Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - LUMOS PHARMA, INC. | nlnk-20160729x8kxex991.htm |

| 8-K - 8-K - LUMOS PHARMA, INC. | nlnk-20160729x8k.htm |

NewLink Genetics Corporation

Nasdaq: NLNK

July 29, 2016

Second Quarter 2016 Financial Results

Agenda

2

Introduction

Jack Henneman, Executive Vice President & CFO

2016 Ongoing Priorities

Charles J. Link, Jr., M.D., Chairman, CEO & CSO

Clinical Updates

Nicholas N. Vahanian, M.D., President & CMO

Restructuring & Second Quarter 2016 Financial Results

Mr. Henneman

Cautionary Note Regarding

Forward-Looking Statements

This presentation contains forward-looking statements of NewLink Genetics that involve substantial

risks and uncertainties. All statements, other than statements of historical facts, contained in this

presentation are forward-looking statements, within the meaning of The Private Securities Litigation

Reform Act of 1995. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,”

“target,” “potential,” “will,” “could,” “should,” “seek” or the negative of these terms or other similar

expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain these identifying words. These forward-looking statements include, among

others, statements about NewLink Genetics’ financial guidance for 2016; results of its clinical trials

for product candidates; NewLink Genetics’ future financial performance, results of operations, cash

position and sufficiency of capital resources to fund its operating requirements; and any other

statements other than statements of historical fact. Actual results or events could differ materially

from the plans, intentions and expectations disclosed in the forward-looking statements that

NewLink Genetics makes due to a number of important factors, including those risks discussed in

“Risk Factors” and elsewhere in NewLink Genetics’ Annual Report on Form 10-K for the year

ended December 31, 2015 and other reports filed with the U.S. Securities and Exchange

Commission (SEC). The forward-looking statements in this presentation represent NewLink'

Genetics’ views as of the date of this presentation. NewLink Genetics anticipates that subsequent

events and developments will cause its views to change. However, while it may elect to update

these forward-looking statements at some point in the future, it specifically disclaims any obligation

to do so. You should, therefore, not rely on these forward-looking statements as representing

NewLink Genetics’ views as of any date subsequent to the date of this presentation.

NASDAQ: NLNK

3

4

Oncology Focused Pipeline

Two IDO pathway inhibitors in clinical development (indoximod and GDC-0919)

Research collaboration with Genentech for IDO and TDO inhibitors

Small molecule program focused on additional immuno-oncology targets

Strong Scientific and Business Leadership

Executing on vision to bring immunotherapies to patients

Strategic collaborations with Genentech/Roche and Merck

Strong cash position

Substantial Near-term News Flow

Multiple opportunities to validate IDO pathway inhibitor programs

Clinical updates on the indoximod program

Clinical advances from partnership with Genentech/Roche for GDC-0919

NewLink Genetics

Building a Leading Immuno-Oncology Company

5

Progress and accelerate the development of indoximod

Continue Genentech and Merck alliances

Advance PTEN and Zika

Evaluate external opportunities for pipeline expansion

Ongoing Priorities

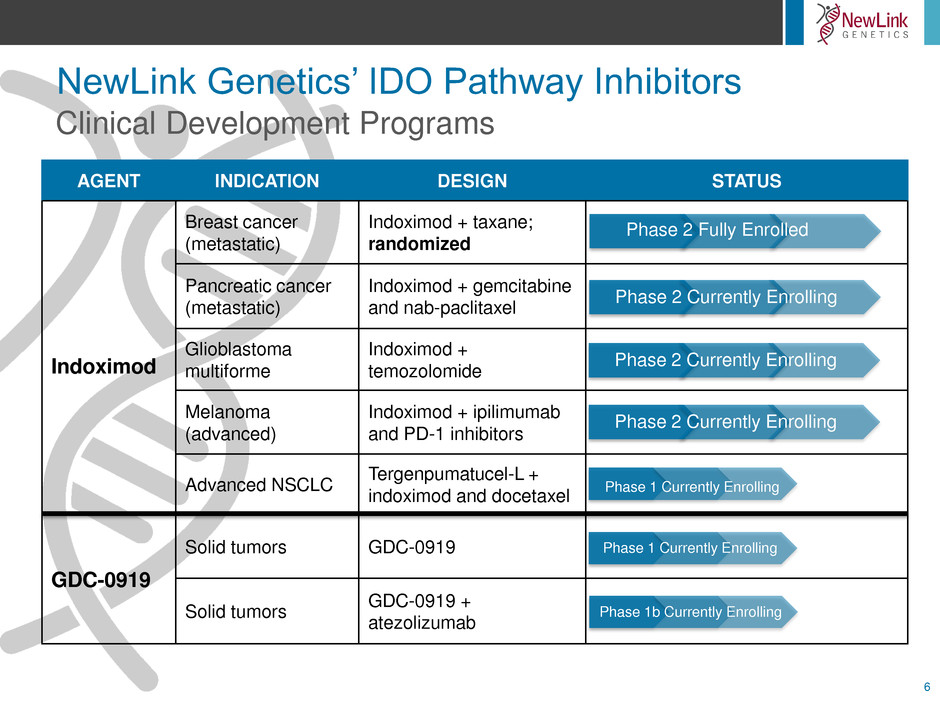

NewLink Genetics’ IDO Pathway Inhibitors

6

AGENT INDICATION DESIGN STATUS

Indoximod

Breast cancer

(metastatic)

Indoximod + taxane;

randomized

Pancreatic cancer

(metastatic)

Indoximod + gemcitabine

and nab-paclitaxel

Glioblastoma

multiforme

Indoximod +

temozolomide

Melanoma

(advanced)

Indoximod + ipilimumab

and PD-1 inhibitors

Advanced NSCLC

Tergenpumatucel-L +

indoximod and docetaxel

GDC-0919

Solid tumors GDC-0919

Solid tumors

GDC-0919 +

atezolizumab

Clinical Development Programs

Phase 2 Fully Enrolled

Phase 2 Currently Enrolling

Phase 2 Currently Enrolling

Phase 2 Currently Enrolling

Phase 1 Currently Enrolling

Phase 1 Currently Enrolling

Phase 1b Currently Enrolling

7

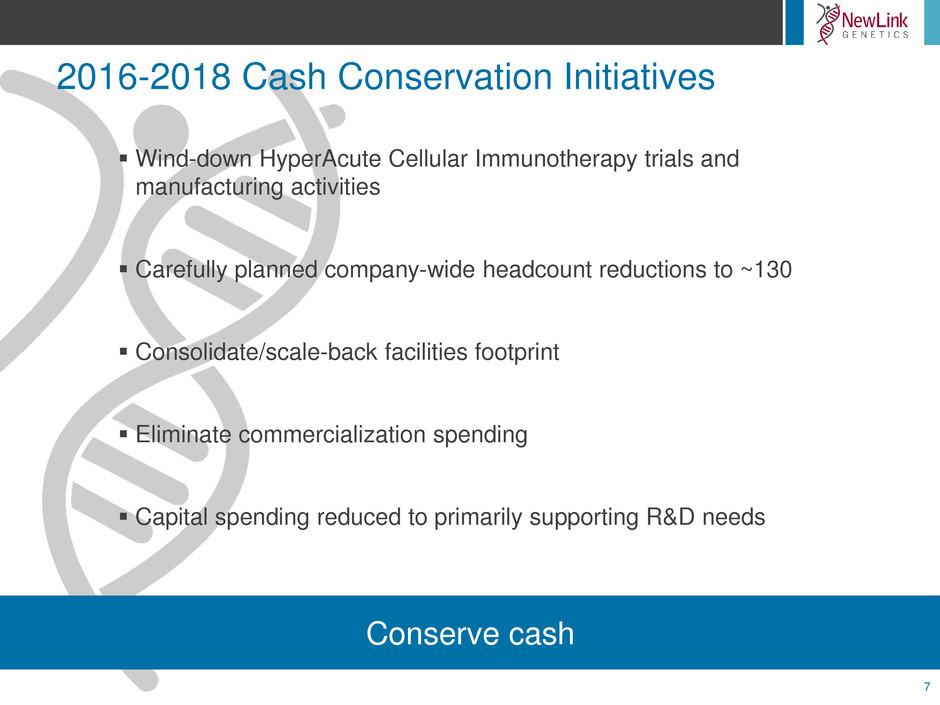

Conserve cash

Wind-down HyperAcute Cellular Immunotherapy trials and

manufacturing activities

Carefully planned company-wide headcount reductions to ~130

Consolidate/scale-back facilities footprint

Eliminate commercialization spending

Capital spending reduced to primarily supporting R&D needs

2016-2018 Cash Conservation Initiatives

8

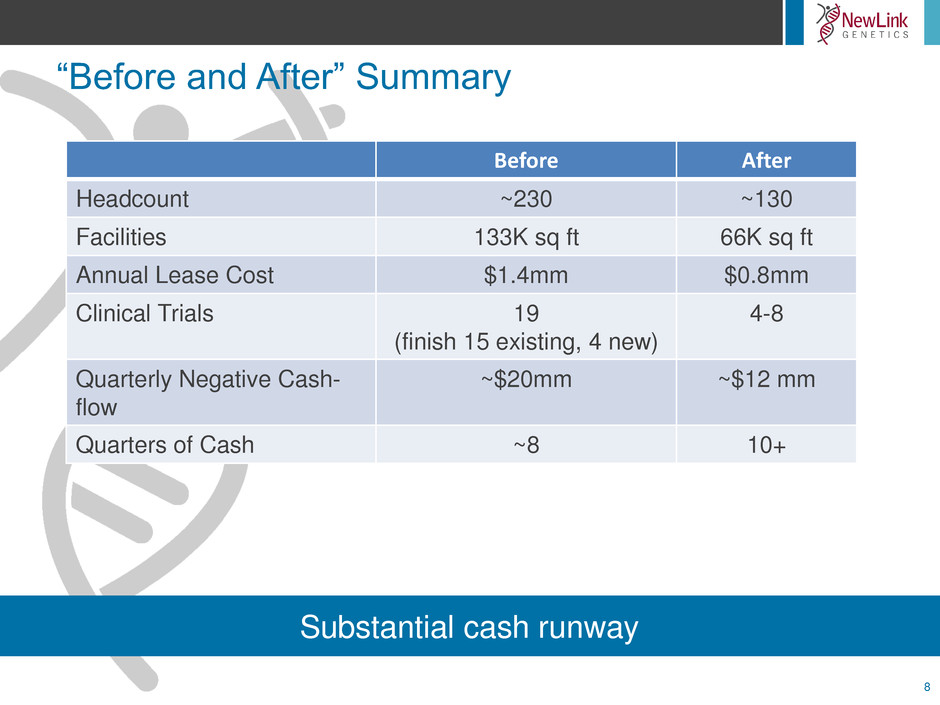

Substantial cash runway

Before After

Headcount ~230 ~130

Facilities 133K sq ft 66K sq ft

Annual Lease Cost $1.4mm $0.8mm

Clinical Trials 19

(finish 15 existing, 4 new)

4-8

Quarterly Negative Cash-

flow

~$20mm ~$12 mm

Quarters of Cash ~8 10+

“Before and After” Summary

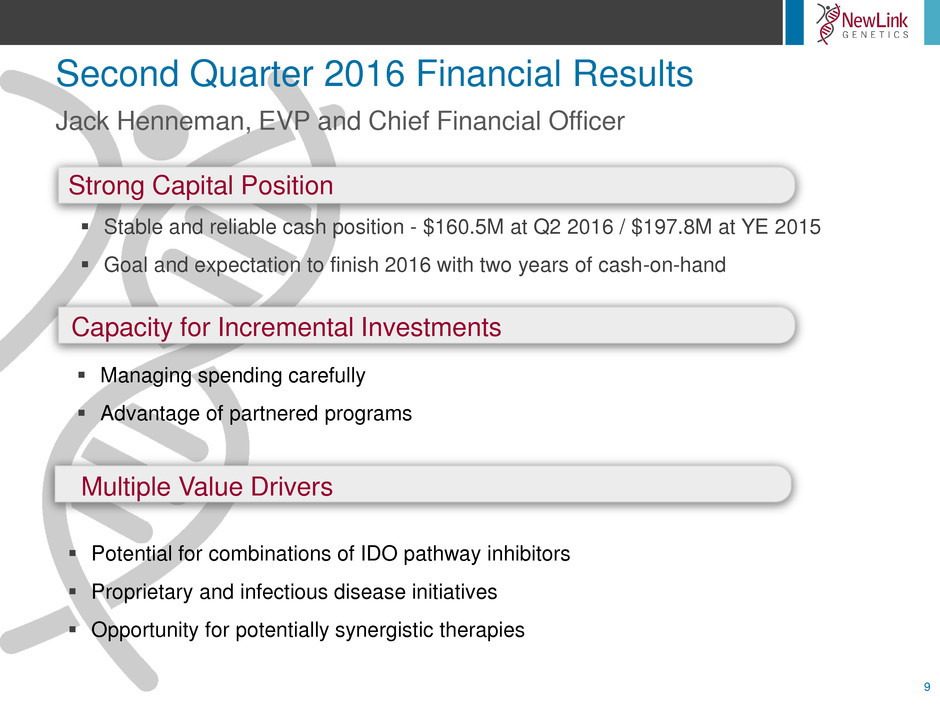

Second Quarter 2016 Financial Results

9

Jack Henneman, EVP and Chief Financial Officer

Strong Capital Position

Stable and reliable cash position - $160.5M at Q2 2016 / $197.8M at YE 2015

Goal and expectation to finish 2016 with two years of cash-on-hand

Multiple Value Drivers

Capacity for Incremental Investments

Managing spending carefully

Advantage of partnered programs

Potential for combinations of IDO pathway inhibitors

Proprietary and infectious disease initiatives

Opportunity for potentially synergistic therapies

10

Q & A