Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CST BRANDS, INC. | exhibit991cst2q2016earning.htm |

| 8-K - 8-K - CST BRANDS, INC. | cst20162qform8-kearningsre.htm |

2Q16 Earnings Call

August 5, 2016

Safe Harbor Statements

Forward-Looking Statements

Statements contained in this presentation that state the Company’s and Partnership’s or management’s expectations or predictions of

the future are forward-looking statements and are intended to be covered by the safe harbor provisions of the Securities Act of 1933,

as amended, and the Securities Exchange Act of 1934, as amended. The words “believe,” “expect,” “should,” “intends,” “estimates,”

and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially

from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to

differ from those expressed or forecasted, see CST filings with the Securities and Exchange Commission (“SEC”), including the Risk

Factors in our most recently filed Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q as filed with the SEC and available

on CST Brand’s website at www.cstbrands.com . If any of these risks or uncertainties materialize, or if our underlying assumptions

prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear

during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no

obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future

events, or otherwise.

Non-GAAP Financial Measures

To supplement our consolidated financial statements prepared in accordance with accounting principles generally accepted in the

United States (“GAAP”) and to better reflect period-over-period comparisons, we use non-GAAP financial measures that either exclude

or include amounts that are not normally excluded or included in the most directly comparable measure, calculated and presented in

accordance with GAAP. Non-GAAP financial measures do not replace and are not superior to the presentation of GAAP financial

results, but are provided to improve overall understanding of our current financial performance and our prospects for the future. We

believe the non-GAAP financial results provide useful information to both management and investors regarding certain additional

financial and business trends relating to financial condition and operating results. In addition, management uses these measures,

along with GAAP information, for reviewing financial results and evaluating our historical operating performance. The non-GAAP

adjustments for all periods presented are based upon information and assumptions available as of the date of this presentation. The

non-GAAP information is not prepared in accordance with GAAP and may not be comparable to non-GAAP information used by other

companies. Information regarding the non-GAAP financial measure referenced in this presentation, including the reconciliation to the

nearest GAAP measure can be found in our financial results press releases, available on our website: www.cstbrands.com.

2

CST Business Overview

Kim Lubel

President, CEO and Chairman of the Board

3

2Q16 Results Summary

(Amounts in millions except Earnings per Share)

Three Months Ended Jun. 30,

% Change

Gross Profit $329 $277 19%

EBITDA $98 $80 23%

Earnings Per Share,

Reported

$0.36 $0.32 13%

Earnings per Share,

Adjusted

$0.39* $0.31* 26%

CST Brands, Inc.

2016 2015

*Adjusted for special items of net $2 million and $1 million for the three month periods ended June 30, 2016 and 2015, respectively

(1) See the CST Brands, Inc. earnings release for (i) a reconciliation of EBITDA, EBITDAR and Adjusted EBITDA to net income and (ii) the

definitions of EBITDA, EBITDAR and Adjusted EBITDA. 4

Second Quarter 2016 Highlights

5

Gross Profit Growth, 2Q16 vs. 2Q15

0%

5%

10%

15%

20%

25%

30%

27%

10%

Merchandise & Services

0%

5%

10%

15%

20%

25%

24%

9%

Motor Fuel

Operational & Strategic Focus

•Same-store OPEX was flat Q/Q (ex- taxes

and rent)

Attacking operating

expenses

•18 NTIs opened year-to-date

•39 NTIs under construction

Continue to execute

organic growth strategy

Repositioning the Network for Growth

Network Comparison CA/WY Flash Foods

2Q Total Fuel Volume 47 million gallons 74 million gallons

2Q Total Fuel Gross

Profits

$7.2mm

$9.4mm

2Q Total M&S Sales $17mm $68mm

2Q M&S Margin % 33.8% 34.5%

Store Count 79 165

Average Sq. Ft. of Stores 1,300 3,500

Sold 79 smaller, fuel-centric stores in CA/WY for $408

million

Bought Flash Foods: 165 larger stores in GA/FL for $425

million (February 1, 2016)

•Creates platform for merchandise & services revenue growth

and NTI store builds

•Integration going well: synergy capture on target for year one

•On track to achieve post-synergy EBITDA multiple of 7-9X

$CAD $CAD

Financial Overview

Clay Killinger

EVP and Chief Financial Officer

6

Key Metrics

Gross Profit (mm)

Three Months Ended Jun. 30,

% Change

Motor Fuel $73 $59 24%

Merchandise & Services $160 $126 27%

Key Metrics

Three Months Ended Jun. 30,

% Change

Core Stores (EOP) 1,225 993 23%

Motor Fuel Gallons Sold (PSPD) 5,245 5,246 0%

Motor Fuel CPG (net of CC) $0.132 $0.126 5%

Merchandise & Services Sales (PSPD) $4,261 $4,070 5%

Merchandise & Services Margin (net of CC) 33.8% 32.7% 110 bps

U.S. Retail (USD)

2016 2015

2016 2015

7

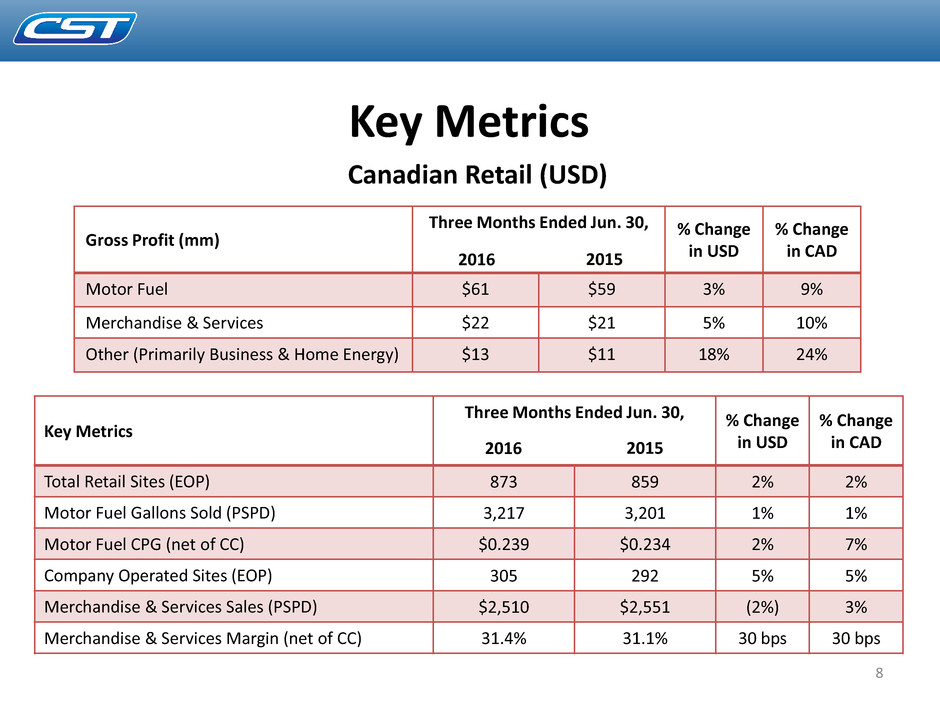

Key Metrics

Gross Profit (mm)

Three Months Ended Jun. 30,

% Change

in USD

% Change

in CAD

Motor Fuel $61 $59 3% 9%

Merchandise & Services $22 $21 5% 10%

Other (Primarily Business & Home Energy) $13 $11 18% 24%

Key Metrics

Three Months Ended Jun. 30, % Change

in USD

% Change

in CAD

Total Retail Sites (EOP) 873 859 2% 2%

Motor Fuel Gallons Sold (PSPD) 3,217 3,201 1% 1%

Motor Fuel CPG (net of CC) $0.239 $0.234 2% 7%

Company Operated Sites (EOP) 305 292 5% 5%

Merchandise & Services Sales (PSPD) $2,510 $2,551 (2%) 3%

Merchandise & Services Margin (net of CC) 31.4% 31.1% 30 bps 30 bps

Canadian Retail (USD)

2016 2015

2016 2015

8

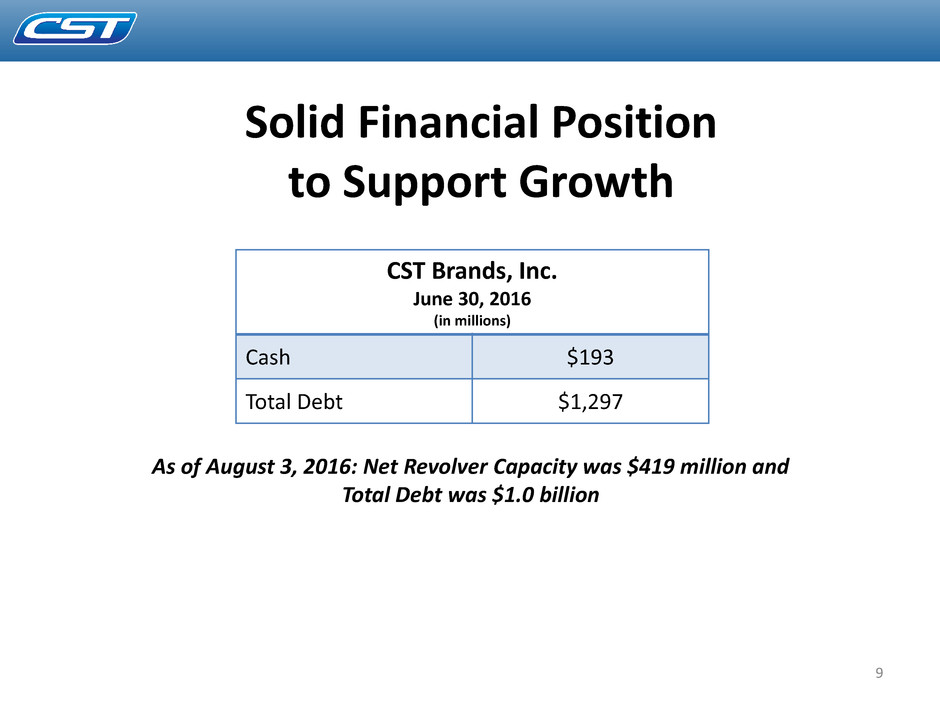

Solid Financial Position

to Support Growth

CST Brands, Inc.

June 30, 2016

(in millions)

Cash $193

Total Debt $1,297

As of August 3, 2016: Net Revolver Capacity was $419 million and

Total Debt was $1.0 billion

9

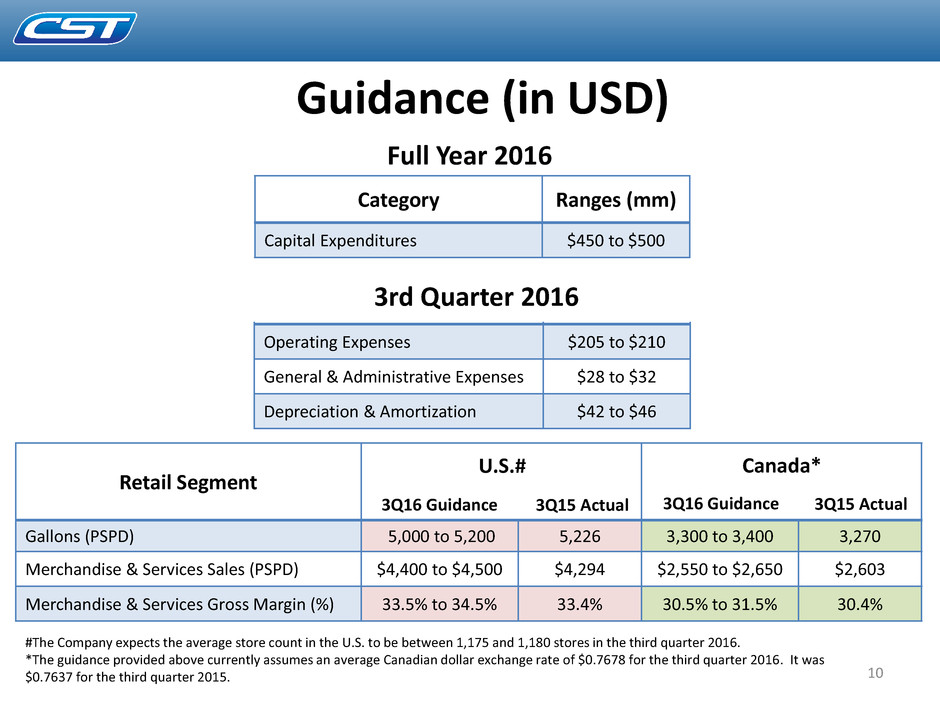

Guidance (in USD)

Retail Segment

Gallons (PSPD) 5,000 to 5,200 5,226 3,300 to 3,400 3,270

Merchandise & Services Sales (PSPD) $4,400 to $4,500 $4,294 $2,550 to $2,650 $2,603

Merchandise & Services Gross Margin (%) 33.5% to 34.5% 33.4% 30.5% to 31.5% 30.4%

U.S.# Canada*

Category Ranges (mm)

Capital Expenditures $450 to $500

3Q16 Guidance 3Q15 Actual 3Q16 Guidance 3Q15 Actual

#The Company expects the average store count in the U.S. to be between 1,175 and 1,180 stores in the third quarter 2016.

*The guidance provided above currently assumes an average Canadian dollar exchange rate of $0.7678 for the third quarter 2016. It was

$0.7637 for the third quarter 2015.

Category Ranges (mm)

Operating Expenses $205 to $210

General & Administrative Expenses $28 to $32

Depreciation & Amortization $42 to $46

3rd Quarter 2016

Full Year 2016

10

U.S. NTI Same Store* Performance

2Q16 vs. 2Q15

(Dollars in Millions, Except Per Store Data)

11 * To qualify as a “same store”, the store needs to be in operation substantially throughout both periods presented. Stores that were temporarily closed for a brief period of time during the periods being

compared remain in the same store sales comparison. If a store is replaced, either at the same location or relocated to a new location, it is removed from the comparison until the new store has been in

operation for substantially all of the periods being compared. NTIs are included in the core same store metrics when they meet this criteria.

2016 2015 2016 2015

Fuel Gross Profit 6.8$ 7.2$ 34.3$ 41.0$

Merchandise & Services Gross Profit 17.9 17.4 53.7 52.4

Store Level Cash Operating Expense (Including rent) (16.6) (14.5) (47.9) (42.3)

EBITDA 8.2$ 10.1$ 40.2$ 51.1$

Rent Expense 2.4 0.2 4.8 0.6

EBITDAR 10.6$ 10.4$ 45.0$ 51.7$

NTI Same Store Information

Company-operated retail sites 78 78 59 59

Motor fuel sales (gallons per site per day) 8,874 8,909 8,791 9,247

Merchandise and services sales (per site per day) 7,224$ 7,124$ 7,158$ 7,052$

Merchandise and services gross profit percentage, net of credit card fees 35.0% 34.3% 34.8% 34.5%

Merchandise and services gross profit dollars 17.9$ 17.4$ 53.7$ 52.4$

Cash Flow Return on Capital Employed

EBITDAR 45.0$ 51.7$

Historical CAPEX - before asset drops (sale/leaseback) 288.3$ 288.3$

Unlevered Cash Flow Return on Capital Employed 16% 18%

EBITDA 40.2$ 51.1$

Adjusted CAPEX - after asset drops (sale/leaseback) 232.7$ 288.3$

Levered Cash Flow Return on Capital Employed 17% 18%

Three Months Ended

June 30,

Trailing Twelve Months

Ended June 30,

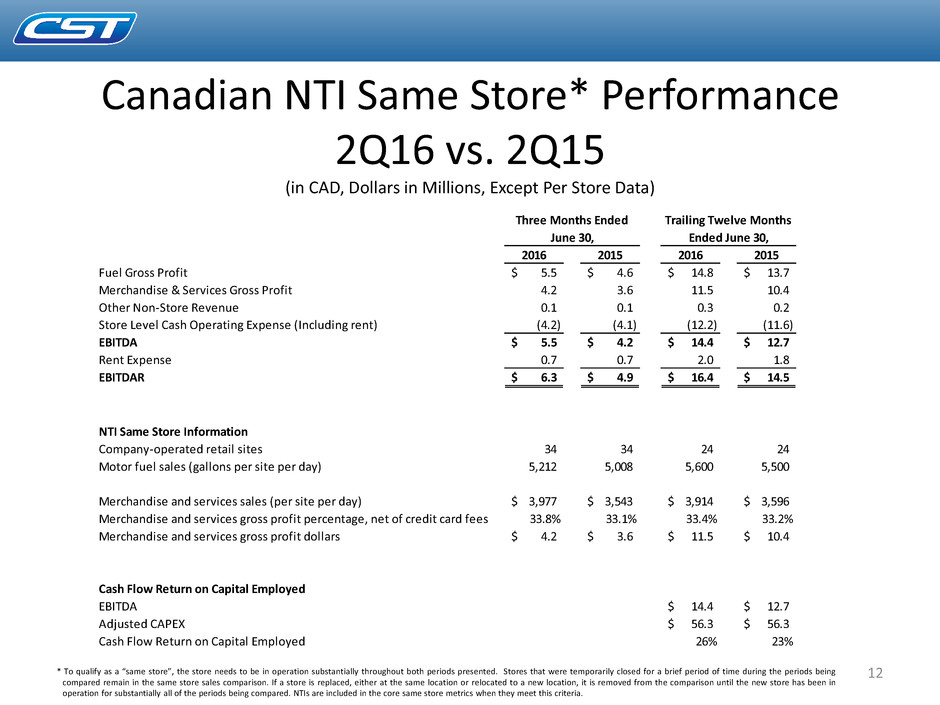

Canadian NTI Same Store* Performance

2Q16 vs. 2Q15

(in CAD, Dollars in Millions, Except Per Store Data)

12 * To qualify as a “same store”, the store needs to be in operation substantially throughout both periods presented. Stores that were temporarily closed for a brief period of time during the periods being

compared remain in the same store sales comparison. If a store is replaced, either at the same location or relocated to a new location, it is removed from the comparison until the new store has been in

operation for substantially all of the periods being compared. NTIs are included in the core same store metrics when they meet this criteria.

2016 2015 2016 2015

Fuel Gross Profit 5.5$ 4.6$ 14.8$ 13.7$

Merchandise & Services Gross Profit 4.2 3.6 11.5 10.4

Other Non-Store Revenue 0.1 0.1 0.3 0.2

Store Level Cash Operating Expense (Including rent) (4.2) (4.1) (12.2) (11.6)

EBITDA 5.5$ 4.2$ 14.4$ 12.7$

Rent Expense 0.7 0.7 2.0 1.8

EBITDAR 6.3$ 4.9$ 16.4$ 14.5$

NTI Same Store Information

Company-operated retail sites 34 34 24 24

Motor fuel sales (gallons per site per day) 5,212 5,008 5,600 5,500

Merchandise and services sales (per site per day) 3,977$ 3,543$ 3,914$ 3,596$

Merchandise and services gross profit percentage, net of credit card fees 33.8% 33.1% 33.4% 33.2%

Merchandise and services gross profit dollars 4.2$ 3.6$ 11.5$ 10.4$

Cash Flow Return on Capital Employed

EBITDA 14.4$ 12.7$

Adjusted CAPEX 56.3$ 56.3$

Cash Flow Return on Capital Employed 26% 23%

Three Months Ended

June 30,

Trailing Twelve Months

Ended June 30,