Attached files

| file | filename |

|---|---|

| EX-99 - EX-99 - Viacom Inc. | d244527dex99.htm |

| EX-3.2 - EX-3.2 - Viacom Inc. | d244527dex32.htm |

| EX-3.1 - EX-3.1 - Viacom Inc. | d244527dex31.htm |

| 8-K - FORM 8-K - Viacom Inc. | d244527d8k.htm |

Exhibit 10

EXECUTION COPY

CONFIDENTIAL SETTLEMENT AND RELEASE AGREEMENT

This confidential settlement and release agreement (“Settlement”) is entered into and effective as of August 18, 2016 (the “Effective Date”), by and among:

(i) Sumner M. Redstone (“SMR”), individually and on behalf of his unborn and unascertained descendants, and in his capacities as a director and Chairman Emeritus of Viacom Inc. (“Viacom”), Settlor, beneficiary and trustee of the “Trust” (as defined below), and an officer, director, and manager of the “NAI Entities” (as defined below) and, through the Trust, a direct or indirect stockholder or member of the NAI Entities. As used in this Settlement, the “Trust” means the Sumner Redstone National Amusements Trust u/d/t dated June 28, 2002,

(ii) Shari E. Redstone (“SER”), individually and on behalf of her unborn and unascertained descendants, and in her capacities as a director and Non-Executive Vice Chair of Viacom, future trustee of the Trust, and an officer, director and, through a trust, stockholder of NAI, a manager of NAIEH and NAIAH,

(iii) each of National Amusements, Inc. (“NAI”), NAI Entertainment Holdings, LLC (“NAIEH”) and NAI Asset Holdings, LLC (“NAIAH”, and collectively with NAI and NAIEH, the “NAI Entities”),

(iv) Viacom,

(v) Philippe P. Dauman (“Dauman”), individually, and in his capacities as President, Chief Executive Officer, a director and Executive Chairman of Viacom, as a former trustee of the Trust and as a former director of NAI and a former manager of NAIEH and NAIAH,

(vi) George S. Abrams (“Abrams”), individually, and in his capacities as a director of Viacom, as a former trustee of the Trust and as a former director of NAI and a former manager of NAIEH and NAIAH,

(vii) Thaddeus Jankowski (“Jankowski”), Jill Krutick (“Krutick”), David Andelman (“Andelman”), Norman Jacobs (“Jacobs”) and Leonard Lewin (“Lewin”), each individually and in his or her capacity as a trustee of the Trust (collectively, the “Other Trustees”, and together with SMR, SER, Tyler, Phyllis, Dauman and Abrams, the “Trustees”), and Jankowski also as an officer or manager of one or more of the NAI Entities, and Andelman and Krutick also as directors of NAI and managers of NAIEH and NAIAH,

(viii) Thomas E. Dooley (“Dooley”), individually, and in his capacity as a director of Viacom,

(ix) Blythe J. McGarvie (“McGarvie”), Frederic V. Salerno (“Salerno”), William Schwartz (“Schwartz”), Charles E. Phillips, Jr. (“Phillips”), Cristiana Falcone Sorrell (“Sorrell”) and Deborah Norville (“Norville”), each individually and in his or her capacity as a director of Viacom (each, an “Independent Director” and collectively the “Independent Directors”),

(x) Phyllis Redstone (“Phyllis”), individually, as a named party in the Massachusetts Action (defined below); and in her capacity as a trustee of the Trust,

EXECUTION COPY

(xi) Tyler Korff (“Tyler”), individually, as a named party in the Massachusetts Action, and in his capacities as a future trustee of the Trust and a director of NAI,

(xii) Brandon Korff (“Brandon”), individually, as a named party in the Massachusetts Action,

(xiii) Kimberlee Korff Ostheimer (“Ostheimer”), individually and on behalf of her children, Harvey Benjamin Ostheimer (“Harvey”) and Haylee Rose Ostheimer (“Haylee”), all of whom are named parties in the Massachusetts Action,

(xiv) Lauren Ellis (“Lauren”), individually, as a named party in the Massachusetts Action.

The individuals and entities listed in (i) through (xiv) above are collectively referred to in this Settlement as the “Parties”. The individuals listed in (vii) and (x) through (xiv) above are collectively referred to in this Settlement as the “Additional Parties”. Notwithstanding anything to the contrary in this Settlement, the Additional Parties shall only be bound by the following Sections of this Settlement and not by any other section or provision hereof: Sections 7, 8, 9, 11, 13, 14, 17 and 19 (collectively, the “Additional Parties Sections”); provided, however, that nothing in this provision limits any protections or benefits to which the Additional Parties are entitled under other sections or provisions of this Settlement.

WHEREAS, there is a pending in Massachusetts a civil action captioned Dauman and Abrams v. Redstone et al., Docket No. NO16E0020QC (the “Massachusetts Action”) in which Dauman and Abrams assert claims;

WHEREAS, there is pending in California a civil action captioned In the Matter of the Sumner M. Redstone National Amusements Trust, Case No. 16STPB00618 (the “California Action”) in which SMR asserts claims;

WHEREAS, there is pending in the Court of Chancery of the State of Delaware a civil action captioned In re Viacom Inc., C.A. No. 12472-CB (Del. Ch.) (the “NAI Action”) in which NAI and NAIEH assert claims;

WHEREAS, there is pending in the Court of Chancery of the State of Delaware a civil action captioned Salerno v. National Amusements, Inc., et al., C.A. No. 12473-CB (Del. Ch.) (the “Salerno Action”) in which Salerno asserts claims and which has been consolidated with C.A. No. 12472-CB under the caption In re Viacom Inc. Section 225 Litigation, Consolidated C.A. No. 12472-CB;

WHEREAS, the NAI Action and the Salerno Action, as consolidated, are pending before the Delaware Court of Chancery (collectively the “Delaware Actions”) and the court has entered an Order Preserving the Status Quo Pending Resolution of Claims in connection therewith (the “Status Quo Order”);

WHEREAS, Section 3 of the Status Quo Order provides for five (5) business days prior written notice to the Parties with respect to certain actions contemplated by this Settlement, including

2

EXECUTION COPY

amendment of the Viacom Bylaws (the “Prior Notice Requirement”), and the Parties irrevocably agree to waive the Prior Notice Requirement as set forth herein;

WHEREAS, Viacom and Dauman are parties to an Amended and Restated Employment Agreement, dated January 15, 2015 (the “PD Employment Agreement”);

WHEREAS, Viacom and Dooley are parties to an Amended and Restated Employment Agreement, dated March 17, 2016 (the “TD Employment Agreement”);

WHEREAS, the Parties desire to settle and resolve, fully and finally, all claims, including, but not limited to, litigation between and among them without any admission of liability, incapacity, undue influence, fault, or wrongdoing;

WHEREAS, as part of this Settlement, the Parties shall, among other things, settle and resolve, fully and finally, all actual and potential claims between and among them, known or unknown, contingent or non-contingent, arising from the beginning of the history of the world and through the Effective Date, including but not limited to claims relating to the conduct alleged, and the claims asserted or that could have been asserted, in the Massachusetts Action, the California Action, and the Delaware Actions;

WHEREAS, as part of this Settlement, the Parties agree to certain terms regarding Dauman’s separation from employment from Viacom and Dooley’s employment by Viacom as set forth herein;

WHEREAS, the board of directors of Viacom (the “Viacom Board”) and the Independent Directors have separately reviewed the terms of this Settlement, and determined that it is in the best interests of Viacom and its stockholders, other than NAI and its stockholders and subsidiaries, to enter into this Settlement;

WHEREAS, the boards of directors and/or managers of the NAI Entities have separately reviewed the terms of this Settlement, and determined that it is in the best interests of NAI, and its subsidiaries, to enter into this Settlement; and

WHEREAS, the Trustees of the Trust have separately reviewed the terms of this Settlement and determined that it is in the best interests of all beneficiaries of the Trust.

NOW THEREFORE, in consideration of the foregoing and of the material covenants and agreements of the Parties contained herein, the receipt and sufficiency of which are acknowledged by the undersigned, it is hereby agreed by and among the Parties as follows:

| 1. | Resignation as President and Chief Executive Officer of Viacom. |

Dauman irrevocably resigns, as of the Effective Date, as President and Chief Executive Officer of Viacom and from all other positions of authority with Viacom or any Viacom subsidiary; provided, however, that Dauman shall continue to serve as a director and non-executive Chairman of Viacom through the earlier of:

| (i) | September 13, 2016, or |

3

EXECUTION COPY

(ii) three (3) days after the Viacom Board votes on the Paramount Investment pursuant to Section 5 (the period ending on the earlier of (i) or (ii), the “Continuation Period”), at which time (i.e., the end of the Continuation Period) his resignation as the non-executive Chairman and director of Viacom shall be effective without any further notice or action.

Viacom and Dauman agree that the Effective Date shall be the “Termination Date” for purposes of the PD Employment Agreement and that such resignation shall be deemed and treated as a termination without “Cause,” a resignation with “Good Reason” for which the applicable notice and cure periods are deemed to have expired on the date immediately preceding the Effective Date, and a “Qualifying Termination” (as such terms are defined in the PD Employment Agreement).

| 2. | Appointment of New Interim President and Chief Executive Officer of Viacom and New Chairman. |

As of the Effective Date, Dooley shall be appointed as the interim President and Chief Executive Officer of Viacom pursuant to the terms of a “Qualifying CEO Offer” (as such term is defined in the TD Employment Agreement) such that the TD Employment Agreement is amended to incorporate those previously negotiated terms set forth on Schedule D to the TD Employment Agreement.

Unless otherwise agreed in writing between Dooley and Viacom (upon approval from the Viacom Board), Dooley’s employment as interim President and Chief Executive Officer of Viacom shall terminate on September 30, 2016, and such termination shall, regardless of the circumstances, be deemed and treated as a termination without “Cause,” resignation with “Good Reason” for which the applicable notice and cure periods are deemed to have expired (uncured) on the date immediately preceding September 30, 2016, and a “Qualifying Termination” (as such terms are defined in the TD Employment Agreement). Notwithstanding the foregoing or anything in the TD Employment Agreement to the contrary, upon five (5) business days’ advance written notice (a “TD Termination Notice”), each of Dooley and the Viacom Board may notify the other party of his or its intent to terminate the employment relationship effective at the end of the last day of such notice period, and any such termination of employment shall, regardless of the motivation or circumstances, be effective at such time and deemed and treated as a termination without “Cause,” resignation with “Good Reason” for which the applicable notice and cure periods are deemed to have expired (uncured) on the date immediately preceding the date of the effective time of termination, and a “Qualifying Termination” (as such terms are defined in the TD Employment Agreement).

Notwithstanding anything to the contrary, Dooley shall remain a director of the Viacom Board for as long, and only for as long, as he is the interim Chief Executive Officer of Viacom. As soon as commercially practicable, but in no event later than seven (7) business days following the Effective Date, Viacom shall (i) establish a grantor trust (the “TD Grantor Trust”) with, subject to review and reasonable comment by Dooley and his counsel, terms and conditions substantially similar to the terms and conditions of the grantor trust established and funded for the benefit of Dauman pursuant to Section 10(c) and Exhibit D of this Settlement and (ii) deposit in such grantor trust the full amount of the “Severance Payment” (as defined in the TD Employment Agreement).

4

EXECUTION COPY

Concurrently with the execution and delivery of this Settlement, the Viacom Board has elected Thomas May as non-executive Chairman of the Viacom Board effective as of the earlier of (i) the first day after the lapse of the Continuation Period, and (ii) the death, retirement or voluntary resignation of Dauman from his office as non-executive Chairman.

| 3. | Actions With Respect to the Viacom Board. |

In connection with the settlement being effected hereby, the Viacom Board and the other applicable Parties have taken or shall take the following actions:

(a) concurrently with the execution and delivery of this Settlement, the Viacom Board has unanimously increased the number of directors of the Viacom Board to sixteen (16) directors and appointed the persons listed on Exhibit A attached hereto (the “New Directors”) as directors of Viacom, effective as of the Effective Date, in accordance with the Amended and Restated Bylaws of Viacom (as amended, the “Bylaws”);

(b) the Viacom Board shall be entitled to appoint or remove directors of one or more committees thereof in accordance with the Bylaws; provided, that (i) concurrently with the execution and delivery of this Settlement, the Viacom Board has adopted resolutions to become effective as of the Effective Date to reconstitute the Compensation Committee, the Governance and Nominating Committee and the Audit Committee such that the members thereof shall be those individuals listed on Exhibit J, (ii) no members of the Compensation Committee, the Governance and Nominating Committee and the Audit Committee, as reconstituted as set forth on Exhibit J, shall be removed from such committee other than for cause prior to the 2017 annual meeting of the Viacom stockholders, and (iii) the NAI Entities represent that to their actual knowledge, each director appointed pursuant to Section 3(a) and appointed to the Compensation Committee, the Governance and Nominating Committee or the Audit Committee pursuant to this Section 3(b) is qualified to serve on such committee pursuant to the rules of the NASDAQ and the charter of the applicable committee;

(c) the Viacom Board shall reduce the number of directors by one (1) director effective upon the effectiveness of Dauman’s resignation as a director and non-executive Chairman;

(d) at such time that Dooley is no longer serving on the Viacom Board, such directorship shall remain vacant until a successor Chief Executive Officer is appointed by the Viacom Board in accordance with the Bylaws, which Chief Executive Officer may be appointed by the Viacom Board as a director in accordance with the Bylaws;

(e) all of the Independent Directors and Abrams shall remain as directors of the Viacom Board until their terms expire at the 2017 annual meeting of Viacom stockholders, subject to earlier cessation of service only due to death, retirement or voluntary resignation;

(f) three Independent Directors, the identity of which shall be determined by NAI in its sole and absolute discretion (the “Other Independent Directors”), shall be nominated by the Viacom Board for election as directors of the Viacom Board at the 2017 annual meeting of Viacom stockholders; provided, that in the event of the death, retirement or voluntary resignation

5

EXECUTION COPY

of any such Independent Director, NAI, in its sole and absolute discretion, shall select another individual to be a nominee as an Other Independent Director for election as a director of the Viacom Board at the 2017 annual meeting of Viacom stockholders (if definitive proxy material for such annual meeting has not yet been mailed) or for appointment as a director for a term ending at the 2018 annual meeting of the Viacom stockholders (if such proxy material has been mailed), subject to the approval, not to be unreasonably withheld or delayed, by the remaining Other Independent Directors then in office (if any);

(g) Prior to the 2017 annual meeting of the Viacom stockholders, the Viacom Board shall not change the number of directors of the Viacom Board, except as set forth in this Settlement; and

(h) The 2017 annual meeting of Viacom stockholders shall be held on a date set by the Governance and Nominating Committee but not later than February 3, 2017.

(i) Viacom and Dauman agree that throughout the Continuation Period the Viacom Board may continue to meet in executive session, without Dauman, Dooley or any other members or former members of management of Viacom present. Viacom and Dauman further agree throughout the Continuation Period to make available to the members of the Viacom Board, including the New Directors, the executives of, and information regarding, Viacom and of any of its subsidiaries when and if reasonably requested by the members of the Viacom Board.

(j) Dooley, acting in conjunction with the Chair of the Governance Committee, shall schedule a meeting as soon as reasonably practicable for the management of Paramount to meet with the Viacom Board for an information session and status update, including a Q&A session as may be requested by members of the Viacom Board, regarding the Paramount Business, which shall include a presentation with respect to the material revenue sources of the Paramount Business, Paramount’s 2016 and 2017 budgets (including actual operating performance for the fiscal year ending September 2016), and a review of current and planned business activities in such level of detail as the Viacom Board may request (including any significant planned transactions). (the “Board Update”).

After the Board Update, the Viacom Board may determine that prior to a Paramount Entity entering into certain categories of ordinary course transactions (e.g., disposing of rights in particular properties or entering into, extending, modifying, or terminating certain types of co-production, co-financing, or other financing activities, significant output agreements or distribution services agreements in domestic and major international territories, “first look” or term deals with particular talent, etc.), Paramount’s management shall consult with, and in some cases, as determined by the Viacom Board, obtain the prior approval of, the Viacom Board. Viacom and its CEO shall cause Paramount and its management to comply with the foregoing obligation and to provide the Viacom Board information on such matters on a regular basis and as may be requested from time to time by the Viacom Board or any of its members.

The foregoing shall not limit any other right or obligation set forth in this Settlement in connection with any Paramount Transaction or otherwise.

6

EXECUTION COPY

The Parties acknowledge that Section 19(h) of this Settlement applies to this Section 3. For the avoidance of doubt, with respect to each action specified above in this Section 3, the NAI Parties (as defined in Section 19(h) below) shall be obligated to take all lawful steps within their power and authority (including voting and directing the vote of shares of Viacom stock under their control) to ensure that such action (including the election as Viacom directors of persons to be nominated for election as Viacom directors) occurs as contemplated by this Section 3.

| 4. | Amendment of Bylaws and Charter of Viacom. |

(a) Concurrent with the Effective Date, each member of the Viacom Board has, by executing this Settlement, executed a written consent amending the Viacom Bylaws in the form attached as Exhibit I.

(b) Concurrent with the Effective Date, the Viacom Board has adopted a resolution approving an amendment to the Amended and Restated Certificate of Incorporation of Viacom (the “Charter”) such that Viacom shall not and shall not have the legal power to do any of the following without the prior written consent of the holders of a majority of the Class A Common Stock, $0.001 par value of Viacom (the “Common A Holders” and the “Class A Common Stock”, respectively), which consent may be granted or withheld by Common A Holders in their sole discretion: (i) enter into any agreement regarding, or consummate, any Paramount Transaction (as defined in Exhibit L attached hereto), (ii) vote or provide the consent of any shares of capital stock, other equity interests, or other securities of any Paramount Entity (as such term is defined in the Bylaws) owned or held, directly or indirectly, by Viacom or any direct or indirect subsidiary thereof, with respect to, or in connection with, a Paramount Transaction, or (iii) whether by merger, consolidation, reorganization or otherwise, amend the Charter in a manner that will or may eliminate or change in any way any of the approval rights of the Class A Common Stock with respect to any of the matters described in this subsection (b)(i) through (b)(iii) (the “Charter Amendment”). The Viacom Board has, by executing this Settlement, submitted the Charter Amendment to the stockholders for adoption by consent in lieu of meeting, and NAI and NAIEH have, by executing this Settlement, approved and adopted the Charter Amendment by consent in lieu of meeting following the adoption by the Viacom Board of the resolution approving the Charter Amendment. The Charter Amendment shall become effective in accordance with applicable laws and regulations.

The Parties acknowledge that Section 19(h) of this Settlement applies to this Section 4. For the avoidance of doubt, with respect to each action specified above in this Section 4, the NAI Parties shall be obligated to take all lawful steps within their power and authority (including voting and directing the vote of shares of Viacom stock) to ensure that such action occurs as contemplated by this Section 4.

Each of the Parties hereby irrevocably waives to the maximum extent permitted by law the Prior Notice Requirement in connection with any matter contemplated by this Settlement, including, without limitation, any amendment to the Viacom Bylaws contemplated herein.

7

EXECUTION COPY

| 5. | Potential Paramount Transaction. |

Viacom hereby authorizes Dauman to continue during the Continuation Period to explore a possible minority and non-controlling investment (the “Paramount Investment”) in Paramount Pictures Corporation and Viacom’s filmed entertainment business (the “Paramount Business”) including, without limitation, to engage financial, legal and other advisors and counsel to assist in such exploration at Viacom’s cost and expense (subject to the Viacom Board’s supervision and directions on or after the Effective Date); provided, however, that no such prospective Paramount Investment shall contain terms that would grant the prospective investor the right to, and shall include commitments by the prospective investor during the term of its investment in the Paramount Business not to seek, or otherwise attempt to gain, any right to (and not to request a waiver of such commitment) (a) acquire a controlling interest in the Paramount Business (including by acquisition of a majority of the voting power thereof) without the Viacom Board’s prior consent and NAI’s prior written consent as would be required under the Charter as set forth in Section 4(b) above, (b) approve or consent to any merger, change of control or other sale transaction involving Viacom, Paramount Pictures Corporation or the Paramount Business, or (c) cause a merger, change of control or other sale transaction involving Viacom, Paramount Pictures Corporation or the Paramount Business.

Dauman must notify any potential investor that any proposed Paramount Investment is subject to the Viacom Board’s approval, including by unanimous vote of the Viacom Board as set forth in Exhibit I. Further, Dauman cannot sign any documentation involving a proposed Paramount Investment unless authorized by the Viacom Board, excepting only customary non-disclosure agreements. Any public comments concerning any prospective Paramount Investment shall be made in good faith and be accurate in all material respects.

If a proposal for the Paramount Investment is formulated, Dauman may submit such initial proposal to the Viacom Board for its consideration, including a detailed description of the initial proposal, a presentation by the financial advisor(s) engaged by Viacom and other information requested by any member of the Viacom Board. SMR and SER may share any such information on a confidential basis with NAI and its legal and financial advisors. For clarity, the independent directors on the Viacom Board shall be entitled to cause Viacom to retain a separate financial advisor to advise the independent directors with respect to any such proposal. The Viacom Board shall provide Dauman with feedback on such proposal, following which Dauman may submit a final proposal to the Viacom Board no earlier than seven (7) days after the submission of the initial proposal, at which time Dauman may request that the Viacom Board consider and vote on such final proposal. Any approval vote on the Paramount Investment shall be subject to NAI’s rights as set forth in Section 4(b) above.

Dauman shall provide the Viacom Board a status update as to any potential Paramount Investment, as soon as reasonably practicable, but no later than September 7, 2016, which update shall include an identification of potential investors and the current status of those discussions, and Dauman shall thereafter keep the Board informed on a regular basis as to such matters.

For clarity, all rights afforded to Dauman pursuant to this Section 5 shall terminate at the end of the Continuation Period.

8

EXECUTION COPY

| 6. | Additional Actions. |

Michael D. Fricklas, Executive Vice President, General Counsel and Secretary of Viacom (“Fricklas”), may resign from his employment with Viacom by written notice to Viacom no more than thirty (30) days after the date on which neither Dauman nor Dooley serve as Chief Executive Officer of Viacom. Such notice shall reference this Section 6, not be subject to cure and have an effective date not less than thirty (30) business days after the date the notice is given, upon which date the noticed resignation shall become effective. Such resignation shall be deemed and for all purposes be treated as termination for “Good Reason” within the meaning of his employment agreement with and all other plans and arrangements of Viacom. Fricklas shall be a third party beneficiary of this Section 6, entitled to rely on and enforce against Viacom the rights intended to be conferred on him hereby. Except as set forth in this Section 6, Viacom’s and Fricklas’ rights and obligations under his employment agreement and other arrangements with Viacom (e.g. the Viacom pension plan and the Viacom 401(k) plan) shall remain unchanged, including without limitation Viacom’s right to terminate Fricklas at any time on the terms set forth in his employment agreement; provided, that the existence of “Cause” under Fricklas’ employment agreement shall not be claimed in respect of the matters addressed in this Settlement.

| 7. | Mutual Releases. |

(a) Each of Viacom, its subsidiaries, affiliates under its control, predecessors, successors and assigns, and the current and former directors, officers, employees, agents, attorneys and representatives of each of them (collectively, the “Viacom Parties”), hereby releases and forever discharges from all liability (w) the NAI Entities, their respective parents, stockholders, members, subsidiaries, affiliates under its control, predecessors, successors and assigns, and the current and former directors, officers, managers, trustees, employees, agents, attorneys, representatives of each of them, except for Dauman and Abrams, and (x) SMR, SER, the Trust and all of its Trustees, Jankowski, Krutick, Tyler, Brandon, Ostheimer, Harvey, Haylee, Lauren, Phyllis, Andelman, Jacobs, Lewin and the agents, attorneys, representatives, heirs, executors and assigns of each of them, individually and in all other capacities (including as trustee or beneficiary of the Trust, as parent or guardian of a beneficiary of the Trust, or as officer, manager or director of one or more of the NAI Entities), except for Dauman and Abrams ((w) and (x) collectively, the “NAI/Redstone Parties”), (y) the New Directors and the agents, attorneys, representatives, heirs, executors and assigns of each of them (collectively, the “New Director Releasees”), and (z) Dauman, Abrams, Salerno, McGarvie, Schwartz, Phillips, Sorrell, Norville, Dooley, and the agents, attorneys, representatives, heirs, executors and assigns of each of them, individually and in all other capacities (including as Trustee of the Trust and as manager or director of the NAI entities) (collectively, the “Officer and Director Parties”), from any and all Claims (defined below) which such Viacom Party ever had, now has or hereafter can, shall or may have, for, upon or by reason of any matter, cause or thing whatsoever from the beginning of the world to the Effective Date of this Settlement, including, but not limited to, any and all Claims arising out of or relating to conduct alleged in, or the claims asserted in or that could have been asserted in, the Massachusetts Action, the California Action, or the Delaware Actions; provided, however, that the releases set forth in this Section 7 shall not affect the Parties’ obligations set forth in this Settlement or limit claims preserved by Dauman pursuant to the First

9

EXECUTION COPY

Dauman Release and the Second Dauman Release and shall not affect the rights of the Viacom Parties to coverage for indemnification under any preexisting insurance policies. The New Director Releasees are intended third party beneficiaries of this Paragraph 7(a).

(b) Each of the NAI/Redstone Parties hereby releases and forever discharges from all liability (x) the Viacom Parties and (y) the Officer and Director Parties from any and all Claims which such NAI/Redstone Party ever had, now has or hereafter can, shall or may have, for, upon or by reason of any matter, cause or thing whatsoever from the beginning of the world to the Effective Date of this Settlement, including, but not limited to, any and all Claims arising out of or relating to conduct alleged in, or the claims asserted in or that could have been asserted in, the Massachusetts Action, the California Action, or the Delaware Actions; provided, however, that the releases set forth in this Section 7 shall not affect the Parties’ obligations set forth in this Settlement, and shall not affect the rights of the NAI/Redstone Parties to coverage for indemnification under any preexisting insurance policies or under any preexisting indemnity rights, obligations or arrangements any of the NAI/Redstone Parties may have with Viacom.

(c) Each of the Officer and Director Parties hereby releases and forever discharges from all liability (x) the NAI/Redstone Parties and (y) the New Director Releasees from any and all Claims which such Officer and Director Party ever had, now has or hereafter can, shall or may have, for, upon or by reason of any matter, cause or thing whatsoever from the beginning of the world to the Effective Date of this Settlement, including, but not limited to, any and all Claims arising out of or relating to conduct alleged in, or the claims asserted in or that could have been asserted in, the Massachusetts Action, the California Action, or the Delaware Actions; provided, however, that the releases set forth in this Section 7 shall not affect the Parties’ obligations set forth in this Settlement or limit claims preserved by Dauman pursuant to the First Dauman Release and the Second Dauman Release, and shall not affect the rights of the Officer and Director Parties to coverage for indemnification under any preexisting insurance policies or under any preexisting indemnity rights, obligations or arrangements any of the Officer and Director Parties may have with Viacom. The New Director Releasees are intended third party beneficiaries of this Paragraph 7(c).

(d) “Claim” shall mean any actual or potential claim, counterclaim, action, cause of action in law or in equity, suit, lien, liability, debt due, sum of money, demand, obligation, accounting, damage, punitive damages, loss, cost or expense, and attorneys’ fees of any nature whatsoever, known or unknown, contingent or non-contingent, whether arising under state, federal or other law, or based on common law, statutory law, regulations or otherwise, including, without limitation, any claim based on alleged breach of contract, breach of fiduciary duty, breach of duty of confidentiality, undue influence, incapacity, fraud, fraudulent inducement, negligent misrepresentation, unjust enrichment or other legal duty, legal fault, offense, quasi-offense or any other theory.

(e) The releases set forth in this Section 7 are effective except to the extent prohibited by law.

(f) For purposes of this Section 7 only, Viacom and its subsidiaries and the Trust and NAI Entities shall not be considered to be affiliates, the Trust and NAI Entities shall not be considered parents of Viacom, and neither Viacom nor any of Viacom’s subsidiaries shall be

10

EXECUTION COPY

considered subsidiaries of the NAI Entities or the Trust. Notwithstanding anything contained in this Settlement to the contrary, nothing contained in this Settlement shall constitute a release of any Claims (i) the Viacom Parties may have against CBS Corporation or its subsidiaries or (ii) that any NAI/Redstone Party may have against any other NAI/Redstone Party.

(g) Each of the Viacom Parties, NAI/Redstone Parties and Officer and Director Parties acknowledges that he, she or it may hereafter discover facts in addition to or different from those that they now know or believe to be true with respect to the subject matter of the Claims released herein, but the Viacom Parties, NAI/Redstone Parties and Officer and Director Parties hereby knowingly and willingly, fully, finally and forever settle and release any and all such Claims as provided in this Settlement, whether known or unknown, suspected or unsuspected, contingent or non-contingent, which now exist or heretofore have existed upon any theory of law or equity now existing or coming into existence in the future. The Viacom Parties, NAI/Redstone Parties and Officer and Director Parties acknowledge that they have read and understand, and have been advised by their respective counsel concerning, California Civil Code Section 1542 and any similar law of any state or territory of the United States or any other jurisdiction.

“A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.”

The Viacom Parties, NAI/Redstone Parties and Officer and Director Parties hereby expressly waive any and all rights and benefits respectively conferred upon them by the provisions of Section 1542 of the California Civil Code, or any similar provision, right and benefit conferred by any law of any state or territory of the United States, or principle of common law.

| 8. | Covenants Not to Sue. |

Each of the Parties warrants, covenants and agrees that she, he or it will not, individually or collectively, bring, maintain, or otherwise institute or allow others within his, her or its control to bring, maintain, or otherwise institute any action in any forum anywhere in the world that challenges:

(a) The validity or legality of this Settlement or the authority of the Parties to execute it;

(b) The validity or legality of the removal and/or resignation of Dauman and Abrams as NAI directors and as Managers of NAIEH and NAIAH;

(c) The validity or legality of the election of Krutick and Ostheimer as NAI directors and Managers of NAIEH and NAIAH;

11

EXECUTION COPY

(d) That SMR, SER, Ostheimer, Krutick, Andelman, Tyler or their respective successors are the lawful and valid directors of NAI and the lawful and valid Managers of NAIEH and NAIAH;

(e) The validity or legality of the removal and/or resignation of Dauman and Abrams as Trustees of the Trust;

(f) The validity or legality of the appointment of Krutick, Jankowski or their respective successors as Trustees of the Trust;

(g) That the lawful and valid Trustees of the Trust are: (a) during SMR’s lifetime: SMR, Andelman, Lewin, Jacobs, Phyllis, Krutick, Jankowski or their respective successors; and (b) after SMR’s death or during periods in which he is deemed “incapacitated” under the terms of the Trust: Andelman, Lewin, Jacobs, Krutick, Jankowski, SER, Tyler or their respective successors;

(h) The capacity of SMR to execute or perform this Settlement and/or asserts that SMR was unduly influenced, by SER or anyone else, to execute or perform this Settlement;

(i) The right of any NAI Entity or any of its directors, officers, members or managers to vote the Viacom shares owned by such NAI Entity or any of its affiliates (of record or beneficially), including, without limitation, with respect to election of directors to the Viacom Board or amendments to Viacom’s Bylaws;

(j) The validity or legality of any actions taken by Dauman and/or Abrams as trustees of the Trust; and

(k) The compliance by Dauman, Dooley, Abrams, SMR, SER, the Independent Directors and/or the NAI Entities with their fiduciary duties (if any) owed to Viacom or its stockholders, or any similar claim arising out of Dauman’s, Dooley’s, SMR’s, SER’s, Abrams’, or the Independent Directors’ or any of the NAI Entities’ respective capacities as Viacom directors or stockholders.

The Parties further agree that she, he or it will not knowingly encourage or voluntarily assist any third-party asserting any of the challenges set forth in this paragraph, provided, however, that nothing contained herein shall prevent or restrict any Party from providing truthful testimony or complying with any applicable law, court order or legal process (including, without limitation, subpoenas).

| 9. | Indemnification. |

Viacom (the “Indemnifying Party”) shall indemnify, defend and hold harmless (x) the Parties to this Settlement that are current and former directors and officers of Viacom (in all of their respective capacities, including as Trustees of the Trust), (y) the NAI Entities (in all of their respective capacities, including as stockholders of Viacom) and their respective stockholders or members, and the respective current and former directors, trustees, officers, and managers of the

12

EXECUTION COPY

NAI Entities and such stockholders or members (in all of their respective capacities, including as Trustees of the Trust), and (z) the agents, attorneys, representatives, heirs, executors and assigns of any of the foregoing ((x), (y), and (z) collectively the “Indemnified Parties”) from any and all Claims brought against any Indemnified Party, or expenses (including but not limited to attorneys’ fees) incurred by such Indemnified Party, including the cost of defense of such claims whether incurred prior to or after the Effective Date and the cost of responding to subpoenas or testifying as a witness, arising out of or relating to the Massachusetts Action, the California Action, the Delaware Actions, actions currently pending before the Delaware Court of Chancery captioned Gilbert v. Redstone, et al., C.A. No. 12478-CG (Del. Ch.), City of Sunrise General Employees’ Retirement Plan v. Redstone, et al., C.A. No. 12545-CB (Del. Ch.), Feuer v. Dauman, et al., C.A. No. 12579-CB (Del. Ch.) and International Union of Operating Engineers Local 478 Pension Fund v. Redstone, et al., C.A. No. 12612-CB (Del. Ch.) or any other stockholder actions, securities disclosure actions or shareholder derivative actions arising from similar facts and circumstances that are filed (such actions, the “Stockholder Actions”), their conduct as stockholders, members, directors, officers, managers, or trustees, and/or their entry into or performance of this Settlement, including challenges against the Independent Directors, the NAI Entities, or the Officer or Director Parties for breach of any alleged fiduciary duty or any other action taken in his or her capacity as a Viacom director or Trustee of the Trust or its capacity as a Viacom stockholder; provided, however, that the indemnification of the NAI Entities shall not apply to the NAI Entities’ and the stockholders or members of the NAI Entities’ costs of defense or prosecution of the Massachusetts Action, the California Action, the Salerno Action, or the NAI Action.

Any Indemnified Party seeking indemnification pursuant to this section shall promptly notify the Indemnifying Party of any such Claim brought by a third party; provided, however, that any delay or failure to timely give such notice or otherwise comply with the foregoing shall only affect the rights of an Indemnified Party hereunder to the extent, if at all, such delay or failure has a prejudicial effect on the defenses or other rights available to the Indemnifying Party with respect to such Claim.

Except with respect to the Stockholder Actions, upon receipt of any such notice, the Indemnifying Party shall have the sole power to direct and control the defense of such Claim, with counsel of its choosing, at its expense (which choice of counsel shall be subject to the Indemnified Party’s prior written consent, such consent not to be unreasonably withheld, conditioned or delayed); provided, however, that the Indemnified Party shall have the right (but not the duty) to participate in the defense thereof and to employ counsel, at his, her or its own expense (except in the case where, based on the advice of counsel to any such Indemnified Party, there is or is expected to be a conflict of interest between the Indemnifying Party and such Indemnified Party, in which case such expenses shall be at the expense of the Indemnifying Party). Subject to the foregoing sentence, any expenses incurred by any Indemnified Party in defending any such Claims brought against any Indemnified Party to which such Indemnified Party would be entitled to indemnification hereunder shall be paid by the Indemnifying Party in advance of the final disposition of such Claim on a monthly basis or on such other mutually agreed-upon schedule.

13

EXECUTION COPY

With respect to the Stockholder Actions, the Indemnified Party shall have the right to select his, her or its own counsel to direct and control the defense of such Claims at the Indemnifying Party’s expense, provided that the Indemnified Party provides the Indemnifying Party with advance notice of its selection of such counsel. The Indemnifying Party shall pay such counsel fees on a monthly basis, as they are incurred.

Notwithstanding the foregoing, the Indemnifying Party shall not, without the prior written consent of the Indemnified Party (which consent shall not be unreasonably withheld, conditioned or delayed), settle, compromise or offer to settle or compromise any Claim that:

| (i) | does not contain a full release of the Indemnified Party, |

(ii) would result in the imposition of a consent order, injunction or decree on the future activity or conduct of the Indemnified Party,

(iii) would result in a finding or admission of liability or wrongdoing or violation of law by the Indemnified Party,

(iv) would result in any monetary liability of the Indemnified Party that will not be paid or reimbursed by the Indemnifying Party, or

(v) would materially and adversely affect the ongoing business of the Indemnified Party.

Notwithstanding the foregoing provisions, the Indemnifying Party shall not be required to indemnify the Indemnified Party for any liabilities and expenses or to reimburse the Indemnified Party pursuant to any expense reimbursement provisions to the extent the Indemnified Party has otherwise actually received payment (under any insurance policy, bylaw or otherwise) of such amounts otherwise indemnifiable or reimbursable hereunder. In addition, the Indemnified Party shall reimburse the Indemnifying Party for any indemnification payments made to the Indemnified Party for any liabilities and expenses to the extent that the Indemnified Party subsequently receives payment of such amounts from another source.

Nothing herein shall limit or restrict any Party’s entitlement to indemnification or advancement of expenses pursuant to 8 Del. C. § 145, Viacom’s Charter or Bylaws or any indemnification agreements or pursuant to any other instrument or arrangement or applicable law. The Parties shall cooperate to the extent practicable to comply with reasonable requirements of Viacom’s and NAI’s respective directors’ and officers’ liability insurance carriers in order to secure coverage under their respective directors’ and officers’ liability insurance.

| 10. | Dauman Separation Payments. |

(a) Notwithstanding anything to the contrary in the PD Employment Agreement, Dauman shall be entitled, without further notice or action (other than the execution and non-revocation of the First Dauman Release (defined in Section 10(b) below)), to the rights and benefits set forth in Paragraph 9(d)(ii) (Termination without Cause or Resignation with Good

14

EXECUTION COPY

Reason) of the PD Employment Agreement, as such rights and payments are set forth on Exhibit B attached hereto (such payments, the “PD Separation Payments”).

(b) Dauman and Viacom shall, subject to any consideration period required under applicable law, execute (i) a release in the form attached hereto as Exhibit C-1 within three (3) business days of the Effective Date (the “First Dauman Release”) and (ii) subject to the Parties’ continued compliance with the terms of this Settlement and the PD Employment Agreement, a release in the form attached hereto as Exhibit C-2 within three (3) business days of the termination of the Continuation Period (the “Second Dauman Release”). Dauman hereby acknowledges and agrees that the PD Separation Payments are contingent on Dauman entering into the First Dauman Release and not revoking (or attempting to revoke) such First Dauman Release during the applicable seven-day revocation period set forth therein.

(c) As soon as commercially practicable, but in no event later than seven (7) business days following the Effective Date, Viacom shall establish and fund a grantor trust (the “PD Grantor Trust”) for the purpose of facilitating the administration of certain payments to Dauman in accordance with the terms of Exhibit D.

(d) Nothing in this Settlement, the First Dauman Release or the Second Dauman Release shall terminate or impair any indemnification rights of Dauman under the Charter or Bylaws, as in effect on the Effective Date, Paragraph 15 (Indemnification) of the PD Employment Agreement, or pursuant to any other instrument or arrangement or applicable law.

(e) Dauman and Viacom each acknowledge and reaffirm their respective rights and obligations under any provisions of the PD Employment Agreement which, by their nature, are capable of surviving the Effective Date, including, without limitation, Paragraphs 7(a) through 7(i) of the PD Employment Agreement (Exclusive Employment, Etc.), Paragraph 19 (Disputes) and Paragraph 25 (Section 409A), and such provisions shall be deemed incorporated into this Settlement as if fully set forth herein.

| 11. | Dismissal of the Litigations |

Within two (2) business days after this Settlement is fully executed and exchanged by the Parties, the Parties shall:

(a) Execute and file with the Probate and Family Court of the State of Massachusetts, Norfolk County, a Stipulation and Proposed Order of Dismissal in the form attached hereto as Exhibit E, providing for the dismissal of all claims, counterclaims and/or cross-claims asserted by any of the Parties against any of the other Parties in the Massachusetts Litigation, with prejudice and at the Parties’ own respective costs;

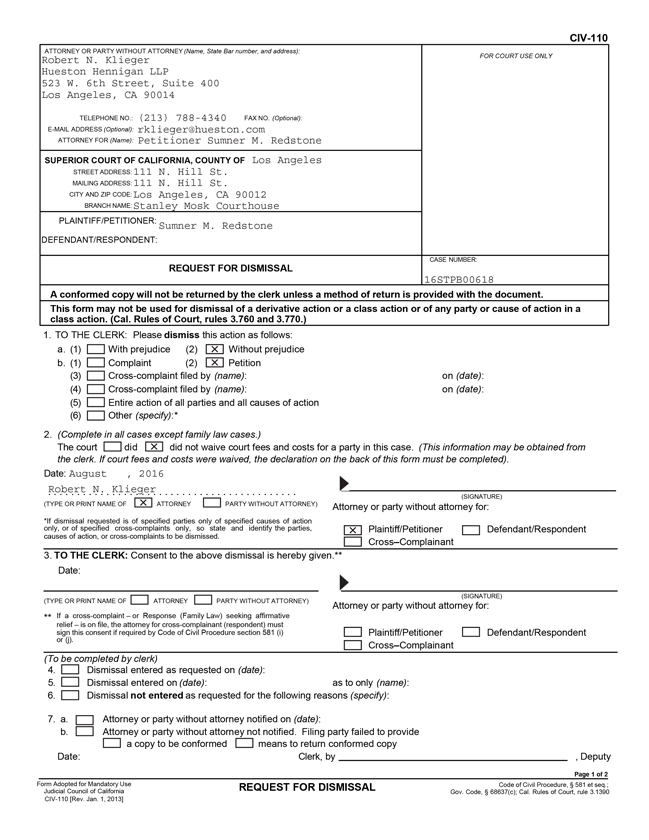

(b) Execute and file with the Superior Court of the State of California, County of Los Angeles, a Request for Dismissal in the form attached hereto as Exhibit F, providing for the dismissal of all claims, counterclaims and/or cross-claims asserted by any Party against any other Party in the California Litigation without prejudice and at the Parties own respective costs; and

15

EXECUTION COPY

(c) Execute and file with the Delaware Court of Chancery, a Stipulation of Dismissal in the form attached hereto as Exhibit G, seeking dismissal of the Delaware Actions with prejudice and at the Parties’ own respective costs.

| 12. | Litigation Costs. |

The Parties hereto agree that any and all costs and expenses incurred by, attributed to or otherwise payable by Dauman, Abrams and/or the members of the Viacom Board (including the Independent Directors) in connection with the Massachusetts Action, the California Actions, the Delaware Actions and the negotiation, enforcement and defense of this Settlement, including, without limitation, attorneys’ fees, expert fees, vendor fees disbursements and fees in connection with the filings set forth in Section 11 hereof (collectively, “Litigation Costs”), shall be paid by Viacom as incurred, and, to the extent any such Litigation Costs have been paid by any of the foregoing individuals prior to the Effective Date, Viacom shall reimburse all such Litigation Costs to the applicable individual upon the execution of this Settlement. Without limiting the foregoing, NAI hereby ratifies and approves all actions taken by the Viacom Board on or prior to the Effective Date only with respect to any Litigation Costs incurred on or prior to the Effective Date and all payments made in respect of such Litigation Costs.

| 13. | No Admission of Liability. |

This Settlement is entered into in the interests of avoiding the expenses and uncertainties of litigation. Neither this Settlement, nor any of its terms and provisions, shall be deemed an admission or concession of any fact, liability, incapacity, undue influence, fault or wrongdoing.

| 14. | Ratification. |

(a) To the extent necessary, Phyllis, SER, Jankowski, Krutick, Tyler, Andelman, Jacobs and Lewin, in their capacities as current and/or future Trustees of the Trust, hereby agree that entering into this Settlement is consistent with the terms of the Trust and in the best interests of the Trust and its current, contingent and remainder beneficiaries and on that basis enter into this Settlement and ratify the decision of SMR to enter into this Settlement as if it were their own; and

(b) SER, Tyler, Andelman, Krutick and Ostheimer, in their capacities as current and/or future directors of NAI and managers of NAIEH and NAIAH, hereby agree that entering into this Settlement is in the best interests of the NAI Entities and ratify the decision of SMR to enter into this Settlement as if it were their own.

| 15. | Status Quo Order. |

In the event that the entry into this Settlement or the actions contemplated thereby are governed by the restrictions set forth in the Status Quo Order, the Parties, including NAI, hereby waive such restrictions pursuant to paragraph 5 of the Status Quo Order, and will provide written notice to the Delaware Chancery Court of such waiver.

16

EXECUTION COPY

| 16. | Press Release. |

The Parties have mutually agreed on the press release attached hereto as Exhibit H and shall mutually agree on a Current Report on Form 8-K for Viacom to file with the Securities and Exchange Commission regarding the matters contained in this Settlement.

| 17. | No Intention to Disparage. |

The Parties express that it is their intention not to disparage any other Party, directly or indirectly. This statement of intention confers no rights or remedies on any Party.

| 18. | D&O Indemnification. |

(a) NAI (solely in its capacity as a stockholder exercising its rights as such, and without incurring any liability or responsibility for any obligation (monetary, contractual or otherwise)) and Viacom shall cause all rights to indemnification, advancement of expenses and exculpation now existing in favor of each of the current directors and officers of Viacom (collectively, the “D&O Indemnified Parties”) in all of their respective capacities as provided in Viacom’s Charter or Bylaws or any resolution of the Viacom Board or any indemnification agreements between Viacom and a D&O Indemnified Party existing as of the Effective Date or pursuant to any other instrument or arrangement or applicable law, including as set forth herein, to survive and continue in full force and effect with respect to each such D&O Indemnified Party for a period of not less than six (6) years after such D&O Indemnified Party ceases to serve on the Viacom Board or as an officer of Viacom, as applicable (the “Coverage Period”). Any repeal or modification of the indemnification and liability limitation or exculpation provisions of Viacom’s Charter and Bylaws applicable to any D&O Indemnified Party prior to the expiration of such Coverage Period shall not adversely affect any right or protection of such D&O Indemnified Party existing as of the Effective Date.

(b) Viacom shall maintain coverage for executive liability insurance (including director and officer and employment practice liability coverage) for the benefit of the D&O Indemnified Parties for the full duration of the Coverage Period with terms and conditions no less favorable to the D&O Indemnified Parties to the insurance coverage as of the Effective Date, and shall cause any successor to assume the same. Any claims-made coverage obtained by Viacom shall include coverage of the D&O Indemnified Parties for the full duration of the Coverage Period.

| 19. | Miscellaneous |

(a) Contemporaneous with the filing of the Stipulation of Dismissal in the form attached hereto as Exhibit E, the Parties shall request that the Probate and Family Court of the State of Massachusetts, Norfolk County, deny the pending Motion to Appoint Guardian Ad Litem based on the representation of Ostheimer that she adequately represents the interests of her minor children.

(b) The Parties hereto represent that they have not heretofore assigned or transferred or purported to assign or transfer to any person or entity any matter released pursuant to this Settlement. The provisions of this Settlement shall be binding upon and inure to the benefit of the Parties and their respective heirs, successors and assigns.

17

EXECUTION COPY

(c) This Settlement and all exhibits, including but not limited to the Stipulations of Dismissal with Prejudice attached hereto as Exhibit E, Exhibit F and Exhibit G, constitute the entire agreement between the Parties as it relates to the subject matter herein with respect to the settlement of the Massachusetts Action, the California Action, and the Delaware Actions. Each Party acknowledges that it is not entering into this Settlement on the basis of or in reliance upon any promise, representation or warranty other than as explicitly contained in this Settlement.

(d) This Settlement may not be modified or amended, except by an instrument in writing signed by all of the Parties adversely affected thereby; provided that prompt notice of any such modification or amendment shall be given to all Parties; provided, further, that this Settlement may be modified or amended, without a need for an instrument in writing signed by any Additional Party (and otherwise without the consent thereof or notice thereto), unless such amendment or modification is to an Additional Party Section in which case an instrument in writing signed by any Additional Party adversely affected thereby shall be required.

(e) Each Party hereby represents and warrants with respect to itself, himself or herself, that (i) the execution and performance of this Settlement is fully authorized, (ii) with respect any Party that is a corporation or other entity, the person or persons executing this Settlement have the necessary and appropriate authority to do so, (iii) no consent, approval or authorization of, or declaration, filing or registration with, any governmental or regulatory authority is required to be made or obtained by a Party that has not been obtained in order to execute and perform its obligations under this Settlement and (iv) upon the due execution by the other Parties hereto, this Settlement is a valid, legal, binding and enforceable obligation of such Party. Each Party shall indemnify, defend and hold harmless each other Party from any and all Claims brought against such other Parties arising out of or relating to a breach by such first Party of any representations or warranties contained in this Settlement.

(f) The Parties agree that each Party is entering into this Agreement by its, his or her own free will and not as the result of any undue influence or other unlawful acts by any other Party or any other person or entity.

(g) This Settlement is being entered into between sophisticated parties, each of which or who has reviewed the Settlement, had the opportunity to discuss it with its, his or her counsel, and is fully knowledgeable about its terms and conditions. The Parties therefore agree that this Settlement shall be construed without regard to the authorship of the language and without any presumption or rule of construction in favor of any of them.

(h) The Parties agree to cooperate in good faith to effect all of the terms of this Settlement. The Other Trustees (including Lewin) and SMR, SER, Tyler and Phyllis agree to take any and all actions that may be necessary to effect or confirm the appointments of Krutick and Jankowski as replacement trustees for Dauman and Abrams. The Parties further agree to execute all papers and documents and to take such other actions as may be necessary and proper to fulfill the terms and conditions of this Settlement. For the avoidance of doubt, SMR, SER, NAI, the Trust and the Other Trustees (collectively, the “NAI Parties”) each hereby agrees, to the extent applicable, to (i) vote all shares of stock of NAI held by the Trust to fulfill their respective obligations under this Settlement and against any other action, proposal, agreement or transaction that would cause a breach of their respective obligations under this Settlement, and (ii) not

18

EXECUTION COPY

commit or agree to take any action or proposal, or take any action (including without limitation entering into any transaction or agreement) that would result in a breach of any covenant, representation or warranty or any other obligation or agreement of any NAI Party or Viacom under this Settlement. NAI shall vote (or cause to be voted) all shares of Viacom stock held by NAI, NAIRI, Inc., any controlled corporate subsidiary or controlled corporate affiliate thereof, or any entity controlled, directly or indirectly, by NAI, excluding Viacom and its subsidiaries, to fulfill its respective obligations under this Settlement and against any other action, proposal, agreement or transaction that would breach its obligations under this Settlement. In the event that any NAI Party transfers, directly or indirectly, any securities of NAI or Viacom to any affiliate (excluding Viacom and its subsidiaries) thereof, such NAI Party, as a condition to any such transfer, shall require such affiliate (excluding Viacom and its subsidiaries) to agree in writing to be bound by all of the terms of this Settlement as a NAI Party as such apply to holders of securities of NAI or Viacom. Viacom hereby agrees to cause all of its subsidiaries to comply with the terms of this Settlement as if such subsidiaries were parties hereto.

(i) The headings in this Settlement have been inserted for reference only. Such headings shall not limit, modify or otherwise affect the terms and provisions hereof. Whenever the words “include”, “includes”, or “including” are used in this Agreement, they are deemed to be followed by the words “without limitation”. The words “hereof”, “herein”, and “hereunder”, and words of similar import, when used in this Settlement, refer to this Settlement as a whole and not to any particular provision of this Settlement.

(j) This Settlement, and all matters arising out of or relating to this Settlement and all transactions and events contemplated hereby, shall be interpreted under and governed by the laws of State of Delaware, without regard to conflict of law principles thereof.

(k) The Parties agree that any legal action brought to interpret or enforce any terms of this Settlement shall be brought in the Delaware Court of Chancery (or, if and only if the Delaware Court of Chancery lacks subject matter jurisdiction, any state or federal court located within the state of Delaware). Each Party hereby consents to the personal jurisdiction of such court(s) for purposes of this subparagraph, and waives any objection thereto based on personal jurisdiction or venue.

(l) This Settlement shall not be admissible as evidence in any litigation between or among the Parties except to enforce the terms expressed herein.

(m) This Settlement may be executed in a number of counterparts, including by facsimile or electronic email, each of which shall constitute an original, but all such counterparts together shall constitute one and the same Settlement. The signatures to this Settlement may be evidenced by facsimile or PDF copies reflecting the signatories hereto, and any such facsimile or PDF copy shall be sufficient evidence of each signature as if it were an original signature.

(n) The Parties acknowledge that the purpose of this Settlement is to settle disputes and release claims. In the event that any provision or portion of this Settlement is found to be void, invalid or unenforceable for any reason, the Parties will continue to interpret this Settlement to accomplish the stated purpose and all other provisions of this Settlement shall remain unaffected to the extent permitted by law.

19

EXECUTION COPY

(o) This Settlement is not intended to and shall not confer any rights or remedies upon any person other than the Parties and their respective successors and permitted assigns; provided each of the Viacom Parties, NAI/Redstone Parties, Officer and Director Parties, and the New Director Releasees shall be a third party beneficiary of Sections 7 and 8, each Indemnified Party shall be a third party beneficiary of Section 9 and each D&O Indemnified Party shall be a third party beneficiary of Section 18.

(p) Each of Dauman and Abrams shall be deemed to have resigned, effective May 20, 2016, from any and all positions that he may hold as a director, manager, officer, employee and/or agent of any of the NAI Entities or any direct or indirect subsidiary thereof; provided, that in no event shall such deemed resignation affect any of Dauman’s or Abram’s rights or entitlements pursuant to Sections 7, 9 and 18 of this Settlement, which shall be determined without reference to this Section 19(p).

(q) Each of Dauman and Abrams shall be deemed to have resigned, effective May 20, 2016, from any position he may have with respect to the Trust, including without limitation as Trustee of the Trust, and has executed a Resignation of Trustee attached as Exhibit K1 and Exhibit K2 respectively; provided, that in no event shall such deemed resignation affect any of Dauman’s or Abram’s rights or entitlements pursuant to Sections 7, 9 and 18 of this Settlement, which shall be determined without reference to this Section 19(q).

(r) Upon the execution of this Settlement, all written discovery requests and deposition notices in the Massachusetts Action, the California Action, and the Delaware Actions served by any Party to this Settlement on any Party to this Settlement are hereby withdrawn, and are no longer of any force or effect.

[remainder of page intentionally left blank]

20

IN WITNESS WHEREOF, the Parties hereto have duly executed this Agreement as of the date set forth above.

| /s/ Sumner M. Redstone |

| Sumner M. Redstone, individually and in his capacities as a director and Chairman Emeritus of Viacom, Settlor, beneficiary and trustee of the Trust, and an officer, director and, through the Trust, stockholder of NAI, and a manager of NAIEH and NAIAH |

| /s/ Shari E. Redstone |

| Shari E. Redstone, individually and in her capacities as a director and Non-Executive Vice Chair of Viacom, future trustee of the Trust, contingent beneficiary of the Trust and an officer, director and, through a trust, stockholder of NAI, and manager of NAIEH and NAIAH |

| /s/ Philippe P. Dauman |

| Philippe P. Dauman, individually, and in his capacities as President, Chief Executive Officer, a director and Executive Chairman of Viacom, as a former trustee of the Trust and as a former director of NAI, and manager of NAIEH and NAIAH |

| /s/ George S. Abrams |

| George S. Abrams, individually, and in his capacities as a director of Viacom, as a former trustee of the Trust and as a former director of NAI, and manager of NAIEH and NAIAH |

| /s/ Thomas E. Dooley |

| Thomas E. Dooley, individually, and in his capacity as a director of Viacom |

[Signature Page to Settlement Agreement]

| /s/ Thaddeus Jankowski |

| Thaddeus Jankowski, individually, and in his capacity as a trustee of the Trust and officer of NAI, NAIAH, and NAIEH (obligating himself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to him) |

| /s/ Jill Krutick |

| Jill Krutick, individually, and in her capacities as a trustee of the Trust, a director of NAI and manager of NAIEH and NAIAH (obligating herself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to her) |

| /s/ David Andelman |

| David Andelman, individually, and in his capacities as a trustee of the Trust and a director of NAI and manager of NAIEH and NAIAH (obligating himself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to him) |

| /s/ Norman Jacobs |

| Norman Jacobs, individually, and in his capacity as a trustee of the Trust (obligating himself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to him) |

| /s/ Leonard Lewin |

| Leonard Lewin, individually, and in his capacity as a trustee of the Trust (obligating himself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to him) |

[Signature Page to Settlement Agreement]

| /s/ Blythe J. McGarvie |

| Blythe J. McGarvie, individually, and in her capacity as a director of Viacom |

| /s/ Frederic V. Salerno |

| Frederic V. Salerno, individually, and in his capacity as a director of Viacom |

| /s/ William Schwartz |

| William Schwartz, individually, and in his capacity as a director of Viacom |

| /s/ Charles E. Phillips, Jr. |

| Charles E. Phillips, Jr., individually, and in his capacity as a director of Viacom |

| /s/ Cristiana Falcone Sorrell |

| Cristiana Falcone Sorrell, individually, and in her capacity as a director of Viacom |

| /s/ Deborah Norville |

| Deborah Norville, individually, and in her capacity as a director of Viacom |

| /s/ Phyllis Redstone |

| Phyllis Redstone, individually, as a named party in the Massachusetts Action and in her capacity as a trustee of the Trust (obligating herself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to her) |

[Signature Page to Settlement Agreement]

| /s/ Tyler Korff | ||

| Tyler Korff, individually, as a named party in the Massachusetts Action and in his capacity as a future trustee of the Trust and a director of NAI (obligating himself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to him) | ||

| /s/ Brandon Korff | ||

| Brandon Korff, individually, as a named party in the Massachusetts Action (obligating himself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to him) | ||

| /s/ Kimberlee Korff Ostheimer | ||

| Kimberlee Korff Ostheimer, individually and as parent and guardian on behalf of her children Harvey Benjamin Ostheimer and Haylee Rose Ostheimer, all of whom are named parties in the Massachusetts Action (obligating them only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to them) | ||

| /s/ Lauren Ellis | ||

| Lauren Ellis, individually, as a named party in the Massachusetts Action (obligating herself only as provided in the Additional Parties Sections, but subject to the protections and benefits of all other sections of the Agreement applicable to her) | ||

| NATIONAL AMUSEMENTS, INC. | ||

| By: |

/s/ Thaddeus P. Jankowski | |

| Name: | Thaddeus P. Jankowski | |

| Title: | Vice President | |

[Signature Page to Settlement Agreement]

| NAI ENTERTAINMENT HOLDINGS, LLC | ||

| By: | /s/ Thaddeus P. Jankowski | |

| Name: | Thaddeus P. Jankowski | |

| Title: | Vice President | |

| NAI ASSET HOLDINGS, LLC | ||

| By: | /s/ Thaddeus P. Jankowski | |

| Name: | Thaddeus P. Jankowski | |

| Title: | Vice President | |

| VIACOM INC. | ||

| By: | /s/ Michael D. Fricklas | |

| Name: | Michael D. Fricklas | |

| Title: | Executive Vice President, General Counsel and Secretary | |

[Signature Page to Settlement Agreement]

Exhibit A

New Directors

| 1. | Kenneth Lerer |

| 2. | Nicole Seligman |

| 3. | Judith McHale |

| 4. | Thomas May |

| 5. | Ron Nelson |

A-1

Exhibit B

PD Separation Payments

Capitalized terms used but not otherwise defined in this Exhibit B shall have the meanings ascribed to such terms in the PD Employment Agreement. In connection with Dauman’s resignation, Viacom shall pay and provide Dauman with the PD Separation Payments described in this Exhibit B, which shall be payable as provided herein.

| A. | Accrued Compensation and Benefits. As contemplated in Paragraph 9(d)(ii)(a) of the PD Employment Agreement, Viacom shall promptly pay to Dauman, on the first regularly scheduled payroll date following the Effective Date, the following accrued compensation: |

| a. | Reimbursement of any unpaid business expenses to which Dauman is entitled pursuant to Paragraph 6 of the PD Employment Agreement that were incurred prior to the Effective Date; and |

| b. | Salary through the Effective Date. |

Dauman shall also be entitled to all other vested compensation and benefits to which he is entitled as of the Effective Date under the terms and conditions applicable to such compensation and benefit. For purposes of clarity, and without limiting the foregoing, such benefits shall include: (i) pursuant to Paragraph 5(c)(i) of the PD Employment Agreement, until the second anniversary of the Effective Date, continued participation for Dauman and his spouse in certain medical, dental and hospitalization plans or programs or the economic equivalent of the benefits if and on the terms required pursuant to Paragraph 5(c)(i) of the PD Employment Agreement; (ii) pursuant to Paragraph 5(c)(ii) of the PD Employment Agreement, until the third anniversary of the Effective Date, (A) use of suitable and appropriate office facilities outside of the Viacom offices to be determined by Dauman and Viacom and (B) continued use of Rosemarie Cresswell (or a replacement designated by Dauman at his discretion) as Dauman’s personal secretary to be compensated at an annual rate of $165,405 (subject to increase at the same rate and with the same frequency as given to similarly situated secretaries at Viacom) and a right for Rosemarie Cresswell (or her replacement) to continue her participation in the same benefit programs in which she participated prior to the Effective Date; and (iii) any vested benefits under the Viacom 401(k) Plan, the Viacom Excess 401(k) Plan for Designated Senior Executives, the Viacom Pension Plan, and the Viacom Excess Pension Plan.

For the avoidance of doubt, the accrued compensation and benefits identified in Part A of this Exhibit B shall not be conditioned on Dauman’s execution and non-revocation of the First Dauman Release or the Second Dauman Release.

| B. | Pro-rata Bonus. As contemplated in Paragraph 9(d)(ii)(b) of the PD Employment Agreement, and subject to Dauman’s execution and non-revocation of the First Dauman Release, Dauman will be entitled to a Bonus for fiscal year 2016 based on his Target Bonus of $20,000,000, prorated for the 323 calendar days elapsed in fiscal year 2016 through the Effective Date. The determination of the amount payable in respect of such pro-rated Bonus shall be made in accordance with the procedures set forth in Paragraph |

B-1

| 9(d)(ii)(b) of the PD Employment Agreement. The prorated Bonus, if any, shall be payable on the earlier of (i) November 30, 2016 or (ii) the date on which bonuses are paid to similarly situated executives who participate in the Senior Executive STIP. |

| C. | Severance Payment. As contemplated by Paragraph 9(d)(ii)(c) of the PD Employment Agreement, and subject to Dauman’s execution and non-revocation of the First Dauman Release, Dauman shall be entitled to a Severance Payment of $58,000,000. $46,400,000 of the Severance Payment shall be payable on the Release Date (as defined in the First Dauman Release) and the remaining $11,600,000 of the Severance Payment will be paid in accordance with Viacom’s regular payroll practices over a period of approximately 29 months following the Release Date. Notwithstanding the foregoing, as contemplated by and in accordance with Paragraph 9(d)(iii) of the PD Employment Agreement, if Dauman materially breaches the non-compete covenant or the no-solicitation covenant set forth in Paragraphs 7(a) and (b) of the PD Employment Agreement and has not cured such breach (if curable) within thirty (30) days following his receipt of notice from Viacom that such breach has occurred, Dauman’s entitlement to any portion of the Severance Payment that has not then been made will cease. |

| D. | Vesting of Stock Options. As contemplated by Paragraph 9(d)(ii)(d) of the PD Employment Agreement, and subject to Dauman’s execution and non-revocation of the First Dauman Release, all of Dauman’s 1,723,349 unvested stock options will vest on the Release Date and any outstanding stock option shall remain exercisable until the applicable period set forth in Paragraph 4(a)(v) of the PD Employment Agreement. |

| E. | Vesting of PSUs. As contemplated by Paragraph 9(d)(ii)(e) of the PD Employment Agreement, and subject to Dauman’s execution and non-revocation of the First Dauman Release, Viacom shall issue to Dauman up to 1,114,425 Shares (plus any dividend equivalents accrued thereon), with respect to unvested PSUs, which number of Shares shall be settled net of applicable withholding taxes to be remitted to the applicable taxing authorities by Viacom. The number of shares to be issued to Dauman will be calculated in accordance with Paragraph 4(b) of the PD Employment Agreement and such shares shall be delivered to Dauman at the times set forth in Paragraph 4(b)(iv) of the PD Employment Agreement. |

| F. | Vesting of PRSUs. As contemplated by Paragraph 9(d)(ii)(f) of the PD Employment Agreement, and subject to Dauman’s execution and non-revocation of the First Dauman Release, Viacom shall issue on the Effective Date to Dauman 300,000 Shares (plus any dividend equivalents accrued thereon) with respect to unvested PRSUs, which number of Shares shall be settled net of applicable withholding taxes to be remitted to the applicable taxing authorities of Viacom. |

| G. | Insurance. As contemplated by Paragraph 9(d)(ii)(g) of the PD Employment Agreement, and subject to Dauman’s execution and non-revocation of the First Dauman Release, Viacom shall continue to provide Dauman with no less than $5,000,000 in life insurance or such lesser amount determined in accordance with the terms set forth in such Paragraph. |

B-2

| H. | Section 409A Delay. As contemplated by Paragraph 25 of the PD Employment Agreement, to the extent that any payment or benefit is delayed pursuant to the Section 409A Amendment, the accrual of interest on such delayed payments during the period of such delay shall be at a rate equal to Viacom’s highest borrowing rate in effect at the Termination Date. |

B-3

Exhibit C-1

FIRST DAUMAN RELEASE

WHEREAS, Philippe P. Dauman (hereinafter referred to as the “Executive”) and Viacom Inc. (hereinafter referred to as “Employer”) are parties to an Employment Agreement, amended and restated as of January 15, 2015 (the “Employment Agreement”), which provided for the Executive’s employment with Employer on the terms and conditions specified therein; and

WHEREAS, pursuant to paragraph 9(d) of the Employment Agreement, the Executive has agreed to execute a release of the type and nature set forth herein as a condition to his entitlement to certain payments and benefits upon his termination of employment with Employer; and

NOW, THEREFORE, in consideration of the premises and mutual promises herein contained and for other good and valuable consideration received or to be received by the Executive in accordance with the terms of the Employment Agreement, it is agreed as follows: