Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy16q3xex991.htm |

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy16q3.htm |

|

Q3 FY 2016 Earnings

Prepared Comments and Slides

August 25, 2016

Michael Iburg

Investor Relations

Phone: 408-333-0233

miburg@Brocade.com

Ed Graczyk

Media Relations

Phone: 408-333-1836

egraczyk@Brocade.com

NASDAQ: BRCD

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Prepared comments provided by Michael Iburg, Investor Relations

Thank you for your interest in Brocade’s Q3 Fiscal 2016 earnings presentation, which includes prepared remarks, cautionary statements and disclosures, slides, and a press release detailing fiscal third quarter 2016 results. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and has been made available on the Brocade Investor Relations website at www.brcd.com. The press release will be issued subsequently via Marketwired.

© 2016 Brocade Communications Systems, Inc. Page 2 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

© 2016 Brocade Communications Systems, Inc. Page 3 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

© 2016 Brocade Communications Systems, Inc. Page 4 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Today’s prepared comments include remarks by Lloyd Carney, Brocade CEO, regarding the company’s quarterly results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at

2:30 p.m. Pacific Time on August 25 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2016 Brocade Communications Systems, Inc. Page 5 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Prepared comments provided by Lloyd Carney, CEO

© 2016 Brocade Communications Systems, Inc. Page 6 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Q3 was a productive quarter for Brocade. Against the backdrop of a mixed macro environment, we posted solid results, with total revenue at the high end of our guidance range. In addition, we closed our acquisition of Ruckus Wireless, continued a strong year of new product introductions across our portfolio, and established a strategic joint venture in China with Guiyang High-Tech Industrial Investment Group.

Our SAN business performed in line with the Q3 outlook provided with our Q2 16 results, and we achieved a significant milestone with the launch of the industry’s first Gen 6 Fibre Channel director portfolio, which we have already begun shipping for revenue. Brocade’s continued leadership in Fibre Channel storage provides customers with a robust and long-term technology upgrade path from the industry’s most trusted name in Fibre Channel storage networking. Strong interest in this technology is driving faster development of the Gen 6 partner ecosystem than we have seen in previous generations.

In IP Networking, while sales into the U.S. federal market were below our expectations in Q3, we exceeded our overall revenue outlook largely due to the strong contribution from Ruckus Wireless, following the completion of our acquisition on May 27, 2016.

We are progressing well with the integration, and our sales teams are already working collaboratively to optimize near-term opportunities. We are excited to bring together the full benefits of our combined portfolios for the network edge, data center and service provider markets. Underscoring our synergies, earlier this week Brocade was named a leader in the IHS WLAN scorecard, which cited the strategic benefits of combining Ruckus’s high performance WLAN offering and Brocade’s extensive switching portfolio. As a networking pure-play addressing the core of the data center to the wireless edge, we are well positioned to expand our market reach, diversify our revenue mix, and drive incremental opportunities for growth.

© 2016 Brocade Communications Systems, Inc. Page 7 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Q3 was an important quarter for our SAN business as we launched the industry’s first Gen 6 Fibre Channel director, the Brocade X6. This new family of products extends our technology leadership and expands upon our portfolio of Gen 6 solutions, including the Brocade G620 switch that we launched in March.

Widespread enthusiasm for Brocade Fibre Channel Gen 6 technology was echoed in our announcement by more than twenty partners and industry analysts, who affirmed the value of our portfolio and roadmap. Moreover, the rapid development of the Gen 6 ecosystem is a strong indication of market readiness for this technology. Today, three of our OEM partners are shipping our Gen 6 directors, with most others expected to launch within the next several months. Further, by early 2017, several of our partners will have 32 Gbps storage arrays in the market, and HBA vendors are already shipping Gen 6 adapters, a meaningful contrast to the launch of Gen 5 several years ago.

Recent industry reports from Gartner and others confirm our long-standing expectation that Fibre Channel will continue to be the protocol of choice for storage area networks for the foreseeable future. Fibre Channel is generally accepted as the lowest latency and most reliable protocol on the market, and these attributes are more critical than ever as the industry moves to adopt high performance, flash-based storage. Legacy networks and lower performance protocols can produce bottlenecks, minimizing the efficacy and economic benefits of all-flash arrays. Further, today’s faster internal interconnect protocols, such as non-volatile memory express (NVMe), similarly require high-throughput storage networks in order to achieve their optimal performance.

During the quarter, SAN revenue was in line with the Q3 outlook provided with our Q2 16 results, declining 9% year-over-year. Director sales declined primarily due to a longer time to closure for many large deals. This was partially offset by stronger switch sales, which were driven largely by pull-through demand from all-flash array deployments. Overall, our SAN results reflect the sluggish storage environment reported by many of our partners. However, we were encouraged by the early demand for Gen 6 directors from a number of our leading-edge customers.

Finally, this week we announcement new capabilities for the Brocade Analytics Monitoring Platform, which we expect to provide incremental revenue opportunities from our current installed base and provide additional incentive for customers to move to the latest generations of Brocade Fibre Channel technology.

© 2016 Brocade Communications Systems, Inc. Page 8 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

We exceeded our fiscal Q3 IP Networking revenue outlook provided with our Q2 results, largely due to the strong contribution from our Ruckus Wireless portfolio, which offset softness in the U.S. federal market.

Ruckus product line strength was primarily driven by better than expected linearity during July, as well as a lower than anticipated adverse revenue impact associated with the purchase accounting-driven fair value adjustments, commonly referred to as purchase price adjustments (PPA), following the completion of our acquisition.

We continued to see increasing demand for the Ruckus ZoneFlex R710 access point, consistent with the emerging industry upgrade cycle to 802.11ac Wave 2. Approximately 15% of our access point revenue came from Wave 2 products in the quarter. In addition, our low-price entry-level R310 802.11ac access point also continues to gain traction. With less than one third of our access point installed base having upgraded to this latest generation today, we believe that this cycle and the growing demand for Wave 2 should continue to provide a long-term growth opportunity.

In terms of the wired IP Networking business, sales into the enterprise and service provider markets came in largely within our expectations. However, weakness in the U.S. federal market in Q3 extended a disappointing year for this vertical. We are hopeful that an improved business environment and our expanded portfolio that now includes wireless solutions will provide greater opportunity in the coming fiscal year. In addition, we saw a decrease in E-rate deal flow, consistent with market commentary relating to funding, timing, and administrative challenges.

During Q3, we were pleased to announce that the Brocade Virtual Application Delivery Controller (vADC) became available on the Microsoft Azure Marketplace, further broadening our market reach. We continue to see active interest in our innovative software technologies from customers that recognize the imperative to transform old, legacy networks to New IP architectures. As a result, our software revenue has continued to grow, however, the market as a whole is not evolving as quickly as we had expected.

© 2016 Brocade Communications Systems, Inc. Page 9 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Fiscal 2016 has been a significant year for product innovation, demonstrating the strong execution of our product and technology teams. Over the last several quarters, we have brought to market groundbreaking new products in strategic areas such as IP fabrics, mobility, automation and network visibility.

During Q3, we continued this momentum with the announcement of the Brocade Workflow Composer, a new server-based platform that provides end-to-end automation of cross-functional IT workflows. Furthering Brocade’s long-standing heritage of network automation leadership, this solution enables greater business agility through a DevOps-style solution for IT operational improvement.

In addition, in keeping with Ruckus’s stated 2016 growth initiatives, we are aggressively expanding our portfolio of indoor and outdoor wireless access points. During the quarter, we began shipping two new offerings in the highly successful Ruckus ZoneFlex™ family, the outdoor T710 and mid-range R510. Expansion of this portfolio extends our market reach and provides further opportunity to continue Ruckus’s track record of outpacing market growth.

We also announced the general availability of Ruckus Cloud Wi-Fi, a wireless local area network (WLAN) management-as-a-service offering, powered by the new Ruckus public cloud platform. Leveraging this platform, we expect to deliver integrated solutions that simplify the configuration, monitoring and troubleshooting of both wired and wireless networks.

© 2016 Brocade Communications Systems, Inc. Page 10 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

In closing, we continue to demonstrate a commitment to market leadership across our portfolio. In storage networking, we have successfully advanced our technology roadmap with the launch of the Brocade Fibre Channel Gen 6 portfolio and additional enhancements to the Brocade Analytics Monitoring Platform. While we are maintaining an appropriately conservative view of the SAN market, we believe that our storage networking business will continue to provide us with long-term revenue opportunity and strong profit contribution.

In IP Networking, we continue to invest strategically, with New IP innovations that are closely aligned with major industry trends. We expect to make additional announcements in our fiscal fourth quarter and believe that we are building a solid foundation for business growth and TAM expansion in the coming years.

Finally, with the successful completion of our acquisition of Ruckus Wireless, we are pleased to welcome this talented and committed team to the Brocade family. Our combined strengths open up new opportunities, and distinguish Brocade as a pure-play networking company for the digital transformation era.

At our Investor Day event on September 21 in New York City, we will provide further details about our progress, take you through our market opportunities, and provide an updated financial model. I encourage you to attend in person or participate virtually and look forward to speaking with you soon.

© 2016 Brocade Communications Systems, Inc. Page 11 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Prepared comments provided by Dan Fairfax, CFO

© 2016 Brocade Communications Systems, Inc. Page 12 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

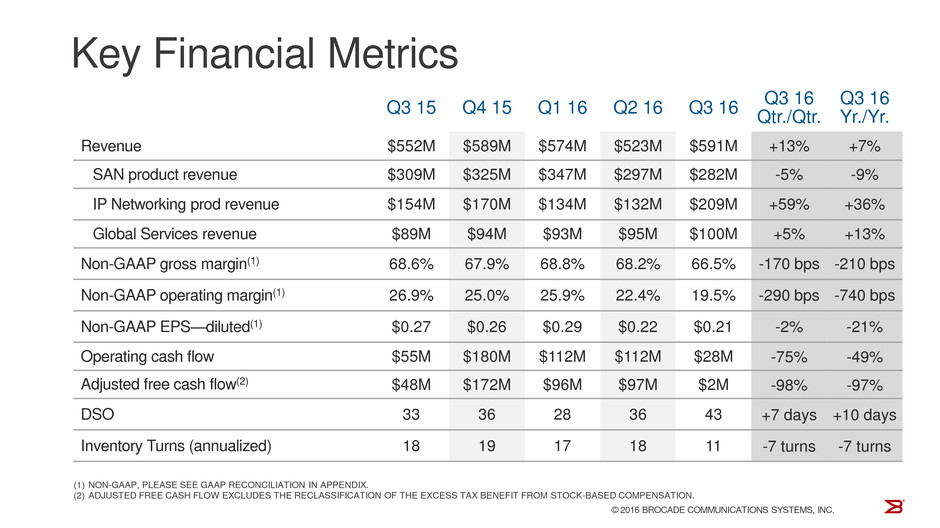

On May 27, 2016, Brocade completed the acquisition of Ruckus Wireless, and the results presented here include approximately two months of Ruckus financial results. In addition, our two-year target model provided at last year’s Investor Day did not contemplate the Ruckus acquisition, therefore we have removed it from this page and will provide a new two-year target model at our upcoming Investor Day on September 21, 2016.

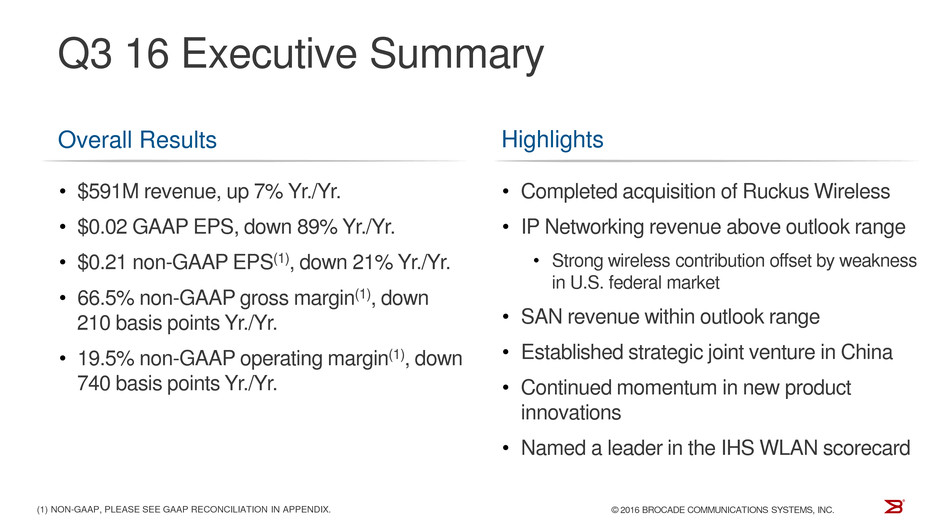

Q3 16 revenue of $591M was up 7% Yr./Yr. primarily driven by Ruckus, which achieved higher than expected revenue. This was primarily due to better than expected linearity during July and lower than expected PPA. SAN product revenue declined 9% Yr./Yr., but was above the midpoint of our outlook range. IP Networking product revenue increased 36% Yr./Yr. primarily due to strong Ruckus Wireless revenue offset by weaker sales to U.S. federal customers.

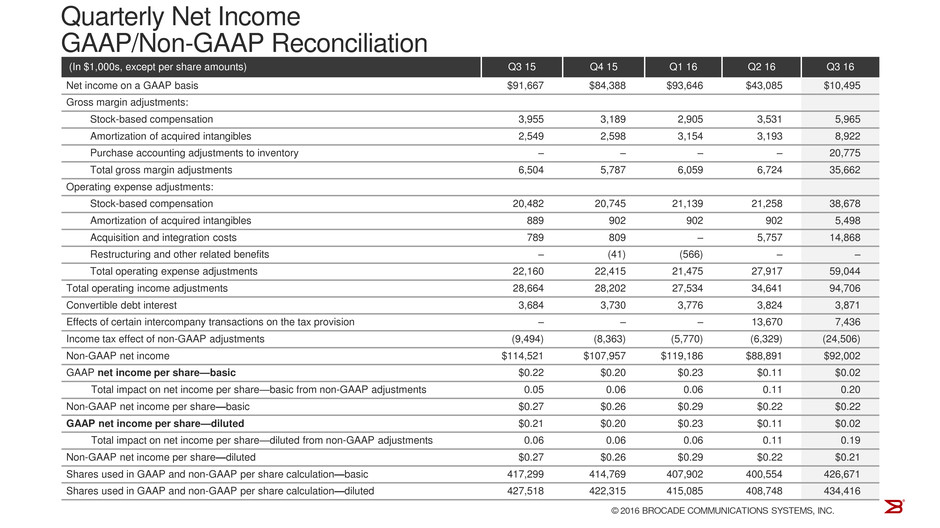

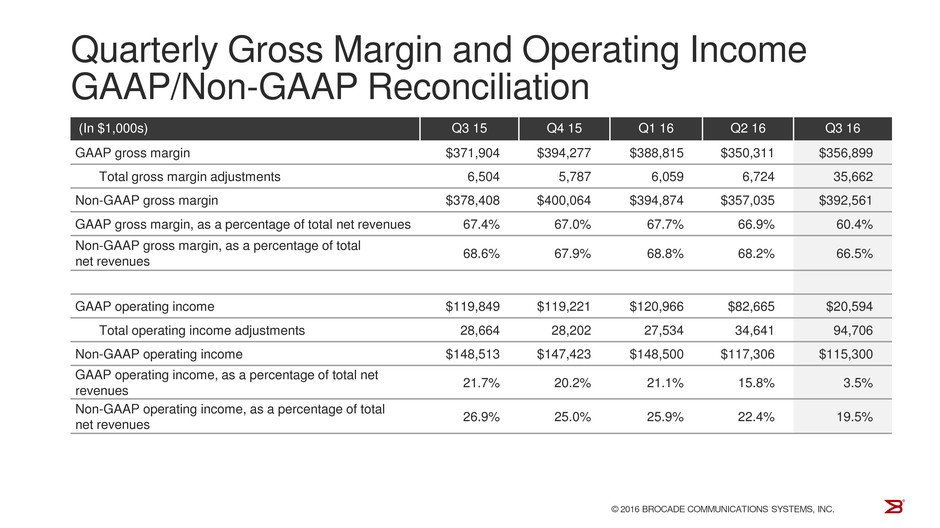

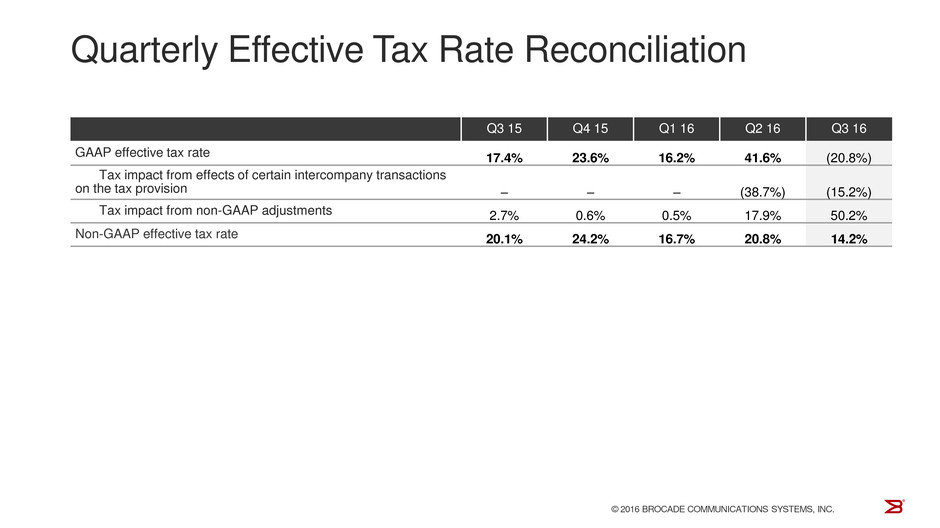

Non-GAAP gross margin was 66.5% in Q3 16, down 210 basis points year-over-year due to lower SAN revenue, customer mix, and deferred revenue PPA, which lowered Ruckus’s services revenue. Non-GAAP operating margin was 19.5% in Q3 16, down 740 basis points from Q3 15 primarily due to higher operating expenses and lower gross margin.

Q3 16 non-GAAP diluted EPS was $0.21, down 21% year-over-year. Although down year-over-year, non-GAAP EPS exceeded our outlook of $0.14 - $0.17 due to higher revenue, higher operating margins, a lower non-GAAP tax rate, and a lower than anticipated share count due to aggressive share repurchases in the quarter.

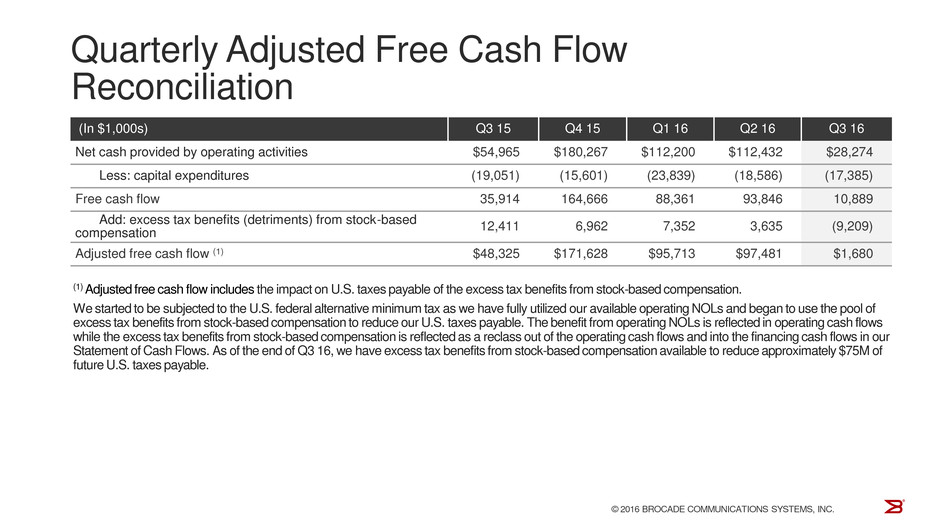

Operating cash flow and adjusted free cash flow were below the Brocade-only outlook ranges of $45-55M and $25-35M, respectively, primarily due to payments made related to the Ruckus acquisition and DSOs extending out by 7 days sequentially.

© 2016 Brocade Communications Systems, Inc. Page 13 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

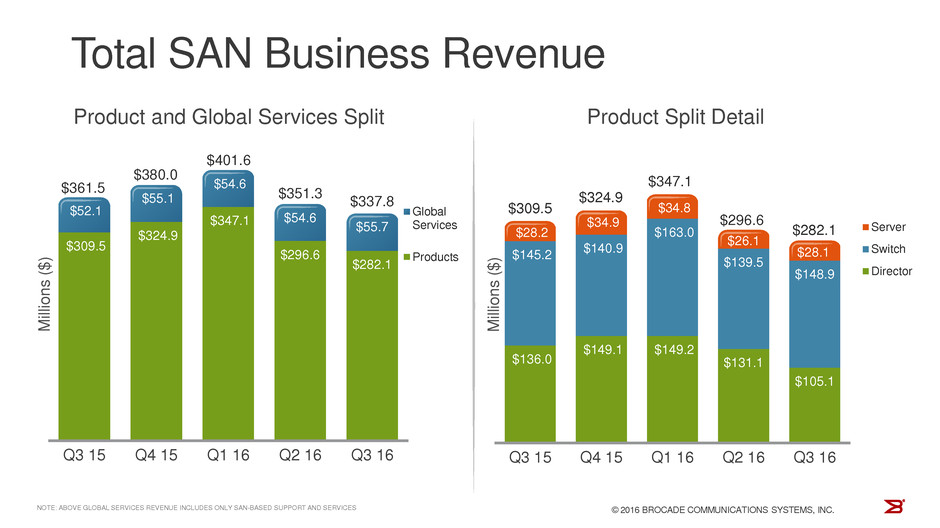

Revenue from our total SAN business, including products and SAN-based support and services, in Q3 16 was $338M, down 7% from Q3 15 as overall product revenue was down 9% and global services revenue was up 7%.

Our SAN product revenue was $282M in the quarter, down 9% Yr./Yr., as director revenue decreased 23%, while fixed switch revenue increased 3% and embedded server revenue was flat. The SAN product revenue decline reflects sluggish storage demand across most partners and geographies as well as the longer time to closure for many large director deals.

During the quarter we experienced encouraging interest in our newly launched Gen 6 directors and, as of today, three of our OEM partners have qualified the platform, and most others are expected to do so over the next several months.

SAN-based global services revenue was $56M, up 7% Yr./Yr. due to several large catch-up renewals in the quarter.

© 2016 Brocade Communications Systems, Inc. Page 14 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

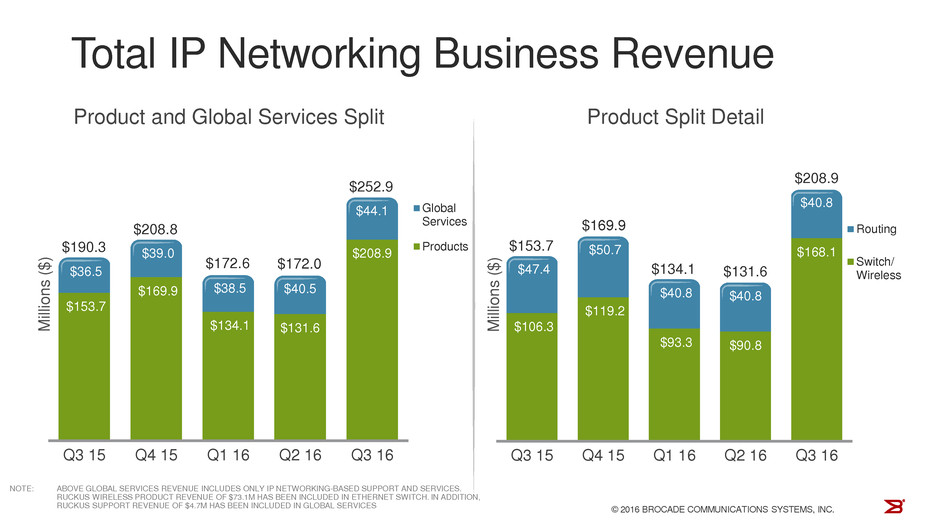

Revenue from our total IP Networking business, including products and IP-based support and services, was $253M, up 33% Yr./Yr., primarily due to the acquisition of Ruckus Wireless, which contributed a total of $78M in the quarter.

Q3 16 IP Networking product revenue was $209M, up 36% Yr./Yr. Ruckus product revenue in the quarter was $73M, above our outlook range primarily due to better than expected linearity during July and lower than expected impact from the deferred revenue PPA. Ruckus’s strength was primarily driven by healthy product demand for indoor and outdoor wireless access points and managed services platforms.

Excluding Ruckus revenue, Brocade IP Networking product revenue was $136M, below the outlook range of $141M to $150M, due primarily to lower than anticipated sales to the U.S. federal market. From a product perspective, Ethernet switches sales were down 10% year-over-year primarily due to lower U.S. federal sales, and router sales were down 14% year-over-year due primarily to lower service provider sales.

IP-based Global Services revenue was $44M, up 21% Yr./Yr., primarily due to incremental service volume from Ruckus of $5M, which was below the historical run-rate due to the deferred revenue PPA, and represents the inclusion of approximately two months of Ruckus service revenue.

© 2016 Brocade Communications Systems, Inc. Page 15 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

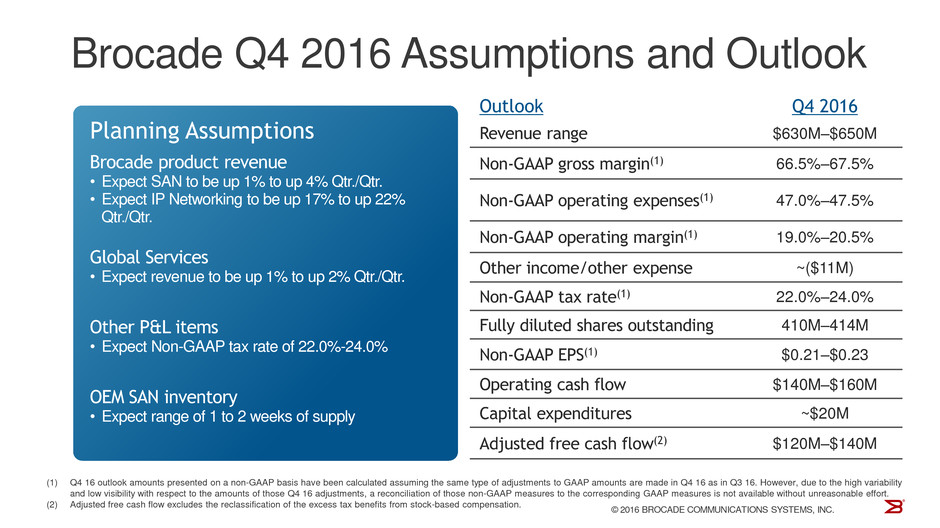

The outlook provided on this page is for the combined company incorporating Ruckus Wireless.

For Q4 16, we have set the following outlook:

• | For Q4 16, we expect SAN product revenue to be up 1% to 4% Qtr./Qtr. as we expect a seasonal improvement in our SAN revenue although not as strong as we typically experience. |

• | We expect Q4 16 IP Networking product revenue to be up 17% to 22% Qtr./Qtr. as we will have a full quarter of wireless revenue and anticipate a partial recovery in our U.S. federal revenue. |

• | We expect our Global Services revenue to be up 1% to 2% Qtr./Qtr. |

• | We expect Q4 16 non-GAAP gross margin to be between 66.5% to 67.5%, and non-GAAP operating margin to be between 19.0% and 20.5%, primarily due to higher spending as we include three months of Ruckus operating expenses and lower gross margins due to the expected mix of SAN and IP revenues. |

• | Operating cash flow is expected to be in the range of $140M - $160M in fiscal Q4 16. We expect DSOs to be in the high-30’s to low-40s for the next several quarters. |

• | At the end of Q3 16, OEM SAN inventory dollars were down 4% year-over-year and was approximately 1.8 weeks of supply based on SAN business revenue. We expect inventory to be between one to two weeks in Q4 16. |

© 2016 Brocade Communications Systems, Inc. Page 16 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Prepared comments provided by Michael Iburg, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on August 25, Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2016 Brocade Communications Systems, Inc. Page 17 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

© 2016 Brocade Communications Systems, Inc. Page 18 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

© 2016 Brocade Communications Systems, Inc. Page 19 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

Additional Financial Information:

Q3 15 | Q2 16 | Q3 16 | ||||

GAAP product gross margin | 68.9 | % | 69.1 | % | 61.6 | % |

Non-GAAP product gross margin | 69.8 | % | 70.2 | % | 68.2 | % |

GAAP services gross margin | 59.7 | % | 57.1 | % | 54.5 | % |

Non-GAAP services gross margin | 62.3 | % | 59.3 | % | 58.0 | % |

Actual and Forecasted Purchase Accounting Adjustments:

Q3 16 Actual | Q4 16 Fcst | Q1 17 Fcst | Q2 17 Fcst | Q3 17 Fcst | Q4 17 Fcst | |||||||||||||

Inventory (1) | $ | (21 | )M | $ | (19 | )M | $ | — | $ | — | $ | — | $ | — | ||||

Revenue (2) | $ | (6 | )M | $ | (2 | )M | $ | (2 | )M | $ | (1 | )M | $ | (1 | )M | $ | (1 | )M |

(1) Gross margin impact of purchase accounting adjustments to inventory (excluded from non-GAAP results).

(2) Gross margin impact of purchase accounting adjustments to deferred revenue (included in non-GAAP results).

© 2016 Brocade Communications Systems, Inc. Page 20 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

© 2016 Brocade Communications Systems, Inc. Page 21 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

© 2016 Brocade Communications Systems, Inc. Page 22 of 23

Brocade Q3 FY 2016 Earnings 8/25/2016

|

© 2016 Brocade Communications Systems, Inc. Page 23 of 23