Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - New York REIT Liquidating LLC | v446391_8k.htm |

Exhibit 99.1

0 February 2014 Investor Presentation August 2016

1 1 Forward Looking Statements & Projections Certain statements included in this presentation are forward - looking statements . Those statements include statements regarding the intent, belief or current expectations of us and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will ,“ " seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions . Actual results may differ materially from those contemplated by such forward - looking statements . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements to reflect changed assumptions , the occurrence of unanticipated events or changes to future operating results over time, unless required by law . The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements : • The outcome of pursuing the Asset Sale Plan (as defined in the company’s form 10 - Q filed with the SEC on August 9 , 2016 ) and the Refinancing Plan ( as defined in the company’s form 10 - Q filed with the SEC on August 9 , 2016 ) is uncertain and exposes us to certain risks, and there can be no assurance that we will be able to implement the Asset Sale Plan or the Refinancing Plan on favorable terms, or at all ; • To the extent any asset sales occur pursuant to the Asset Sale Plan or otherwise, there can be no assurance as to timing of and the amount of proceeds of such sales to be distributed to our stockholders ; • Our ability to exercise our option (the “WWP Option”) to purchase the balance of the equity interest in WWP Holdings , LLC that we do not own in the future depends on our ability to raise additional capital, and we may not be able to raise additional capital, through the Refinancing Plan or otherwise, on favorable terms or at all ; in addition the existing mortgage loans encumbering Worldwide Plaza includes provisions which could restrict our ability to assume those loans upon exercise of the WWP Option ; • Our credit facility with Capital One, National Association and the other lenders thereto contains certain financial and operating covenants and other terms that could adversely affect our ability to engage in the type of actions contemplated by the Asset Sale Plan and other asset sales unless we are able to successfully implement the Refinancing Plan ; • All of our executive officers are also officers, managers or holders of a direct or indirect interest in our Advisor and other entities affiliated with AR Global Investments, LLC (the successor business to AR Capital, LLC, " AR Global") ; as a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor’s compensation arrangements with us and other investor entities advised by AR Global affiliates , and conflicts in allocating time among these entities and us, which could negatively impact our operating results ; • We depend on tenants for revenue, and, accordingly, our revenue is dependent upon the success and economic viability of our tenants ; • We may not be able to achieve our rental rate objectives on new and renewal leases and our expenses could be greater, which may impact our results of operations ; • Our properties may be adversely affected by economic cycles and risks inherent to the New York metropolitan statistical area, especially New York City ; • We may be unable to pay or maintain cash dividends or increase dividends over time . Amounts paid to our stockholders may be a return of capital and not a return on a stockholder's investment ; • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates, including fees payable upon the sale of properties ; • We may fail to continue to qualify to be treated as a real estate investment trust for U . S . federal income tax purposes (“ REIT ”) • We may be adversely affected by changes in general economic, business and political conditions, including the possibility of intensified international hostilities, acts of terrorism, and changes in conditions of United States or international lending, capital and financing markets . This presentation includes estimated projections of future operating results. These projections were not prepared in accordan ce with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections. This information is not fact and shou ld not be relied upon as being necessarily indicative of future results; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong. Important factors that may affect act ual results and cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the company and other factors described under “Risk Factors” sections of the Company’s Annual Repor t o n Form 10 - K and any subsequent Quarterly Reports on Form 10 - Q or Current Reports on Form 8 - K and “Forward - Looking Statements.” The projections also reflect assumptions as to certain business decisions that are subject t o change. As a result, actual results may differ materially from those contained in the estimates. Accordingly, there can be no assurance that the estimates will be realized. This presentation also contains estimates and information concerning our industry, including market position, market size, an d g rowth rates of the markets in which we participate, that are based on industry publications and reports. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to th ese estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncerta int y and risk due to variety of factors, including those described in the “Risk Factors” section of the Company’s Annual Report on Form 10 - K and any subsequent Quarterly Reports on Form 10 - Q or Current Reports on Form 8 - K. These and other factors could cause results to differ materially from those expressed in these publications and reports.

2 Company Overview x In - place rents estimated to be 10% to 15% below market x Significant same - store cash NOI growth potential x 100% New York City x ~96% office & retail x 93.0% occupied x Average lease term of ~9.3 years x ~ 45% combined debt/enterprise value x ~2.7x combined interest coverage x Shares trading at a discount to estimated NAV New York City Focus High Quality Portfolio Solid Balance Sheet Strong Growth Prospects Valuation Note: All metrics as of June 30, 2016

3 Portfolio Snapshot (as of 6/30/16) (1) In - place rents are estimated to be 10 - 15% below market Number of Properties 19 Square Feet 3.3 million Occupancy 93.0% % SF Expiring by Year (2) 2016 0.2% 2017 3.6% 2018 5.3% Sub - total 9.1% (1) Includes pro rata share of unconsolidated joint venture. (2) Excludes 122,896 square feet of the hotel (which excludes 5,716 square feet leased to the hotel restaurant tenant). Total va can t square footage at June 30, 2016 was ~218k square feet.

4 82% 14% 3% Cash Rent Portfolio Mix (1) (1) Calculations are as of June 30, 2016 (2) Includes retail at office buildings (3) Includes parking and hotel assets Note: Calculations based on Annualized Cash Rents as defined in the supplemental information included in Exhibit 99.2 of the compan y’s form 8 - K filed with the SEC on August 9 th , 2016 (excluding Viceroy Hotel and 416 Washington Street parking garage which are third party managed and based on June 30, 2016 LTM Cash NOI) Cash Rent by Property Type Manhattan Cash Rent by Borough NYRT is: » 98% Manhattan » 96% Office/Retail Office Retail (2) Other (3) Manhattan Office Outer - Borough 98% 2%

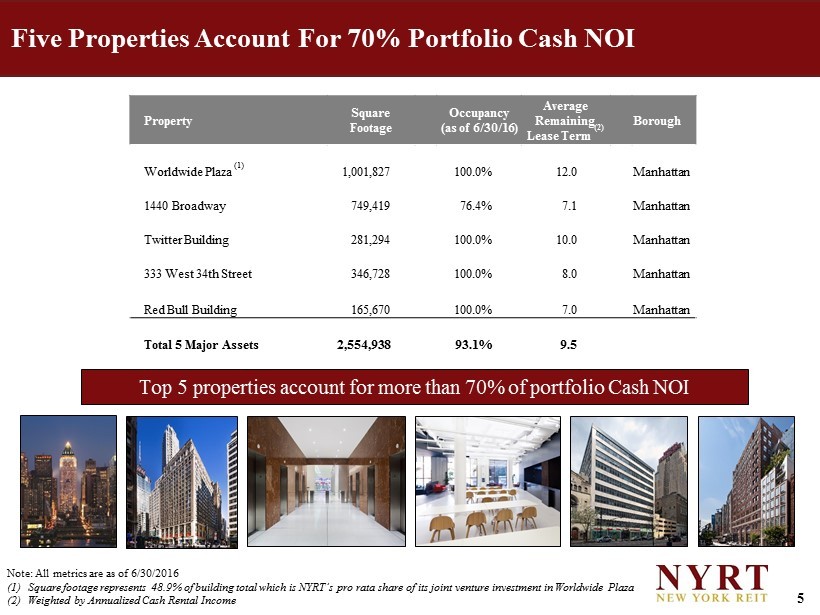

5 Five Properties Account For 70% Portfolio Cash NOI Note: All metrics are as of 6/30/2016 (1) Square footage represents 48.9 % of building total which is NYRT’s pro rata share of its joint venture investment in Worldwide Plaza (2) Weighted by Annualized Cash Rental Income Top 5 properties account for more than 70 % of portfolio Cash NOI Property Square Footage Occupancy (as of 6/30/16) Average Remaining Lease Term (2) Borough Worldwide Plaza (1) 1,001,827 100.0% 12.0 Manhattan 1440 Broadway 749,419 76.4% 7.1 Manhattan Twitter Building 281,294 100.0% 10.0 Manhattan 333 West 34th Street 346,728 100.0% 8.0 Manhattan Red Bull Building 165,670 100.0% 7.0 Manhattan Total 5 Major Assets 2,554,938 93.1% 9.5

6 0.2% 3.6% 5.3% 1.1% 2.7% 2016 2017 2018 2019 2020 (1) As of June 30, 2015. Excludes Hotel and Multifamily properties. Note: As of June 30, 2016. 171,000 SF is attributed to Rent Path, Inc. (formerly Primedia) at 1440 Broadway Well - Staggered Lease Maturity Schedule Office & Retail Portfolio SF Expiring (000’s) Less than 15% lease rollover in the next five years 6.3 SF 106.4 SF 159.3 SF 32.1 SF 80.1 SF

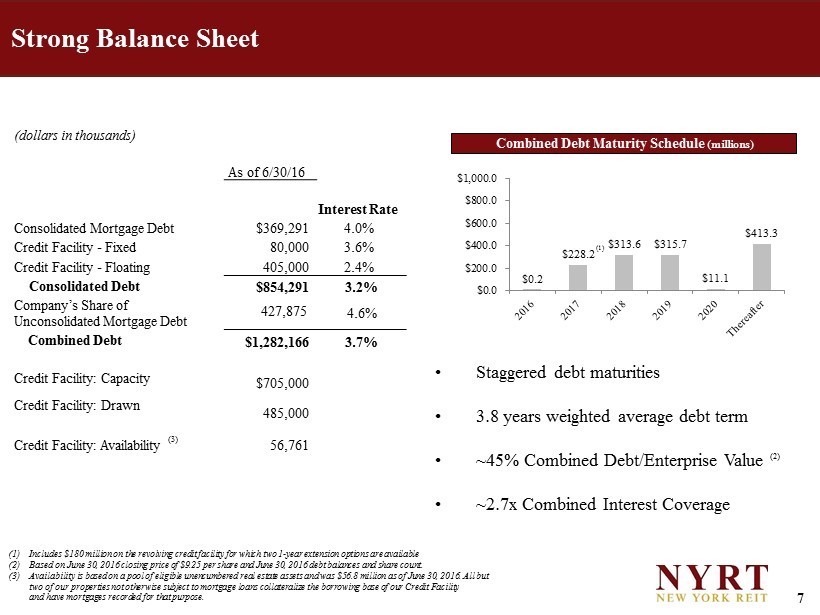

7 $0.2 $228.2 $313.6 $315.7 $11.1 $413.3 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 Strong Balance Sheet (1) Includes $180 million on the revolving credit facility for which two 1 - year extension options are available (2) Based on June 30, 2016 closing price of $9.25 per share and June 30, 2016 debt balances and share count. (3) Availability is based on a pool of eligible unencumbered real estate assets and was $56.8 million as of June 30, 2016. All but two of our properties not otherwise subject to mortgage loans collateralize the borrowing base of our Credit Facility and have mortgages recorded for that purpose. (dollars in thousands ) As of 6/30/16 Interest Rate Consolidated Mortgage Debt $369,291 4.0% Credit Facility - Fixed 80,000 3.6% Credit Facility - Floating 405,000 2.4% Consolidated Debt $ 854,291 3.2% Company’s Share of Unconsolidated Mortgage Debt 427,875 4.6% Combined Debt $ 1,282,166 3.7% Credit Facility: Capacity $705,000 Credit Facility: Drawn 485,000 Credit Facility: Availability (3) 56,761 Combined Debt Maturity Schedule (millions) • Staggered debt maturities • 3.8 years weighted average debt term • ~45% Combined Debt/Enterprise Value (2) • ~2.7x Combined Interest Coverage (1)

8 (1) Per NYRT Q2 2016 Quarterly Supplemental; quarterly figure is multiplied by 4 to arrive at an annualized number (2) Includes income from Advance Magazine and Mulberry who expired in Q2; also includes ~$132k of non - recurring revenue at 218 W 18 th Street (3) Includes free rent from executed leases that commenced during or after Q2 2016 (CVS, and Nordstrom) (4) Estimated incremental NOI with lease up to 95% from 76 % at end of Q2 2016 Note: Cash net operating income (“Cash NOI”) is a non - GAAP metric and is further defined in the “Non - GAAP Metrics” section of this presentation Same - Store NOI Bridge Run Rate Q2 Cash NOI ( 1 ) $ 121 mm Less: Viceroy Hotel Q2 Cash NOI (1) (4) mm Plus: Free Rent in Q2 (1 ) 3 mm Less: Income From Leases Expiring in Q2 (2) (2) Mm =Adjusted Run Rate Q4 Cash NOI (excluding Viceroy) $118mm Key Events: Approximate Incremental Cash NOI (millions) A) Contractual Free Rent Burn Off (Not Included in Q2) (3) 4 B) Stabilize Viceroy Hotel Cash NOI 10 C) 1440 Broadway Stabilization (4) 10 D) Mark to Market 2016 & 2017 Lease Rollover 2 Total Cash NOI from Key Events $26 Total Run Rate Cash NOI + Key Events $ 144 Other Contractual Rent Increases (2 years @ 3%) 9 Target Stabilized Cash NOI $ 152

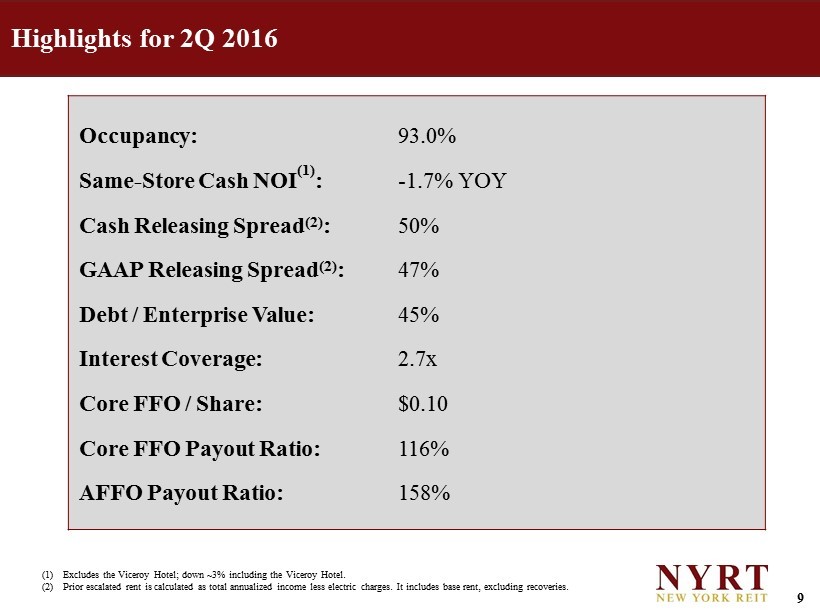

9 Highlights for 2Q 2016 Occupancy: 93.0% Same - Store Cash NOI (1) : - 1.7% YOY Cash Releasing Spread (2) : 50% GAAP Releasing Spread (2) : 47% Debt / Enterprise Value: 45% Interest Coverage: 2.7x Core FFO / Share: $0.10 Core FFO Payout Ratio: 116% AFFO Payout Ratio: 158% (1) Excludes the Viceroy Hotel; down ~3% including the Viceroy Hotel. (2) Prior escalated rent is calculated as total annualized income less electric charges. It includes base rent, excluding recover ies .

10 Non - GAAP Metrics This presentation uses certain non - GAAP metrics, including Funds from Operations (“FFO”), Adjusted Funds from Operations (“AFFO” ), Core Funds From Operations (“ Core FFO”), Net Operating Income (“NOI”), Cash Net Operating Income (“Cash NOI”) and Incremental Net Operating Income (“Incremental NOI”). We believe that, since real estate values historically rise and fall with market conditions, including inflation, int ere st rates, the business cycle, unemployment and consumer spending, presentations of operating results for a REIT using histori cal accounting may be something less informative than such non - GAAP financial metrics. However, these non - GAAP metrics should be read in conjunction with our reported GAAP financial statement s. Note that our computation of these non - GAAP performance metrics may not be comparable to similarly - named performance metrics rep orted by other REITs or real estate companies, limiting their usefulness as a comparative measure. We compensate for these li mit ations by relying primarily on our GAAP results and using the non - GAAP measures only for supplemental purposes. Please see our consolidated financial statements and the related notes thereto. We use these non - GAAP metrics as an important part of our report and planning processes to, among other things,: • Monitor and evaluate the performance of our business operations; • Facilitate management’s internal comparisons of the historical operating performance of our business operations; • Facilitate management’s external comparisons of the results of our overall business to the historical operating performance ot her companies that may have different capital structures and debt levels; • Analyze and evaluate financial and strategic planning decisions regarding future operating investments; • Provide useful information to investors regarding financial and business trends related to our results of operations; and • Plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. These non - GAAP measures have limitations as analytical tools, and you should not consider any of these measures in isolation or as a substitute for analyses of our income or cash flows as reported under GAAP. Some these limitations are: • They do not reflect our cash expenditures, or future requirements for capital expenditures, or contractual commitments; • They do not reflect changes in, or cash requirements for, our working capital needs; • They do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; and depreciation, amortization and non - cash expense items that are reflected in our statements of cash flows . Funds from operations (FFO) Pursuant to the revised definition of funds from operations adopted by the Board of Governors of the National Association of Rea l Estate Investment Trusts (“NAREIT”), we calculate funds from operations (FFO), by adjusting net income (loss) (computed in accordance with GAAP, including non - recurring items) for gains (or losses) from sales of properties, impairment losses on depreciable real estate of consolidated real estate, impairment losses on investments in unconsolidated joint ventures dri ven by a measurable decrease in the fair value of depreciable real estate held by the unconsolidated joint ventures, real estate related depreciation and amortization, and after adjustment for unconsolidated partnerships and joint ventures. FFO is a non - GAAP financial measure. The use of FFO, combined with the required GAAP presentations, has been fundamentally beneficial in improv ing the understanding of operating results of REITs among the investing public and making comparisons of REIT operating results more meaningful. Management generally considers FFO to be a useful measure for reviewing our comparative operating and financial performance because, by excluding gains and losses related to asset sales (land and property), impairment losses and real estate asset depreciation and amortization (which can vary among owners of identical assets in similar condition based on historical cost accounting and useful life estimates) , F FO can help one compare the operating performance of a company’s real estate between periods or as compared to different companies . Our computation of FFO may not be comparable to FFO reported by other REITs or real estate companies that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently. FF O should not be considered as an alternative to net income (determined in accordance with GAAP) as an indication of our performance. FFO does not represent cash generated from operating activities de termined in accordance with GAAP, and is not a measure of liquidity or an indicator of our ability to make cash dividends. We believe that to further understand our performance, FFO should be compared with our reported net income and considered in addition to cash flows determined in accordance with GAAP, as presented in our consolidated financial statements. Adjusted funds from operations (AFFO) AFFO is Core FFO, excluding certain income or expense items that we consider more reflective of investing activities, other n on - cash income and expense items and the income and expense effects of other activities that are not a fundamental attribute of our business plan. These items include unrealized gains and losses , which may not ultimately be realized, such as gains or losses on derivative instruments, gains or losses on contingent valuation rights and gains and losses on investments. In addi tio n, by excluding non - cash income and expense items such as amortization of above and below market leases, equity - based compensation expenses, amortization of deferred financing costs and straight - line rent from AFFO we believe we provide useful information regarding income and expense items which have no cash impact and do not provide liquidity to the Company or require capital r eso urces of the Company. We exclude certain interest expenses related to securities that are convertible to common stock as the shares are assumed to have converted to common sto ck in our calculation of weighted average common shares - fully diluted, if applicable. Furthermore we include certain cash inflows and outflows that are reflective of operating activities including preferred returns on joint ventures, second generation tenant improvements and leasing commissions (included in the period in which the lease commences) and recurring capital expen dit ures. We also include items such as free rent credits paid by sellers because these funds are paid to us during the free rent period and therefore improve our liquidity and ability to pay dividends and second generation capital expenditures in our calculation of AFFO because these funds are paid in order to maintain the level of operating performance. Although our AFFO may not be comparable to that of other REITs and real estate companies, we believe it provides a meaningful indicator of our ability to fund cash needs and to make cash dividends to stockholders. In addition, we believe that to further understand our liquidity, AFFO should be compared with our ca sh flows determined in accordance with GAAP, as presented in our consolidated financial statements. AFFO does not represent cash generated from operating activities determined in accordance wit h GAAP, and AFFO should not be considered as an alternative to net income (determined in accordance with GAAP) as an indication of our performance, as an alternative t o n et cash flows from operating activities ( determined in accordance with GAAP), or as a measure of our liquidity. Core funds from operations (Core FFO) Core FFO is FFO, excluding transaction related costs and other items that are considered to be not comparable from period to per iod, such as gains on sales of securities and investments, miscellaneous revenue, such as lease termination fees and insurance proceeds, and expenses related to the early extinguishment of debt. Additionally, we exclude transaction related expenses, which are primarily comprised of expenses related to our strategic alternatives process, as these expenses are not the result of th e o perations of our properties. By excluding transaction related costs and other items that are considered to be not comparable from period to period, we believe Core FFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management's analysis of the investing and operating performance of our properties. Net operating income (NOI) Net operating income (NOI) is a non - GAAP financial measure equal to net income, the most directly comparable GAAP financial meas ure, less discontinued operations, plus corporate general and administrative expense, acquisition and transaction costs, depreciation and amortization and interest expense, income from unconsolidated joint ventures, interest, other non - cash items and other income and gains from investments in securities. NOI is adjusted to include our pro rata share of NOI from unconsol ida ted joint ventures. We use NOI internally as a performance measure and believe NOI provides useful information to investors regarding our financial condition and results of operations because it reflects only those income and expense items that are incurred at the property level. Therefore, we believe NOI is a useful measure for evaluating the operating performan ce of our real estate assets and to make decisions about resource allocations . Further, we believe NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects th e impact on operations from trends in occupancy rates, rental rates, operating costs, acquisition activity on an unleveraged basis, providing perspective not immediately apparent from net income. NOI excludes certain components from net income in order to provide results that are more closely related to a property’s results of operations. For example, inte res t expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level. In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level. NOI presented by us may not be comparable to NOI reported by other REITs that define NOI differently. We believe that in order to facilitate a clear understanding of our operating results, NOI should be examined in conjunction with net in com e, as presented in our consolidated financial statements. NOI should not be considered as an alternative to net income as an indication of our performance or to cash flows as a measure of our liquidity or ability to make dividends. Cash net operating income (Cash NOI) NOI, presented on a cash basis, which is NOI after eliminating the effects of straight - lining of rent and fair value lease reven ue. Annualized Adjusted Cash NOI NOI, presented on a cash basis, which is equal to NOI after eliminating the effects of straight - line rent and fair value lease r evenue, plus contractual free rent. The quarterly number is multiplied by 4 to arrive at an annualized figure. Non - GAAP Reconciliation NYRT has filed supplemental information packages with the Securities and Exchange Commission ("SEC") to provide additional disclosure and financial information for the benefit of NYRT’s various stakeholders, including reconciliations of all non - GAAP measures contained in this Investor Presentation. The supplemental package can be found under "Investors — Quarterly Supplemental“ section of NYRT’s website at www.nyrt.com and on the SEC website at www.sec.gov . 10