Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bluegreen Vacations Holding Corp | d191913d8k.htm |

| EX-99.1 - PRESS RELEASE - Bluegreen Vacations Holding Corp | d191913dex991.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - Bluegreen Vacations Holding Corp | d191913dex21.htm |

OTCQB: BFCF; BFCFB NYSE: BBX July 28, 2016 Exhibit 99.2

BFC Financial – BBX Capital 2

BFC – BBX Merger Announcement July 28, 2016 BFC Financial Corporation (“BFC Financial” and/or “BFC”) (OTCQB: BFCF; BFCFB) and BBX Capital Corporation (“BBX Capital” and/or “BBX”) (NYSE: BBX) announced today that they have entered into a definitive merger agreement between the companies. Under the terms of the merger agreement, which was unanimously approved by a special committee comprised of BBX’s independent directors as well as the boards of directors of both companies, BBX’s shareholders other than BFC will be entitled to receive, at their election, 5.4 shares of BFC’s Class A Common Stock or $20.00 in cash for each share of BBX’s Class A Common Stock held by them. BBX Capital’s shareholders will have the right to elect to receive all cash, all stock, or a combination of cash and stock in exchange for their shares. BFC currently owns approximately 81% of BBX’s Class A Common Stock and 100% of its Class B Common Stock. If the merger is consummated, BBX will be a wholly owned subsidiary of BFC. 3

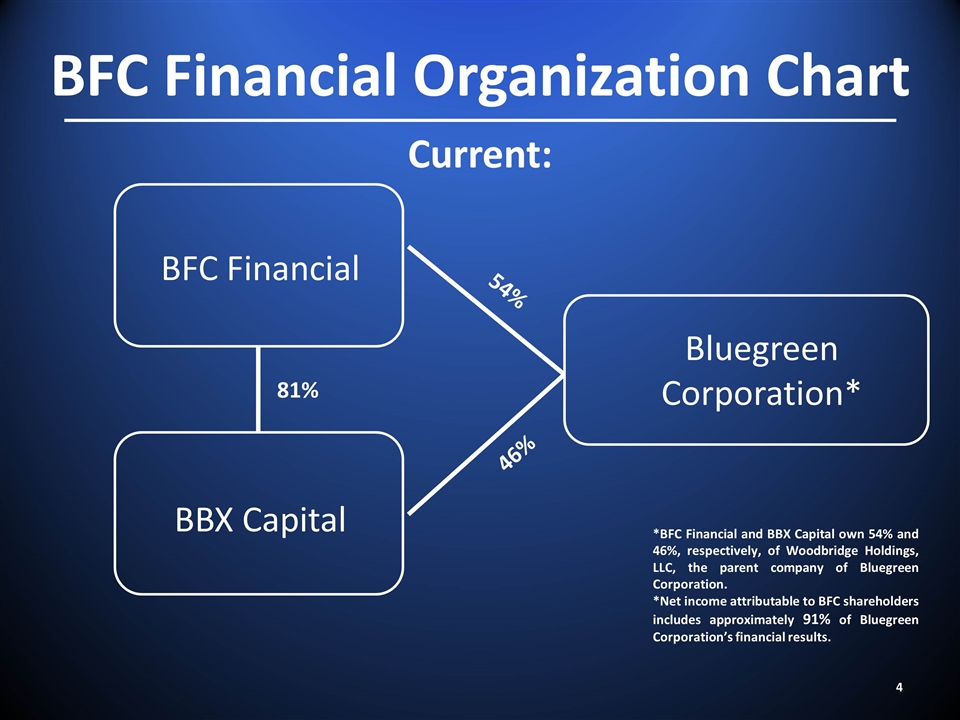

54% 46% 81% BFC Financial BBX Capital Bluegreen Corporation* *BFC Financial and BBX Capital own 54% and 46%, respectively, of Woodbridge Holdings, LLC, the parent company of Bluegreen Corporation. *Net income attributable to BFC shareholders includes approximately 91% of Bluegreen Corporation’s financial results. 4 BFC Financial Organization Chart Current:

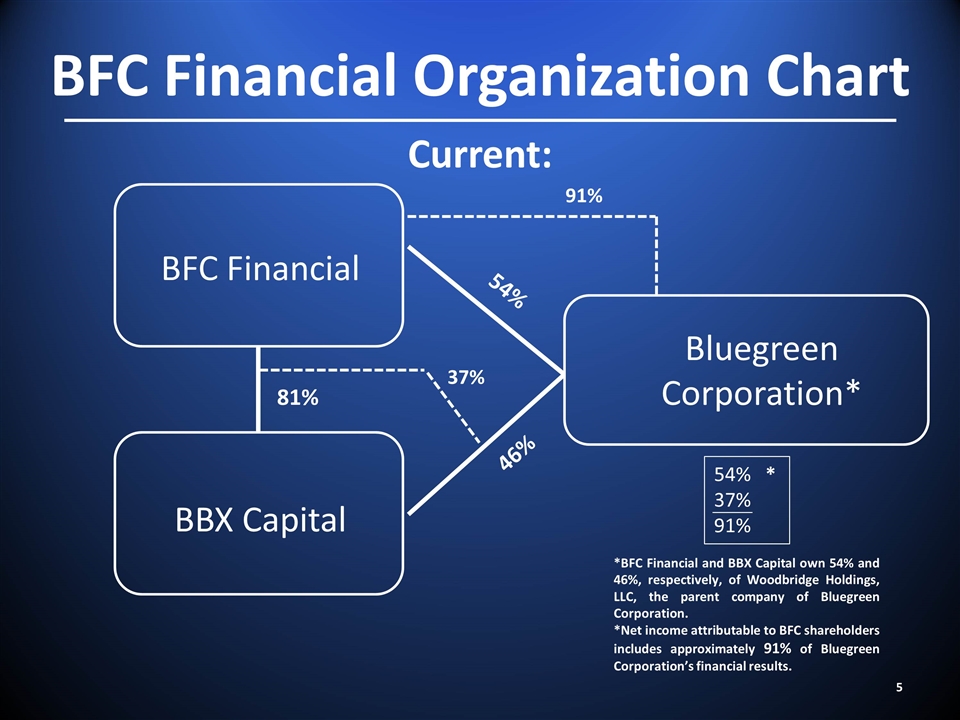

54% 46% 81% BFC Financial BBX Capital Bluegreen Corporation* *BFC Financial and BBX Capital own 54% and 46%, respectively, of Woodbridge Holdings, LLC, the parent company of Bluegreen Corporation. *Net income attributable to BFC shareholders includes approximately 91% of Bluegreen Corporation’s financial results. 91% 37% 54% 37% 91% * 5 BFC Financial Organization Chart Current:

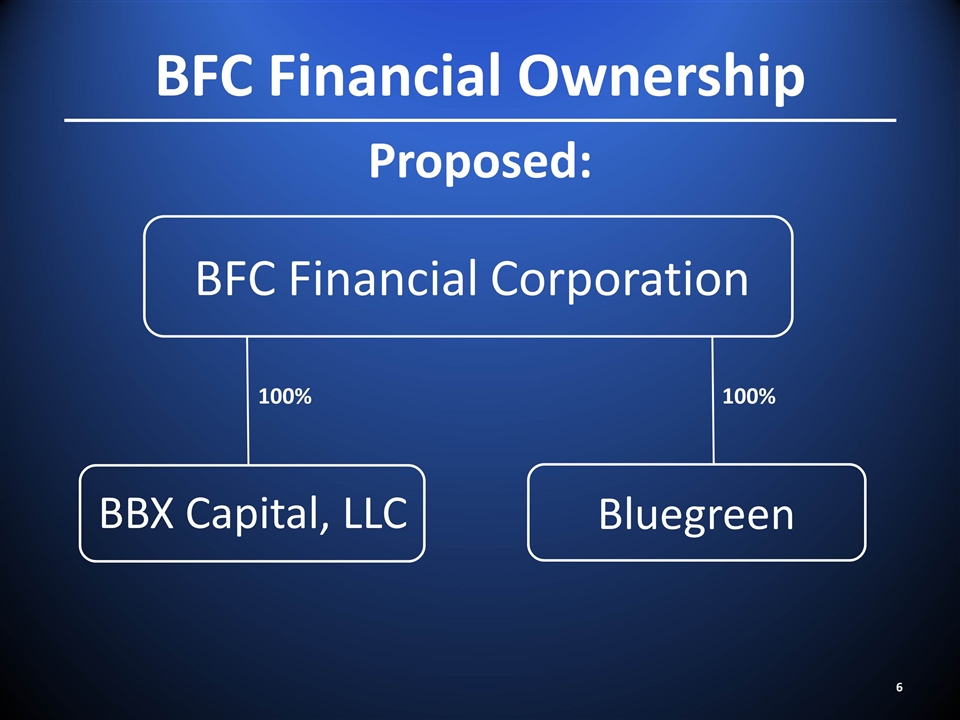

BFC Financial Ownership Proposed: BFC Financial Corporation BBX Capital, LLC Bluegreen 100% 6 100%

BFC – BBX Merger Announcement Anticipated Benefits Derived from the Proposed Merger One company instead of two companies with overlapping assets One stock ticker Simpler corporate structure Concentrate Investor Relations to a single company Increase in liquidity for shareholders of the combined company Unlock the visibility of Bluegreen to a single company Consolidate and streamline combined companies 7

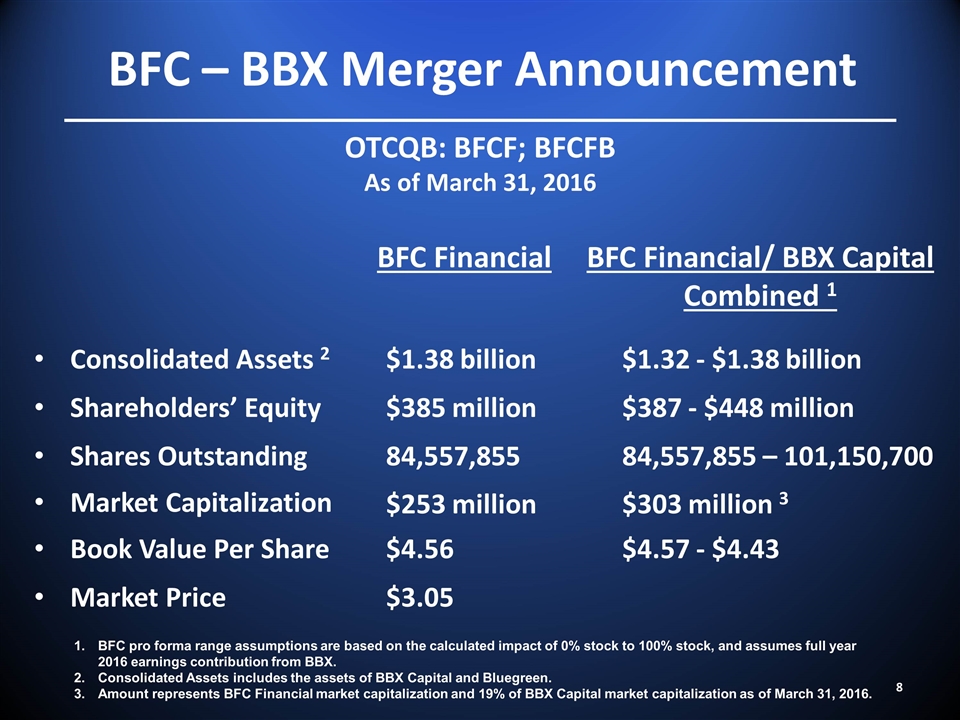

BFC – BBX Merger Announcement OTCQB: BFCF; BFCFB As of March 31, 2016 BFC Financial BFC Financial/ BBX Capital Combined 1 Consolidated Assets 2 $1.38 billion $1.32 - $1.38 billion Shareholders’ Equity $385 million $387 - $448 million Shares Outstanding Market Capitalization 84,557,855 $253 million 84,557,855 – 101,150,700 $303 million 3 Book Value Per Share $4.56 $4.57 - $4.43 Market Price $3.05 BFC pro forma range assumptions are based on the calculated impact of 0% stock to 100% stock, and assumes full year 2016 earnings contribution from BBX. Consolidated Assets includes the assets of BBX Capital and Bluegreen. Amount represents BFC Financial market capitalization and 19% of BBX Capital market capitalization as of March 31, 2016. 8

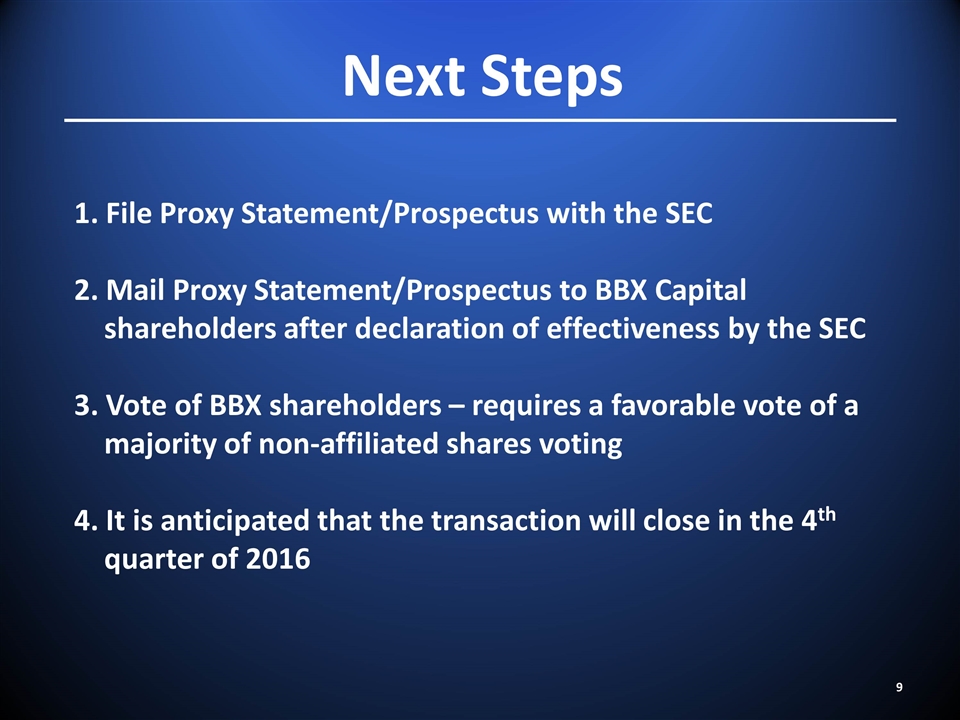

Next Steps 1. File Proxy Statement/Prospectus with the SEC 2. Mail Proxy Statement/Prospectus to BBX Capital shareholders after declaration of effectiveness by the SEC 3. Vote of BBX shareholders – requires a favorable vote of a majority of non-affiliated shares voting 4. It is anticipated that the transaction will close in the 4th quarter of 2016 9

For further information, please visit: BFC Financial Corporation: www.BFCFinancial.com BBX Capital: www.BBXCapital.com Bluegreen Corporation: www.BluegreenVacations.com BFC – BBX Merger Announcement 10 BFC Financial and BBX Capital Contact Info: Investor Relations: Leo Hinkley, Managing Director, 954-940-4994 Email: LHinkley@BFCFinancial.com, LHinkley@BBXCapital.com

OTCQB: BFCF; BFCFB NYSE: BBX July 28, 2016