Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LILIS ENERGY, INC. | v446818_8k.htm |

Exhibit 99.1

Corporate Presentation August 2016

This presentation may contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1 995. The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, indicates a fo rward - looking statement. These statements and all the projections in this presentation are subject to risks and uncertainties and are based on the beliefs a nd assumptions of management, and information currently available to management. The actual results could differ materially from a conclusion, forecast or proj ect ion in the forward - looking information. The identification in this presentation of factors that may affect the company’s future performance and the accu rac y of forward - looking statements is meant to be illustrative and by no means exhaustive . All forward - looking statements should be evaluated with the understanding of their inherent uncertainty. Factors that could caus e the company’s actual results to differ materially from those expressed or implied by forward - looking statements include, but are not limited to: The success of the company’s exploration and development efforts; the price of oil, gas and other produced gasses and liquids; the worldwide economic situation; changes i n i nterest rates or inflation; the ability of the company to transport gas, oil and other products; the ability of the company to raise additional capital, as i t m ay be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital; the company’s capital costs, which may be a ffe cted by delays or cost overruns; cost of production; environmental and other regulations, as the same presently exist or may later be amended; the company’s a bil ity to identify, finance and integrate any future acquisitions; and the volatility of the company’s stock price . See “Risk Factors” in the company’s 2015 Annual Report on Form 10 - K, Quarterly Reports on 10 - Q and other public filings and press releases. RESERVE/RESOURCE DISCLOSURE The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves th at meet the SEC’s definitions of such terms. Reserve estimates that are intended to meet SEC guidelines are included in our periodic reports filed with th e S EC. In this presentation, we sometimes also refer to broader, less precise terms when characterizing reserve estimates, such as “resource potential” and “ est imated ultimate recovery”, or “EUR”, which the SEC does not permit to be disclosed in SEC filings and are not intended to conform to SEC filing requirement s. These estimates are by their nature more speculative than those disclosed in our SEC filings and thus are subject to substantially greater uncertainty of bei ng realized. They are based on internal estimates, are not reviewed or reported upon by any independent third party and are subject to ongoing review. Actu al quantities recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery of reserves include the scope of our actual d ril ling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices (including prevailing oil and gas pr ice s), availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual recoveries of oil an d natural gas in place, length of horizontal laterals, actual drilling results, including geological and mechanical factors affecting recovery rates, and other fa ctors. These estimates may change significantly as the development of properties provides additional data . Investors are urged to consider closely the oil and gas disclosures in the company’s 2015 Annual Report on Form 10 - K. Confidentiality. Information contained herein is confidential between the Recipient of this information and Lilis Energy, Inc. It is strictly und erstood that this information shall not be shared with any third party without the written permission from Lilis Energy, Inc. Any dissemination or distribution of any information contained herein is strictly prohibited. Informational Purposes. The Information contained herein as been prepared for informational purposes only and should not be construed as an offer to sel l or the solicitation of an offer to buy any security. Such information includes forward looking statements, estimates and project ion s, which are inherently uncertain, being based on assumptions and subjective judgments which may not prove to be accurate. No Liability . Recipients are urged to consult with their own independent financial advisors with respect to any investment. All information contained here in should be independently verified. Neither Lilis Energy, Inc. nor any of its officers, directors, members, employees or consul tan ts, accept and liability whatsoever for any direct or consequential loss arising from any use of information contain in this presentation. Investing in securitie s c an be speculative and can carry a high degree of risk. IRS Circular 230 Disclosure. Lilis Energy, Inc. and its affiliates do not provide tax advice. Accordingly, and discussion of U.S. tax matters included her ein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, mark eti ng or recommendation by anyone not affiliated with Lilis Energy, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax - rel ated penalties. Disclaimer Strictly Private and Confidential

In June 2016, Lilis entered the Permian Basin through a merger with a distressed Delaware Basin operator • Acquired producing Permian asset at attractive valuation 3 – $30,000 per flowing barrel and $4,100 per acre • Expanded management team adds value, experience • Completed $20 million equity raise • Recapitalized balance sheet Strictly Private and Confidential 3 Lilis Energy Operational Summary Permian Entry Market Stats (as of 8/8/16) Net Acreage 11,400 Delaware Basin 3,772 DJ Basin 7,618 Net Daily Production ~ 650 boe/d YE 2015 Proved Reserves 860 Mboe Market Cap $15.5 million Adjusted Market Cap 4 $33.6 million Total Enterprise Value 5 $38.1 million Share Price $ 1.10 52 - Week Range 6 $ 0.50 - $ 31.50 Premium Assets Top Shale Plays Delaware Basin and DJ Basin Permian Growth Story Re - entry program allows Permian production ramp with efficient use of capital High - Quality Reserve Base Over 500 possible 1 horizontal l ocations in Delaware Basin with net resource potential 2 of over 130 Mboe 1. Possible locations are calculated using required spacing as determined by observing results on wells, how they are being drilled within the play an d analysis of Permeability and Porosity on well logs 2. See forward looking statements for explanations of EUR and resource potential 3. Based on transaction value of $28.3 million, transaction value = consideration paid plus approx fair value of net assets assumed 4. Assumes 18.2 million of converted preferred shares 5. Adjusted Mkt Cap minus cash, plus current maturity of LT debt, convertible notes, notes payable and other LT liabilities 6. Adjusted for Stock Split

• Acquire : Target financially distressed companies with economic production and attractive acreage • Develop : Pursue drilling and recompletion opportunities on a highly selective basis, focused on existing properties in the Permian Basin which are economic at today’s price deck Investment Highlights Continue Dual Growth Strategy Acquire & Develop Proven Management Team Strategically Building Scale Investment Opportunity Strictly Private and Confidential 4 • New management and board have extensive experience and track records of creating substantial shareholder value • Expanded operating and technical teams bring experience in core basins • New management and board are highly invested in the company and aligned with shareholders • Built - in economic advantages through existing vertical wellbores • Selectively expanding in the Permian Basin and DJ Basin, through strategic and acreage acquisitions • The Delaware Basin is especially attractive for its multi - stack resource plays and favorable economics • Well positioned for growth following the recapitalization and equity raise • Management well - aligned with shareholders with substantial equity investment in company • The company is trading at a substantial discount to Delaware Basin peers

Eight Niobrara wells, Weld County, CO • Participated in the drilling of 8 Noble operated wells in Wattenberg • Current production is ~ 130 boe/d Wolfe #3H Workover • Replaced jet pump • 100% increase in oil production, initial net production increase ~100 boe/d Wolfe #5 Workover • ESP repair • Successful operation, well is back online Tubb Estate 21 - 2 Workover • Replaced rod pump • Increased production 25 bo/d, up from 4 bo/d Shammo # 1 Recompletion • Testing the lower Wolfcamp • C omplete both C & D formations with uphole recompletion on existing vertical wellbore • Commence upon acquisition of minority working interest Bison #1H • Wolfcamp A Re - Entry • Spud in September Strictly Private and Confidential 5 Recent Activity Completed I ncreased net production ~250 boe/d during first 45 post closing Near - term Capital Plans

Permian Asset Overview • Contiguous acreage on Loving - Winkler County line in Texas and Lea County, New Mexico • 7,857 Gross Acres / 3,772 Net acres, 95% HBP • Current production ~ 500 Boe /d • 19 vertical wells & 2 Horizontal producing from multiple formations: Wolfcamp , Brushy Canyon, Bell Canyon, Strawn & Atoka • 12 Horizontal Re - Entries, targeting Wolfcamp , Bone Springs and Avalon • Over 500 possible 1 Horizontal Locations with net resource potential 2 of over 130 Mboe Strictly Private and Confidential 6 LOVING COUNTY WINKLER COUNTY LEA COUNTY, NEW MEXICO 1. Possible locations are calculated using required spacing as determined by observing results on wells, how they are being drilled within the play an d analysis of Permeability and Porosity on well logs 2. See forward looking statements for explanations of EUR and resource potential Lilis Acreage

Delaware Offset Map Strictly Private and Confidential 7

• Vertical wellbores allow for horizontal Re - Entry • Extensive well control – N o seismic or pilot holes required • Full suite of logs penetrate entire Wolfcamp interval • Target formation cuttings scientifically analyzed • Existing ROW agreements in - place, no new ROWs issued • Field infrastructure in - place Strictly Private and Confidential 8 Strategic Advantage Significant Value in Delaware • Awaiting approvals for salt water disposal well • Evaluating gas gathering options – Ensuring capacity – Removing existing rentals Cost Reduction Initiatives Existing Well Logs 10 14 16 19 Wolfcamp Bone Springs Avalon Delaware Current Proposed Anticipated SWD Savings ~80% cost reduction

• Core Wattenberg acreage in Weld County, Colorado – 774 Net acres • Additional DJ Basin acage in Laramie County, Wyoming and Nebraska – 6,844 Net acres • Current production ~ 150 Boe/d • 16 producing wells from the Niobrara, Codell, and J Sand • Recently participated in the drilling of eight new wells – Operated by Noble – Current Production ~ 130 boe/d • Near term horizontal development in Weld County, both Niobrara and Codell 956 net acres 5,888 net acres 774 net acres 9 DJ Basin Asset Overview Strictly Private and Confidential 9

Minimizing D&C Cost • Utilize 12 vertical wellbores to complete re - entry program, targeting three Permian formations • Re - entry removes need to drill vertical section, ~$2 million of cost savings per well, enhances returns Maximizing Resource Recovery • Evolving drilling and completion techniques, lateral length and well spacing generating significant production and EUR enhancement • 6 Re - Entry locations capable of testing extended laterals • E xit 2017 production rate projected over 3,000 boe/d Strictly Private and Confidential 10 18 - Month Capital Plans 2016 – 2017 Capital Allocation 7 3 2 Wolfcamp Bone Springs Avalon EUR 1 by Formation (Mboe) 100% Delaware Basin 900 500 500 Wolfcamp Bone Springs Avalon Wolfcamp Bone Springs Avalon 1. See forward looking statements for explanations of EUR and resource potential

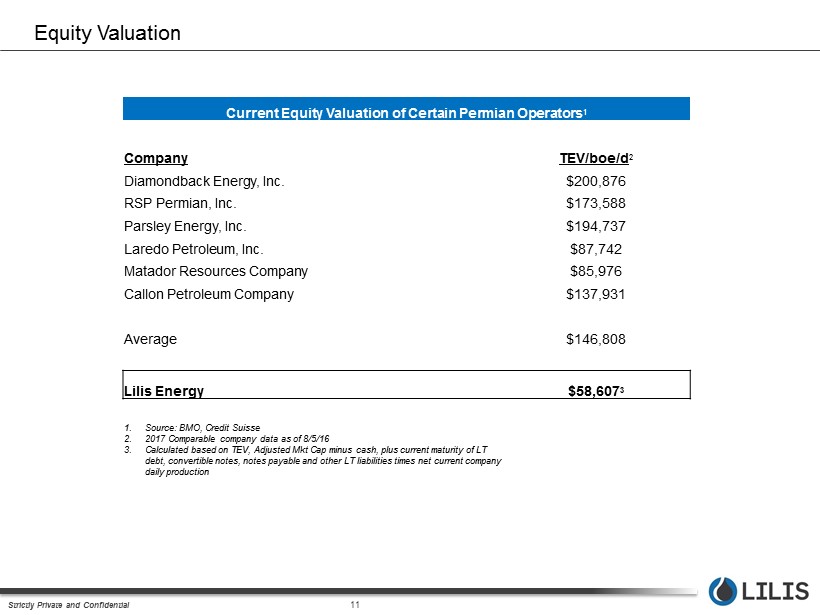

Current Equity Valuation of Certain Permian Operators 1 Company TEV/ boe /d 2 Diamondback Energy, Inc. $200,876 RSP Permian, Inc. $173,588 Parsley Energy, Inc. $ 194,737 Laredo Petroleum, Inc. $87,742 Matador Resources Company $85,976 Callon Petroleum Company $137,931 Average $ 146,808 Lilis Energy $58,607 3 1. Source : BMO, Credit Suisse 2. 2017 Comparable company data as of 8/5/16 3. Calculated based on TEV, Adjusted Mkt Cap minus cash, plus current maturity of LT debt, convertible notes, notes payable and other LT liabilities times net current company daily production Strictly Private and Confidential 11 Equity Valuation

Selected 2016 M&A Permian Basin Transactions 1 Number of Transactions 15 Mean Transaction Value ($mm) $332.7 Avg. price per boe ($/boe) $52.16 Avg. price per boe/d ($/boe/d) $256,347 Avg. price per Acre ($/acre) $ 20,366 Implied Permian Asset Value Implied Value per boe ($/boe) $133 million 2 Implied Value per boe/d ($/boe/d) $128 million 3 Implied Value per Acre ($/acre) $77 million 4 Average Implied Asset Value $112 million 5 Current LLEX TEV $38.1 million 6 LLEX Appox Transaction Value $28.3 million 7 Strictly Private and Confidential 12 Transaction Comp Valuation 1. Source: Credit Suisse 2. Calculated based on Av $/ boe times Proved Reserves plus 6 engineered PUD locations 3. Calculated based on Av $/ boe /d times current Permian production 4. Calculated based on Av $/acre times Permian net acreage 5. Calculated based on Av of implied values 6. Calculated based on Adjusted Mkt Cap minus cash, plus current maturity of LT debt, convertible notes, notes payable and other LT liabilities times net current company daily production 7. T ransaction value of $28.3 million, transaction value = consideration paid plus approx. fair value of net assets assumed

• Ground floor opportunity to participate in a high - quality E&P company • Shareholders alignment with a strong management and Board of Directors • Highly d esirable assets in one of the best North American basins which generates attractive economics at $35 oil • Low - risk , near - term growth in production, cash flow and reserves • Substantially discounted equity valuation compared to industry comparables • Ability to grow organically and to be an opportunistic acquirer Strictly Private and Confidential 13 Conclusion

Appendix Strictly Private and Confidential

• R onald D . Ormand , Executive Chairman of the Board | Brings more than 34 years of industry experience . He has completed over $ 25 billion of capital markets and $ 10 billion of financial advisory transactions as both a principal and banker . Mr . Ormand was a Co - founder and senior executive at Magnum Hunter Resources Corporation (NYSE : MHR) . While with MHR, Mr . Ormand executed a strategy to grow MHR from sub - $ 30 million enterprise value to over $ 3 . 2 billion in 4 ½ years . Mr . Ormand has served as a member of numerous Board of Directors, most recently the Executive Chairman of the Board of MLV & Co . , where he oversaw and led the acquisition of MLV by FBR Capital Markets (NASDAQ : FBRC) . • Abraham “ Avi ” Mirman, Chief Executive Officer and Director | 20 - year background in the securities industry and was appointed CEO in April 2014 , after serving as the Company’s President beginning in September 2013 . He was appointed to Lilis Energy’s Board of Directors in September 2014 . Previously, Mr . Mirman served as the Managing Director, Investment Banking at T . R . Winston & Company, LLC from April 2013 to October 2014 . He and TRW completed over $ 85 . 0 million of financing and debt restructuring for Lilis Energy . Between 2006 and 2011 , Mr . Mirman served as Chairman of the Board of Cresta Capital Strategies LLC ; between 2011 and 2012 , he served as Head of Investment Banking at BMA Securities ; and between 2012 and February 2013 , he served as Head of Investment Banking at John Thomas Financial . Mr . Mirman has extensive experience in financial and securities matters, and obtaining financing for and providing financial advisory services to micro - cap public companies, including oil and gas and other energy companies . He graduated from the State University of New York at Buffalo with a B . S . in Political Science . • Michael Pawelek, President and Director | Over 35 years of exploration and production and oilfield services industries experience . Prior to Lilis , he was the CEO and President of Brushy Resources, Inc . , Impetro Resources LLC as well as its predecessor, South Texas Oil Company, a public company . He began his career as a geophysicist with Clayton Williams Company ; was a district geophysicist with TXO Production Corporation ; founded CPX Petroleum which drilled over 60 wells under his management ; founded and was the CEO of Universal Seismic Associates, Inc . , which generated annual revenue of $ 65 million and had over 400 employees ; served as VP of Operations of Amenix USA, Inc . , a private exploration and production company focused on oil and natural gas exploration in Louisiana ; was President of BOSS Exploration & Production Corporation, a privately held Gulf Coast production company ; and served as President of Sonterra Resources, Inc . , a company that has oil and natural gas assets in Texas state waters in Matagorda Bay . He received a BS degree in Engineering from Texas A&M . Strictly Private and Confidential 15 Management

• Ed Shaw, Chief Operating Officer | Mr . Shaw served as the COO of Starboard Resources . He began his career as a systems analyst before becoming involved in the oil and gas industry . He has prior experience in Saudi Arabia and in New Zealand researching and developing methods of monitoring oil wells to optimize production, including using existing products integrated with emerging telemetry technologies . With a strong background in computing and software, Mr . Shaw ensures that the company takes advantage of all softwares and technological advances in the industry . He holds a Diploma in Electrical Engineering . • Kevin Nanke , Executive Vice President and Chief Financial Officer | Joined Lilis Energy in March 2015 . Mr . Nanke has served in diverse finance and accounting executive positions in the oil and gas industry for more than 25 years . He previously served as Treasurer and Chief Financial Officer of Delta Petroleum Corporation from 1999 to 2012 , and as its Controller from 1995 to 1999 . During his tenure, Mr . Nanke helped raise $ 1 . 4 billion in public and private financings and was instrumental in preserving a $ 1 . 3 billion tax loss carry - forward when the company successfully completed a reorganization and emerged as Par Petroleum Corporation in 2011 . Concurrent to his positions, Mr . Nanke served as Treasurer and CFO of Delta’s E&P subsidiary, Amber Resources, and as Treasurer, CFO and Director of Delta’s E&P subsidiary, DHS Drilling Company . Prior to joining Delta, Mr . Nanke was employed by KPMG LLP, a leading global audit, tax and advisory firm . Mr . Nanke received a Bachelor of Arts degree in Accounting from the University of Northern Iowa in 1989 and is a Certified Public Accountant (inactive ) . • Joe Pawelek, Vice President of Corporate Finance and Investor Relations Prior to joining Lilis Energy, Mr . Pawelek served as Associate and Head of Business Development at Brushy Resources, Inc . since 2012 . Mr . Pawelek earned a degree from Baylor University with a Bachelor of Business Administration in Finance and Economics and a Masters in Business Administration from The University of Texas at San Antonio . • Ariella Fuchs, General Counsel & Secretary | Joined Lilis Energy in March 2015 . Previously, Ms . Fuchs served as an associate with Baker Botts L . L . P . from April 2013 to February 2015 , specializing in securities transactions and corporate governance . From January 2010 to March 2013 , she was an associate at White & Case LLP and Dewey and LeBoeuf LLP in the firm’s mergers and acquisitions groups . Ms . Fuchs received a J . D . degree from New York Law School and a B . A . degree in Political Science from Tufts University . Strictly Private and Confidential 16 Management

Joe Pawelek VP of Corporate Finance and Investor Relations 210.999.5400 CorProminence David Boral 512.222.2560