Attached files

| file | filename |

|---|---|

| EX-8.2 - EX-8.2 - Ottawa Bancorp Inc | d189351dex82.htm |

| EX-99.4 - EX-99.4 - Ottawa Bancorp Inc | d189351dex994.htm |

| EX-99.3 - EX-99.3 - Ottawa Bancorp Inc | d189351dex993.htm |

| EX-23.2 - EX-23.2 - Ottawa Bancorp Inc | d189351dex232.htm |

| EX-8.1 - EX-8.1 - Ottawa Bancorp Inc | d189351dex81.htm |

| EX-5.0 - EX-5.0 - Ottawa Bancorp Inc | d189351dex50.htm |

| EX-1.3 - EX-1.3 - Ottawa Bancorp Inc | d189351dex13.htm |

| EX-1.2 - EX-1.2 - Ottawa Bancorp Inc | d189351dex12.htm |

| S-1/A - S-1/A - Ottawa Bancorp Inc | d189351ds1a.htm |

Exhibit 99.2

Ottawa Savings Bank

Ottawa Bancorp, Inc.

PROPOSED MAILING AND INFORMATIONAL MATERIALS

INDEX

Produced by the Financial Printer

| 1. | Dear Member Letter* |

| 2. | Dear Member Letter for Non Eligible Jurisdictions* |

| 3. | Dear Friend Letter - Eligible Account Holders who are no longer Depositors* |

| 4. | Dear Potential Investor Letter* |

| 5. | Dear Prospective Investor Letter - Used as a Cover Letter for States Requiring “Agent” Mailing* |

| 6.-7. | Proxy Q&A* |

| 8.-11. | Stock Q&A* |

| 12. | Proxy Reminder / Important (immediate follow-up) |

| 13. | Proxy Reminder / Second Request |

| 14-15. | Proxy Card |

| 16. | Stock Order Form (page 1 of 2)* |

| 17. | Stock Order Form Certification (page 2 of 2)* |

| 18. | Stock Order Form Guidelines* |

Produced by the Stock Information Center

| 19. | Mailing Insert/Lobby Poster |

| 20. | Dear Subscriber/Acknowledgment Letter - Initial Response to Stock Order Received |

| 21. | Dear Stockholder - Confirmation Letter |

| 22. | Dear Interested Investor - No Shares Available Letter |

| 23. | Welcome Stockholder Letter - For Initial DRS Statement Mailing |

| 24. | Dear Interested Subscriber Letter - Subscription Rejection |

| 25. | Letter for Sandler O’Neill Mailing to Clients* |

| 26. | DRS Q&A |

| 27. | Invitation Letter – Informational Meetings |

| 28. | Tombstone (Meeting Advertisement) |

| 29. | Tombstone (Offering Advertisement) |

| * | Accompanied by a Prospectus |

Ottawa Savings Bank

Dear Member:

We are pleased to announce that the Boards of Directors of Ottawa Savings Bank, Ottawa Bancorp, Inc., Ottawa Savings Bancorp MHC and Ottawa Savings Bancorp, Inc. have unanimously adopted a plan of conversion and reorganization under which we will convert from the mutual holding company form to the full stock form of organization and raise additional capital in a stock offering. Upon the completion of the conversion and reorganization, Ottawa Savings Bank will become a wholly-owned subsidiary of our new public holding company, Ottawa Bancorp, Inc. We believe this transition to a more common and flexible organizational structure, together with the proceeds raised in the stock offering, will better support our continued growth.

The Proxy Card

As a depositor or qualifying borrower of Ottawa Savings Bank, you are a member of Ottawa Savings Bancorp MHC. To complete the conversion, your participation is extremely important. On behalf of the Board of Directors, I ask that you help us meet our goal by reading the enclosed material and then casting your vote “FOR” the plan of conversion and reorganization. You may vote by mail by returning your proxy card in the enclosed postage-paid envelope marked “PROXY RETURN.” If you have more than one account, you may receive more than one proxy card. Please vote all proxy cards received. There are no duplicates.

If the plan of conversion and reorganization is approved, let me assure you that:

| • | existing deposit accounts and loans will not undergo any change; |

| • | deposit accounts will continue to be federally insured to the maximum extent permitted by law; and |

| • | voting for approval will not obligate you to buy any shares of common stock. |

The Stock Order Form

As a qualifying depositor or borrower, you also have nontransferable rights to subscribe for shares of common stock of Ottawa Bancorp, Inc. on a priority basis. The enclosed prospectus describes the stock offering in more detail. Please read the prospectus carefully before making an investment decision.

If you wish to subscribe for shares of common stock, please complete the enclosed stock order form and return it to Ottawa Bancorp, Inc., together with payment for the shares, using the enclosed postage-paid envelope marked “STOCK ORDER RETURN” or by overnight delivery service to our Stock Information Center located at 925 LaSalle Street, Ottawa, IL 61350. You may also hand deliver stock order forms at this location. We will not accept stock order forms at our other banking offices. Your order must be physically received (not postmarked) by Ottawa Bancorp, Inc. no later than : .m., Central Time, on day, , 2016.

If you have any questions after reading the enclosed material, please call our Stock Information Center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays.

Sincerely,

Jon Kranov

President and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

1

Ottawa Savings Bank

Dear Member:

We are pleased to announce that the Boards of Directors of Ottawa Savings Bank, Ottawa Bancorp, Inc., Ottawa Savings Bancorp MHC and Ottawa Savings Bancorp, Inc. have unanimously adopted a plan of conversion and reorganization under which we will convert from the mutual holding company form to the full stock form of organization and raise additional capital in a stock offering. Upon the completion of the conversion and reorganization, Ottawa Savings Bank will become a wholly-owned subsidiary of our new public holding company, Ottawa Bancorp, Inc. We believe this transition to a more common and flexible organizational structure, together with the proceeds raised in the stock offering, will better support our continued growth.

As a depositor or qualifying borrower of Ottawa Savings Bank, you are a member of Ottawa Savings Bancorp MHC. To complete the conversion, your participation is extremely important. On behalf of the Board of Directors, I ask that you help us meet our goal by reading the enclosed material and then casting your vote “FOR” the plan of conversion and reorganization. You may vote by mail by returning your proxy card in the enclosed postage-paid envelope marked “PROXY RETURN.” If you have more than one account, you may receive more than one proxy card. Please vote all proxy cards received. There are no duplicates.

If the plan of conversion and reorganization is approved, let me assure you that:

| • | existing deposit accounts and loans will not undergo any change; and |

| • | deposit accounts will continue to be federally insured to the maximum extent permitted by law. |

We regret that we are unable to offer you common stock in the subscription offering because the laws of your jurisdiction require us to register (1) the to-be-issued common stock of Ottawa Bancorp, Inc. or (2) as an agent of Ottawa Bancorp, Inc. to solicit the sale of such stock, and the number of eligible subscribers located in your jurisdiction does not justify the expense of such registration.

If you have any questions after reading the enclosed material, please call our Stock Information Center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays.

Sincerely,

Jon Kranov

President and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

2

Ottawa Savings Bank

Dear Friend of Ottawa Savings Bank:

We are pleased to announce that the Boards of Directors of Ottawa Savings Bank, Ottawa Bancorp, Inc., Ottawa Savings Bancorp MHC and Ottawa Savings Bancorp, Inc. have unanimously adopted a plan of conversion and reorganization under which we will convert from the mutual holding company form to the full stock form of organization and raise additional capital in a stock offering. Upon the completion of the conversion and reorganization, Ottawa Savings Bank will become a wholly-owned subsidiary of our new public holding company, Ottawa Bancorp, Inc. We believe this transition to a more common and flexible organizational structure, together with the proceeds raised in the stock offering, will better support our continued growth.

As a former depositor of Ottawa Savings Bank, you have nontransferable rights to subscribe for shares of common stock of Ottawa Bancorp, Inc. on a priority basis. The enclosed prospectus describes the stock offering in more detail. Please read the prospectus carefully before making an investment decision.

If you wish to subscribe for shares of common stock, please complete the enclosed stock order form and return it to Ottawa Bancorp, Inc., together with payment for the shares, using the enclosed postage-paid envelope marked “STOCK ORDER RETURN” or by overnight delivery service to our Stock Information Center located at 925 LaSalle Street, Ottawa, IL 61350. You may also hand deliver stock order forms at this location. We will not accept stock order forms at our other banking offices. Your order must be physically received (not postmarked) by Ottawa Bancorp, Inc. no later than : .m., Central Time, on day, , 2016.

If you have any questions after reading the enclosed material, please call our Stock Information Center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays.

Sincerely,

Jon Kranov

President and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

3

Ottawa Bancorp, Inc.

Dear Potential Investor:

We are pleased to provide you with the enclosed material regarding the stock offering by Ottawa Bancorp, Inc., the proposed new holding company for Ottawa Savings Bank. This information packet includes the following:

PROSPECTUS: This document provides detailed information about our proposed conversion from the mutual holding company form to the full stock form of organization and the related stock offering by Ottawa Bancorp, Inc. Please read it carefully before making an investment decision.

STOCK ORDER FORM: Use this form to subscribe for shares of common stock. Please complete the form and return it to Ottawa Bancorp, Inc., together with payment for the shares, using the enclosed postage-paid envelope marked “STOCK ORDER RETURN” or by overnight delivery service to our Stock Information Center located at 925 LaSalle Street, Ottawa, IL 61350. You may also hand deliver stock order forms at this location. We will not accept stock order forms at our other banking offices. Your order must be physically received (not postmarked) by Ottawa Bancorp, Inc. no later than : .m., Central Time, on day, , 2016.

We are pleased to offer you this opportunity to become one of our stockholders. If you have any questions after reading the enclosed material, please call our Stock Information Center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays.

Sincerely,

Jon Kranov

President and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

4

Sandler O’Neill + Partners, L.P.

Dear Prospective Investor:

At the request of Ottawa Bancorp, Inc. (the “Company”), we have enclosed materials regarding the Company’s offering of common stock in connection with the conversion of Ottawa Savings Bancorp MHC from the mutual holding company form to the full stock form of organization. Materials include a prospectus and a stock order form, which offer you the opportunity to subscribe for shares of common stock of Ottawa Bancorp, Inc., the proposed new holding company for Ottawa Savings Bank.

Please read the prospectus carefully before making an investment decision. If you have any questions after reading the enclosed material, please call the Stock Information Center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time, and ask for a Sandler O’Neill representative. The Stock Information Center will be closed weekends and bank holidays. If you decide to subscribe for shares, your order, together with payment for the shares, must be physically received (not postmarked) by Ottawa Bancorp, Inc. no later than : .m., Central Time, on day, , 2016.

We have been asked to forward these documents to you in view of certain requirements of the securities laws of your jurisdiction. We should not be understood as recommending or soliciting in any way any action by you with regard to the enclosed material.

Sandler O’Neill & Partners, L.P.

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

5

Ottawa Savings Bank

Proxy Questions and Answers

Questions & Answers About Voting

We are pleased to announce that the Boards of Directors of Ottawa Savings Bank, Ottawa Bancorp, Inc., Ottawa Savings Bancorp MHC and Ottawa Savings Bancorp, Inc. have unanimously adopted a plan of conversion and reorganization (the “Plan”) under which we will convert from the mutual holding company form to the full stock form of organization and raise additional capital in a stock offering. The Plan must be approved by the depositors and certain borrowers of Ottawa Savings Bank, who are the members of Ottawa Savings Bancorp MHC, at a special meeting of members. Your Board of Directors urges you to vote “FOR” the Plan.

Your vote is very important. If you have more than one account or have a qualifying loan, you may receive more than one proxy. Please vote all proxy cards received. There are no duplicates.

| Q. | Why is Ottawa Savings Bank converting to the full stock form of organization? |

| A. | We are converting because we believe that the transition to a more common and flexible organizational structure, together with the proceeds raised in the stock offering, will better support our continued growth. |

| Q. | Is Ottawa Savings Bank being sold to another bank? |

| A. | No. The conversion is simply a change in our organizational structure; we are not being sold to or merged with any other bank. |

| Q. | What changes will occur as a result of the conversion? Will there be changes at my local branch? |

| A. | No changes are planned in the way we operate our business. The conversion will have no effect on the staffing, products or services we offer to our customers through our offices, except to enable us to expand our existing products and potentially add additional products and services in the future. |

| Q. | Will the conversion affect any of my deposit accounts or loans? |

| A. | No. The conversion will have no effect on the balance or terms of any deposit account. Your deposits will continue to be federally insured to the fullest extent permissible by law. The terms, including interest rates, of your loans with us will also be unaffected by the conversion. |

| Q. | Who is eligible to vote on the Plan? |

| A. | Depositors of Ottawa Savings Bank as of the close of business on , 2016 and each former borrower of Twin Oaks Savings Bank (which merged with Ottawa Savings Bank) as of December 31, 2014 whose loan remained outstanding at Ottawa Savings Bank as of the close of business on , 2016, who continue to be depositors and borrowers of Ottawa Savings Bank as of the date of the special meeting of members, are eligible to vote at the special meeting of members. |

| Q. | What vote is required to approve the Plan by Members? |

| A. | The Plan must be approved by the affirmative vote of a majority of the total number of outstanding votes entitled to be cast by the members of Ottawa Savings Bancorp MHC at the special meeting of members. |

6

| Q. | Why did I receive several proxies? |

| A. | If you have more than one deposit or loan account, you may have received more than one proxy, depending upon the ownership structure of your accounts or your borrower status. You will receive a separate proxy statement and proxy card if you are also a current stockholder of Ottawa Savings Bancorp, Inc. Please vote all proxy cards that you received. There are no duplicates. |

| Q. | Does my vote for the conversion mean that I must buy common stock of Ottawa Bancorp, Inc.? |

| A. | No. Voting for the Plan does not obligate you to buy any shares of common stock of Ottawa Bancorp, Inc. |

| Q. | How do I vote my proxy? |

| A. | You can vote by mailing your signed proxy card(s) in the postage-paid envelope marked “PROXY RETURN”. |

| Q. | Are two signatures required on the proxy card for a joint account? |

| A. | No. Only one signature is required on a proxy card for a joint account. |

| Q. | Who should sign proxies for trust or custodian accounts? |

| A. | The trustee or custodian must sign proxies for such accounts, not the beneficiary. Please indicate your title on the proxy card. |

| Q. | I am the executor (administrator) for a deceased depositor. Can I sign the proxy card? |

| A. | Yes. Please indicate on the card the capacity in which you are signing. |

Additional Information

| Q. | What if I have additional questions? |

| A. | Ottawa Savings Bancorp MHC’s proxy statement and Ottawa Bancorp, Inc.’s prospectus that accompany this brochure describe the conversion in detail. Please read the proxy statement and prospectus carefully before voting and/or subscribing for stock. If you have any questions after reading the enclosed material, you may call our Stock Information Center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays. |

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

7

Ottawa Bancorp, Inc.

Stock Questions and Answers

Questions & Answers About the Stock Offering

We are pleased to announce that the Boards of Directors of Ottawa Savings Bank, Ottawa Bancorp, Inc., Ottawa Savings Bancorp MHC and Ottawa Savings Bancorp, Inc. have unanimously adopted a plan of conversion and reorganization (the “Plan”) under which we will convert from the mutual holding company form to the full stock form of organization. In connection with the conversion, Ottawa Bancorp, Inc., the proposed new holding company for Ottawa Savings Bank, is offering up to 2,383,950 shares of common stock for sale at $10.00 per share in a subscription offering and, subject to the priority rights of subscribers in the subscription offering, in a community offering.

Investing in common stock involves certain risks. For a discussion of these risks and other factors, investors are urged to read the accompanying prospectus before making an investment decision.

| Q. | Who can purchase stock in the subscription offering? |

| A. | Only qualifying depositors and certain borrowers of Ottawa Savings Bank and Ottawa Savings Bank’s tax-qualified employee stock benefit plans may purchase shares of stock in the subscription offering. The common stock is being offered in the following order of priority: |

| 1) | Eligible Account Holders - Depositors of Ottawa Savings Bank with aggregate balances of $50 or more at the close of business on May 31, 2015. |

| 2) | Tax-Qualified Plans - Ottawa Savings Bank’s tax-qualified employee stock benefit plans. |

| 3) | Supplemental Eligible Account Holders - Depositors of Ottawa Savings Bank with aggregate balances of $50 or more at the close of business on June 30, 2016 and who are not otherwise eligible in category (1) above. |

| 4) | Other Members - Depositors of Ottawa Savings Bank at the close of business on , 2016 and each former borrower of Twin Oaks Savings Bank as of December 31, 2014 whose loans remained outstanding at Ottawa Savings Bank as of the close of business on , 2016 and who are not otherwise eligible in categories (1) or (3) above. |

| Q. | I am not eligible to purchase stock in the subscription offering. May I still place an order to purchase shares? |

| A. | Subject to the priority rights of qualifying depositors and borrowers and the Bank’s stock benefit plans in the subscription offering, common stock may be offered to the general public in a community offering. Natural persons (including trusts of natural persons) residing in LaSalle and Grundy Counties in Illinois will be given preference in the community offering. The community offering may begin concurrently with, or any time after, the commencement of the subscription offering. |

| Q. | Am I guaranteed to receive shares if I place an order? |

| A. | No. It is possible that orders received during the offering period will exceed the number of shares being sold. Such an oversubscription would result in shares being allocated among subscribers starting with subscribers who are Eligible Account Holders. If the offering is oversubscribed in the subscription offering, no orders received in the community offering will be filled. |

8

| Q. | How many shares of stock are being offered, and at what price? |

| A. | Ottawa Bancorp, Inc. is offering between 1,762,050 and 2,383,950 shares of common stock at a price of $10.00 per share. |

| Q. | How much stock can I purchase? |

| A. | The minimum purchase is 25 shares ($250). As more fully described in the plan of conversion and reorganization and in the prospectus, the maximum purchase by any person in the subscription or community offering is 15,000 shares ($150,000). In addition, no person, together with their associates, or group of persons acting in concert, may purchase more than 25,000 shares ($250,000) of common stock in the offering. |

| Q. | How do I order stock? |

| A. | If you decide to subscribe for shares, you must return your properly completed and signed stock order form, along with full payment for the shares, to Ottawa Bancorp, Inc. by mail using the enclosed postage-paid envelope marked “STOCK ORDER RETURN” or by overnight delivery service to our Stock Information Center located at 925 LaSalle Street, Ottawa, IL 61350. You may also hand deliver stock order forms at this location. We will not accept stock order forms at our other banking offices. Your order must be physically received (not postmarked) by Ottawa Bancorp, Inc. no later than : .m., Central Time, on day, , 2016. |

| Q. | How can I pay for my shares of stock? |

| A. | You can pay for the common stock by check, money order, or withdrawal from your deposit account or certificate of deposit at Ottawa Savings Bank. Checks and money orders must be made payable to Ottawa Bancorp, Inc. Withdrawals from a certificate of deposit at Ottawa Savings Bank to buy shares of common stock may be made without penalty. |

| Q. | Can I use my Ottawa Savings Bank home equity line of credit to pay for shares of common stock? |

| A. | No. Ottawa Savings Bank cannot knowingly lend funds to anyone to subscribe for shares. This includes the use of funds available through an Ottawa Savings Bank home equity line of credit. |

| Q. | Can I subscribe for shares using funds in my IRA at Ottawa Savings Bank? |

| A. | No. Federal regulations do not permit the purchase of common stock with funds held in your existing IRA or other qualified plan at Ottawa Savings Bank. To use these funds to subscribe for common stock, you need to establish a “self-directed” IRA or other trust account with an unaffiliated trustee. The transfer of these funds takes time, so please make arrangements as soon as possible. However, if you intend to subscribe for common stock using your eligibility as an IRA account holder but plan to use funds from sources other than your IRA account, you need not close and transfer your IRA account. Please call our Stock Information Center if you require additional information. |

| Q. | When is the deadline to subscribe for stock? |

| A. | A properly completed stock order form with the required full payment must be physically received (not postmarked) by Ottawa Bancorp, Inc. no later than : .m., Central Time, on day, , 2016. |

| Q. | Can I subscribe for shares in the subscription offering and add someone else who is not on my account to my stock registration? |

| A. | No. Federal regulations prohibit the transfer of subscription rights. |

| Q. | Can I subscribe for shares in my name alone if I have a joint account? |

| A. | Yes. |

9

| Q. | I have custodial accounts at Ottawa Savings Bank with my minor children. May I use these accounts to purchase stock in the subscription offering? |

| A. | Yes. However, the stock must be registered in the custodian’s name for the benefit of the minor child under the Uniform Transfers to Minors Act. A custodial account does not entitle the custodian to purchase stock in his or her own name. If the child has reached the age of majority, the child must subscribe for the shares in his or her own name. |

| Q. | I have a business or trust account at Ottawa Savings Bank. May I use these accounts to purchase stock in the subscription offering? |

| A. | Yes. However, the stock must be purchased in the name of the business or trust. A business or trust account does not entitle the owner of or signatory for the business or the trustee to purchase stock in his or her own name. |

| Q. | Will payments for common stock earn interest until the conversion closes? |

| A. | Yes. Any payment made by check or money order will earn interest at 0.06% from the date the order is processed to the completion or termination of the conversion. Depositors who pay for their stock by withdrawal authorization from an account at Ottawa Savings Bank will receive interest at the contractual rate on the account until the completion or termination of the offering. |

| Q. | Will dividends be paid on the stock? |

| A. | Beginning with the first full quarter following the completion of the conversion, we intend to pay cash dividends on a quarterly basis. Initially, we expect the quarterly dividends to be $0.04 per share. However, the amount of dividends to be paid will be subject to our capital requirements, our financial condition and results of operations, tax considerations, statutory and regulatory limitations, and general economic conditions. We cannot assure you that we will pay dividends in the future, or that any such dividends will not be reduced or eliminated in the future. |

| Q. | Will my stock be covered by deposit insurance? |

| A. | No. |

| Q. | Where will the stock be traded? |

| A. | Upon completion of the conversion and reorganization, our shares of common stock are expected to be listed on the Nasdaq Capital Market under the symbol “OTTW.” |

| Q. | Can I change my mind after I place an order to subscribe for stock? |

| A. | No. After receipt, your order may not be modified or withdrawn. |

| Q. | What happens to the Ottawa Savings Bancorp, Inc. shares I currently own? |

| A. | The shares of common stock owned by the existing public stockholders of Ottawa Savings Bancorp, Inc. will be exchanged for shares of common stock of Ottawa Bancorp, Inc. based on an exchange ratio that will result in existing public stockholders owning approximately the same percentage of Ottawa Bancorp, Inc. common stock as they owned of Ottawa Savings Bancorp, Inc. common stock immediately prior to the completion of the conversion. The actual number of shares you receive will depend upon the number of shares we sell in our offering and will be announced shortly before the completion of the conversion. |

10

| Q. | If I purchase shares of common stock during the offering, when will I receive my stock? |

| A. | Physical stock certificates will not be issued. Our transfer agent will send you a stock ownership statement, via the Direct Registration System (DRS), by first class mail as soon as practicable after the completion of the conversion. Although the shares of Ottawa Bancorp, Inc. common stock will have begun trading, brokerage firms may require that you have received your stock ownership statement prior to selling your shares. Your ability to sell the shares of common stock prior to your receipt of the statement will depend on arrangements you may make with your brokerage firm. |

| Q. | What is direct registration and DRS? |

| A. | Direct registration is the ownership of stock registered in your own name on the books of Ottawa Bancorp, Inc., without taking possession of a printed stock certificate. Instead, your ownership is recorded and tracked as an accounting entry (“book entry”) on the books of Ottawa Bancorp, Inc. DRS is a system that electronically moves investors’ positions between brokers and transfer agents for issuers that offer direct registration. |

Additional Information

| Q. | What if I have additional questions? |

| A. | Ottawa Bancorp, Inc.’s prospectus that accompanies this brochure describes the conversion in detail. Please read the prospectus carefully before making an investment decision. If you have any questions after reading the enclosed material, you may call our Stock Information Center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays. |

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

11

IMPORTANT REMINDER

|

PLEASE SUPPORT US

|

Ottawa Savings Bank

Dear Member:

As a follow-up to our recent proxy mailing, WE URGE YOU TO VOTE ALL OF YOUR PROXY CARDS on the proposed plan of conversion and reorganization. We value your relationship with Ottawa Savings Bank and ask for your support by voting the enclosed proxy card today.

If you are unsure whether you voted, please vote the enclosed proxy card. If you have already voted all of your proxy card(s), I would like to extend my appreciation for your vote. Let me assure you that:

| • | The conversion will not affect the terms of your deposit accounts or loans. |

| • | Deposit accounts will continue to be federally insured to the legal maximum. |

| • | Voting does not obligate you to buy stock. |

Thank you for choosing Ottawa Savings Bank, and we appreciate your vote. If you have any questions, please call our Stock Information Center at ( ) - .

Sincerely,

Jon Kranov

President and Chief Executive Officer

The Plan of Conversion and Reorganization must be approved by a majority of the votes eligible to be cast.

Your Board of Directors urges you to vote “FOR” the Plan of Conversion and Reorganization.

| FOR |

|

If you have more than one account or a qualifying loan you may receive more than one proxy card.

Please support us by voting all proxy cards received.

12

SECOND REQUEST

|

PLEASE SUPPORT US

|

Ottawa Savings Bank

Dear Member:

As a follow-up to our recent proxy mailing, our records show that YOU HAVE NOT VOTED ALL OF YOUR PROXY CARDS on the proposed plan of conversion and reorganization. We value your relationship with Ottawa Savings Bank and ask for your support by voting the enclosed proxy card today.

If you are unsure whether you voted, please vote the enclosed proxy card. If you have already voted all of your proxy card(s), I would like to extend my appreciation for your vote. Let me assure you that:

| • | The conversion will not affect the terms of your deposit accounts or loans. |

| • | Deposit accounts will continue to be federally insured to the legal maximum. |

| • | Voting does not obligate you to buy stock. |

Thank you for choosing Ottawa Savings Bank, and we appreciate your vote. If you have any questions, please call our Stock Information Center at ( ) - .

Sincerely,

Jon Kranov

President and Chief Executive Officer

The Plan of Conversion and Reorganization must be approved by a majority of the votes eligible to be cast.

Your Board of Directors urges you to vote “FOR” the Plan of Conversion and Reorganization.

| FOR |

|

If you have more than one account or a qualifying loan you may receive more than one proxy card.

Please support us by voting all proxy cards received.

13

|

OTTAWA SAVINGS BANCORP MHC |

REVOCABLE PROXY | |||||||

| þ | Please vote by marking one of the boxes as shown. | The undersigned hereby acknowledges receipt of a Notice of Special Meeting of Members of Ottawa Savings Bancorp MHC called for [MEETING DATE] and a Proxy Statement for the Special Meeting (and the accompanying Prospectus) before signing this proxy. | ||||||

|

1. |

The approval of a plan of conversion and reorganization, pursuant to which Ottawa Savings Bank will be reorganized from the mutual holding company corporate structure into the fully public stock holding company structure (as described on the reverse side of this proxy card). |

|||||||

| â | ||||||||

|

FOR ¨ AGAINST ¨ |

| |||||||

| Signature | Date | |||||||

| IMPORTANT: Please sign your name exactly as it appears on this proxy. Joint accounts need only one signature. When signing as an attorney, administrator, agent, officer, executor, trustee, guardian, etc., please add your full title to your signature.

| ||||||||

|

NOTE: PLEASE SIGN, DATE AND PROMPTLY RETURN ALL PROXY CARDS IN THE ENCLOSED POSTAGE-PREPAID PROXY REPLY ENVELOPE. NONE ARE DUPLICATES.

| ||||||||

|

|

|

|

| |||||

ã

DETACH HERE

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR” APPROVAL OF THE PLAN OF CONVERSION AND REORGANIZATION.

|

u VOTE BY MAIL

|

|

þ VOTE, SIGN, DATE & MAIL YOUR PROXY CARD(S)

PROXY RETURN ENVELOPE

|

|

YOU MAY RETURN ALL PROXY CARDS RECEIVED IN ONE ENVELOPE

|

VOTING DOES NOT OBLIGATE YOU TO BUY STOCK AND DOES NOT AFFECT THE TERMS OF OR INSURANCE ON YOUR DEPOSIT ACCOUNTS.

IF YOU HAVE MORE THAN ONE DEPOSIT ACCOUNT OR A QUALIFYING LOAN, YOU MAY RECEIVE MORE THAN ONE PROXY CARD

DEPENDING ON THE OWNERSHIP STRUCTURE OF YOUR ACCOUNTS.

PLEASE SUPPORT US BY VOTING ALL PROXY CARDS RECEIVED.

14

| OTTAWA SAVINGS BANCORP MHC | REVOCABLE PROXY | |

|

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF OTTAWA SAVINGS BANCORP MHC

The undersigned member of Ottawa Savings Bancorp MHC hereby appoints , and , and each of them with the power of substitution in each, as proxy to cast all votes which the undersigned is entitled to cast at a special meeting of members to be held at , Ottawa, Illinois at : .m., local time, on [MEETING DATE], and at any and all adjournments and postponements thereof, and to act with respect to all votes that the undersigned would be entitled to cast, if then personally present, in accordance with the instructions on the reverse side hereof:

FOR or AGAINST the Plan of Conversion and Reorganization pursuant to which Ottawa Savings Bancorp MHC will convert from the mutual holding company to the fully public stock holding company structure and a Maryland-chartered corporation named Ottawa Bancorp, Inc. will offer shares of its common stock for sale.

This proxy, properly signed and dated, will be voted as directed by the undersigned member. UNLESS CONTRARY DIRECTION IS GIVEN, THIS PROXY, PROPERLY SIGNED AND DATED, WILL BE VOTED FOR APPROVAL OF THE PLAN OF CONVERSION AND REORGANIZATION. In addition, this proxy will be voted at the discretion of the Board of Directors upon any other matter as may properly come before the special meeting. No such matters are anticipated.

The undersigned may revoke this proxy at any time before it is voted by delivering to the Corporate Secretary of Ottawa Savings Bancorp MHC either a written revocation of the proxy or a duly executed proxy bearing a later date, or by appearing at the special meeting and voting in person.

IMPORTANT: PLEASE VOTE, DATE AND SIGN ON THE REVERSE SIDE. NOT VOTING WILL HAVE THE SAME EFFECT AS VOTING AGAINST THE PLAN OF CONVERSION AND REORGANIZATION. OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE PLAN OF CONVERSION AND REORGANIZATION. VOTING DOES NOT OBLIGATE YOU TO BUY STOCK. (Continued on reverse side) | ||

ã

DETACH HERE

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR” APPROVAL OF THE PLAN OF CONVERSION AND REORGANIZATION.

VOTING DOES NOT OBLIGATE YOU TO BUY STOCK AND DOES NOT AFFECT THE TERMS OF OR INSURANCE ON YOUR DEPOSIT ACCOUNTS.

IF YOU HAVE MORE THAN ONE DEPOSIT ACCOUNT OR A QUALIFYING LOAN, YOU MAY RECEIVE MORE THAN ONE PROXY CARD

DEPENDING ON THE OWNERSHIP STRUCTURE OF YOUR ACCOUNTS.

PLEASE SUPPORT US BY VOTING ALL PROXY CARDS RECEIVED.

15

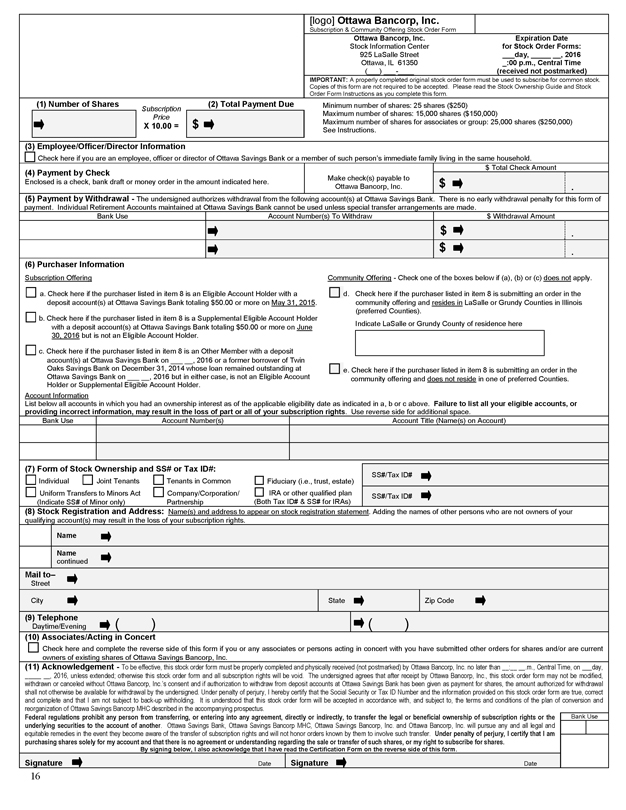

[logo] Ottawa Bancorp, Inc.

Subscription &

Community Offering Stock Order Form

Ottawa Bancorp, Inc.

Stock Information

Center

925 LaSalle Street

Ottawa, IL 61350

(___)___-____

Expiration Date

for Stock Order Forms:

___day, _____ __, 2016

_:00 p.m., Central Time

(received not postmarked)

IMPORTANT: A properly completed original stock order form must be used to subscribe for common stock. Copies of this form are not required to be accepted. Please read the Stock

Ownership Guide and Stock Order Form Instructions as you complete this form.

(1) Number of Shares

Subscription Price X 10.00 =

(2) Total Payment Due

$

Minimum number of shares: 25 shares ($250)

Maximum number of shares: 15,000 shares ($150,000)

Maximum number of shares for associates or

group: 25,000 shares ($250,000)

See Instructions.

(3)

Employee/Officer/Director Information

Check here if you are an employee, officer or director of Ottawa Savings Bank or a member of such person’s immediate

family living in the same household.

(4) Payment by Check

Enclosed is a

check, bank draft or money order in the amount indicated here.

Make check(s) payable to

Ottawa Bancorp, Inc.

$ Total Check Amount

$.

(5) Payment by Withdrawal - The undersigned authorizes withdrawal from the following

account(s) at Ottawa Savings Bank. There is no early withdrawal penalty for this form of payment. Individual Retirement Accounts maintained at Ottawa Savings Bank cannot be used unless special transfer arrangements are made.

Bank Use

Account Number(s) To Withdraw

$ Withdrawal Amount

$.

$.

(6) Purchaser Information

Subscription Offering

a. Check here if the purchaser listed in item 8 is an Eligible Account

Holder with a deposit account(s) at Ottawa Savings Bank totaling $50.00 or more on May 31, 2015.

b. Check here if the purchaser listed in item 8 is a Supplemental

Eligible Account Holder with a deposit account(s) at Ottawa Savings Bank totaling $50.00 or more on June 30, 2016 but is not an Eligible Account Holder.

c. Check

here if the purchaser listed in item 8 is an Other Member with a deposit account(s) at Ottawa Savings Bank on ___ __, 2016 or a former borrower of Twin Oaks Savings Bank on December 31, 2014 whose loan remained outstanding at Ottawa Savings Bank on

___ __, 2016 but in either case, is not an Eligible Account Holder or Supplemental Eligible Account Holder.

Community Offering - Check one of the boxes below if

(a), (b) or (c) does not apply.

d. Check here if the purchaser listed in item 8 is submitting an order in the community offering and resides in LaSalle or Grundy

Counties in Illinois (preferred Counties).

Indicate LaSalle or Grundy County of residence here

e. Check here if the purchaser listed in item 8 is submitting an order in the community offering and does not reside in one of preferred Counties.

Account Information

List below all accounts in which you had an ownership interest as of the

applicable eligibility date as indicated in a, b or c above. Failure to list all your eligible accounts, or providing incorrect information, may result in the loss of part or all of your subscription rights. Use reverse side for additional space.

Bank Use

Account Number(s)

Account Title (Name(s) on Account)

(7) Form of Stock Ownership and SS# or Tax ID#:

Individual

Joint Tenants

Tenants in Common

Fiduciary (i.e., trust, estate)

Uniform Transfers to Minors Act (Indicate SS# of Minor only)

Company/Corporation/Partnership

IRA or other qualified plan (Both Tax ID# & SS# for IRAs)

SS#/Tax ID#

SS#/Tax ID#

(8) Stock Registration and Address: Name(s) and address to appear

on stock registration statement. Adding the names of other persons who are not owners of your qualifying account(s) may result in the loss of your subscription rights.

Name

Name continued

Mail to-

Street

City

State

Zip Code

(9) Telephone

Daytime/Evening

( )

( )

(10) Associates/Acting in Concert

Check here and complete the reverse side of this form if you or any associates or persons acting in concert with you have submitted other orders for shares and/or are current

owners of existing shares of Ottawa Savings Bancorp, Inc.

(11) Acknowledgement - To be effective, this stock order form must be properly completed and physically

received (not postmarked) by Ottawa Bancorp, Inc. no later than __:__ __.m., Central Time, on ___day, _____ __, 2016, unless extended; otherwise this stock order form and all subscription rights will be void. The undersigned agrees that after

receipt by Ottawa Bancorp, Inc., this stock order form may not be modified, withdrawn or canceled without Ottawa Bancorp, Inc.’s consent and if authorization to withdraw from deposit accounts at Ottawa Savings Bank has been given as payment for

shares, the amount authorized for withdrawal shall not otherwise be available for withdrawal by the undersigned. Under penalty of perjury, I hereby certify that the Social Security or Tax ID Number and the information provided on this stock order

form are true, correct and complete and that I am not subject to back-up withholding. It is understood that this stock order form will be accepted in accordance with, and subject to, the terms and conditions of the plan of conversion and

reorganization of Ottawa Savings Bancorp MHC described in the accompanying prospectus.

Federal regulations prohibit any person from transferring, or entering into

any agreement, directly or indirectly, to transfer the legal or beneficial ownership of subscription rights or the underlying securities to the account of another. Ottawa Savings Bank, Ottawa Savings Bancorp MHC, Ottawa Savings Bancorp, Inc. and

Ottawa Bancorp, Inc. will pursue any and all legal and equitable remedies in the event they become aware of the transfer of subscription rights and will not honor orders known by them to involve such transfer. Under penalty of perjury, I certify

that I am purchasing shares solely for my account and that there is no agreement or understanding regarding the sale or transfer of such shares, or my right to subscribe for shares.

By signing below, I also acknowledge that I have read the Certification Form on the reverse side of this form.

Bank Use

Signature Date

Signature Date

16

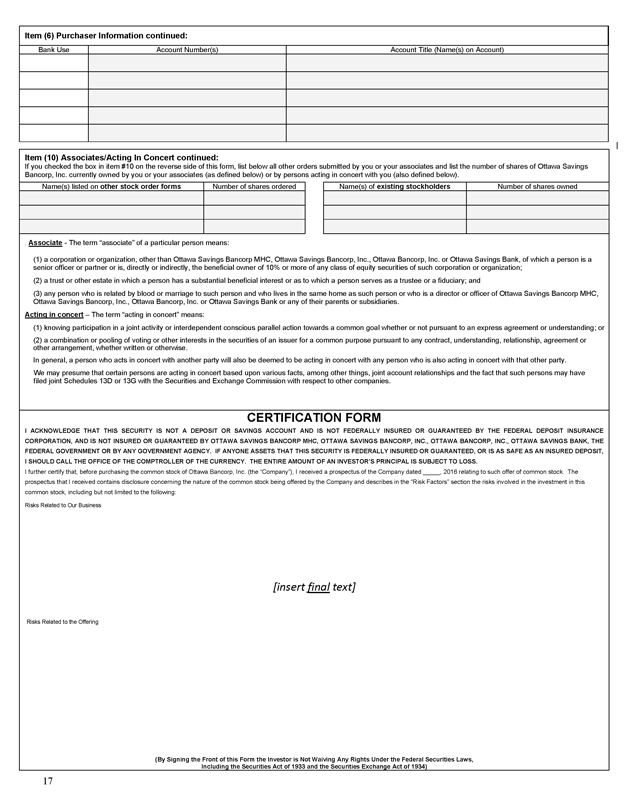

Item (6) Purchaser Information continued:

Bank Use

Account Number(s)

Account Title (Name(s) on Account)

Item (10) Associates/Acting In Concert continued:

If you checked the box in item #10 on the

reverse side of this form, list below all other orders submitted by you or your associates and list the number of shares of Ottawa Savings Bancorp, Inc. currently owned by you or your associates (as defined below) or by persons acting in concert

with you (also defined below).

Name(s) listed on other stock order forms

Number of shares ordered

Name(s) of existing stockholders

Number of shares owned

Associate - The term “associate” of a particular person

means:

(1) a corporation or organization, other than Ottawa Savings Bancorp MHC, Ottawa Savings Bancorp, Inc., Ottawa Bancorp, Inc. or Ottawa Savings Bank, of

which a person is a senior officer or partner or is, directly or indirectly, the beneficial owner of 10% or more of any class of equity securities of such corporation or organization;

(2) a trust or other estate in which a person has a substantial beneficial interest or as to which a person serves as a trustee or a fiduciary; and

(3) any person who is related by blood or marriage to such person and who lives in the same home as such person or who is a director or officer of Ottawa Savings Bancorp MHC,

Ottawa Savings Bancorp, Inc., Ottawa Bancorp, Inc. or Ottawa Savings Bank or any of their parents or subsidiaries.

Acting in concert - The term “acting in

concert” means:

(1) knowing participation in a joint activity or interdependent conscious parallel action towards a common goal whether or not pursuant to an

express agreement or understanding; or

(2) a combination or pooling of voting or other interests in the securities of an issuer for a common purpose pursuant to

any contract, understanding, relationship, agreement or other arrangement, whether written or otherwise.

In general, a person who acts in concert with another

party will also be deemed to be acting in concert with any person who is also acting in concert with that other party.

We may presume that certain persons are

acting in concert based upon various facts, among other things, joint account relationships and the fact that such persons may have filed joint Schedules 13D or 13G with the Securities and Exchange Commission with respect to other companies.

CERTIFICATION FORM

I ACKNOWLEDGE THAT THIS SECURITY IS NOT A DEPOSIT OR

SAVINGS ACCOUNT AND IS NOT FEDERALLY INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION, AND IS NOT INSURED OR GUARANTEED BY OTTAWA SAVINGS BANCORP MHC, OTTAWA SAVINGS BANCORP, INC., OTTAWA BANCORP, INC., OTTAWA SAVINGS BANK, THE

FEDERAL GOVERNMENT OR BY ANY GOVERNMENT AGENCY. IF ANYONE ASSETS THAT THIS SECURITY IS FEDERALLY INSURED OR GUARANTEED, OR IS AS SAFE AS AN INSURED DEPOSIT, I SHOULD CALL THE OFFICE OF THE COMPTROLLER OF THE CURRENCY. THE ENTIRE AMOUNT OF AN

INVESTOR’S PRINCIPAL IS SUBJECT TO LOSS.

I further certify that, before purchasing the common stock of Ottawa Bancorp, Inc. (the “Company”), I

received a prospectus of the Company dated _____, 2016 relating to such offer of common stock. The prospectus that I received contains disclosure concerning the nature of the common stock being offered by the Company and describes in the “Risk

Factors” section the risks involved in the investment in this common stock, including but not limited to the following:

Risks Related to Our Business

[insert final text]

Risks Related to the Offering

(By Signing the Front of this Form the Investor is Not Waiving Any Rights Under the Federal Securities Laws,

Including the Securities Act of 1933 and the Securities Exchange Act of 1934)

17

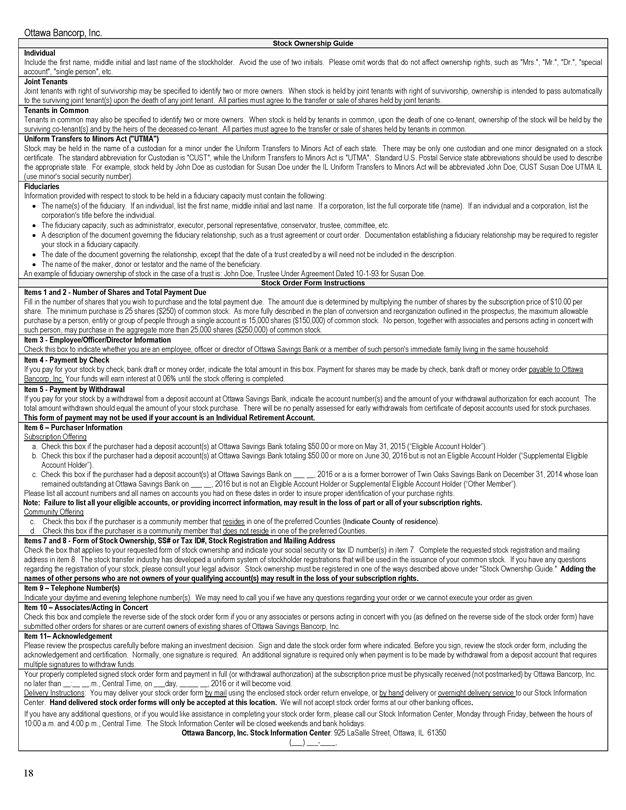

Ottawa Bancorp, Inc.

Stock Ownership Guide

Individual

Include the first name, middle initial and last name of the

stockholder. Avoid the use of two initials. Please omit words that do not affect ownership rights, such as “Mrs.”, “Mr.”, “Dr.”, “special account”, “single person”, etc.

Joint Tenants

Joint tenants with right of survivorship may be specified to identify two or

more owners. When stock is held by joint tenants with right of survivorship, ownership is intended to pass automatically to the surviving joint tenant(s) upon the death of any joint tenant. All parties must agree to the transfer or sale of

shares held by joint tenants.

Tenants in Common

Tenants in common may also be

specified to identify two or more owners. When stock is held by tenants in common, upon the death of one co-tenant, ownership of the stock will be held by the surviving co-tenant(s) and by the heirs of the deceased co-tenant. All parties

must agree to the transfer or sale of shares held by tenants in common.

Uniform Transfers to Minors Act (“UTMA”)

Stock may be held in the name of a custodian for a minor under the Uniform Transfers to Minors Act of each state. There may be only one custodian and one minor designated on a

stock certificate. The standard abbreviation for Custodian is “CUST”, while the Uniform Transfers to Minors Act is “UTMA”. Standard U.S. Postal Service state abbreviations should be used to describe the appropriate

state. For example, stock held by John Doe as custodian for Susan Doe under the IL Uniform Transfers to Minors Act will be abbreviated John Doe, CUST Susan Doe UTMA IL (use minor’s social security number).

Fiduciaries

Information provided with respect to stock to be held in a fiduciary capacity must

contain the following:

The name(s) of the fiduciary. If an individual, list the first name, middle initial and last name. If a corporation, list the full

corporate title (name). If an individual and a corporation, list the corporation’s title before the individual.

The fiduciary capacity, such as

administrator, executor, personal representative, conservator, trustee, committee, etc.

A description of the document governing the fiduciary relationship, such as

a trust agreement or court order. Documentation establishing a fiduciary relationship may be required to register your stock in a fiduciary capacity.

The date

of the document governing the relationship, except that the date of a trust created by a will need not be included in the description.

The name of the maker, donor

or testator and the name of the beneficiary.

An example of fiduciary ownership of stock in the case of a trust is: John Doe, Trustee Under Agreement Dated 10-1-93

for Susan Doe.

Stock Order Form Instructions

Items 1 and 2 - Number of Shares

and Total Payment Due

Fill in the number of shares that you wish to purchase and the total payment due. The amount due is determined by multiplying the number

of shares by the subscription price of $10.00 per share. The minimum purchase is 25 shares ($250) of common stock. As more fully described in the plan of conversion and reorganization outlined in the prospectus, the maximum allowable

purchase by a person, entity or group of people through a single account is 15,000 shares ($150,000) of common stock. No person, together with associates and persons acting in concert with such person, may purchase in the aggregate more than

25,000 shares ($250,000) of common stock.

Item 3 - Employee/Officer/Director Information

Check this box to indicate whether you are an employee, officer or director of Ottawa Savings Bank or a member of such person’s immediate family living in the same household.

Item 4 - Payment by Check

If you pay for your stock by check, bank draft or

money order, indicate the total amount in this box. Payment for shares may be made by check, bank draft or money order payable to Ottawa Bancorp, Inc. Your funds will earn interest at 0.06% until the stock offering is completed.

Item 5 - Payment by Withdrawal

If you pay for your stock by a withdrawal from a deposit

account at Ottawa Savings Bank, indicate the account number(s) and the amount of your withdrawal authorization for each account. The total amount withdrawn should equal the amount of your stock purchase. There will be no penalty assessed

for early withdrawals from certificate of deposit accounts used for stock purchases. This form of payment may not be used if your account is an Individual Retirement Account.

Item 6 - Purchaser Information

Subscription Offering

a. Check this box if the purchaser had a deposit account(s) at Ottawa Savings Bank totaling $50.00 or more on May 31, 2015 (“Eligible Account Holder”).

b. Check this box if the purchaser had a deposit account(s) at Ottawa Savings Bank totaling $50.00 or more on June 30, 2016 but is not an Eligible Account Holder

(“Supplemental Eligible Account Holder”).

c. Check this box if the purchaser had a deposit account(s) at Ottawa Savings Bank on , 2016 or a is a

former borrower of Twin Oaks Savings Bank on December 31, 2014 whose loan remained outstanding at Ottawa Savings Bank on , 2016 but is not an Eligible Account Holder or Supplemental Eligible Account Holder (“Other Member”).

Please list all account numbers and all names on accounts you had on these dates in order to insure proper identification of your purchase rights.

Note: Failure to list all your eligible accounts, or providing incorrect information, may result in the loss of part or all of your subscription rights.

Community Offering

c. Check this box if the purchaser is a community member that resides in

one of the preferred Counties (Indicate County of residence).

d. Check this box if the purchaser is a community member that does not reside in one of the preferred

Counties.

Items 7 and 8 - Form of Stock Ownership, SS# or Tax ID#, Stock Registration and Mailing Address

Check the box that applies to your requested form of stock ownership and indicate your social security or tax ID number(s) in item 7. Complete the requested stock registration

and mailing address in item 8. The stock transfer industry has developed a uniform system of stockholder registrations that will be used in the issuance of your common stock. If you have any questions regarding the registration of your

stock, please consult your legal advisor. Stock ownership must be registered in one of the ways described above under “Stock Ownership Guide.” Adding the names of other persons who are not owners of your qualifying account(s) may

result in the loss of your subscription rights.

Item 9 - Telephone Number(s)

Indicate your daytime and evening telephone number(s). We may need to call you if we have any questions regarding your order or we cannot execute your order

as given.

Item 10 - Associates/Acting in Concert

Check this box and complete

the reverse side of the stock order form if you or any associates or persons acting in concert with you (as defined on the reverse side of the stock order form) have submitted other orders for shares or are current owners of existing shares of

Ottawa Savings Bancorp, Inc.

Item 11 - Acknowledgement

Please review the

prospectus carefully before making an investment decision. Sign and date the stock order form where indicated. Before you sign, review the stock order form, including the acknowledgement and certification. Normally, one signature is

required. An additional signature is required only when payment is to be made by withdrawal from a deposit account that requires multiple signatures to withdraw funds.

Your properly completed signed stock order form and payment in full (or withdrawal authorization) at the subscription price must be physically received (not postmarked) by Ottawa

Bancorp, Inc. no later than : . m., Central Time , on day , , 2016 or it will become void.

Delivery Instructions: You may deliver your stock order form by mail

using the enclosed stock order return envelope, or by hand delivery or overnight delivery service to our Stock Information Center. Hand delivered stock order forms will only be accepted at this location. We will not accept stock order

forms at our other banking offices.

If you have any additional questions, or if you would like assistance in completing your stock order form, please call our

Stock Information Center, Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays.

Ottawa Bancorp, Inc. Stock Information Center: 925 LaSalle Street, Ottawa, IL 61350

( ) -

, 18

Ottawa Savings Bank

Please Support Us

Vote Your Proxy Card Today

FOR

If you have more than one account, you may have received more than one proxy card

depending upon the ownership structure of your accounts.

Please vote all proxy cards that you received.

19

Ottawa Bancorp, Inc.

, 2016

Dear Subscriber:

We hereby acknowledge receipt of your order and payment for Ottawa Bancorp, Inc. common stock at $10.00 per share. If you are issued shares, the shares will be registered as indicated above.

At this time, we cannot confirm the number of shares of Ottawa Bancorp, Inc. common stock, if any, that will be issued to you. Following completion of the stock offering, shares will be allocated in accordance with the plan of conversion and reorganization. Once the offering has been completed, you will receive by mail from our transfer agent, Computershare Trust Company, N.A., a confirmation indicating your ownership of Ottawa Bancorp, Inc. common stock.

Please retain this letter and refer to the batch and item number indicated below for any future inquiries you may have regarding this order.

If you have any questions, please call our Stock Information Center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time.

Ottawa Bancorp, Inc.

Stock Information Center

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

20

Ottawa Bancorp, Inc.

, 2016

Dear Stockholder:

Thank you for your interest in Ottawa Bancorp, Inc. Our offering has been completed and we are pleased to confirm your subscription for shares at a price of $10.00 per share. If your subscription was paid for by check, bank draft or money order, interest earned on the funds submitted and any refund due to you will be mailed promptly.

The closing of the transaction occurred on , 2016; this is your stock purchase date. Trading is expected to commence on the Nasdaq Capital Market under the symbol “OTTW” on , 2016.

A statement indicating the number of shares of Ottawa Bancorp, Inc. you have purchased will be mailed to you shortly. This statement will be your evidence of ownership of Ottawa Bancorp, Inc. stock. All shares of Ottawa Bancorp, Inc. common stock will be in book entry form and paper stock certificates will not be issued.

Ottawa Bancorp, Inc.

Stock Information Center

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

21

Ottawa Bancorp, Inc.

, 2016

Dear Interested Investor:

We recently completed our subscription offering. Unfortunately, due to the demand for shares from persons with priority rights, stock was not available for our [Supplemental Eligible Account Holders, Other Members or community friends]. If your subscription was paid for by check, bank draft or money order, a refund of your funds with interest will be mailed promptly. If funds were held in your Ottawa Savings Bank account, these funds are now available.

We appreciate your interest in Ottawa Bancorp, Inc. and hope you become an owner of our stock in the future. Our stock has commenced trading on the Nasdaq Capital Market under the symbol “OTTW.”

Ottawa Bancorp, Inc.

Stock Information Center

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

22

Ottawa Bancorp, Inc.

, 2016

Welcome Stockholder:

Thank you for your interest in Ottawa Bancorp, Inc. (the “Company”). Our offering has been completed and we are pleased to enclose a statement from our transfer agent reflecting the number of shares of the Company’s common stock purchased by you in the offering at a price of $10.00 per share. The transaction closed on , 2016; this is your stock purchase date. If your subscription was paid for by check, bank draft or money order, or if your subscription was not filled in full, any interest earned on the funds submitted or refund due will be mailed promptly.

The enclosed statement will be your evidence of ownership of Ottawa Bancorp, Inc. common stock. All stock sold in the subscription and community offerings has been issued in book entry form through the direct registration system (“DRS”). No physical stock certificates will be issued. Please examine this statement carefully to be certain that it properly reflects the number of shares you purchased and the names in which the ownership of the shares are to be shown on the books of the Company. A short question and answer sheet regarding your DRS statement is enclosed for your information. If you also owned shares of Ottawa Savings Bancorp, Inc. prior to completion of the offering, a Letter of Transmittal regarding the exchange of those shares for new Ottawa Bancorp, Inc. shares, along with other materials, has been mailed to you separately.

If you have any questions about your statement, please contact our transfer agent (by mail, telephone, or via the internet) as follows:

Computershare Trust Company, N.A.

Attention: Investor Relations Department

Street

City, State Zip Code

1 (xxx) xxx-xxxx

www.xxxxxx

Trading is expected to commence on the Nasdaq Capital Market under the symbol “OTTW” on , 2016. Please contact a broker if you choose to purchase additional shares or sell your stock in the future.

On behalf of the Board of Directors, officers and employees of Ottawa Bancorp, Inc., I thank you for supporting our offering and welcome you as a stockholder.

Sincerely,

Jon Kranov

President and Chief Executive Officer

The shares of common stock are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

23

Ottawa Bancorp, Inc.

, 2016

Dear Interested Subscriber:

We regret to inform you that Ottawa Bancorp, Inc., the holding company for Ottawa Savings Bank, did not accept your order for shares of Ottawa Bancorp, Inc. common stock in its community offering. This action is in accordance with our plan of conversion and reorganization, which gives Ottawa Bancorp, Inc. the absolute right in its discretion to reject the order of any person, in whole or in part, in the community offering.

If your order was paid for by check, enclosed is your original check.

Ottawa Bancorp, Inc.

Stock Information Center

The shares of common stock are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

24

Sandler O’Neill + Partners, L.P.

, 2016

To Our Friends:

We are enclosing material in connection with the stock offering by Ottawa Bancorp, Inc., the proposed new holding company for Ottawa Savings Bank.

Sandler O’Neill & Partners, L.P. is acting as marketing agent in connection with the subscription and community offerings, which will conclude at :00 p.m., Central Time, on , 2016.

Members of the general public are eligible to participate in the community offering. If you have any questions about the offering, please do not hesitate to call the stock information center at ( ) - , Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays.

Sandler O’Neill & Partners, L.P.

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

25

Ottawa Bancorp, Inc.

DIRECT REGISTRATION: Holding Your Shares in Book Entry

Ottawa Bancorp, Inc. (the “Company”) has elected to require former registered stockholders of Ottawa Savings Bancorp, Inc. and new stockholders of Ottawa Bancorp, Inc. to use the Direct Registration System (“DRS”) as a means of recording and maintaining the registered shares of Ottawa Bancorp, Inc. they will receive as a result of Ottawa Savings Bank’s “second-step conversion.” This flyer outlines what DRS is and what it means to you as a registered stockholder.

What is DRS?

DRS is the system that electronically moves investors’ positions between brokers and transfer agents for issuers that offer direct registration. Direct registration is the ownership of stock registered in your own name on the books of the Company, without taking possession of a printed stock certificate. Instead, your ownership is recorded and tracked as an accounting entry on the books of the Company.

Why is the Company offering DRS?

DRS gives our stockholders several advantages:

| • | It eliminates the risk of loss or theft of your stock certificate and the potential cost and inconvenience of having to obtain a surety bond to replace a lost certificate; and |

| • | It eliminates the need for you to store your certificates and retrieve them should you wish to transfer or sell your shares. |

How will I know how many shares I own?

The Company’s transfer agent, Computershare Trust Company, N.A., will periodically send you an account statement showing you how many shares are held by you in book-entry.

What happens if I lose a DRS account statement?

If you need a duplicate statement of ownership, contact Computershare and they will mail you a new one.

How can I transfer shares to my broker?

To transfer your shares to your brokerage account, provide your broker with:

| • | The most recent copy of your transfer agent account statement; |

| • | The Social Security number on your account; |

| • | Your transfer agent account number (which is on the statement); |

| • | Computershares’ DTC number, which is 7807; and |

| • | The number of whole shares held in book-entry that you wish to transfer to your brokerage account. |

Your broker will request that your shares be delivered to your brokerage account through the Depository Trust Company’s Profile System.

If I have more questions, how can I get answers?

You can go on-line to the Computershare’s website, www.computershare.com, or call their Investor Relations Department at to speak to a representative.

26

Ottawa Bancorp, Inc.

, 2016

Dear :

The Boards of Directors of Ottawa Savings Bank, Ottawa Bancorp, Inc., Ottawa Savings Bancorp, Inc. and Ottawa Savings Bancorp MHC have unanimously adopted a plan of conversion and reorganization under which Ottawa Savings Bancorp MHC will convert from the mutual holding company form to the full stock form of organization.

To learn more about the stock offering, you are cordially invited to join members of our senior management team at [an informational meeting] [a reception] to be held at on at :00 . , Central Time. A member of our staff will be calling to confirm your interest in attending the meeting.

If you would like additional information regarding the meeting, our reorganization or our stock offering, please call our Stock Information Center at ( ) - , Monday through Friday between the hours of 10:00 a.m. to 4:00 p.m., Central Time.

Sincerely,

Jon Kranov

President and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

27

Ottawa Savings Bank

(logo)

An Invitation

To Attend a Community Meeting

Ottawa Bancorp, Inc., the proposed new holding company for Ottawa Savings Bank, is offering shares of its common stock in connection with the conversion of Ottawa Savings Bancorp MHC into the full stock form of organization.

Up to 2,383,950 shares of Ottawa Bancorp, Inc. common stock are being offered at a price of $10.00 per share.

If you would like to learn more about our stock offering, or would like to attend a community meeting, we invite you to obtain a prospectus and offering material by calling our Stock Information Center at ( ) - , Monday through Friday between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays.

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

28

Ottawa Savings Bank

(logo)

Ottawa Bancorp, Inc.

Commences Stock Offering

Ottawa Bancorp, Inc., the proposed new holding company for Ottawa Savings Bank, is offering shares of its common stock for sale in connection with the conversion of Ottawa Savings Bancorp MHC into the full stock form of organization.

Up to 2,383,950 shares of Ottawa Bancorp, Inc. common stock are being offered at a price of $10.00 per share. As a member of the community served by Ottawa Savings Bank, you may have the opportunity to purchase shares in the offering.

If you would like to learn more about our stock offering, we invite you to obtain a prospectus and offering material by calling our Stock Information Center at ( ) - , Monday through Friday between the hours of 10:00 a.m. and 4:00 p.m., Central Time. The Stock Information Center will be closed weekends and bank holidays.

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

29