Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HESKA CORP | form8kpressreleaseq22016.htm |

Exhibit 99.1

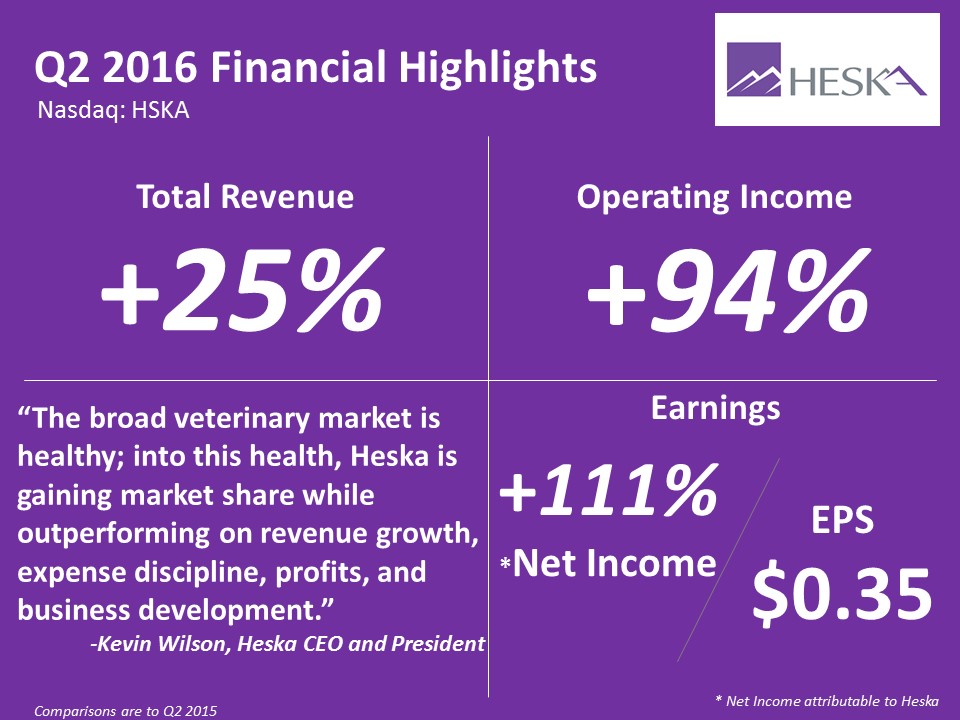

Heska Reports Record Second Quarter Results

Revenue Up 25% to $30 million; Earnings Per Share up 106% to $0.35

LOVELAND, CO, August 3, 2016 -- Heska Corporation (NASDAQ: HSKA - News; "Heska" or the "Company"), a provider of advanced veterinary diagnostic and specialty products, today reported financial results for its second quarter ended June 30, 2016.

Second Quarter 2016 Record Results with Prior Year Comparison:

• | Revenue up 25% to $30.0 million. |

• | Operating income up 94% to $3.6 million. |

• | Net income attributable to Heska up 111% to $2.5 million, or $0.35 per diluted share. |

Kevin Wilson, Chief Executive Officer and President of Heska, commented, “For many quarters now, Heska teams have consistently worked harder and smarter to deliver outsized current results while laying solid foundations for the future. The men and women of Heska have again delivered on both goals in the second quarter. The broad veterinary market is healthy; into this health, Heska is gaining market share while outperforming on revenue growth, expense discipline, profits, and business development. Heska is

very well positioned. Along with sharing our good results today, we also want to say thank you to our veterinary customers and industry partners. We are honored that they continue to choose Heska and we are motivated to keep delighting them so that they continue to choose Heska for many, many more years.”

Financial Results

2016 second quarter revenue was $30.0 million, a 25% year over year increase. Second quarter Core Companion Animal Health segment revenue increased 18% to $24.5 million, up from $20.8 million in the second quarter of 2015, on a strong performance from blood testing instruments and consumables and digital imaging. Other Vaccines, Pharmaceuticals and Products segment revenue rose 74% to $5.5 million during the period, up from $3.2 million in the second quarter of 2015. Gross profit rose 23% to $12.7 million in the current quarter, compared to $10.3 million in the second quarter of 2015. Total operating expenses in the second quarter of 2016 were $9.1 million, or 30.5% of sales, a 4.9% improvement over the $8.5 million, or 35.4% of sales, in the prior year period. The Company reported second quarter 2016 operating income of $3.6 million, compared to operating income of $1.8 million in the second quarter of 2015. Income before income taxes was $3.5 million in the second quarter of 2016, compared to income before income taxes of $1.8 million in the prior year period. In the second quarter of 2016, net income attributable to Heska Corporation was $2.5 million, or $0.35 per diluted share, compared to $1.2 million, or $0.17 per diluted share, in the second quarter of 2015.

Balance Sheet

At June 30, 2016, Heska had $6.7 million in cash and working capital of $27.1 million. Stockholders' equity increased to $75.7 million, up from $63.5 million as of December 31, 2015.

Adoption of New Stock Compensation Expense Standard

In the quarter ended June 30, 2016, we early adopted new guidance issued by the Financial Accounting Standards Board that simplified several aspects related to the accounting for share-based payment transactions, including, among other things, the accounting for income taxes. As a result of this early adoption, we recognized additional income tax benefits as an increase to net income of $0.5 million or $0.07 per diluted share for the three and six months ended June 30, 2016.

Investor Conference Call

Management will conduct a conference call on August 3, 2016 at 9 a.m. MDT (11 a.m. EDT) to discuss the second quarter 2016 financial results. To participate, dial 866-952-1907 (domestic) or 785-424-1826 (international) and reference conference call access number 5254856. The conference call will also be broadcast live over the Internet at www.heska.com. To listen, simply log on to the web at this address at least ten minutes prior to the start of the call to register, and download and install any necessary audio software. Telephone replays of the conference call will be available for playback on Heska's home page at www.heska.com until August 17, 2016. The telephone replay may be accessed by dialing 888-203-1112 (domestic) or 719-457-0820 (international). The replay access number is 5254856.

About Heska

Heska Corporation (NASDAQ: HSKA - News) sells advanced veterinary diagnostic and specialty products. Heska's state-of-the-art offerings include blood testing instruments and supplies, digital imaging products, software and services, and single use products and data services, allergy testing and immunotherapy, and single-use offerings such as in-clinic diagnostic tests and heartworm preventive products. The Company’s core focus is on the canine and feline markets where it strives to provide high value products and unparalleled support to veterinarians. For further information on Heska and its products, visit www.heska.com.

Forward-Looking Statements

This announcement contains forward-looking statements regarding Heska's future financial and operating results. These statements are based on current expectations and are subject to a number of risks and uncertainties. Investors should note that there is an inherent risk in using past results, including trends, to predict future outcomes, including financial results and perceived customer behavior. Factors that could affect the business and financial results of Heska generally include, but are not limited to, the following: uncertainties related to Heska's ability to measure and predict trends in the veterinary market; uncertainties related to Heska's ability to measure and predict the effectiveness of commercial relationships; uncertainties related to the future impact of recent business development activity; risks related to Heska's reliance on third-party suppliers, which is substantial; competition; and the risks set forth in Heska's filings and future filings with the Securities and Exchange Commission, including those set forth in Heska's Quarterly Report on Form 10-Q for the three months ended June 30, 2016.

Financial Table Follows:

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

2015 | 2016 | 2015 | 2016 | |||||||||||||

Revenue: | ||||||||||||||||

Core companion animal health | $ | 20,757 | $ | 24,464 | $ | 40,329 | $ | 47,898 | ||||||||

Other vaccines, pharmaceuticals and products | 3,153 | 5,501 | 6,475 | 9,213 | ||||||||||||

Total revenue, net | 23,910 | 29,965 | 46,804 | 57,111 | ||||||||||||

Cost of revenue | 13,613 | 17,283 | 26,423 | 32,987 | ||||||||||||

Gross profit | 10,297 | 12,682 | 20,381 | 24,124 | ||||||||||||

Operating expenses: | ||||||||||||||||

Selling and marketing | 5,239 | 5,386 | 10,699 | 11,005 | ||||||||||||

Research and development | 392 | 523 | 811 | 1,098 | ||||||||||||

General and administrative | 2,837 | 3,217 | 6,021 | 6,495 | ||||||||||||

Total operating expenses | 8,468 | 9,126 | 17,531 | 18,598 | ||||||||||||

Operating income | 1,829 | 3,556 | 2,850 | 5,526 | ||||||||||||

Interest and other expense (income), net | 37 | 34 | 174 | (99 | ) | |||||||||||

Income before income taxes | 1,792 | 3,522 | 2,676 | 5,625 | ||||||||||||

Income tax expense: | ||||||||||||||||

Current income tax expense | 82 | 87 | 126 | 161 | ||||||||||||

Deferred income tax expense | 532 | 693 | 789 | 1,275 | ||||||||||||

Total income tax expense | 614 | 780 | 915 | 1,436 | ||||||||||||

Net income | 1,178 | 2,742 | 1,761 | 4,189 | ||||||||||||

Net income (loss) attributable to non-controlling interest | (19 | ) | 220 | (34 | ) | 482 | ||||||||||

Net income attributable to Heska Corporation | $ | 1,197 | $ | 2,522 | $ | 1,795 | $ | 3,707 | ||||||||

Basic earnings per share attributable to Heska Corporation | $ | 0.19 | $ | 0.38 | $ | 0.29 | $ | 0.56 | ||||||||

Diluted earnings per share attributable to Heska Corporation | $ | 0.17 | $ | 0.35 | $ | 0.26 | $ | 0.51 | ||||||||

Weighted average outstanding shares used to compute basic earnings per share attributable to Heska Corporation | 6,283 | 6,695 | 6,232 | 6,641 | ||||||||||||

Weighted average outstanding shares used to compute diluted earnings per share attributable to Heska Corporation | 7,075 | 7,249 | 6,980 | 7,206 | ||||||||||||

Balance Sheet Data

(in thousands)

December 31, 2015 | June 30, 2016 | |||||||

(unaudited) | ||||||||

Cash and cash equivalents | $ | 6,890 | $ | 6,669 | ||||

Total current assets | 41,262 | 42,687 | ||||||

Note receivable - related party | 1,516 | — | ||||||

Total assets | 109,719 | 119,625 | ||||||

Line of credit | 143 | — | ||||||

Other short-term borrowings, including current portion of long-term note payable | 159 | 412 | ||||||

Total current liabilities | 18,803 | 15,576 | ||||||

Long-term note payable, net of current portion | 69 | 229 | ||||||

Non-controlling interest | 15,747 | 15,866 | ||||||

Total stockholders' equity | 63,528 | 75,658 | ||||||