Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AgroFresh Solutions, Inc. | a081116form8-kjefferies.htm |

AgroFresh Solutions, Inc.

Jefferies Industrials Conference

August 11, 2016

2

In addition to historical information, this presentation contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this presentation that address activities, events or

developments that the Company expects or anticipates will or may occur in the future are forward-looking statements and are identified with, but not limited to, words

such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions (or the negative versions of such words or

expressions). Forward-looking statements include, without limitation, information concerning the Company’s possible or assumed future results of operations,

including all statements regarding financial guidance, anticipated future growth, business strategies, competitive position, industry environment, potential growth

opportunities and the effects of regulation. These statements are based on management’s current expectations and beliefs, as well as a number of assumptions

concerning future events. Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of

which are outside the Company’s management’s control that could cause actual results to differ materially from the results discussed in the forward-looking

statements. These risks include, without limitation, the risk of increased competition and the ability of the business to grow and manage growth profitably; costs

related to the Company’s transaction with The Dow Chemical Company (“Dow”) consummated on July 31, 2015 (the “Business Combination”) and/or related to

operating AgroFresh as a stand-alone public company; changes in applicable laws or regulations, and the possibility that the Company may be adversely affected by

other economic, business, and/or competitive factors. Some of these risks and uncertainties are identified and discussed in the Company’s filings with the SEC,

including the Annual Report on Form 10-K filed on March 11, 2016, available at the SEC’s website at www.sec.gov.

As a result of the Business Combination, the Company was identified as the acquirer for accounting purposes, and the AgroFresh Business, which is the business

conducted prior to the closing of the Business Combination by Dow through a combination of wholly-owned subsidiaries and operations of Dow, including through

AgroFresh Inc. in the United States, is the acquiree and accounting Predecessor. The Company’s financial statement presentation reflects the AgroFresh Business as

the “Predecessor” for periods through July 31, 2015 (the “Closing Date”). On the Closing Date, the Company, which was formerly named Boulevard Acquisition Corp.,

was re-named AgroFresh Solutions, Inc. and is the “Successor” for periods after the Closing Date, which includes consolidation of the AgroFresh Business

subsequent to the Closing Date. The acquisition was accounted for as a business combination using the acquisition method of accounting, and the Successor

financial statements reflect a new basis of accounting that is based on the fair value of net assets acquired. As a result of the application of the acquisition method of

accounting as of the effective time of the Business Combination, the financial statements for the Predecessor period and for the Successor period are presented on

different bases. The historical financial information of Boulevard Acquisition Corp. prior to the Business Combination has not been reflected in the Predecessor period

financial statements as those amounts are not considered to be material.

This presentation contains certain financial measures, in particular Adjusted EBITDA, which are not presented in accordance with GAAP. These non-GAAP financial

measures are being presented because the Company believes these non-GAAP financial measures provide meaningful supplemental information that is used by the

Company’s management to evaluate the Company’s performance. Management believes that these measures enhance a reader’s understanding of the financial

performance of the Company, are more indicative of operating performance of the Company, and facilitate a better comparison among fiscal periods, as the non-

GAAP measures exclude items that are not considered core to the Company’s operations. In particular, Adjusted EBITDA is a key measure used by the Company to

evaluate its performance, and is calculated by the Company in a manner consistent with the definition of Consolidated EBITDA in the Company’s Credit Agreement.

The Company does not intend for any of the non-GAAP financial measures contained in this presentation to be a substitute for any GAAP financial information.

Readers of this presentation should use these non-GAAP financial measures only in conjunction with the comparable GAAP financial measures. A reconciliation of

non-GAAP Adjusted EBITDA to the most comparable GAAP measure is provided in the appendix to this presentation.

SmartFresh, Harvista, RipeLock, AdvanStore and LandSpring are trademarks of AgroFresh Solutions, Inc.

Safe Harbor

3

• Secular growth story addressing

global trends in food production and

consumption

• Transformative 1-MCP technology

used today primarily to preserve

apples using SmartFreshTM

• Industry leader operating with capital

light, high service driven, direct sales

business model to diversified

customer base >3,000 customers

• Focus on expansion with

SmartFreshTM comprising ~90% of

current sales

• Significant growth potential with 80%

gross margins and 50+% EBITDA

margins

AgroFresh Provides Solutions for Food Freshness

Apples 87%

Pears 6%

Kiwis 2%

Flowers 2%

Other 3%

North America 36%

EMEA 40%

Latin America 15%

Asia Pacific 9%

FY2015 Revenue by Crop

FY2015 Revenue by Region

4

AgroFresh Holds Leadership Position

with High Service Business Model

Solid

Financial

Profile

• Asset-light business model and proprietary technologies generate strong margins and cash flow

• Consistent cash flow supports leverage profile and funding of future acquisitions

• New technologies expected to drive sustained, profitable growth

• Strong underlying global demand dynamics

• Growth driven by penetration and adoption of current technologies with existing customers,

current and new geographies, and additional crops

• Additional acquisition-driven growth from adjacent technologies and services

Attractive

Growth

Potential

• Over a decade of delivering technologies, services and expertise to produce market

• 400+ registrations in 45+ countries

• $100+ million invested in our technologies during the past 10 years

Proven

Solutions

• Low-cost, high-impact solutions throughout value chain

• Compelling return on investment for customers

• Offerings changed the game on providing consumers year-round access to produce

• Long-term relationships and proven performance results in high customer satisfaction

Compelling

Customer

Benefits

5

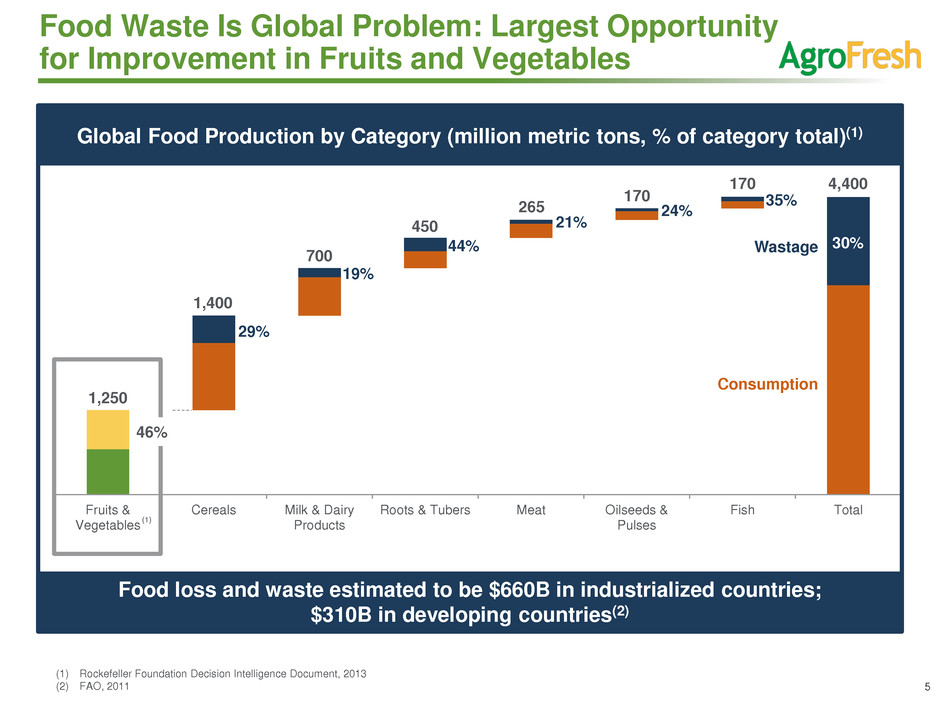

Fruits &

Vegetables

Cereals Milk & Dairy

Products

Roots & Tubers Meat Oilseeds &

Pulses

Fish Total

Food Waste Is Global Problem: Largest Opportunity

for Improvement in Fruits and Vegetables

Food loss and waste estimated to be $660B in industrialized countries;

$310B in developing countries(2)

1,400

700

1,250

450

265

170

170 4,400

29%

19%

44%

21%

24%

35%

30% Wastage

Consumption

46%

(1) Rockefeller Foundation Decision Intelligence Document, 2013

(2) FAO, 2011

(1)

Global Food Production by Category (million metric tons, % of category total)(1)

6

AgroFresh Addresses All Five

Supply Chain Points of Food Loss

Source: NRDC, 2012; FAO, 2011

2%

11%

20%

3%

3%

Grain Products

Seafood

Fruits & Vegetables

Meat

Milk

2%

0.5%

3%

2%

0.25%

Grain Products

Seafood

Fruits & Vegetables

Meat

Milk

10%

5%

1%

4%

0.5%

Grain Products

Seafood

Fruits & Vegetables

Meat

Milk

2%

9.5%

12%

4%

0.25%

Grain Products

Seafood

Fruits & Vegetables

Meat

Milk

27%

28%

12%

17%

Grain Products

Seafood

Fruits & Vegetables

Meat

Milk

Production

Losses

Postharvest,

Handling and

Storage Losses

Processing and

Packaging

Losses

Distribution and

Retail Losses

Consumer

Losses

33%

7

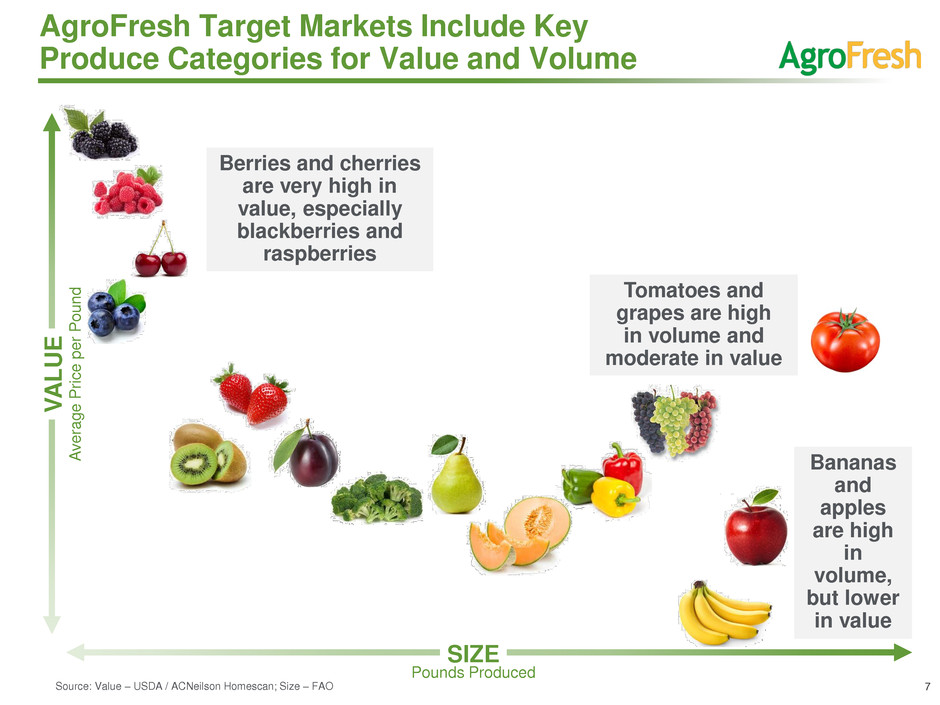

Bananas

and

apples

are high

in

volume,

but lower

in value

AgroFresh Target Markets Include Key

Produce Categories for Value and Volume

V

A

LU

E

SIZE

Pounds Produced

A

v

e

ra

g

e

P

ri

c

e

p

e

r

P

o

u

n

d

Berries and cherries

are very high in

value, especially

blackberries and

raspberries

Tomatoes and

grapes are high

in volume and

moderate in value

Source: Value – USDA / ACNeilson Homescan; Size – FAO

8

Global Pear Production

(excluding China and Iran)

(metric tons in millions)

Global Apple Production

(excluding China and Iran)

(metric tons in millions)

Global Apple and Pear Production are

Top Two Segments for AgroFresh Today

30.4

32.0

31.4

32.4

33.8

32.3

2010 2011 2012 2013 2014 2015

6.6

7.0

6.0

6.5 6.4 6.3

2010 2011 2012 2013 2014 2015

Source: USDA

9

Proprietary 1-MCP Technology Preserves

and Enhances Quality of Fruit

Current Portfolio New Product Launches

Product

Function Maintains fruit

quality post-

harvest during

storage and

transport

Pre-harvest

application to

maximize peak

ripening, fruit

quality and

harvest

management

Regulates

banana

ripening,

benefiting

retailers and

consumers

Proprietary

sensor

technology and

analytics to

optimize fruit

storage

Improves

seedling vigor

and produce

yields

Key

Markets

Apples, pears Apples, pears Bananas Apples, pears Tomatoes,

peppers

Status Market leader Launching in

four countries in

2016

Product trials

under way with

key customers

Prototype

scheduled for

Q3 introduction

Announced in

July; initial sales

expected in H2

2016

1-MCP Underpins Five Product Offerings that Drive Growth

10

Strong market position driven by differentiated

technologies, customer-focused service model and

deeply-ingrained customer relationships

Ethylene Control Product Sales

For Apple Treatment(1)

~25%

of AgroFresh sales under no or

limited patent protection(1)

SmartFresh and Harvista Provide

Unparalleled Performance and Service

All Others

SmartFreshTM α-CD Encapsulated 1-MCP

Preferred Method of Ethylene Control Delivery

▼ Produced on site by mixing numerous chemicals

▼ Requires two-step application process

Gas

1-MCP

▼ Requires specialized handling and storage

▼ Must be transported at extremely low

temperatures

Liquid

1-MCP

▲ Accurate and consistent dosing and application

▲ Easy to store and transport

▲ Consistent quality and purity

α-CD

Encapsulated

1-MCP

80% +

gross margins in countries with

and without patent protection(2)

97%

(1) Management estimate

(2) Includes countries with both molecule and encapsulation patents and just encapsulation patents.

11

Long-term, RipeLock expected

to add $25M in sales by 2020

Registrations for RipeLock

technology held in countries that

import estimated 16.5 billion

pounds of bananas annually

RipeLock Opens Adjacent Space in Bananas

• RipeLock couples 1-MCP technology with

unique packaging system to control

ripening and reduce spoilage

• Creates value from post-harvest through

shipment; from retail store to consumer

• Trials with 20 retail customers being

completed in 2016

• Production sales expected by year-end

• Along value chain, various partners could

experience a 3-to-6 times return on

investment

Target market is traded volume

of bananas: ~22 billion pounds

imported into U.S. and Europe

More than 230 billion pounds

of bananas produced annually

globally

12

Extensions into New Crops

Early Signals of Expansion Strategy

Market Need

Reduces transplant shock, resulting in

less seedling mortality and faster crop

establishment, which leads to a

healthier crop

Provides customers with a natural

solution to improve storage stability and

shelf life, effectively suppressing the

spread of fungal pathogens and the

resulting damages

Value Created Increased crop yield Extends post-harvest lifespan

Crops Served Tomatoes, peppers Grapes, strawberries, raspberries and blackberries

Launch Status Initial sales expected in Q3 2016 Sales expected in 1-to-2 years

Patent or

Registration Data

Registered in Florida; registration

package filed in California

Registration in Israel currently; further

registrations to be sought in U.S., Latin

America and Europe.

13

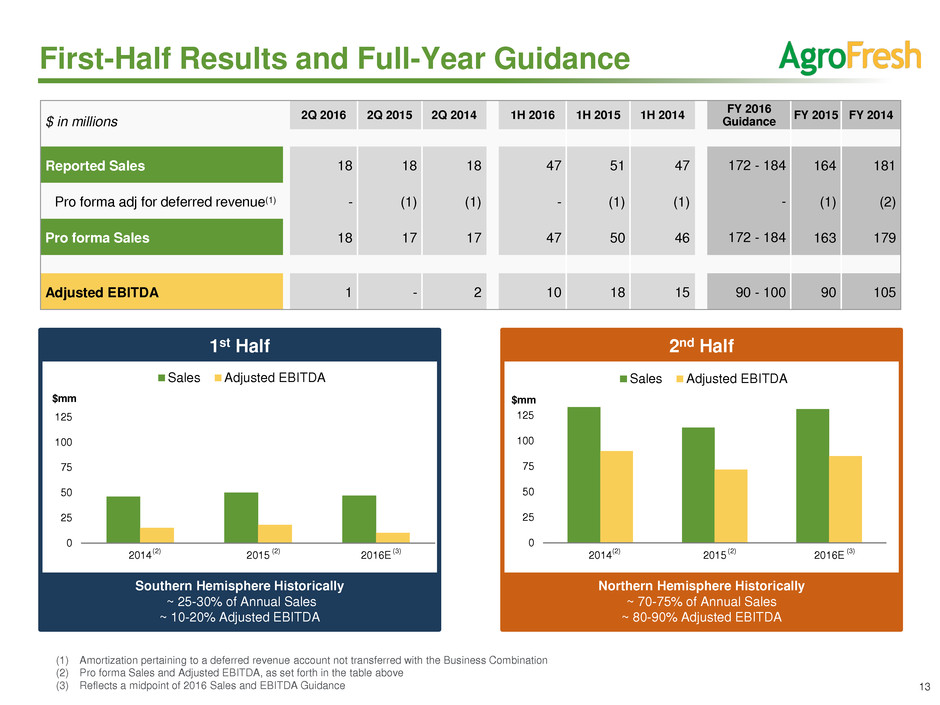

First-Half Results and Full-Year Guidance

0

25

50

75

100

125

2014 2015 2016E

$mm

Sales Adjusted EBITDA

0

25

50

75

100

125

2014 2015 2016E

$mm

Sales Adjusted EBITDA

Southern Hemisphere Historically

~ 25-30% of Annual Sales

~ 10-20% Adjusted EBITDA

Northern Hemisphere Historically

~ 70-75% of Annual Sales

~ 80-90% Adjusted EBITDA

(1) Amortization pertaining to a deferred revenue account not transferred with the Business Combination

(2) Pro forma Sales and Adjusted EBITDA, as set forth in the table above

(3) Reflects a midpoint of 2016 Sales and EBITDA Guidance

(2) (3) (2) (3) (2) (2)

1st Half 2nd Half

$ in millions

2Q 2016 2Q 2015 2Q 2014 1H 2016 1H 2015 1H 2014

FY 2016

Guidance

FY 2015 FY 2014

Reported Sales

18 18 18 47 51 47 172 - 184 164 181

Pro forma adj for deferred revenue(1)

- (1) (1) - (1) (1) - (1) (2)

Pro forma Sales

18 17 17 47 50 46 172 - 184 163 179

Adjusted EBITDA

1 - 2 10 18 15 90 - 100 90 105

14

~25 - 30%

Historically

~80 - 90%

Historically

~10 - 20%

Historically

EBITDA

~70 - 75%

Historically

REVENUE

Apple Production Seasons Creates Significant

Cyclicality for AgroFresh Services

Northern Hemisphere

Southern Hemisphere

HarvistaTM Sales

HarvistaTM Sales

SmartFreshTM Sales

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Flowering Fruit Set and

Growing

Harvest Storage 1-12 Months

Flowering Harvest Fruit Set and Growing

Storage 1-12

Months Storage 1-12 Months

Fruit Set and

Growing

SmartFreshTM Sales

TM Trademark of AgroFresh

15

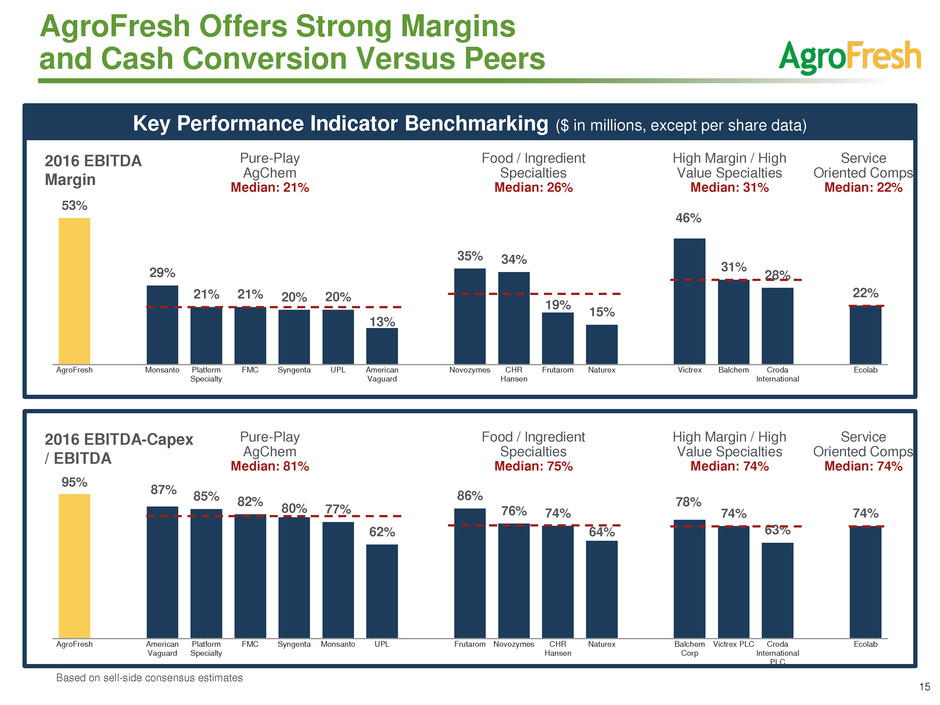

AgroFresh Offers Strong Margins

and Cash Conversion Versus Peers

Key Performance Indicator Benchmarking ($ in millions, except per share data)

95%

87%

85% 82%

80% 77%

62%

86%

76% 74%

64%

78%

74%

63%

74%

AgroFresh American

Vaguard

Platform

Specialty

FMC Syngenta Monsanto UPL Frutarom Novozymes CHR

Hansen

Naturex Balchem

Corp

Victrex PLC Croda

International

PLC

Ecolab

Pure-Play

AgChem

Median: 81%

Food / Ingredient

Specialties

Median: 75%

High Margin / High

Value Specialties

Median: 74%

Service

Oriented Comps

Median: 74%

2016 EBITDA-Capex

/ EBITDA

53%

29%

21% 21% 20% 20%

13%

35% 34%

19%

15%

46%

31%

28%

22%

AgroFresh Monsanto Platform

Specialty

FMC Syngenta UPL American

Vaguard

Novozymes CHR

Hansen

Frutarom Naturex Victrex Balchem Croda

International

Ecolab

Pure-Play

AgChem

Median: 21%

Food / Ingredient

Specialties

Median: 26%

High Margin / High

Value Specialties

Median: 31%

Service

Oriented Comps

Median: 22%

2016 EBITDA

Margin

Based on sell-side consensus estimates

16

AgroFresh Provides Solutions for Food Freshness

• Secular growth story addressing

global trends in food production and

consumption

• Transformative 1-MCP technology

used today primarily to preserve

apples using SmartFreshTM

• Industry leader operating with capital

light, high service driven, direct sales

business model to diversified

customer base >3,000 customers

• Focus on expansion with

SmartFreshTM comprising ~90% of

current sales

• Significant growth potential with 80%

gross margins and 50+% EBITDA

margins

Apples 87%

Pears 6%

Kiwis 2%

Flowers 2%

Other 3%

North America 36%

EMEA 40%

Latin America 15%

Asia Pacific 9%

FY2015 Revenue by Crop

FY2015 Revenue by Region

17

Appendix

Reg G Reconciliation of U.S. GAAP

to non-GAAP Financial Measures

18

Reg G Reconciliation

The following is a reconciliation between the non-GAAP financial measure of Adjusted EBITDA to its most directly comparable GAAP financial

measure, net loss:

*During the three months ended June 30, 2016, the Company identified certain additional non-recurring professional fees and other costs that were not previously included as add-backs in

the Company's calculation of Adjusted EBITDA but are included in the above calculation for the three and six months ended June 30, 2016. Approximately $0.5 million of such non-recurring

professional fees and other costs were incurred during the three months ended March 31, 2016. Such amounts are included as an add-back to net income to calculate Adjusted EBITDA for

the six months ended June 30, 2016. Had such amounts been included in the calculation of Adjusted EBITDA for the three months ended March 31, 2016 as previously reported by the

Company, Adjusted EBITDA for such period would have been $9.0 million, as compared to the $8.5 million originally reported.

(1) The amortization of inventory step-up related to the acquisition of AgroFresh is charged to income based on the pace of inventory usage.

(2) Expenses incurred during the period added back to EBITDA related to equity compensation, depreciation and amortization largely associated with the asset step-up and other non-recurring

expenses incurred during the period.

(3) Interest paid on the term loan, inclusive of accretion for debt discounts, debt issuance costs and contingent consideration.

(4) Non-recurring professional fees associated with becoming a stand-alone public company.

(5) R&D savings related to two projects (Invinsa and IDC).

(6) Severance costs related to our former Chief Executive Officer, former President, and other personnel, including the net share-based compensation cost due to acceleration of vesting on

restricted stock and forfeiture of stock options.

(7) Non-cash fair value measurement adjustment related to the contingent earn-out liability.

(8) Deferred revenue associated with a revenue agreement not included in the Business Combination.