Attached files

| file | filename |

|---|---|

| 8-K - THE BANCORP, INC. FORM 8-K - Bancorp, Inc. | bancorp8k.htm |

| EX-99.2 - EXHIBIT 99.2 - Bancorp, Inc. | ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Bancorp, Inc. | ex99-1.htm |

| EX-10.2 - EXHIBIT 10.2 - Bancorp, Inc. | ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - Bancorp, Inc. | ex10-1.htm |

| EX-3.1 - EXHIBIT 3.1 - Bancorp, Inc. | ex3-1.htm |

Exhibit 10.3

SUBSCRIPTION AGREEMENT

This SUBSCRIPTION AGREEMENT (this "Agreement") is made as of the 5th day of August 2016, by and between The Bancorp, Inc., a Delaware corporation (the "Company"), and the investors listed on Schedule A hereto (each an "Investor" and collectively the "Investors").

WHEREAS, the Company has entered into a Securities Purchase Agreement dated the date hereof (the "Securities Purchase Agreement") with the purchasers party thereto (the "PIPE Purchasers") for the private placement (the "Offering") of 7,560,000 shares of common stock of the Company, par value $1.00 per share ("Common Stock") at a price of $4.50 per share, and 40,000 shares of a newly-created convertible preferred stock, Series C Mandatorily Convertible Cumulative Non-Voting Perpetual Preferred Stock, par value $0.01 per share ("Preferred Stock" and together with the Common Stock, the "Securities") at a price of $1,000 per share;

WHEREAS, in connection with the Offering, the PIPE Purchasers have entered into a Registration Rights Agreement dated as of the date hereof (the "Registration Rights Agreement");

WHEREAS, the Preferred Stock will mandatorily convert into shares of Common Stock upon obtaining requisite stockholder approval ("Conversion Approval") pursuant to the rules of the NASDAQ Stock Market ("NASDAQ");

WHEREAS, each Investor wishes to purchase the number of shares of Common Stock set forth beside his or her name on Schedule A hereto;

WHEREAS, the Investors are officers and/or directors of the Company and, accordingly, the transaction contemplated by this Agreement may result in the shares of Common Stock to be issued pursuant to this Agreement being treated by NASDAQ as executive compensation ("Executive Compensation Approval").

NOW, THEREFORE, in consideration of the premises and the mutual covenants and agreements hereinafter set forth and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and Investor hereby agree as follows:

| 1. | Contingent Purchase of Securities |

| a. | Purchase and Issuance of the Shares. Upon the Company obtaining from its stockholders Conversion Approval and Executive Compensation Approval (together the "Conditional Approvals"), each Investor hereby irrevocably agrees to purchase from the Company, and the Company hereby agrees to sell to each Investor, on the Closing Date (as hereinafter defined), the number of shares of Common Stock set forth next to each Investor's name on Schedule A at price of $4.50 per share (the "Purchase Price"). On the Closing Date, upon receipt of payment therefor in accordance with this Agreement, the Company shall deliver to the Investor the purchased shares of Common Stock in book entry form through the Company's transfer agent. |

| b. | Delivery of the Purchase Price. On the Closing Date, each Investor shall deliver to the Company the Purchase Price in immediately available funds by wire transfer or such other form of payment as shall be acceptable to the Company and Investor. |

| c. | Closing. The closing (the "Closing"), shall take place at the offices of Ledgewood, a professional corporation, at 2001 Market Street, Suite 3400, Philadelphia, PA 19103 no later than three (3) business days after obtaining the Conditional Approvals ("Closing Date"). |

| d. | Termination. This Agreement and each of the rights and obligations of the Company and each Investor shall terminate upon the earlier of (i) termination of the Securities Purchase Agreement, (ii) failure of the Company to obtain the Conditional Approvals, and (iii) one (1) year from the date hereof. |

| 2. | Representations and Warranties of Investor |

Each Investor represents and warrants to the Company that:

| a. | Accredited Investor. Investor represents that he, she or it is an "accredited investor" as such term is defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended (the "Securities Act"), and acknowledges that the sale contemplated hereby is being made in reliance, among other things, on a private placement exemption to "accredited investors" under the Securities Act and similar exemptions under applicable state law. |

| b. | Intent. Investor is purchasing the shares of Common Stock solely for investment purposes, for Investor's own account and/or for the account or benefit of its members or affiliates, and not with a view to the distribution thereof and Investor has no present arrangement to sell such shares to or through any person or entity. |

| c. | Restrictions on Transfer. Investor acknowledges and understands that the shares of Common Stock are being offered in a transaction not involving a public offering in the United States within the meaning of the Securities Act and have not been registered under the Securities Act and, if in the future Investor decides to offer, resell, pledge or otherwise transfer the shares, that such shares may be offered, resold, pledged or otherwise transferred only (A) pursuant to an effective registration statement filed under the Securities Act, (B) pursuant to an exemption from registration under Rule 144 promulgated under the Securities Act, if available, or (C) pursuant to any other available exemption from the registration requirements of the Securities Act, and in each case in accordance with any applicable securities laws of any state or any other jurisdiction. |

| d. | Sophisticated Investor. The Investor is sophisticated in financial matters and able to evaluate the risks and benefits of the investment in the shares to purchased hereby. |

| e. | Independent Investigation. Investor has relied upon an independent investigation of the Company and has not relied upon any information or representations made by any third parties or upon any oral or written representations or assurances from the Company, its officers, directors or employees or any other representatives or agents of the Company. |

| f. | No General Solicitation. Investor is not investing in the shares to be issued hereby as a result of or subsequent to any general solicitation or general advertising, including but not limited to any advertisement, article, notice or other communication published in any newspaper, magazine, or similar media or broadcast over television or radio, or presented at any seminar or meeting. |

| 3. | Governing Law; Jurisdiction; Waiver of Jury Trial |

Notwithstanding the place where this Agreement may be executed by any of the parties hereto, the parties agree that this Agreement shall be governed by and construed in accordance with the laws of the State of Delaware. The parties hereto hereby waive any right to a jury trial in connection with any litigation pursuant to this Agreement and the transactions contemplated hereby.

| 4. | Assignment; Entire Agreement; Amendment |

| a. | Assignment. Neither this Agreement nor any rights hereunder may be assigned by any party to any other person other than by Investor to one or more of his or her affiliates. |

| b. | Entire Agreement. This Agreement sets forth the entire agreement and understanding between the parties as to the subject matter thereof and merges and supersedes all prior discussions, agreements and understandings of any and every nature among them. |

| c. | Amendment. Except as expressly provided in this Agreement, neither this Agreement nor any term hereof may be amended, waived, discharged or terminated other than by a written instrument signed by the party against whom enforcement of any such amendment, waiver, discharge or termination is sought. |

| d. | Binding upon Successors. This Agreement shall be binding upon and inure to the benefit of the parties hereto and to their respective heirs, legal representatives, successors and permitted assigns. |

[remainder of page intentionally left blank]

This subscription is accepted by the Company on the day of August 2016.

|

|

THE BANCORP, INC.

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

Name: Damian Kozlowski

|

|

|

|

Title: Chief Executive Officer

|

Accepted and agreed on the date hereof

|

|

INVESTOR:

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

Name:

|

|

|

|

Title:

|

[Subscription Agreement]

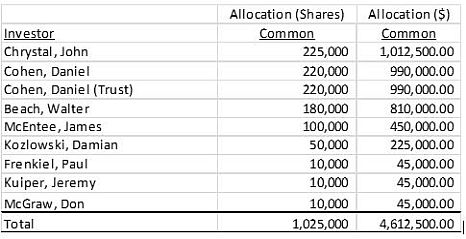

SCHEDULE A