Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Aleris Corp | a2q16earningsrelease.htm |

| 8-K - 8-K - Aleris Corp | alerisform8-k2q16earningsr.htm |

1

Second Quarter 2016

Earnings Presentation

August 4, 2016

2

IMPORTANT INFORMATION

This information is current only as of its date and may have changed. We undertake no obligation to update this information in light of new information, future events or otherwise. This

information contains certain forecasts and other forward looking information concerning our business, prospects, financial condition and results of operations, and we are not making any

representation or warranty that this information is accurate or complete. See “Forward-Looking Information” below.

BASIS OF PRESENTATION

We completed the sale of our recycling and specification alloys and extrusions businesses in the first quarter of 2015. We have reported these businesses as discontinued operations for all

periods presented, and reclassified the results of operations of these businesses as discontinued operations. Except as otherwise indicated, the discussion of the Company’s business and

financial information throughout this presentation refers to the Company’s continuing operations and the financial position and results of operations of its continuing operations.

FORWARD-LOOKING INFORMATION

Certain statements contained in this press release are “forward-looking statements” within the meaning of the federal securities laws. Statements under headings with “Outlook” in the title and

statements about our beliefs and expectations and statements containing the words “may,” “could,” “would,” “should,” “will,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,”

“project,” “look forward to,” “intend” and similar expressions intended to connote future events and circumstances constitute forward-looking statements. Forward-looking statements include

statements about, among other things, future costs and prices of commodities, production volumes, industry trends, anticipated cost savings, anticipated benefits from new products, facilities,

acquisitions or divestitures, projected results of operations, achievement of production efficiencies, capacity expansions, future prices and demand for our products and estimated cash flows

and sufficiency of cash flows to fund capital expenditures. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ

materially from those contained in or implied by any forward-looking statement. Some of the important factors that could cause actual results to differ materially from those expressed or

implied by forward-looking statements include, but are not limited to, the following: (1) our ability to successfully implement our business strategy; (2) the success of past and future

acquisitions and divestitures; (3) the cyclical nature of the aluminum industry, material adverse changes in the aluminum industry or our end-uses, such as global and regional supply and

demand conditions for aluminum and aluminum products, and changes in our customers’ industries; (4) increases in the cost, or limited availability, of raw materials and energy; (5) our ability

to enter into effective metal, energy and other commodity derivatives or arrangements with customers to manage effectively our exposure to commodity price fluctuations and changes in the

pricing of metals, especially London Metal Exchange-based aluminum prices; (6) our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our debt

obligations; (7) our ability to fulfill our substantial capital investment requirements; (8) competitor pricing activity, competition of aluminum with alternative materials and the general impact of

competition in the industry end-uses we serve; (9) our ability to retain the services of certain members of our management; (10) the loss of order volumes from any of our largest customers;

(11) our ability to retain customers, a substantial number of whom do not have long-term contractual arrangements with us; (12) risks of investing in and conducting operations on a global

basis, including political, social, economic, currency and regulatory factors; (13) variability in general economic conditions on a global or regional basis; (14) current environmental liabilities

and the cost of compliance with and liabilities under health and safety laws; (15) labor relations (i.e., disruptions, strikes or work stoppages) and labor costs; (16) our internal controls over

financial reporting and our disclosure controls and procedures may not prevent all possible errors that could occur; (17) our levels of indebtedness and debt service obligations, including

changes in our credit ratings, material increases in our cost of borrowing or the failure of financial institutions to fulfill their commitments to us under committed credit facilities; (18) our ability

to access the credit or capital markets; (19) the possibility that we may incur additional indebtedness in the future; (20) limitations on operating our business as a result of covenant

restrictions under our indebtedness, and our ability to pay amounts due under the Senior Notes; and (21) other factors discussed in our filings with the Securities and Exchange Commission,

including the sections entitled “Risk Factors” contained therein. Investors, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements,

whether in response to new information, futures events or otherwise, except as otherwise required by law.

NON-GAAP INFORMATION

The non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, commercial margin, and variations thereof) are not measures of

financial performance calculated in accordance with U.S. GAAP and should not be considered as alternatives to net income and loss attributable to Aleris Corporation or any other

performance measure derived in accordance with GAAP or as alternatives to cash flows from operating activities as a measure of our liquidity. Non-GAAP measures have limitations as

analytical tools and should be considered in addition to, not in isolation or as a substitute for, or as superior to, our measures of financial performance prepared in accordance with GAAP.

Management believes that certain non-GAAP financial measures may provide investors with additional meaningful comparisons between current results and results in prior periods.

Management uses non-GAAP financial measures as performance metrics and believes these measures provide additional information commonly used by the holders of our senior debt

securities and parties to the 2015 ABL Facility with respect to the ongoing performance of our underlying business activities, as well as our ability to meet our future debt service, capital

expenditure and working capital needs. We calculate our non-GAAP financial measures by eliminating the impact of a number of items we do not consider indicative of our ongoing operating

performance, and certain other items. You are encouraged to evaluate each adjustment and the reasons we consider it appropriate for supplemental analysis. See “Appendix.”

INDUSTRY INFORMATION

Information regarding market and industry statistics contained in this presentation is based on information from third party sources as well as estimates prepared by us using certain

assumptions and our knowledge of these industries. Our estimates, in particular as they relate to our general expectations concerning the aluminum industry, involve risks and uncertainties

and are subject to changes based on various factors, including those discussed under “Risk Factors” in our filings with the Securities and Exchange Commission.

Forward-Looking and Other Information

3

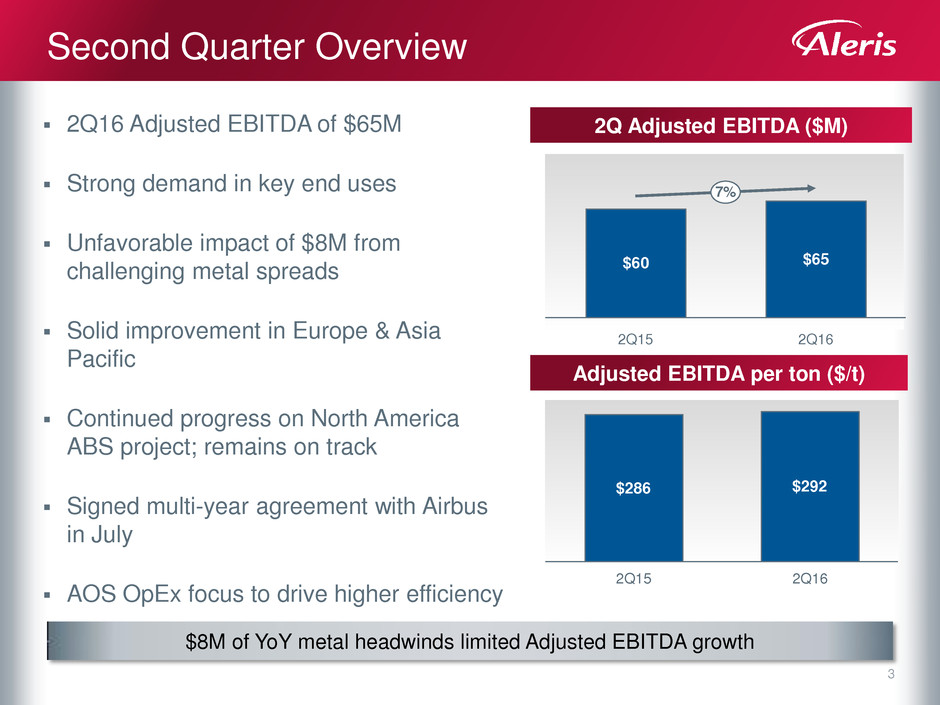

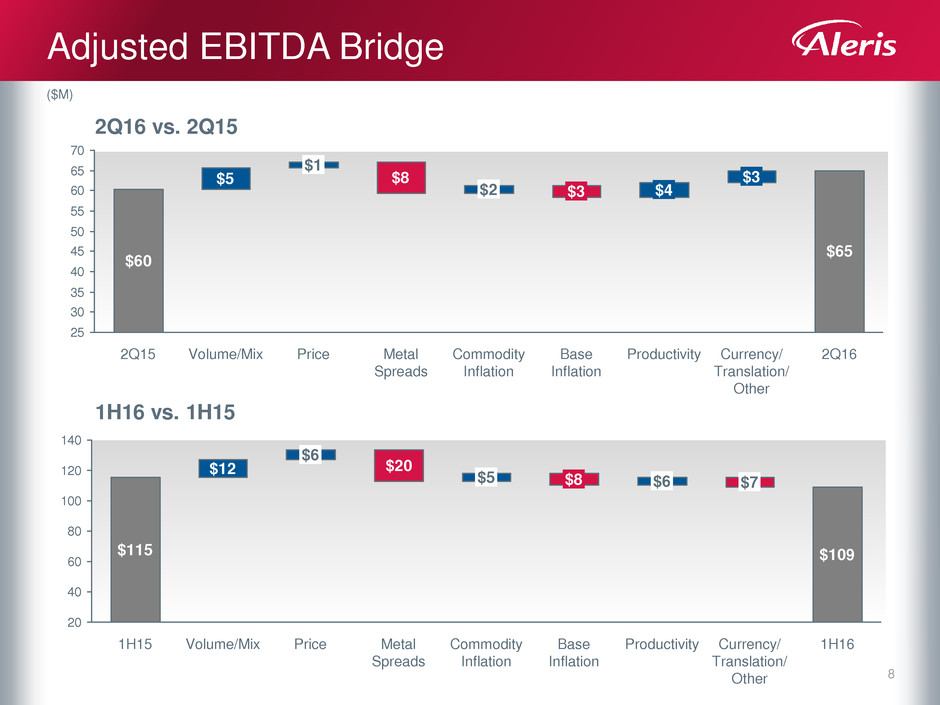

$8M of YoY metal headwinds limited Adjusted EBITDA growth

2Q16 Adjusted EBITDA of $65M

Strong demand in key end uses

Unfavorable impact of $8M from

challenging metal spreads

Solid improvement in Europe & Asia

Pacific

Continued progress on North America

ABS project; remains on track

Signed multi-year agreement with Airbus

in July

AOS OpEx focus to drive higher efficiency

Second Quarter Overview

2Q Adjusted EBITDA ($M)

$60 $65

7%

2Q16 2Q15

Adjusted EBITDA per ton ($/t)

$292$286

2Q15 2Q16

4

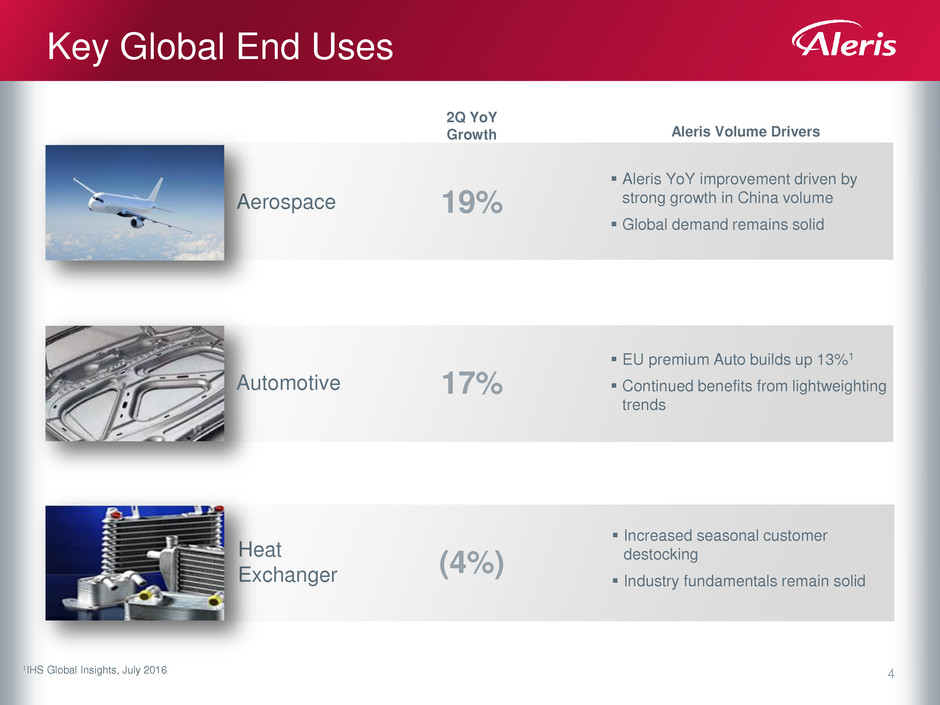

Key Global End Uses

1IHS Global Insights, July 2016

Aleris YoY improvement driven by

strong growth in China volume

Global demand remains solid

Aerospace 19%

EU premium Auto builds up 13%1

Continued benefits from lightweighting

trends

Automotive

Increased seasonal customer

destocking

Industry fundamentals remain solid

Heat

Exchanger

Aleris Volume Drivers

2Q YoY

Growth

17%

(4%)

5

Agreement significantly expands Aleris’ range of products with Airbus

Airbus multi-year agreement

beginning in 2017

Aleris aluminum plate and sheet will

be used in production of all Airbus

aircraft programs; expected to deliver

increased volumes

Contract introduces new alloys &

wing skins to our product mix, a

higher value mix

Extends our strategic relationship with

Airbus

Airbus Multi-Year Supply Agreement

Koblenz,

Germany

Zhenjiang,

China

Products supplied from facilities in

Koblenz, Germany and Zhenjiang,

China – leverages our global

aerospace platform

6

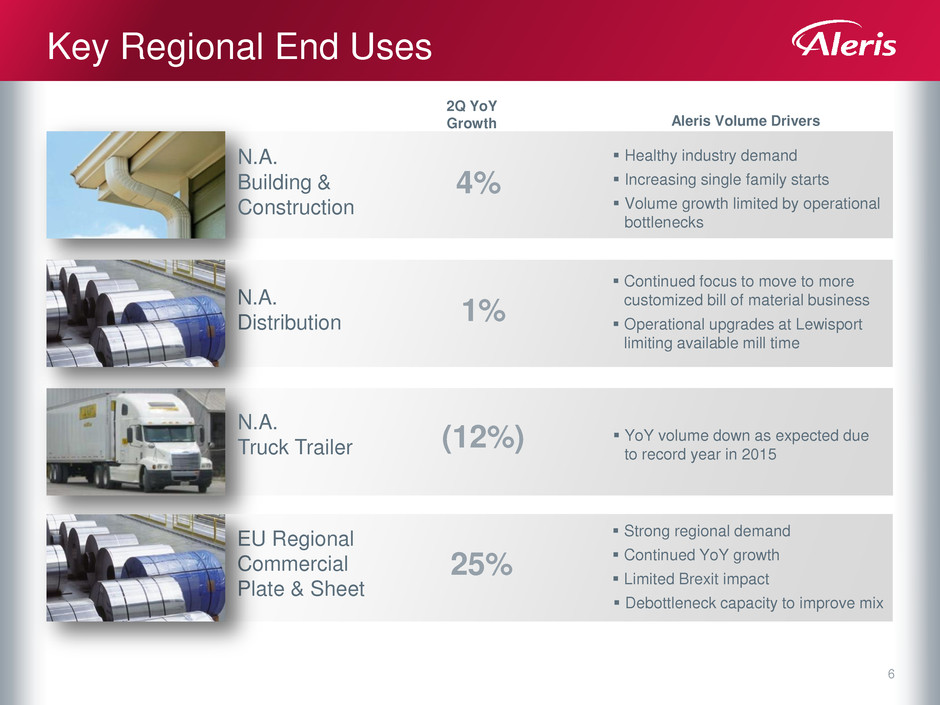

Key Regional End Uses

Healthy industry demand

Increasing single family starts

Volume growth limited by operational

bottlenecks

N.A.

Building &

Construction

4%

YoY volume down as expected due

to record year in 2015

N.A.

Truck Trailer

Strong regional demand

Continued YoY growth

Limited Brexit impact

Debottleneck capacity to improve mix

EU Regional

Commercial

Plate & Sheet

Continued focus to move to more

customized bill of material business

Operational upgrades at Lewisport

limiting available mill time

N.A.

Distribution

2Q YoY

Growth

1%

(12%)

25%

Aleris Volume Drivers

7

Project remains on target for 2017 shipments

Deployed $309M as of 2Q16 for Lewisport ABS expansion

Installations and commissioning continue to show progress; on target for

all key milestones

Lewisport Automotive Expansion Update

2014 2015 2016F

$14 $155 $200

ESTIMATED LEWISPORT ABS EXPANSION CAPEX ($M)

2Q16

$62

8

Adjusted EBITDA Bridge

$60

$5 $8

$65

25

30

35

40

45

50

55

60

65

70

2Q16 Currency/

Translation/

Other

$3

Productivity

$4

Base

Inflation

$3

Commodity

Inflation

$2

Metal

Spreads

Price

$1

Volume/Mix 2Q15

1H16 vs. 1H15

($M)

$115

$12 $20

$109

20

40

60

80

100

120

140

1H16 Currency/

Translation/

Other

$7

Productivity

$6

Base

Inflation

$8

Commodity

Inflation

$5

Metal

Spreads

Price

$6

Volume/Mix 1H15

2Q16 vs. 2Q15

9

North America

Metal spread environment remains challenging;

continued lower scrap availability

Unable to offset metal headwinds with volume

growth

Operational issues limited our ability to take full

advantage of demand

Volume (kT) Segment Adjusted EBITDA ($M)

2Q16 Performance 2Q Adjusted EBITDA Bridge ($M)

127 129

2Q15

2%

2Q16

$34

$28

2Q16 2Q15

Adj. EBITDA / ton

$269 $219

$28

$7

$34

$30

$15

$35

$25

$40

$20

$10

$5

$0

2Q16 Productivity

$0

Base

Inflation

$2

Commodity

Inflation

$1

Metal

Spreads

Price

$1

Volume/Mix

$1

2Q15

10

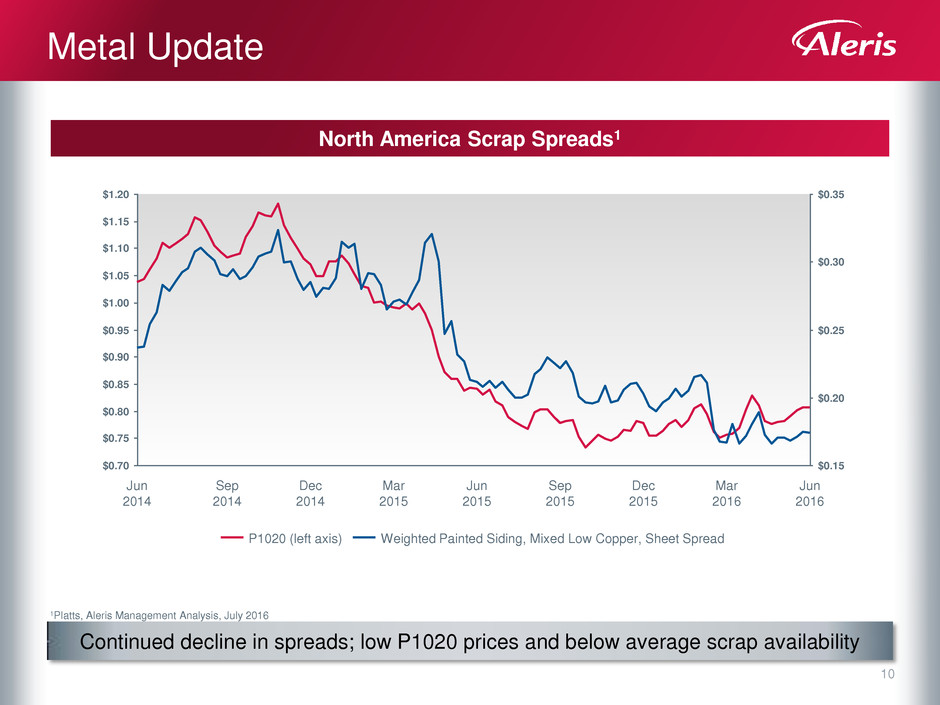

Continued decline in spreads; low P1020 prices and below average scrap availability

Metal Update

$1.00

$0.20

$1.20

$0.85

$1.10

$0.95

$0.90

$1.05

$0.35

$0.25

$1.15

$0.30

$0.15

$0.80

$0.75

$0.70

Jun

2016

Mar

2016

Dec

2015

Sep

2015

Jun

2015

Mar

2015

Dec

2014

Sep

2014

Jun

2014

1Platts, Aleris Management Analysis, July 2016

P1020 (left axis) Weighted Painted Siding, Mixed Low Copper, Sheet Spread

North America Scrap Spreads1

11

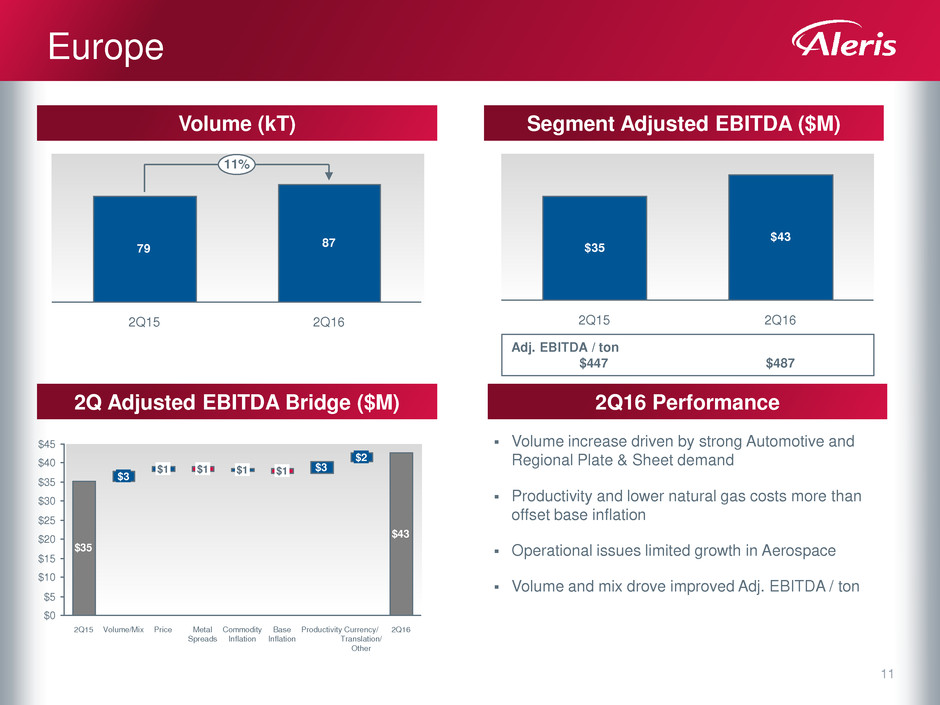

Europe

Volume increase driven by strong Automotive and

Regional Plate & Sheet demand

Productivity and lower natural gas costs more than

offset base inflation

Operational issues limited growth in Aerospace

Volume and mix drove improved Adj. EBITDA / ton

Volume (kT) Segment Adjusted EBITDA ($M)

2Q16 Performance 2Q Adjusted EBITDA Bridge ($M)

79

87

11%

2Q16 2Q15

$35

$43

2Q16 2Q15

Adj. EBITDA / ton

$447 $487

$43

$3

$35

$10

$40

$30

$20

$15

$35

$45

$5

$25

$0

Currency/

Translation/

Other

$2

Productivity 2Q16

$1

Volume/Mix

$3

2Q15 Base

Inflation

Metal

Spreads

$1

Commodity

Inflation

$1 $1

Price

12

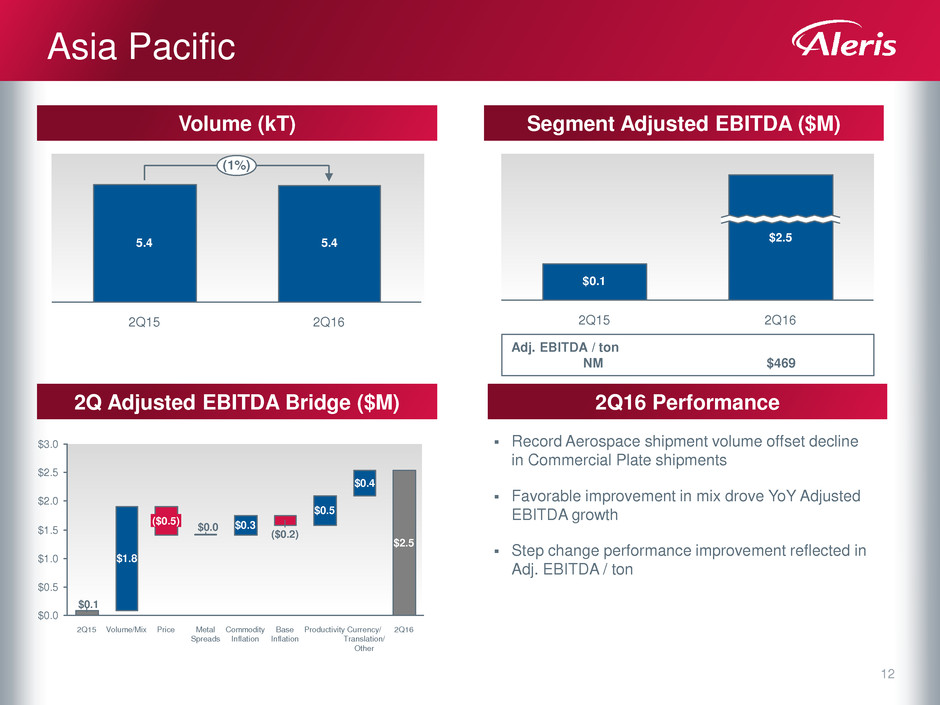

Asia Pacific

Record Aerospace shipment volume offset decline

in Commercial Plate shipments

Favorable improvement in mix drove YoY Adjusted

EBITDA growth

Step change performance improvement reflected in

Adj. EBITDA / ton

Volume (kT) Segment Adjusted EBITDA ($M)

2Q16 Performance 2Q Adjusted EBITDA Bridge ($M)

5.4 5.4

2Q16 2Q15

(1%)

$0.1

2Q16

$2.5

2Q15

Adj. EBITDA / ton

NM $469

$1.8

$0.3

$0.5

$0.4

$2.5

$0.0

$0.1

$0.0

$2.0

$2.5

$1.5

$1.0

$3.0

$0.5

Base

Inflation

2Q16 Currency/

Translation/

Other

Metal

Spreads

Productivity Commodity

Inflation

($0.2)

2Q15 Price

($0.5)

Volume/Mix

13

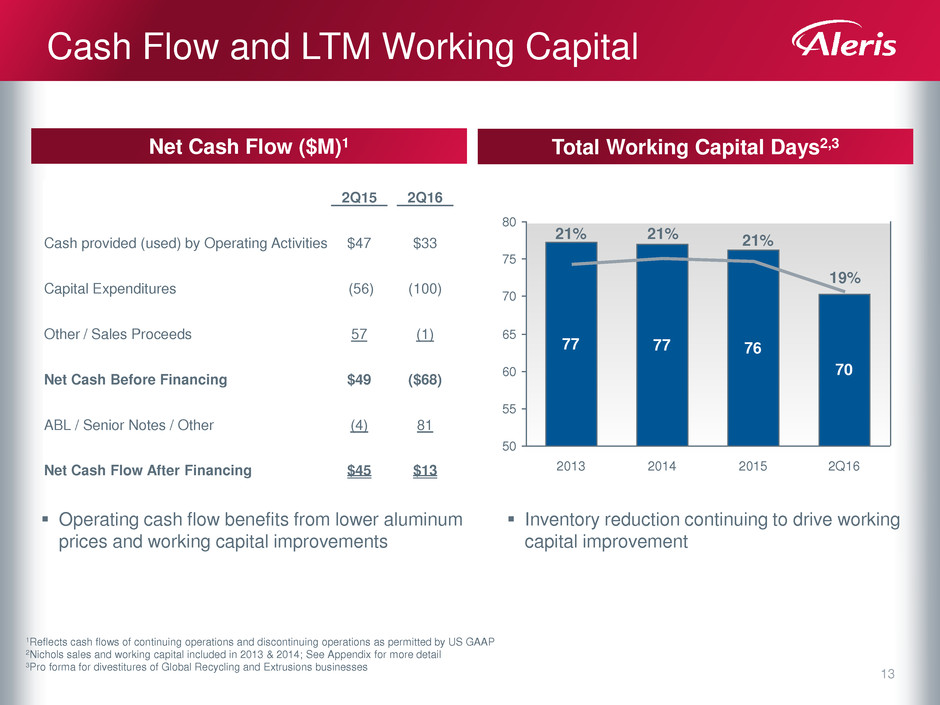

Cash Flow and LTM Working Capital

Net Cash Flow ($M)1

77 77 76

70

19%

21%21%21%

50

55

60

65

70

75

80

2Q16 2015 2014 2013

Inventory reduction continuing to drive working

capital improvement

Operating cash flow benefits from lower aluminum

prices and working capital improvements

2Q15 2Q16

Cash provided (used) by Operating Activities $47 $33

Capital Expenditures (56) (100)

Other / Sales Proceeds 57 (1)

Net Cash Before Financing $49 ($68)

ABL / Senior Notes / Other (4) 81

Net Cash Flow After Financing $45 $13

Total Working Capital Days2,3

1Reflects cash flows of continuing operations and discontinuing operations as permitted by US GAAP

2Nichols sales and working capital included in 2013 & 2014; See Appendix for more detail

3Pro forma for divestitures of Global Recycling and Extrusions businesses

14

Sufficient liquidity to support growth objectives

Capital & Liquidity Overview

6/30/2016

Cash $75

Availability under ABL Facility 283

Liquidity $358

Capital Structure ($M)

Liquidity Summary ($M)

$91 $82 $96 $88

$44

$174

$82

$201

$225

$4

2Q16

$100

$16

$2

2016E

$350-$375

$58-83

$280

2015

$315

1H16

$222

$14

2013

$188

$107

2012

$298

2014

$121

Lewisport ABS Project & Other Upgrades

Maintenance

Other Growth

Capital Expenditures Summary ($M)1

1Excludes discontinued operations CapEx of $75M, $50M, $43M, $15M in 2012-2015

2Amounts exclude applicable discounts

3Other excludes $44M of exchangeable notes

4Excludes Non-Recourse China Loan Facilities

5Secured debt includes $100M of outstanding ABL Facility balance and $550M of 2021 Secured Notes

6/30/2016

Cash $75

ABL 100

Notes2 990

Non-Recourse China Loan Facilities2 200

Other2,3 5

Net Debt $1,220

LTM Adjusted EBITDA $217

Net Debt / Adj.EBITDA 5.6x

Net Recourse Debt4 / Adj. EBITDA 4.7x

Secured Debt5 / Adj. EBITDA 3.0x

15

Year-over-year performance expected to exceed second half of 2015

Global Aerospace volumes expected to exceed prior year

Improved North America Building and Construction volumes

Order patterns for regionally-based Europe Plate and Sheet and B&C

products expected to outpace prior year

Unfavorable metal spreads and tight scrap supply will continue to impact

results; impact expected to be less significant than in the first half of 2016

Aleris Operating System is expected to drive favorable productivity as

operating performance improves and stabilizes

2H16 Outlook

16

Appendix

17

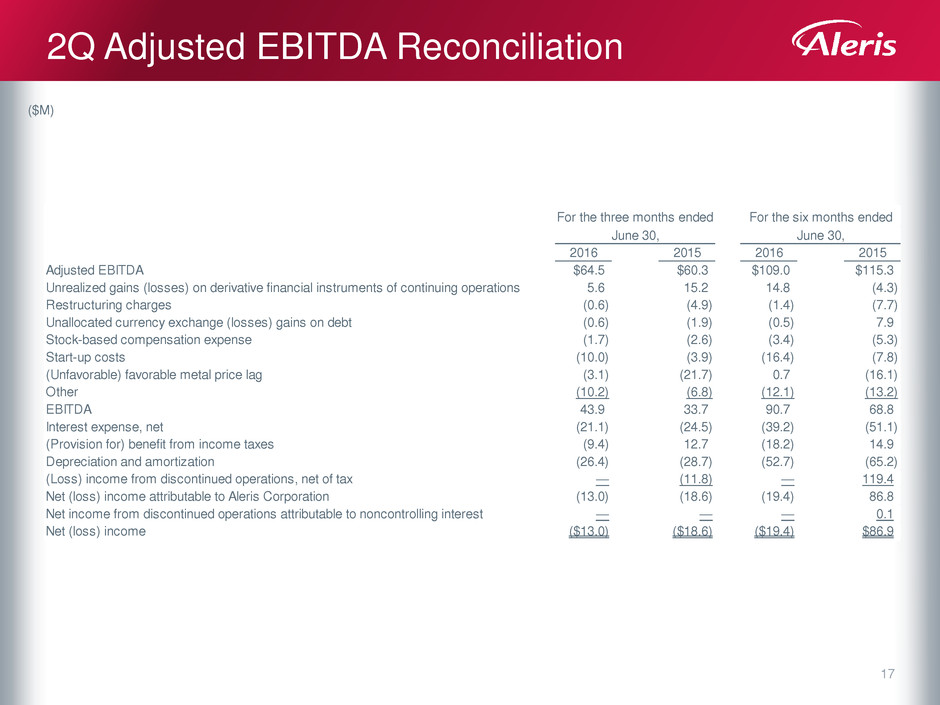

2Q Adjusted EBITDA Reconciliation

($M)

2016 2015 2016 2015

Adjusted EBITDA $64.5 $60.3 $109.0 $115.3

Unrealized gains (losses) on derivative financial instruments of continuing operations 5.6 15.2 14.8 (4.3)

Restructuring charges (0.6) (4.9) (1.4) (7.7)

Unallocated currency exchange (losses) gains on debt (0.6) (1.9) (0.5) 7.9

Stock-based compensation expense (1.7) (2.6) (3.4) (5.3)

Start-up costs (10.0) (3.9) (16.4) (7.8)

(Unfavorable) favorable metal price lag (3.1) (21.7) 0.7 (16.1)

Other (10.2) (6.8) (12.1) (13.2)

EBIT A 43.9 33.7 90.7 68.8

Interest expense, net (21.1) (24.5) (39.2) (51.1)

(Provision for) benefit from income taxes (9.4) 12.7 (18.2) 14.9

Depreciation and amortization (26.4) (28.7) (52.7) (65.2)

(Loss) income from discontinued operations, net of tax — (11.8) — 119.4

Net (loss) income attributable to Aleris Corporation (13.0) (18.6) (19.4) 86.8

Net income from discontinued operations attributable to noncontrolling interest — — — 0.1

Net (loss) income ($13.0) ($18.6) ($19.4) $86.9

For the three months ended

June 30,

For the six months ended

June 30,

18

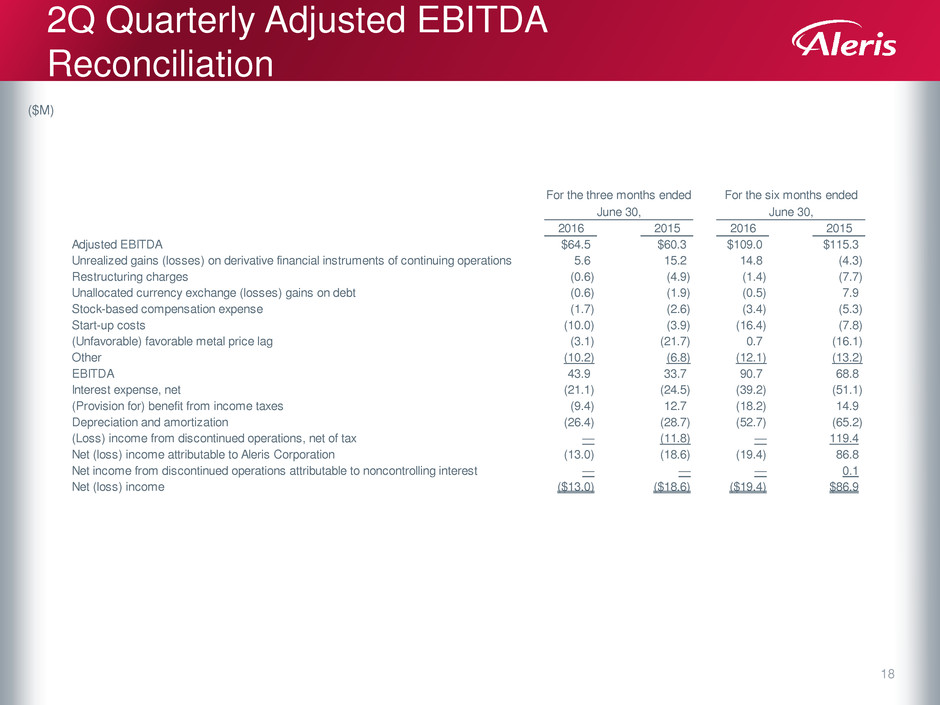

2Q Quarterly Adjusted EBITDA

Reconciliation

($M)

2016 2015 2016 2015

Adjusted EBITDA $64.5 $60.3 $109.0 $115.3

Unrealized gains (losses) on derivative financial instruments of continuing operations 5.6 15.2 14.8 (4.3)

Restructuring charges (0.6) (4.9) (1.4) (7.7)

Unallocated currency exchange (losses) gains on debt (0.6) (1.9) (0.5) 7.9

Stock-based compensation expense (1.7) (2.6) (3.4) (5.3)

Start-up costs (10.0) (3.9) (16.4) (7.8)

(Unfavorable) favorable metal price lag (3.1) (21.7) 0.7 (16.1)

Other (10.2) (6.8) (12.1) (13.2)

EBITDA 43.9 33.7 90.7 68.8

Interest expense, net (21.1) (24.5) (39.2) (51.1)

(Provision for) benefit from income taxes (9.4) 12.7 (18.2) 14.9

Depreciation and amortization (26.4) (28.7) (52.7) (65.2)

(Loss) income from discontinued operations, net of tax — (11.8) — 119.4

Net (loss) income attributable to Aleris Corporation (13.0) (18.6) (19.4) 86.8

Net income from discontinued operations attributable to noncontrolling interest — — — 0.1

Net (loss) income ($13.0) ($18.6) ($19.4) $86.9

For the three months ended

June 30,

For the six months ended

June 30,

19

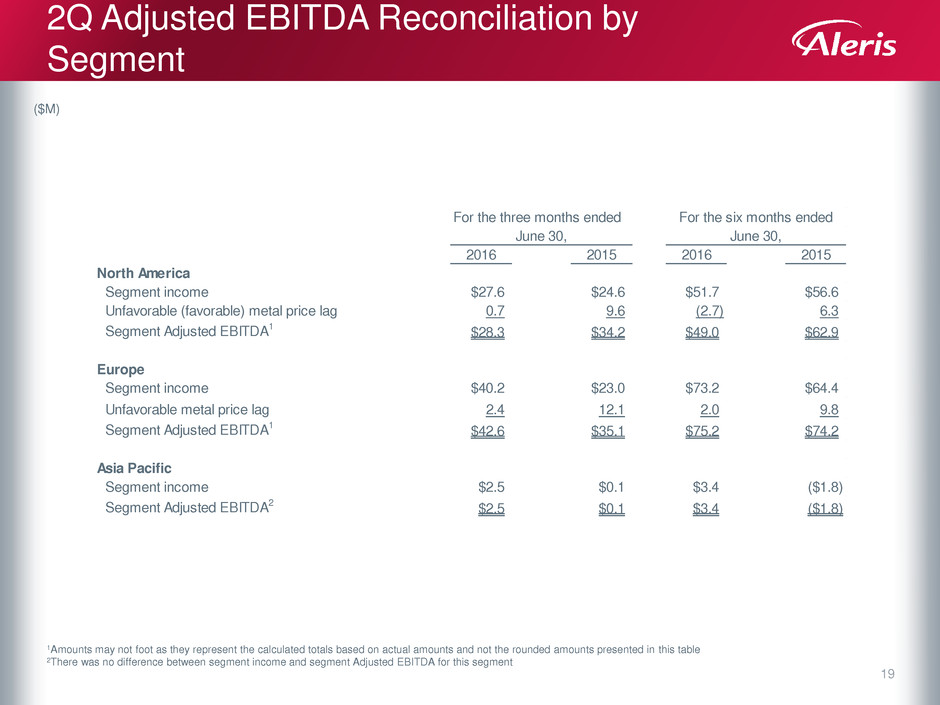

2Q Adjusted EBITDA Reconciliation by

Segment

($M)

1Amounts may not foot as they represent the calculated totals based on actual amounts and not the rounded amounts presented in this table

2There was no difference between segment income and segment Adjusted EBITDA for this segment

2016 2015 2016 2015

North America

Segment income $27.6 $24.6 $51.7 $56.6

Unfavorable (favorable) metal price lag 0.7 9.6 (2.7) 6.3

Segment Adjusted EBITDA1 $28.3 $34.2 $49.0 $62.9

Europe

Segment income $40.2 $23.0 $73.2 $64.4

Unfavorable metal price lag 2.4 12.1 2.0 9.8

Segment Adjusted EBITDA1 $42.6 $35.1 $75.2 $74.2

Asia Pacific

Segment income $2.5 $0.1 $3.4 ($1.8)

Segment Adjusted EBITDA2 $2.5 $0.1 $3.4 ($1.8)

For the three months ended

June 30,

For the six months ended

June 30,

20

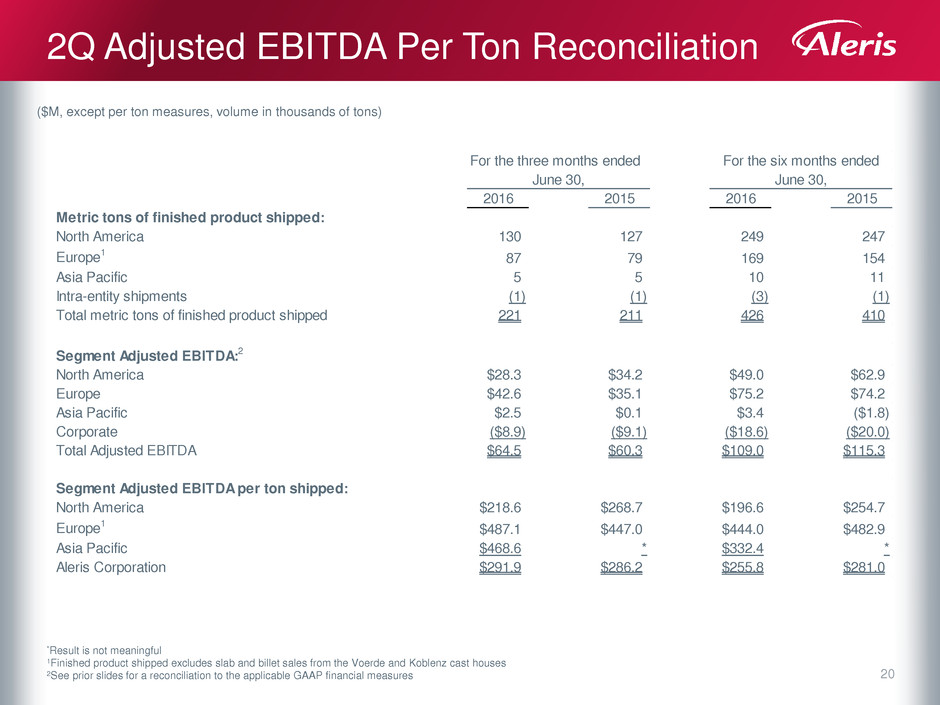

2Q Adjusted EBITDA Per Ton Reconciliation

($M, except per ton measures, volume in thousands of tons)

*Result is not meaningful

1Finished product shipped excludes slab and billet sales from the Voerde and Koblenz cast houses

2See prior slides for a reconciliation to the applicable GAAP financial measures

2016 2015 2016 2015

Metric tons of finished product shipped:

North America 130 127 249 247

Europe1 87 79 169 154

Asia Pacific 5 5 10 11

Intra-entity shipments (1) (1) (3) (1)

Total metric tons of finished product shipped 221 211 426 410

Segment Adjusted EBITDA:2

North America $28.3 $34.2 $49.0 $62.9

Europe $42.6 $35.1 $75.2 $74.2

Asia Pacific $2.5 $0.1 $3.4 ($1.8)

Corporate ($8.9) ($9.1) ($18.6) ($20.0)

Total Adjusted EBITDA $64.5 $60.3 $109.0 $115.3

Segment Adjusted EBITDA per ton shipped:

North America $218.6 $268.7 $196.6 $254.7

Europe1 $487.1 $447.0 $444.0 $482.9

Asia Pacific $468.6 * $332.4 *

Aleris Corporation $291.9 $286.2 $255.8 $281.0

For the three months ended

June 30,

For the six months ended

June 30,

21

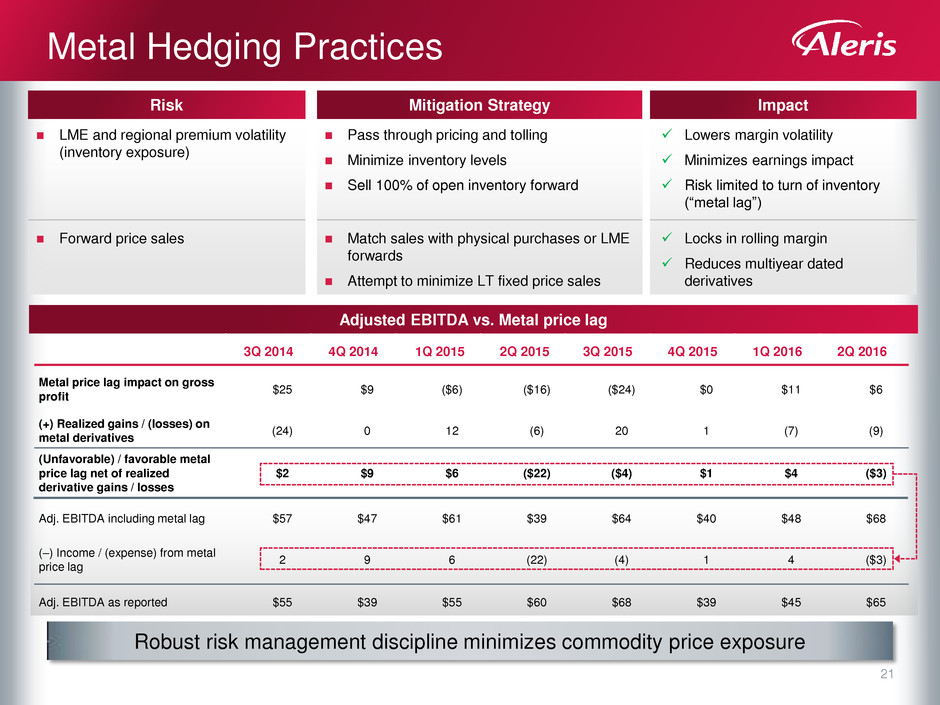

Robust risk management discipline minimizes commodity price exposure

Metal Hedging Practices

Pass through pricing and tolling

Minimize inventory levels

Sell 100% of open inventory forward

LME and regional premium volatility

(inventory exposure)

Risk Impact Mitigation Strategy

Lowers margin volatility

Minimizes earnings impact

Risk limited to turn of inventory

(“metal lag”)

Match sales with physical purchases or LME

forwards

Attempt to minimize LT fixed price sales

Forward price sales Locks in rolling margin

Reduces multiyear dated

derivatives

Adjusted EBITDA vs. Metal price lag

Adj. EBITDA including metal lag $57 $47 $61 $39 $64 $40 $48 $68

(–) Income / (expense) from metal

price lag

2 9 6 (22) (4) 1 4 ($3)

Adj. EBITDA as reported $55 $39 $55 $60 $68 $39 $45 $65

3Q 2014 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Metal price lag impact on gross

profit

$25 $9 ($6) ($16) ($24) $0 $11 $6

(+) Realized gains / (losses) on

metal derivatives

(24) 0 12 (6) 20 1 (7) (9)

(Unfavorable) / favorable metal

price lag net of realized

derivative gains / losses

$2 $9 $6 ($22) ($4) $1 $4 ($3)

22

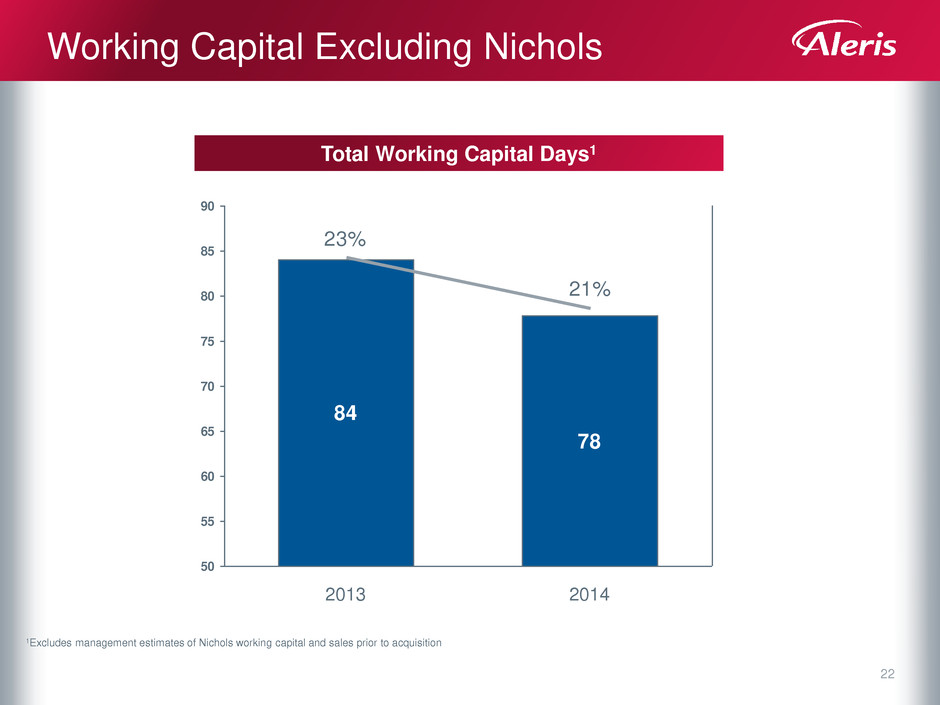

Working Capital Excluding Nichols

84

78

21%

23%

50

55

60

65

70

75

80

85

90

2013 2014

Total Working Capital Days1

1Excludes management estimates of Nichols working capital and sales prior to acquisition