Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Carbonite Inc | a8-kq22016earningsrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - Carbonite Inc | exhibit991q22016.htm |

CARBONITE 2016 SECOND QUARTER FINANCIAL RESULTS

August 2, 2016

JERRY SISITSKY

VP, Investor Relations

SAFE HARBOR STATEMENT

These slides and the accompanying oral presentation contain "forward-looking statements" within the meaning of the Securities Act of 1933 and the

Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent the

Company's views as of the date they were first made based on the current intent, belief or expectations, estimates, forecasts, assumptions and

projections of the Company and members of our management team. Words such as "expect," "anticipate," "should," "believe," "hope," "target," "project,"

"goals," "estimate," "potential," "predict," "may," "will," "might," "could," "intend," variations of these terms or the negative of these terms and similar

expressions are intended to identify these forward-looking statements. Those statements include, but are not limited to, statements regarding guidance

on our future financial results and other projections or measures of future performance, the expected future results of the acquisition of EVault, including

revenues and growth rates; the Company’s ability to successfully integrate EVault’s business; and the Company’s expectations regarding its future

performance. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are

beyond the Company's control. The Company's actual results could differ materially from those stated or implied in forward-looking statements due to a

number of factors, including, but not limited to, the Company's ability to profitably attract new customers and retain existing customers, including the

customers of EVault, the Company's dependence on the market for cloud backup services, the Company's ability to manage growth, and changes in

economic or regulatory conditions or other trends affecting the Internet and the information technology industry. These and other important risk factors

are discussed under the heading "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 filed with the

Securities and Exchange Commission, which is available on www.sec.gov. Except as required by law, we do not undertake any obligation to update our

forward-looking statements to reflect future events, new information or circumstances.

This presentation contains non-GAAP financial measures including, but not limited to, non-GAAP Revenue, non-GAAP Gross Margin, non-GAAP Net

Income Per Share and Adjusted Free Cash Flow. A reconciliation to GAAP can be found in the financial schedules included in our most recent earnings

press release which can be found on Carbonite’s website, investor.carbonite.com, in the Company’s filings or with the SEC at www.sec.gov.

3

MOHAMAD ALI

President & CEO

ANTHONY FOLGER

CFO & Treasurer

carbonite.com

$22.6 $21.7 $21.6 $22.9 $21.4

$13.1 $12.5 $15.8

$29.4 $32.3$35.7 $34.2

$37.4

$52.3 $53.7

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

Q215 Q315 Q415 Q116 Q216

Consumer SMB

Q216 BOOKINGS

6

Q216 Growth Y/Y

Total Bookings $53.7M 50%

SMB $32.3M 147%

Consumer $21.4M (5%)

Source: SEC filings

SMB 60% of

Total Bookings

carbonite.com

BOOKINGS: SMB DRIVING GROWTH, CONSUMER DRIVING CASH

SMB Consumer

• SMB Bookings $32.3M

• SMB Subscription Bookings $24.5M

• Margin Profile ~80%

Cloud Backup and DRaaS Cloud Backup

• Consumer Bookings $21.4M

• Cash Contribution ~$3.5M

• Margin Profile Mid-60%

SaaS Subscription Model Key to Long-Term Strategy

7

carbonite.com

Q216 GAAP AND NON-GAAP REVENUE

8

$34.0 $34.6 $35.1

$48.7

$54.2

$0.0

$20.0

$40.0

$60.0

Q215 Q315 Q415 Q116 Q216

Q216 Growth Y/Y

GAAP Revenue $53.4M 57%

Non-GAAP revenue $54.2M 60%

Source: SEC filings

For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.com

Non-GAAP revenue

carbonite.com

Q216 GAAP AND NON-GAAP GROSS MARGINS

9

72.6% 73.2%

75.3%

71.9% 72.5%

50.0%

60.0%

70.0%

80.0%

Q215 Q315 Q415 Q116 Q216

For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.com

Q216 Growth Y/Y

GAAP Gross Margin 70.3% (90 bps)

Non-GAAP Gross Margin 72.5% (10 bps)

Source: SEC filings

Non-GAAP Gross Margin

carbonite.com

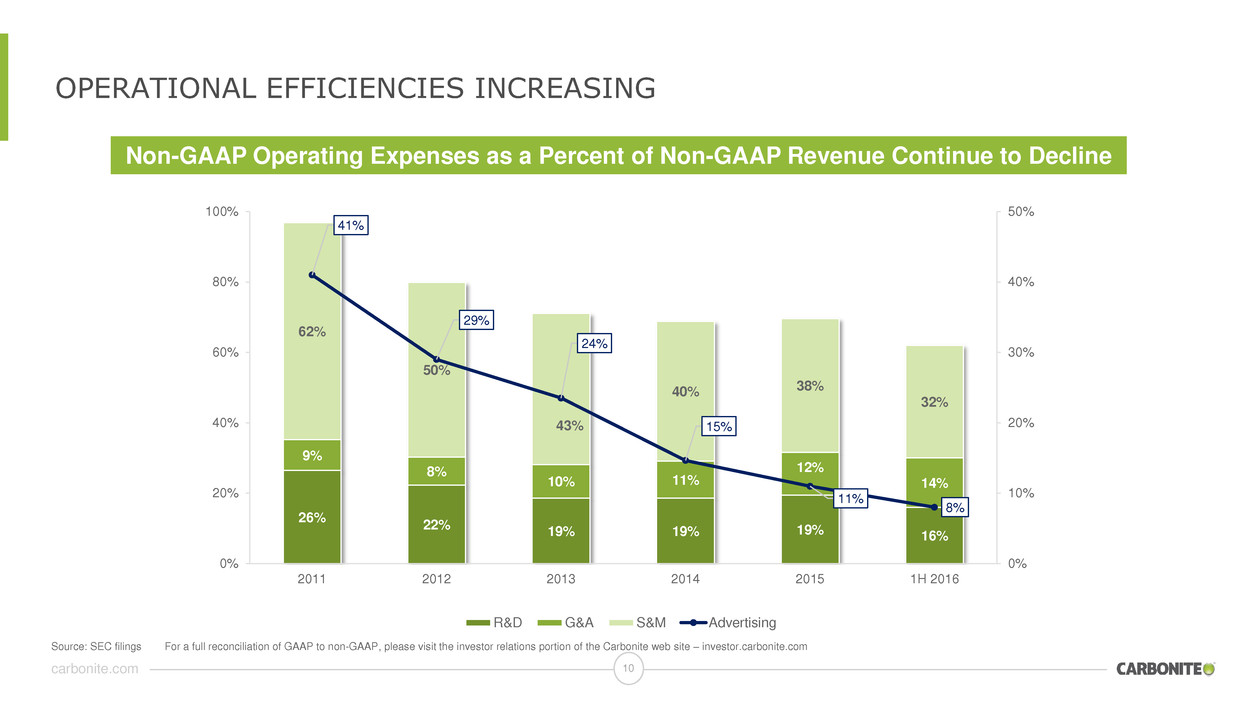

OPERATIONAL EFFICIENCIES INCREASING

10

For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.comSource: SEC filings

26%

22% 19% 19% 19% 16%

9%

8%

10% 11%

12%

14%

62%

50%

43%

40% 38%

32%

41%

29%

24%

15%

11%

8%

0%

10%

20%

30%

40%

50%

0%

20%

40%

60%

80%

100%

2011 2012 2013 2014 2015 1H 2016

R&D G&A S&M Advertising

Non-GAAP Operating Expenses as a Percent of Non-GAAP Revenue Continue to Decline

carbonite.com

Q216 TOTAL CASH AND ADJUSTED FREE CASH FLOW

11

$3.2

$1.4

$7.1

($0.5)

$7.3

($8.0)

($4.0)

$0.0

$4.0

$8.0

Q215 Q315 Q415 Q116 Q216

Adjusted Free Cash Flow

For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.com

Numbers may not foot due to rounding.

Q216

Total Cash and Investments $43.2M

Stock buyback $1.3M

Source: SEC filings

12carbonite.com

BUSINESS OUTLOOK*

Q316

GAAP Revenue $44.5M - $49.5M

Non-GAAP Revenue $45.0M - $50.0M

Non-GAAP Net Income Per Share $0.06 - $0.10

FY 2016

a/o 5/3/2016 a/o 8/2/2016

SMB Bookings $102.5M - $112.5M $110.0M - $120.0M

Consumer Bookings Y/Y Growth (10%) – 0% (10%) – 0%

GAAP Revenue Not guided $192.7M - $202.7M

Non-GAAP Revenue $177.5M - $192.5M $195.0M - $205.0M

Non-GAAP Net Income Per Share $0.31 - $0.35 $0.48 - $0.52

Non-GAAP Gross Margin 69.0% - 71.0% 70.0% - 72.0%

Adjusted Free Cash Flow $9.0M - $13.0M $11.0M - $15.0M

With respect to our expectations under "Business Outlook" above, the Company has not reconciled non-GAAP net income per share to net income (loss) per share because we do not provide guidance for stock-based compensation

expense, litigation-related expense, acquisition-related expense, amortization expense on intangible assets and the income tax effect of non-GAAP adjustments as we are unable to quantify certain of these amounts that would be required

to be included in the GAAP measure without unreasonable efforts. In addition, the Company believes such reconciliations would imply a degree of precision that would be confusing or misleading to investors.

MOHAMAD ALI

President & CEO

14carbonite.com

2016 ACCOMPLISHMENTS

EVault Integration Ahead of Plan

• Go-To-Market

• Integrated Carbonite and EVault go-to-market teams in Europe

• Selling EVault branded products through select North American partners

• Integrated Carbonite and EVault large strategic partners

• On track to launch EVault branded appliance for Carbonite small business customers in 2H 2016

• Data Center Consolidations

• Pricing and Packaging Refresh

• Engineering

• Streamlined and right-sized engineering organization

• Focused on developing the most impactful features for customers and partners

15carbonite.com

THOUGHT LEADERSHIP: FIGHTRANSOMWARE.COM

The Ransomware threat is real

• 6,000,000+ ransomware viruses in existence

• $325M+ in damages in 2015

• Backing up with Carbonite is a proven defense

• Carbonite helped more than 5,000 customers recover

from ransomware in last 12 months

• Launched FightRansomware.com July 2016

• @ FightRansomware #FightRansomware

Sources: McAfee Labs, Cyber Threat Security Alliance, Carbonite

carbonite.com 16

Source: Gartner, IDC, Markets and Research

CAPABILITIES: CAPITALIZE ON GROWING MARKETS

• Data Protection market is $6B (2014)

growing to more than $8B (2019) – IDC

• Cloud Backup portion of Data Protection is growing

approximately 13% - Markets & Research

• Disaster Recovery as a Service (DRaaS) portion of

Data Protection is growing 25% - Gartner

17carbonite.com

SUCCESSFULLY DELIVERING RESULTS

Successful

integration Continued

operational

discipline

CONSISTENTLY STRONG FINANCIAL AND OPERATING RESULTS

THANK YOU

DEFINITION OF NON-GAAP MEASURES

Bookings: Bookings represent the aggregate dollar value of customer subscriptions and software arrangements, which may include multiple

revenue elements, such as software licenses, hardware, professional services and post-contractual support, received during a period

and are calculated as revenue recognized during a particular period plus the change in total deferred revenue, excluding deferred

revenue recorded in connection with acquisitions, net of foreign exchange during the same period.

Non-GAAP revenue: Excludes the impact of purchase accounting adjustments for the acquisition of EVault.

Non-GAAP gross margin: Excludes the impact of purchase accounting adjustments, amortization expense on intangible assets, stock-based

compensation expense, and acquisition-related expense.

Non-GAAP net income (loss) and non-GAAP net income (loss) per share: Non-GAAP net income (loss) and non-GAAP net income (loss) per share

excludes the impact of purchase accounting adjustments, amortization expense on intangible assets, stock-based compensation expense, litigation-

related expense, restructuring-related expense, acquisition-related expense, hostile takeover-related expense, CEO transition expense, and the income

tax effect of non-GAAP adjustments.

Non-GAAP operating expense: Excludes amortization expense on intangible assets, stock-based compensation expense, litigation related expense,

restructuring-related expense, acquisition-related expense, hostile takeover-related expense, and CEO transition expense.

Adjusted Free cash flow: Adjusted free cash flow is calculated by subtracting the cash paid for the purchase of property and equipment and adding the

payments related to corporate headquarter relocation, acquisition-related payments, hostile takeover-related payments, CEO transition payments,

restructuring-related payments, litigation-related payments and the cash portion of the lease exit charge from net cash provided by operating activities.