Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Goodman Networks Inc | d232968dex992.htm |

| EX-99.1 - EXHIBIT 99.1 - Goodman Networks Inc | d232968dex991.htm |

| 8-K - FORM 8-K - Goodman Networks Inc | d232968d8k.htm |

Exhibit 99.3

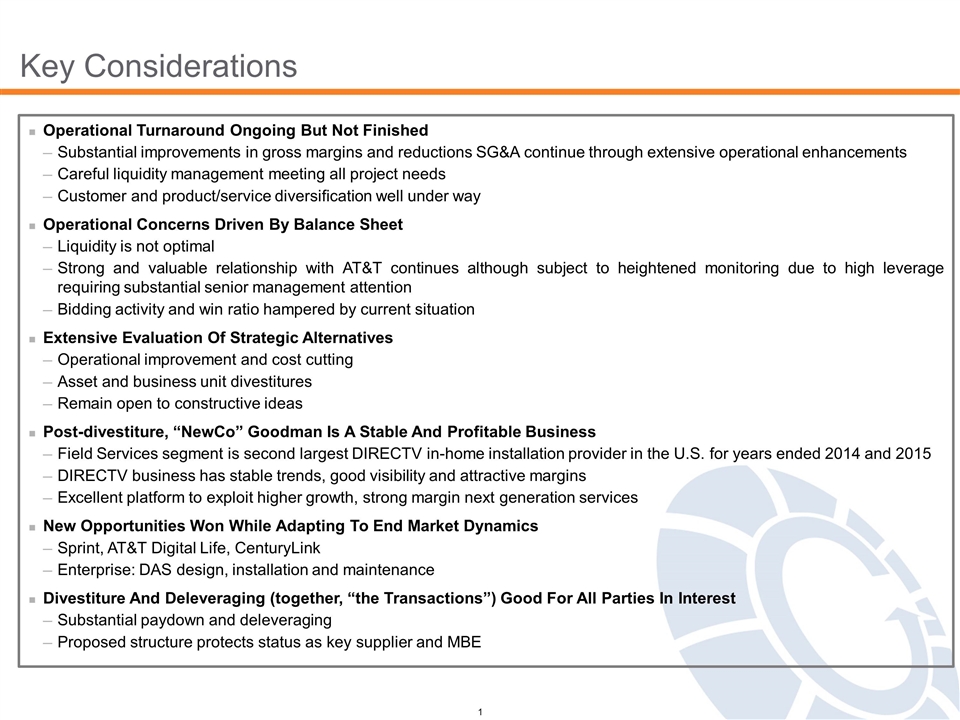

Key Considerations Operational Turnaround Ongoing But Not Finished Substantial improvements in gross margins and reductions SG&A continue through extensive operational enhancements Careful liquidity management meeting all project needs Customer and product/service diversification well under way Operational Concerns Driven By Balance Sheet Liquidity is not optimal Strong and valuable relationship with AT&T continues although subject to heightened monitoring due to high leverage requiring substantial senior management attention Bidding activity and win ratio hampered by current situation Extensive Evaluation Of Strategic Alternatives Operational improvement and cost cutting Asset and business unit divestitures Remain open to constructive ideas Post-divestiture, “NewCo” Goodman Is A Stable And Profitable Business Field Services segment is second largest DIRECTV in-home installation provider in the U.S. for years ended 2014 and 2015 DIRECTV business has stable trends, good visibility and attractive margins Excellent platform to exploit higher growth, strong margin next generation services New Opportunities Won While Adapting To End Market Dynamics Sprint, AT&T Digital Life, CenturyLink Enterprise: DAS design, installation and maintenance Divestiture And Deleveraging (together, “the Transactions”) Good For All Parties In Interest Substantial paydown and deleveraging Proposed structure protects status as key supplier and MBE 1

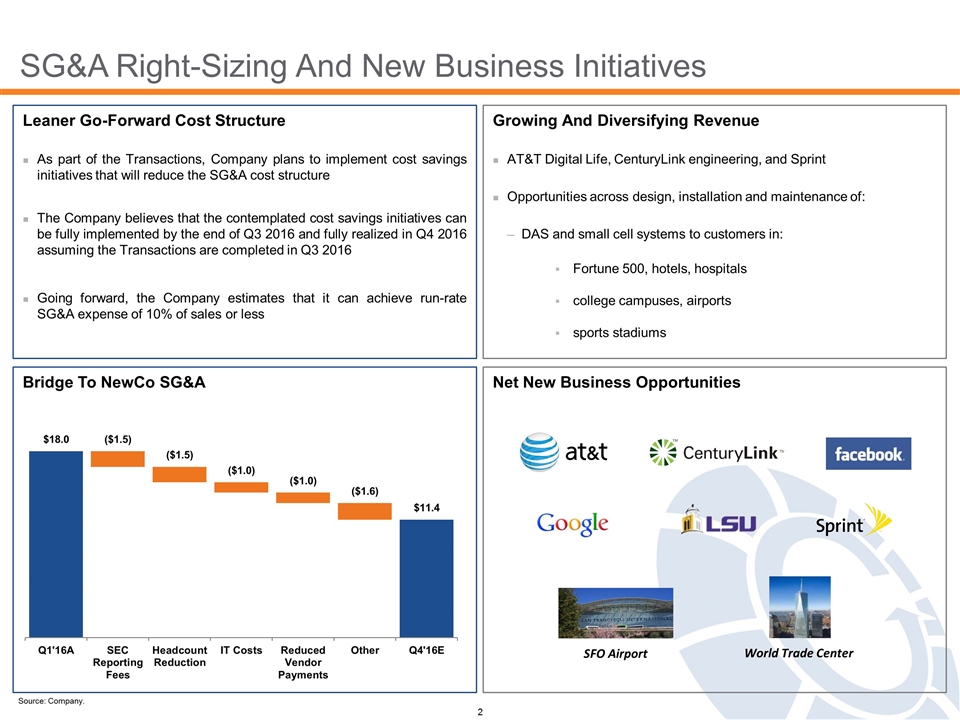

SG&A Right-Sizing And New Business Initiatives Source: Company. Leaner Go-Forward Cost Structure As part of the Transactions, Company plans to implement cost savings initiatives that will reduce the SG&A cost structure The Company believes that the contemplated cost savings initiatives can be fully implemented by the end of Q3 2016 and fully realized in Q4 2016 assuming the Transactions are completed in Q3 2016 Going forward, the Company estimates that it can achieve run-rate SG&A expense of 10% of sales or less Growing And Diversifying Revenue AT&T Digital Life, CenturyLink engineering, and Sprint Opportunities across design, installation and maintenance of: DAS and small cell systems to customers in: Fortune 500, hotels, hospitals college campuses, airports sports stadiums Bridge To NewCo SG&A Net New Business Opportunities Label on last bar changed from Q3 to Q4. Please confirm if acceptable. World Trade Center SFO Airport Label on last bar changed from Q3 to Q4. Please confirm if acceptable. 2

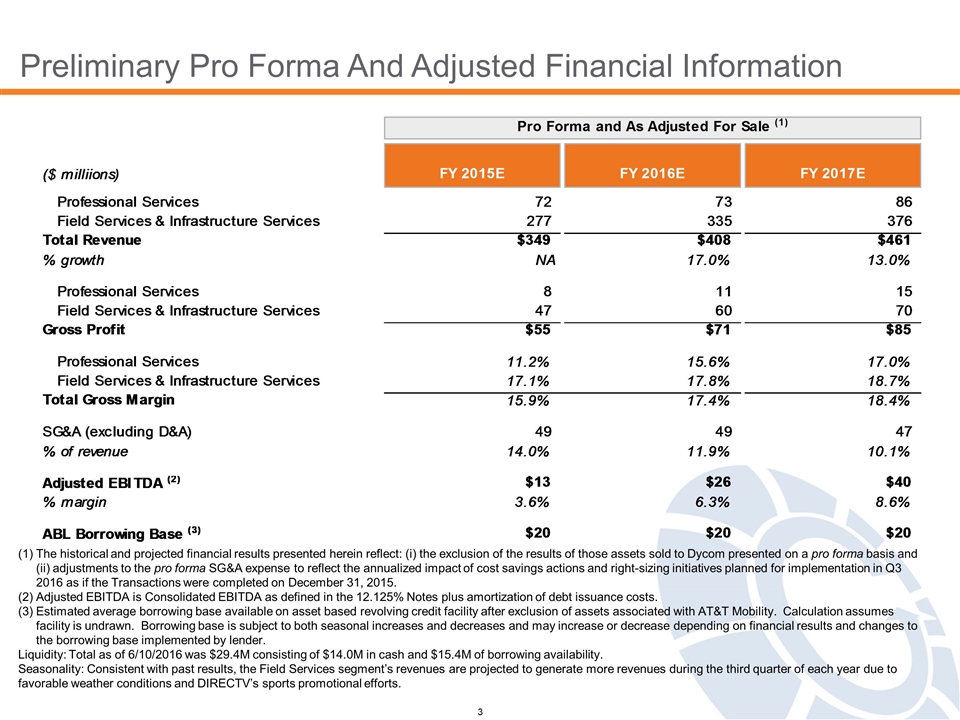

Preliminary Pro Forma And Adjusted Financial Information The historical and projected financial results presented herein reflect: (i) the exclusion of the results of those assets sold to Dycom presented on a pro forma basis and (ii) adjustments to the pro forma SG&A expense to reflect the annualized impact of cost savings actions and right-sizing initiatives planned for implementation in Q3 2016 as if the Transactions were completed on December 31, 2015. Adjusted EBITDA is Consolidated EBITDA as defined in the 12.125% Notes plus amortization of debt issuance costs. Estimated average borrowing base available on asset based revolving credit facility after exclusion of assets associated with AT&T Mobility. Calculation assumes facility is undrawn. Borrowing base is subject to both seasonal increases and decreases and may increase or decrease depending on financial results and changes to the borrowing base implemented by lender. Liquidity: Total as of 6/10/2016 was $29.4M consisting of $14.0M in cash and $15.4M of borrowing availability. Seasonality: Consistent with past results, the Field Services segment’s revenues are projected to generate more revenues during the third quarter of each year due to favorable weather conditions and DIRECTV’s sports promotional efforts. 3

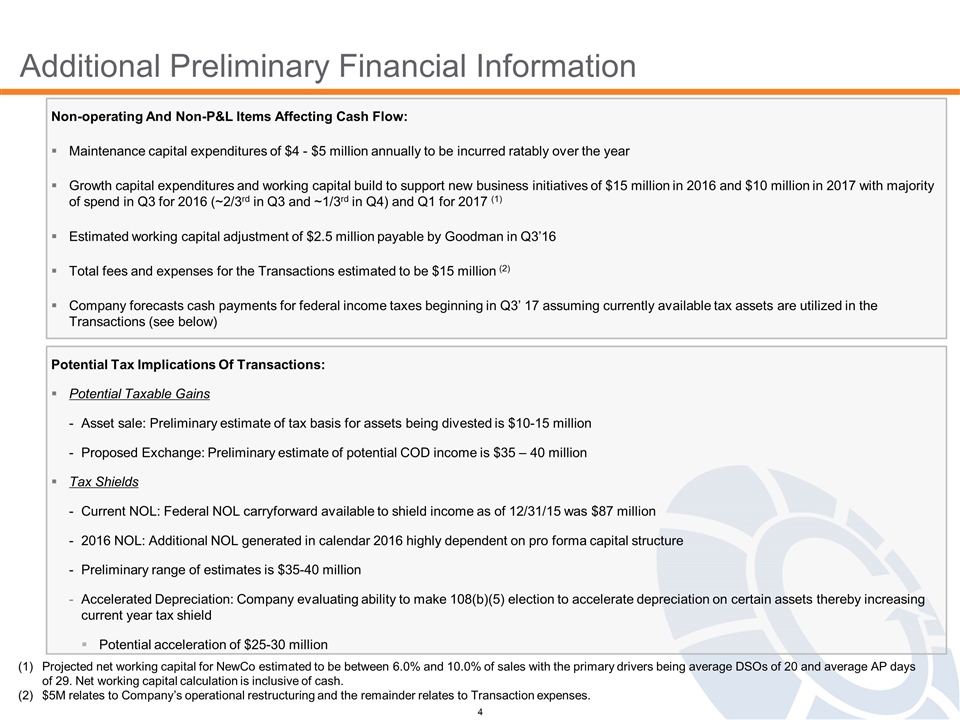

Additional Preliminary Financial Information Non-operating And Non-P&L Items Affecting Cash Flow: Maintenance capital expenditures of $4 - $5 million annually to be incurred ratably over the year Growth capital expenditures and working capital build to support new business initiatives of $15 million in 2016 and $10 million in 2017 with majority of spend in Q3 for 2016 (~2/3rd in Q3 and ~1/3rd in Q4) and Q1 for 2017 (1) Estimated working capital adjustment of $2.5 million payable by Goodman in Q3’16 Total fees and expenses for the Transactions estimated to be $15 million (2) Company forecasts cash payments for federal income taxes beginning in Q3’ 17 assuming currently available tax assets are utilized in the Transactions (see below) Potential Tax Implications Of Transactions: Potential Taxable Gains Asset sale: Preliminary estimate of tax basis for assets being divested is $10-15 million Proposed Exchange: Preliminary estimate of potential COD income is $35 – 40 million Tax Shields Current NOL: Federal NOL carryforward available to shield income as of 12/31/15 was $87 million 2016 NOL: Additional NOL generated in calendar 2016 highly dependent on pro forma capital structure Preliminary range of estimates is $35-40 million Accelerated Depreciation: Company evaluating ability to make 108(b)(5) election to accelerate depreciation on certain assets thereby increasing current year tax shield Potential acceleration of $25-30 million Projected net working capital for NewCo estimated to be between 6.0% and 10.0% of sales with the primary drivers being average DSOs of 20 and average AP days of 29. Net working capital calculation is inclusive of cash. $5M relates to Company’s operational restructuring and the remainder relates to Transaction expenses. 4

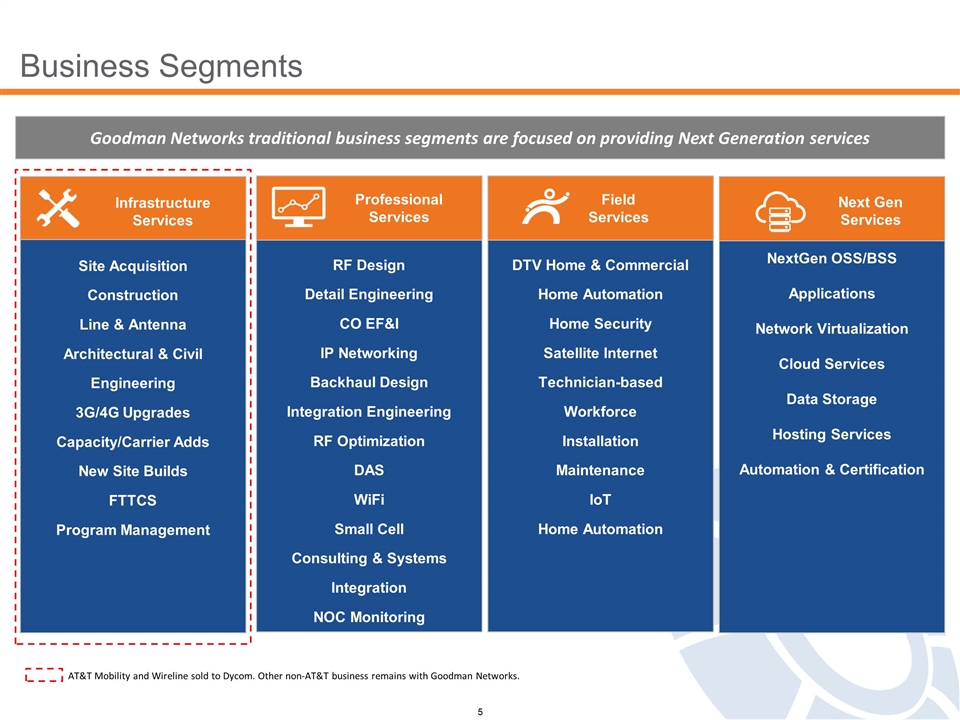

RF Design Detail Engineering CO EF&I IP Networking Backhaul Design Integration Engineering RF Optimization DAS WiFi Small Cell Consulting & Systems Integration NOC Monitoring Staff Augmentation AT&T Mobility and Wireline sold to Dycom. Other non-AT&T business remains with Goodman Networks. Infrastructure Services Site Acquisition Construction Line & Antenna Architectural & Civil Engineering 3G/4G Upgrades Capacity/Carrier Adds New Site Builds FTTCS Program Management Infrastructure Services RF Design Detail Engineering CO EF&I IP Networking Backhaul Design Integration Engineering RF Optimization DAS WiFi Small Cell Consulting & Systems Integration NOC Monitoring Staff Augmentation Professional Services DTV Home & Commercial Home Automation Home Security Satellite Internet Technician-based Workforce Installation Maintenance IoT Home Automation Field Services NextGen OSS/BSS Applications Network Virtualization Cloud Services Data Storage Hosting Services Automation & Certification Next Gen Services Business Segments Goodman Networks traditional business segments are focused on providing Next Generation services 5

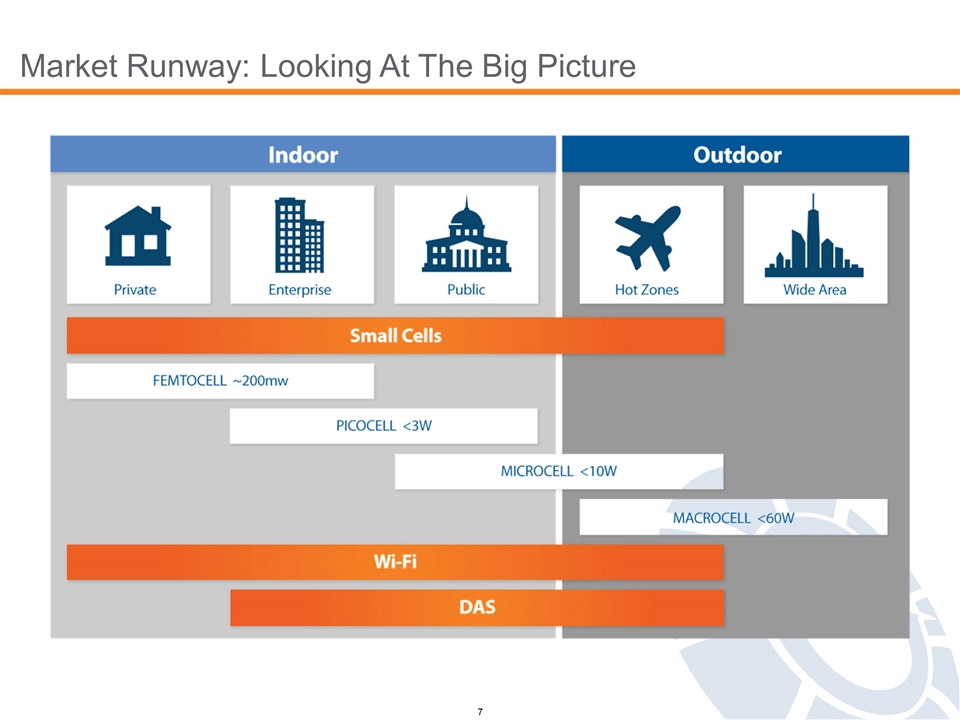

LTE investments have peaked in the US The next round of investment will be made in capacity enhancements for dense urban areas Typically, with each generation of mobile technology, 100K new cell sites have been added for capacity and coverage However, most of the macro network is built out for four major operators Additionally, there is tremendous capex pressure But consumer demands continue to grow at 60-70% nationally, doubling for T-Mobile and Sprint Hence, the focus is going to be on small cell deployments for Gbps capacity 5G also required for dealing with massive IoT sensors Opportunities in managing licensed/unlicensed networks for devices, IoT, industrial, smart cities, etc. Emerging Market Trends 6

Market Runway: Looking At The Big Picture 7

Ecosystem Solutions Pico Wi-Fi Macro Femto Micro Micro Femto Wi-Fi Micro Micro Femto Wi-Fi Pico Wi-Fi Femto Wi-Fi Femto Wi-Fi Ecosystem Solutions 8

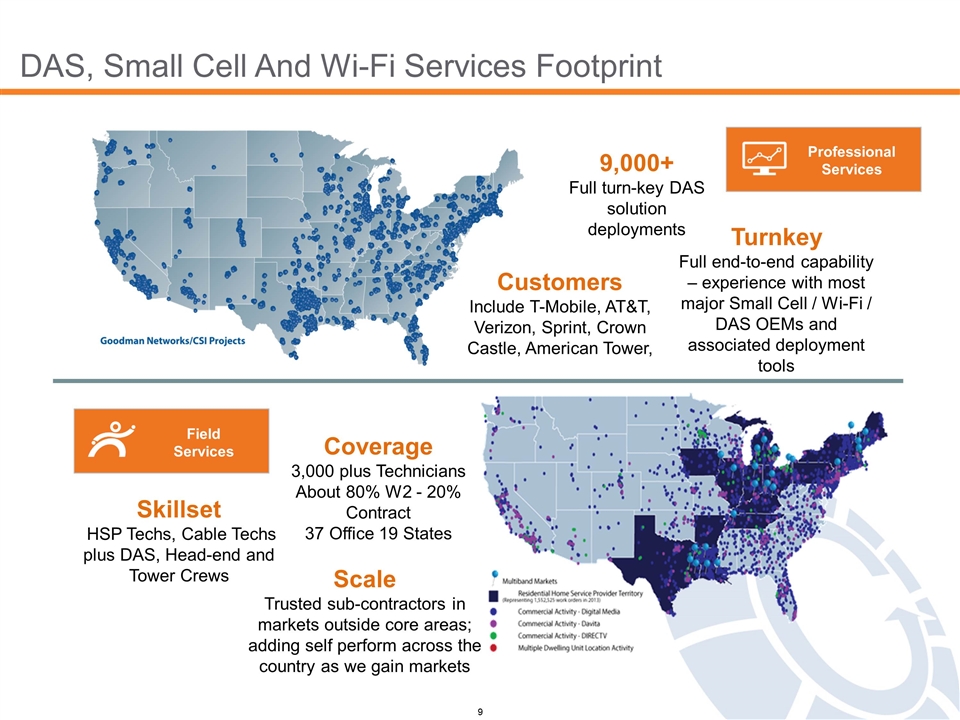

Turnkey Full end-to-end capability – experience with most major Small Cell / Wi-Fi / DAS OEMs and associated deployment tools 9,000+ Full turn-key DAS solution deployments Customers Include T-Mobile, AT&T, Verizon, Sprint, Crown Castle, American Tower, Coverage 3,000 plus Technicians About 80% W2 - 20% Contract 37 Office 19 States Skillset HSP Techs, Cable Techs plus DAS, Head-end and Tower Crews Scale Trusted sub-contractors in markets outside core areas; adding self perform across the country as we gain markets DAS, Small Cell And Wi-Fi Services Footprint Professional Services Field Services 9

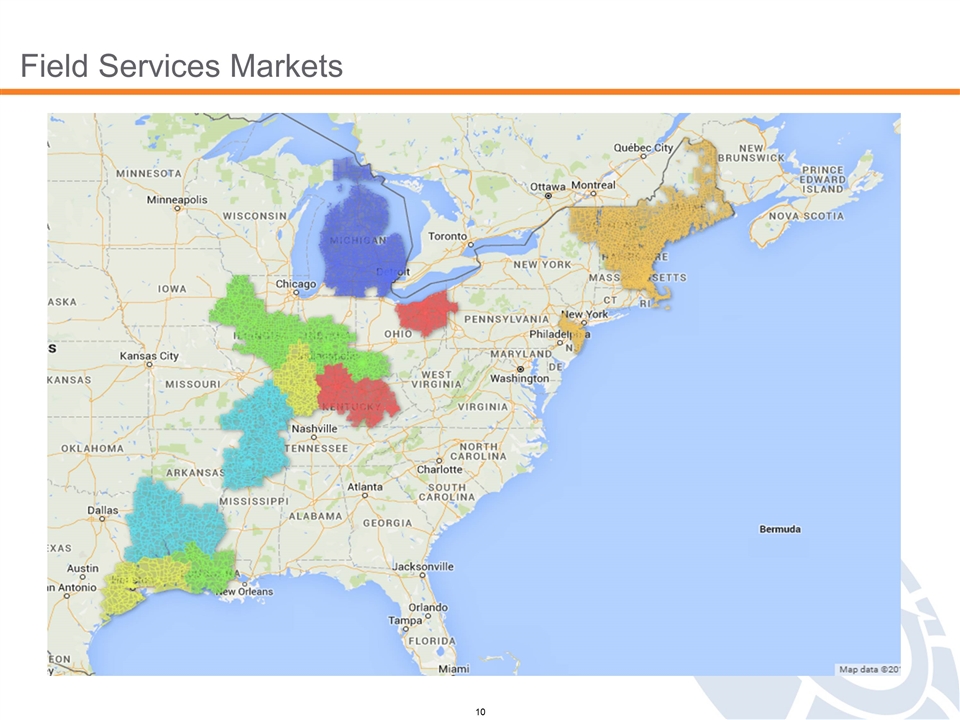

Field Services Markets 10