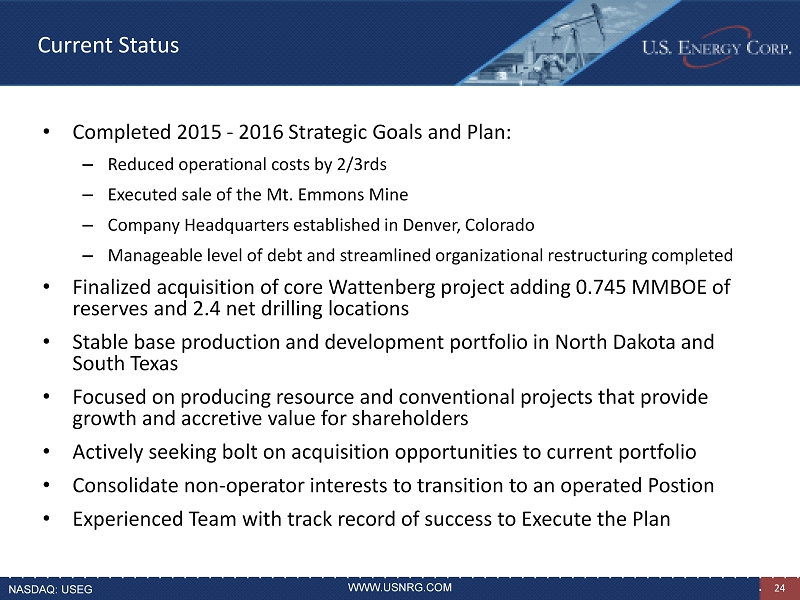

NASDAQ: USEG WWW.USNRG.COM 24 Current Status • Completed 2015 - 2016 Strategic Goals and Plan: – Reduced operational costs by 2/3rds – Executed sale of the Mt. Emmons Mine – Company Headquarters established in Denver, Colorado – Manageable level of debt and streamlined organizational restructuring completed • Finalized acquisition of core Wattenberg project adding 0.745 MMBOE of reserves and 2.4 net drilling locations • Stable base production and development portfolio in North Dakota and South Texas • Focused on producing resource and conventional projects that provide growth and accretive value for shareholders • Actively seeking bolt on acquisition opportunities to current portfolio • Consolidate non - operator interests to transition to an operated Postion • Experienced Team with track record of success to Execute the Plan

NASDAQ: USEG WWW.USNRG.COM 25 David Veltri is the CEO and President of U.S. Energy Corp. Mr. Veltri has over 35 years of oil and gas industry experience. Mr. Veltri has managed and engineered all phases of upstream and mid - stream oil and gas operations. Prior to joining U.S. Energy Corp., Mr. Veltri was the Chief Operating Officer of Denver, Colorado based Emerald Oil, Inc. While at Emerald, Mr. Veltri was played a key role in converting the Company from a non - operated position into an operator through the development of a three rig drilling program with field operations from well spud to sales. Mr. Veltri’s previous roles include Vice President / General Manager of Baytex Energy USA Ltd., where he managed that company's transition in the Williston Basin from non - operator to an operated upstream oil and gas business with working interests in over 100,000 acres, 100 wells, a two - rig drilling program, completion operations and an active acquisition program. Other previous roles include Production Manager at El Paso Exploration and Production Company, Vice President of Production and Drilling at Yuma Exploration and Production Company, Project Engineer at EOG Resources, and Vice President of Production and Engineering at Chesapeake Energy Corp. Management – Track Record of Success

NASDAQ: USEG WWW.USNRG.COM 26 Shareholder Contact: NASDAQCM: USEG Headquarters: U.S. Energy Corp. 4643 S. Ulster St. Suite 970 Denver, CO 80237 P. 1 - 303 - 993 - 3200 Investor Relations: P. 1 - 800 - 776 - 9271 IR@usnrg.com Web site: www.usrng.com