Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION - Wonhe High-Tech International, Inc. | f10q0616ex32_wonhehightech.htm |

| EX-31.2 - CERTIFICATION - Wonhe High-Tech International, Inc. | f10q0616ex31ii_wonhehightech.htm |

| EX-31.1 - CERTIFICATION - Wonhe High-Tech International, Inc. | f10q0616ex31i_wonhehightech.htm |

U. S. Securities and Exchange Commission

Washington, D. C. 20549

FORM 10-Q

☒ QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2016

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File No. 0-54744

WONHE HIGH-TECH INTERNATIONAL, INC.

(Name of Registrant in its Charter)

| Nevada | 26-0775642 | |

(State of Other Jurisdiction of incorporation or organization) |

(I.R.S.

Employer I.D. No.) |

Room 1001, 10th Floor, Resource Hi-Tech Building South Tower

No. 1 Songpingshan Road, North Central Avenue North High-Tech Zone

Nanshan District, Shenzhen, Guangdong Province, P.R. China 518057

(Address of Principal Executive Offices)

Issuer's Telephone Number: 852-2815-0191

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☒ |

APPLICABLE ONLY TO CORPORATE ISSUERS: Indicate the number of shares outstanding of each of the Registrant's classes of common stock, as of the latest practicable date:

August 19, 2016

Common Voting Stock: 73,510,130

WONHE HIGH-TECH INTERNATIONAL, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE FISCAL QUARTER ENDED JUNE 30, 2016

TABLE OF CONTENTS

| Page No | ||

| Part I | Financial Information | |

| Item 1. | Financial Statements (unaudited): | 1 |

| Consolidated Balance Sheets (Unaudited) – June 30, 2016 and December 31, 2015 | 1 | |

| Consolidated Statements of Income and Other Comprehensive Income (Unaudited) - for the Three and Six Months Ended June 30, 2016 and 2015 | 3 | |

| Consolidated Statement of Changes in Stockholders Equity (Unaudited) for the Six Months Ended June 30, 2016 | 6 | |

| Consolidated Statements of Cash Flows (Unaudited) – for the Six Months Ended June 30, 2016 and 2015 | 7 | |

| Notes to Consolidated Financial Statements (Unaudited) | 9 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 33 |

| Item 3 | Quantitative and Qualitative Disclosures about Market Risk | 38 |

| Item 4. | Controls and Procedures | 38 |

| Part II | Other Information | |

| Item 1. | Legal Proceedings | 39 |

| Items 1A. | Risk Factors | 39 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 39 |

| Item 3. | Defaults upon Senior Securities | 39 |

| Item 4. | Mine Safety Disclosures | 39 |

| Item 5. | Other Information | 39 |

| Item 6. | Exhibits | 39 |

| Signatures | 40 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN U.S. $)

ASSETS | June 30, 2016 | December 31, 2015 | ||||||

| (Unaudited) | ||||||||

| Current assets: | ||||||||

| Cash | $ | 46,282,021 | $ | 52,074,752 | ||||

| Accounts receivable | 4,711,400 | 3,645,907 | ||||||

| Inventory | 76,878 | - | ||||||

| Prepaid expense | 5,314 | - | ||||||

| Total current assets | 51,075,613 | 55,720,659 | ||||||

| Fixed assets | 869,006 | 2,161,102 | ||||||

| Less: accumulated depreciation | (362,961 | ) | (416,521 | ) | ||||

| Fixed assets, net | 506,045 | 1,744,581 | ||||||

| Other assets: | ||||||||

| Intangible assets, net | 12,979 | 16,749 | ||||||

| Investment in project | 17,780,799 | 5,852,430 | ||||||

| Other assets | 17,058 | 17,121 | ||||||

| Prepaid income taxes | 336,159 | 1,164,478 | ||||||

| Total other assets | 18,146,995 | 7,050,778 | ||||||

| TOTAL ASSETS | $ | 69,728,653 | $ | 64,516,018 | ||||

See accompanying notes to the consolidated financial statements.

| 1 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN U.S. $)

LIABILITIES AND stockholders’ EQUITY | June

30, | December 31, 2015 | ||||||

| (Unaudited) | ||||||||

| Current liabilities: | ||||||||

| Payroll payable | $ | 67,044 | $ | 47,891 | ||||

| Taxes payable | 252,255 | 176,997 | ||||||

| Loan from stockholder | 354,913 | 335,655 | ||||||

| Accrued expenses and other payables | 199,009 | 192,550 | ||||||

| Total current liabilities | 873,221 | 753,093 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock: $0.001 par value; 10,000,000 shares authorized; none issued and outstanding | - | - | ||||||

| Common stock: $0.001 par value; 90,000,000 shares authorized; 73,510,130 and 58,510,130 shares issued and outstanding at June 30, 2016 and December 31, 2015, respectively | 73,510 | 58,510 | ||||||

| Additional paid-in capital | 38,781,666 | 37,592,346 | ||||||

| Retained earnings | 10,211,326 | 7,610,229 | ||||||

| Statutory reserve fund | 1,999,640 | 1,695,564 | ||||||

| Other comprehensive (loss) | (3,112,900 | ) | (1,989,695 | ) | ||||

| Stockholders’ equity before noncontrolling interests | 47,953,242 | 44,966,954 | ||||||

| Noncontrolling interests | 20,902,190 | 18,795,971 | ||||||

| Total stockholders’ equity | 68,855,432 | 63,762,925 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 69,728,653 | $ | 64,516,018 | ||||

See accompanying notes to the consolidated financial statements.

| 2 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME (LOSS)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

Three

Months Ended | Six Months Ended June 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Sales | $ | 11,215,593 | $ | 7,243,941 | $ | 21,635,734 | $ | 13,424,684 | ||||||||

| Cost of sales | (7,500,281 | ) | (3,864,137 | ) | (14,366,343 | ) | (7,115,998 | ) | ||||||||

| Gross profit | 3,715,312 | 3,379,804 | 7,269,391 | 6,308,686 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development expenses | 106,409 | 31,597 | 153,518 | 55,385 | ||||||||||||

| Selling and marketing | 146,988 | 117,409 | 301,712 | 131,362 | ||||||||||||

| General and administrative | 306,086 | 163,336 | 673,398 | 301,444 | ||||||||||||

| Total operating expenses | 559,483 | 312,342 | 1,128,628 | 488,191 | ||||||||||||

| Income from operations | 3,155,829 | 3,067,462 | 6,140,763 | 5,820,495 | ||||||||||||

| Non-operating income (loss): | ||||||||||||||||

| Interest income | 83,474 | 48,592 | 172,828 | 81,672 | ||||||||||||

| Other non-operating expenses | (1,447 | ) | - | (4,181 | ) | - | ||||||||||

| Total non-operating income | 82,027 | 48,592 | 168,647 | 81,672 | ||||||||||||

See accompanying notes to the consolidated financial statements.

| 3 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME (LOSS)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

Three

Months Ended | Six

Months Ended | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Income before provision for income taxes | 3,237,856 | 3,116,054 | 6,309,410 | 5,902,167 | ||||||||||||

| Provision for income taxes | 417,690 | 390,606 | 814,995 | 739,841 | ||||||||||||

| Net income | 2,820,166 | 2,725,448 | 5,494,415 | 5,162,326 | ||||||||||||

| Noncontrolling interests | (1,328,692 | ) | (135,942 | ) | (2,589,242 | ) | (257,495 | ) | ||||||||

| Net income attributable to common stockholders | $ | 1,491,474 | $ | 2,589,506 | $ | 2,905,173 | $ | 4,904,831 | ||||||||

| Earnings per common share, basic and diluted | $ | 0.02 | $ | 0.05 | $ | 0.05 | $ | 0.11 | ||||||||

| Weighted average shares outstanding, basic and diluted | 70,378,262 | 53,864,745 | 64,444,196 | 46,165,213 | ||||||||||||

See accompanying notes to the consolidated financial statements.

| 4 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME (LOSS)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Comprehensive income (loss): | ||||||||||||||||

| Net income | $ | 1,491,474 | $ | 2,725,448 | $ | 2,905,173 | $ | 5,162,326 | ||||||||

| Foreign currency translation adjustment | (2,043,425 | ) | 6,368 | (1,606,228 | ) | 162,125 | ||||||||||

| Comprehensive (loss) income | (551,951 | ) | 2,731,816 | 1,298,945 | 5,324,451 | |||||||||||

| Comprehensive income (loss) attributable to noncontrolling interests | (714,801 | ) | (136,881 | ) | (2,106,220 | ) | (264,352 | ) | ||||||||

Net comprehensive income (loss) attributable to common stockholders | $ | (1,266,752 | ) | $ | 2,594,935 | $ | (807,275 | ) | $ | 5,060,099 | ||||||

See accompanying notes to the consolidated financial statement.

| 5 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF changes in Stockholders’ EQUITY

FOR THE SIX months ended JUNE 30, 2016

(UNAUDITED, IN U.S. $)

| Common Stock | Additional Paid-in Capital | Retained Earnings | Statutory Reserve Fund | Noncontrolling Interests | Other Comprehensive Income | Total | ||||||||||||||||||||||

| Balance, December 31, 2015 | $ | 58,510 | $ | 37,592,346 | $ | 7,610,229 | $ | 1,695,564 | $ | 18,795,971 | $ | (1,989,695 | ) | $ | 63,762,925 | |||||||||||||

| Sales of common stock | 15,000 | 1,189,320 | 1,204,320 | |||||||||||||||||||||||||

| Net Income | - | - | 2,905,173 | - | 2,589,242 | - | 5,494,415 | |||||||||||||||||||||

| Appropriation of statutory reserve | - | - | (304,076 | ) | 304,076 | - | - | - | ||||||||||||||||||||

| Other comprehensive income | - | - | - | - | (483,023 | ) | (1,123,205 | ) | (1,606,228 | ) | ||||||||||||||||||

| Balance, June 30, 2016 | $ | 73,510 | $ | 38,781,666 | $ | 10,211,326 | $ | 1,999,640 | $ | 20,902,190 | $ | (3,112,900 | ) | $ | 68,855,432 | |||||||||||||

See accompanying notes to the consolidated financial statements.

| 6 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| Six Months Ended June 30, | ||||||||

| 2016 | 2015 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 5,494,415 | $ | 5,162,326 | ||||

| Adjustment to reconcile net income to net cash provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 157,810 | 47,906 | ||||||

| Loss on disposal of fixed assets | 4,170 | - | ||||||

| Change in operating assets and liabilities: | ||||||||

| (Increase) decrease in accounts receivable | (1,065,430 | ) | 553,325 | |||||

| (Increase) in inventory | (76,878 | ) | (2,774 | ) | ||||

| (Increase) in prepaid expenses | (5,314 | ) | - | |||||

| Decrease in prepaid income taxes | 828,319 | 726,970 | ||||||

| Increase in payroll payable | 19,153 | 16,008 | ||||||

| Increase (decrease) in taxes payable | 75,258 | (21,585 | ) | |||||

| Increase (decrease) in accrued expenses and other payable | 6,459 | (13,419 | ) | |||||

| Net cash provided by operating activities | 5,437,962 | 6,468,757 | ||||||

| Cash flows from Investing activities: | ||||||||

| Purchase of property, plant and equipment | (57,320 | ) | (519,508 | ) | ||||

| Purchase of intangible assets | (7,618 | ) | (22,032 | ) | ||||

| Investment in project | (11,136,879 | ) | - | |||||

| Net cash (used in) investing activities | (11,201,817 | ) | (541,540 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from sales of common stocks | 1,204,320 | 15,196,298 | ||||||

| Proceeds from stockholder loan | - | 51,898 | ||||||

| Net cash provided by financial activities | 1,204,320 | 15,248,196 | ||||||

| Effect of exchange rate changes on cash | (1,233,196 | ) | 162,320 | |||||

| Net change in cash | (5,792,731 | ) | 21,337,733 | |||||

| Cash, beginning | 52,074,752 | 34,447,100 | ||||||

| Cash, ending | $ | 46,282,021 | $ | 55,784,833 | ||||

See accompanying notes to the consolidated financial statements.

| 7 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

Six

Months Ended | ||||||||

| 2016 | 2015 | |||||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for income taxes | $ | - | $ | - | ||||

| Cash paid for interest | $ | - | $ | - | ||||

| Noncash Investing activities: | ||||||||

| Fixed assets transferred to investment in project | $ | 1,125,125 | $ | - | ||||

| Noncash financing activities: | ||||||||

| Payment of accrued expenses by stockholder | $ | 25,000 | $ | - | ||||

See accompanying notes to the consolidated financial statements.

| 8 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

|

1. | ORGANIZATION AND BUSINESS |

Wonhe High-Tech International, Inc. (the “Company” or “Wonhe High-Tech”) was incorporated in the State of Nevada on August 13, 2007. The Company changed its name from Baby Fox International, Inc. to Wonhe High-Tech International, Inc. on April 20, 2012. On June 27, 2012, the Company acquired all of the outstanding capital stock of World Win International Holding Ltd. or “World Win” in exchange for 19,128,130 shares of the Company’s common stock (the “Share Exchange”).

As a result of the acquisition in June 2012, the Company’s consolidated subsidiaries included World Win, the Company’s wholly-owned subsidiary, which is incorporated under the laws of the British Virgin Island (“BVI”), Kuayu International Holdings Group Limited (Hong Kong), or “Kuayu,” a wholly-owned subsidiary of World Win which is incorporated under the laws of Hong Kong, and Shengshihe Management Consulting (Shenzhen) Co., Ltd., or “Shengshihe Consulting,” a wholly-owned subsidiary of Kuayu which is incorporated under the laws of the People’s Republic of China (“PRC”). The Company also consolidated the financial position and results of operations of Shenzhen Wonhe Technology Co., Ltd., or “Shenzhen Wonhe,” a company incorporated under the laws of the PRC which was effectively and substantially controlled by Shengshihe Consulting through a series of captive agreements. Shenzhen Wonhe was considered a variable interest entity (“VIE”) of Shengshihe Consulting.

On May 30, 2012, Shenzhen Wonhe entered into (i) an Exclusive Technical Service and Business Consulting Agreement, (ii) a Proxy Agreement, (iii) Share Pledge Agreement, and (iv) Call Option Agreement with Shengshihe Consulting. The foregoing agreements are collectively referred to as the “VIE Agreements.”

Exclusive Technical Service and Business Consulting Agreement: Pursuant to the Exclusive Technical Service and Business Consulting Agreement, Shengshihe Consulting provided technical support, consulting, training, marketing and business consulting services to Shenzhen Wonhe as related to its business activities. In consideration for such services, Shenzhen Wonhe agreed to pay as an annual service fee to Shengshihe Consulting, 95% of Shenzhen Wonhe’s annual net income plus an additional monthly payment of approximately $8,015 (RMB 50,000). The agreement had an unlimited term and could only be terminated by mutual agreement of the parties.

Proxy Agreement: Pursuant to the Proxy Agreement, the stockholders of Shenzhen Wonhe agreed to irrevocably entrust Shengshihe Consulting to designate a qualified person, acceptable under PRC law and foreign investment policies, to vote all of the equity interests in Shenzhen Wonhe held by each of its stockholders. The Agreement had an unlimited term and could only be terminated by mutual agreement of the parties.

| 9 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 1. | ORGANIZATION AND BUSINESS (continued) |

Call Option Agreement: Pursuant to the Call Option Agreement, Shengshihe Consulting had an exclusive option to purchase, or to designate a purchaser for, to the extent permitted by PRC law and foreign investment policies, part or all of the equity interests in Shenzhen Wonhe held by each of its stockholders. To the extent permitted by PRC laws, the purchase price for the entire equity interest was approximately $0.16 (RMB1.00) or the minimum amount required by PRC law or government practice.

Share Pledge Agreement: Pursuant to the Share Pledge Agreement, the stockholders of Shenzhen Wonhe pledged their shares to Shengshihe Consulting to secure the obligations of Shenzhen Wonhe under the Exclusive Technical Service and Business Consulting Agreement. In addition, the stockholders of Shenzhen Wonhe agreed not to transfer, sell, pledge, dispose of or create any encumbrance on their interests in Shenzhen Wonhe that would affect Shengshihe Consulting’s interests.

Until September 15, 2015, Shengshihe Management controlled Shenzhen Wonhe through the above contractual agreements, which made Shenzhen Wonhe a variable interest entity, the effect of which was to cause the balance sheet and operating results of Shenzhen Wonhe to be consolidated with those of Shengshihe Management in the Company’s financial statements.

On September 15, 2015, Shengshihe Consulting, exercised its option to purchase all of the registered equity of Shenzhen Wonhe. The purchase price paid for the equity was RMB10,000 (approximately $1,569). The equity was purchased from Qing Tong, Nanfang Tong, Youliang Wang and Jingwu Li, who are the members of Wonhe High-Tech's Board of Directors. As a result of the acquisition by Shengshihe Consulting of the registered ownership of Shenzhen Wonhe, the balance sheet and operating results of Shenzhen Wonhe will hereafter continue to be consolidated with those of Shengshihe Consulting as its 100% owned subsidiary.

In July 2015, World Win, the Company's wholly-owned subsidiary, organized Wonhe Multimedia Commerce Ltd. ("Australian Wonhe") under Australian law. 60% of the capital stock of Australian Wonhe was issued to World Win, 25% was issued to Wonhe International (Hong Kong), which is wholly owned and controlled by Qing Tong, who is Chairman of the Board of Wonhe High-Tech and the remaining 15% was issued to three non-affiliated financial consultants. On August 5, 2015, World Win sold all of the outstanding capital stock of Kuayu to Australian Wonhe. In exchange for Kuayu, Australian Wonhe paid World Win $10,000 Hong Kong Dollars (US $1,290). Kuayu is the sole owner of Shengshihe Consulting, which in turn had the VIE agreements with Shenzhen Wonhe at that time, the Company's VIE and operating company. The sale of Kuayu, therefore, reduced the interest of the Company in its operating company by 40%.

On December 21, 2015, the Company’s 60% owned subsidiary, Australia Wonhe was listed on the ASX and sold 16,951,802 of its ordinary shares for net proceeds of $1,941,318.

| 10 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 1. | ORGANIZATION AND BUSINESS (continued) |

The 33,750,000 shares of Australia Wonhe issued to the chairman of the board’s wholly owned company, Wonhe International (Hong Kong), and the 20,250,000 shares issued to the financial consultants were recognized as compensation during the nine months ended September 30, 2015. The value of the compensation was determined using the public offering price of $0.13952 US per share for the shares to be sold in Australia. The total stock compensation recognized was $7,534,080.

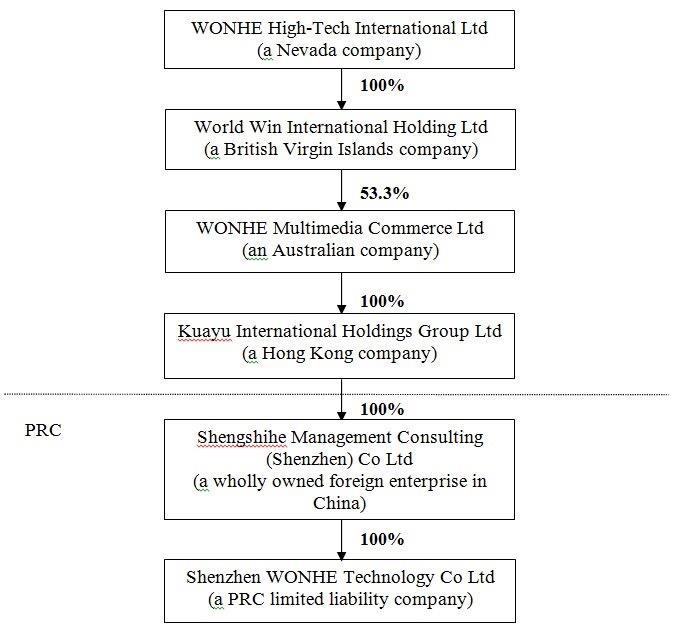

The Company’s current organization structure is as follows:

| 11 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 1. | ORGANIZATION AND BUSINESS (continued) |

Shenzhen Wonhe is a Chinese entity established on November 16, 2010 with registered capital of $7,495,000. It specializes in the research and development, outsourced-manufacturing and sale of hi-tech products based on x86 (instruction set architecture based on the Intel 8086 CPU) and ARM (32-bit reduced instruction set architecture). Current products still under research and development include a Smart Media Box (SMB), Home Smart Server (HSS), Mini PC (MPC), All in One PC (AIO-PC), Business PAD (B-PAD), and Portable PAD (P-PAD). The Company started to sell its new product HMC 720 in the last quarter of 2014. In addition, the Company started to sell another new product, a Wi-Fi-Router with model number YLT-100S, during the first quarter of 2015 and model number YLT-300S during the second quarter of 2015. YLT-100S is used by individuals, and YLT-300S is used in shopping malls. Shenzhen Wonhe is located in the Shenzhen, Guangdong Province in the PRC.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Accounting and Presentation

The accompanying consolidated financial statements have been prepared on the accrual basis of accounting. The consolidated financial statements as of and for the three and six months ended June 30, 2016 and 2015 include Wonhe High-Tech, World Win, Wonhe Multimedia, Kuayu, Shengshihe Consulting and Shenzhen Wonhe. All significant intercompany accounts and transactions have been eliminated in consolidation.

The unaudited interim consolidated financial statements of the Company as of June 30, 2016 and for the three and six months ended June 30, 2016 and 2015, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the SEC which apply to interim financial statements. Accordingly, they do not include all of the information and footnotes normally required by accounting principles generally accepted in the United States of America for annual financial statements. In the opinion of management, such information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The interim consolidated financial information should be read in conjunction with the consolidated financial statements and the notes thereto, included in the Company’s Form 10-K filed with the SEC. The results of operations for the three and six months ended June 30, 2016 and 2015 are not necessarily indicative of the results to be expected for future quarters or for the year ending December 31, 2016.

All consolidated financial statements and notes to the consolidated financial statements are presented in United States dollars (“US Dollar” or “US$” or “$”).

| 12 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Foreign Currency Translation

Almost all of the Company’s assets are located in the PRC. The functional currency for the majority of the operations is the Renminbi (“RMB”). For Kuayu, the functional currency for the majority of its operations is the Hong Kong Dollar (“HKD”). For Australian Wonhe, the functional currency is the Australian dollar (“AUD”). The Company uses the US Dollar for financial reporting purposes. The consolidated financial statements of the Company have been translated into US dollars in accordance with the Financial Accounting Standards Board “FASB” Accounting Standards Codification “ASC” section 830, “Foreign Currency Matters.”

All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. The consolidated statements of operations and other comprehensive income (loss) amounts have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of the Company’s consolidated financial statements are recorded as other comprehensive income (loss).

The exchange rates used to translate amounts in RMB into US dollars for the purposes of preparing the consolidated financial statements are as follows:

June

30, | December 31, 2015 | ||||||||

(Unaudited)

| |||||||||

| Balance sheet items, except for stockholders’ equity, as of periods end | 0.1505 | 0.1540 | |||||||

| 13 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Foreign Currency Translation (continued)

| Three Months Ended June 30, | Six

Months Ended | ||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | ||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||

| Amounts included in the statements of income and cash flows for the periods | 0.1531 | 0.1633 | 0.1530 | 0.1629 | |||||||||||||

The exchange rates used to translate amounts in AUD into US dollars for the purposes of preparing the consolidated financial statements are as follows:

June

30, | December 31, 2015 | ||||||||

| (Unaudited) | |||||||||

| Balance sheet items, except for stockholders’ equity, as of periods end | 0.7441 | 0.7288 | |||||||

| Three Months Ended June 30, | Six

Months Ended | ||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | ||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||

| Amounts included in the statements of income and cash flows for the periods | 0.7456 | 0.7773 | 0.7337 | 0.7819 | |||||||||||||

For the three and six months ended June 30, 2016 and 2015, foreign currency translation adjustments of $(2,043,425) and $6,368 respectively, $(1,606,228) and $162,125, respectively, have been reported as other comprehensive income (loss). Other comprehensive income (loss) of the Company consists solely of foreign currency translation adjustments. Pursuant to FASB ASC 740-30-25-17, “Exceptions to Comprehensive Recognition of Deferred Income Taxes,” the Company does not recognize deferred U.S. taxes related to the undistributed earnings of its foreign subsidiaries and, accordingly, recognizes no income tax expense or benefit from foreign currency translation adjustments.

| 14 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Foreign Currency Translation (continued)

For the three and six months ended June 30, 2016 and 2015, foreign currency translation adjustments of $(2,043,425) and $6,368 respectively, $(1,606,228) and $162,125, respectively, have been reported as other comprehensive income (loss). Other comprehensive income (loss) of the Company consists solely of foreign currency translation adjustments. Pursuant to FASB ASC 740-30-25-17, “Exceptions to Comprehensive Recognition of Deferred Income Taxes,” the Company does not recognize deferred U.S. taxes related to the undistributed earnings of its foreign subsidiaries and, accordingly, recognizes no income tax expense or benefit from foreign currency translation adjustments.

Although government regulations now allow convertibility of the RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that the RMB could be converted into US and Australian dollars at that rate or any other rate.

The value of the RMB against the US and Australian dollar may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. Any significant revaluation of the RMB may materially affect the Company’s financial condition in terms of US dollar reporting.

Revenue and Cost Recognition

The Company receives revenues from the sale of electronic products. The Company’s revenue recognition policies are in compliance with SEC Staff Accounting Bulletin (“SAB”) 104 (codified in FASB ASC Topic 605). Sales revenue is recognized when the products are delivered and when customer acceptance occurs, the price is fixed or determinable, no other significant obligations of the Company exist and collectability is reasonably assured. Finished goods are delivered from outsourced manufacturers to the Company. Revenue is recognized when the title to the products has been passed to the customer, which is the date the products are picked up by the customer at the Company’s location or delivered to the designated locations by Company employees and accepted by the customer and the previously discussed requirements are met. The customer’s acceptance occurs upon inspection at the time of pickup or delivery by signing an acceptance form.

| 15 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Revenue and Cost Recognition (continued)

The Company does not provide its customers with the right of return. A 36-month warranty is offered to customers for exchange or repair of defective products, the cost of which is substantially covered by the outsourced manufacturers’ warranty policies as specified in the contract between the Company and its outsourced manufacturers. As a result, the Company does not recognize a warranty liability.

The Company follows the guidance set forth by FASB ASC 605-45-45 to assess whether the Company acts as the principal or agent in the transaction. The determination involves judgment and is based on an evaluation of whether the Company has the substantial risks and rewards of ownership under the terms of the arrangement. Based on the assessment, the Company determined it acts as a principal in the transaction and reports revenues on the gross basis.

FASB ASC 605-45-45 sets forth eight criteria that support reporting recognition of gross revenue (i.e. principal sales) and three that support reporting net revenue (i.e. agent sales). As applied to the relationship between the Company, its manufacturers, and its customers, the following are the criteria that support reporting gross revenue:

| ● | Shenzhen Wonhe is the primary obligor in each sale, as it is responsible for fulfillment of customer orders, including the acceptability of the products purchased by the customer. |

| ● | Shenzhen Wonhe has general inventory risk, as it takes title to a product before that product is ordered by or delivered to a customer. |

| ● | Shenzhen Wonhe establishes its own pricing for its products. |

| ● | Shenzhen Wonhe has discretion in supplier selection. |

| ● | Shenzhen Wonhe designed the Home Media Center Model 720 (the “HMC720”) and the two Wifi Routers and is responsible for all of its specifications. |

| ● | Shenzhen Wonhe has physical inventory loss risk until the product is delivered to the customer. |

| ● | Shenzhen Wonhe has full credit risk for amounts billed to its customers. |

The only criterion supporting recognition of gross revenue that is not satisfied by the relationship between the Company and its manufacturers is: the entity changes the product or performs part of the service. Moreover, none of the three criteria supporting recognition of net revenue is present in the Company’s sales transactions. For this reason, the Company records gross revenue with respect to sales by Shenzhen Wonhe.

| 16 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Fair Value of Financial Instruments

FASB ASC 820 specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

| Level 1 | Inputs – Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access. |

| Level 2 | Inputs – Inputs other than the quoted prices in active markets that are observable either directly or indirectly. |

| Level 3 | Inputs – Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements. |

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurements. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. As of June 30, 2016 and December 31, 2015, none of the Company’s assets and liabilities were required to be reported at fair value on a recurring basis. Carrying values of non-derivative financial instruments, including cash, accounts receivable and various payables, approximate their fair values due to the short term nature of these financial instruments. There were no changes in methods or assumptions during the periods presented.

Advertising Costs

Advertising costs are paid to an advertising agency for market analysis and strategic planning and are charged to operations when incurred. Advertising costs were $114,803 and $97,980, respectively, $229,461 and $97,740, respectively, for the three and six months ended June 30, 2016 and 2015.

| 17 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Research and Development Costs

The Company develops software to be marketed as part of its products, and that is not for internal use. The software is essential to the functionality of the Company’s tangible products. Therefore, the Company accounts for research and development costs incurred in development of its software in accordance with FASB ASC 985-20.

Research and development costs are charged to operations when incurred. Development costs of computer software to be sold, leased, or otherwise marketed are subject to capitalization beginning when a product’s technological feasibility has been established and ending when a product is available for general release to customers. In most instances, the Company’s products are released soon after technological feasibility has been established. Therefore, costs incurred subsequent to achievement of technological feasibility are usually not significant, and generally most software development costs have been expensed as incurred. Research and development costs were $106,409 and $31,597, respectively, $153,518 and $55,385, respectively, for the three and six months ended June 30, 2016 and 2015.

Cash and Cash Equivalents

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Accounts Receivable

Accounts receivable are stated at cost, net of an allowance for doubtful accounts. Receivables outstanding longer than the payment terms are considered past due. The Company provides an allowance for doubtful accounts for estimated losses resulting from the failure of customers to make required payments, when due. The Company reviews the accounts receivable on a periodic basis and makes allowances where there is doubt as to the collectability of the outstanding balance. In evaluating the collectability of an individual receivable balance, the Company considers many factors, including the age of the balance, the customer’s payment history, its current credit-worthiness and current economic trends. As of June 30, 2016 and December 31, 2015, the Company considered all accounts receivable collectable and an allowance for doubtful accounts was not necessary. For the three and six months ended June 30, 2016 and 2015, the Company did not write off any accounts receivable as bad debts.

| 18 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Fixed Assets and Depreciation

Fixed assets are recorded at cost, less accumulated depreciation. Cost includes the price paid to acquire the asset, and any expenditure that substantially increases the asset’s value or extends the useful life of an existing asset. Leasehold improvements are amortized over the lesser of the remaining term of the lease or the estimated useful lives of the improvements. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the periods benefited. Maintenance and repairs are generally expensed as incurred.

The estimated useful lives for fixed asset categories are as follows:

| Office equipment | 5 years | ||

| Motor vehicles | 5 years | ||

| Leasehold improvements | Shorter of the remaining term of the lease or life of the improvement |

Impairment of Long-lived Assets

The Company applies FASB ASC 360, “Property, Plant and Equipment,” which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company may recognize the impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to those assets. No impairment of long-lived assets was recognized for the periods presented.

Statutory Reserve Fund

Pursuant to corporate law of the PRC, Shengshihe Consulting and Shenzhen Wonhe are required to transfer 10% of their net income, as determined under PRC accounting rules and regulations, to a statutory reserve fund until such reserve balance reaches 50% of their registered capital. The statutory reserve fund is non-distributable, other than during liquidation, and can be used to fund prior years’ losses, if any, and may be utilized for business expansion or used to increase registered capital, provided that the remaining reserve balance after such use is not less than 25% of the registered capital. As of June 30, 2016, $1,999,640 has been transferred from retained earnings to the statutory reserve fund.

| 19 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Income Taxes

The Company accounts for income taxes in accordance with FASB ASC 740, “Income Taxes” (“ASC 740”), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent the future tax consequences for those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses that are available to offset future taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized

ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with these tax positions. As of June 30, 2016 and December 31, 2015, the Company did not have any liabilities for unrecognized tax benefits.

The income tax laws of various jurisdictions in which the Company and its subsidiaries operate are summarized as follows:

United States

The Company is subject to United States tax at graduated rates from 15% to 35%. No provision for income taxes in the United States has been made as the Company had no U.S. taxable income for the three and six months ended June 30, 2016 and 2015.

BVI

World Win is incorporated in the BVI and is governed by the income tax laws of the BVI. According to current BVI income tax law, the applicable income tax rate for the Company is 0%.

| 20 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Income Taxes (continued)

Australia

Australian Wonhe is incorporated in Australia. Pursuant to the income tax laws of Australia, the Company is not subject to tax on non-Australia source income.

Hong Kong

Kuayu International is incorporated in Hong Kong. Pursuant to the income tax laws of Hong Kong, the Company is not subject to tax on non-Hong Kong source income.

PRC

Shenzhen Wonhe and Shengshihe Consulting are subject to an Enterprise Income Tax at 25% and each file their own tax returns. Consolidated tax returns are not permitted in China. On July 23, 2012, the National Tax Bureau, Shenzhen Nanshan Branch declared that Shenzhen Wonhe is qualified for the preferential tax treatment afforded by the PRC to enterprises engaged in the development of software or integrated circuits. As a result, starting from its first profitable year, Shenzhen Wonhe had a two-year exemption from the Enterprise Income Tax and has a 50% exemption for the next three years commencing January 1, 2014. The tax regulations required that the enterprise pay income tax until its eligibility for the exemption is determined - i.e. until the local tax bureau determines that the enterprise has recorded its first profitable year. Payments were made of approximately $2,600,000 (RMB 16,107,000) based upon 2012 income while the local tax bureau reviewed the Company’s financial results. The National Tax Bureau determined that the Company had realized a profit in 2012. Since the Company was declared exempt from tax with respect to 2012, the payments that were made will be applied to future income taxes due. The payments have been reflected as prepaid income taxes on the balance sheet as of June 30, 2016 and December 31, 2015. For the three and six months ended June 30, 2015, the Company offset the income tax provision of $390,606 and $739,841, respectively. For the three and six months ended June 30, 2016, the Company offset the income tax provision of $417,690 and $814,995, respectively, leaving a balance of prepaid income taxes of $336,159 on June 30, 2016.

Noncontrolling Interests

The noncontrolling interest in Wonhe Multimedia is not attributable, directly or indirectly to the Company, is measured at its carrying value in the stockholders’ equity section of the consolidated balance sheets.

| 21 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Net Income (Loss) Per Share

The Company computes net income (loss) per common share in accordance with FASB ASC 260, “Earnings Per Share” (“ASC 260”). Under the provisions of ASC 260, basic net income per common share is computed by dividing the amount available to common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted income per common share is computed by dividing the amount available to common stockholders by the weighted average number of shares of common stock outstanding plus the effect of any dilutive shares outstanding during the period. Accordingly, the number of weighted average shares outstanding as well as the amount of net income per share are presented for basic and diluted per share calculations for the period reflected in the accompanying consolidated statements of operations and other comprehensive income. There were no dilutive shares outstanding during the three and six months ended June 30, 2016 and 2015.

| 3. | Recently Issued Accounting Standards |

In June 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The new standard requires financial assets measured at amortized cost be presented at the net amount expected to be collected, through an allowance for credit losses that is deducted from the amortized cost basis. The standard will be effective for the Company beginning January 1, 2020, with early application permitted. The Company is evaluating the impact of adopting this new accounting guidance on its consolidated financial statements.

In May, 2016, the FASB issued ASU No. 2016-10, Revenue with Contracts with Customers: Narrow-scope Improvements and Practical Expedients, which is an amendment to ASU No. 2014-09 that clarifies the objective of the collectability criterion, to allow entities to exclude amounts collected from customers from all sales taxes from the transaction price, to specify the measurement date for noncash consideration is contract inception, variable consideration guidance applies only to variability resulting from reasons other than the form of the consideration, and clarification on contract modifications at transition. The implementation guidelines follow ASU No. 2014-09.

In April, 2016, the FASB issued ASU No. 2016-10, Revenue with Contracts with Customers: Identifying Performance Obligations and Licensing, which is an amendment to ASU No. 2014-09 that clarifies the aspects of identifying performance obligations and the licensing implementing guidance, while retaining the related principles within those areas. The implementation guidelines follow ASU No. 2014-09.

| 22 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 3. | Recently Issued Accounting Standards (continued) |

In March, 2016, the FASB issued ASU No. 2016-08, Revenue with Contracts with Customers: Principal versus Agent Considerations (Reporting Revenue Gross versus net), which is an amendment to ASU No. 2014-09 that improved the operability and understandability of implementation guidance versus agent considerations by clarifying the determination of principal versus agent. The implementation guidelines follow ASU No. 2014-09.

In March 2016, the FASB issued ASU No. 2016-06, Contingent Put and Call Options in Debt Instruments, Derivatives and Hedging (Topic 815). ASU 2016-06 clarifies that determining whether the economic characteristics of a put or call are clearly and closely related to its debt host requires only an assessment of the four-step decision sequence outlined in FASB ASC paragraph 815-15-25-24. Additionally, entities are not required to separately assess whether the contingency itself is clearly and closely related. The standard is effective for public business entities in interim and annual periods in fiscal years beginning after December 15, 2016. Early adoption is permitted in any interim period for which the entity’s financial statements have not been issued, but would be retroactively applied to the beginning of the year that includes the interim period. The standard requires a modified retrospective transition approach, with a cumulative catch-up adjustment to opening retained earnings in the period of adoption. For instruments that are eligible for the fair value option, an entity has a one-time option to irrevocably elect to measure the debt instrument affected by the standard in its entirety at fair value with changes in fair value recognized in earnings. The Company does not expect the application of this guidance to have a material impact on the Company’s Consolidated Statements of Operations or Consolidated Statements of Condition.

In March 2016, the FASB issued ASU 2016-07, Investments—Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting. This new guidance effectively removes the retroactive application imposed in current guidance when an investment qualifies for use of the equity method as a result of an increase in the level of ownership interest or degree of influence. The amendments require that the equity method investor add the cost of acquiring the additional interest in the investee to the current basis of the investor’s previously held interest and adopt the equity method of accounting as of the date the investment becomes qualified for equity method accounting. The new standard becomes effective for the Company on January 1, 2017. Early adoption is permissible. The Company does not anticipate the adoption of ASU 2015-11 to have a material impact on the consolidated financial statements and related disclosures

In March 2016, the FASB Issued ASU No. 2016-09, Compensation-Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting. The updated guidance changes how companies account for certain aspects of share-based payment awards to employees, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. The standard will be effective for the Company beginning January 1, 2017, with early application permitted. The Company is evaluating the impact of adopting this new accounting guidance on its consolidated financial statements.

| 23 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 3. | Recently Issued Accounting Standards (continued) |

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases. The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. This accounting standard update is not expected to have a material impact on the Company’s financial statements.

In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. The updated guidance enhances the reporting model for financial instruments, which includes amendments to address aspects of recognition, measurement, presentation and disclosure. The update to the standard is effective for the Company beginning June 1, 2018. The Company is currently evaluating the effect the guidance will have on the Consolidated Financial Statements.

In August 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date. The amendment is effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15, 2017. Earlier application is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The Company is evaluating the impact of this standard on its Consolidated Financial Statements.

| 24 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 4. | fixed assets |

Fixed assets at June 30, 2016 and December 31, 2015 are summarized as follows:

| June 30, 2016 | December 31, 2015 | ||||||||

| (Unaudited) | |||||||||

| Office equipment | $ | 222,419 | $ | 211,897 | |||||

| Motor vehicles | 646,587 | 661,703 | |||||||

| Production equipment | - | 1,287,502 | |||||||

| 869,006 | 2,161,102 | ||||||||

| Less: accumulated depreciation | (362,961 | ) | (416,521 | ) | |||||

| Fixed assets, net | $ | 506,045 | $ | 1,744,581 | |||||

Depreciation expense charged to operations for the three and six months ended June 30, 2016 and 2015 was $55,171 and $20,443, respectively, $146,750 and $42,951, respectively.

| 5. | INTANGIBLE assets |

Intangible assets at June 30, 2016 and December 31, 2015 are summarized as follows:

| June 30, 2016 | December 31, 2015 | ||||||||

| (Unaudited) | |||||||||

| Software | $ | 51,886 | $ | 45,432 | |||||

| Less: accumulated amortization | (38,907 | ) | (28,683 | ) | |||||

| Intangible assets, net | $ | 12,979 | $ | 16,749 | |||||

Amortization expense charged to operations for the three and six months ended June 30, 2016 and 2015 was $1,727 and $2,790, respectively $11,060 and $4,955, respectively.

| 6. | commitments |

Leases

On September 30, 2013, the Company entered into a lease agreement with an unrelated party at a monthly rental of $9,075 per month. The lease expired on August 31, 2014. On September 1, 2014, the Company renewed the lease agreement at the same rent for twelve months. The lease was terminated in May 2015 without incurring any penalties.

| 25 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 6. | commitments (continued) |

Leases (continued)

In May 2015, the Company entered into a new lease agreement with an unrelated party at a monthly rent of $11,360 for one year, expiring in May 2016. In May 2016, the Company renewed this lease at the same monthly rent to May 2017.

Rent expenses for the three and six months ended June 30, 2016 and 2015 was $34,081 and $39,696, respectively, $68,119 and $71,716, respectively.

In order to research and develop a new project, the Company leased a laboratory from an unrelated party. The lease has a three year term, from May 6, 2015 to May 5, 2018. The lease fee the laboratory for the three months ended March 31, 2016 is $58,962.

Employment Agreements

Shenzhen Wonhe, our operating subsidiary, has employment agreements with our officers Nanfang Tong and Qing Tong:

Nanfang Tong’s employment agreement, as the chief executive officer, provides for a monthly salary of RMB 8,000 (approximately US $1,224) and expires on October 31, 2016. Mr. Tong is eligible for a bonus which is determined by, and at the discretion of, the Board of Directors of the Company, based on a review of Mr. Tong’s performance.

Qing Tong’s employment agreement as an officer provides for a monthly salary of RMB 10,000 (approximately US $1,530) and expires on October 31, 2016. Mr. Tong is eligible for a bonus which is determined by, and at the discretion of, the Board of Directors of the Company, based on a review of Mr. Tong’s performance.

Other than the salary and necessary social benefits required by the government, which are defined in the employment agreements, we currently do not provide other benefits to the officers at this time. Other than government severance payments, our executive officers are not entitled to severance payments upon the termination of their employment agreements or following a change in control.

PRC employment law requires an employee be paid severance pay based on the number of years worked with the employer at the rate of one month’s wage for each full year worked. Any period of more than six months but less than one year shall be counted as one year. The severance pay payable to an employee for any period of less than six months shall be one-half of his monthly wages. The monthly salary mentioned above is defined as the average salary of 12 months before revocation or termination of the employment contract.

| 26 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 6. | commitments (continued) |

Strategic Cooperation Agreement

In April 2015, the Company entered into a distribution agreement with Shenzhen Yunlutong Technology Co., Ltd (“YLT”), which is owned by one of the Company’s directors, who owns 4.87% of the Company’s common stock. The agreement expires in three years. Under the agreement, YLT shall purchase 662,000 commercial routers from Shenzhen WONHE, with 200,000 purchased during the first year, 220,000 during the second year and 242,000 during the third year, for a total purchase price of RMB 926,800,000 (US $148,566,040). Any change in share ownership of YLT shall be approved by Shenzhen Wonhe. In addition, Shenzhen Wonhe obtained an exclusive right to acquire YLT if its gross annual revenues reach RMB 150,000,000 (US $24,480,000) and net annual profit reaches RMB 12,500,000 (US $2,040,000) during the term of the agreement. YLT agreed not to sell any equity or issue any debt during the 3 years. The price of the acquisition shall be established by an independent appraiser.

| 7. | RELATED PARTY TRANSACTIONS |

From time to time, a stockholder/officer loans money to the Company, primarily to meet the non-RMB cash requirements of the parent and its subsidiaries. The loans are non-interest bearing, and the balance due was $354,913 and $335,655 at June 30, 2016 and December 31, 2015, respectively.

The proceeds of the loans were principally used to pay professional and legal fees incurred in the U.S. and other operating expenses for Wonhe High-Tech and Shengshihe Consulting incurred since their inception. The balance is reflected as loan from stockholder.

| 8. | sale of Common stock |

In April 2015, Wonhe High-Tech International, Inc. sold 20,130,000 shares of common stock to 21 unrelated individuals, three individuals who were shareholders of Shenzhen Wonhe at the time, and three unrelated companies in a private offering in the PRC. The purchase price for the shares was approximately RMB 4.72 (US $0.77) per share, or a total of RMB 93,000,600 (US $15,196,298). The shares were sold to accredited investors for their own accounts. The offering was exempt from registration under the Securities Act of 1933 pursuant to Section 4(2) and Section 4(5) of the Securities Act. The offering was also sold in compliance with the exemption from registration provided by Regulation S, as all of the purchasers were residents of the People’s Republic of China.

| 27 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 8. | sale of Common stock (continued) |

Of the 20,130,000 shares sold, 4,600,000 (22.7%) were sold to two directors and one officer/director of the Company. On the date of sale, the Company’s common stock was quoted on the OTCQB at $3.07 per share. Since over 75% of the shares in this offering were sold to unrelated parties at $0.77 per share, and no shares of the Company’s common stock were traded on the OTCQB from January 1, 2015 to April 22, 2015, the Company believes that the sales price of $0.77 was more representative of the fair value per share than the ORCQB price of $3.07. As a result, management believes that the $0.77 per share was a fair price and recorded no compensation related to the share sold to the officer and directors of the Company.

On April 19, 2016 the Company sold a total of 15,000,000 shares of common stock to two investors in a private offering. Qing Tong, a member of the Registrant's board of directors, purchased 3,000,000 shares. The remaining 12,000,000 shares were purchased by an unaffiliated entity. The purchase price for the shares was 0.52 Renminbi (approx. $.08) per share, or a total of 7,800,000 Renminbi (approx. $1,200,000).

The shares were sold to investors who are accredited investors and were purchasing for their own accounts. The offering, therefore, was exempt from registration under the Securities Act of 1933 pursuant to Section 4(2) and Section 4(5) of the Securities Act. The offering was also sold in compliance with the exemption from registration provided by Regulation S, as all of the purchasers were residents of the People’s Republic of China.

| 9. | Income taxes |

The Company is required to file income tax returns in both the United States and the PRC. Its operations in the United States have been insignificant and income taxes have not been accrued. In the PRC, the Company files tax returns for Shenzhen Wonhe and Shengshihe Consulting.

The provision for (benefit from) income taxes consists of the following for the three and six months ended June 30, 2016 and 2015:

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | ||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | ||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||

| Current | $ | 417,690 | $ | 390,606 | $ | 814,995 | $ | 739,841 | |||||||||

| Deferred | - | - | - | - | |||||||||||||

| $ | 417,690 | $ | 390,606 | $ | 814,995 | $ | 739,841 | ||||||||||

| 28 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 9. | Income taxes (continued) |

The following is a reconciliation of the statutory rate with the effective income tax rate for the three and six months ended June 30, 2016 and 2015.

For the Three Months Ended June 30, 2016 | For the Six Months Ended June 30, 2016 | ||||||||||||||||

| Tax Provision | Rate of Tax | Tax Provision | Rate of Tax | ||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||

| Tax at PRC statutory rate | $ | 809,464 | 25.0 | % | $ | 1,577,353 | 25.0 | % | |||||||||

| Subsidiaries/VIE tax holiday | (391,774 | ) | (12.1 | ) | (762,358 | ) | (12.1 | ) | |||||||||

| Effective tax rate | $ | 417,690 | 12.9 | % | $ | 814,995 | 12.9 | % | |||||||||

For the Three Months Ended June 30, 2015 | For the Six Months Ended June 30, 2015 | ||||||||||||||||

| Tax Provision | Rate of Tax | Tax Provision | Rate of Tax | ||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||

| Tax at PRC statutory rate | $ | 779,014 | 25.0 | % | $ | 1,475,542 | 25.0 | % | |||||||||

| VIE tax holiday | (388,408 | ) | (12.5 | ) | (735,701 | ) | (12.5 | ) | |||||||||

| Effective tax rate | $ | 390,606 | 12.5 | % | $ | 739,841 | 12.5 | % | |||||||||

The following presents the aggregate dollar and per share effects of the Company’s subsidiaries/VIE tax holidays:

Three Months Ended June 30, | Six

Months Ended | ||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | ||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||

| Aggregate dollar effect of tax holiday | $ | 444,411 | $ | 388,408 | $ | 814,995 | $ | 735,701 | |||||||||

| Per share effect, basic and diluted | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | |||||||||

The Company’s PRC tax filings for the tax years ended December 31, 2014 and 2013 were examined by the tax authorities. The examinations were completed and resulted in no adjustments.

| 29 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 9. | Income taxes (continued) |

The Company did not file its U.S. federal income tax returns, including, without limitation, information returns on Internal Revenue Service (“IRS”) Form 5471, “Information Return of U.S. Persons with Respect to Certain Foreign Corporations” for the fiscal year ended June 30, 2012, the six month period ended December 31, 2012, a short year income tax return required to be filed as a result of the change in the fiscal year and the years ended December 31, 2015, 2014 and 2013. Failure to furnish any income tax and information returns with respect to any foreign business entity required, within the time prescribed by the IRS, subjects the Company to civil penalties. Management is of the opinion that penalties, if any, that may be assessed would not be material to the consolidated financial statements.

Because the Company did not generate any income in the United States or otherwise have any U.S. taxable income, the Company does not believe that it has any U.S. federal income tax liabilities with respect to any transactions that the Company or any of its subsidiaries may have engaged in through December 31, 2015. However, there can be no assurance that the IRS will agree with this position, and therefore the Company ultimately could be liable for U.S. federal income taxes, interest and penalties. The tax year ended June 30, 2012, six-month tax period ended December 31, 2012, and the tax years ended December 31, 2015, 2014 and 2013 remain open to examination by the IRS.

All of the Company’s operations are conducted in the PRC. At June 30, 2016, the Company’s unremitted foreign earnings of its PRC subsidiaries totaled approximately $19.2 million and the Company held approximately $46.2 million of cash and cash equivalents in the PRC. These unremitted earnings are planned to be reinvested indefinitely into the operations of the Company in the PRC. While repatriation of cash held in the PRC may be restricted by local PRC laws, most of the Company’s foreign cash balances could be repatriated to the United States but, under current U.S. income tax laws, would be subject to U.S. federal income taxes less applicable foreign tax credits. Determination of the amount of unrecognized deferred U.S. income tax liability on the unremitted earnings is not practicable because of the complexities associated with this hypothetical calculation, and as the Company does not plan to repatriate any cash in the PRC to the United States during the foreseeable future, no deferred tax liability has been accrued.

| 10. | CONTINGENCIES |

As disclosed in Note 9, the Company was delinquent in filing certain tax returns with the U.S. Internal Revenue Service. The Company is unable to determine the amount of penalties, if any, that may be assessed at this time. Management is of the opinion that penalties, if any, that may be assessed would not be material to the consolidated financial statements.

| 30 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 10. | CONTINGENCIES (continued) |

The Company did not file the information reports for the years ended December 31, 2015, 2014, 2013 and 2012, concerning its interest in foreign bank accounts on form TDF 90-22.1, “Report of Foreign Bank and Financial Accounts” (“FBAR”). Not complying with the FBAR reporting and recordkeeping requirements will subject the Company to civil penalties up to $10,000 for each of its foreign bank accounts. The Company has not determined the amount of any penalties that may be assessed at this time and believes that penalties, if any, that may be assessed would not be material to the consolidated financial statements.

| 11. | Concentration of Credit Risk |

Cash and cash equivalents

Substantially all of the Company’s bank accounts are in banks located in the People’s Republic of China and are not covered by protection similar to that provided by the FDIC on funds held in United States banks. The Company’s bank account in Australia is protected by the Australian government up to AUD 250,000.

Major customers

Two customers accounted for approximately 49% of total sales for the three months ended June 30, 2016 and one customer accounted for approximately 10% of total sales for the three months ended June 30, 2015. One customer accounted for approximately 37% of total sales for the six months ended June 30, 2016 and the same customer accounted approximately 11% of total sales for the six months ended June 30, 2015. Four customers accounted for approximately 87% of accounts receivable as of June 30, 2016, the largest being approximately 49%. Four customers accounted for approximately 94% of accounts receivable as of December 31, 2015, the largest being 34%.

| 12. | CONTRIBUTIONS TO MULTI-EMPLOYER WELFARE PROGRAMS |

Shenzhen Wonhe is required to make contributions to PRC multi-employer welfare programs by government regulations sometimes identified as the Mainland China Contribution Plan. Specifically, the following regulations require that the Company pay a percentage of employee salaries into the specified plans:

| Regulation | Plan | % of Salary | |||||

| Shenzhen Special Economic Zone Social Retirement Insurance Regulations | Pension | 13 | % | ||||

| Shenzhen Work-Related Injury Insurance Regulations | Workers Comp. | 0.4 | % | ||||

| Guangdong Unemployment Insurance Regulations | Unemployment | 2 | % | ||||

| Housing Provident Fund Management Regulations | Housing | 5 | % | ||||

| Shenzhen Social Medical Insurance Measures | Medical | 6.5% or 0.6 | %* | ||||

| Guangdong Employees Maternity Insurance | Maternity | 0.5% or 0.2 | %* | ||||

| 31 |

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2016 AND 2015

(UNAUDITED, IN U.S. $)

| 12. | CONTRIBUTIONS TO MULTI-EMPLOYER WELFARE PROGRAMS (continued) |

* Depending on their position in the Company, employees receive either hospitalization, medical and maternity insurance or comprehensive medical and maternity insurance, which is a lower premium.

Total contributions to employee welfare programs for the three and six months ended June 30, 2016 and 2015 were as follow:

| For the three months ended June 30, | For the six months ended June 30, | ||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | ||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||

| Total contributions | $ | 8,992 | $ | 4,217 | $ | 20,715 | $ | 14,512 | |||||||||

| 13. | INVESTMENT IN PROJECT |

On January 12, 2016 the Company's operating subsidiary, Shenzhen Wonhe Technology Co., Ltd. ("Shenzhen Wonhe"), entered into an agreement titled "Wireless Network Coverage Project in Beijing Area" with Guangdong Kesheng Enterprise Co., Ltd. ("Guangdong Kesheng"). The agreement contemplates that the two parties will work together to develop a wireless network in certain designated areas of Beijing. The commercial purpose of the network will be to serve as a vehicle for advertising and marketing, with the revenue to be shared between Shenzhen Wonhe and Guangdong Kesheng.

Shenzhen Wonhe has committed in the agreement to provide 382,990,000 RMB (USD $58.25 million, USD$17,780,799 of which was expended as of June 30, 2016) to the project, including 226,010,000 RMB (USD $34.37 million) in cash and 118,980,000 RMB (USD $18.09 million) in routers and other equipment. Shenzhen Wonhe will also contribute the network that it recently developed in the Tongzhou District of Beijing as a pilot project, at a cost of 38,000,000 RMB (USD $5.78 million). Shenzhen Wonhe's cash contribution will be paid over three years: 104,498,990 RMB in 2016, 84,636,558 RMB in 2017 and 36,871,412 RMB in 2018. Shenzhen Wonhe has also committed to develop the data systems that will be used by the network. Guangdong Kesheng has committed to supervise the engineering and construction, coordinate relationships with local government, and manage the network's operations.

Prior to the signing of the official investment contract, the Company invested RMB38,000,000 (USD $5.78 million) to develop a network station in one of the contracted “Wireless Network Coverage Project” locations, the TongZhou District of Beijing, as a pilot project. As of June 30, 2016, total payments for the pilot project were included in “investment in project” in the consolidated balance sheet.

| 32 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |