Attached files

| file | filename |

|---|---|

| 8-K - KIMBALL INTERNATIONAL, INC. FORM 8-K - KIMBALL INTERNATIONAL INC | kbalform8-k09142016.htm |

INVESTOR PRESENTATION

September 2016

Exhibit 99.1

SAFE HARBOR STATEMENT

Certain statements contained within this release are considered forward-looking under the

Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties

including, but not limited to, the risk that any projections or guidance, including revenues,

margins, earnings, or any other financial results are not realized, our ability to fully realize

the expected benefits of the restructuring plan, the outcome of a governmental review of our

subcontractor reporting practices, adverse changes in the global economic conditions,

significant volume reductions from key contract customers, significant reduction in customer

order patterns, financial stability of key customers and suppliers, and availability or cost of

raw materials. Additional cautionary statements regarding other risk factors that could have

an effect on the future performance of the Company are contained in the Company's Form

10-K filing for the fiscal year ended June 30, 2016 and other filings with the Securities and

Exchange Commission.

1

COMPANY SNAPSHOT

Headquarters: Jasper, IN, USA

Founded: 1950

Employees: ~3,000

Furniture focused since Oct 31, 2014 Spin-off

FY’16 Revenue: $635M

FY’16 Adj. Pro Forma Operating Profit: $40.8M / 6.4%

FY ‘15 Revenue: $601M

FY ’15 Adj. Pro Forma Operating Profit: $29.3M / 4.9%

2

Design Driven and Award Winning Furniture Brands

Evolving Office Environment Driving Demand and Continued Hospitality Growth

Dividend Yield Approximates 2%

Accelerating Revenue From New Product Introductions - Increasing Market Share

WHY INVEST IN US

Improving Financial Performance

Capital Available for Growth

3

Strong Return on Capital Relative to Competitors

WHO WE ARE

Kimball International, Inc. creates design

driven, innovative furnishings sold through

our family of brands: Kimball Office,

National Office Furniture, and Kimball

Hospitality. Our diverse portfolio offers

solutions for the workplace, learning,

healing, and hospitality

environments. Dedicated to our Guiding

Principles, our values and integrity are

evidenced by public recognition as a

highly trusted company and an employer

of choice.

“We Build Success” by establishing long-

term relationships with customers,

employees, suppliers, share owners and the

communities in which we operate.

We are committed to sales growth,

profitability and return on capital that is

among the best in each of our markets.

We Build Success

4

5

Commercial

Government Education

Healthcare

Finance Hospitality

Contract Magazine

Top 10 Brand in

Desks/Credenzas

HOW WE ARE RECOGNIZED

6

Increased mobility/technology requires flexible

work space

Shifting to more open and collaborative office

layouts to promote teamwork

Promotion of healthy work environments

Real Estate Optimization

Change is driving furniture demand

New Work

Areas

MARKET CHANGES DRIVING OFFICE FURNITURE DEMAND

7

176

0

0

137

132

126

237

23

23

46

46

46

51

132

156

252

202

59

FURNITURE INDUSTRY INDICATORS

8

3.9%

7.2%

-35.0%

-30.0%

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

0

2000

4000

6000

8000

10000

12000

14000

16000

BIFMA

($millions)

S

ou

rc

e

U

S

B

ur

ea

u

of

E

co

no

m

ic

A

na

ly

si

s

S

ou

rc

e:

U

S

B

ur

ea

u

of

L

ab

or

S

ta

tis

tic

s

S

ou

rc

e:

A

IA

Continued

Growth

MIXED U.S. FURNITURE LEADING INDICATORS

July marks 6th

month in a row

of positive

billings

9

0

200

400

600

800

1000

1200

1400

1600

1800

1

2

/1

/2

0

0

2

6

/1

/2

0

0

3

1

2

/1

/2

0

0

3

6

/1

/2

0

0

4

1

2

/1

/2

0

0

4

6

/1

/2

0

0

5

1

2

/1

/2

0

0

5

6

/1

/2

0

0

6

1

2

/1

/2

0

0

6

6

/1

/2

0

0

7

1

2

/1

/2

0

0

7

6

/1

/2

0

0

8

1

2

/1

/2

0

0

8

6

/1

/2

0

0

9

1

2

/1

/2

0

0

9

6

/1

/2

0

1

0

1

2

/1

/2

0

1

0

6

/1

/2

0

1

1

1

2

/1

/2

0

1

1

6

/1

/2

0

1

2

1

2

/1

/2

0

1

2

6

/1

/2

0

1

3

1

2

/1

/2

0

1

3

6

/1

/2

0

1

4

1

2

/1

/2

0

1

4

6

/1

/2

0

1

5

1

2

/1

/2

0

1

5

6

/1

/2

0

1

6

US Corporate Profit After Tax

With IVA and CCA adjustment ($billion)

100

105

110

115

120

125

130

8

/1

/2

0

0

4

2

/1

/2

0

0

5

8

/1

/2

0

0

5

2

/1

/2

0

0

6

8

/1

/2

0

0

6

2

/1

/2

0

0

7

8

/1

/2

0

0

7

2

/1

/2

0

0

8

8

/1

/2

0

0

8

2

/1

/2

0

0

9

8

/1

/2

0

0

9

2

/1

/2

0

1

0

8

/1

/2

0

1

0

2

/1

/2

0

1

1

8

/1

/2

0

1

1

2

/1

/2

0

1

2

8

/1

/2

0

1

2

2

/1

/2

0

1

3

8

/1

/2

0

1

3

2

/1

/2

0

1

4

8

/1

/2

0

1

4

2

/1

/2

0

1

5

8

/1

/2

0

1

5

2

/1

/2

0

1

6

8

/1

/2

0

1

6

Service Sector Employement

(millions workers)

Architectural Billing Index

3.1%

2.9%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

Luxury Upper Scale Upscale Upper Middle

Scale

Midscale Economy Independents US

2016 2017

Source: PWC Hospitality Directions May 2015

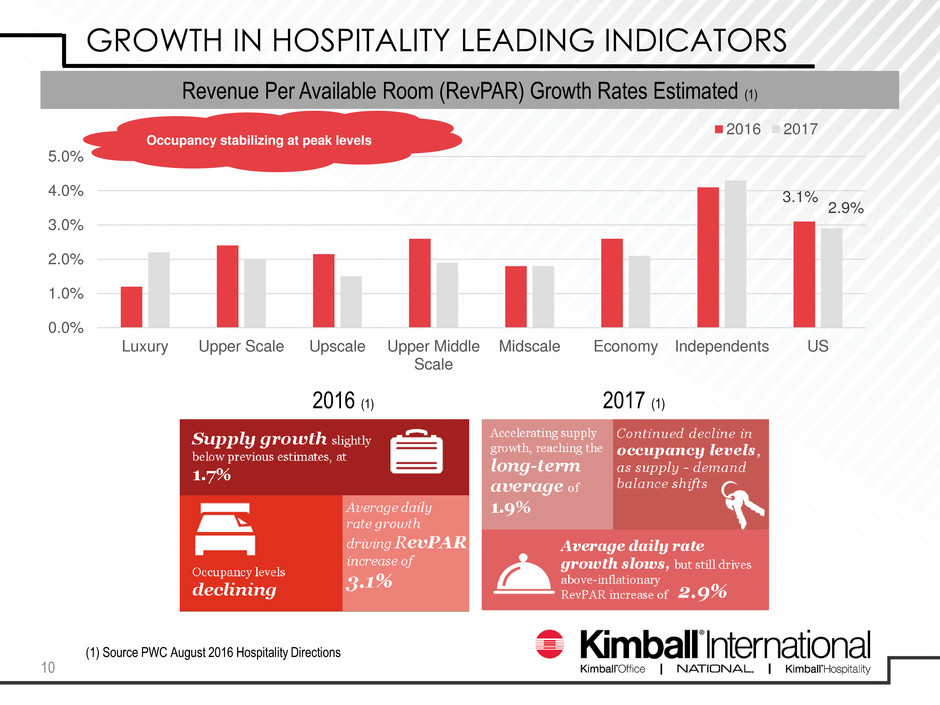

Revenue Per Available Room (RevPAR) Growth Rates Estimated (1)

Occupancy stabilizing at peak levels

GROWTH IN HOSPITALITY LEADING INDICATORS

10

2016 (1) 2017 (1)

(1) Source PWC August 2016 Hospitality Directions

KIMBALL INTERNATIONAL

FINANCIAL OVERVIEW

Basis of financial information is Continuing Operations

adjusted for certain non-operating

and non-core transactions for comparability. Financial

information included throughout is unaudited.

11

12

STRONG SALES GROWTH IN NEW PRODUCT INTRODUCTIONS

OFFICE FURNITURE (1)

5%

21%

26%

57%

33%

45%

54%

34%

0%

10%

20%

30%

40%

50%

60%

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

($ in millions)

(1) Unaudited

Year Over Year Growth

13

29% of

total

office

furniture

sales

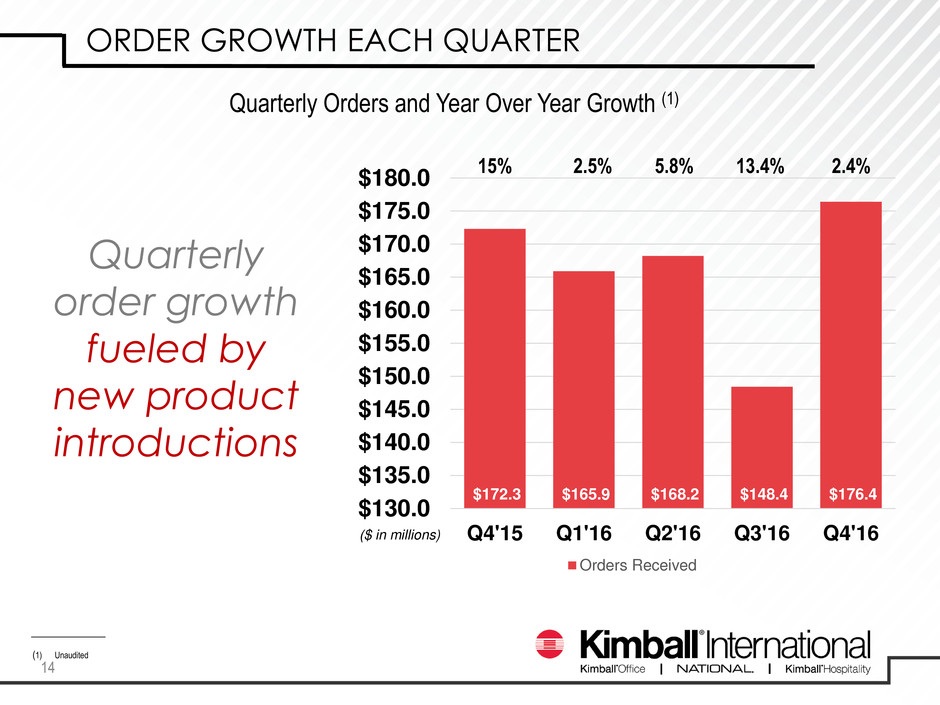

ORDER GROWTH EACH QUARTER

14

$172.3 $165.9 $168.2 $148.4 $176.4

$130.0

$135.0

$140.0

$145.0

$150.0

$155.0

$160.0

$165.0

$170.0

$175.0

$180.0

Q4'15 Q1'16 Q2'16 Q3'16 Q4'16

Orders Received

($ in millions)

(1) Unaudited

Quarterly Orders and Year Over Year Growth (1)

Quarterly

order growth

fueled by

new product

introductions

15% 2.5% 5.8% 13.4% 2.4%

ORDER TREND RELATIVE TO OFFICE FURNITURE MARKET

15

* Sales and order data are not available for the Hospitality furniture industry (BIFMA industry data excludes Hospitality

furniture). Therefore, to get a comparable industry comparison, sales and orders for the Hospitality vertical are excluded from

the Kimball International numbers presented in this graph.

7%

8%

13%

6% 6%

4%

2%

0% -1%

3%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

Q4'15 Q1'16 Q2'16 Q3'16 Q4'16

Orders *

Kimball Int'l (excluding Hospitality vertical)

Office Furniture Industry (BIFMA)

Growth in

orders

exceeded

industry

growth for

each of the

last 5 quarters

PROGRESS BEING MADE TOWARDS 8% TO 9%

OPERATING INCOME GUIDANCE

16

1.3%

-1.0%

2.0%

4.9%

6.4%

4.6%

4.0% 4.2%

6.6% 6.6%

7.5%

4.8%

6.7%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

2012 2013 2014 2015 2016 Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16

Fiscal Quarterly

Best Q3 in 10 years.

Seasonal lower

sales in Q3 results

in lower Operating

Healthcare cost

up $1.7M.

Impacted margin

by 100bps.

_____________________

(1) Unaudited. See Appendix for Non-GAAP reconciliation.

ADJUSTED FREE CASH FLOW(1)

17

_____________________

(1) Unaudited. Defined as adjusted net income, plus depreciation and amortization, less capital expenditures, plus non-cash stock compensation, plus

change in working capital. Adjusted net income is a non-GAAP measurement equal to GAAP net income excluding after-tax restructuring charges.

Fiscal Year 2016

Adjusted Net Income $25.7

Depreciation/Amortization 15.0

Capital Expenditures (16.2)

Non-Cash Stock Comp 5.5

Change in Working Capital 4.6

Adjusted Free Cash Flow $34.6

($ in millions)

18

CUMULATIVE QUARTERLY TOTAL RETURN

FINANCIAL OUTLOOK

19

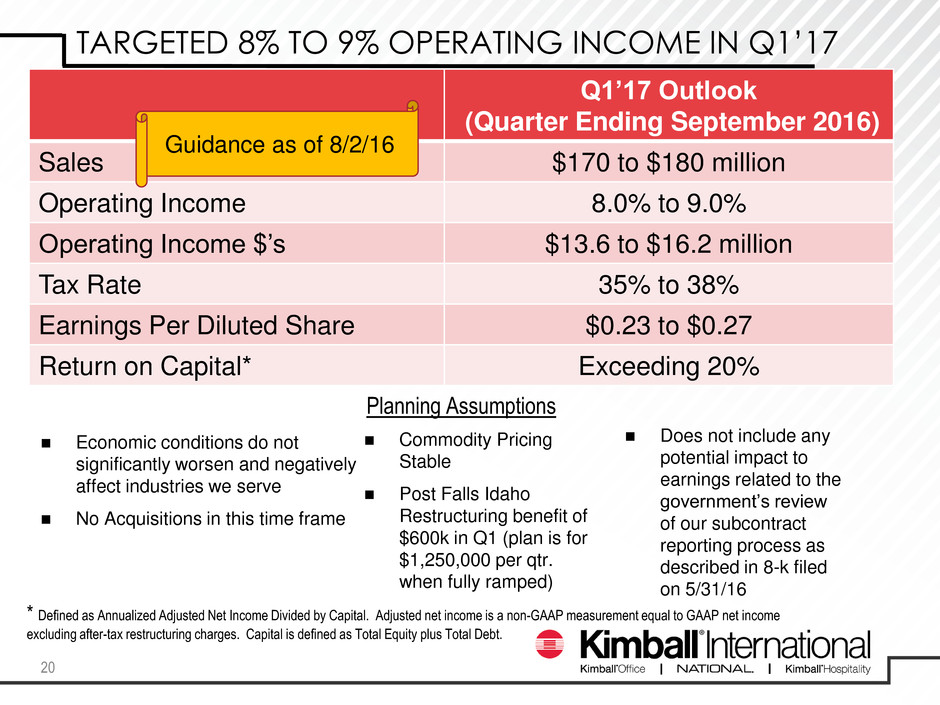

Q1’17 Outlook

(Quarter Ending September 2016)

Sales $170 to $180 million

Operating Income 8.0% to 9.0%

Operating Income $’s $13.6 to $16.2 million

Tax Rate 35% to 38%

Earnings Per Diluted Share $0.23 to $0.27

Return on Capital* Exceeding 20%

* Defined as Annualized Adjusted Net Income Divided by Capital. Adjusted net income is a non-GAAP measurement equal to GAAP net income

excluding after-tax restructuring charges. Capital is defined as Total Equity plus Total Debt.

Economic conditions do not

significantly worsen and negatively

affect industries we serve

No Acquisitions in this time frame

Commodity Pricing

Stable

Post Falls Idaho

Restructuring benefit of

$600k in Q1 (plan is for

$1,250,000 per qtr.

when fully ramped)

Planning Assumptions

TARGETED 8% TO 9% OPERATING INCOME IN Q1’17

20

Does not include any

potential impact to

earnings related to the

government’s review

of our subcontract

reporting process as

described in 8-k filed

on 5/31/16

Guidance as of 8/2/16

APPENDIX

21

ANNUAL NON-GAAP RECONCILIATION (UNAUDITED)

22

(millions $) 2013 2014 2015 2016

Operating Income from Continuing Operations -$10.6 $1.9 $17.3 $33.5

Add: Spin Cost – Included in SGA

Add: Restructuring

$1.5 $3.2

$5.3

$7.3

Adjusted Operating Income from Continuing Operations -$10.6 $3.4 $25.8 $40.8

Adjusted Operating Income from Continuing Operations as a % of Sales -2.1% .6% 4.3% 6.4%

Add: Employee Retirements – Included in SGA (1)

Add: Other Non-operational – Included in SGA (2)

Add: SERP –Included in SGA (3)

$5.0

$1.7

$6.8

-$.5

$2.6

$3.3

$0.6

Adjusted Pro Forma Operating Income from Continuing Operations before

External Reverse Synergies

-$3.9 $12.3 $29.7 $40.8

Deduct: External Reverse Synergies (4) -$1.3 -$1.2 -$0.4

Adjusted Pro Forma Operating Income from Continuing

Operations (4)

-$5.2 $11.1 $29.3 $40.8

Adjusted Pro Forma Operating Income from Continuing

Operations as a % of Sales

-1.0% 2.0% 4.9% 6.4%

_____________________

(1) Estimated cost associated with the retirement and separation of people due to spin. Costs include that for salary, incentive compensation, performance shares, retirement contribution, and payroll tax.

(2) Includes: pre-tax airplane write-off $1.2M and gain from sale of idle property of $1.7M in FY’14.

(3) SERP expense is added back to adjusted operating income because amount is offset in other income (expense) section of income statement. Net Income is not affected by SERP.

(4) Adjusted pro forma operating income includes external reverse synergies representing estimated increases to the cost structure necessitated by the split into two companies. For example, pre-spin Kimball had one board of directors, and such

costs were allocated to Furniture and Electronics. Post spin, there are two boards with each company experiencing a cost increase merely because of the separation. Other examples include IT expenditures and certain insurance cost among

others. The $1.3M per year reflected in the table above is a mid-point of a range estimated to be from $1.0M to $1.5M adjusting the adjusted pro forma operating income from continuing operations to reflect this estimated increase in cost

structure post spin. In addition to external cost, internal reverse synergy cost also exist and are embedded in the calculation of Operating Income from continuing operations reducing income. Different than external cost, these costs do not

have to be separately deducted in this reconciliation because by way of the discontinued operation calculation this cost increase remains within the computed Operating Income from continuing operations. As an example for this type of cost,

pre-spin Kimball had an SEC financial reporting function, and such costs were allocated to Furniture and Electronics. Post spin, there are two separate functions experiencing a cost increase as it takes more resource to perform this function

for two separate companies than one. This cost increase is estimated to be $500k to $1M. So in total, it is estimated that reverse synergy cost will increase cost structure post spin by $1.5 to $2.5M per year as already reflected in the

adjusted results included in the reconciliation above.

QUARTERLY NON-GAAP RECONCILIATION (UNAUDITED)

23

(millions $) Q4’15 Q1’16 Q2’16 Q3’16 Q4’16

Operating Income from Continuing Operations $8.6 $9.7 $10.0 $4.3 $9.5

Add: Spin Cost – Included in SGA

Add: Restructuring

$.2

$1.6

$1.2

$2.0

$2.8

$1.3

Adjusted Operating Income from Continuing Operations $10.4 $10.9 $12.0 $7.1 $10.8

Adjusted Operating Income from Continuing Operations as a % of Sales 6.5% 7.0% 7.3% 4.7% 6.6%

Add: SERP –Included in SGA (1) -$.6 $.3 $.1 $.2

Adjusted Pro Forma Operating Income from Continuing Operations $10.4 $10.3 $12.3 $7.2 $11.0

Adjusted Pro Forma Operating Income from Continuing Operations

as a % of Sales

6.6% 6.6% 7.5% 4.8% 6.7%

_____________________

(1) SERP expense is added back to adjusted operating income because amount is offset in other income (expense) section of income statement. Net Income is not affected by SERP.