Attached files

| file | filename |

|---|---|

| EX-21.1 - SUBSIDIARIES - US ENERGY CORP | exhibit21_1.htm |

| EX-32.1 - CEO SOX CERT - US ENERGY CORP | exhibit32_1.htm |

| EX-23.1 - CONSENT OF CAWLEY, GILLESPIE & ASSOCIATES, INC. - US ENERGY CORP | exhibit23_1.htm |

| EX-23.0 - CONSENT OF RYDER SCOTT COMPANY L.P. - US ENERGY CORP | exhibit23_0.htm |

| EX-99.2 - RESERVE REPORT (CAWLEY, GILLESPIE & ASSOCIATES, INC.) - US ENERGY CORP | exhibit99_2.htm |

| EX-32.2 - CFO SOX CERT - US ENERGY CORP | exhibit32_2.htm |

| EX-31.2 - CFO CERT - US ENERGY CORP | exhibit31_2.htm |

| EX-99.1 - RESERVE REPORT (RYDER SCOTT COMPANY L.P.) - US ENERGY CORP | exhibit99_1.htm |

| EX-31.1 - CEO CERT - US ENERGY CORP | exhibit31_1.htm |

| EX-23.2 - CONSENT OF INDEPENDENT REGISTERED ACCOUNTING FIRM HEIN & ASSOCIATES LLP - US ENERGY CORP | exhibit23_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year Ended December 31, 2010

|

|

¨

|

Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from ___________ to ___________

|

Commission File Number 000-6814

|

U.S. ENERGY CORP.

|

|

(Exact Name of Company as Specified in its Charter)

|

|

Wyoming

|

83-0205516

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

|

|

877 North 8th West, Riverton, WY

|

82501

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code:

|

(307) 856-9271

|

|

Securities registered pursuant to Section 12(b) of the Act:

None

|

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value

|

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.YES ¨ NO þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.YES ¨ NO þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers, pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).YES ¨ NO þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2010): $121,356,000.

|

Class

|

Outstanding at March 11, 2011

|

|

|

Common stock, $.01 par value

|

27,196,495

|

Documents incorporated by reference: None.

-2-

TABLE OF CONTENTS

Page

|

Cautionary Statement Regarding Forward-Looking Statements

|

5

|

|

PART I

|

7

|

|

ITEM 1. BUSINESS

|

7

|

|

Overview

|

7

|

|

Industry Segments/Principal Products

|

7

|

|

Office Location and Website

|

7

|

|

Business

|

7

|

|

Oil and Gas

|

7

|

|

Activities other than Oil and Gas

|

16

|

|

ITEM 1 A. RISK FACTORS

|

18

|

|

Risks Involving Our Business

|

18

|

|

Risks Related to Our Stock

|

29

|

|

ITEM 1 B. UNRESOLVED STAFF COMMENTS

|

30

|

|

ITEM 2. PROPERTIES

|

30

|

|

ITEM 3. LEGAL PROCEEDINGS

|

44

|

|

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITITY HOLDERS

|

46

|

|

PART II

|

46

|

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SECURITIES

|

46

|

|

ITEM 6. SELECTED FINANCIAL DATA

|

49

|

-3-

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULT OF OPERATIONS

|

51

|

|

Forward Looking Statement

|

51

|

|

General Overview

|

51

|

|

Liquidity and Capital Resources

|

53

|

|

Capital Resources

|

56

|

|

Capital Requirements

|

60

|

|

Results of Operations

|

62

|

|

Critical Accounting Policies

|

68

|

|

Future Operations

|

71

|

|

Effects of Changes in Prices

|

71

|

|

Contractual Obligations

|

72

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

73

|

|

ITEM 8. FINANCIAL STATEMENTS

|

74

|

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

125

|

|

ITEM 9A. CONTROLS AND PROCEDURES

|

125

|

|

ITEM 9B. OTHER INFORMATION

|

128

|

|

PART III

|

128

|

|

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

|

128

|

|

ITEM 11. EXECUTIVE COMPENSATION

|

128

|

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED MATTERS

|

128

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

128

|

|

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

129

|

|

PART IV

|

132

|

|

ITEM 15. EXHIBITS, FINANCIAL STATEMENTS, SCHEDULES, REPORTS AND FORMS 8-K

|

132

|

|

SIGNATURES

|

135

|

-4-

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information discussed in this Annual Report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). All statements, other than statements of historical facts, are forward-looking statements. Examples of such statements in this Annual Report concern planned capital expenditures for oil and gas exploration; payment or amount of dividends on our common stock in the future; continued earnings swings; cash expected to be available for continued work programs; recovered volumes and values of oil and gas approximating third-party estimates of oil and gas reserves; anticipated increases in oil and gas production; drilling and completion activities in the Williston Basin and other areas; timing for drilling of additional wells; expected spacing for wells to be drilled with our industry partner Brigham Exploration Company in the Bakken/Three Forks formations; and expected well spacing for wells to be drilled with our other industry partners Houston Energy, Southern Resources; PetroQuest Energy, Cirque Resources LP, WR Production Company, Crimson Exploration and Zavanna.

Additional forward-looking statements in this Annual Report related to when payout may be reached for the wells drilled in 2010 with Brigham; the number of locations for wells that may be available for drilling with any of our other industry partners; expected working and net revenue interests, and costs of wells, for the drilling programs with any of our partners; actual decline rates for producing wells in the Bakken/Three Forks formations; submission of a Plan of Operations to the U.S. Forest Service and approval of such Plan in connection with the Mt. Emmons project and the expected length of time to permit and develop the Mt. Emmons project; expected time to receive a return on investment from the geothermal prospects; future cash flows and borrowings; pursuit of potential acquisition opportunities; anticipated business activities in the Gillette, Wyoming area and their impact on our Gillette, Wyoming multi-family housing complex; our expected financial position; and other plans and objectives for future operations.

These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “project,” “plan,” “believe,” “intend,” “achievable,” “anticipate,” “will,” “continue,” “potential,” “should,” “could,” and similar terms and phrases. Though we believe that the expectations reflected in these statements are reasonable, they do involve certain assumptions, risks and uncertainties. Results could differ materially from those anticipated in these statements as a result of certain factors, including, among others:

For oil and gas:

|

·

|

having sufficient cash flow from operations and/or other sources to fully develop our undeveloped acreage positions;

|

|

·

|

volatility in oil and natural gas prices, including potential depressed natural gas prices and/or declines in oil prices, which would have a negative impact on operating cash flow and could require ceiling test write-downs on our oil and gas assets;

|

|

·

|

the possibility that the oil and gas industry may be subject to new adverse regulatory or legislative actions (including changes to existing tax rules and regulations and changes in environmental regulation);

|

|

·

|

the general risks of exploration and development activities, including the failure to find oil and natural gas in sufficient commercial quantities to provide a reasonable expectation of a return on investment;

|

-5-

|

·

|

future oil and natural gas production rates, and/or the ultimate recoverability of reserves, falling below estimates;

|

|

·

|

the ability to replace oil and natural gas reserves as they deplete from production;

|

|

·

|

environmental risks;

|

|

·

|

availability of pipeline capacity and other means of transporting crude oil and natural gas production; and

|

|

·

|

competition in leasing new acreage and for drilling programs with operating companies, resulting in less favorable terms.

|

For the molybdenum property:

|

·

|

the ability to obtain permits required to initiate mining and processing operations, and Thompson Creek Metals Company USA’s continued participation as operator of the property; and

|

|

·

|

completion of a feasibility study based on a comprehensive mine plan, which indicates that the property warrants construction and operation of mine and processing facilities, taking into account projected capital expenditures and operating costs in the context of molybdenum price trends.

|

|

·

|

we are responsible for the operating costs of the water treatment plant until such time as Thompson Creek makes their election to own a percentage of the property at which time the costs will be split proportionately by percentage of ownership.

|

For real estate:

|

·

|

failure of energy-related business activities in the Gillette, Wyoming area to support sufficient demand for apartments for us to realize a return on the investment.

|

|

·

|

during 2011 we determined that we would finance and sell the multifamily housing project in Gillette, Wyoming. With the proceeds from the property we plan on furthering our oil and gas business. The selling price may not meet our expectations.

|

For geothermal activities:

|

·

|

the ability to acquire additional Bureau of Land Management and/or other acreage positions in targeted prospect areas, obtain required permits to explore the acreage, drill development wells to establish commercial geothermal resources, and the ability of Standard Steam Trust LLC (“SST”) to access third-party capital to reduce reliance on capital calls to its members (including U.S. Energy Corp.) for continued operations. We have notified SST that we do not intend to fund any cash calls which will result in a dilution of our ownership of SST.

|

Finally, our future results will depend upon various other risks and uncertainties, including, but not limited to, those detailed in the section entitled “Risk Factors” in this Annual Report. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements made above and elsewhere in this Annual Report. Other than as required under securities laws, we do not assume a duty to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, changes in expectations, or otherwise.

-6-

PART I

Item 1 – Business

Overview

U.S. Energy Corp. (“U.S. Energy” or “We”), a Wyoming corporation organized in 1966, acquires and develops oil and gas and other mineral properties. We are continuing to invest aggressively by participating (through passive non-operating investments) in oil and gas plays with industry partners, and, in 2011, by acting as operator for selected properties.

We are maintaining steady progress with our partner, Thompson Creek Metals Company (USA), in the long-term development of the Mt. Emmons molybdenum property in west central Colorado. A multifamily apartment project serving the residential market in Gillette, Wyoming was completed in 2008, and it is generating positive cash flow; we do not intend to make more investments in the real estate housing sector and anticipate financing or selling the multifamily apartment project.

Industry Segments/Principal Products

At December 31, 2010, we have three operating segments: Oil and gas, real estate, and minerals (including geothermal).

Office Location and Website

Principal executive offices are located at 877 North 8th West, Riverton, Wyoming 82501, telephone 307-856-9271.

Our website is www.usnrg.com. We make available on this website, through a direct link to the Securities and Exchange Commission’s website at http://www.sec.gov, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and Forms 3, 4 and 5 for stock ownership by directors and executive officers. You may also find information related to our corporate governance, board committees and code of ethics on our website. Our website and the information contained on or connected to our website is not incorporated by reference herein and our web address is included only for textual reference to the SEC filings.

Business

Oil and Gas

At December 31, 2010:

|

·

|

Estimated proved reserves of 1,954,941 BOE (79% oil, 18% natural gas and 3% plant products), $44.7 million standardized measure and $52.1 million PV10, representing increases of 80%, 123%, and 102% over the 2009 reserves, standardized measure and PV10, respectively.

|

|

·

|

Gross and net leases of 89,496 and 29,370 acres. At March 1, 2011, gross and net leases covered 97,221 and 33,213 acres.

|

|

·

|

Seventeen gross (6.38 net) producing wells (19 and 6.71 at March 1, 2011).

|

|

·

|

1,230 BOE/D average for 2010 (1,051 BOE/D at March 1, 2011).

|

-7-

|

·

|

Exploration and development agreements with eight industry partners and a wholly-owned Bakken/Three Forks acreage play (five partners and no acreage play in 2009). At March 1, 2011, we added another agreement (with Crimson Exploration, Inc.) for a total of nine partners.

|

PV10 (present value before taxes (discounted at ten percent)) is widely used in the oil and gas industry, and is followed by institutional investors and professional analysts to compare companies. However, PV10 data is not an alternative to the standardized measure of discounted future net cash flows, which is calculated under GAAP and includes the effects of income taxes. The following table reconciles PV10 to the Standardized Measure of Discounted Future Net Cash Flows, which are presented in Note G to the Company’s Consolidated Financial Statements.

|

(In thousands)

|

||||||||||||

|

At December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Standardized measure of discounted net cash flows

|

$ | 44,653 | $ | 19,984 | $ | 3,318 | ||||||

|

Future income tax expense (discounted)

|

7,420 | 5,776 | 1,993 | |||||||||

|

PV-10

|

$ | 52,073 | $ | 25,760 | $ | 5,311 | ||||||

Activities with Operating Partners in Oil and Gas

The Company holds a geographically diverse portfolio of oil weighted prospects in varying stages of exploration and development, of which a majority of the properties are structured with eight different operating partners (nine at March 1, 2011). Prospect stages range from exploration and completion work, leasing activities (some with current partners to enlarge the land base, some for our own account), and seismic and other early stage science to identify drilling prospects (some with current partners, some for our own account).

A number of the programs were identified and structured in house. Each of the operators for the principal prospects has a substantial technical staff. We believe that these arrangements allow us to deliver value to shareholders without having to build the full staff of geologists, engineers and land personnel needed to work in diverse environments, such as deep Gulf Coast gas formations (PetroQuest), horizontal drilling in North Dakota (Brigham and Zavanna) and South Texas (Crimson Exploration) as well as conventional drilling in California’s San Joaquin Basin.

We do intend to increase our technical staff (a landman and petroleum engineer) to be in position to operate selected properties we acquire on our own such as in Colorado and Montana (see “Operated Oil and Gas Activities”). However, consistent with industry practice with smaller independent companies, we still would utilize specialized consultants with local expertise as needed.

Existing oil and gas projects with operating partners are in these areas:

Williston Basin

With Brigham Exploration Company. On August 24, 2009, we entered into a Drilling Participation Agreement (the “DPA”) with a wholly-owned subsidiary of Brigham Exploration Company. The DPA provides for U.S. Energy and Brigham to jointly explore for oil and gas in up to 19,200 gross acres in a portion of Brigham’s Rough Rider prospect in Williams and McKenzie Counties, North Dakota.

-8-

Under our agreement with Brigham, we earned working interests, out of Brigham’s interests, in fifteen 1,280-acre spacing units in Brigham’s Rough Rider project area, which is located in Williams and McKenzie Counties, North Dakota, by participating in the drilling of one initial well on each unit of acreage. Accordingly, we have earned the rights to drill up to 30 gross wells in the Bakken formation and an additional 30 gross wells in the Three Forks formation, for a total of 60 gross wells, based on current spacing rules in North Dakota. If the spacing is ultimately increased to four wells per 1,280 acre spacing unit, the potential number of drilling locations could increase to 120 gross wells.

The leases in the units are a combination of fee and state leases. In some areas, the rights may be depth limited to the Bakken and the upper part of the Three Fork formations, due to leases obtained by Brigham from third parties, while other leases may have rights to all depths. Working interests earned vary according to Brigham’s initial working interest, after-payout provisions and the provisions governing each stage of the program. At our current projected drilling rate, we expect that it will take four to six years to drill all of the wells on these units.

Our earn-in rights were staged in three groups of units, and were earned upon paying our share of all drilling and completion, or plugging and abandonment costs (if applicable), for all the initial wells (one for each unit) in each group. The numbers of initial wells (and units in the groups) consist of: Six in the First Group; four in the Second Group; and five in the Third Group. For information on the wells drilled through the date this Annual Report was filed, see “Item 2 – Properties – Oil and Natural Gas” below. At the date this Annual Report was filed, we have drilled all 15 wells in the initial phase of the DPA and have completed 12 wells, and are planning on drilling four to six additional (infill) gross wells in 2011.

Brigham is the operator for all the units covered by the DPA, and is compensated for services pursuant to an industry standard operating agreement, except that the customary non-consent provisions have been revised as to the drilling of subsequent wells (see below).

First Group: We earned 65% of Brigham’s initial working interest in six 1,280 acre units; our working interest ranges from 61.46% to 29.58% (48.55% to 23.80% net revenue interest (“NRI”)), for an average 49.54% working interest.

When we have received production revenues (less property and production taxes) from all six of the initial wells in this First Group, equal to our costs on a pooled basis (“Pooled Payout”), our working interest will be reduced to 42.25% of Brigham’s initial working interest in the initial wells, and the NRI will decrease to a range of 31.56% to 15.47%, for an average 25.45% NRI. At December 31, 2010, we projected Pooled Payout for this First Group would occur in the second or third quarter of 2011. Subsequent to December 31, 2010, we have experienced significant workover expense related to one of the six wells, which will delay the Pooled Payout.

U.S. Energy earned 36% of Brigham’s initial working interest to all the acreage in the applicable unit. Brigham will have no back in rights on any subsequent drilling locations in these units (or in any of the units we earned in the Second and Third Groups). All working interest ownership in each initial well, and all the subsequent wells, will be subject to proportionate reduction for third party lease hold rights. At December 31, 2010, three subsequent wells (two producing, one in completion) had been drilled in the First Group.

Second Group: In 2010, we participated in the drilling and completion of the four wells in the Second Group. Brigham gave us notice that it would be taking 50% of the working interest available to it, and we elected to take the remaining 50% of the working interest available to Brigham. The four wells were producing in 2010; our working interest ranges from 48.03% to 21.02% (NRIs of 37.80% to 16.29%).

-9-

We have earned working interest rights in all the acreage in these four units. For future wells drilled in these units, we will hold 36% of Brigham’s initial working interest (without back in rights), subject to proportionate reduction for third party lease hold rights. After Pooled Payout on the Second Group’s four wells, we will assign to Brigham 35% of our working interest in the initial wells in each spacing unit, and the NRI will decrease to a range of 24.26% to 10.61%. We anticipate Pooled Payout for the Second Group will be reached in third or fourth quarter 2012.

Third Group: On January 11, 2010, Brigham gave us notice that it would be taking 50% of the working interest available to it. In accordance with the DPA, we elected to take the remaining 50% of the working interest available to Brigham. All five wells in this group were drilled or being drilled at December 31, 2010; at December 31, 2010, one was producing, one was drilling, one was completing, and two were awaiting completion work. Working (and net revenue) interests range from 41.76% (32.96% NRI) to 20.01% (15.81% NRI).

We have earned 36% of Brigham’s initial working interest in all the acreage in the units in this Third Group (which will not be subject to back in rights), proportionately reduced for third party lease hold rights. After payout on a per initial well basis (“Unpooled Payout”), we will assign 27.7% of our working interest in each initial well to Brigham, resulting in NRIs of 23.83% to 11.49%). We expect Unpooled Payout to be reached on these initial wells in 2013 through 2014.

Non-Participation in Subsequent Wells. Under the form of operating agreement which governs operations for each of the 15 units, after the applicable initial well, we will have the right to elect not to participate in the drilling or completion in subsequent wells proposed to be drilled in a unit. If U.S. Energy or Brigham should make an election not to participate, the non-participating party will assign all its rights in the proposed well to the participating entity for no consideration. However, our working interest rights in all acreage remaining in the unit would not be affected by the assignment.

With Zavanna, LLC. In December 2010, we signed two agreements with Zavanna, LLC (a private oil and gas company based in Denver, Colorado), and other parties, and paid $10,987,000 cash, to acquire, initially (see below), a 35% working interest out of Zavanna’s working interests in oil and gas leases covering approximately 6,050 net acres in McKenzie County, North Dakota. Net revenue interests are expected to be in the range of 28% to 26.95%, proportionately reduced depending on Zavanna’s actual WI%.

The acreage is in two parcels – the Yellowstone Prospect and the SE HR Prospect. We expect this program will result in 31 gross 1,280 acre spacing units (with various working interests of up to 35%), with the potential of 124 gross Bakken and 124 gross Three Forks wells.

In December 2010, we committed to the drilling of one initial horizontal test wells into the Bakken Formation and paid an advance of $1,433,000 for drilling costs on an initial well in the Yellowstone Prospect which began drilling in January 2011 and reached total depth in February 2011. A second well spud in February 2011. A third well (which will be the initial well on the SE HR Prospect), is expected to begin drilling in second quarter 2011.

Our interests in all the acreage is subject to reduction by operation of a 30% reversionary working interest in the separate acreage packages under each agreement. On the earlier of 36 months after spudding each initial test well (the “Project Payout Period”), or reaching “Project Payout,” our 35% working interest will be reduced to 24.5% (with the NRI % also being proportionately reduced). Project Payout is that point in time when we have received proceeds from the sale of production (or from sale of all or part of the acreage to third parties) equal to 130% of: the $10,987,000 (paid on execution of the

-10-

agreements), plus all drilling and completion costs (including dry hole costs) and surface gathering facilities, for all wells drilled on the acreage (and on any additional acreage acquired in the two Areas of Mutual Interest contemplated by the agreements), referred to as the “Project Payout Properties.”

However, if Project Payout does not occur within the 36 month Project Payout Period, the reduction due to operation of the reversionary working interest will take effect on all acreage other than the Project Payout Properties, i.e., that acreage in which wells not have commenced drilling (including all infill locations in drilling units where the Project Payout Properties are located, and the interest in all subsequent operations thereon). After expiration of the Project Payout Period, all costs and expenses related to the Project Payout Properties will continue to be included in the Project Payout calculation until Project Payout occurs.

With Crimson Exploration Inc. On February 22, 2011 USE entered into a participation agreement with Crimson Exploration Inc. (“Crimson”) to acquire a 30% working interest in an oil prospect and associated leases located in Zavala County, Texas.

Under the terms of the agreement, USE will earn a 30% working interest (22.5% net revenue interest) in approximately 4,675 gross contiguous acres (1,402.5 net mineral acres) through a combination of a cash payment and commitment well carry. All future drilling and leasing will be on a heads up basis. For competitive reasons, the financial terms of the transaction will not be disclosed at this time.

The prospect is an Eagle Ford shale oil window target in Zavala County, Texas. Crimson will operate and tentatively plans to spud the first well in the area during the second quarter of this year. The well is planned to be drilled to a total drilling depth of approximately 12,500 feet (~6,000 ft. vertical, ~6,500 ft. horizontal), and to be completed with 14 fracture stimulation stages.

Texas and Louisiana

With PetroQuest Energy, Inc. Five wells have been drilled in coastal Louisiana with PetroQuest (NYSE: PQ). Three dry holes were plugged and abandoned and two wells are producing (both wells produce natural gas and oil); our working interests in the producers is (a) 14% (10.46% NRI before payout (9.76% NRI after payout), and (b) 53.33% (36% NRI). We expect to drill more wells with PetroQuest in 2011 but none have been signed up as of the date this Annual Report is filed. At payout on one of the producing wells (plus 6% annual interest), we will assign 15% of our working interest to a third-party consultant, and an additional 5% of our working interest at 200% of payout. Payout was reached for this well in January 2011.

With Yuma Exploration and Production Company, Inc. We have a working interest in a seismic, lease acquisition and drilling program with Yuma (a private company) that covers approximately 88,320 acres in South Louisiana. Seismic data collection has been completed and is being evaluated. This lease/option program continues through April 27, 2012; in 2010, one well was drilled and watered out and one was in completion at December 31, 2010 (working interests (NRI) in these wells is (a) 4.79% (3.62% NRI, decreasing to 3.17% NRI after payout), and (b) 4.79% (3.78% NRI, decreasing to 3.31% after payout – see below). We expect that Yuma will recommend drilling at least six more prospects in 2011. Participants will have the opportunity to opt in or out of any prospect leasing program, and the initial well in each prospect. Each prospect will have a separate operating agreement designating Yuma as operator. It is expected that the program will yield multiple oil and natural gas prospects, with exploration activities continuing for a number of years.

-11-

The Company holds a 4.79% working interest, Yuma owns an approximate 48% working interest, and the balance (approximately 47.21%) is held by third parties. At payout we will assign to a third party consultant 12.5% of our working interest in each producing well. For their working interests, the participants (other than Yuma) have paid 80% of the initial seismic, overhead and some land costs ($1.2 million by USE), and Yuma is paying 20%. All land and exploration costs going forward are to be paid according to the working interest percentages.

With Houston Energy L.P. In 2009 and 2010, we participated with Houston Energy in drilling two producing wells and three dry holes; in the producers (drilled in 2009), we own a working interest of (a) 8.50% (6.23% NRI after payout, reducing to 4.91% NRI after payout for a consultant’s back in interest); and (b) 25% (17.63% NRI after payout, reducing to 15.42% NRI after payout for a consultant’s back in interest).

We entered into two new agreements with Houston Energy in 2010:

NE Delta Farms Prospect Participation Agreement (Lafourche and Jefferson Parishes, Louisiana)

By paying $60,000 (our share of Houston Energy’s lease acquisition costs), we acquired a working interest before the casing point decision (“CPD”) is made (to complete or abandon a well), in all the prospects (approximately 496 gross acres (123 net mineral acres), we acquired a 33% working interest before the CPD on each prospect (24.75% after CPD (18.19% NRI). An affiliate of Houston Energy, and the 3D seismic company involved in the prospect, will receive a total 4.5% ORRI on the leases in this program.

Subsequent to year end, this well was determined to be non-productive and will be plugged and abandoned.

Gaines County, Texas Participation Agreement (Five Prospects – GTY Permian Basin)

We paid our share ($310,000) of Houston Energy’s lease acquisition and related costs, to acquire a 13.33% working interest (10.00% after CPD), representing an estimated 7.9% NRI. These prospects are burdened by a 3.0% ORRI in favor of an affiliate of Houston Energy. Two non productive wells were drilled on these prospects in 2010 ($529,000 net to USE). Up to 3 additional wells could be drilled under this agreement in 2011.

With Southern Resources Company This agreement covers a 13.5% working interest (9.86% NRI) in 1,282 gross (173 net) acres in Hardin County, Texas (approximately midway between Houston and Beaumont). If we elect to proceed by participating in the initial test well (and paying our $135,000 of seismic, land acquisition and legal costs), we will earn our working interest in all the acreage, and the seller will have an 18.75% carried working interest (to the CPD) in the initial test well, and a 12.5% carried working interest in the second test well (to the CPD). Subsequent wells will be paid proportionate to the all parties’ working interests. Mueller Exploration, Inc. will operate all wells. If the initial test well is not spudded by June 1, 2011, the agreement will terminate.

With WR Production Company. In March 2010, we signed an agreement with WR Production, LLC to purchase a 10% working interest (7.4% average NRI) in 898 gross (90 net) acres. We have paid $188,000 for prospect and leasehold costs to the date of the agreement. Initial well drilling costs will include 3.33% of WP’s working interest share.

-12-

California

With Cirque Resources LP (Kern County, California) Under an October 2010 agreement with Cirque Resources LP (“Cirque”) (a private exploration and development company based in Denver, Colorado), we paid $2,498,000 to Cirque to purchase a 40% working interest (32% NRI) in Cirque’s leases on 6,120 net mineral acres (2,448 acres net to our interest), in the San Joaquin Basin. Of the amount paid, $1,620,000 is an advance against our 40% working interest for the initial well, including 33% of Cirque’s 60% working interest share for the well. Cirque’s lease assignments are held in escrow, until the end of the well’s drilling phase; if we have paid all the drilling costs (ours and Cirque’s carry), the assignments will be recorded and released to us.

Completion and all other costs and expenses on the initial well and for all subsequent wells and any midstream projects (gathering, compressors, and processing/treatment facilities) will be paid by participants in proportion to their working interests. We are estimating our share of total completion costs for the initial well to be in the range of $640,000. Cirque is the operator for all operations on the prospect.

The primary target in the Moose Prospect is the Miocene; the initial well will be drilled to approximately 13,000 feet to test the Stevens Sands in a stratigraphic trap on the flank of the Elk Hills anticline. Current spacing rules and current interpretation of geological data indicate that up to 40 additional locations could be drilled. Additional seismic work including re-analysis of existing 2D and modeling into 3D may be undertaken to further scientific evaluations.

Operated Oil and Gas Activities

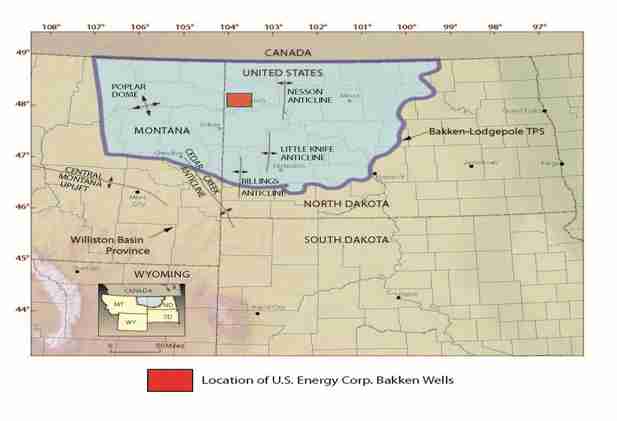

Montana Acreage Play

During 2010, U.S. Energy acquired 100% working interest in approximately 16,560 gross mineral acres (11,627 net mineral acres) of undeveloped leasehold interests, fee mineral interest and operating rights in oil and gas leases in Northeast Montana for approximately $809,000. In addition to landowner royalties which range from 12.5% to 15%, some of the leases are burdened with Overriding Royalty Interests (“ORRI”) in favor of the seller as follows:

2% ORRI on leases that have a total royalty interest (“RI”) of 12.5 or less; 1.0% ORRI on leases that have a total RI greater than 12.5% but less than or equal to 15%; 1% ORRI on leases that have a RI greater than 15% but less than or equal to 16.67 %; 0.5% ORRI on leases that have a RI greater than 16.67% but less than or equal to 19%.

We can buy back the ORRIs at any time on a sliding scale of from $60 per net mineral acre where the total royalty interest (exclusive of the ORRIs) is 12.5% or less, down to $15 where the total royalty interest is more than 16.67% but less than or equal to 19%.

Leasing and drilling activities by other companies looking to find Bakken Shale and Three Forks production in the Northeast part of Montana increased significantly in 2010. We are holding our acreage for future exploration and development, and may enlist the participation of industry partners at some point in the future. USE is the operator. No arrangements with other companies have been negotiated to date, and no wells have been drilled on our acreage.

-13-

Apache and Buffalo Creek Prospects (Southeast Colorado)

On January 26, 2011 we paid $87,000 to buy an 80% working interest in leases covering 2,994 net mineral acres in southeast Colorado, for their joint development (U.S. Energy as operator) with the sellers, who retained 20% of the working interest (and, only as to the acreage in the Buffalo Creek acreage, the positive difference between an 80% NRI and landowners’ royalties). We can buy back these ORRIs for $50,000 if the initial production on the initial well is 100 or less barrels of oil per day, and $100,000 if initial production is more than 100 barrels per day.

In addition, we will pay all the drilling costs of the initial well, to the casing point; if the sellers do not elect to participate in completion, the sellers will forfeit to USE their 20% working interest in the 160 acres associated with the well. There will be only one “initial well” to which this provision applies.

Additional leases may be acquired in the area; if acquired from the sellers, the price will be at their cost, without ORRIs or carried working interest. USE is the operator.

Going Forward

In 2011 and beyond, U.S. Energy intends to seek additional opportunities in the oil and natural gas sector, including further acquisition of assets, participation with current and new industry partners in their exploration and development projects, acquisition of operating companies, and the purchase and exploration of new acreage positions.

Credit Facility

On July 30, 2010, we established a credit facility to increase access to capital. This arrangement is available only for our oil and gas segment, and provides us with the flexibility of investing and funding drilling/completion work without having to sell assets. We expect significant borrowings to be serviced with cash flow, and/or equity financing.

The Senior Secured Revolving Credit Facility (the “Facility”) allows us to borrow up to $75 million from a syndicate of banks, financial institutions and other entities, including BNP Paribas (“BNPP,” and, together with other members of the syndicate, the “Lenders”). BNPP also is the administrative agent for the Facility, which is governed by the following documents: Credit Agreement; Mortgage, Deed of Trust, Assignment of As-Extracted Collateral, Security Agreement, Fixture Filing and Financing Statement (the “Mortgage”); and Guaranty and Pledge Agreement (the “Guaranty”), which are referred to below together as the “Facility Documents.” The following summarizes the principal provisions of the Facility as set forth in the Facility Documents, which are filed as exhibits to this Annual Report.

We formed a wholly-owned subsidiary Energy One LLC (“Energy One”), which will be the borrower under the Facility. We assigned to Energy One all of our right, title and interest in and to current and acquired-in-the-future oil and gas properties and equipment related thereto, rights under various operating agreements, proceeds from sale of production and from sale or other disposition (including without limitation farm-ins and farm-outs). We also have unconditionally and irrevocably guaranteed Energy One’s performance of its obligations under the Credit Agreement, including without limitation Energy One’s payment of all borrowings and related fees thereunder.

-14-

From time to time until expiration of the Facility (July 30, 2014), if Energy One is in compliance with the Facility Documents, Energy One may borrow, pay, and re-borrow from the Lenders, up to an amount equal to the Borrowing Base (initially established at $12 million, currently $18.5 million). Energy One borrowed $3.0 million under this Credit Facility on February 18, 2011. Proceeds from the borrowing were used to purchase an interest in Crimson Exploration’s Eagle Ford shale oil prospect in Zavala County, Texas.

The Borrowing Base will be determined semi-annually (more often at the request of BNPP or Energy One), with updated reserve reports prepared by the Company’s independent consulting engineers. Any proposed increase in the Borrowing Base will require approval by all Lenders, and any proposed Borrowing Base decrease will require approval by Lenders holding not less than two-thirds of outstanding loans and loan commitments.

Interest will be payable quarterly at the greater of the Prime Rate, the Federal Funds Effective Rate (plus 0.5%), and the adjusted LIBO for the three prior months (plus 1%), plus, in any event, an additional 1.25% to 3.25%, depending on the amount of the loan relative to the Borrowing Base. Interest rates on outstanding loans are adjustable each day by BNPP as administrative agent. Energy One may prepay principal at any time without premium or penalty, but all outstanding principal will be due on July 30, 2014. If there is a decrease in the Borrowing Base, outstanding principal will be due over the five months following the determination.

Energy One is required to comply with customary affirmative covenants, and with negative covenants. The principal negative covenants (measured at various times as provided in the Credit Agreement) are not permitting (i) Interest Coverage Ratio (Interest Expense to EBITDAX) to be less than 3.0 to 1; (ii) Total Debt to EBITDAX to be greater than 3.5 to 1; and (iii) Current Ratio (current assets plus unused lender commitments under the Borrowing Base) to be a minimum of 1.0 to 1.0. EBITDAX is defined in the Credit Agreement as Consolidated Net Income, plus non-cash charges.

Madison Williams and Company

Since March 2009, Madison Williams and Company (“MWC”), has helped us identify and structure three of the principal drilling programs (Brigham, Zavanna and Crimson), through its relationships with these operators. MWC also assisted in setting up the BNP Paribas credit facility. MWC is acting as our exclusive financial advisor in connection with the purchase or acquisition of oil and gas assets, including oil and gas companies, oil and gas working interests, and joint ventures or similar types of oil and gas ventures from entities that we have mutually agreed to approach regarding possible transactions. The firm also provides financial advisory and investment banking services.

In 2010 and 2009, we paid a total of $1,316,400 to MWC (and its predecessor, the principal capital markets business of SMH Capital, see below): $75,000 general advisory fees; $92,500 retainer fees; expense reimbursements of $70,600; and transaction fees of $1,078,300 related to negotiating and setting up the Credit Facility with BNP Paribas, and the Brigham and Zavanna deals. We will also be paying MWC a fee for the Crimson transaction which was closed in 2011.

The foregoing payments do not include MWC’s services as lead underwriter and bookrunner for USE’s $26.25 million public equity financing in fourth quarter 2009, which was governed by a separate agreement as well as an underwriting agreement for the financing. We anticipate that MWC will have the same role in future public financings.

-15-

MWC is a private management-owned investment banking firm; until late 2009, it was the principal capital markets business of SMH Capital, when it was spun out of Sanders Morris Harris Group. MWC has extensive experience in providing a broad range of services to the energy industry.

Activities other than Oil and Gas

Molybdenum

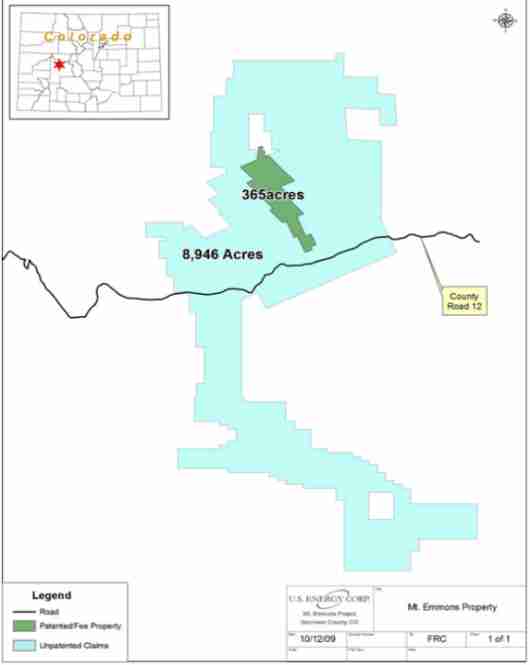

On August 19, 2008, U.S. Energy and Thompson Creek Metals Company USA (“TCM”), a Colorado corporation headquartered in Englewood, Colorado, entered into an Exploration, Development and Mine Operating Agreement for our Mount Emmons molybdenum property. TCM assigned the agreement to Mt. Emmons Moly Company, a Colorado corporation and wholly owned subsidiary of TCM effective September 11, 2008. Under the terms of the agreement TCM may acquire up to a 75% interest for $400 million (option payments of $6.5 million and project expenditures of $393.5 million).

The Agreement covers two distinct periods of time: The Option Period, during which TCM may exercise an option to acquire up to a 50% interest in Mount Emmons; and the Joint Venture Period, during which TCM will form a joint venture with us, and also have an option to acquire up to an additional 25% interest.

The Option Period:

Through December 31, 2010, TCM has paid us $500,000 (at the September 2008 closing), (not refundable), and $3 million for the $1.0 million option payments for 2009, 2010 and 2011. TCM has the continuing option to make three more $1 million annual payments.

The option is exercisable in two stages:

First Stage - For 15%. At TCM’s election within 36 months of incurring a minimum of $15,000,000 in expenditures on or related to Mount Emmons, TCM may acquire an undivided working interest of 15% in Mount Emmons. TCM also must make the option payments, but each such payment will be credited against the required annual expenditure amount. Following is a table of the options and expenditures due from TCM through June 2011:

|

Option Payments and Expenditure Amounts, and Deadlines

|

||||

| $ | 500,000 |

Option Payment

|

At Closing*

|

|

| $ | 2,000,000 |

Expenditures

|

December 31, 2008*

|

|

| $ | 1,000,000 |

Option Payment

|

January 1, 2009**

|

|

| $ | 4,000,000 |

Expenditures

|

December 31, 2009**

|

|

| $ | 1,000,000 |

Option Payment

|

January 1, 2010**

|

|

| $ | 4,000,000 |

Expenditures

|

December 31, 2010***

|

|

| $ | 1,000,000 |

Option Payment

|

January 1, 2011***

|

|

| $ | 1,500,000 |

Expenditures

|

June 30, 2011

|

|

| $ | 15,000,000 | |||

| * | Paid in 2008 | |||

| ** | Paid in 2009 | |||

| *** | Paid in 2010 | |||

Costs to operate the water treatment plant at the property are being paid solely by us until TCM elects to exercise its option to own an interest in the property.

-16-

Second Stage - For an Additional 35%. If by July 31, 2018, TCM has incurred a total of at least $43,500,000 of expenditures (including amounts during the first stage) and paid us the total $6,500,000 of option payments (for a total of $50,000,000), TCM may elect to acquire an additional 35% (for a total of 50% after it exercised the first stage option for 15%). None of the interests acquired by TCM will be subject to any overriding royalties to us.

Upon failure by TCM to incur the required amount of expenditures by a deadline, or make an Option Payment to U.S. Energy, subject to the terms of the Agreement, the Agreement may be terminated without further obligation to us from TCM. TCM may terminate the Agreement at any time, but if earned and elected to accept, TCM will retain the interest earned and be responsible for that share of all costs and expenses related to Mount Emmons.

The Joint Venture Period; Joint Venture Terms:

Within six months of TCM’s election to acquire the 50% interest, TCM, in its sole discretion, shall elect to form a Joint Venture and either: (i) participate on a 50%-50% basis with us, with each party to bear their own share of expenditures from formation date; or (ii) acquire up to an additional 25% interest in the project by paying 100% of all expenditures equal to $350 million (for a total of $400 million, including the $50 million to earn the 50% interest in the Second Stage of the Option Period), at which point the participation would be 75% TCM and 25% U.S. Energy. Provided however, if TCM makes expenditures of at least $70 million of the $350 million in expenditures and TCM decides not to fund the additional $280 million in expenditures, TCM will have earned an additional 2.5% (for a total of 52.5%). Thereafter, TCM will earn an incremental added percentage interest for each dollar it spends toward the total $350 million amount.

At any time before incurring the entire $350 million, TCM in its sole discretion, may determine to cease funding 100% of expenditures, in which event U.S. Energy and TCM then would share expenditures in accordance with their participation interests at that date. With certain exceptions, either party’s interest is subject to dilution in the event of non-participation in funding the Joint Venture’s budgets.

Management of the Property

TCM is Project Manager of the Mount Emmons Project. A four person Management Committee governs the projects’ operations, with two representatives each from U.S. Energy and TCM. TCM will have the deciding vote in the event of a committee deadlock.

If and when Mount Emmons goes into production, TCM will purchase our share of the molybdic oxide produced at an average price as published in Platt’s Metals Weekly price less a discount with a cap and a floor. The discount band will be adjusted every five years based upon the United States’ gross domestic product.

Renewable Energy — Geothermal

At December 31, 2010 we owned a minority ownership interest, 22.8%, in a geothermal partnership, Standard Steam Trust, LLC (“SST”).

-17-

In April 2010, SST sold two prospects to a global geothermal industry company, for $8.72 million cash. If the buyer constructs a power plant with more than 30 megawatts of generating capacity, additional cash will be paid to SST equal to $350,000 for each additional megawatt. Our investment in SST does not obligate us to fund any future cash calls. If we elect not to fund cash calls, we will suffer dilution. We have notified that we do not intend to fund any cash calls to the partners which will result in a dilution of our ownership of SST.

Real Estate

In 2008, we completed construction of a nine building, 216-unit multifamily apartment complex in Gillette, Wyoming at a total all-in cost of $24.5 million. The occupancy rate was 89% at December 31, 2010. The Company had an appraisal completed as of December 31, 2010 which valued the property at $21.0 million. An impairment of $1.5 million was therefore recorded at December 31, 2010 on the property. Although the property produces positive cash flow from its operations, the return from oil and gas investments is expected to yield a higher return. The Company therefore plans on selling this property in the future to continue growing its oil and gas business.

Item 1A - Risk Factors

The following risk factors should be carefully considered in evaluating the information in this Annual Report.

Risks Involving Our Business

Global Financial Stress and Credit Crisis.

The continuing Great Recession and concomitant credit crisis and related turmoil in the global financial system may have a material impact on our ability to finance the purchase and/or exploitation of oil and gas properties. The availability of credit to our industry partners may also affect their ability to generate new exploration and development prospects, to meet their obligations to us, and/or on their liquidity, which could result in operational delays or even their failure to make required payments. Additionally, volatility in oil prices, particularly a significant and sustained drop in current oil prices could have a negative impact on our financial position, results of operations, and cash flows.

Risks Related to Climate Change.

While the scope and timing of climate change is not determinate, the adoption of laws and regulations, and international accords to which the United States is a party, could affect our oil and natural gas business segment. The emergence of trends such as a worldwide increase in hybrid power motor vehicle sales, and/or decreased personal motor vehicle use by individuals, in response to perceived negative impacts on the climate from “greenhouse emissions,” could result in lower world-wide consumption of, and prices for, crude oil. Additionally, as part of state-level efforts to reduce these emissions, operating restrictions on emissions by drilling rigs and completion equipment could be enacted, leading to an increase in drilling and completion costs.

In January 2011, President Obama stated that his administration would request legislation reducing if not eliminating various “tax breaks” now available to the oil and gas exploration and production industry. The 2012 budget published in February 2011 proposes many of the same items for legislation that were in the 2011 budget, including proposals to terminate oil and gas company tax preferences, including repeals of expensing intangible drilling costs, passive loss limitations for working interests in oil and natural gas properties, percentage depletion for oil and natural gas wells, and increasing the amortization period for

-18-

geological and geophysical expenses to seven years. If such proposals were enacted substantially as proposed, our income from oil and natural gas investments would be decreased and additional capital likely would become more expensive and more difficult to obtain. Additional adverse impacts could flow from enactment of Federal legislation aimed directly at controlling and reducing emissions of greenhouse emissions. See also the next risk factor.

The adoption of climate change legislation could result in increased operating costs and reduced demand for oil and natural gas.

In June 2009, the U.S. House of Representatives approved adoption of the “American Clean Energy and Security Act of 2009,” also known as the “Waxman-Markey cap-and-trade legislation” or ACESA. The purpose of ACESA was to control and reduce emissions of “greenhouse gases,” or “GHGs,” in the United States. GHGs are certain gases, including carbon dioxide and methane that may be contributing to warming of the Earth’s atmosphere and other climatic changes. ACESA would establish an economy-wide cap on emissions of GHGs in the United States and would require an overall reduction in GHG emissions of 17% (from 2005 levels) by 2020, and by over 80% by 2050. Under ACESA, most sources of GHG emissions would be required to obtain GHG emission “allowances” corresponding to their annual emissions of GHGs. The number of emission allowances issued each year would decline as necessary to meet ACESA’s overall emission reduction goals. As the number of GHG emission allowances declines each year, the cost or value of allowances is expected to escalate significantly. The net effect of ACESA will be to impose increasing costs on the combustion of carbon-based fuels such as oil, refined petroleum products, and natural gas. The U.S. Senate began work on its own legislation for controlling and reducing emissions of GHGs in the United States, but the legislation stalled in 2010.

The U.S. Environmental Protection Agency is also separately undertaking a rulemaking process to determine whether GHGs will be designated as “pollutants” under the existing Federal Clean Air Act.

Though it is not predicted whether such legislation will be reintroduced and made law, or EPA rule making will be implemented, legislation and/or rule making along the lines previously contemplated would likely require us to incur increased operating costs, and could have an adverse effect on the oil and gas industry.

We will require funding in addition to working capital at December 31, 2010.

We were able to maintain adequate working capital in 2010 primarily through a December 2009 public offering of 5 million shares for $24.3 million of net proceeds. Working capital at December 31, 2010 was $11.1 million, an amount sufficient to continue substantial exploration and development work in oil and gas, but not enough to take full advantage of the opportunities we now have or be in position for new opportunities. We could spend up to $46 million in 2011 for work on existing programs.

Additionally, all of our partner agreements have customary industry non-consent provisions: If a well is proposed to be drilled or completed but a working interest owner doesn’t participate, resulting revenues (which otherwise would go to the non-participant) flow to the participants until they receive from 200% to 300% of the capital they put up to cover the non-participant’s share.

As a result, in order to be in position to avoid non-consent penalties, and make opportunistic investments in new assets, we will be evaluating various options to obtain additional capital, including loans through the Credit Facility, sale of equity and sale of the apartment complex in Gillette, Wyoming.

-19-

Beyond 2011, we may have capital needs from time to time in excess of funds on hand. The minerals business presents the opportunity for significant returns on investment, but achievement of such returns is subject to high risk. As examples:

|

·

|

Initial results from one or more of the oil and gas programs could be marginal but warrant investing in more wells. Dry holes, over budget exploration costs, low commodity prices, or any combination of these factors, could result in production revenues below projections, thus adversely impacting cash expected to be available for continued work in a program, its ultimate returns falling below projections, and a reduction in cash for investment in other programs.

|

|

·

|

We are paying the annual costs (approximately $1.8 million) to operate and maintain the water treatment plant at the Mount Emmons Project until such time as Thompson Creek Metals elects to acquire an interest. Thereafter, we would be responsible for paying our proportionate share of plant costs. Of greater potential significance, should Thompson Creek Metals elect to participate in the Mount Emmons Project up to the 75% level and expends $400 million on the property, thereafter we would be responsible for our 25% share of all costs, which could be very substantial.

|

These types of events could require a reassessment of priorities and therefore potential re-allocations of existing capital and mandate obtaining new capital.

Competition may limit our opportunities in the oil and gas business.

The oil and natural gas business is very competitive. We compete with many public and private exploration and development companies in finding investment opportunities. We also compete with oil and gas operators in acquiring acreage positions. Our principal competitors are small to mid-size companies with in-house petroleum exploration and drilling expertise. Many of our competitors possess and employ financial, technical and personnel resources substantially greater than ours. They may be willing and able to pay more for oil and natural gas properties than our financial resources permit, and may be able to define, evaluate, bid for and purchase a greater number of properties. In addition, there is substantial competition in the oil and natural gas industry for investment capital, and we may not be able to compete successfully in raising additional capital if needed.

Successful exploitation of the Williston Basin and the Eagle Ford Shale is subject to risks related to horizontal drilling and completion techniques.

Operations in the Williston Basin and the Eagle Ford Shale involve utilizing the latest drilling and completion techniques to generate the highest possible cumulative recoveries and therefore generate the highest possible returns. Risks that are encountered while drilling include, but are not limited to, landing the well bore in the desired drilling zone, staying in the zone while drilling horizontally through the shale formation, running casing the entire length of the well bore and being able to run tools and other equipment consistently through the horizontal well bore.

Completion risks include, but are not limited to, being able to fracture stimulate the planned number of stages, being able to run tools the entire length of the well bore during completion operations, and successfully cleaning out the well bore after completion of the final fracture stimulation stage. Ultimately, the success of these latest drilling and completion techniques can only be evaluated over time as more wells are drilled and production profiles are established over a sufficiently long time period.

-20-

The results of the drilling programs in the Williston Basin and the Eagle Ford Shale are subject to more uncertainties than drilling in more established formations in other areas.

Williston Basin

Although numerous wells have been drilled and completed in the Bakken and Three Forks formations in the Williston Basin, with horizontal wells and completion techniques that have proven to be successful in other shale formations, industry’s drilling and production history in the formation generally remains somewhat limited. The ultimate success of these drilling and completion strategies and techniques will be better evaluated over time as more wells are drilled and longer term production profiles are established.

In addition, based on reported decline rates in these formations, estimated average monthly rates of production may decline by approximately 70% during the first twelve months of production. However, actual decline rates may be significantly different than expected. Due to the limited horizontal production data for the Bakken and Three Forks formations, drilling and production results are more uncertain than encountered in other formations and areas with histories. Good results from wells we have participated in may not be replicated in additional wells, even in the same drilling unit.

Through the date this Annual Report was filed, one of the wells we have drilled with Brigham was completed in the Three Forks Formation, and the rest have been completed in the Bakken Formation. Brigham (and other operators) have reported successful completion of Three Forks wells in other parts of the Williston Basin, The Three Forks, underlying the Bakken, is an unconventional carbonate formation (sand and porous rock) which is prospective for oil and gas. It is believed to be separate from the Bakken. However, the Three Forks has been explored to a lesser extent than the Bakken in many areas of the Basin, and its characteristics are not as well defined. Accordingly, we may encounter more uncertainty in drilling Three Forks wells with Brigham, compared with drilling Bakken wells.

The foregoing considerations also apply to our opportunities to drill the same formations with Zavanna.

Eagle Ford Shale

The Eagle Ford Shale, covering 14 counties in South Texas, is now a very active area for exploration and development, involving large companies (such as Shell, ConocoPhillips, and Chesapeake Energy) as well as a host of mid-size to small independents. However, like the Bakken, since the data base is still evolving, the Eagle Ford characteristics are not well defined and thus can present more uncertainty than more mature drilling areas.

Operating in less developed regions of the Williston Basin has risks that include, but are not limited to, securing access to takeaway capacity and securing access to equipment and service providers on a timely and cost effective basis, and some of the initial gas production is lost to flaring.

Access to adequate gathering systems or pipeline takeaway capacity is limited in the Williston Basin. In order to secure takeaway capacity, our operators may be forced to enter into arrangements that are not as favorable to operators in other areas. Additionally, access to equipment and service providers may not be available on a timely or cost effective basis, which could delay a drilling program.

As of the date this Annual Report was filed, all of the wells we have drilled with Brigham have produced oil and natural gas (generally an initial ratio of about 85% oil and 15% gas). Oil sales commence immediately after completion work is finished, but natural gas is flared (burned off) until the well can be hooked up to a transmission line. Installation of a gathering system can take from 90 to 120

-21-

days, or longer, depending on well location, weather conditions, and availability of service providers. As of the date this Annual Report was filed, all but 2 of our wells with Brigham are selling gas.

We may encounter the same operating issues in the drilling program with Zavanna.

We may not be able to drill wells on a substantial portion of our Williston Basin and Eagle Ford Shale acreage.

We may not be able to participate in all or even a substantial portion of the many locations we have earned through the Drilling Participation Agreement with Brigham, and available to us through the Zavanna program, or the drilling locations available in the Crimson Participation Agreement. The extent of our participation will depend on drilling and completion results, commodity prices, the availability and cost of capital relative to ongoing revenues from completed wells, and other factors.

Lower oil and natural gas prices may cause us to record ceiling limitation write-downs, which would reduce stockholders’ equity.

We use the full cost method of accounting to account for our oil and natural gas investments. Accordingly, we capitalize the cost to acquire, explore for and develop these properties. Under full cost accounting rules, the net capitalized cost of oil and gas properties may not exceed a “ceiling limit” that is based upon the present value of estimated future net revenues from proved reserves, discounted at 10%, plus the lower of the cost or fair market value of unproved properties. If net capitalized costs exceed the ceiling limit, we must charge the amount of the excess to earnings (called a “ceiling limitation write-down”). The risk of a ceiling test write-down increases when oil and gas prices are depressed or if we have substantial downward revisions in estimated proved reserves.

Under the full cost method, all costs associated with the acquisition, exploration and development of oil and gas properties are capitalized and accumulated in a country-wide cost center. This includes any internal costs that are directly related to development and exploration activities, but does not include any costs related to production, general corporate overhead or similar activities. Proceeds received from disposals are credited against accumulated cost, except when the sale represents a significant disposal of reserves, in which case a gain or loss is recognized. The sum of net capitalized costs and estimated future development and dismantlement costs for each cost center is depleted on the equivalent unit-of-production method, based on proved oil and gas reserves. Excluded from amounts subject to depletion are costs associated with unevaluated properties.

Under the full cost method, net capitalized costs are limited to the lower of unamortized cost reduced by the related net deferred tax liability and asset retirement obligations or the cost center ceiling. The cost center ceiling is defined as the sum of (i) estimated future net revenue, discounted at 10% per annum, from proved reserves, based on unescalated costs, adjusted for contract provisions, any financial derivatives that hedge our oil and gas revenue and asset retirement obligations, and unescalated oil and gas prices during the period, (ii) the cost of properties not being amortized, and (iii) the lower of cost or market value of unproved properties included in the cost being amortized, less (iv) income tax effects related to tax assets directly attributable to the natural gas and crude oil properties. If the net book value reduced by the related net deferred income tax liability and asset retirement obligations exceeds the cost center ceiling limitation, a non-cash impairment charge is required in the period in which the impairment occurs.

Effective for years ending on and after December 31, 2009, the SEC amended the disclosure rules to require such revenue estimates to be based on the average price received during the 12-month period before the ending date of the period covered by the report, determined as an unweighted average of the

-22-

first-day-of-the-month price for each month within such period. Accordingly, our estimated future net revenues as of December 31, 2010 and 2009 are based on the monthly average price received during the full year period. For 2008, in accordance with SEC disclosure requirements previously in effect, estimated future net revenues (discounted at 10% per annum) from proved reserves were calculated based upon prices for oil and natural gas at December 31, 2008.

Full cost pool capitalized costs are amortized over the life of production of proven properties. Capitalized costs at December 31, 2010 and 2009, which were not included in the amortized cost pool, were $21.6 million and $5.4 million, respectively. These costs consist of wells in progress, costs for seismic analysis of potential drilling locations, as well as land costs, all related to unproved properties.

We perform a quarterly and annual ceiling test for each of our oil and gas cost centers (at December 31, 2010 and 2009, there was one such cost center (the United States)). The ceiling test incorporates assumptions regarding pricing and discount rates over which we have no influence in the determination of present value. In arriving at the ceiling test for the year ended December 31, 2010, we used $79.43 per barrel for oil and $4.376 per MMbtu for natural gas to compute the future cash flows of each of the producing properties at that date. The discount factor used was 10%.

Capitalized costs for oil and gas properties did not exceed the ceiling test limit in 2010. During 2009, we recorded a non-cash write down of $1.5 million. We may be required to recognize additional pre-tax non-cash impairment charges (write-downs) in future reporting periods depending on the results of oil and gas operations and/or market prices for oil, and to a lesser extent natural gas.

The Williston Basin oil price differential could have adverse impacts on our revenues.

Generally, crude oil produced from the Bakken formation in North Dakota is high quality (36 to 44 degrees API, which is comparable to West Texas Intermediate Crude). However, due to takeaway constraints, oil prices in the Williston Basin generally have been from $8.00 to $10.00 less than prices for other areas in the United States.

Drilling and completion costs for the wells we drill in the Williston Basin are comparable to other areas where there is no price differential. As a result of this reverse leverage effect, a significant prolonged downturn in oil prices on a national basis could result in a ceiling limitation write-down of the oil and gas properties we hold. Such a price downturn also could reduce cash flow from the Williston Basin properties, and adversely impact our ability to participate fully in drilling with Brigham and Zavanna.

Our business may be impacted by adverse commodity prices.

Since June, 2009, oil prices have ranged from a ten year high with a spot price of $133.88 per barrel, to $41.12 per barrel at December 31, 2008, to $74.47 at the end of 2009, to $91.38 at December 31, 2010. Global markets, in reaction to the Great Recession, and perceived upticks or downticks in future global supply, have caused these large fluctuations. The first quarter 2011 political changes in the Mideast may continue to propel oil prices to or beyond the highs experienced in late 2008, but drop if the “fear premium” fades. This could add to the risks associated with our hedging program (see the risk factor “The use of hedging arrangements in oil and gas production could result in financial losses or reduce income” below).

Natural gas prices are historically volatile, and reached a ten year high during July 2008 on the City Gate at $12.48 per thousand cubic feet of natural gas, then down to $6.24 per Mcf at December 31, 2009, and further down to $4.40 at December 30, 2010. Molybdenum prices have declined from a ten year high

-23-

of $38.00 per pound in June 2005 to a ten year low average price of $8.03 per pound in April 2009. The average price at December 31, 2010 was $16.60 per pound, compared to $11.50 per pound at year end 2009. Price stabilization or improvement in 2011 will be dependent on continued strong demand, but demand could weaken if industrial consumption sags due to economic constraints in key markets (particularly China and Southeast Asia). Significant oil price declines from December 31, 2010 would decrease anticipated revenues and could impair the carrying value of our producing properties.

We do not have independent reports on the value of some of the mineral properties.

We have not yet completed a feasibility study on the Mount Emmons Project. A feasibility study would establish the potential economic viability of the molybdenum property based on a reassessment of historical and additional drilling and sampling data, the design and costs to build and operate a mine and mill, the cost of capital, and other factors. A feasibility study conducted by professional consulting and engineering firms will determine if the deposits contain proved reserves (i.e., amounts of minerals in sufficient grades that can be extracted profitably under current commodity pricing assumptions and estimated development and operating costs).

Geothermal renewable reserve reports estimate the energy potential of geothermal properties in terms of capacity to generate electricity with plants to be built on the properties in the future. Currently we have no reserve reports for our geothermal properties.

The timing and cost to obtain reports for the Mt. Emmons molybdenum property or the geothermal properties cannot be predicted. However, when such reports are obtained, they may not support our internal valuations of the properties, and additionally may not be sufficient to maintain business relationships with current industry partners, or attract new partners or investment capital.

The development of oil and gas properties involves substantial risks that may result in a total loss of investment.

The business of exploring for and developing natural gas and oil properties involves a high degree of business and financial risks, and thus a significant risk of loss of initial investment even a combination of experience, knowledge and careful evaluation may not be able to overcome. The cost of drilling, completing and operating wells is often uncertain. Factors which can delay or prevent drilling or production, or otherwise impact expected results include but are not limited to:

|

·

|

unexpected drilling conditions;

|

|

·

|

permitting with State and Federal agencies;

|

|

·

|

easements from land owners;

|

|

·

|

adverse weather;

|

|

·

|

high pressure or irregularities in geologic formations;

|

|

·

|

equipment failures;

|

|

·

|

title problems;

|

|

·

|

fires, explosions, blowouts, cratering, pollution and other environmental risks or accidents;

|

|

·

|

changes in government regulations;

|

|

·

|

reductions in commodity prices;

|

|

·

|

pipeline ruptures; and

|

|

·

|

unavailability or high cost of equipment and field services and labor.

|

-24-

A productive well may become uneconomic in the event that unusual quantities of water or other non-commercial substances are encountered in the well bore, which impair or prevent production. We may participate in wells that are unproductive or, though productive, won’t produce in economic quantities.