Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - LUMOS PHARMA, INC. | nlnk-20171231xex321.htm |

| EX-31.2 - EXHIBIT 31.2 - LUMOS PHARMA, INC. | nlnk-20171231xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - LUMOS PHARMA, INC. | nlnk-20171231xex311.htm |

| EX-23.1 - EXHIBIT 23.1 - LUMOS PHARMA, INC. | nlnk-20171231xex231.htm |

| EX-21.1 - EXHIBIT 21.1 - LUMOS PHARMA, INC. | nlnk-20171231xex211.htm |

| EX-10.61 - EXHIBIT 10.61 - LUMOS PHARMA, INC. | nlnk-20171231xex1061.htm |

| EX-10.48.1 - EXHIBIT 10.48.1 - LUMOS PHARMA, INC. | nlnk-20171231xex10481.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

For the fiscal year ended December 31, 2017.

o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

For the transition period from to .

Commission File Number

001-35342

NEWLINK GENETICS CORPORATION

(Exact name of Registrant as specified in Its Charter)

Delaware | 42-1491350 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2503 South Loop Drive

Ames, Iowa 50010

(515) 296-5555

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: | Common Stock, par value $0.01 | |

Name of each exchange on which registered: | The Nasdaq Global Market | |

Securities registered pursuant to Section 12(g) of the Act: | None | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer x | |

Non-accelerated filer o | Smaller reporting company o | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the common stock held by non-affiliates of the registrant based on the closing sale price of the registrant’s common stock on June 30, 2017, as reported by the NASDAQ Global Market, was $159,637,289. Shares of the registrant’s common stock beneficially owned by each executive officer and director of the registrant and by each person known by the registrant to beneficially own 10% or more of its outstanding common stock have been excluded, in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily conclusive.

As of March 2, 2018, there were 37,155,838 shares of the registrant’s Common Stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference to our definitive Proxy Statement for our 2018 Annual Meeting of Stockholders.

NewLink Genetics Corporation

Table of Contents

Page | |||

Part I | |||

Item 1. | |||

Item 1A. | |||

Item 1B. | |||

Item 2. | |||

Item 3. | |||

Item 4. | |||

Part II | |||

Item 5. | |||

Item 6. | |||

Item 7. | |||

Item 7A. | |||

Item 8. | |||

Item 9. | |||

Item 9A. | |||

Item 9B. | |||

Part III | |||

Item 10. | |||

Item 11. | |||

Item 12. | |||

Item 13. | |||

Item 14. | |||

Part IV | |||

Item 15. | |||

Item 16. | |||

Signatures | |||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and such statements are subject to the “safe harbor” created by those sections. Forward-looking statements involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this Annual Report on Form 10-K, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “contemplate,” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements regarding the following: our plans to develop and commercialize our product candidates; our ongoing and planned preclinical studies and clinical trials; the timing of release of the results of interim analyses or other data from ongoing clinical studies; the timing for completion of enrollment and outcomes of our ongoing clinical studies; the timing of and our ability to obtain and maintain regulatory approvals for our product candidates; the clinical utility of our product candidates; our plans to leverage our existing technologies to discover and develop additional product candidates; our ability to quickly and efficiently identify and develop product candidates; our commercialization, marketing and manufacturing capabilities and strategy; our intellectual property position; the potential benefits of strategic collaboration agreements and our ability to enter into strategic arrangements; our estimates regarding expenses, future revenues, capital requirements and needs for additional financing; and other risks and uncertainties, including those listed under the caption “Risk Factors.”

The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Annual Report on Form 10-K. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. These statements involve known and unknown risks and uncertainties that may cause our, or our industry's results, levels of activity, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to such differences include, among other things, those discussed under the captions “Business,” “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements not specifically described above also may be found in these and other sections of this report.

We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so, even if new information becomes available, except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report on Form 10-K.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. You are also advised to consult any further disclosures we make on related subjects in our Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K.

3

PART I

Item 1. | BUSINESS |

Overview

NewLink Genetics Corporation (the "Company", "NewLink", "we", "our" or "us") is a late clinical-stage immuno-oncology company focused on discovering and developing novel immunotherapeutic products for the treatment of patients with cancer. Our leading small-molecule product candidates currently in clinical development target the indoleamine-2, 3-dioxygenase, or IDO, pathway, which is one of the key pathways for cancer immune escape. These product candidates, indoximod, NLG802 (a prodrug of indoximod) and NLG919 (formerly navoximod or GDC-0919), are IDO pathway inhibitors with mechanisms of action that center around breaking the immune system’s tolerance to cancer.

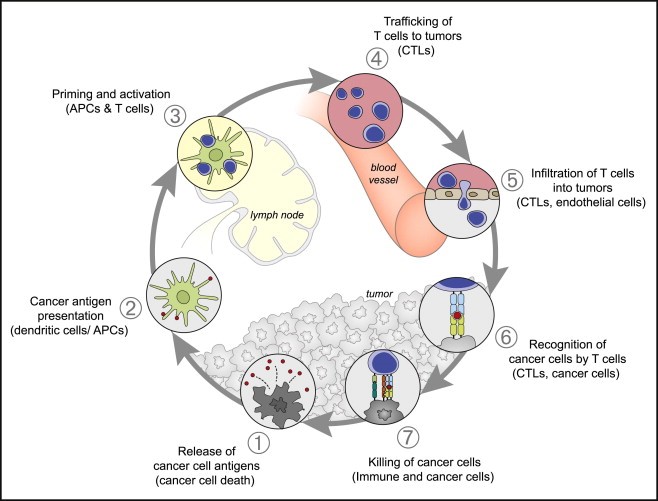

In cancer, the IDO pathway regulates immune response by suppressing T-cell activation, which enables cancer to avoid immune response. IDO is overexpressed in many cancers, both within tumor cells as a direct defense against T-cell attack, and also within antigen presenting cells in tumor-draining lymph nodes, thereby promoting peripheral tolerance to tumor associated antigens, or TAAs. When hijacked by developing cancers in this manner, the IDO pathway may facilitate the survival, growth, invasion and metastasis of malignant cells whose expression of TAAs might otherwise be recognized and attacked by the immune system.

The IDO pathway refers to a series of reactions initiated by IDO that result in the reduction of the amino acid tryptophan in the local tumor environment. We believe the local presence of tryptophan in adequate concentrations promotes antitumor T-cells, and the local reduction of tryptophan combined with the presence of the break-down product of tryptophan metabolism, kynurenine, is understood to suppress the activation of T-cells. Preclinical and, increasingly, clinical data suggest that IDO pathway inhibitors may also enhance the anti-tumor effects of other immunotherapies, chemotherapies and radiation when used as a combination therapy for patients with cancer.

We had a net loss of $72.0 million for the year ended December 31, 2017. We expect to continue to have losses for the foreseeable future as we advance our product candidates through late-stage clinical trials, pursue regulatory approval of our product candidates, and expand our commercialization activities in anticipation of one or more of our product candidates receiving marketing approval.

Founded in 1999 and headquartered in Ames, Iowa, and Austin, Texas, we have clinical, research and development staff dedicated to our pipeline of product candidates for patients with cancer and other diseases.

Our Strategy

Our strategy is to discover, develop and commercialize immunotherapeutic products for the treatment of patients with cancer where there are unmet needs with current therapies. The critical components of our business strategy in 2018 include:

• | Initiating randomization portion of Indigo301, a pivotal Phase 3 trial for patients with advanced melanoma, in the second of third quarter of 2018 |

• | Obtaining full Phase 2 results of indoximod plus checkpoint inhibitors in metastatic melanoma in the first half of 2018 |

• | Initiating Indigo201, a randomized Phase 2 trial for patients with metastatic pancreatic cancer, in the first half of 2018 |

• | Obtaining full Phase 2 results from the single-arm trial of indoximod plus gemcitabine nab-paclitaxel in metastatic pancreatic cancer in first half of 2018 |

• | Presenting two abstracts at the AACR Annual Meeting 2018, including data from a Phase 1 study of indoximod for pediatric patients with malignant brain tumors and data providing additional characterization of the differentiated mechanism of action of indoximod |

• | Continuing to evaluate indoximod in additional oncology indications |

4

IDO Pathway Inhibitors

We have a clinical development program focused on the IDO Pathway. Our small-molecule IDO pathway inhibitor product candidates currently in clinical development include indoximod, NLG802 and NLG919. Our product candidates are designed to counteract immunosuppressive effects of the IDO pathway, a fundamental mechanism regulating immune response. Indoximod and NLG919 are two distinct small molecules that target the IDO pathway through different mechanisms of action and therefore could represent two different clinical and commercial opportunities. Indoximod acts as a tryptophan mimetic, thereby signaling the activation of antitumor T-cells by the up regulation of mTOR, acts directly on T-cells, and modulates AhR-mediated effects. NLG919 and similar molecules of other companies seek to inhibit the IDO enzyme directly and thereby prevent the metabolism of tryptophan into kynurenine.

We have observed an encouraging safety profile for our IDO pathway inhibitors. They are also orally bioavailable and we believe they offer the potential to be synergistic with other therapies such as radiation, chemotherapy, vaccination and immunotherapies involving other checkpoint inhibitors such as anti-PD-1, anti-PD-L1 or anti-CLTA4. Clinical data suggests an increase in activity without adding significant toxicity.

Indoximod

Indoximod, our lead IDO pathway inhibitor, is currently in clinical development in combination with other cancer therapeutics for patients with melanoma, pancreatic cancer, pediatric brain tumors, and acute myeloid leukemia. We believe there may be additional opportunities to apply indoximod to a broader set of cancer indications. Indoximod has been studied in more than 700 patients to date and has been generally well-tolerated, including in combination with PD-1 checkpoint inhibitors, various chemotherapy agents and a cancer vaccine.

A U.S. patent covering salt and prodrug formulations of indoximod was issued to us on August 15, 2017 providing exclusivity until at least 2036. We are currently pursuing international patent coverage for these formulations.

In September 2017, we announced updated data from NLG2103 a Phase 2 clinical trial evaluating the addition of indoximod to the standard of care checkpoint inhibitors approved for patients with advanced melanoma (pembrolizumab, ipilimumab, or nivolumab). The interim data represent a cohort of 51 evaluable patients who received indoximod in combination with pembrolizumab. Evaluable patients were defined as those having at least one on-treatment imaging study. The primary outcome measure of the trial is objective response rate, or ORR, and secondary outcome measures include progression free survival, or

5

PFS, disease control rate, or DCR, and evaluation of safety and tolerability. The ORR was 61% (31/51) with a complete response of 20% (10/51) and a DCR of 80% (41/51). The PFS, by RECIST criteria was 56% at one year with median PFS, or mPFS, of 12.9 months. We expect to present the full data set for all the patients in this study plus checkpoint blockade in metastatic melanoma in the first half of 2018.

A summary of the results for those 51 patients for both periods is set forth in the table below. | |

Phase 2 Clinical Data n (%) | |

(data as of August 2017) | |

ORR | 31 (61) |

CR (complete response) | 10 (20) |

PR (partial response) | 21 (41) |

SD (stable disease) | 10 (20) |

DCR | 41 (80) |

PD (progressive disease) | 10 (20) |

mPFS | 12.9 months |

PFS at 12 months | 56% |

Indigo301, our pivotal Phase 3 clinical trial, is an investigation of indoximod in combination with a checkpoint inhibitor compared to the checkpoint inhibitor alone for patients with advanced unresectable or metastatic melanoma. Indigo301 has a 1:1 randomized, double blind, placebo controlled design. Participating investigators will be allowed to choose either of the U.S. Food and Drug Administration, or FDA, approved PD-1 checkpoint inhibitors, KEYTRUDA® (pembrolizumab) or OPDIVO® (nivolumab) and patients will then be randomized to receive indoximod or placebo in conjunction with the checkpoint inhibitor. The trial will have co-primary endpoints of progression free survival and overall survival. The planned enrollment is 624 patients. We intend to initiate the randomization portion of Indigo301 in the second or third quarter of 2018 and we expect to complete enrollment in 2019.

We plan to use our new salt formulation of indoximod in Indigo301. Clinical evaluation of the indoximod salt formulation is being addressed in ongoing trials. Initial data from these trials suggest that the tablets of indoximod salt, manufactured in accordance with the original specifications, achieved different exposure levels of indoximod in humans than we had anticipated. The exposure levels observed ranged from below to above the level typically observed with the standard clinical dose of indoximod freebase gel capsules. We have therefore made minor modifications, including a change to the specifications. We have accordingly extended the clinical evaluation to test the modified tablets in healthy volunteers. We expect the results of the evaluation of the new indoximod tablets within approximately 60 days of the filing of this Form 10-K, and those results will determine how quickly we can begin the pivotal portion of Indigo301. If results from these clinical trials raise meaningful concerns about the performance of the indoximod salt formulation, the time and expense required to initiate and complete our Indigo301 clinical trial would likely increase.

In addition, we have completed our own single-arm Phase 2 trial of indoximod plus chemotherapy in metastatic pancreatic cancer and expect to present the full data set in the first half of 2018. We also plan to initiate Indigo201, a randomized blinded Phase 2 trial of indoximod plus durvalumab plus chemotherapy in metastatic pancreatic cancer in collaboration with AstraZeneca.

NLG802

NLG802 is a prodrug of indoximod. NLG802 is intended to increase bioavailability and exposure to indoximod above the levels currently achievable by direct oral administration. We filed an Investigational New Drug application, or IND, with the FDA in the first quarter of 2017 and the first patient was dosed with NLG802 in a Phase 1 clinical trial in July 2017. The purpose of this Phase 1 trial is to assess preliminary safety and to determine the recommended dose for subsequent Phase 2 evaluations. NLG802 is a new chemical entity with patent coverage into 2036. We are also pursuing international patent coverage for NLG802.

NLG919

NLG919, a direct enzymatic inhibitor, was previously in clinical development as part of our collaboration with Genentech. In October 2014, we entered into an exclusive worldwide license and collaboration agreement with Genentech, or the Genentech

6

Agreement. The Genentech Agreement provided for the development and commercialization of NLG919. On June 6, 2017, we received a formal notice of Genentech’s intent to terminate the Genentech Agreement with respect to NLG919 and such termination was effective December 6, 2017. As part of the partial termination, worldwide rights to NLG919 reverted back to the Company and Genentech granted us a license under certain of Genentech’s intellectual property to develop and commercialize NLG919. We continue to explore the potential for further development and licensing opportunities.

In addition, under the Genentech Agreement, we conducted a two-year pre-clinical research program with Genentech to discover novel next generation IDO/tryptophan-2,3-dioxygenase, or TDO, inhibitors. The research program ended in November 2016, but our collaboration with Genentech continues with respect to next generation IDO/TDO inhibitors identified through the research program.

Additional Product Candidates

Additional clinical-stage product candidates in our pipeline include two product candidates that utilize our HyperAcute® Cellular Immunotherapy technology and two small molecules we acquired in 2017 from Daré Bioscience, Inc. (previously Cerulean Pharma Inc.). The HyperAcute Immunology candidates, tergenpumatucel-L and dorgenmeltucel-L, are in Phase 2 clinical trials for patients with advanced lung cancer and melanoma, respectively. We have substantially reduced our financial commitment for the HyperAcute Cellular Immunotherapy product candidates, and have no plans to conduct additional clinical trials. We also have two other small molecules, CRLX101 and CRLX301, being evaluated in early clinical development for patients with advanced solid malignancies. Additional clinical trials with the CRLX101 or CRLX301 product candidates are under consideration, pending the outcome of the current studies and the availability of resources.

Ebola Vaccine Candidate

In November 2014, we entered into an exclusive, worldwide license and collaboration agreement, or the Merck Agreement, with Merck to develop and potentially commercialize our rVSV∆G-ZEBOV GP vaccine product candidate and other aspects of our vaccine technology. The rVSV∆G-ZEBOV GP vaccine product candidate was originally developed by the Public Health Agency of Canada, or PHAC, and is designed to utilize the rVSV vector to induce immunity against Ebola virus when replacing the VSV glycoprotein with corresponding glycoproteins from filoviruses. Under the Merck Agreement, we received an upfront payment of $30.0 million in October 2014, and in February 2015 we received a milestone payment of $20.0 million. We have the potential to earn royalties on sales of the vaccine in certain countries, if the vaccine is approved and if Merck successfully commercializes it. rVSV∆G-ZEBOV GP is also eligible to receive a priority review voucher and we are entitled to a portion of the value of the voucher if it is granted. In addition to milestone payments from Merck, we were awarded contracts for development of the rVSV∆G-ZEBOV GP from the U.S. BioMedical Advanced Research & Development Authority, or BARDA, and the Defense Threat Reduction Agency, or DTRA, totaling $52.1 million during 2016 and $67.0 million during 2014 and 2015, in 2017 funds of $2.1 million were de-obligated from the DTRA grant awards. We have received total awards of $118.8 million.

Cancer Market Overview

Cancer is the second-leading cause of death in the United States; the American Cancer Society estimated that more than 600,000 deaths will occur in 2018 and almost 1.7 million new cancer cases are expected to be diagnosed in 2018. Despite a number of advances in the diagnosis and treatment of cancer over the past decade, overall five-year survival rates from all cancer types is 69% for the period spanning 2007-2013 according to the National Cancer Institute.

Cancer is characterized by abnormal cells that grow and proliferate, forming masses called tumors. Under certain circumstances, these proliferating cells can metastasize, or spread, throughout the body and produce deposits of tumor cells called metastases. As the tumors grow, they may cause tissue and organ failure and, ultimately, death. To be effective, cancer therapies must eliminate or control the growth of the cancer.

The specialized cells of the immune system recognize specific chemical structures called antigens. Generally, foreign antigens trigger an immune response that results in the removal of disease-causing agents from the body. Cancer cells, however, frequently display antigens that are also found on normal cells. The immune system may not be able to distinguish between tumors and normal cells and therefore may be unable to mount a strong anti-cancer response. Additionally, tumors often express abnormal proteins that could be recognized by the immune system. However, tumors also have various immune-suppressive defense mechanisms that may prevent the immune system from fully activating and recognizing these abnormal antigens.

Current therapies, such as surgery, radiation, hormone treatments and chemotherapy, do not directly address this immune-evasive characteristic of cancer and may not have the desired therapeutic effect. Active immunotherapies stimulate the immune

7

system, the body's natural mechanism for fighting disease, and may overcome some of the limitations of current standard-of-care cancer therapies.

Limitations of Current Cancer Therapies

We believe current cancer treatment alternatives suffer from a number of limitations that impair their effectiveness including:

• | Toxicity. Chemotherapeutic agents are highly toxic to the human body and often cause a variety of side effects, which may include nausea and vomiting, bleeding, anemia and mucositis. Targeted therapeutics may have fewer systemic toxicities, but still tend to have off-target effects such as gastrointestinal inflammation, severe skin reactions and breathing difficulties. These effects limit a patient's ability to tolerate treatment thereby depriving the patient of the potential benefit of additional treatments or treatment combinations that might otherwise destroy or prevent the growth of cancer cells. Once educated as to the limited efficacy, limited increased survival and potentially significant toxicity of existing treatment alternatives, patients diagnosed with terminal cancer often choose to limit or forego therapy in order to avoid further compromising their quality of life. Patients with advanced stage cancer often cannot tolerate cancer therapy, and certain therapies have been shown to hasten death in some cases as the patient's health deteriorates. |

• | Development of resistance. While many current therapeutic approaches may be effective against a particular target, the overall impact of these therapies on treating cancer is limited because the abundance and diversity of tumor cells are believed to enable cancers to adapt and become resistant to these treatments over time resulting in reduced longer-term efficacy. |

• | Short-term approach. Incremental survival benefit is the primary objective of many currently marketed and development-stage cancer therapeutics. In general, many drugs show modest impact on overall survival or only affect progression-free survival. Other than surgical tumor removal, curative intent is often not a focus or realistic potential outcome of many current cancer therapies. |

• | Immune system suppression. Cancer is difficult to treat in part because cancer cells use sophisticated strategies to evade the immune system. Cancer treatment often involves the introduction of an agent, such as a chemical, an antibody or radiation, which causes cell apoptosis (programmed cell death) or inhibit the proliferation of all cells, including immune cells, thereby indirectly suppressing the immune system. A weakened immune system not only further inhibits the body's natural ability to fight cancer, but also causes patients to become more susceptible to infections and other diseases. |

Grants and Contracts with the United States Government

Other than the upfront payments received in 2014 from Genentech and Merck, grants and contracts with the United States Government accounted for substantially all of our revenue in each of the last four fiscal years. In December 2014, BARDA awarded us a contract, as the prime contractor, in the amount of $30.0 million to support the manufacturing and development activities of our Ebola vaccine product candidate, including clinical development through a new 330-person Phase 1b clinical trial. In 2015, BARDA awarded us another $4.5 million under the base contract and exercised an $18.0 million option on our existing contract to support the scale-up of the manufacturing process related to our Ebola vaccine product candidate. In 2016, BARDA awarded us additional awards under the base contract of $24.5 million, for a total amount of $76.8 million received in awards. In October 2016, we announced that BARDA had issued us a new $24.8 million contract to support the advanced development of the investigational rVSV∆G-ZEBOV GP vaccine candidate, designated V920, designed to induce immunity against the Ebola Zaire virus. The new award includes an additional $51.0 million of contract options which may be exercised by BARDA. The new funding is in support of manufacturing facility readiness, manufacturing process qualification activities, and additional clinical trials to support regulatory approval of the V920 vaccine currently being led by our partner, Merck.

We have also received funding from the United States Department of Defense to support the development of contract manufacturing for the vaccine product candidate for clinical trials. We were awarded funds of $6.4 million from DTRA under the initial base contract and additions to this contract during 2014. In September 2015, DTRA awarded us another $8.1 million base contract with future options totaling $5.2 million to support various development activities of our Ebola vaccine product candidate. In March 2016, DTRA awarded us another $2.9 million base contract with future options totaling $6.3 million. In 2017 funds of $2.1 million were deobligated from the DTRA grant awards.

Manufacturing

We currently contract with manufacturing organizations to develop and manufacture the novel formulations for our

8

indoximod and NLG802 product candidates. We believe that many suppliers would be available for the production of these product candidates, if required. We currently have no plans to build our own manufacturing facility to support these product candidates.

Should we need additional supply of the NLG919 product candidate, we would be responsible for the manufacturing and would seek to contract with manufacturing organizations to develop and manufacture NLG919. We currently have no plans to build our own manufacturing facility to support this product candidate.

Merck has assumed responsibility for manufacturing the Ebola vaccine product candidate in accordance with the Merck Agreement.

Sales and Marketing

We currently own exclusive worldwide commercial rights to all our product candidates other than the Ebola vaccine candidate. We plan to build a commercial infrastructure to support any of these products, should they receive FDA or other applicable regulatory authorization. In addition, we may pursue collaborations or co-promotion arrangements with pharmaceutical and biotechnology companies to complement these efforts or for particular indications or in specific territories. We intend that our commercial infrastructure will be a fully integrated and highly experienced team, consisting of sales, marketing, medical affairs, market access and other positions necessary for a successful product launch.

Competition

The biopharmaceutical industry is highly competitive. Given the significant unmet patient need for new therapies, oncology is an area of focus for many public and private biopharmaceutical companies, public and private universities and research organizations actively engaged in the discovery and research and development of products for cancer. As a result, there are and will likely continue to be extensive research and substantial financial resources invested in the discovery and development of new oncology products. In addition, there are a number of multinational pharmaceutical companies and large biotechnology companies currently marketing or pursuing the development of products or product candidates targeting the same cancer indications as our product candidates.

Many of our competitors, either alone or with their strategic collaborators, have substantially greater financial, technical and human resources than we do and significantly greater experience in the discovery and development of drugs, obtaining FDA and other regulatory approvals, and the commercialization of those products. Accordingly, our competitors may be more successful in obtaining approval for drugs and achieving widespread market acceptance. Our competitors' drugs may be more effective, or more effectively marketed and sold, than any drug we may commercialize and may render our product candidates obsolete or non-competitive before we can recover the expenses of developing and commercializing any of our product candidates. We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available.

We also face competition from pharmaceutical and biotechnology companies, academic institutions, government agencies and private research organizations in recruiting and retaining highly qualified scientific personnel and consultants and developing and acquiring technologies, obtaining patent protection, and securing sufficient capital resources for the often lengthy period between technological conception and commercial sales. Moreover, technology controlled by third parties that may be advantageous to our business may be acquired or licensed by our competitors, thereby preventing us from obtaining technology on commercially reasonable terms, if at all. We will also compete for the services of third parties that may have already developed or acquired internal biotechnology capabilities or made commercial arrangements with other biopharmaceutical companies to target the diseases on which we have focused both inside and outside of the United States.

Immunotherapy Products for Cancer

The cancer immunotherapy landscape is broad but still in the early stages of development as compared to more established approaches like cytotoxic chemotherapy. Several immunotherapy products to treat cancer been approved in recent years. Multiple drugs classified as checkpoint inhibitors have been approved since 2011 targeting either CTLA-4, PD-1 or PDL-1 via antibody blockade. Additionally, there have been regulatory approvals for other immunotherapies in the classes of CAR-T and oncolytic virus. The indications for which these agents have been approved include some indications that we are pursuing or plan to pursue in our clinical development. Other indications in our clinical development plan, such as pancreatic cancer, malignant brain tumors and AML, do not currently have any FDA approved immunotherapies for immune checkpoint inhibitors.

We face intense competition in our development activities. We face competition from many companies in the United States and abroad, including a number of large pharmaceutical companies, firms specialized in the development and production of vaccines, checkpoint inhibitors, and other immunotherapies, and major universities and research institutions. Competitors in

9

our lead indoximod indication for patients with unresectable or metastatic melanoma include: Bristol Myers Squibb Company, Merck, Genentech Inc., and Incyte Corporation, each of which is conducting or is awaiting results from Phase 3 clinical trials in this indication. Many companies are developing or commercializing products in areas that we have targeted for product development. Some of these products use therapeutic approaches that may compete directly with our product candidates. Most of our competitors possess substantially greater financial, technical and human resources than we possess. In addition, many of our competitors have significantly greater experience than we have in conducting preclinical and nonclinical testing and human clinical trials of product candidates, scaling up manufacturing operations and obtaining regulatory approvals of drugs and manufacturing facilities. We are also facing increasing competition in enrolling patients in our clinical trials. Accordingly, our competitors may succeed in obtaining regulatory approval for drugs more rapidly than we do. If we obtain regulatory approval and launch commercial sales of our product candidates, we also will compete with respect to manufacturing efficiency and sales and marketing capabilities, areas in which we currently have limited experience.

Strategic Collaborations

AstraZeneca Collaboration

On September 25, 2017, we entered into a clinical collaboration agreement with AstraZeneca to evaluate the combination of indoximod and durvalumab, AstraZeneca's anti-PD-L1 monoclonal antibody, along with standard of care chemotherapy for patients with metastatic pancreatic cancer. We and AstraZeneca have agreed to initiate a randomized, placebo-controlled, Phase 2 clinical trial with the primary objective to evaluate the efficacy and safety of the immuno-oncology-based indoximod/durvalumab combination compared to gemcitabine/ABRAXANE alone. Some patients will be enrolled into a smaller cohort evaluating the combination of durvalumab with gemcitabine/ABRAXANE. From the date of our agreement with AstraZeneca and for 90 days after the completion of such combination study, we may not conduct a clinical trial involving the combination of indoximod and any compound that targets PD-1 or PD-L1 (other than durvalumab) for the metastatic pancreatic cancer indication, and AstraZeneca may not conduct a clinical trial involving the combination of durvalumab and any IDO pathway inhibitor (other than indoximod) for the metastatic pancreatic cancer indication.

Indigo201, the Phase 2 clinical trial, will be funded equally by both companies, with us serving as the study sponsor. Our share of the aggregate expense of the trial is not expected to have a material effect on our financial position. We expect to begin enrolling patients in the first half of 2018.

The market opportunity for the treatment of pancreatic cancer is substantial. Approximately 55,000 new cases of pancreatic cancer in the United States will be diagnosed in 2018 according to the American Cancer Society, and a little over 44,000 people will die of the disease this year. Pancreatic cancer is difficult to detect in its early stages and approximately 52% of all pancreatic cancers are metastatic, or advanced, in nature and are associated with a poor prognosis. The 5-year survival rate for pancreatic cancer overall is only 8%, and drops to a low of 3% for individuals whose pancreatic cancer has metastasized to distant regions of the body.

Genentech Agreement

In October 2014, we entered into the Genentech Agreement for the development and commercialization of NLG919, our clinical stage IDO pathway inhibitor, and a research collaboration for the discovery of next generation IDO/TDO inhibitors to be developed and commercialized under the Genentech Agreement. Under the terms of the Genentech Agreement, we received an upfront non-refundable payment of $150.0 million in 2014 and funding for our participation in the research collaboration, which ended in November 2016.

On June 6, 2017, we received a formal notice of Genentech’s intent to terminate the Genentech Agreement with respect to NLG919. The agreement was terminated in part on December 6, 2017 and the rights to NLG919 reverted back to the Company. As part of the partial termination, Genentech granted to us an exclusive license under certain intellectual property of Genentech, to develop and commercialize NLG919, and we are obligated to pay to Genentech a royalty on future net sales of NLG919 in the low single digits.

Our collaboration with Genentech continues with respect to next generation IDO/TDO inhibitors identified through the research program.

Genentech retains the exclusive, sublicensable, royalty-bearing license that we granted to it, under certain of our patents and know-how, to develop and commercialize next generation IDO/TDO inhibitors, and we remain committed to work exclusively with Genentech with respect to IDO/TDO compounds, other than indoximod and NLG919, for a specified number of years.

10

Genentech would be responsible for and would fund development, manufacturing and commercialization of any next generation IDO/TDO compounds that it elects to pursue. We have retained the option under the Genentech Agreement to co-promote next generation IDO/TDO products with Genentech in the United States, subject to certain conditions, if and when such products are approved for sale. We would be eligible to receive milestone payments of up to $561.0 million upon achieving certain development, regulatory, and sales-based milestones with respect to any next generation IDO/TDO inhibitor products. We retain the right to exercise an option to co-promote any products for the U.S. market and we are also eligible to receive escalating royalty payments on potential commercial sales of products by Genentech.

We have retained all rights to indoximod, our proprietary IDO pathway inhibitor and reformulations or prodrugs related to indoximod, including the ability to develop, commercialize, license and divest indoximod in our discretion.

Unless earlier terminated, the Genentech Agreement will continue in effect for as long as Genentech has payment obligations to us. Each party may terminate the Genentech Agreement for the other party’s uncured material breach or the other party’s bankruptcy or insolvency. Genentech may terminate the Genentech Agreement for convenience upon 180 days written notice.

Merck Agreement

In November 2014, we entered into the Merck Agreement to research, develop and potentially commercialize our Ebola vaccine product candidate and certain other aspects of our vaccine technology. The Ebola vaccine product candidate was originally developed by PHAC. Under the Merck Agreement, we received an upfront payment of $30.0 million in 2014 and a milestone payment of $20.0 million in 2015, and we have the potential to earn royalties on sales of the vaccine in certain countries, if the vaccine is approved and if Merck successfully commercializes it. In July 2015, we announced that the international partnership studying the rVSV∆G-ZEBOV GP (Ebola) vaccine candidate in Guinea released interim data suggesting that it is effective in the prevention of Ebola in a large Phase 3 clinical trial. The rVSV∆G-ZEBOV GP product candidate will continue to be studied in clinical trials. In February 2017 the final report from the trial confirmed that rVSV∆G-ZEBOV GP offers substantial protection against Ebola virus disease, with no cases among vaccinated individuals without the infection from day 10 after vaccination in both randomized and non-randomized clusters.

Under the terms of the Merck Agreement, Merck is granted the exclusive rights to the Ebola vaccine product candidate. The Ebola vaccine product candidate is under a licensing arrangement with BioProtection Systems Corporation, or BPS, our wholly owned subsidiary and a licensee of PHAC. Under these license arrangements, PHAC retains non-commercial rights pertaining to the vaccine candidate. The Merck Agreement was amended on December 5, 2017 in connection with our entry into an amended and restated PHAC license on December 5, 2017. The amended Merck Agreement absolves BPS from any future obligation to negotiate or amend the terms of the PHAC license, converts the scope of Merck's sublicense under PHAC’s intellectual property rights to be non-exclusive in the Ebola Sudan field of use, and requires Merck to reimburse us in certain circumstances where we may be obligated to pay royalties to PHAC as a result of Merck’s product sales but Merck would not otherwise be obligated to pay a royalty to us.

Unless earlier terminated, the Merck Agreement will continue in effect for as long as Merck has royalty payment obligations to us. Merck may terminate the Merck Agreement for convenience upon a specified period of notice or for certain safety reasons with immediate effect. In the event of Merck’s uncured material breach of its obligations under the Merck Agreement with respect to a particular product, we may terminate the Merck Agreement with respect to that product. We may also terminate the Merck Agreement with respect to certain products in the event Merck pursues an alternate product under certain circumstances. Each party may terminate the Merck Agreement for the other party’s bankruptcy or insolvency.

Intellectual Property

We believe that patent protection and trade secret protection are important to our business and that our future success will depend, in part, on our ability to maintain our technology licenses, maintain trade secret protection, obtain and maintain patents and operate without infringing the proprietary rights of others both in the United States and abroad. We believe that obtaining identical patents and protection periods for a given technology throughout all markets of the world will be difficult because of differences in patent laws. In addition, the protection provided by non-U.S. patents, if any, may be weaker than that provided by U.S. patents. We have established and continue to build proprietary positions for our IDO pathway inhibitor technology and our HyperAcute technology in the United States and abroad. As of December 31, 2017, our patent portfolio included nineteen patent families relating to our IDO pathway inhibitor technology and five patent families relating to our HyperAcute technology.

Our IDO pathway inhibitor technology patent portfolio contains several key U.S. patent families that protect indoximod, NLG802, and NLG919. A series of patents covering indoximod were exclusively licensed from Augusta University Research

11

Institute, formerly known as Georgia Regents Research Institute, Georgia Health Sciences University Research Institute, Inc. and the Medical College of Georgia Research Institute. The first patent family contains six issued U.S. patents expiring in 2018, 2019 and 2021. This family contains patents having claims to pharmaceutical compositions of 1-methyl-tryptophan (US 8,198,265), methods of increasing T-cell activation (US 6,451,840) and methods of augmenting rejection of tumor cells (US 6,482,416) by administering an IDO inhibitor. The second patent family contains four issued U.S. patents directed to pharmaceutical compositions of indoximod (US 8,232,313, expires in 2024) and to methods of using indoximod to treat cancer (US 7,598,287, US 8,580,844 and 9,463,239 expires in 2027, 2025, and 2024, respectively). In addition, we have a granted US patent (US 9,732,035) and worldwide pending patent applications covering indoximod prodrugs and novel formulations of indoximod (PCT/US2016/035391). We do not currently have any granted non-U.S. patents covering indoximod prodrugs and novel formulations of indoximod, and we cannot assure that we will be able to secure any such patents.

We believe that significant barriers to entry in the IDO space are provided by three key patent families covering compositions of matter and methods of use of different classes of IDO inhibitor compounds, and are fully owned by us: 1) PCT/US2008/085167 with granted applications in Europe (EP2227233), China, Japan, Canada, and Hong Kong; 2) PCT/US2010/054289, with granted patents in the US (8,722,720), Europe (EP2493862) and Canada (CA2778115); and 3) PCT/US2012/033245, which covers the IDO inhibitor compound NLG919, currently in clinical development. The national counterparts of the third family provide protection at least until 2032, not counting any patent term adjustment in the United States. This patent has been granted in the United States, Europe, Australia, China, Israel, Japan, Mexico and New Zealand with multiple applications pending in other countries. Additional barriers to entry are provided through exclusive licenses with Lankenau Institute for Medical Research, or LIMR, and various NewLink-owned inventions, in which we are pursuing patent protection for specific combination therapies targeting the IDO pathway, as well as protection for novel families of inhibitor compounds and second generation products. Four patent families that cover different classes of IDO inhibitor compounds and methods of treatment of cancer have been licensed from LIMR and are represented by several international pending cases and the issued patents US 7,714,139, US 8,476,454, CA 2520586, US 7,705,022, US 8,008,281, JP 4921965, CN ZL200480014321.1, CA 2520172, US 8,383,613, US 8,389,568. An additional patent family co-owned by us and LIMR covers compositions and methods of use of another family of IDO inhibitor compounds (PCT/US2009/041609, with issued patents US 8,748,469, US9174942, Canada 2722159, China 102083429, and pending applications in Europe and Japan).

There is one principal family of patents and patent applications relating to our HyperAcute product candidates and HyperAcute technology. That patent family is exclusively licensed from Central Iowa Health System and includes two pending patent applications and 25 registered U.S. and foreign patents related to the HyperAcute technology. This patent family provides basic composition of matter patent protection and methods of manufacturing and use of such compositions extending until 2024 and has already resulted in granted patents in U.S. (US 7,763,461, US 8,551,474, US 8,535,658, US 9,474,801, US 9,474,771), Europe (EP 1549353 B1), Mexico (278681), Japan (4966496) and Canada (2501744), all covering pharmaceutical compositions for inhibiting pre-established tumor growth comprising attenuated allogeneic tumor cells modified with alpha-Gal. Similar composition claims as well as methods of use for treating pre-established tumors are currently being further pursued in the U.S. and China.

We exclusively license from Central Iowa Health System or own several other patents relating to alpha-Gal technology, which we believe provide additional barriers to entry in the space occupied by our HyperAcute technology. Additional coverage include five applications issued in the United States (US Patents No. 7,998,486, 8,357,777, 8,916,169, 9,090,643 and 9,512,158) and Europe (EP2089051) covering isolated tumor antigens comprising alpha-Gal residues. The issued United States and European patents expire between 2027 and 2029. Additional patent applications have been filed covering the use of carbohydrate-modified glycoproteins (PCT/US2014/025702) and correlates of efficacy to tumor vaccine (PCT/US2014/038231).

In order to protect the confidentiality of our technology, including trade secrets and know-how and other proprietary technical and business information, we require all of our employees, consultants, advisors and collaborators to enter into confidentiality agreements that prohibit the use or disclosure of confidential information. The agreements also oblige our employees, consultants, advisors and collaborators to assign or license to us ideas, developments, discoveries and inventions made by such persons in connection with their work with us. We cannot be sure that these agreements will maintain confidentiality, will prevent disclosure, or will protect our proprietary information or intellectual property, or that others will not independently develop substantially equivalent proprietary information or intellectual property.

The pharmaceutical industry is highly competitive and patents have been applied for by, and issued to, other parties relating to products or new technologies that may be competitive with those being developed by us. Therefore, any of our product candidates may give rise to claims that it infringes the patents or proprietary rights of other parties now or in the future. Furthermore, to the extent that we, our consultants, or manufacturing and research collaborators, use intellectual property owned by others in work performed for us, disputes may also arise as to the rights to such intellectual property or in related or resulting know-how and inventions. An adverse claim could subject us to significant liabilities to such other parties and/or require disputed rights to

12

be licensed from such other parties. A license required under any such patents or proprietary rights may not be available to us, or may not be available on acceptable terms. If we do not obtain such licenses, we may encounter delays in product market introductions, or may find that we are prevented from the development, manufacture or sale of products requiring such licenses. In addition, we could incur substantial costs in defending ourselves in legal proceedings instituted before patent and trademark offices in the United States, the European Union, or other ex-U.S. territories, or in a suit brought against us by a private party based on such patents or proprietary rights, or in a suit by us asserting our patent or proprietary rights against another party, even if the outcome is not adverse to us.

Licensing Agreements

IDO Pathway Inhibitor Technology

The following licensing agreement covers technologies and intellectual property rights related to our IDO pathway inhibitor technology and product candidates:

Augusta University Research Institute License Agreement

We are a party to a License Agreement dated September 13, 2005, or the AURI IDO Agreement, with Augusta University Research Institute, or AURI, which was formerly known as Georgia Regents Research Institute, the Georgia Health Sciences University Research Institute, Inc. and the Medical College of Georgia Research Institute. The AURI IDO Agreement was amended on March 28, 2006, April 27, 2006, February 13, 2007, July 12, 2013, July 10, 2014, and March 15, 2016. The AURI IDO Agreement grants us, including our affiliates, an exclusive, worldwide license, under specified AURI patent rights and related technology to make, use, import, sell and offer for sale products that are covered by licensed patent rights or incorporates or uses licensed technology in all medical applications.

Our license from AURI is subject to AURI's retained right to use, and to permit its academic research collaborators to use, such AURI patent rights and technology for research and educational purposes. In addition, the license is subject to certain rights of and obligations to the U.S. government under applicable law, to the extent that such intellectual property was created using funding provided by a U.S. federal agency. We may grant sublicenses under such license, subject to the prior approval of AURI, not to be unreasonably withheld or delayed.

In consideration of such license grant, we are obligated to pay to AURI specified license fees (including issuing shares of our common stock), annual license maintenance fees, reimbursement of patent prosecution costs, potential milestone payments in an aggregate amount up to approximately $2.8 million per licensed product (which, as a result of the March 15, 2016 amendment, includes certain prodrugs of indoximod), and royalties as a single-digit percentage of net sales of the licensed products, subject to minimum royalty payments and royalty rates depending on the type of license product. In addition, if we grant a sublicense under the license granted by AURI, we must pay to AURI a percentage of the consideration we receive from the sublicensee. We made a milestone payment of $1.0 million in connection with the March 15, 2016 amendment the AURI IDO Agreement.

If we fail to develop the licensed products in a non-cancer field, specifically infectious disease or diagnostics, AURI may convert our license in such field to a non-exclusive license.

Unless terminated earlier, the AURI IDO Agreement will remain in effect until the expiration of the last licensed AURI patents. Pending the status of certain patent applications and the payment of appropriate maintenance, renewal, annuity or other governmental fees, we expect the last patent will expire under this agreement in 2027, excluding any patent term adjustments or patent term extensions or additional patents issued that are included under the license. AURI may terminate this agreement for our uncured material breach, bankruptcy or similar proceedings. We may terminate this agreement for AURI’s uncured material breach or upon written notice to AURI. For a period of one year following the termination of the agreement, we may sell our licensed products that are fully manufactured and part of our normal inventory at the date of termination. We have the right to assign the AURI Agreement to our affiliates or in connection with the transfer of all or substantially all of our assets relating to the agreement, but any other assignment requires the prior written consent of AURI.

The PTEN Drug Discovery Program

The following licensing agreement covers technologies and intellectual property rights for our PTEN drug discovery program:

Augusta University Research Institute License Agreement (PTEN)

We have a License Agreement with AURI dated March 15, 2016, or the AURI PTEN License Agreement, pursuant to which AURI granted us an exclusive, worldwide, sublicensable license, under specified AURI patents and related technology, to

13

make, use, import, sell and offer for sale, in the cancer field, PTEN inhibitor products, or royalty-bearing products, that are covered by licensed patents or certain of our patents or that were researched or developed using licensed technology.

We notified AURI of our intent to terminate this license in February 2018 and the license will terminate in March 2018. Under the terms of the AURI PTEN License Agreement, we paid an upfront payment to AURI of $1.0 million in 2016 and were obligated to pay AURI potential milestone payments in an aggregate amount up to approximately $4.3 million and royalties at a single-digit or less percentage of net sales of royalty-bearing products. Our obligation to pay milestones and royalties will not terminate upon the termination of the AURI PTEN License Agreement and will continue on a country-by-country and product-by-product basis until the later of (a) expiration of the last valid claim of our patents covering such royalty-bearing product in such country and (b) 10 years after the first commercial sale of such product in such country. We do not anticipate incurring any future payment obligations because we are no longer pursuing the development of PTEN inhibitor products.

Concurrent with the termination notice for the AURI PTEN License Agreement, we also notified AURI that we would not renew the Research Services Agreement with AURI, or the AURI PTEN Research Services Agreement, which was signed concurrently with the AURI PTEN License Agreement and is set to expire in March 2018. Under this agreement, AURI performed certain research services directed to PTEN inhibitors as agreed by the parties during the term of the agreement in exchange for mutually agreed compensation. We own all data and results generated by AURI under the AURI PTEN Research Services Agreement, and AURI owns all other know-how and patents arising from its work under the AURI PTEN Research Services Agreement. Except for terms intended to survive past expiration, we have no further obligations to AURI under the AURI PTEN Research Services Agreement.

Vaccines for the Biodefense Field

The following licensing agreement to which BPS is a party covers technology and intellectual property rights applicable to BPS’s development of vaccines for the biodefense field:

Public Health Agency of Canada License Agreement

BPS is a party to a license agreement with PHAC, dated May 4, 2010, which was amended and restated on December 5, 2017, or the PHAC License. Under the terms of the PHAC License, BPS has a worldwide, personal, non-transferable, sole, revocable, royalty-bearing license under specified patent rights and know-how, for the development and commercialization of products directed to the prevention, prophylaxis and treatment of Ebola (Zaire), a rVSV based on viral hemorrhagic fever, or VHF virus, and a worldwide, personal, non-transferable, non-exclusive, revocable, royalty-bearing license, under specified patent rights and know-how, for the development and commercialization of products directed to the prevention, prophylaxis and treatment of Ebola (Sudan), a VHF virus. The license granted to BPS is subject to Canada’s retained rights to use the licensed patent rights and technology to improve the patent rights, carry out educational purposes, and for the development of the patent rights where BPS cannot obtain regulatory approval or meet demand. BPS may also grant sublicenses under the PHAC License, provided that each sublicense is consistent with the terms and conditions of the PHAC License and contain certain mandatory sublicensing provisions.

We granted a sublicense under the PHAC License to Merck in November 2014 when we entered into a license and collaboration agreement with Merck to develop and potentially commercialize our Ebola vaccine product candidate. The PHAC License provides express consent for Merck to sublicense or subcontract its sublicensed rights under certain circumstances.

In consideration of the license grants, under the terms of the PHAC License, BPS must pay to Canada annual license maintenance fees, patent prosecution costs, potential milestone payments in an aggregate amount up to approximately C$475,000, and royalties as a low single-digit percentage of the sales price of the licensed products sold by BPS, its affiliates or sublicensees in countries outside of Africa and GAVI eligible countries, which royalty rate varies depending on whether additional technology licenses are required to sell the licensed product, and whether the licensed product is covered by a valid claim of a patent licensed under the PHAC License. In addition to the milestones and royalties discussed above, BPS is required to pay to Canada a percentage in the low double digits of certain consideration BPS receives from Merck or any other sublicensee over specified thresholds. BPS is obligated to use commercially reasonable efforts to develop and market the licensed products. If BPS breaches its obligations and fails to cure the breach, PHAC may terminate the PHAC License.

In November 2014, we entered into a licenses and collaboration agreement with Merck to develop and potentially commercialize our Ebola vaccine product candidate. The Merck Agreement includes a sublicense of the patents subject to the PHAC License.

Unless terminated earlier, the PHAC License will remain in effect until the earlier of (i) July 28, 2033; or (ii) such time that BPS and its sublicensees cease all development and commercialization of the technologies that are licensed to the Company under the PHAC License. Canada may terminate this agreement for BPS's failure to use commercially reasonable efforts to

14

commercialize, failure to pay, breach of confidentiality, cessation of business, criminal conviction or other breach of its obligations under the agreement. BPS may not assign the PHAC License to a third party without the prior written consent of Canada, not to be unreasonably withheld. This agreement will terminate automatically if BPS files for bankruptcy or similar proceedings or if BPS assigns the PHAC License under certain circumstances without prior written consent of Canada.

Government Regulation

We operate in a highly regulated industry that is subject to significant federal, state, local and foreign regulation. Our present and future business has been, and will continue to be, subject to a variety of laws including, the Federal Food, Drug, and Cosmetic Act, or FDC Act, and the Public Health Service Act, among others.

The FDC Act and other federal and state statutes and regulations govern the testing, manufacture, safety, effectiveness, labeling, storage, record keeping, approval, advertising and promotion of our products. As a result of these laws and regulations, product development and product approval processes are very expensive and time consuming.

FDA Approval Process

In the United States, pharmaceutical products, including biologics, are subject to extensive regulation by the FDA. The FDC Act and other federal and state statutes and regulations govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling, and import and export of pharmaceutical products. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending new drug applications, or NDAs, or biologic license applications, or BLAs, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution.

Pharmaceutical product development in the U.S. typically involves preclinical laboratory and animal tests, the submission to the FDA of an investigational new drug application, or IND, which must become effective before clinical testing may commence, and adequate and well-controlled clinical trials to establish the safety and effectiveness of the drug or biologic for each indication for which FDA approval is sought. Satisfaction of FDA pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease.

Preclinical tests include laboratory evaluation as well as animal trials to assess the characteristics and potential pharmacology and toxicity of the product. The conduct of the preclinical tests must comply with federal regulations and requirements including good laboratory practices. The results of preclinical testing are submitted to the FDA as part of an IND along with other information including information about product chemistry, manufacturing and controls and a proposed clinical trial protocol. Long term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If the FDA has not objected to the IND within this 30-day period, the clinical trial proposed in the IND may begin.

Clinical trials involve the administration of the investigational new drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted in compliance with federal regulations, good clinical practices, or GCP, as well as under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. Each protocol involving testing on U.S. patients and subsequent protocol amendments must be submitted to the FDA as part of the IND.

The FDA may order the temporary or permanent discontinuation of a clinical trial at any time or impose other sanctions if it believes that the clinical trial is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. The clinical trial protocol and informed consent information for patients in clinical trials must also be submitted to an institutional review board, or IRB, for approval. An IRB may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the IRB's requirements, or may impose other conditions. Clinical trials to support NDAs or BLAs, which are applications for marketing approval, are typically conducted in three sequential Phases, but the Phases may overlap. In Phase 1, the initial introduction of the drug into healthy human subjects or patients, the drug is tested to assess metabolism, pharmacokinetics, pharmacological actions, side effects associated with increasing doses and, if possible, early evidence on effectiveness. Phase 2 usually involves trials in a limited patient population, to determine the effectiveness of the drug for a particular indication or indications, dosage tolerance and optimum dosage, and identify common adverse effects and safety risks.

15

If a compound demonstrates evidence of effectiveness and an acceptable safety profile in Phase 2 evaluations, Phase 3 clinical trials are undertaken to obtain additional information about clinical efficacy and safety in a larger number of patients, typically at geographically dispersed clinical trial sites, to permit the FDA to evaluate the overall benefit-risk relationship of the drug and to provide adequate information for the labeling of the drug.

In the case of product candidates for severe or life-threatening diseases such as cancer, the initial human testing is often conducted in patients rather than in healthy volunteers. Since these patients already have the target disease, these studies may provide initial evidence of efficacy traditionally obtained in Phase 2 clinical trials and thus these trials are frequently referred to as Phase 1B clinical trials. Additionally, when product candidates can do damage to normal cells, it is not ethical to administer such drugs to healthy patients in a Phase 1 clinical trial. After completion of the required clinical testing, an NDA or, in the case of a biologic, a BLA, is prepared and submitted to the FDA. FDA approval of the marketing application is required before marketing of the product may begin in the U.S. The marketing application must include the results of all preclinical, clinical and other testing and a compilation of data relating to the product's pharmacology, chemistry, manufacture, and controls. Submission of an NDA or BLA also requires the payment of a substantial user fee, unless a waiver applies.

The FDA has 60 days from its receipt of an NDA or BLA to determine whether the application will be accepted for filing based on the agency's threshold determination that it is sufficiently complete to permit substantive review. Once the submission is accepted for filing, the FDA begins an in-depth review. The FDA has agreed to certain performance goals in the review of marketing applications. Most such applications for non-priority drug products are reviewed within 10 months of their acceptance for filing, and for priority designated applications, within six months of their acceptance for filing. The review process may be extended by the FDA for three additional months to consider new information submitted during the review or clarification regarding information already provided in the submission. The FDA may also refer applications for novel drug products or drug products which present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations. Before approving a marketing application, the FDA will typically inspect one or more clinical sites to assure compliance with GCP. The FDA may also inspect one or more non-clinical study sites to assure compliance with GLP. Additionally, the FDA will inspect the proposed facility or the facilities at which the drug substance or drug product is manufactured, tested, packaged or labeled. The FDA will not approve the product unless it has compliance with GCP, GLP, and current good manufacturing practices, or cGMPs, and the marketing application (the NDA or, in the case of biologics, the BLA) contains data that provide substantial evidence that the drug is safe and effective in the indication or indications studied. Manufacturers of biologics also must comply with FDA's general biological product standards to demonstrate that the product is safe, pure and potent.

After the FDA evaluates the marketing application and the manufacturing facilities, it issues an Approval Letter, or a Complete Response letter. A Complete Response letter outlines the deficiencies in the submission and may require substantial additional testing or information in order for the FDA to reconsider the application. If and when those deficiencies have been addressed in a resubmission of the marketing application, FDA will re-initiate review. If it is satisfied that the deficiencies have been addressed, the FDA will issue an Approval Letter. The FDA has committed to reviewing such resubmissions in two or six months depending on the type of information included. It is not unusual for the FDA to issue a Complete Response letter because it believes that the drug is not safe enough or effective enough or because it does not believe that the data submitted are reliable or conclusive.

An Approval Letter authorizes commercial marketing of the drug with specific prescribing information for specific indication or indications. As a condition of approval of the marketing application, the FDA may require substantial post-approval testing and surveillance to monitor the drug's safety or efficacy and may impose other conditions, including labeling restrictions and Risk Evaluation and Mitigation Strategies, or REMS, which can materially affect the potential market and profitability of the drug. Once granted, product approvals may be withdrawn if compliance with regulatory standards is not maintained or problems are identified following initial marketing.

The Hatch-Waxman Act

In seeking approval for marketing of a drug or biologic through an NDA or BLA, respectively, applicants are required to list with the FDA each patent with claims that cover the applicant's product or FDA approved method of using this product. Upon approval of a product, each of the patents listed in the application for the drug is then published in the FDA's Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book. Drugs listed in the Orange Book can, in turn, be cited by potential competitors in support of approval of an abbreviated new drug application, or ANDA. An ANDA provides for marketing of a drug product that has the same active ingredients in the same strengths and dosage form as the listed drug and has been shown through bioequivalence testing to be therapeutically equivalent to the listed drug. ANDA applicants are not required to conduct or submit results of preclinical or clinical tests to prove the safety or effectiveness of their drug product,

16

other than the requirement for bioequivalence testing. Drugs approved in this way are commonly referred to as “generic equivalents” to the listed drug, and can often be substituted by pharmacists under prescriptions written for the original listed drug.

The ANDA applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA's Orange Book. Specifically, the applicant must certify that: (i) the required patent information has not been filed; (ii) the listed patent has expired; (iii) the listed patent has not expired, but will expire on a particular date and approval is sought after patent expiration; or (iv) the listed patent is invalid or will not be infringed by the new product. A certification that the new product will not infringe the already approved product's listed patents or that such patents are invalid is called a Paragraph IV certification. If the applicant does not challenge the listed patents, the ANDA application will not be approved until all the listed patents claiming the referenced product have expired.

If the ANDA applicant has provided a Paragraph IV certification to the FDA, the applicant must also send notice of the Paragraph IV certification to the NDA applicant and patent holders once the ANDA has been accepted for filing by the FDA. The NDA applicant and patent holders may then initiate a patent infringement lawsuit in response to the notice of the Paragraph IV certification. The filing of a patent infringement lawsuit within 45 days of the receipt of a Paragraph IV certification notification automatically prevents the FDA from approving the ANDA until the earlier of 30 months, expiration of the patent, settlement of the lawsuit or a decision in the infringement case that is favorable to the ANDA applicant.

The ANDA application also will not be approved until any non-patent exclusivity, such as exclusivity for obtaining approval of a new chemical entity, listed in the Orange Book for the referenced product has expired. Federal law provides a period of five years following approval of a drug containing no previously approved active moiety, during which ANDAs for generic versions of those drugs cannot be submitted unless the submission contains a Paragraph IV challenge to a listed patent, in which case the submission may be made four years following the original product approval. Federal law provides for a period of three years of exclusivity following approval of a listed drug that contains previously approved active ingredients but is approved in a new dosage form, route of administration or combination, or for a new use, the approval of which was required to be supported by new clinical trials conducted by or for the sponsor, during which the FDA cannot grant effective approval of an ANDA based on that listed drug.

Ongoing Regulatory Requirements

Once an NDA or BLA is approved, a product will be subject to certain post-approval requirements. For instance, the FDA closely regulates the post-approval marketing and promotion of drugs, including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the internet.