Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atlantic Capital Bancshares, Inc. | acb-form8xkinvestorpresent.htm |

1

Atlantic Capital Bancshares, Inc. (ACBI)

Investor Presentation

August 2, 2016

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and

section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect our current views with respect

to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of

words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,”

“seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a

future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations,

estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by

their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not

guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe

that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be

materially different from the results expressed or implied by the forward-looking statements.

The following risks, among others, could cause actual results to differ materially from the anticipated results or other expectations

expressed in the forward-looking statements: (1) the expected growth opportunities and cost savings from the transaction with First Security

Group, Inc. (“First Security”) may not be fully realized or may take longer to realize than expected; (2) revenues following the transaction

with First Security and recent branch sales may be lower than expected as a result of deposit attrition, increased operating costs, and

customer loss and business disruption may be greater than expected; (3) diversion of management time on merger related issues; (4)

changes in asset quality and credit risk; (5) the cost and availability of capital; (6) customer acceptance of the combined company’s

products and services; (7) customer borrowing, repayment, investment and deposit practices; (8) the introduction, withdrawal, success and

timing of business initiatives; (9) the impact, extent, and timing of technological changes; (10) severe catastrophic events in our geographic

area; (11) a weakening of the economies in which the combined company will conduct operations may adversely affect its operating results;

(12) the U.S. legal and regulatory framework, including those associated with the Dodd-Frank Wall Street Reform and Consumer Protection

Act could adversely affect the operating results of the combined company; (13) the interest rate environment may compress margins and

adversely affect net interest income; (14) changes in trade, monetary and fiscal policies of various governmental bodies and central banks

could affect the economic environment in which we operate; (15) our ability to determine accurate values of certain assets and liabilities;

(16) adverse behaviors in securities, public debt, and capital markets, including changes in market liquidity and volatility; (17) our ability to

anticipate interest rate changes correctly and manage interest rate risk presented through unanticipated changes in our interest rate risk

position and/or short- and long-term interest rates; (18) unanticipated changes in our liquidity position, including but not limited to our ability

to enter the financial markets to manage and respond to any changes to our liquidity position; (19) adequacy of our risk management

program; (20) increased costs associated with operating as a public company; (21) competition from other financial services companies in

the companies’ markets could adversely affect operations; and (22) other factors described in Atlantic Capital’s reports filed with the

Securities and Exchange Commission and available on the SEC’s website (www.sec.gov).

2

Non-GAAP Financial Information

Statements included in this presentation include non-GAAP financial measures and should be read long with the accompanying tables,

which provide a reconciliation of non-GAAP financial measures to GAAP financial measures. Atlantic Capital management uses non-GAAP

financial measures, including: (i) operating net income; (ii) operating non-interest expense; (iii) operating provision for loan losses, (iv)

taxable equivalent net interest margin, (v) efficiency ratio (vi) operating return on assets; (vii) operating return on equity: (viii) tangible

common equity and (ix) deposits excluding deposits assumed in branch sales, in its analysis of the Company's performance.

Management believes that non-GAAP financial measures provide a greater understanding of ongoing performance and operations, and

enhance comparability with prior periods. Non-GAAP financial measures should not be considered as an alternative to any measure of

performance or financial condition as determined in accordance with GAAP, and investors should consider Atlantic Capital’s performance

and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of

the Company. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a

substitute for analysis of the results or financial condition as reported under GAAP. Non-GAAP financial measures may not be comparable

to non-GAAP financial measures presented by other companies.

3

Proprietary & Confidential

Overview

Atlantic Capital was organized in 2006 and completed an initial equity capital raise of

$125 million in 2007

Focused on banking:

Small to mid-sized enterprises with revenues up to $250 million

Highly-select group of institutional caliber commercial real estate developers and

investors

Principals of our commercial clients, professionals and their practices

Differentiated by providing superior expertise, competitive capabilities, and high

touch service delivery

Completed acquisition of First Security on October 31, 2015

Public market liquidity and value by listing shares on NASDAQ

Geographic diversification into Eastern Tennessee

Business mix diversification

Sold 7 offices in Eastern Tennessee as part of repositioning of First Security’s retail

business

Closed in 2nd quarter of 2016

4

Proprietary & Confidential

Atlantic Capital Strategy

Become a premier southeastern

business and private banking company

Investing in people and

capabilities to accelerate

organic growth and build

profitability

Results are evidence of

meaningful progress

Attractive interest rate risk

position

Completed acquisition of First

Security on October 31, 2015

Ongoing evaluation of new

market expansion through

mergers and acquisitions and

de novo entry

Patient and disciplined

approach with focus on

shareholder value

Accelerated Organic Growth Strategic Expansion

5

Proprietary & Confidential

Atlantic Capital Highlights

Opened in 2007 to serve middle market companies in

southeastern US

Organically grew to $1.4 billion in assets despite market downturn

Well positioned to capitalize on Atlanta market recovery, new

market expansion and higher interest rates

Supplemented by recently completed strategic acquisition of First

Security

Leadership continuity in key markets

Broad experience in all business lines

Focused on small to mid-sized companies and private banking

services to individuals

Initiatives in place to maintain robust top line growth

Operating model will produce enhanced efficiencies going forward

Consistently high asset quality

NPAs/total assets 0.07% as of June 30, 2016

Organic Growth

Story in Desirable

Markets

Experienced

Management Team

Attractive Business

Mix

Strong Growth

Prospects

Disciplined Risk

Management

6

Legacy ACB

Loans Held for Investment

$1,046

$1,791

$1,887 $1,942

Financial Highlights

Total loans held for investment increased:

$55 million, or 2.9%, from March 31, 2016 and

$151 million, or 8.5%, from year end

Total deposits (excluding deposits assumed in branch sales) increased:

$74 million, or 3.5%, from March 31, 2016 and

$109 million, or 5.3%, from year end

Dollars in millions

*excluding deposits sold in branch sales. This is a non-GAAP financial measure. Please see “Non-GAAP Reconciliation” on page 21 for more details.

Deposits* Total Assets

7

Combined Bank

$1,382

$2,639 $2,725

$2,808

$1,129

$2,049 $2,085

$2,158

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Q3

2015

Q4

2015

Q1

2016

Q2

2016

$0.13

$0.44

$0.38

$0.55

$0.62

$0.14 $0.15

Q1 Q2

2016 2016

Financial Highlights

Dollars in thousands

*Operating noninterest income, operating diluted earnings and efficiency ratio are non-GAAP financial measures that exclude merger-related expenses

and net gain on sale of branches. Please see “Non-GAAP Reconciliation” on page 21 for more details.

$2,797 $2,888

$3,875

$5,342

$9,399

$4,420

$4,995

64.2%

73.5% 75.9%

69.1% 68.8%

75.2% 72.0%

8

Efficiency Ratio* Operating Noninterest Income*

Diluted Earnings Per Share – Operating*

2.99%

2.75% 2.75%

2.85%

2.98%

3.26%

3.05%

3.12%

3.00%

2011 2012 2013 2014 2015

Net Interest Margin

2011 2012 2013 2014 2015

Q1 Q2

2016 2016

2011 2012 2013 2014 2015 Q1 Q2

2016 2016

2011 2012 2013 2014 2015 Q1 Q2

2016 2016

excludes purchase accounting adjustments

1.39% 1.44% 1.32%

1.10% 1.06%

0.93% 0.95%

Q1 Q2

2016 2016

0.71%

0.43%

0.36%

0.12%

0.40%

0.08% 0.07%

Superior Credit Quality

9

0.79%

0.49%

0.36%

0.00%

0.45%

0.02% 0.05%

Allowance for Loan Losses / Total Loans

Non-Performing Loans / Total Loans Non-Performing Assets / Total Assets

1.43%

-0.32%

0.02%

-0.01%

0.05%

0.35%

0.00%

Net Charge Offs / Total Average Loans

Q1 Q2

2016 2016

2011 2012 2013 2014 2015 Q1 Q2

2016 2016

2011 2012 2013 2014 2015

2011 2012 2013 2014 2015

Q1 Q2

2016 2016 2011 2012 2013 2014 2015

YTD 2016:

0.17%

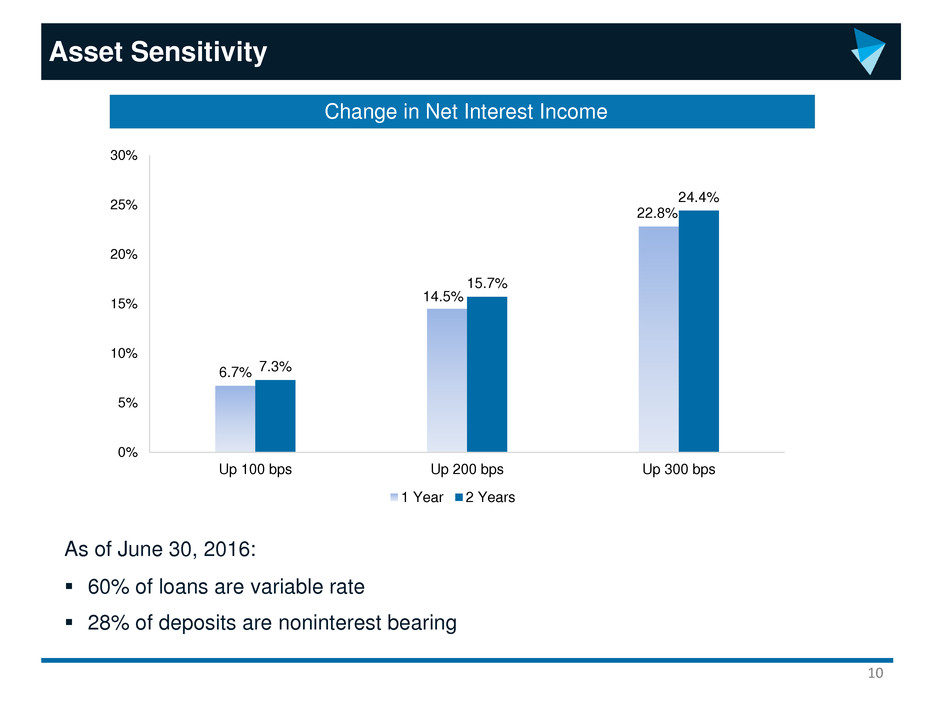

Asset Sensitivity

Change in Net Interest Income

10

6.7%

14.5%

22.8%

7.3%

15.7%

24.4%

0%

5%

10%

15%

20%

25%

30%

Up 100 bps Up 200 bps Up 300 bps

1 Year 2 Years

As of June 30, 2016:

60% of loans are variable rate

28% of deposits are noninterest bearing

Diversified Loan Mix

Dollars in thousands

Loans Held For Investment

at Jun. 30, 2016

11

Loan Growth by Type

Jun. 30,

2016

Dec. 31,

2015

YTD

Change

Loans held for investment

Commercial loans:

Commercial and industrial 508,516$ 467,083$ 41,433$

Commercial real estate:

Multifamily 79,144 78,778 366

Owner occupied 351,419 320,656 30,763

Investment 431,633 446,979 (15,346)

Construction and land:

1-4 family residential

construction 9,611 6,609 3,002

Other construction,

development and land 199,536 159,749 39,787

Mortgage warehouse loans 126,108 84,350 41,758

Total commercial loans 1,705,967 1,564,204 141,763

Residential:

Residential mortgages 103,313 110,381 (7,068)

Home equity 80,321 80,738 (417)

Total residential loans 183,634 191,119 (7,485)

Consumer 29,788 30,451 (663)

Other 28,168 6,901 21,267

1,947,557 1,792,675 154,882

(5,420) (2,006) (3,414)

Total loans held for investment 1,942,137$ 1,790,669$ 151,468$

Less net deferred fees and other

unearned income

C&I

Owner Occupied

CRE

Construction and land

Mortgage Warehouse

Residential mortgages

Home equity

Consumer & Other

26%

18%

11%

7%

5%

4%

26%

3%

Attractive Deposit Mix

28%

11%

1%

42%

8%

10%

Noninterest-bearing

Interest Checking

Savings

Money Market

Time

Brokered

12

Jun. 30,

2016

% of

Total

Dec. 31,

2015

% of

Total

Noninterest-bearing 592,043$ 28% 544,561$ 24%

Interest checking 231,091 11% 232,868 10%

Savings 30,839 1% 28,922 1%

Money market 913,094 42% 875,441 39%

Time 178,615 8% 183,206 8%

Brokered 212,623 10% 183,810 8%

Deposits to be assumed

in branch sale - 0% 213,410 10%

Total Deposits 2,158,305$ 100% 2,262,218$ 100%

Cost of deposits 0.35% 0.28%

Deposits

at Jun. 30, 2016

Deposit Growth by Type

Dollars in thousands

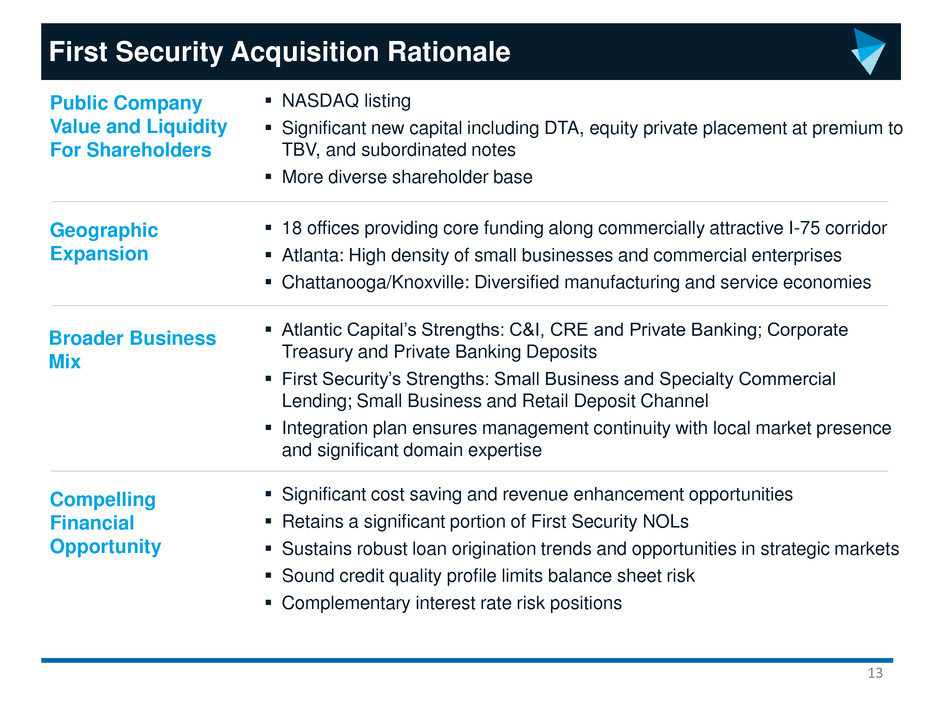

First Security Acquisition Rationale

NASDAQ listing

Significant new capital including DTA, equity private placement at premium to

TBV, and subordinated notes

More diverse shareholder base

18 offices providing core funding along commercially attractive I-75 corridor

Atlanta: High density of small businesses and commercial enterprises

Chattanooga/Knoxville: Diversified manufacturing and service economies

Atlantic Capital’s Strengths: C&I, CRE and Private Banking; Corporate

Treasury and Private Banking Deposits

First Security’s Strengths: Small Business and Specialty Commercial

Lending; Small Business and Retail Deposit Channel

Integration plan ensures management continuity with local market presence

and significant domain expertise

Significant cost saving and revenue enhancement opportunities

Retains a significant portion of First Security NOLs

Sustains robust loan origination trends and opportunities in strategic markets

Sound credit quality profile limits balance sheet risk

Complementary interest rate risk positions

Public Company

Value and Liquidity

For Shareholders

Geographic

Expansion

Broader Business

Mix

Compelling

Financial

Opportunity

13

Creates a leading middle market commercial bank operating along the I-75 corridor

Attractive Market Demographics

Atlanta-Sandy Springs-Roswell, GA MSA

• Total Population 2014: Approximately 5.6 million

• 2014-2019 Population Growth: 6.4% projected

• Median Household Income 2014: $52,533

• Total Deposits in Market: Approximately $130 billion

Chattanooga, TN-GA MSA includes Dalton and Cleveland

• Total Population 2014: Approximately 544,000

• 2014-2019 Population Growth: 4.0% projected

• Median Household Income 2014: $41,704

• Total Deposits in Market: Approximately $8.5 billion

Knoxville, TN MSA

• Total Population 2014: Approximately 855,000

• 2014-2019 Population Growth: 3.1% projected

• Median Household Income 2014: $44,405

• Total Deposits in Market: Approximately $14.7 billion

Source: Nielsen, SNL Financial

14

2016 Priorities

15

Complete integration of the acquired First Security businesses including the

realization of estimated cost savings

Continue the trajectory of growth and profit improvement in legacy Atlantic

Capital businesses

Reposition legacy First Security businesses for improved performance

Consider further geographic expansion, particularly de novo or team lift-out

opportunities in other attractive metropolitan markets

The New Atlantic Capital

Three attractive growth markets

Focus on corporate, business and private banking

Solid relationship deposit funding

Sound credit quality

Positioned for interest rate increase

Pursuing disciplined strategic

expansion with a focus on

shareholder value

Organic

Growth

Strategic

Opportunities

16

APPENDIX

Management Biographies

Name and Title Age Experience

Patrick Oakes

Executive Vice President &

Chief Financial Officer

48 • Former Chief Financial Officer of Square 1 Financial, Inc.

• Former Executive Vice President and Chief Financial Officer of Encore Bancshares, Inc.

• Former Senior Vice President and Treasurer for Sterling Bancshares, Inc.

• Chartered Financial Analyst

Douglas Williams

Chief Executive Officer

58 • Chief Executive Officer of Atlantic Capital since its inception

• Former Managing Director and Head of Wachovia Corporation’s International Corporate Finance Group

• Held numerous roles within Wachovia, including Executive Vice President and Head of the Global

Corporate Banking Division; Chief Risk Officer for all corporate, institutional, and wholesale banking

activities; Executive Vice President and Co-Head of Wachovia’s Capital Markets Division and Executive

Vice President and Head of Wachovia’s US Corporate Banking Division

• Chairman of the Community Depository Institutions Advisory Council (CDIAC) of the Federal Reserve

Bank of Atlanta and its representative to the CDIAC of the Federal Reserve Board of Governors

• Serves on the Boards of the Metro Atlanta Chamber of Commerce, the Georgia Chamber of Commerce,

and the YMCA of Metropolitan Atlanta and the High Museum of Art and is a Member of the Buckhead

Coalition

Michael Kramer

President,

Chief Operating Officer

58 • Chief Executive Officer and President of First Security since December and Chief Executive Officer of

FSGBank since 2011

• Former Managing Director of Ridley Capital Group

• Former Director, Chief Executive Officer and President of Ohio Legacy Corporation

• Former Chief Operating Officer and Chief Technology Officer of Integra Bank Corporation

• Serves on the Boards of Chattanooga Chamber of Commerce, Chattanooga United Way, The

Tennessee Bankers Association and the Chattanooga Young Life Committee

18

ACBI Historical Balance Sheet

19

June 30, March 31, December 31, June 30,

(in thousands, except share and per share data) 2016 2016 2015 2015

ASSETS

Cash and due from banks $ 40,309 $ 36,585 $ 45,848 $ 11,943

Interest-bearing deposits in banks 239,387 91,608 130,900 53,457

Other short-term investments 20,548 32,861 26,137 62,059

Cash and cash equivalents 300,244 161,054 202,885 127,459

Securities available-for-sale 328,370 364,422 346,221 140,716

Other investments 22,575 11,899 8,034 4,811

Loans held for sale 29,061 95,291 95,465 1,768

Loans held for investment 1,942,137 1,886,763 1,790,669 1,056,688

Less: allowance for loan losses (18,377) (17,608) (18,905) (11,985)

Loans held for investment, net 1,923,760 1,869,155 1,771,764 1,044,703

Branch premises held for sale – 7,200 7,200 –

Premises and equipment, net 21,770 22,780 23,145 3,345

Bank owned life insurance 61,378 60,981 60,608 30,252

Goodwill and intangible assets, net 31,674 33,914 35,232 1,055

Other real estate owned 951 1,760 1,982 27

Other assets 88,039 96,213 86,244 19,131

Total assets $ 2,807,822 $ 2,724,669 $ 2,638,780 $ 1,373,267

LIABILITIES AND SHAREHOLDERS' EQUITY

Deposits:

Noninterest-bearing demand $ 592,043 $ 560,363 $ 544,561 $ 327,775

Interest-bearing checking 231,091 215,176 232,868 115,614

Savings 30,839 29,788 28,922 437

Money market 913,094 862,120 875,441 546,408

Time 178,615 187,750 183,206 16,597

Brokered deposits 212,623 229,408 183,810 96,230

Deposits to be assumed in branch sale – 197,857 213,410 –

Total deposits 2,158,305 2,282,462 2,262,218 1,103,061

Federal funds purchased and securities sold under agreements to repurchase 14,047 11,824 11,931 30,000

Federal Home Loan Bank borrowings 240,000 60,000 – 85,349

Long-term debt 49,281 49,239 49,197 –

Other liabilities 42,123 26,491 27,442 8,372

Total liabilities 2,503,756 2,430,016 2,350,788 1,226,782

SHAREHOLDERS' EQUITY

Preferred stock, no par value; 10,000,000 shares authorized; no shares issued and

outstanding as of June 30, 2016, March 31, 2016, December 31, 2015 and June 30, 2015 – – – –

Common stock, no par value; 100,000,000 shares authorized;

24,750,163, 24,569,823, 24,425,546, and 13,562,125 shares issued and outstanding as of

June 30, 2016, March 31, 2016, December 31, 2015, and June 30, 2015, respectively 289,353 288,270 286,367 136,752

Retained earnings 11,219 6,073 3,141 9,076

Accumulated other comprehensive income (loss) 3,494 310 (1,516) 657

Total shareholders’ equity 304,066 294,653 287,992 146,485

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 2,807,822 $ 2,724,669 $ 2,638,780 $ 1,373,267

Atlantic Capital Bancshares, Inc.

Consolidated Balance Sheets (interim periods unaudited)

ACBI Historical Income Statement

($ in thousands)

20

Atlantic Capital Bancshares, Inc.

Consolidated Statements of Income (unaudited)

(in thousands except per share data)

June 30,

2016

March 31,

2016

December

31, 2015

September

30, 2015

June 30,

2015

June 30,

2016

June 30,

2015

INTEREST INCOME

Loans, including fees $ 20,282 $ 19,625 $ 16,688 $ 9,423 $ 9,500 $ 39,907 $ 18,451

Investment securities - available-for-sale 1,327 1,601 1,224 664 710 2,928 1,413

Interest and dividends on other interest‑earning assets 507 273 328 247 271 780 529

Total interest income 22,116 21,499 18,240 10,334 10,481 43,615 20,393

INTEREST EXPENSE

Interest on deposits 1,841 1,673 1,355 751 769 3,514 1,511

Interest on Federal Home Loan Bank advances 147 44 7 52 117 191 231

Interest on federal funds purchased and securities sold under

agreements to repurchase 87 67 10 20 25 154 49

Interest on long-term debt 832 810 841 17 – 1,642 –

Other – 38 79 – – 38 –

Total interest expense 2,907 2,632 2,292 840 911 5,539 1,791

NET INTEREST INCOME BEFORE PROVISION FOR LOAN LOSSES 19,209 18,867 15,948 9,494 9,570 38,076 18,602

Provision for loan losses 777 368 7,623 (137) 185 1,145 549

NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES 18,432 18,499 8,325 9,631 9,385 36,931 18,053

NONINTEREST INCOME

Service charges 1,392 1,498 1,265 521 501 2,890 827

Gains on sale of securities available-for-sale 11 33 – 10 – 44 –

Gains on sale of other assets 31 48 103 – – 79 –

Mortgage income 447 339 163 – – 786 –

Trust income 386 314 192 – – 700 –

Derivatives income 98 65 89 67 65 163 148

Bank owned life insurance 398 393 365 227 1,336 791 1,567

SBA lending activities 1,204 880 904 745 903 2,084 1,261

TriNet lending activities 761 383 – – – 1,144 –

Gains on sale of branches 3,885 – – – – 3,885 –

Other noninterest income 267 467 379 159 223 734 407

Total noninterest income 8,880 4,420 3,460 1,729 3,028 13,300 4,210

NONINTEREST EXPENSE

Salaries and employee benefits 10,420 10,555 9,661 4,859 4,836 20,975 9,578

Occupancy 1,274 1,100 907 419 423 2,374 844

Equipment and software 724 686 608 243 225 1,410 444

Professional services 760 748 1,020 208 273 1,508 382

Postage, printing and supplies 159 169 115 21 18 328 42

Communications and data processing 694 916 555 313 342 1,610 673

Marketing and business development 317 267 197 90 77 584 123

FDIC premiums 493 398 273 161 189 891 355

Merger and conversion costs 1,210 749 7,172 718 756 1,959 1,264

Amortization of intangibles 668 762 526 – – 1,430 –

Other noninterest expense 2,224 1,916 2,205 639 682 4,140 1,318

Total noninterest expense 18,943 18,266 23,239 7,671 7,821 37,209 15,023

INCOME (LOSS) BEFORE PROVISION FOR INCOME TAXES 8,369 4,653 (11,454) 3,689 4,592 13,022 7,240

Provision for income taxes 3,222 1,722 (3,293) 1,463 1,690 4,944 2,624

NET INCOME (LOSS) $ 5,147 $ 2,931 $ (8,161) $ 2,226 $ 2,902 $ 8,078 $ 4,616

Net income (loss) per common share‑basic $ 0.21 $ 0.12 $ (0.40) $ 0.16 $ 0.21 $ 0.33 $ 0.34

Net income (loss) per common share‑diluted $ 0.20 $ 0.12 $ (0.40) $ 0.16 $ 0.21 $ 0.32 $ 0.33

Weighted average shares - basic 24,644,755 24,485,900 20,494,895 13,562,125 13,552,820 24,565,328 13,509,441

Weighted average shares - diluted 25,158,694 24,993,597 21,004,577 13,904,395 13,895,090 25,082,968 13,846,975

Six months endedThree months ended

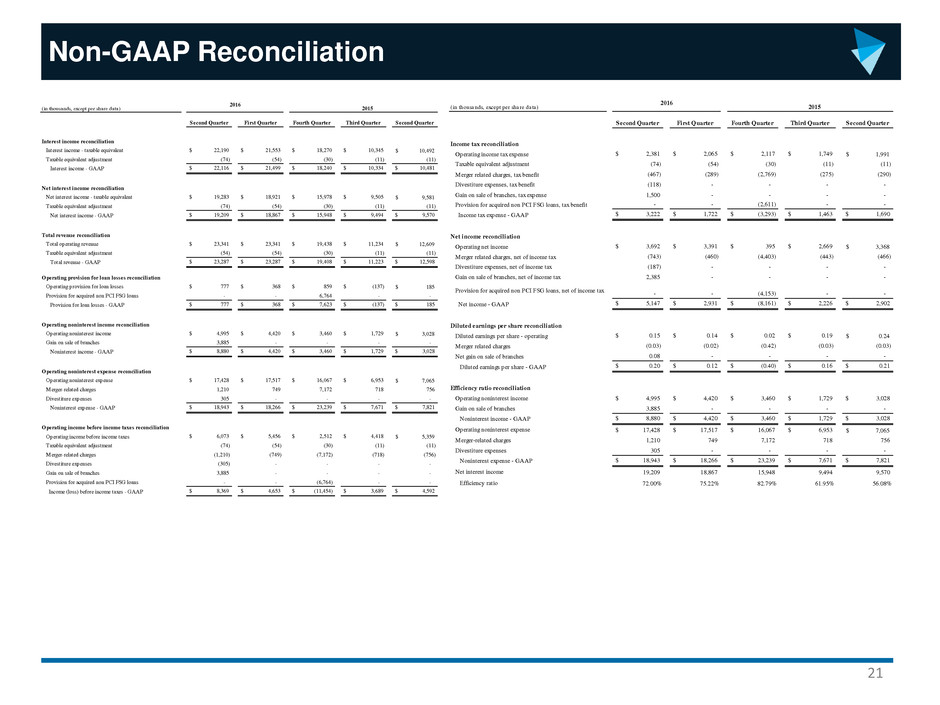

Non-GAAP Reconciliation

21

(in thousands, except per share data)

Second Quarter First Quarter Fourth Quarter Third Quarter Second Quarter

Interest income reconciliation

Interest income - taxable equivalent $ 22,190 $ 21,553 $ 18,270 $ 10,345 10,492$

Taxable equivalent adjustment (74) (54) (30) (11) (11)

Interest income - GAAP $ 22,116 $ 21,499 $ 18,240 $ 10,334 $ 10,481

Net interest income reconciliation

Net interest income - taxable equivalent $ 19,283 $ 18,921 $ 15,978 $ 9,505 9,581$

Taxable equivalent adjustment (74) (54) (30) (11) (11)

Net interest income - GAAP $ 19,209 $ 18,867 $ 15,948 $ 9,494 $ 9,570

Total revenue reconciliation

Total operating revenue $ 23,341 $ 23,341 $ 19,438 $ 11,234 12,609$

Taxable equivalent adjustment (54) (54) (30) (11) (11)

Total revenue - GAAP $ 23,287 $ 23,287 $ 19,408 $ 11,223 $ 12,598

Operating provision for loan losses reconciliation

Operating provision for loan losses $ 777 $ 368 $ 859 $ (137) 185$

Provision for acquired non PCI FSG loans - - 6,764 - -

Provision for loan losses - GAAP $ 777 $ 368 $ 7,623 $ (137) $ 185

Operating noninterest income reconciliation

Operating noninterest income $ 4,995 $ 4,420 $ 3,460 $ 1,729 3,028$

Gain on sale of branches 3,885 - - - -

Noninterest income - GAAP $ 8,880 $ 4,420 $ 3,460 $ 1,729 $ 3,028

Operating noninterest expense reconciliation

Operating noninterest expense $ 17,428 $ 17,517 $ 16,067 $ 6,953 7,065$

Merger-related charges 1,210 749 7,172 718 756

Divestiture expenses 305 - - - -

Noninterest expense - GAAP $ 18,943 $ 18,266 $ 23,239 $ 7,671 $ 7,821

Operating income before income taxes reconciliation

Operating income before income taxes $ 6,073 $ 5,456 $ 2,512 $ 4,418 5,359$

Taxable equivalent adjustment (74) (54) (30) (11) (11)

Merger-related charges (1,210) (749) (7,172) (718) (756)

Divestiture expenses (305) - - - -

Gain on sale of branches 3,885 - - - -

Provision for acquired non PCI FSG loans - - (6,764) - -

Income (loss) before income taxes - GAAP $ 8,369 $ 4,653 $ (11,454) $ 3,689 $ 4,592

2015

2016

(in thousands, except per share data)

Second Quarter First Quarter Fourth Quarter Third Quarter Second Quarter

Income tax reconciliation

Operating income tax expense $ 2,381 $ 2,065 $ 2,117 $ 1,749 1,991$

Taxable equivalent adjustment (74) (54) (30) (11) (11)

Merger related charges, tax benefit (467) (289) (2,769) (275) (290)

Divestiture expenses, tax benefit (118) - - - -

Gain on sale of branches, tax expense 1,500 - - - -

Provision for acquired non PCI FSG loans, tax benefit - - (2,611) - -

Income tax expense - GAAP $ 3,222 $ 1,722 $ (3,293) $ 1,463 $ 1,690

Net income reconciliation

Operating net income $ 3,692 $ 3,391 $ 395 $ 2,669 3,368$

Merger related charges, net of income tax (743) (460) (4,403) (443) (466)

Divestiture expenses, net of income tax (187) - - - -

Gain on sale of branches, net of income tax 2,385 - - - -

Provision for acquired non PCI FSG loans, net of income tax

- - (4,153) - -

Net income - GAAP $ 5,147 $ 2,931 $ (8,161) $ 2,226 $ 2,902

Diluted earnings per share reconciliation

Diluted earnings per share - operating $ 0.15 $ 0.14 $ 0.02 $ 0.19 0.24$

Merger related charges (0.03) (0.02) (0.42) (0.03) (0.03)

Net gain on sale of branches 0.08 - - - -

Diluted earnings per share - GAAP $ 0.20 $ 0.12 $ (0.40) $ 0.16 $ 0.21

Efficiency ratio reconciliation

Operating noninterest income $ 4,995 $ 4,420 $ 3,460 $ 1,729 $ 3,028

Gain on sale of branches 3,885 - - - -

Noninterest income - GAAP $ 8,880 $ 4,420 $ 3,460 $ 1,729 $ 3,028

Operating noninterest expense $ 17,428 $ 17,517 $ 16,067 $ 6,953 7,065$

Merger-related charges 1,210 749 7,172 718 756

Divestiture expenses 305 - - - -

Noninterest expense - GAAP $ 18,943 $ 18,266 $ 23,239 $ 7,671 $ 7,821

Net interest income 19,209 18,867 15,948 9,494 9,570

Efficiency ratio 72.00% 75.22% 82.79% 61.95% 56.08%

2015

2016