Attached files

| file | filename |

|---|---|

| 8-K - 8-K - First Internet Bancorp | inbk-2016x09investorpresen.htm |

First Internet Bancorp

Investor Presentation

Second Quarter 2016

Exhibit 99.1

Forward Looking Statement

This presentation may contain forward-looking statements with respect to the financial condition, results of

operations, plans, objectives, future performance or business of the Company. Forward-looking statements

are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,”

“estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. Forward-looking statements

are not a guarantee of future performance or results, are based on information available at the time the

statements are made and involve known and unknown risks, uncertainties and other factors that could

cause actual results to differ materially from the information in the forward-looking statements. Factors that

may cause such differences include: failures of or interruptions in the communications and information

systems on which we rely to conduct our business; failure of our plans to grow our commercial real estate

and commercial and industrial loan portfolios; competition with national, regional and community financial

institutions; the loss of any key members of senior management; fluctuations in interest rates; general

economic conditions; risks relating to the regulation of financial institutions; and other factors identified in

reports we file with the SEC. All statements in this presentation, including forward-looking statements,

speak only as of the date they are made, and the Company undertakes no obligation to update any

statement in light of new information or future events.

2

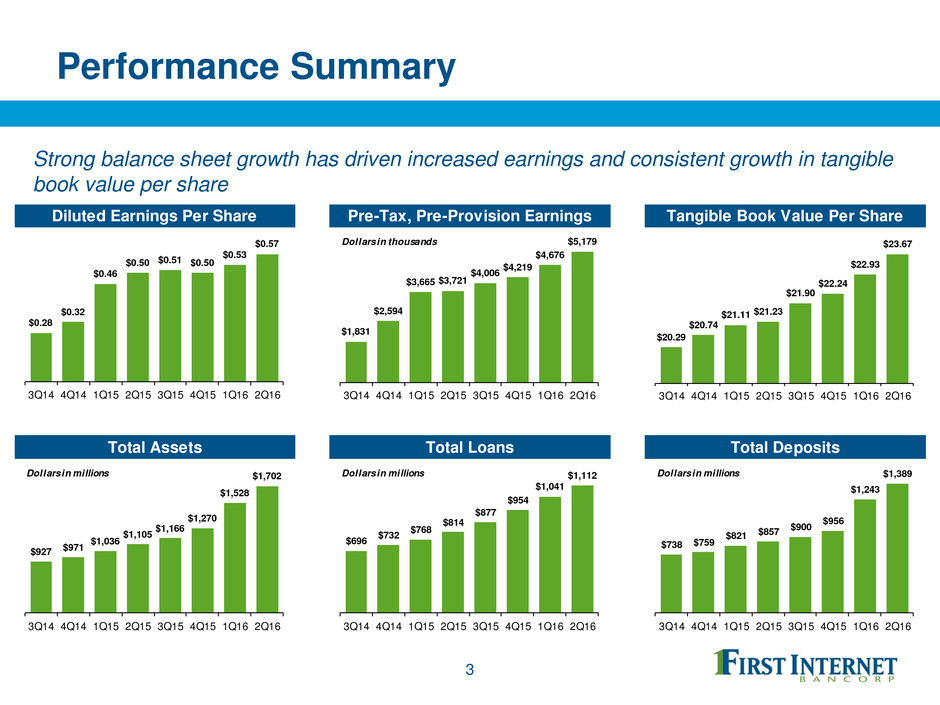

Performance Summary

3

Strong balance sheet growth has driven increased earnings and consistent growth in tangible

book value per share

Diluted Earnings Per Share Pre-Tax, Pre-Provision Earnings Tangible Book Value Per Share

Total Assets Total Loans Total Deposits

$0.28

$0.32

$0.46

$0.50 $0.51 $0.50

$0.53

$0.57

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

$1,831

$2,594

$3,665 $3,721

$4,006

$4,219

$4,676

$5,179

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Dollars in thousands

$927 $971

$1,036

$1,105

$1,166

$1,270

$1,528

$1,702

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Dollars in millions

$696

$732

$768

$814

$877

$954

$1,041

$1,112

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Dollars in millions

$20.29

$20.74

$21.11 $21.23

$21.90

$22.24

$22.93

$23.67

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

$738 $759

$821 $857

$900

$956

$1,243

$1,389

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Dollars in millions

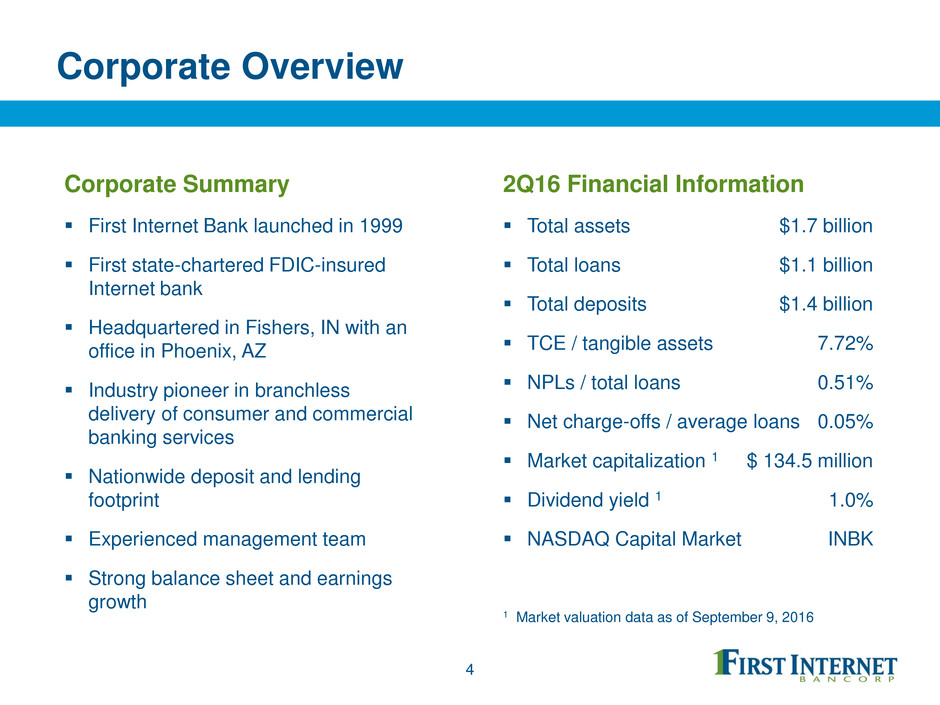

Corporate Overview

Corporate Summary

First Internet Bank launched in 1999

First state-chartered FDIC-insured

Internet bank

Headquartered in Fishers, IN with an

office in Phoenix, AZ

Industry pioneer in branchless

delivery of consumer and commercial

banking services

Nationwide deposit and lending

footprint

Experienced management team

Strong balance sheet and earnings

growth

4

2Q16 Financial Information

Total assets $1.7 billion

Total loans $1.1 billion

Total deposits $1.4 billion

TCE / tangible assets 7.72%

NPLs / total loans 0.51%

Net charge-offs / average loans 0.05%

Market capitalization 1 $ 134.5 million

Dividend yield 1 1.0%

NASDAQ Capital Market INBK

1 Market valuation data as of September 9, 2016

Strategic Objectives

Drive revenue growth and positive operating leverage

Achieve consistent strong profitability

Deploy capital in an accretive manner focused on building shareholder value

Capitalize on consumer trends by capturing greater deposit market share among

digital banking adopters

Maintain strong asset quality and focus on disciplined risk management

Expand asset generation channels to supplement growth and increase

profitability

Continue investing in technology to remain a digital banking leader and increase

efficiency

5

6

Corporate Recognition

First Internet Bank has been recognized for its innovation and is consistently ranked among

the best banks to work for, enhancing its ability to attract and retain top-level talent

TechPoint 2016 Mira Award “Tech-enabled

Company of the Year”

Top 10 finalist – 2016 Indiana Public Company of

the year presented by the CFA Society and FEI

American Banker’s “Best Banks to Work For”

2016

2015

2014

2013

Workplace Dynamics’ “Indianapolis Star Top

Workplaces”

2016

2015

2014

“Best Places to Work in Indiana”

2016

2013

Mortgage Technology 2013 awarded top honors

in the Online Mortgage Originator category

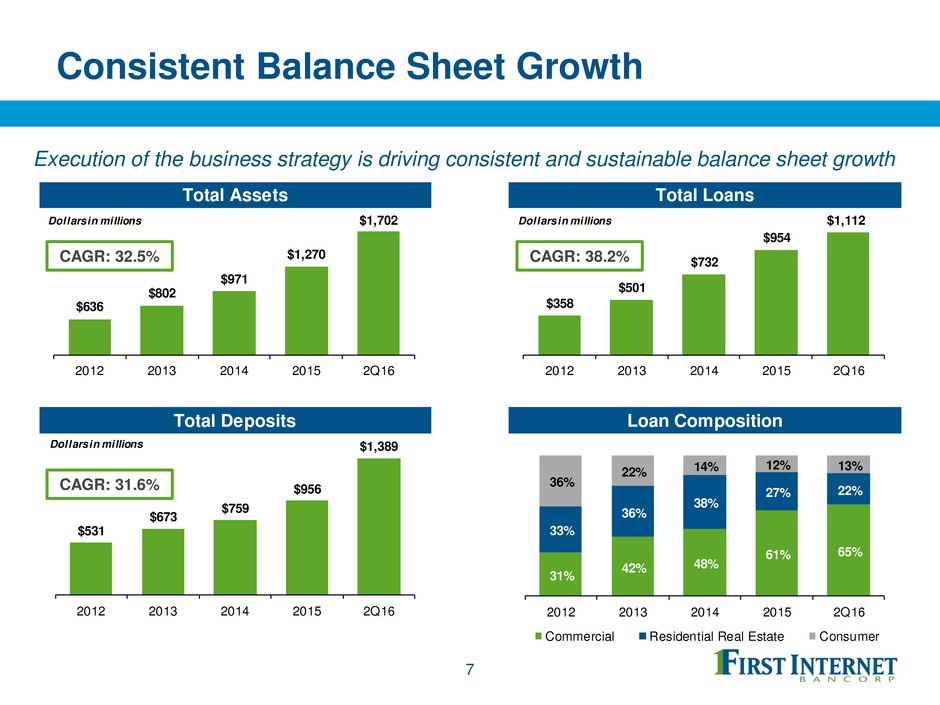

Consistent Balance Sheet Growth

7

Execution of the business strategy is driving consistent and sustainable balance sheet growth

Total Assets Total Loans

Total Deposits Loan Composition

$636

$802

$971

$1,270

$1,702

2012 2013 2014 2015 2Q16

Dollars in millions

$358

$501

$732

$954

$1,112

2012 2013 2014 2015 2Q16

Dollars in millions

$531

$673

$759

$956

$1,389

2012 2013 2014 2015 2Q16

Dollars in millions

31%

42% 48%

61% 65%

33%

36%

38%

27% 22%

36%

22% 14%

12% 13%

2012 2013 2014 2015 2Q16

Commercial Residential Real Estate Consumer

CAGR: 32.5% CAGR: 38.2%

CAGR: 31.6%

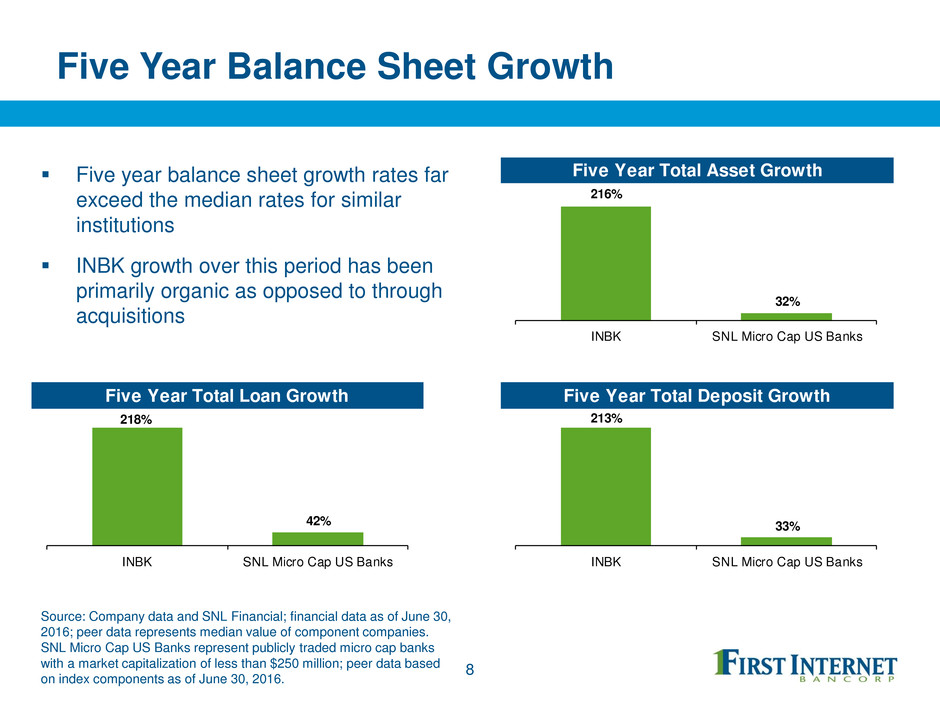

Five Year Balance Sheet Growth

Five year balance sheet growth rates far

exceed the median rates for similar

institutions

INBK growth over this period has been

primarily organic as opposed to through

acquisitions

8

Source: Company data and SNL Financial; financial data as of June 30,

2016; peer data represents median value of component companies.

SNL Micro Cap US Banks represent publicly traded micro cap banks

with a market capitalization of less than $250 million; peer data based

on index components as of June 30, 2016.

Five Year Total Asset Growth

Five Year Total Loan Growth Five Year Total Deposit Growth

218%

42%

INBK SNL Micro Cap US Banks

213%

33%

INBK SNL Micro Cap US Banks

216%

32%

INBK SNL Micro Cap US Banks

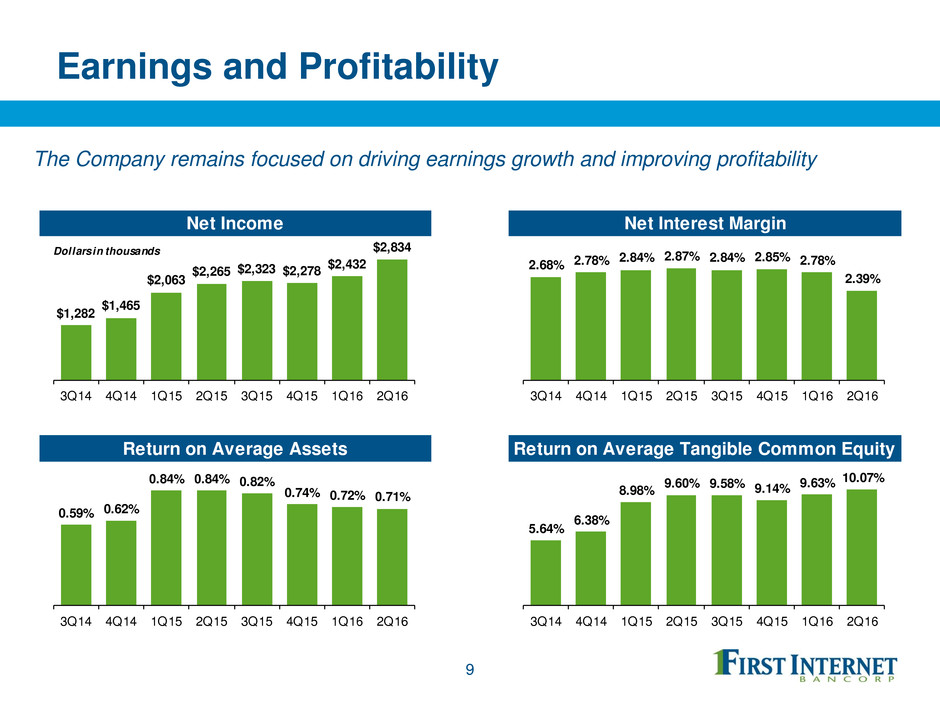

Earnings and Profitability

9

The Company remains focused on driving earnings growth and improving profitability

Net Income Net Interest Margin

Return on Average Assets Return on Average Tangible Common Equity

$1,282

$1,465

$2,063

$2,265 $2,323 $2,278

$2,432

$2,834

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Dollars in thousands

2.68% 2.78%

2.84% 2.87% 2.84% 2.85% 2.78%

2.39%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

0.59% 0.62%

0.84% 0.84% 0.82%

0.74% 0.72% 0.71%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

5.64%

6.38%

8.98%

9.60% 9.58% 9.14% 9.63%

10.07%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

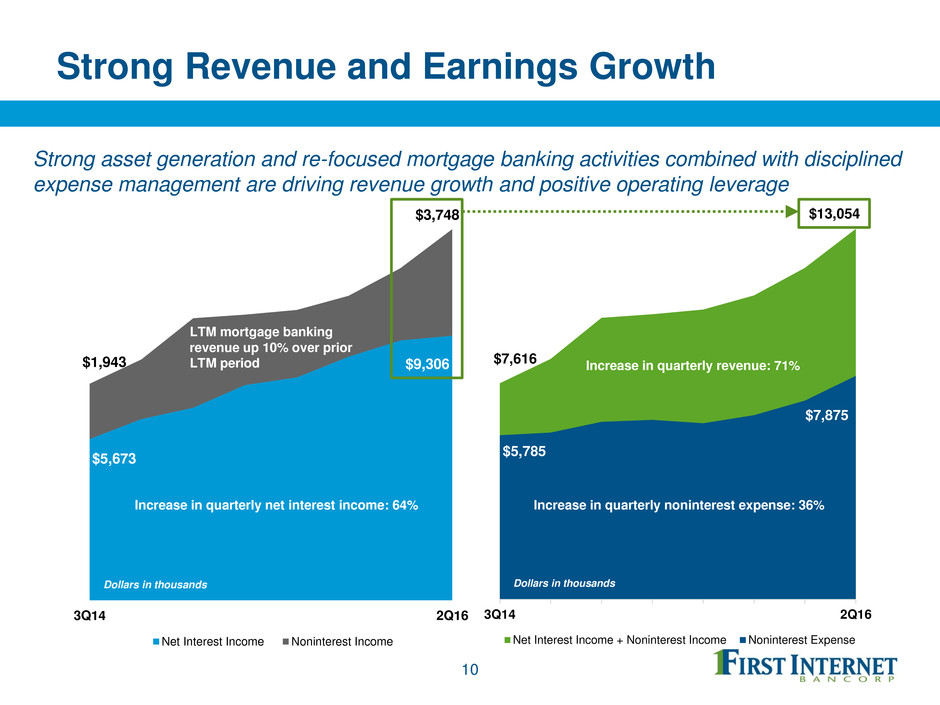

Strong Revenue and Earnings Growth

10

Strong asset generation and re-focused mortgage banking activities combined with disciplined

expense management are driving revenue growth and positive operating leverage

$7,616

$13,054

$5,785

$7,875

3Q14 2Q16

Net Interest Income + Noninterest Income Noninterest Expense

Dollars in thousands

Increase in quarterly noninterest expense: 36%

Increase in quarterly revenue: 71%

$5,673

$9,306 $1,943

$3,748

3Q14 2Q16

Net Interest Income Noninterest Income

Dollars in thousands

Increase in quarterly net interest income: 64%

LTM mortgage banking

revenue up 10% over prior

LTM period

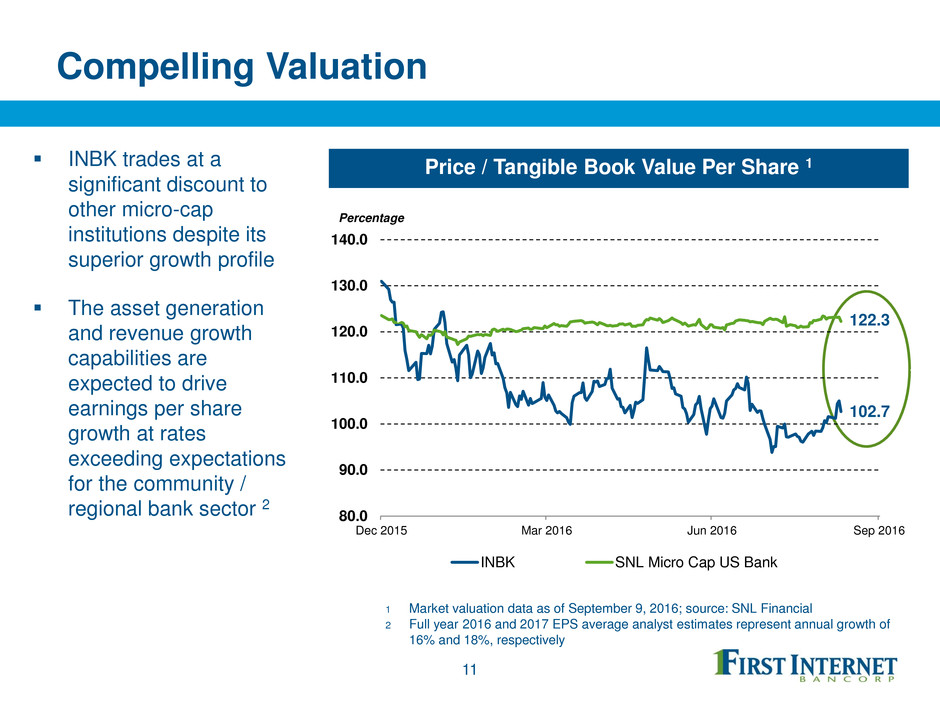

Compelling Valuation

INBK trades at a

significant discount to

other micro-cap

institutions despite its

superior growth profile

The asset generation

and revenue growth

capabilities are

expected to drive

earnings per share

growth at rates

exceeding expectations

for the community /

regional bank sector 2

11

Price / Tangible Book Value Per Share 1

1 Market valuation data as of September 9, 2016; source: SNL Financial

2 Full year 2016 and 2017 EPS average analyst estimates represent annual growth of

16% and 18%, respectively

80.0

90.0

100.0

110.0

120.0

130.0

140.0

Dec 2015 Mar 2016 Jun 2016 Sep 2016

INBK SNL Micro Cap US Bank

Percentage

122.3

102.7

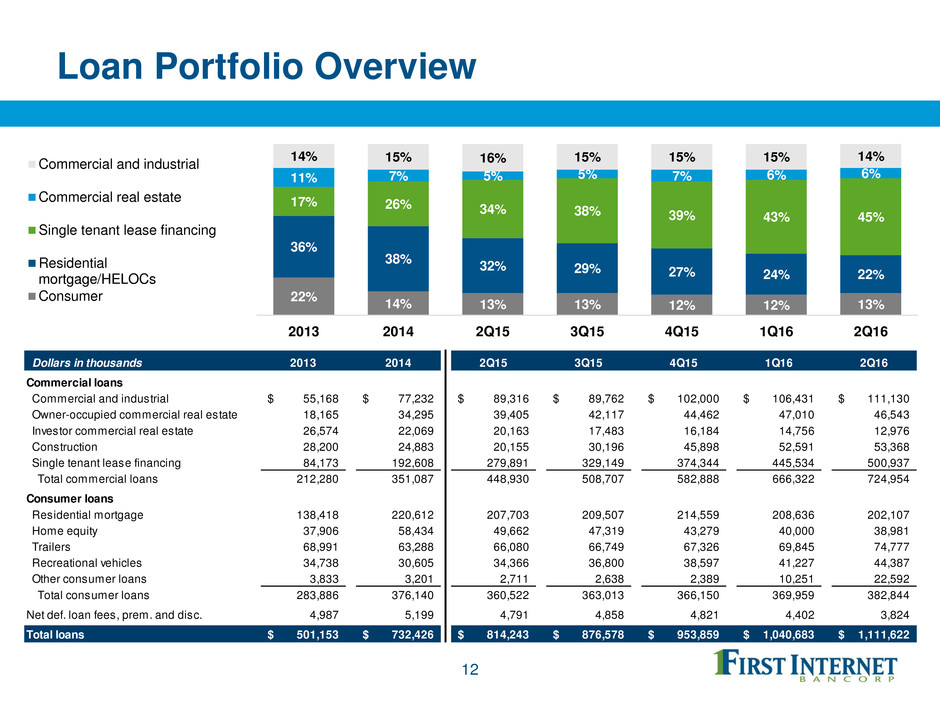

Loan Portfolio Overview

12

Dollars in thousands 2013 2014 2Q15 3Q15 4Q15 1Q16 2Q16

Commercial loans

Commercial and industrial 55,168$ 77,232$ 89,316$ 89,762$ 102,000$ 106,431$ 111,130$

Owner-occupied commercial real estate 18,165 34,295 39,405 42,117 44,462 47,010 46,543

Investor commercial real estate 26,574 22,069 20,163 17,483 16,184 14,756 12,976

Construction 28,200 24,883 20,155 30,196 45,898 52,591 53,368

Single tenant lease financing 84,173 192,608 279,891 329,149 374,344 445,534 500,937

Total commercial loans 212,280 351,087 448,930 508,707 582,888 666,322 724,954

Consumer loans

Residential mortgage 138,418 220,612 207,703 209,507 214,559 208,636 202,107

Home equity 37,906 58,434 49,662 47,319 43,279 40,000 38,981

Trailers 68,991 63,288 66,080 66,749 67,326 69,845 74,777

Recreational vehicles 34,738 30,605 34,366 36,800 38,597 41,227 44,387

Other consumer loans 3,833 3,201 2,711 2,638 2,389 10,251 22,592

Total consumer loans 283,886 376,140 360,522 363,013 366,150 369,959 382,844

Net def. loan fees, prem. and disc. 4,987 5,199 4,791 4,858 4,821 4,402 3,824

Total loans 501,153$ 732,426$ 814,243$ 876,578$ 953,859$ 1,040,683$ 1,111,622$

22%

14% 13% 13% 12% 12% 1 %

36%

38%

32% 29% 27% 24% 22%

17% 26% 34% 8% 9% 3% 45%

11% 7% 5% 5% 7% 6% 6%

14% 15% 16% 15 15% 15% 14

2013 2014 2Q15 3Q15 4Q15 1Q16 2Q16

Commercial and industrial

Commercial real estate

Single tenant lease financing

Residential

mortg ge/HELOCs

Consumer

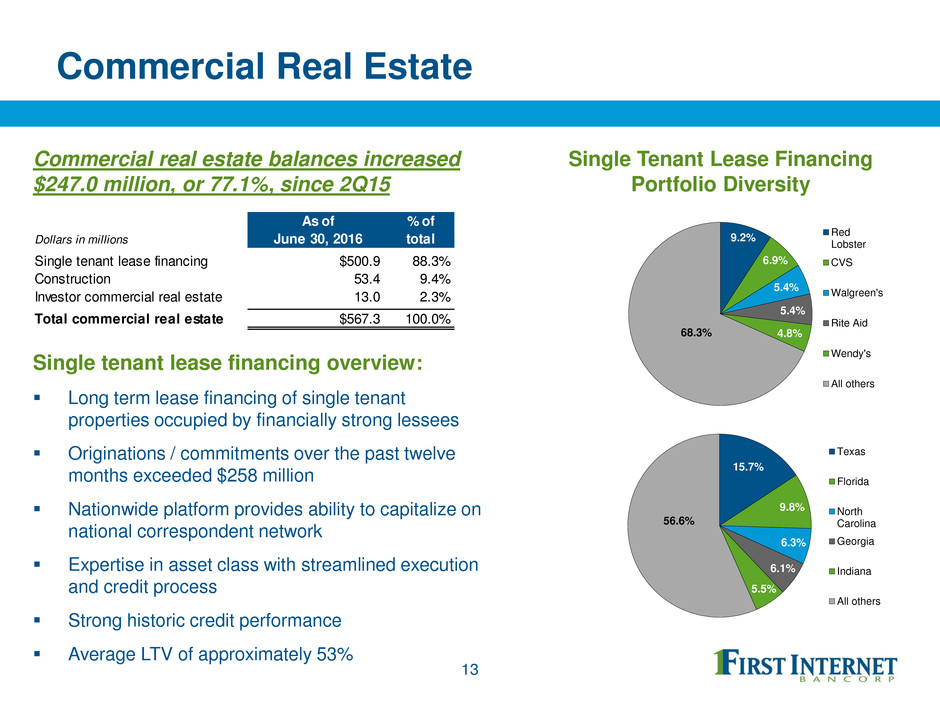

Commercial Real Estate

Single tenant lease financing overview:

Long term lease financing of single tenant

properties occupied by financially strong lessees

Originations / commitments over the past twelve

months exceeded $258 million

Nationwide platform provides ability to capitalize on

national correspondent network

Expertise in asset class with streamlined execution

and credit process

Strong historic credit performance

Average LTV of approximately 53%

13

Commercial real estate balances increased

$247.0 million, or 77.1%, since 2Q15

Single Tenant Lease Financing

Portfolio Diversity

As of % of

Dollars in millions June 30, 2016 total

Single tenant lease financing $500.9 88.3%

Construction 53.4 9.4%

Investor commercial real estate 13.0 2.3%

Total commercial real estate $567.3 100.0%

9.2%

6.9%

5.4%

5.4%

4.8%68.3%

Red

Lobster

CVS

Walgreen's

Rite Aid

Wendy's

All others

15.7%

9.8%

6.3%

6.1%

5.5%

56.6%

Texas

Florida

North

Carolina

Georgia

Indiana

All others

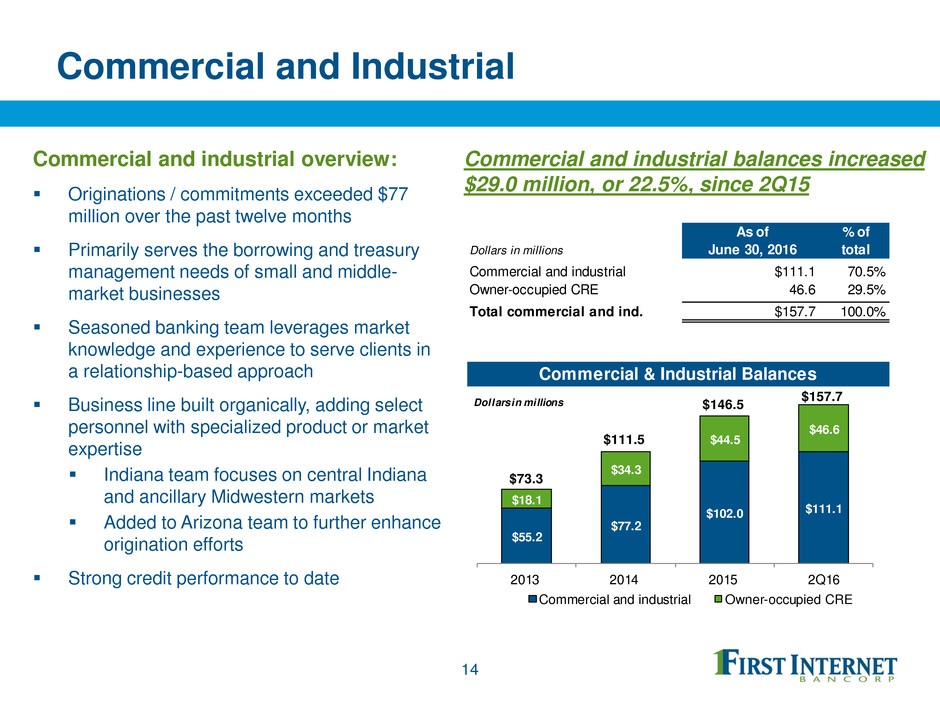

Commercial and Industrial

Commercial and industrial overview:

Originations / commitments exceeded $77

million over the past twelve months

Primarily serves the borrowing and treasury

management needs of small and middle-

market businesses

Seasoned banking team leverages market

knowledge and experience to serve clients in

a relationship-based approach

Business line built organically, adding select

personnel with specialized product or market

expertise

Indiana team focuses on central Indiana

and ancillary Midwestern markets

Added to Arizona team to further enhance

origination efforts

Strong credit performance to date

14

Commercial and industrial balances increased

$29.0 million, or 22.5%, since 2Q15

As of % of

Dollars in millions June 30, 2016 total

Commercial and industrial $111.1 70.5%

Owner-occupied CRE 46.6 29.5%

Total commercial and ind. $157.7 100.0%

Commercial & Industrial Balances

$55.2

$77.2

$102.0 $111.1

$18.1

$34.3

$44.5

$46.6

2013 2014 2015 2Q16

Commercial and industrial Owner-occupied CRE

Dollars in millions

$73.3

$111.5

$146.5

$157.7

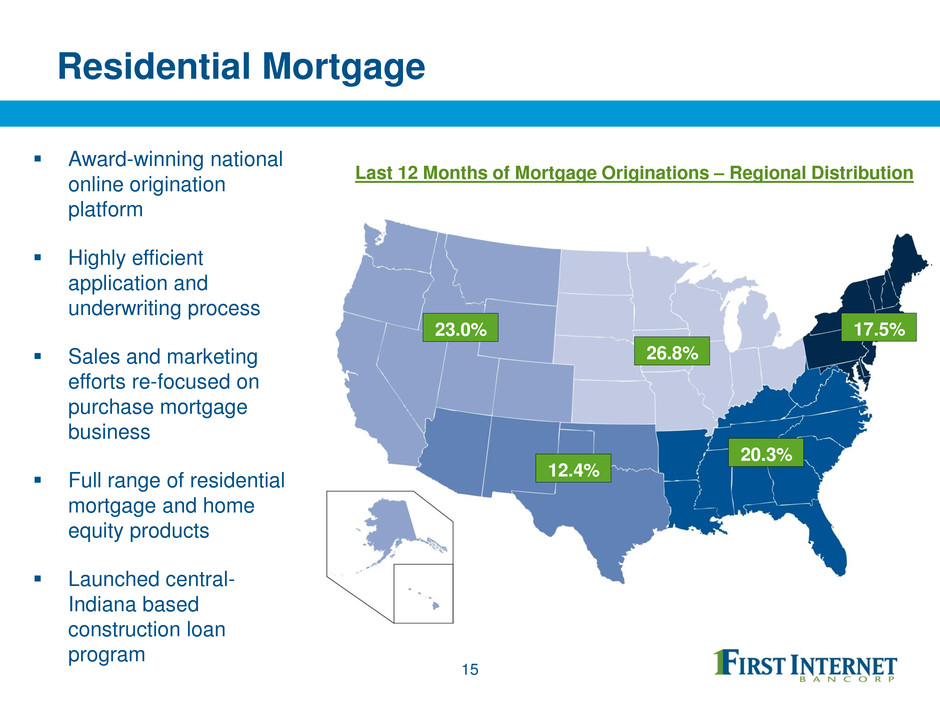

Residential Mortgage

15

Last 12 Months of Mortgage Originations – Regional Distribution

Award-winning national

online origination

platform

Highly efficient

application and

underwriting process

Sales and marketing

efforts re-focused on

purchase mortgage

business

Full range of residential

mortgage and home

equity products

Launched central-

Indiana based

construction loan

program

23.0%

12.4%

26.8%

20.3%

17.5%

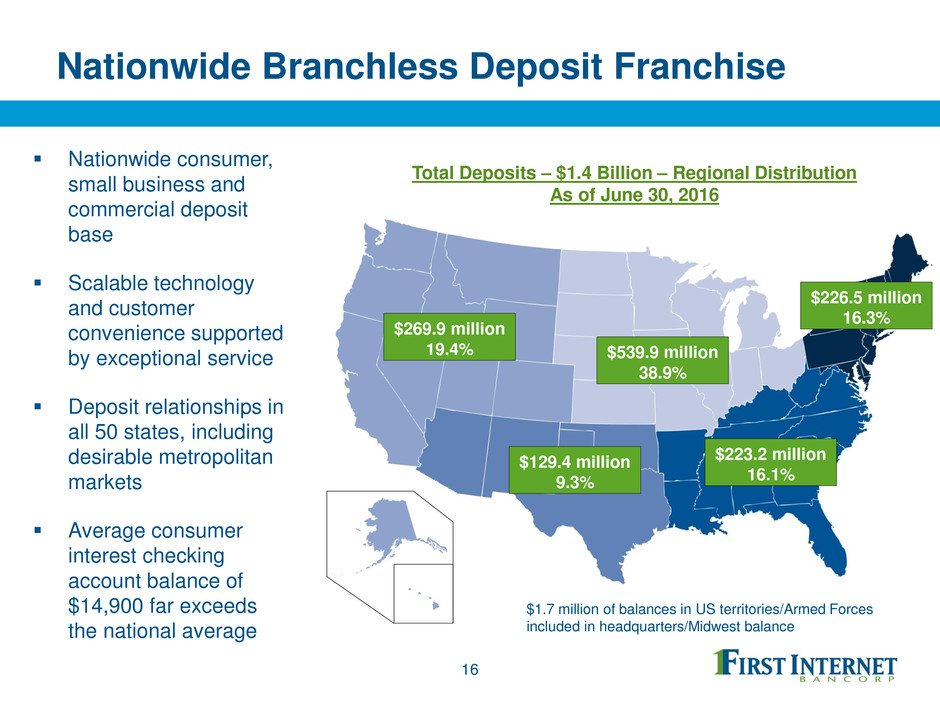

Nationwide Branchless Deposit Franchise

16

Total Deposits – $1.4 Billion – Regional Distribution

As of June 30, 2016

Nationwide consumer,

small business and

commercial deposit

base

Scalable technology

and customer

convenience supported

by exceptional service

Deposit relationships in

all 50 states, including

desirable metropolitan

markets

Average consumer

interest checking

account balance of

$14,900 far exceeds

the national average

$269.9 million

19.4%

$129.4 million

9.3%

$539.9 million

38.9%

$223.2 million

16.1%

$226.5 million

16.3%

$1.7 million of balances in US territories/Armed Forces

included in headquarters/Midwest balance

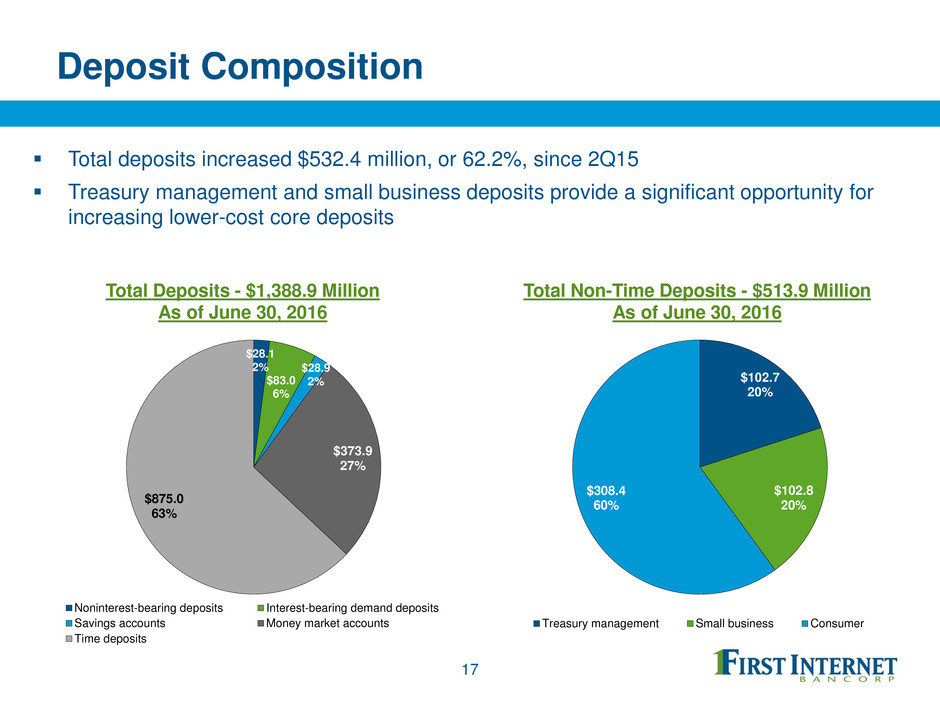

Deposit Composition

Total deposits increased $532.4 million, or 62.2%, since 2Q15

Treasury management and small business deposits provide a significant opportunity for

increasing lower-cost core deposits

17

Total Deposits - $1,388.9 Million

As of June 30, 2016

Total Non-Time Deposits - $513.9 Million

As of June 30, 2016

$28.1

2%

$83.0

6%

$28.9

2%

$373.9

27%

$875.0

63%

Noninterest-bearing deposits Interest-bearing demand deposits

Savings accounts Money market accounts

Time deposits

$102.7

20%

$102.8

20%

$308.4

60%

Treasury management Small business Consumer

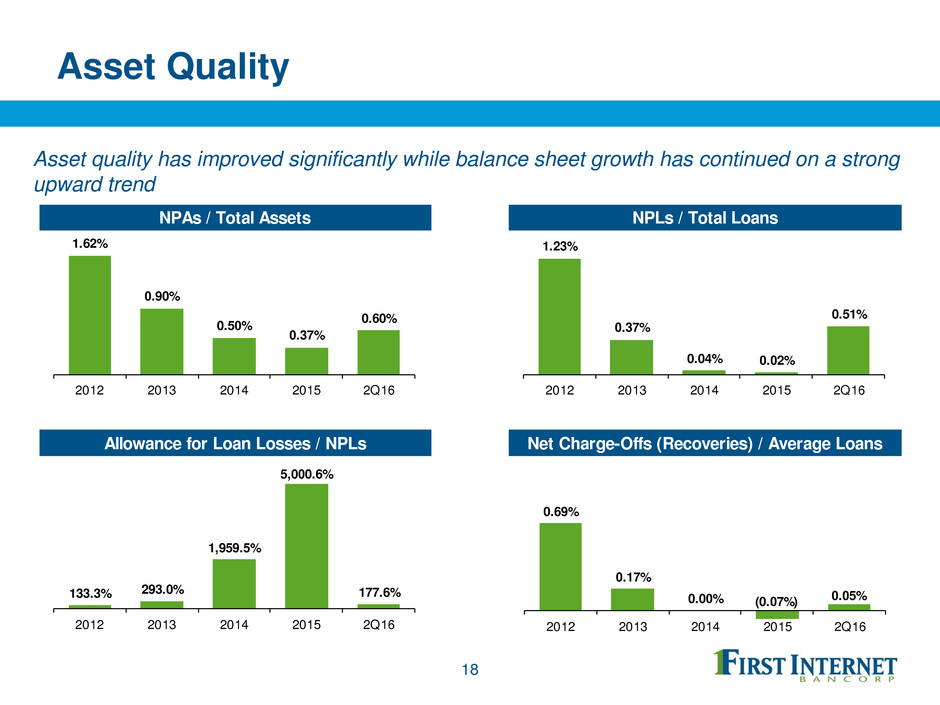

Asset Quality

18

Asset quality has improved significantly while balance sheet growth has continued on a strong

upward trend

NPAs / Total Assets NPLs / Total Loans

Allowance for Loan Losses / NPLs Net Charge-Offs (Recoveries) / Average Loans

1.62%

0.90%

0.50%

0.37%

0.60%

2012 2013 2014 2015 2Q16

1.23%

0.37%

0.04% 0.02%

0.51%

2012 2013 2014 2015 2Q16

133.3% 293.0%

1,959.5%

5,000.6%

177.6%

2012 2013 2014 2015 2Q16

0.69%

0.17%

0.00% (0.07%) 0.05%

2012 2013 2014 2015 2Q16

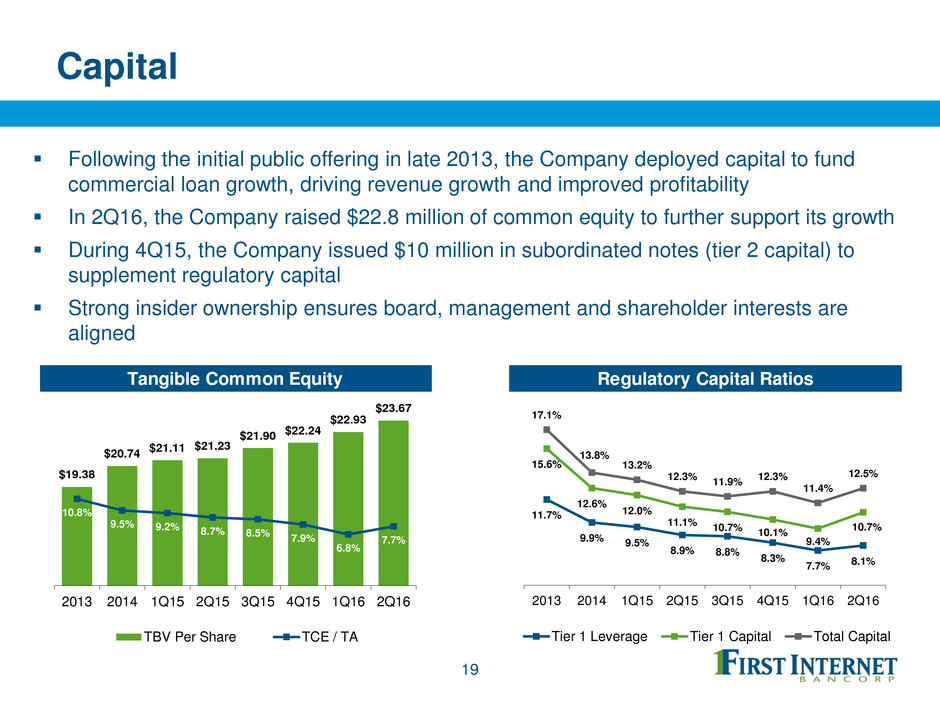

Capital

19

Following the initial public offering in late 2013, the Company deployed capital to fund

commercial loan growth, driving revenue growth and improved profitability

In 2Q16, the Company raised $22.8 million of common equity to further support its growth

During 4Q15, the Company issued $10 million in subordinated notes (tier 2 capital) to

supplement regulatory capital

Strong insider ownership ensures board, management and shareholder interests are

aligned

Tangible Common Equity Regulatory Capital Ratios

11.7%

9.9% 9.5%

8.9% 8.8%

8.3%

7.7% 8.1%

15.6%

12.6%

12.0%

11.1%

10.7% 10.1%

9.4%

10.7%

17.1%

13.8%

13.2%

12.3%

11.9%

12.3%

11.4%

12.5%

2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Tier 1 Leverage Tier 1 Capital Total Capital

$19.38

$20.74 $21.11

$21.23

$21.90 $22.24

$22.93

$23.67

10.8%

9.5% 9.2% 8.7% 8.5%

7.9%

6.8%

7.7%

2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

TBV Per Share TCE / TA

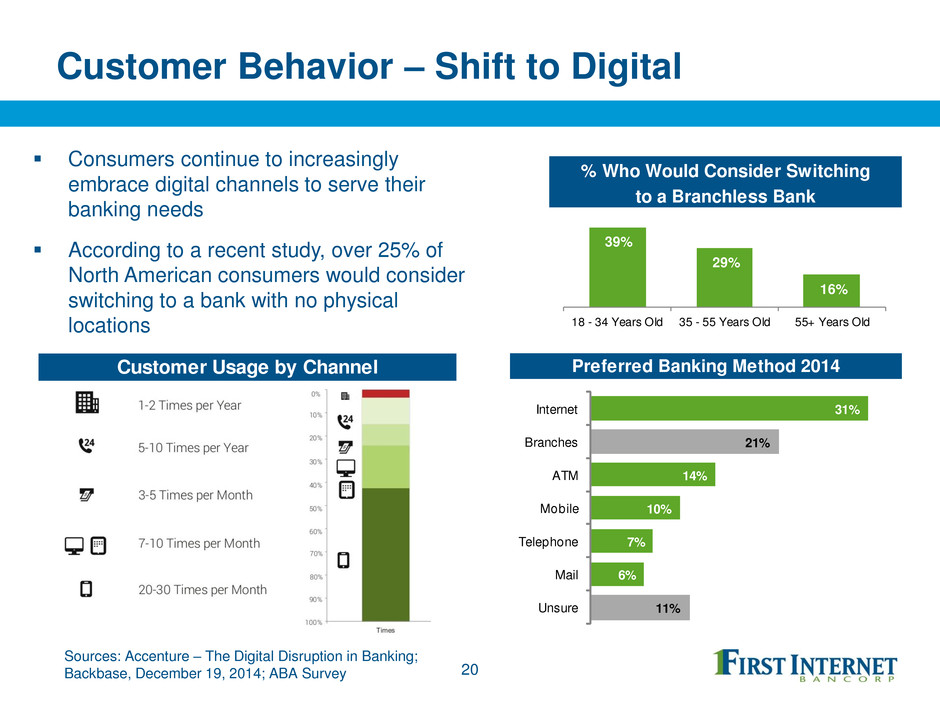

Customer Behavior – Shift to Digital

Consumers continue to increasingly

embrace digital channels to serve their

banking needs

According to a recent study, over 25% of

North American consumers would consider

switching to a bank with no physical

locations

20

Sources: Accenture – The Digital Disruption in Banking;

Backbase, December 19, 2014; ABA Survey

Customer Usage by Channel

Preferred Banking Method 2014

31%

21%

14%

10%

7%

6%

11%

Internet

Branches

ATM

Mobile

Telephone

Mail

Unsure

% Who Would Consider Switching

to a Branchless Bank

39%

29%

16%

18 - 34 Years Old 35 - 55 Years Old 55+ Years Old

Investment Summary

Strong earnings growth and rapidly improving profitability

Demonstrated track record of deploying capital to fuel loan growth while

maintaining strong asset quality

Investments in commercial lending platform are producing results

Geographic and credit product diversity provide ability to generate sustained

balance sheet growth

Consumer banking platform well-positioned to capitalize on changing consumer

preferences

Full service, technology-driven model will deliver increasing efficiency

Experienced management team committed to building shareholder value

21

First Internet Bancorp

Investor Presentation

Second Quarter 2016