Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MYERS INDUSTRIES INC | d259673d8k.htm |

INVESTOR PRESENTATION - FALL 2016 MYERS INDUSTRIES, INC.

Exhibit 99.1 |

SAFE

HARBOR

STATEMENT

Statements in this presentation concerning the Company’s goals, strategies, and

expectations for business and financial results may be

"forward-looking statements" within the meaning of the Private Securities

Litigation Reform Act of 1995 and are based on current indicators

and expectations. Whenever you read a statement that is not simply

a statement of historical fact (such as when we describe what we

"believe," "expect," or "anticipate" will occur, and other

similar statements), you must remember that our expectations may not be correct, even though we believe they are reasonable. We do not guarantee that the transactions and events described will happen as described

(or that they will happen at all). You should review this

presentation with the understanding that actual future results may

be materially different from what we expect. Many of the factors that will determine these results are beyond our ability to control or predict.

You are cautioned not to put undue reliance on any forward-looking

statement. We do not intend, and undertake no obligation, to update these forward-looking statements. These statements involve a number of risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in the applicable

statements. Such risks include: (1) Changes in the markets for the

Company’s business segments (2) Changes in trends and demands in the

markets in which the Company competes (3) Unanticipated downturn in

business relationships with customers or their purchases (4) Competitive

pressures on sales and pricing (5) Raw material availability, increases in

raw material costs, or other production costs (6) Harsh weather

conditions (7) Future economic and financial conditions in the United

States and around the world (8) Inability of the Company to meet future

capital requirements (9) Claims, litigation and regulatory actions against

the Company (10) Changes in laws and regulations affecting the

Company Myers Industries, Inc. encourages investors to learn more about

these risk factors. A detailed explanation of these factors is available in the Company’s publicly filed quarterly and annual reports, which can be found online at www.myersindustries.com and at the SEC.gov website.

2 |

3 BOARD AND NEW CEO EVALUATING ENTERPRISE STRATEGY » David Banyard named President and CEO of Myers Industries in December 2015 » Previously held leadership positions at Danaher Corporation (NYSE: DHR) and Roper Technologies (NYSE: ROP) » History of increasing revenue and cash flow in niche businesses through: » Focus on clear, crisp commercial processes » Playing to the company’s strengths » Implementing lean manufacturing » Talent management » Currently working with Board of Directors to formulate a revised enterprise strategy » Improving cash flow is core to the strategy » Completed strategic marketing reviews » Implementing commercial process improvements and lean tools » Assessing various capital deployment options » Strategic update to the investment community expected to be communicated in late 2016 or early 2017 |

CORPORATE

GOVERNANCE |

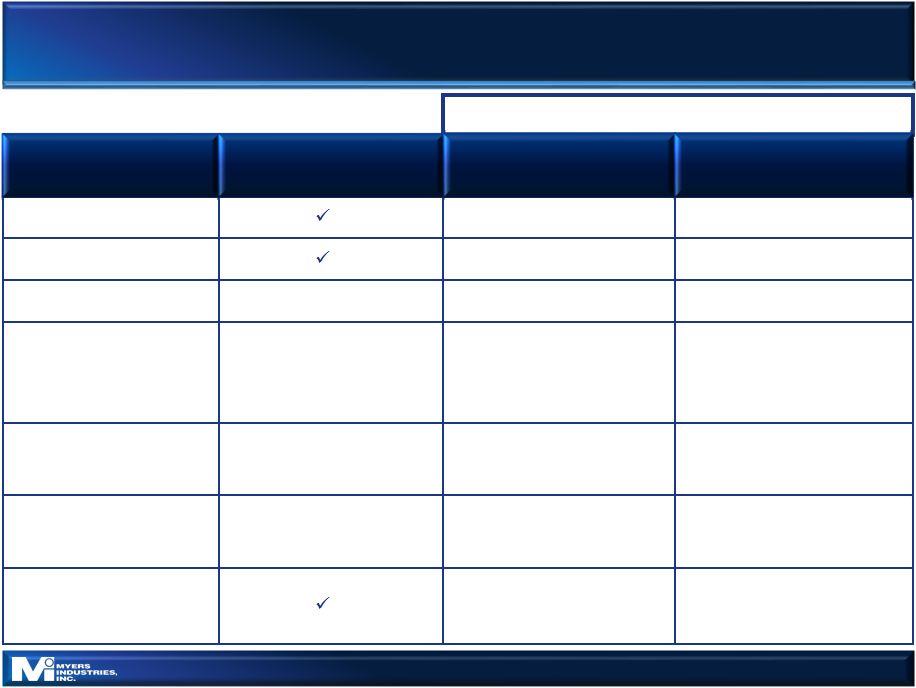

5 BOARD HAS CONSISTENTLY IMPLEMENTED BEST PRACTICES ISS 2016 Board Study GOVERNANCE PRACTICE MYERS INDUSTRIES SMALL CAP COMPANIES S&P 500 COMPANIES Annual Elections 53% 83% Independent Board Chair 38% 26% Board Independence 89% AVG of 78% AVG of 83% Committee Independence Audit - 100% Compensation - 100% Governance - 100% Audit – Not Listed Compensation - 98.4% AVG Governance – Not Listed Audit – Not Listed Compensation - 99.7% AVG Governance – Not Listed Number of Financial Experts 2 AVG of 1.9 AVG of 2.5 Board Diversity 22% female 0% minority 13% female 7% minority 20% female 13% minority Board & Committees Complete Annual Self- Evaluations |

Myers has

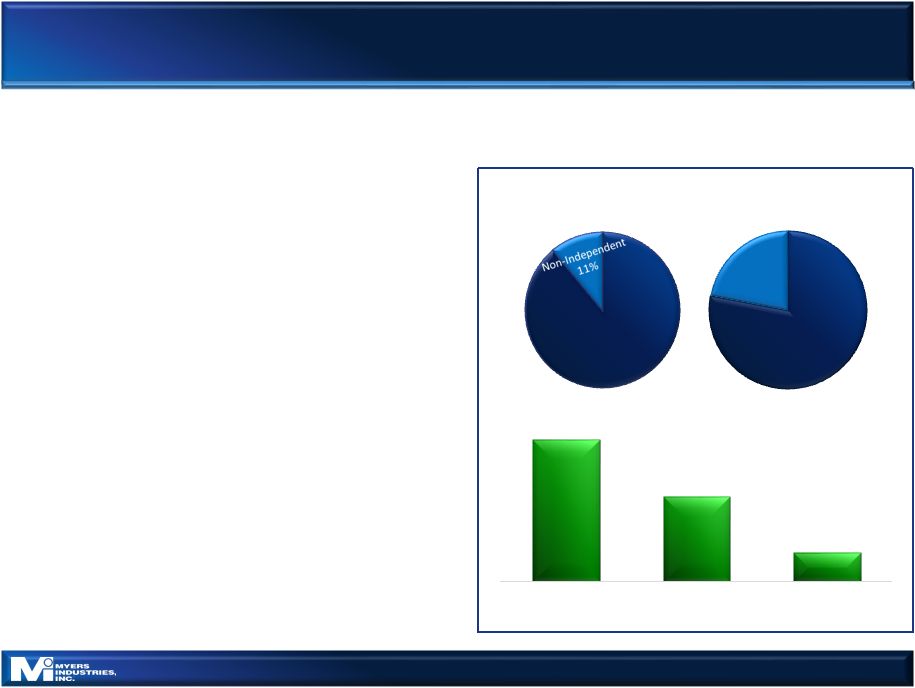

an experienced and effective Board focused on shareholder value creation 6 COMMITTED AND EXPERIENCED BOARD » The Board is composed of 9 members, 8 of whom are independent » The Board’s composition includes relevant expertise from diverse areas: » Half of the independent directors have joined the Board since 2014 » Board succession plan in place » Sales & Marketing » Audit & Risk Management » Strategic Planning » Mergers & Acquisitions » Polymer Manufacturing » Compensation » Industrial Operations » Finance & Accounting » Distribution » Investment Banking Board Composition » 2015: F. Jack Liebau, Jr. » 2015: Bruce Lisman » 2016: Jane Scaccetti » 2016: Daniel R. Lee Independent 89% Male 78% Female 22% 5 3 1 0-3 Years 5-7 Years 7-10 Years |

EXECUTIVE

COMPENSATION

|

8 PERFORMANCE-DRIVEN

COMPENSATION

» Pay for performance » Reasonable post-employment/change in control provisions » Double trigger change in control provisions » Share ownership guidelines » Independent compensation advisors » Tally sheets to evaluate and monitor NEO compensation » Clawback policy » Enter into employment contracts » Offer tax gross-ups » Reprice underwater options » Allow cash buyouts of underwater options » Permit derivative transactions or short sales by directors, officers or employees » Provide perquisites WHAT WE DO WHAT WE DON’T

DO

Our executive compensation program is designed to implement our

executive pay philosophy to attract and retain the best talent in our

industries and pay for performance |

9 PERFORMANCE-DRIVEN

COMPENSATION

ELEMENTS OF CEO PAY COMPARISON

Compensation Elements 2015 2016 Base salary Guaranteed Guaranteed Annual bonus Budgeted EBITDA Budgeted Cash flow Budgeted operating profit Growth in operating profit Budgeted cash flow Long-term incentives Performance cash awards Stock options Restricted stock units Performance stock units Stock options Restricted stock units Retirement and other benefits Qualified retirement plan Supplemental executive retirement plan Annual physical examination Qualified retirement plan Annual physical examination Executive perquisites Car allowance Use of Company’s country club membership* None In March, the Compensation Committee approved the below changes to the incentive pay program in an effort to address shareholder concerns *Use of membership was at user’s own expense |

10 2016 CEO COMPENSATION MIX » Annual bonus tied to: » Achieving budgeted operating profit¹ » Growth in operating profit¹ » Achieving budgeted cash flow » Long-term incentives: » Performance stock units » Tied to ROIC achievement over 3 years » Increases stock ownership » Aligned with shareholders’ desire to improve stock price » Stock options » Restricted stock units 1. Operating profit more closely aligned with how the Company measures the performance of its businesses.

2. If stock options not considered performance based, 66.5% compensation at

risk. TIED

TO KEY PERFORMANCE METRICS Salary 22.5% Annual Bonus 22.5% Service Based Restricted Stock 11.0% Performance Stock Units 33.0% Stock Options 11.0% 2016 CEO Compensation Mix at Target 66.5% Performance Based² 11% Service Based 22.5% Salary Based 55% Long-term Incentives 22.5% Short-term Incentives 22.5% Salary Based |

INTERNAL CONTROL

OVER FINANCIAL REPORTING |

12 INTERNAL CONTROL OVER FINANCIAL REPORTING Myers is taking the following actions to further ensure effective internal controls over financial reporting » Reviewing and updating internal control processes and documentation at every business to identify and remediate control gaps » Completing balance sheet and account reconciliation reviews at every business unit twice in calendar year 2016 » All reviews conducted by a member of the corporate controller group » Supplementing the technical competence of our accounting staff with additional training and resources » Plan approved by entire Board at April 2016 board meeting » Providing monthly updates to Audit Committee Chair and quarterly updates to entire audit

committee ENHANCING INTERNAL CONTROL STRUCTURE |

|