Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Prestige Consumer Healthcare Inc. | exhibit991fy17-q1earningsr.htm |

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | a8-kpressreleasejune2016.htm |

Exhibit 99.1

This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such

as statements regarding the Company’s expected financial performance, including revenue growth, adjusted EPS, and adjusted free cash flow,

expansion of market share for the Company’s Invest for Growth brands, the Company’s investment in digital, product development and

marketing initiatives, the impact of and expected use of proceeds from recent brand divestitures, and the Company’s ability to de-lever and

increase M&A capacity. Words such as "continue," "will," “expect,” “project,” “anticipate,” “likely,” “estimate,” “may,” “should,” “could,” “would,” and

similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and

involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those

expressed or implied by such forward-looking statements. These factors include, among others, general economic and business conditions,

regulatory matters, competitive pressures, the impact of the Company’s digital, product development and marketing initiatives, supplier issues,

unexpected costs, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March

31, 2016. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation.

Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in

this presentation, whether as a result of new information, future events, or otherwise.

All adjusted GAAP numbers presented are reconciled to their closest GAAP measurement in the attached reconciliation schedule and in our

earnings release in the “About Non-GAAP Financial Measures” section.

Agenda for Today's Discussion

I. Performance Highlights

II. Financial Oueruiew

Ill. FY 17 Outloo� and the Road Ahead

First Qu arter FY 17 Results 3

I. Performance Highlights

Dramamine· Co 41BM#@R+

Cli!Gr

eyes®

MONISTAT�

� (§$1,ffl

Debrox�

Invest for Growth portfolio is comprised of Core OTC brands and International.*

Q1 consolidated Revenue of $209.6 million, up 9.1% versus PY Q1

— Organic growth of approximately +1%(1) on a constant currency basis, following a strong Q4

— Revenue growth of +4.4% for Invest for Growth* portfolio on a constant currency basis(1)

— DenTek contributed $16.6 million of Revenue during the quarter

Consistent and innovative marketing supports long-term growth of Invest for Growth brands

— New product introductions driving growth of Invest for Growth brands

— Strategy of focusing A&P behind Invest for Growth portfolio

Gross Margin of 58.0% in line with PY Q1

Adjusted EPS of $0.59(2), up 13.5% versus the PY Q1

Strong Adjusted Free Cash Flow of $50.2(2) million, exceeding the PY Q1 of $42.7 million

— Leverage of 4.8x(3)

DenTek integration completed

— Focus on enhancing and executing marketing plans

Divested three brands from Manage for Cash portfolio, which consists of non-core OTC and Household Cleaning

— Meaningful progress toward goal of 85% of Revenue from Invest for Growth brands

Invest for Growth portfolio is comprised of Core OTC brands and International.*

Source: Data reflects retail dollar sales percentage growth versus prior period for consumption growth and organic revenue growth.

FY 15 and FY 16 data shown as previously presented for Core OTC.

Q1 FY 17 data for Invest for Growth portfolio comprised of Core OTC brands and International. Core OTC brands reflect: Monistat (after Q2 FY 16), BC/Goody’s, Clear Eyes, Dramamine, Debrox, Chloraseptic, Luden’s, Little Remedies,

Compound W, Nix (after Q2 FY 16), Beano, Efferdent and The Doctor’s IRI multi-outlet + C-Store retail dollar sales for relevant period. International includes Canadian consumption for leading retailers, and Australia/ROW shipment data as

a proxy for consumption.

FY 15

>2x Category

Growth

4.1%

8.3%

3.3%

3.5%

5.9%

4.4%

FY 16

Q1

FY 17 *

*

Canada’s #1 Selling heartburn relief

brand; long-lasting relief

Retail & Club Store

Displays

Begins working immediately;

Acid-shielding foam barrier neutralizes

excess stomach acid

A full line of nasal saline products for

adults and children

A full line of oral rehydration products for

adults and children

+25% Growth Since Acquisition+25% Growth Since Acquisition

Murine/Clear Eyes: Expanding Our International Eye Care

Footprint

•

New Zealand

I 5"'111YON10Cl0SCDC'IEL10S •

Eye mist

"'CfearEyes

PHARMACY MEDICINE •

Clear

eyes

PHARMACY MEDICINE •

Clear

eyes'J\

Australia

� ........ ffltat- loochn.., ...........

RED EYES son'. EY£S ORV EY£S

..G'l.wr.r'- -�-

Nordic

OooM>qn

Cleareyes

0,1.)m,:lml

njendraber

""in-;rw

n11ph;m1tinhtrdmr.hlorid

Cleye

0,12mglml

gyedrAper

opplssning

n•fa,olinhydroldorid

�u arter F y

Hong Kong

South Africa

-

1 7

•,-.1U�""l

:moisture

eyes •

'-"I ••' .;; · •. . . . ' 15 rnl �··pen

1 .. '"

I • t,1UR).!'IE'

ij i clear eyes

_eye_ •

Results

MU�NE ®

Chile

Korea

1 1

Dramamine·

II. Financial Oueruiew

Co

41BM#@R+

Cli!Gr

eyes®

MONISTAT�

� (§$1,ffl

Debrox�

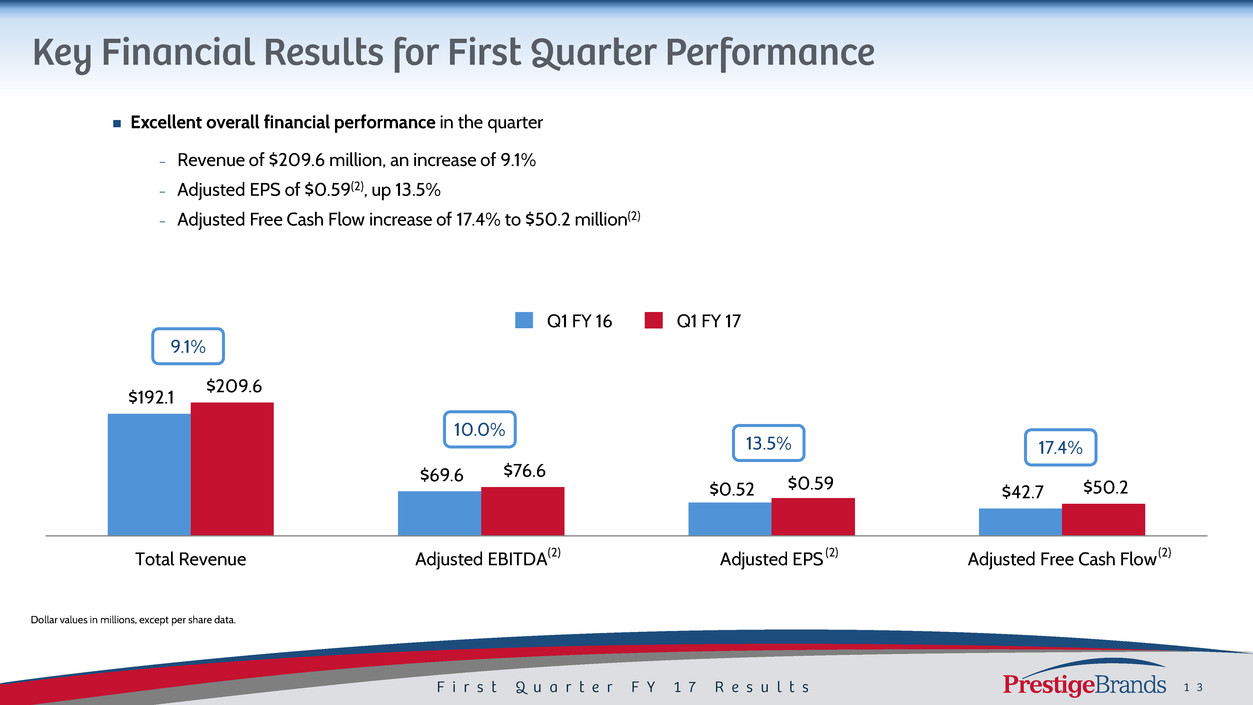

Excellent overall financial performance in the quarter

− Revenue of $209.6 million, an increase of 9.1%

− Adjusted EPS of $0.59(2), up 13.5%

− Adjusted Free Cash Flow increase of 17.4% to $50.2 million(2)

$192.1

$69.6

$42.7

$209.6

$76.6

$50.2

Total Revenue Adjusted EBITDA Adjusted EPS Adjusted Free Cash Flow

Q1 FY 17Q1 FY 16

9.1%

10.0%

13.5% 17.4%

$0.52 $0.59

(2) (2) (2)

Dollar values in millions, except per share data.

Q1 FY 17 Q1 FY 16 % Chg

Total Revenue 209.6$ 192.1$ 9.1%

Gross Margin 121.6 112.2 8.3%

% Margin 58.0% 58.4%

A&P 27.6 26.4 4.6%

% Total Revenue 13.2% 13.8%

Adjusted G&A(2) 17.3 16.2 7.1%

% Total Revenue 8.3% 8.4%

Adjusted EBITDA(2) 76.6$ 69.6$ 10.0%

% Margin 36.6% 36.2%

Adjusted Net Income(2) 31.4$ 27.4$ 14.7%

Adjusted Earnings Per Share(2) 0.59$ 0.52$ 13.5%

Revenue growth of +9.1%

– Organic growth of approximately 1% excluding the impact of Fx

– DenTek contributed $16.6 million of Revenue during the quarter

Gross Margin of 58.0%

A&P 13.2% of Revenue, $1.2 million more than Q1 FY 16

Adjusted EBITDA Margin of 36.6%(2)

Adjusted Net Income +14.7%(2) over Q1 FY16, ahead of topline growth

Dollar values in millions, except per share data.

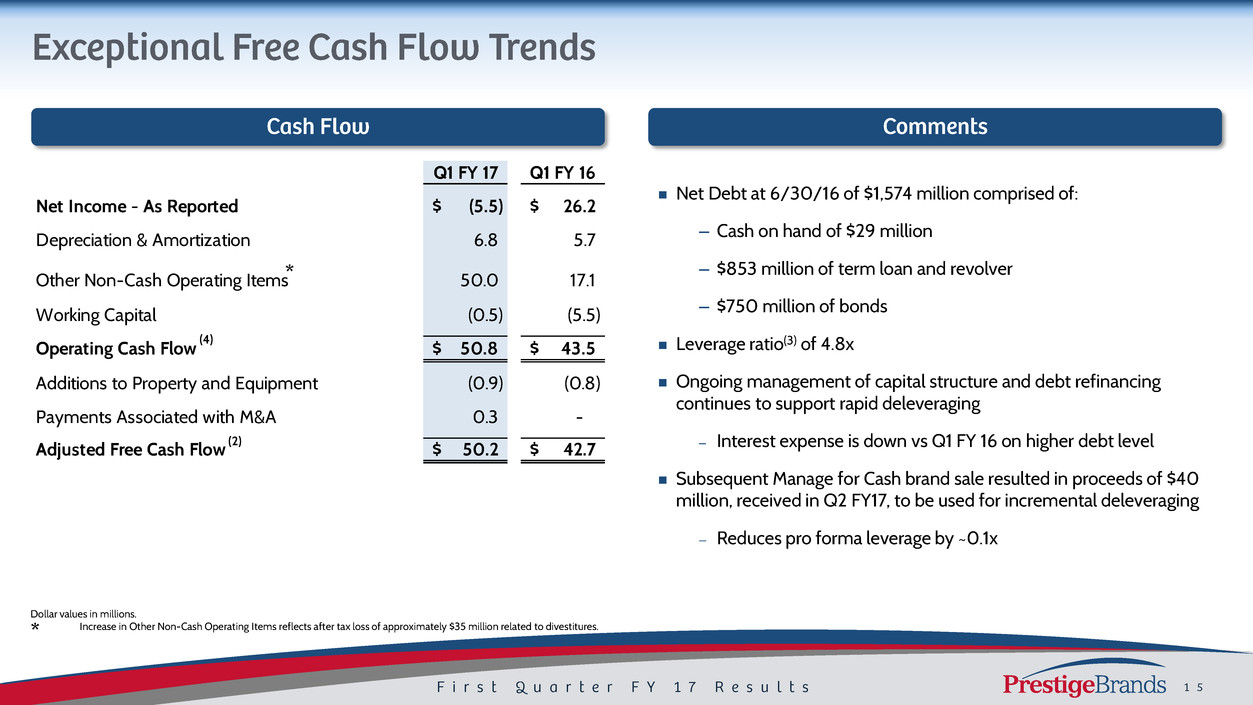

Q1 FY 17 Q1 FY 16

Net Income - As Reported (5.5)$ 26.2$

Depreciation & Amortization 6.8 5.7

Other Non-Cash Operating Items 50.0 17.1

Working Capital (0.5) (5.5)

Operating Cash Flow 50.8$ 43.5$

Additions to Property and Equipment (0.9) (0.8)

Payments Associated with M&A 0.3 -

Adjusted Free Cash Flow 50.2$ 42.7$

Net Debt at 6/30/16 of $1,574 million comprised of:

– Cash on hand of $29 million

– $853 million of term loan and revolver

– $750 million of bonds

Leverage ratio(3) of 4.8x

Ongoing management of capital structure and debt refinancing

continues to support rapid deleveraging

– Interest expense is down vs Q1 FY 16 on higher debt level

Subsequent Manage for Cash brand sale resulted in proceeds of $40

million, received in Q2 FY17, to be used for incremental deleveraging

– Reduces pro forma leverage by ~0.1x

(4)

(2)

Dollar values in millions.

Increase in Other Non-Cash Operating Items reflects after tax loss of approximately $35 million related to divestitures.*

*

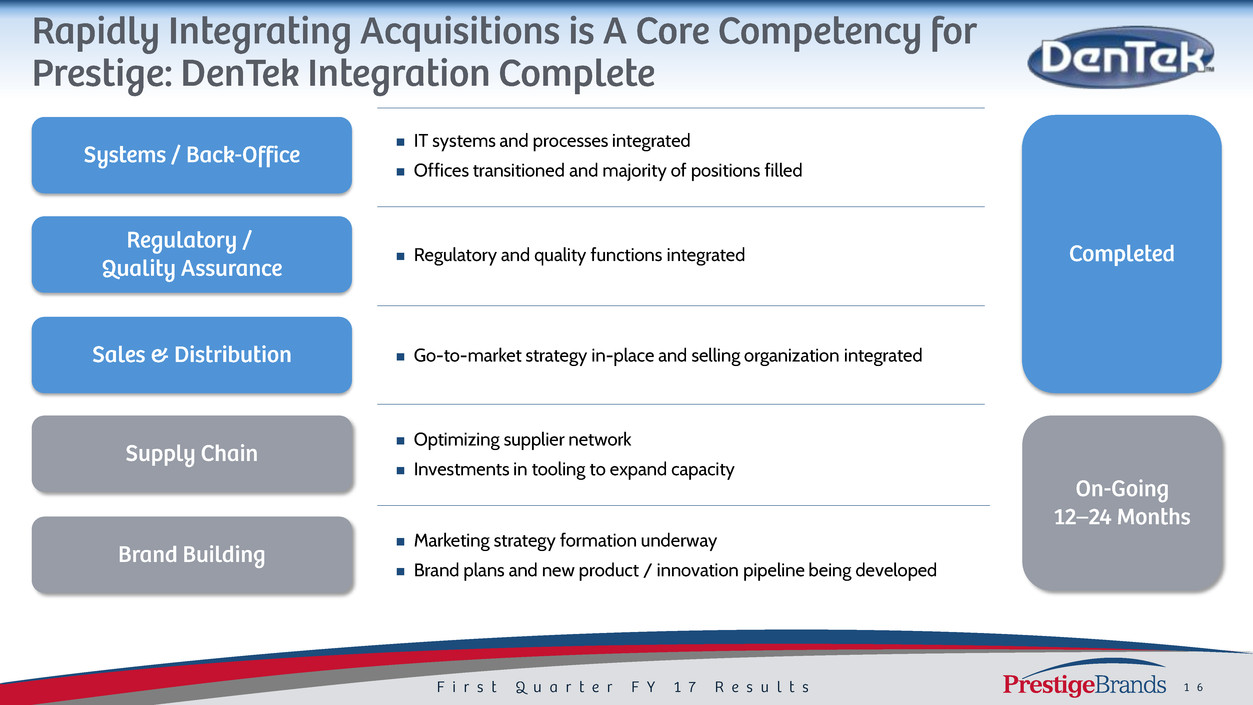

IT systems and processes integrated

Offices transitioned and majority of positions filled

Regulatory and quality functions integrated

Go-to-market strategy in-place and selling organization integrated

Optimizing supplier network

Investments in tooling to expand capacity

Marketing strategy formation underway

Brand plans and new product / innovation pipeline being developed

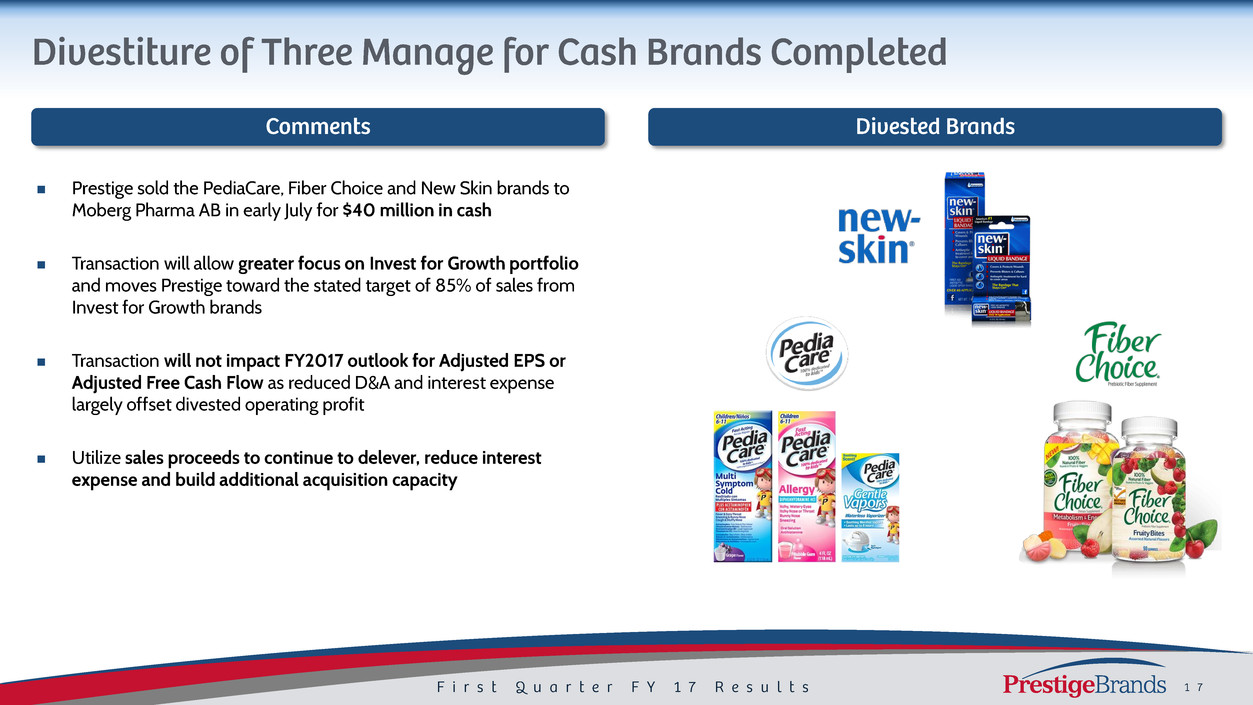

Prestige sold the PediaCare, Fiber Choice and New Skin brands to

Moberg Pharma AB in early July for $40 million in cash

Transaction will allow greater focus on Invest for Growth portfolio

and moves Prestige toward the stated target of 85% of sales from

Invest for Growth brands

Transaction will not impact FY2017 outlook for Adjusted EPS or

Adjusted Free Cash Flow as reduced D&A and interest expense

largely offset divested operating profit

Utilize sales proceeds to continue to delever, reduce interest

expense and build additional acquisition capacity

Ill. FY 17 Outlook and the Road Ahead

Dramamine· Co 41BM#@R+

Cli!Gr

eyes®

MONISTAT�

� (§$1,ffl

Go!'!1f.!-'!!ne Debrox· Ca re

na

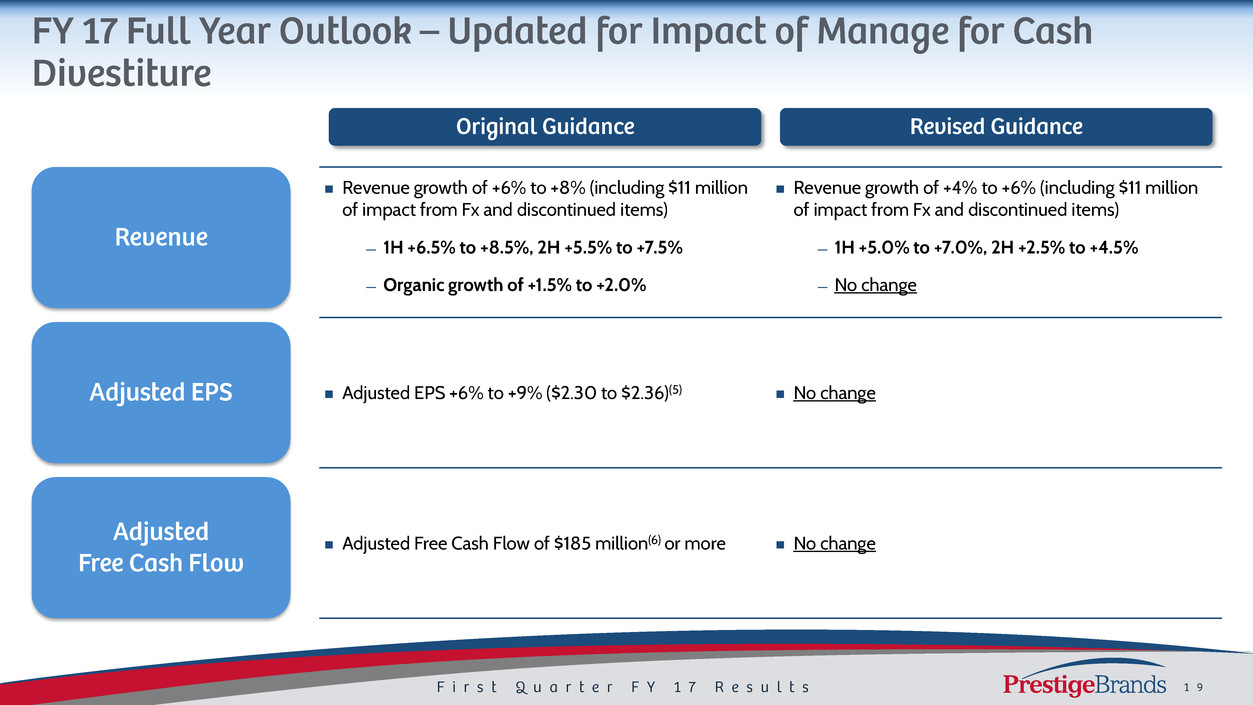

Revenue growth of +6% to +8% (including $11 million

of impact from Fx and discontinued items)

— 1H +6.5% to +8.5%, 2H +5.5% to +7.5%

— Organic growth of +1.5% to +2.0%

Revenue growth of +4% to +6% (including $11 million

of impact from Fx and discontinued items)

— 1H +5.0% to +7.0%, 2H +2.5% to +4.5%

— No change

Adjusted EPS +6% to +9% ($2.30 to $2.36)(5) No change

Adjusted Free Cash Flow of $185 million(6) or more No change

Continue Invest for Growth market share expansion with strong momentum heading into Q2

Increase digital investments

Focus on new product development and marketing innovation

Expand focus on developing professional marketing

Focus on all channels of distribution including c-store, dollar, and e-commerce

Integration completed

Executing on A&P plan, set stage for continued long term growth

Prioritize and invest in new product pipeline

Manage for Cash brand divestitures consistent with stated strategy and accretive to organic growth

Rapid deleveraging and increasing M&A capacity expected in FY 17

Opportunity set consistent with long term trends

Committed to aggressive and disciplined M&A strategy

Care

First �u arter FY 17 Results �21

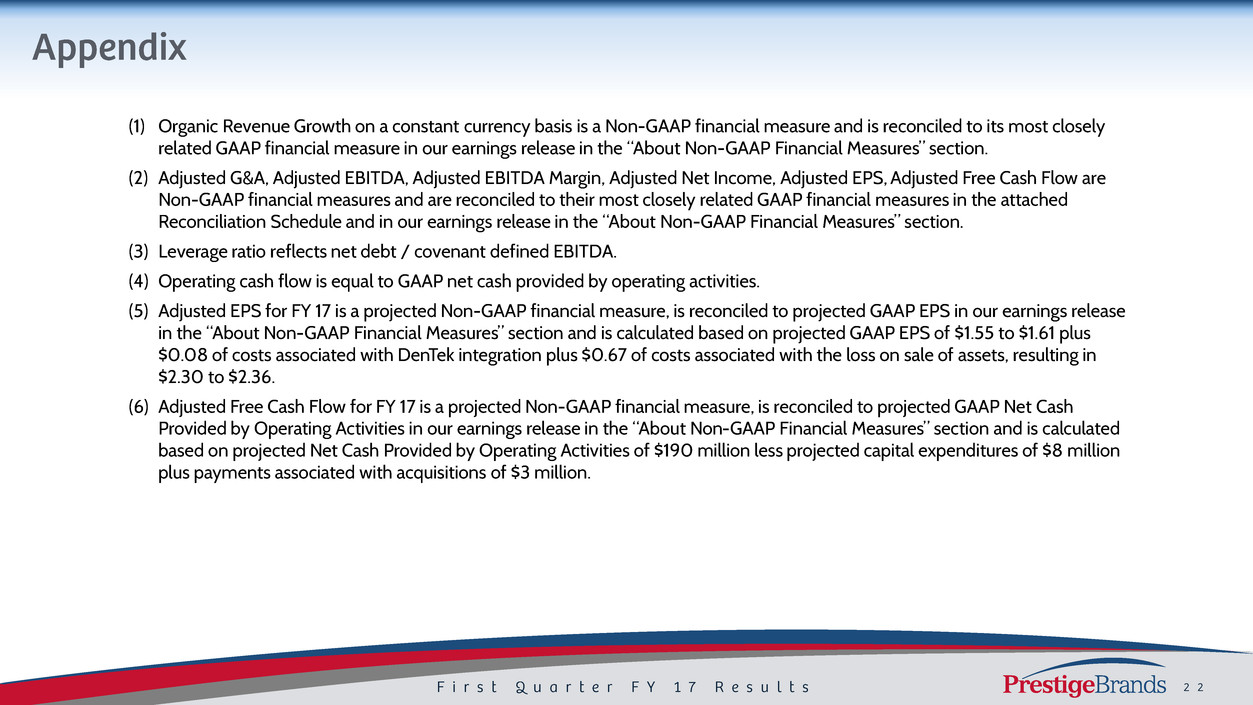

(1) Organic Revenue Growth on a constant currency basis is a Non-GAAP financial measure and is reconciled to its most closely

related GAAP financial measure in our earnings release in the “About Non-GAAP Financial Measures” section.

(2) Adjusted G&A, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted EPS, Adjusted Free Cash Flow are

Non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in the attached

Reconciliation Schedule and in our earnings release in the “About Non-GAAP Financial Measures” section.

(3) Leverage ratio reflects net debt / covenant defined EBITDA.

(4) Operating cash flow is equal to GAAP net cash provided by operating activities.

(5) Adjusted EPS for FY 17 is a projected Non-GAAP financial measure, is reconciled to projected GAAP EPS in our earnings release

in the “About Non-GAAP Financial Measures” section and is calculated based on projected GAAP EPS of $1.55 to $1.61 plus

$0.08 of costs associated with DenTek integration plus $0.67 of costs associated with the loss on sale of assets, resulting in

$2.30 to $2.36.

(6) Adjusted Free Cash Flow for FY 17 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash

Provided by Operating Activities in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated

based on projected Net Cash Provided by Operating Activities of $190 million less projected capital expenditures of $8 million

plus payments associated with acquisitions of $3 million.

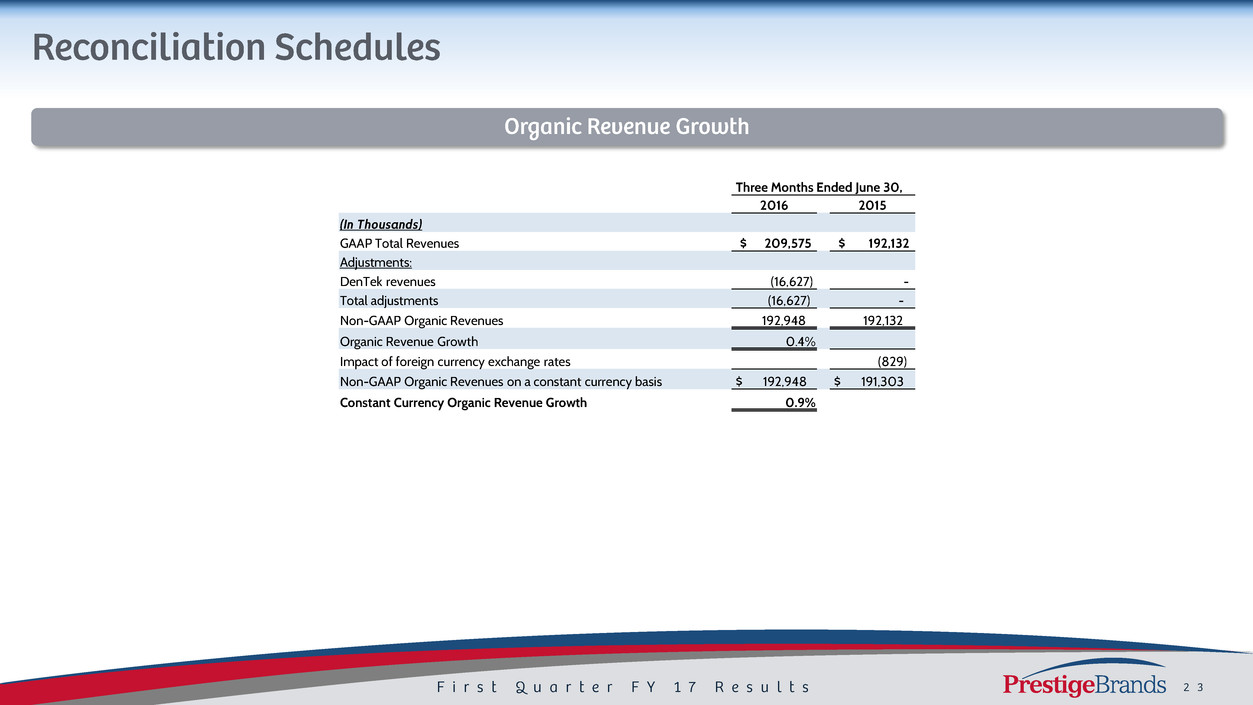

Three Months Ended June 30,

2016 2015

(In Thousands)

GAAP Total Revenues $ 209,575 $ 192,132

Adjustments:

DenTek revenues (16,627) -

Total adjustments (16,627) -

Non-GAAP Organic Revenues 192,948 192,132

Organic Revenue Growth 0.4%

Impact of foreign currency exchange rates (829)

Non-GAAP Organic Revenues on a constant currency basis $ 192,948 $ 191,303

Constant Currency Organic Revenue Growth 0.9%

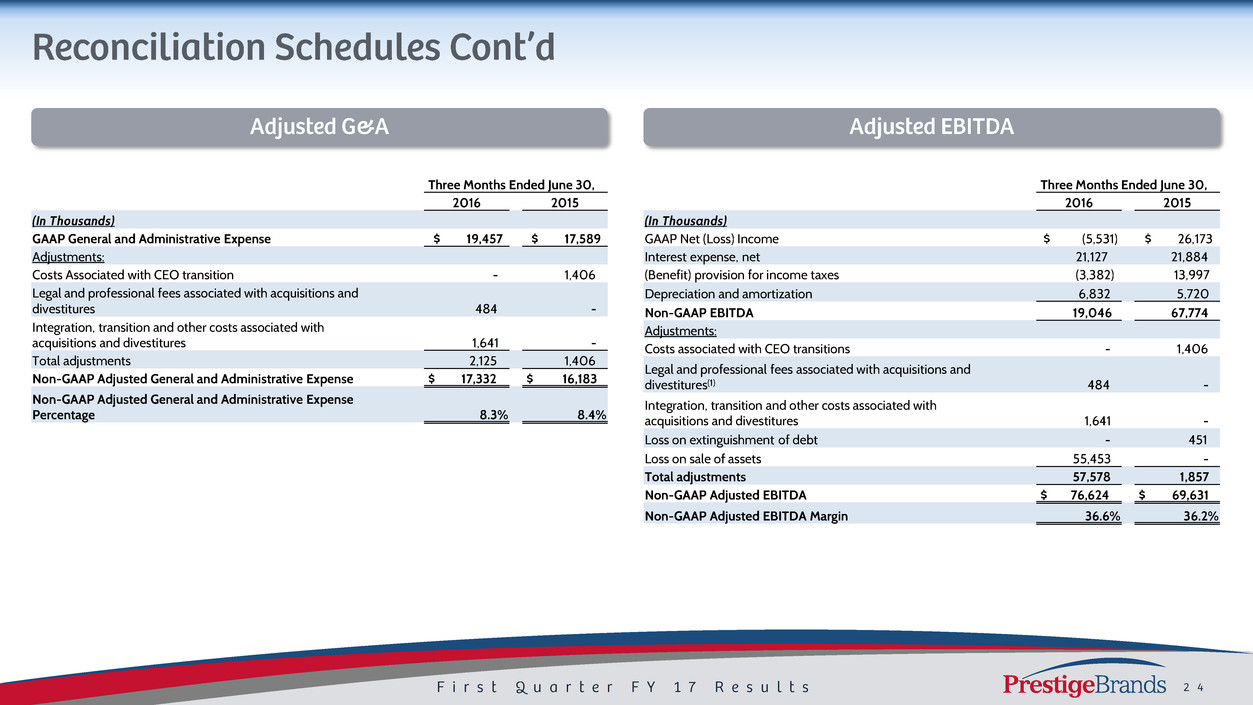

Three Months Ended June 30,

2016 2015

(In Thousands)

GAAP General and Administrative Expense $ 19,457 $ 17,589

Adjustments:

Costs Associated with CEO transition - 1,406

Legal and professional fees associated with acquisitions and

divestitures 484 -

Integration, transition and other costs associated with

acquisitions and divestitures 1,641 -

Total adjustments 2,125 1,406

Non-GAAP Adjusted General and Administrative Expense $ 17,332 $ 16,183

Non-GAAP Adjusted General and Administrative Expense

Percentage 8.3% 8.4%

Three Months Ended June 30,

2016 2015

(In Thousands)

GAAP Net (Loss) Income $ (5,531) $ 26,173

Interest expense, net 21,127 21,884

(Benefit) provision for income taxes (3,382) 13,997

Depreciation and amortization 6,832 5,720

Non-GAAP EBITDA 19,046 67,774

Adjustments:

Costs associated with CEO transitions - 1,406

Legal and professional fees associated with acquisitions and

divestitures(1) 484 -

Integration, transition and other costs associated with

acquisitions and divestitures 1,641 -

Loss on extinguishment of debt - 451

Loss on sale of assets 55,453 -

Total adjustments 57,578 1,857

Non-GAAP Adjusted EBITDA $ 76,624 $ 69,631

Non-GAAP Adjusted EBITDA Margin 36.6% 36.2%

Three Months Ended June 30,

2016 2015

Net Income EPS Net Income EPS

(In Thousands)

GAAP Net (Loss) Income $ (5,531) $(0.10) $ 26,173 $ 0.49

Adjustments:

Costs associated with CEO transition - - 1,406 0.03

Legal and professional fees associated with

acquisitions and divestitures 484 0.01 - -

Integration, transition and other costs associated

with acquisitions and divestitures 1,641 0.03 - -

Loss on extinguishment of debt - - 451 0.01

Loss on sale of assets 55,453 1.04 - -

Tax impact of adjustments (20,658) (0.39) (657) (0.01)

Total Adjustments 36,920 0.69 1,200 0.03

Non-GAAP Adjusted Net Income and Adjusted EPS $ 31,389 $ 0.59 $ 27,373 $ 0.52

Three Months Ended June 30,

2016 2015

(In Thousands)

GAAP Net (Loss) Income $ (5,531) $ 26,173

Adjustments:

Adjustments to reconcile net (loss) income to net

cash provided by operating activities as shown in

the Statement of Cash Flows 56,796 22,856

Changes in operating assets and liabilities, net of

effects from acquisitions as shown in the

Statement of Cash Flows (514) (5,508)

Total Adjustments 56,282 17,348

GAAP Net cash provided by operating activities 50,751 43,521

Purchase of property and equipment (895) (780)

Non-GAAP Free Cash Flow 49,856 42,741

Integration, transition and other payments

associated with acquisitions and divestitures 331 -

Non-GAAP Adjusted Free Cash Flow $ 50,187 $ 42,741

2017 Projected EPS

Low High

Projected FY'17 GAAP EPS $ 1.55 $ 1.61

Adjustments:

Costs associated with DenTek integration 0.08 0.08

Loss on sale of assets 0.67 0.67

Total Adjustments 0.75 0.75

Projected Non-GAAP Adjusted EPS $ 2.30 $ 2.36

2017

Projected

Free Cash

Flow

(In millions)

Projected FY'17 GAAP Net Cash provided by operating activities $ 190

Additions to property and equipment for cash (8)

Projected Non-GAAP Free Cash Flow 182

Payments associated with acquisitions 3

Adjusted Non-GAAP Projected Free Cash Flow 185