Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - PG&E Corp | ex99_2.htm |

| 8-K - PG&E CORPORATION 8-K 8-30-2016 - PG&E Corp | form8k.htm |

Exhibit 99.1

Post Test-Year Ratemaking2017 GRC Public WorkshopAugust 30, 2016

2017 - 2019 Summary PG&E Forecast PG&E Forecast PG&E Forecast Settlement Settlement Settlement 2017 2018 2019 2017 2018 2019 Capital-Related RRQ $5,030 $5,392 $5,664 $4,946 $5,304 $5,582 Rate Base $24,541 $25,708 $26,937 $24,331 $25,379 $26,328 Capital Additions $4,083 $3,880 $4,206 $3,920 $3,655 $3,578 Expense RRQ $3,205 $3,310 $3,406 $3,058 $3,145 $3,228 Escalation Rates Labor 3.20% 3.34% 3.20% 2.40% 2.40% 2.40% Material Global Insight Global Insight Global Insight Global Insight Global Insight Global Insight Medical N/A 5.01% 1.52% N/A 3.90% 3.80% Total RRQ $8,235 $8,702 $9,070 $8,004 $8,449 $8,810 (Millions of Nominal Dollars) * Consistent with capital expenditures shown in Appendix A, capital additions include cost of removal, capitalized pension contributions and common and general. Capitalized pension contributions and the non-GRC components of common and general are excluded from PG&E’s authorized GRC capital revenue requirements and rate base.

2017 - 2019 Summary PG&E Forecast PG&E Forecast Settlement Settlement 2018 2019 2018 2019 Capital-Related RRQ Increase $363 $272 $358 $277 Taxes $135 $38 $151 $85 Depreciation $134 $135 $123 $116 Return $94 $99 $84 $76 Expense RRQ Increase $104 $96 $86 $84 Labor Escalation $51 $51 $36 $37 Medical Escalation $9 $3 $7 $7 Materials & Contract $36 $34 $35 $33 Payroll, Business Tax & Other $8 $8 $8 $7 Total $467 $368 $444 $361 (Millions of Nominal Dollars) *

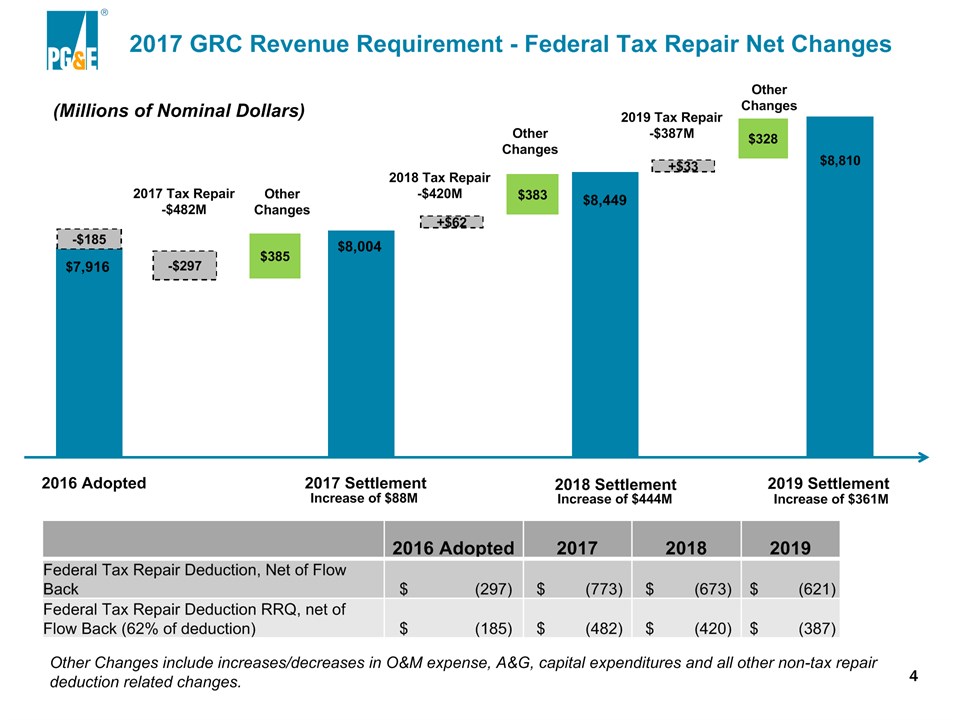

-$185 $7,916 2016 Adopted 2017 Settlement $385 $8,004 -$297 +$62 2018 Tax Repair-$420M $383 2017 Tax Repair-$482M Other Changes Other Changes $8,449 2018 Settlement +$33 2019 Tax Repair-$387M $328 Other Changes $8,810 2019 Settlement 2016 Adopted 2017 2018 2019 Federal Tax Repair Deduction, Net of Flow Back $ (297) $ (773) $ (673) $ (621) Federal Tax Repair Deduction RRQ, net of Flow Back (62% of deduction) $ (185) $ (482) $ (420) $ (387) 2017 GRC Revenue Requirement - Federal Tax Repair Net Changes Increase of $88M Increase of $444M Increase of $361M (Millions of Nominal Dollars) Other Changes include increases/decreases in O&M expense, A&G, capital expenditures and all other non-tax repair deduction related changes. *