Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - ABERCROMBIE & FITCH CO /DE/ | a2016q2anftranscriptfina.htm |

| EX-99.2 - EXHIBIT 99.2 - ABERCROMBIE & FITCH CO /DE/ | q22016quarterlyhistory.htm |

| EX-99.1 - EXHIBIT 99.1 - ABERCROMBIE & FITCH CO /DE/ | q22016earningsrelease.htm |

| 8-K - 8-K - ABERCROMBIE & FITCH CO /DE/ | a8-30x16form8xkxearningsre.htm |

INVESTOR PRESENTATION

2016 SECOND QUARTER

2

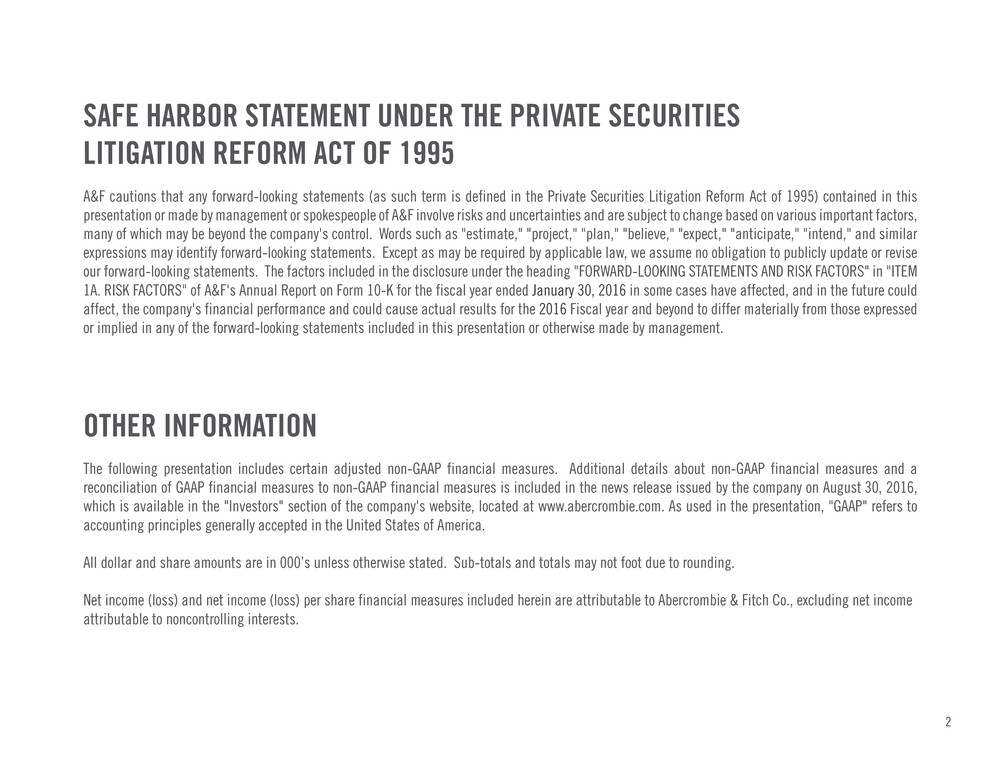

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this

presentation or made by management or spokespeople of A&F involve risks and uncertainties and are subject to change based on various important factors,

many of which may be beyond the company's control. Words such as "estimate," "project," "plan," "believe," "expect," "anticipate," "intend," and similar

expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise

our forward-looking statements. The factors included in the disclosure under the heading "FORWARD-LOOKING STATEMENTS AND RISK FACTORS" in "ITEM

1A. RISK FACTORS" of A&F's Annual Report on Form 10-K for the fiscal year ended January 30, 2016 in some cases have affected, and in the future could

affect, the company's financial performance and could cause actual results for the 2016 Fiscal year and beyond to differ materially from those expressed

or implied in any of the forward-looking statements included in this presentation or otherwise made by management.

OTHER INFORMATION

The following presentation includes certain adjusted non-GAAP financial measures. Additional details about non-GAAP financial measures and a

reconciliation of GAAP financial measures to non-GAAP financial measures is included in the news release issued by the company on August 30, 2016,

which is available in the "Investors" section of the company's website, located at www.abercrombie.com. As used in the presentation, "GAAP" refers to

accounting principles generally accepted in the United States of America.

All dollar and share amounts are in 000’s unless otherwise stated. Sub-totals and totals may not foot due to rounding.

Net income (loss) and net income (loss) per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income

attributable to noncontrolling interests.

3

Q2 ADJUSTED P&L SUMMARY*

* The Q2 Adjusted P&L Summary for the current and prior periods is presented on an adjusted non-GAAP basis, and excludes the effect of certain items set out on page 4.

2016 % OF NET SALES 2015 % OF NET SALES

NET SALES $783,160 100.0% $817,756 100.0%

GROSS PROFIT 477,107 60.9% 507,241 62.0%

OPERATING EXPENSE 493,838 63.1% 490,753 60.0%

OPERATING INCOME (LOSS) (16,731) -2.1% 16,488 2.0%

INTEREST EXPENSE, NET 4,741 0.6% 4,567 0.6%

INCOME (LOSS) BEFORE TAXES (21,472) -2.7% 11,921 1.5%

TAX EXPENSE (BENEFIT) (5,762) -0.7% 1,902 0.2%

NET INCOME (LOSS) $(16,808) -2.1% $8,597 1.1%

NET INCOME (LOSS) PER SHARE

BASIC $(0.25) $0.12

DILUTED $(0.25) $0.12

WEIGHTED-AVERAGE SHARES

OUTSTANDING

BASIC 67,944 69,713

DILUTED 67,944 70,094

4

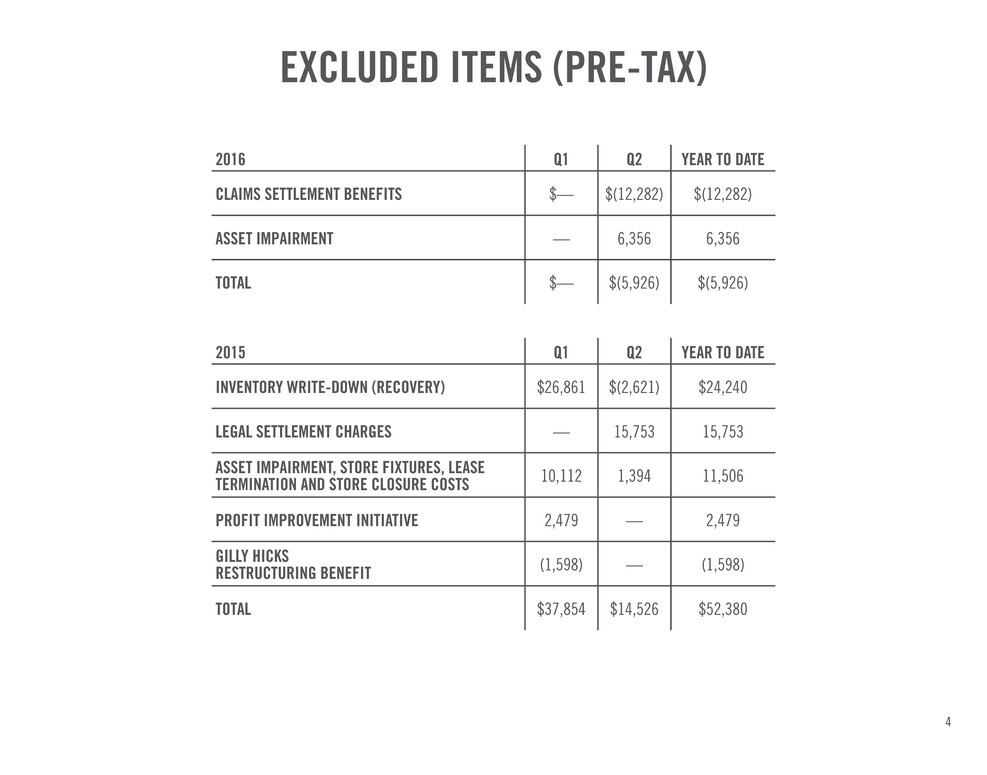

EXCLUDED ITEMS (PRE-TAX)

2016 Q1 Q2 YEAR TO DATE

CLAIMS SETTLEMENT BENEFITS $— $(12,282) $(12,282)

ASSET IMPAIRMENT — 6,356 6,356

TOTAL $— $(5,926) $(5,926)

2015 Q1 Q2 YEAR TO DATE

INVENTORY WRITE-DOWN (RECOVERY) $26,861 $(2,621) $24,240

LEGAL SETTLEMENT CHARGES — 15,753 15,753

ASSET IMPAIRMENT, STORE FIXTURES, LEASE

TERMINATION AND STORE CLOSURE COSTS 10,112 1,394 11,506

PROFIT IMPROVEMENT INITIATIVE 2,479 — 2,479

GILLY HICKS

RESTRUCTURING BENEFIT (1,598) — (1,598)

TOTAL $37,854 $14,526 $52,380

5

Q1 Q2 YTD

TOTAL COMPANY (4)% (4)% (4)%

BRAND:

ABERCROMBIE (1) (8)% (7)% (7)%

HOLLISTER 0% (2)% (1)%

GEOGRAPHY:

UNITED STATES (2)% (4)% (3)%

INTERNATIONAL (7)% (4)% (5)%

Q2 2016 COMPARABLE SALES*

* Comparable sales are calculated on a constant currency basis. Sales include store and DTC sales.

(1) Abercrombie includes the company's Abercrombie & Fitch and abercrombie kids brands.

6

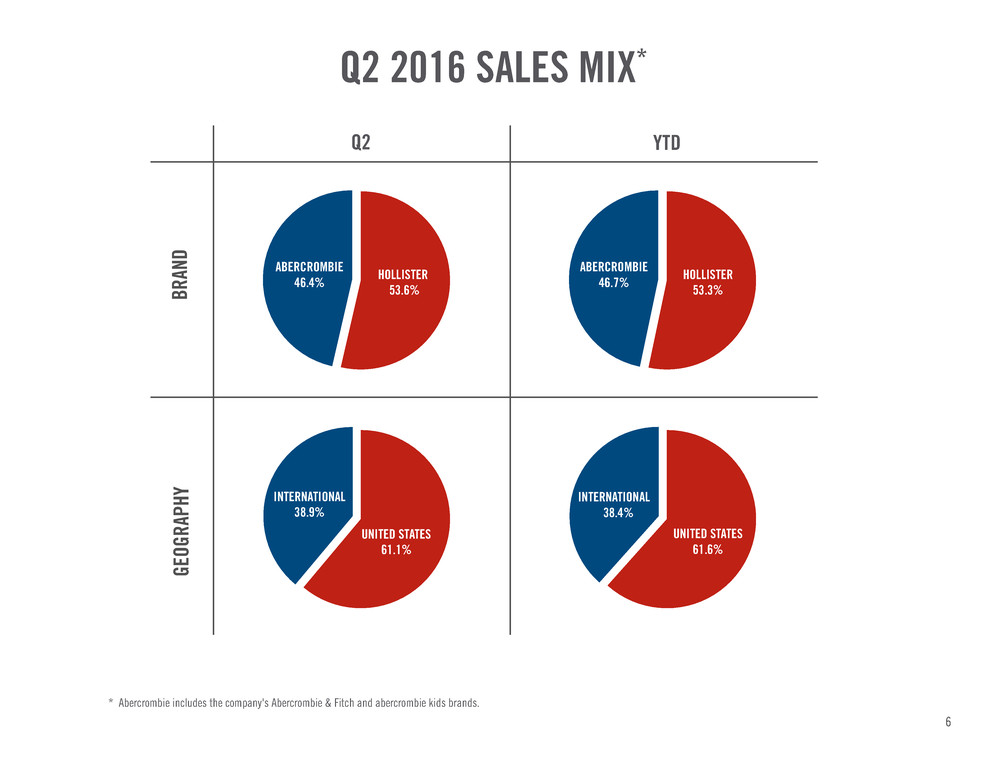

* Abercrombie includes the company's Abercrombie & Fitch and abercrombie kids brands.

Q2 2016 SALES MIX*

Q2

ABERCROMBIE

46.4% HOLLISTER 53.6%

YTD

ABERCROMBIE

46.7% HOLLISTER53.3% BRAN

D

INTERNATIONAL

38.9%

UNITED STATES

61.1%

INTERNATIONAL

38.4%

UNITED STATES

61.6%

GEOGRAPH

Y

7

Q2 ADJUSTED OPERATING EXPENSE*

* Q2 Adjusted Operating Expense for the current and prior periods is presented on an adjusted non-GAAP basis, and excludes the effect of certain items set out of page 4.

(1) Includes rent, other landlord charges, utilities, depreciation and other occupancy expense.

(2) Includes selling payroll, store management and support, other store expense, direct-to-consumer expense, and distribution center costs.

(3) Rounded based on reported percentages.

2016 % OF NET SALES 2015 % OF NET SALES Δ bps (3)

STORE OCCUPANCY (1) $172,287 22.0% $180,468 22.1% (10)

ALL OTHER (2) 210,630 26.9% 207,331 25.4% 150

STORES AND DISTRIBUTION 382,917 48.9% 387,799 47.4% 150

MARKETING, GENERAL &

ADMINISTRATIVE 111,719 14.3% 104,093 12.7% 160

OTHER OPERATING INCOME (798) (0.1)% (1,139) (0.1)% —

TOTAL $493,838 63.1% $490,753 60.0% 310

8

SHARE REPURCHASES

FY 2016 FY 2015

SHARES

REPURCHASED COST

AVERAGE

COST

SHARES

REPURCHASED COST

AVERAGE

COST

Q1 — — — — — —

Q2 — — — — — —

Q3 2,460.5 $50,029 20.33

Q4 — — —

FULL YEAR — — — 2,460.5 $50,029 $20.33

9

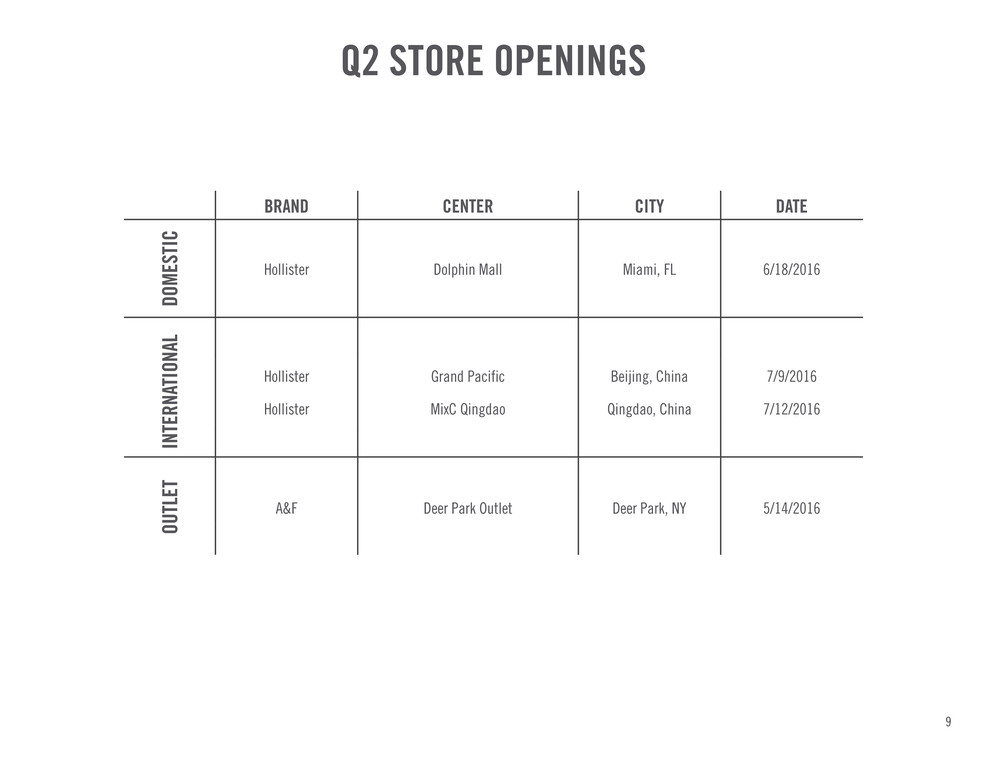

Q2 STORE OPENINGS

BRAND CENTER CITY DATE

DOMESTI

C

Hollister Dolphin Mall Miami, FL 6/18/2016

INTERN

ATIONA

L

Hollister Grand Pacific Beijing, China 7/9/2016

Hollister MixC Qingdao Qingdao, China 7/12/2016

OUTLE

T

A&F Deer Park Outlet Deer Park, NY 5/14/2016

10

Q2 STORE COUNT ACTIVITY

(1) Abercrombie includes the company's Abercrombie & Fitch and abercrombie kids brands. Locations with abercrombie kids carveouts within Abercrombie &

Fitch stores are represented as a single store count. Excludes one international franchise store as of July 30, 2016 and April 30, 2016.

(2) Excludes two international franchise stores as of July 30, 2016 and April 30, 2016.

(3) Includes 39 stores in Asia and 8 stores in the Middle East.

ALL BRANDS TOTAL U.S. CANADA EUROPE REST OF WORLD (3)

START OF Q2 2016 925 745 18 117 45

OPENINGS 4 2 — — 2

CLOSINGS (3) (3) — — —

END OF Q2 2016 926 744 18 117 47

ABERCROMBIE (1)

START OF Q2 2016 373 334 7 17 15

OPENINGS 1 1 — — —

CLOSINGS (2) (2) — — —

END OF Q2 2016 372 333 7 17 15

HOLLISTER CO. (2)

START OF Q2 2016 552 411 11 100 30

OPENINGS 3 1 — — 2

CLOSINGS (1) (1) — — —

END OF Q2 2016 554 411 11 100 32

11

FULL YEAR OUTLOOK UPDATES*

FOR FISCAL 2016, THE COMPANY NOW EXPECTS:

• COMPARABLE SALES TO REMAIN CHALLENGING THROUGH THE SECOND HALF OF THE YEAR, WITH A

DISPROPORTIONATE EFFECT FROM FLAGSHIP AND TOURIST LOCATIONS

• ADVERSE EFFECTS FROM FOREIGN CURRENCY ON SALES OF APPROXIMATELY $25 MILLION AND ON OPERATING

INCOME OF APPROXIMATELY $20 MILLION, WITH THE GREATEST IMPACT IN THE THIRD QUARTER

• A GROSS MARGIN RATE FLAT TO LAST YEAR'S ADJUSTED NON-GAAP RATE OF 61.9%, BUT DOWN IN THE THIRD

QUARTER DUE TO ADVERSE EFFECTS FROM FOREIGN CURRENCY

• OPERATING EXPENSE DOLLARS TO BE DOWN SLIGHTLY TO LAST YEAR'S ADJUSTED NON-GAAP OPERATING EXPENSE,

WITH INVESTMENTS IN MARKETING, SKEWED TOWARDS THE THIRD QUARTER, OFFSET BY SAVINGS FROM EXPENSE

REDUCTION EFFORTS

• AN EFFECTIVE TAX RATE IN THE MID-TO-UPPER 30S

• NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS OF APPROXIMATELY $5 MILLION

• A WEIGHTED AVERAGE DILUTED SHARE COUNT OF APPROXIMATELY 68 MILLION SHARES, EXCLUDING THE EFFECT OF

POTENTIAL SHARE BUYBACKS

• CAPITAL EXPENDITURES TO BE AT THE LOW END OF THE RANGE OF $150 MILLION TO $175 MILLION

* Excluded from the company's outlook are the effects of certain potential items, including, but not limited to, insurance recoveries, impairments and other items.

12

BRAND POSITIONING

13

14

15

16

17

BRAND POSITIONING

18

19

20

21