Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ASSOCIATED BANC-CORP | asb20160630ex-991.htm |

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | asb-20160630form8kpr.htm |

SECOND QUARTER 2016

EARNINGS PRESENTATION

JULY 21, 2016

FORWARD-LOOKING STATEMENTS

Important note regarding forward-looking statements:

Statements made in this presentation which are not purely historical are forward-looking statements, as

defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding

management’s plans, objectives, or goals for future operations, products or services, and forecasts of its

revenues, earnings, or other measures of performance. Such forward-looking statements may be

identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,”

“intend,” “outlook” or similar expressions. Forward-looking statements are based on current management

expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ

materially from those contained in the forward-looking statements. Factors which may cause actual

results to differ materially from those contained in such forward-looking statements include those

identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are

incorporated herein by reference.

1

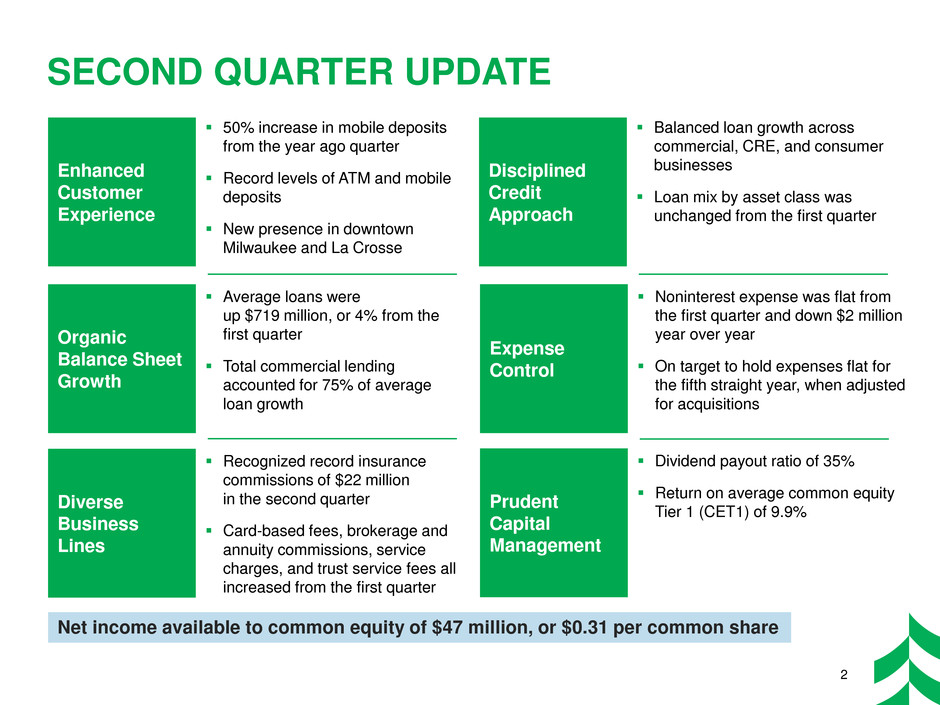

SECOND QUARTER UPDATE

Net income available to common equity of $47 million, or $0.31 per common share

2

Enhanced

Customer

Experience

50% increase in mobile deposits

from the year ago quarter

Record levels of ATM and mobile

deposits

New presence in downtown

Milwaukee and La Crosse

Organic

Balance Sheet

Growth

Average loans were

up $719 million, or 4% from the

first quarter

Total commercial lending

accounted for 75% of average

loan growth

Diverse

Business

Lines

Recognized record insurance

commissions of $22 million

in the second quarter

Card-based fees, brokerage and

annuity commissions, service

charges, and trust service fees all

increased from the first quarter

Disciplined

Credit

Approach

Balanced loan growth across

commercial, CRE, and consumer

businesses

Loan mix by asset class was

unchanged from the first quarter

Expense

Control

Noninterest expense was flat from

the first quarter and down $2 million

year over year

On target to hold expenses flat for

the fifth straight year, when adjusted

for acquisitions

Prudent

Capital

Management

Dividend payout ratio of 35%

Return on average common equity

Tier 1 (CET1) of 9.9%

($ in millions)

$1.5 $1.4 $1.4 $1.4 $1.4

$5.4 $5.7 $5.8 $5.9 $6.1

$4.1 $4.3

$4.4 $4.5

$4.7

$7.2 $7.1

$6.9 $7.1

$7.5

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Commercial & Business Commercial Real Estate

Residential Mortgage Home Equity & Other Consumer

($30)

($29)

$2

$73

$116

$185

$192

$210

CRE

Investor

18%

Construction

6%

Commercial

& Business

38%

Residential

Mortgage

31%

Home Equity

5%

Other

Consumer

2%

LOAN PORTFOLIO TRENDS

Average Net Loan Change (from 1Q 2016)

Loan Mix – 2Q 2016 (Average)

Average Quarterly Loans

$18.5 $18.2

Total

Commercial

& Business

+5%

$18.5

$18.9

$19.6

Home Equity &

Other Consumer

Commercial Real Estate

Residential Mortgage

Power & Utilities

Mortgage Warehouse

REIT

($ in billions)

General Commercial

3

Oil and Gas

CREDIT QUALITY TRENDS

($ IN MILLIONS)

$140 $180 $178

$251 $281

$60

$84 $124

$150

$176

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Oil and Gas

$149 $134 $158 $157 $154

$11 $13

$20

$129 $129

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Oil and Gas

Potential Problem Loans Nonaccrual Loans

$9 $8 $8

$4 $2

$13 $19

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Oil and Gas

Net Charge Offs Allowance to Total / Oil and Gas Loans

1.4% 1.4% 1.5% 1.4% 1.4%

3.4%

3.8%

5.6%

6.5%

5.6%

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

ALLL / Total Loans

Oil and Gas ALLL / Oil and Gas Loans

4

$200

$264

$302

$401

$457

$160 $147

$178

$286

$21

$283

$17

Houston based

9 staff, including 2 in-house

engineers

90 years of combined

experience

$26, 3.4% $29, 3.8%

$42, 5.6% $49, 6.5% $42, 5.6%

OIL AND GAS LENDING UPDATE

Spring redeterminations: Complete except for 3 credits;

the reviews have largely resulted in borrowing base

decreases

New business: New loan fundings of $86 million; offset by

repayments and charge offs

Energy reserves: Declined due to charge offs; returned to

prior year end level

1 – Based on borrowers’ % revenue from oil/gas

5

~$1 billion in exposure

4% of total loans

57 credits

Exclusively focused on the

upstream sector

Exposure is approximately

60% oil and 40% gas1

100% of loans are

reserve secured

Management Second Quarter Update

Portfolio

Mix

Underwriting

$658 $587 $522

$402 $387

$88 $158

$210

$225 $240

$11 $13 $20

$129 $129

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Pass Criticized / Classified Nonaccrual

$757 $758 $752 $756 $756

Period End Loans by Credit Quality and Related Reserves

($ millions)

Net Interest Margin

3.15% 3.13% 3.14% 3.16% 3.12%

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

3.38% 3.38% 3.37% 3.41% 3.35%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

$140

$144

$148

$153

$157

$161

$165

$169

$174

$178

2.83% 2.82% 2.82% 2.81% 2.81%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

$-

$4

$8

$12

$16

$20

$24

$28

$32

$36

$40

$44

$48

$52

$56

$60

$64

$68

$72

$76

$80

$84

$88

$92

$96

$ 00

$104

$108

$112

$116

$120

$124

$128

$132

$136

$140

$144

$148

$152

$156

$160

$164

$168

$172

$176

$180

$165

$170 $169 $171

$176

$1

$1 $2 $1

$1

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Interest Recoveries, Prepayment Fees, & Deferred Fees

Net Interest Income Net of Interest Recoveries, Prepayment Fees, &

Deferred Fees

Yield on Interest-earning Assets Net Interest Income & Net Interest Margin

Total Interest-earning Yield

NET INTEREST INCOME AND MARGIN TRENDS

($ in millions)

0.21% 0.22% 0.22%

0.30% 0.31%

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Interest-bearing Deposit Costs Other Funding Costs

0.40% 0.40% 0.41% 0.39%

$171

Total Loan Yield

$172

0.45%

$171

$166

$177

Cost of Interest-bearing Liabilities

6

$10

$7 $8

$4 $4

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

NONINTEREST INCOME TRENDS

($ IN MILLIONS)

Mortgage Banking (net) Income

$66 $64 $63 $65

$67

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Fee-based Revenue

1 – Fee-based Revenue = A non-GAAP financial measure, is the sum of trust service fees, service charges on deposit accounts, card-based and other nondeposit fees,

insurance commissions, and brokerage and annuity commissions.

Please refer to Noninterest Income as presented on Page 3 of the Financial Tables, Consolidated Statements of Income

$86

$80

$83 $83

1

Insurance Commissions

$20

$18 $18

$21 $22

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

$82

7

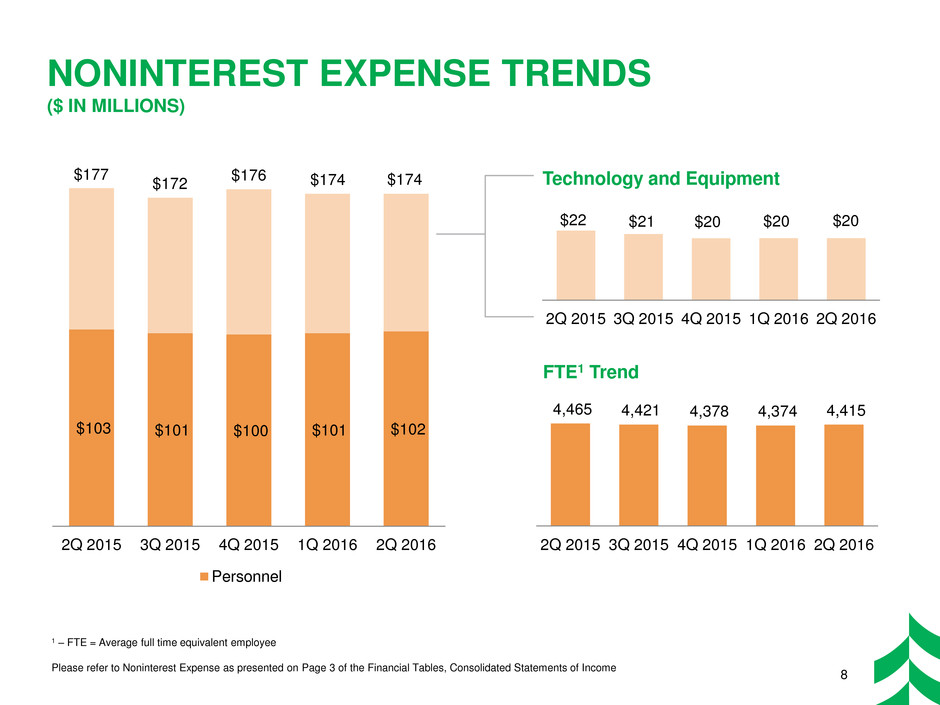

$103 $101 $100 $101 $102

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

Personnel

$22 $21 $20 $20 $20

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

NONINTEREST EXPENSE TRENDS

($ IN MILLIONS)

Technology and Equipment

1 – FTE = Average full time equivalent employee

Please refer to Noninterest Expense as presented on Page 3 of the Financial Tables, Consolidated Statements of Income

FTE1 Trend

$177

$172

$176 $174 $174

4,465 4,421 4,378 4,374 4,415

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016

8

2016 OUTLOOK

9

High single digit annual average

loan growth

Maintain Loan to Deposit ratio

under 100%

In the absence of Federal

Reserve action to raise rates,

NIM expected to be

approximately flat

Approximately flat to prior year

NONINTEREST

EXPENSE

Approximately flat to prior year

Continue to follow stated

corporate priorities for capital

deployment

Dependent on loan growth and

changes in risk grade or other

indications of credit quality

BALANCE

SHEET

NET INTEREST

MARGIN

NONINTEREST

INCOME

CAPITAL

PROVISION

oninterest

Expense

Balance Sheet

et Interest

argin

oninterest

ncome

apital

rovision