Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - United Financial Bancorp, Inc. | ex-99120160630.htm |

| 8-K - 8-K - United Financial Bancorp, Inc. | a8-k20160630.htm |

Second Quarter 2016 Earnings

NASDAQ Global Select Market: UBNK

Create Your Balance

2 NASDAQ: UBNK

This Presentation contains forward-looking statements that are within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements

are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties. These risks and uncertainties

could cause our results to differ materially from those set forth in such forward-looking statements. Forward-looking statements can be identified by the fact

that they do not relate strictly to historical or current facts. Words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “estimates,” “targeted”

and similar expressions, and future or conditional verbs, such as “will,” “would,” “should,” “could” or “may” are intended to identify forward-looking

statements but are not the only means to identify these statements. Forward-looking statements involve risks and uncertainties. Actual conditions, events or

results may differ materially from those contemplated by a forward-looking statement. Factors that could cause this difference — many of which are beyond

our control — include without limitation the following: Any forward-looking statements made by or on behalf of us in this Presentation speak only as of the

date of this Presentation. We do not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the

date the forward-looking statement was made. The reader should; however, consult any further disclosures of a forward-looking nature we may make in

future fi l ings.

With regard to presentations compared to peer institutions, the peer companies include: BHLB, BNCL, BPFH, BRKL, CBU, CUBI, DCOM, EGBN, FCF, FFIC, INDB,

KRNY, NBTB, NWBI, PFS, SASR, STBA, TMP, TRST, WSFS

Data for peers is sourced from SNL Financial LLC.

NON-GAAP FINANCIAL MEASURES

This presentation references non-GAAP financial measures incorporating tangible equity and related measures, and operating earnings excluding non-

recurring costs. These measures are commonly used by investors in evaluating financial condition. GAAP earnings are lower than core earnings primarily due

to non-recurring conversion, balance sheet restructuring and cost cutting initiative related expenses. The efficiency ratio represents the ratio of non-interest

expenses to the sum of net interest income before provision for loan losses and non-interest income, exclusive of net gain (loss) on limited partnership

investments. The pre-provision net revenue to average assets ratio represents the ratio of net interest income, on a fully tax-equivalent basis, fees and other

non-interest income, net of non-credit-related expenses as a percent of total average assets. The pre-provision net revenue to average equity ratio

represents the ratio of net interest income, on a fully tax-equivalent basis, fees and other non-interest income, net of non-credit-related expenses as a

percent of total average equity. Reconciliations are in earnings releases at www.unitedfinancialinc.com.

Forward Looking Statements

3 NASDAQ: UBNK

Corporate Contacts

William H. W. Crawford, IV

Chief Executive Officer

Eric R. Newell, CFA

Executive Vice President, Chief Financial Officer

860-291-3722 or ENewell@bankatunited.com

Investor Information:

Marliese L. Shaw

Executive Vice President, Corporate Secretary/Investor Relations Officer

860-291-3622 or MShaw@bankatunited.com

4 NASDAQ: UBNK

Table of Contents

Page

Key Objectives 5

Second Quarter Income Statement Walk 6

Second Half 2016 Forecast 7

Purchase Accounting 8

Mortgage Banking 9

Commercial Real Estate 10

Indexed Pipelines 11

Appendix 12

5 NASDAQ: UBNK

Four Key Objectives

Objective Progress

Align earning asset growth with organic capital and low

cost core deposit generation to maintain strong capital

and liquidity

(a) average earning asset growth linked quarter totaled

$38.2 million compared to average deposit growth of

$26.9 million; (b) 3.5% annualized 2Q16 DDA growth; (c)

annualized loan growth in 2Q16 of 7%

Re-Mix cash flows into higher yielding risk adjusted

return on assets with lower funding costs relative to

peers.

(a) cost of funds improved by 1 bps linked quarter; (b)

26% annualized growth in OOCRE and C&I loans

Invest in people, systems, and technology to grow

revenue and improve customer experience while

maintaining attractive cost structure.

(a) introduced new electronic based checking product;

(b) 29% increase in new checking account openings

from linked quarter; (c) Operating Non-Interest

Expense/ Average Assets (NIE/AA) at 2.08%

Grow operating revenue, maximize operating earnings,

grow tangible book value, pay dividend. Achieve more

revenue into NII and core fee income.

(a) 7% annualized increase in tangible book value (TBV);

(b) 3.70% dividend yield in second quarter 2016

6 NASDAQ: UBNK

Second Quarter Walk

(Dollars in thousands) GAAP Net Income Operating Net Income

Actual First Quarter 2016 $ 11,894 $ 10,946

Loan Interest Income (2,396 ) (468 )

Fee Income 480 480

Investment Income (37 ) (37 )

Interest Expense 47 54

Net Interest Income (1,906 ) 29

Provision (936 ) (936 )

Net Interest Income after Provision (2,842 ) (907 )

Service Charges and Fees (235 ) (236 )

Security Gains/Losses (1,085 ) —

Mortgage Banking 1,471 1,471

Gains/Losses on Limited Partnerships (568 ) (568 )

Other 222 223

Non-Interest Income (195 ) 890

Salaries and Benefits (2,222 ) (864 )

Marketing (431 ) (431 )

Other 1,735 298

Total Operating Expense (918 ) (997 )

Taxes 1,119 90

Total Change (2,836 ) (924 )

Actual Second Quarter 2016 $ 9,058 $ 10,022

7 NASDAQ: UBNK

Second Half 2016 Forecast

Actual

Q1 2016

Actual

Q2 2016 Second Half 2016

Operating Net Interest Margin 2.95% 2.94% ~ 2.94%

Loan Growth 3.0%* 7.0%* mid single digits

Provision / Average Gross Loans 0.23%* 0.31%* 0.27% - 0.30%*

Non-Interest Income Run Rate $26.9 million* $26.1 million* $24.0 -$27.0 million*

Non-Interest Expense Run Rate $135.1 million* $138.7 million* $130 million*

Effective Tax Rate 13.0% 6.8% 15.0%

*Note: Loan Growth, Provision/Average Gross Loans, Fee Income and

NIE calculations are annualized.

8 NASDAQ: UBNK

Purchase Accounting at June 30, 2016

(Dollars in thousands)

Premium

(Discount)

Weighted

Average Life

Projected Quarter

Net Interest

Income Impact

Projected

2H2016 Impact

Consumer $9,148.4 3.9 $(589.8) $(1,179.5)

Commercial (12,386.0) 3.3 943.9 1,887.8

Residential 6,808.8 3.5 (490.1) (980.3)

Total Interest Income Impact $3,571.2 $(136.0) $(272.0)

Total Purchased Liabilities $2,394.4 $1,441.4

Total Net Interest Income Impact $1,169.4

Note: Loan accretion / amortization projections can fluctuate due to a variety of factors including: changes in borrower cred it quality, loan sales, and prepayment speeds.

9 NASDAQ: UBNK

• Origination

volume increase

in June 30, 2016

quarter by $49.4

MM for a total

Q2 volume of

$173.5 MM in

mortgages.

• A record 65.9% in

30 year FRM,

60.5% of which

was sold into the

Secondary

Market

• Purchase volume

represented

58.1% of total

production in

Q2 2016

Mortgage Banking

10 NASDAQ: UBNK

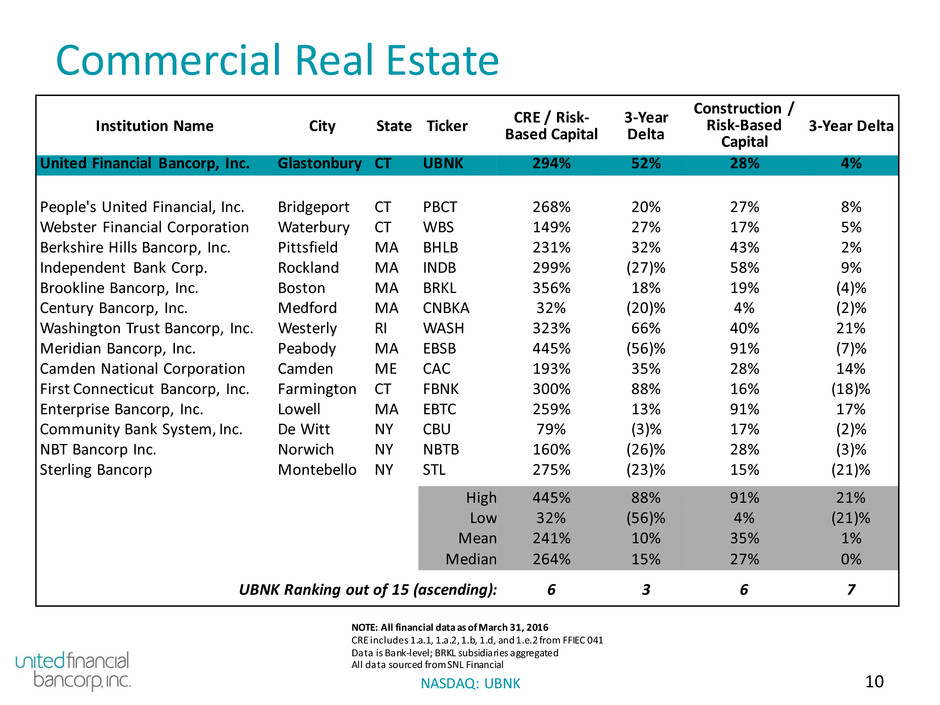

Commercial Real Estate

Institution Name City State Ticker

CRE / Risk-

Based Capital

3-Year

Delta

Construction /

Risk-Based

Capital

3-Year Delta

United Financial Bancorp, Inc. Glastonbury CT UBNK 294% 52% 28% 4%

People's United Financial, Inc. Bridgeport CT PBCT 268% 20% 27% 8%

Webster Financial Corporation Waterbury CT WBS 149% 27% 17% 5%

Berkshire Hills Bancorp, Inc. Pittsfield MA BHLB 231% 32% 43% 2%

Independent Bank Corp. Rockland MA INDB 299% (27)% 58% 9%

Brookline Bancorp, Inc. Boston MA BRKL 356% 18% 19% (4)%

Century Bancorp, Inc. Medford MA CNBKA 32% (20)% 4% (2)%

Washington Trust Bancorp, Inc. Westerly RI WASH 323% 66% 40% 21%

Meridian Bancorp, Inc. Peabody MA EBSB 445% (56)% 91% (7)%

Camden National Corporation Camden ME CAC 193% 35% 28% 14%

First Connecticut Bancorp, Inc. Farmington CT FBNK 300% 88% 16% (18)%

Enterprise Bancorp, Inc. Lowell MA EBTC 259% 13% 91% 17%

Community Bank System, Inc. De Witt NY CBU 79% (3)% 17% (2)%

NBT Bancorp Inc. Norwich NY NBTB 160% (26)% 28% (3)%

Sterling Bancorp Montebello NY STL 275% (23)% 15% (21)%

High 445% 88% 91% 21%

Low 32% (56)% 4% (21)%

Mean 241% 10% 35% 1%

Median 264% 15% 27% 0%

UBNK Ranking out of 15 (ascending): 6 3 6 7

NOTE: All financial data as of March 31, 2016

CRE includes 1.a.1, 1.a.2, 1.b, 1.d, and 1.e.2 from FFIEC 041

Data is Bank-level; BRKL subsidiaries aggregated

All data sourced from SNL Financial

11 NASDAQ: UBNK

Indexed Pipeline Metrics

Index value 06/30/2015 = 100.0

Index value 06/30/2016 = 73.3

CAGR = (26.7%)

Index value 06/30/2015 = 100

Index value 06/30/2016 = 82

CAGR = (17.7%)

12 NASDAQ: UBNK

APPENDIX

13 NASDAQ: UBNK

Balance Sheet Trends

QoQ YoY

2Q16 vs 1Q16 2Q16 vs 2Q15

Balance Sheet ($ in thousands) 2Q2016 1Q2016 4Q2015 3Q2015 2Q2015 $ Change % Change $ Change % Change

ASSETS

Cash and cash equivalents $ 97,441 $ 87,234 $ 95,176 $ 98,310 $ 84,525 $ 10,207 11.7 % $ 12,916 15.3 %

Securities

1,087,748 1,104,93

2

1,073,734 1,095,10

8

1,076,91

9

(17,184 ) (1.6 ) 10,829 1.0

Loans held for sale 30,558 7,560 10,136 13,511 28,017 22,998 304.2 2,541 9.1

Residential real estate

1,171,300 1,176,35

7

1,179,915 1,190,74

5

1,167,83

0

(5,057 ) (0.4 ) 3,470 0.3

Home equity 460,058 446,515 431,282 335,220 333,983 13,543 3.0 126,075 37.7

Other consumer 211,065 217,725 233,064 5,236 5,206 (6,660 ) (3.1 ) 205,859 3,954.3

Residential construction 49,338 42,205 41,084 33,648 24,306 7,133 16.9 25,032 103.0

Investor non-occupied CRE

1,675,821 1,648,32

1

1,673,248 1,580,84

8

1,458,22

9

27,500 1.7 217,592 14.9

Owner occupied CRE 384,324 376,511 322,084 340,047 305,522 7,813 2.1 78,802 25.8

Commercial business 671,687 614,235 603,332 576,899 634,529 57,452 9.4 37,158 5.9

Commercial construction (ADC) 107,302 128,007 129,922 146,975 142,462 (20,705 ) (16.2 ) (35,160 ) (24.7 )

Loans - net

4,702,337 4,621,98

8

4,587,062 4,185,03

2

4,048,77

0

80,349 1.7 653,567 16.1

Deferred tax asset, net 31,395 32,222 33,094 31,554 31,822 (827 ) (2.6 ) (427 ) (1.3 )

Premises and equipment, net 53,021 53,685 54,779 55,919 57,131 (664 ) (1.2 ) (4,110 ) (7.2 )

Intangible Assets 121,953 122,354 122,787 123,220 123,637 (401 ) (0.3 ) (1,684 ) (1.4 )

Cash surrender value of BOLI 126,734 125,920 125,101 125,186 124,287 814 0.6 2,447 2.0

Other Assets* 163,897 163,349 126,672 115,182 105,582 548 0.3 58,315 55.2

Total Assets

$ 6,415,084

$

6,319,24

4 $ 6,228,541 $

5,843,02

2 $

5,680,69

0

$ 95,840 1.5 % $ 734,394 12.9 %

LIABILITIES AND STOCKHOLDERS' EQUITY

Liabilities: QoQ YoY

Deposits: 2Q16 vs 1Q16 2Q16 vs 2Q15

Non-interest-bearing $ 673,624 $ 657,144 $ 657,718 $ 622,535 $ 610,279 $ 16,480 2.5 % $ 63,345 10.4 %

Interest-bearing 3,781,717 3,876,90

1

3,779,353 3,640,43

6

3,571,97

2

(95,184 ) (2.5 ) 209,745 5.9

Total Deposits 4,455,341 4,534,04

5

4,437,071 4,262,97

1

4,182,25

1

(78,704 ) (1.7 ) 273,090 6.5

Mortgagors' and investor escrow accounts 14,040 9,696 13,526 8,108 15,168 4,344 44.8 (1,128 ) (7.4 )

FHLB advances and other borrowings 1,222,160 1,073,03

4

1,099,020 893,865 825,963 149,126 13.9 396,197 48.0

Accrued expenses and other liabilities 79,350 69,191 53,403 56,626 45,313 10,159 14.7 34,037 75.1

Total liabilities 5,770,891 5,685,96

6

5,603,020 5,221,57

0

5,068,69

5

84,925 1.5 702,196 13.9

Total stockholders' equity 644,193 633,278 625,521 621,452 611,995 10,915 1.7 32,198 5.3

Total liabilities and stockholders' equity

$ 6,415,084 $ 6,319,24

4

$ 6,228,541 $ 5,843,02

2

$ 5,680,69

0

$ 95,840 1.5 % $ 734,394 12.9 %

*Other assets include FHLBB stock (at cost), accrued interest receivable, in addition to other assets

14 NASDAQ: UBNK

Commercial Banking Overview

• Asset quality remains exceptional through diversification, granularity,

that is accretive to risk adjusted capital

Investor CRE & ADC by Property Type

$1,783 Million

C&I & Owner Occupied CRE by Industry

$1,056 Million

15 NASDAQ: UBNK

Investment Portfolio

Portfolio Stats ($ in millions) 2016Q2 2016Q1

Market Value 1,088 1,105

Yield 2.95 % 2.94 %

Average Rating AA AA

MBS Portfolio 596 613

Total Portfolio Duration (years) 3.0 3.1

Summary of Quarterly Securities

Purchases

2016Q2 2016Q1

Average Yield 2.90 % 2.95 %

Average Rating AA AA

16 NASDAQ: UBNK

Asset Quality

($ in thousands, except percentage data) 2016Q2 2016Q1 2015Q4 2015Q3 2015Q2

Non-accrual loans $ 32,038 $ 29,285 $ 32,191 $ 32,240 $ 30,028

TDR - non-accruing 6,713 7,143 5,611 4,605 5,346

Total non-performing loans 38,751 36,428 37,802 36,845 35,374

OREO 702 659 755 258 227

Total non-performing assets $ 39,453 $ 37,087 $ 38,557 $ 37,103 $ 35,601

NPLs to total loans 0.82 % 0.78 % 0.82 % 0.88 % 0.87 %

NPAs to total assets 0.61 % 0.59 % 0.62 % 0.63 % 0.63 %

Net charge offs $ 1,163 $ 1,075 $ 724 $ 1,276 $ 904

Annualized NCOs to average loans 0.10 % 0.09 % 0.07 % 0.12 % 0.09 %

Allowance for loan losses to non-performing loans 97.96 % 97.45 % 89.64 % 83.68 % 81.57 %

Allowance for loan losses to total loans 0.80 % 0.76 % 0.73 % 0.73 % 0.71 %

Provision for loan losses (annualized)/Average Loans 0.31 % 0.23 % 0.35 % 0.31 % 0.45 %

17 NASDAQ: UBNK

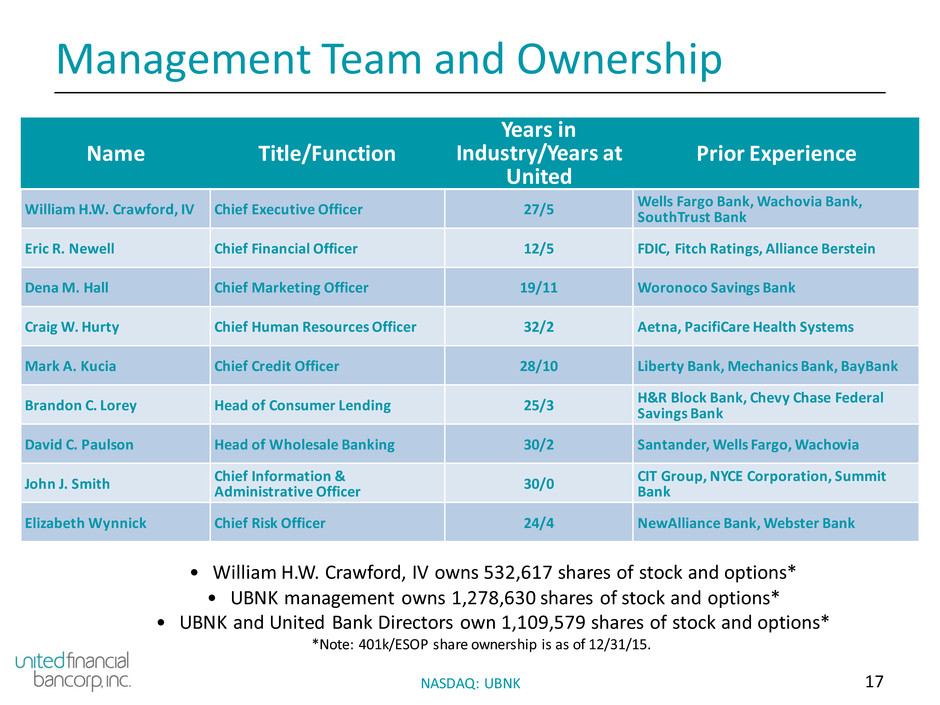

Management Team and Ownership

• William H.W. Crawford, IV owns 532,617 shares of stock and options*

• UBNK management owns 1,278,630 shares of stock and options*

• UBNK and United Bank Directors own 1,109,579 shares of stock and options*

*Note: 401k/ESOP share ownership is as of 12/31/15.

Name Title/Function

Years in

Industry/Years at

United

Prior Experience

William H.W. Crawford, IV Chief Executive Officer 27/5 Wells Fargo Bank, Wachovia Bank,

SouthTrust Bank

Eric R. Newell Chief Financial Officer 12/5 FDIC, Fitch Ratings, Alliance Berstein

Dena M. Hall Chief Marketing Officer 19/11 Woronoco Savings Bank

Craig W. Hurty Chief Human Resources Officer 32/2 Aetna, PacifiCare Health Systems

Mark A. Kucia Chief Credit Officer 28/10 Liberty Bank, Mechanics Bank, BayBank

Brandon C. Lorey Head of Consumer Lending 25/3 H&R Block Bank, Chevy Chase Federal

Savings Bank

David C. Paulson Head of Wholesale Banking 30/2 Santander, Wells Fargo, Wachovia

John J. Smith Chief Information &

Administrative Officer

30/0 CIT Group, NYCE Corporation, Summit

Bank

Elizabeth Wynnick Chief Risk Officer 24/4 NewAlliance Bank, Webster Bank

18 NASDAQ: UBNK

Non-GAAP Reconciliation

Three Months Ended

June 30,

2016

March 31,

2016

December 31,

2015

September 30,

2015

June 30,

2015

Net income $ 9,058 $ 11,894 $ 9,902 $ 13,381 $ 13,332

Adjustments:

Net interest (income) expense 35 (1,900 ) (1,617 ) (4,092 ) (3,512 )

Non-interest (income) expense (367 ) (1,452 ) (519 ) 59 (360 )

Non-interest expense 1,814 1,893 3,586 244 454

Income tax (benefit) expense (518 ) 511 (65 ) 1,326 1,196

Net adjustment 964 (948 ) 1,385 (2,463 ) (2,222 )

Total operating net income $ 10,022 $ 10,946 $ 11,287 $ 10,918 $ 11,110

Total net interest income $ 41,496 $ 43,402 $ 40,693 $ 41,643 $ 40,903

Adjustments:

Impact from purchase accounting fair value marks:

Amortization (accretion) of loan mark 835 (1,094 ) (718 ) (2,787 ) (2,194 )

Accretion of deposit mark 359 359 444 841 845

Accretion of borrowings mark 441 447 455 464 473

Net adjustment 35 (1,900 ) (1,617 ) (4,092 ) (3,512 )

Total operating net interest income $ 41,531 $ 41,502 $ 39,076 $ 37,551 $ 37,391

Total non-interest income $ 6,532 $ 6,727 $ 8,463 $ 7,818 $ 9,371

Adjustments:

Net (loss) gain on sales of securities (367 ) (1,452 ) (300 ) 59 (360 )

BOLI claim benefit — — (219 ) — —

Net adjustment (367 ) (1,452 ) (519 ) 59 (360 )

Total operating non-interest income 6,165 5,275 7,944 7,877 9,011

Total operating net interest income 41,531 41,502 39,076 37,551 37,391

Total operating revenue $ 47,696 $ 46,777 $ 47,020 $ 45,428 $ 46,402

19 NASDAQ: UBNK

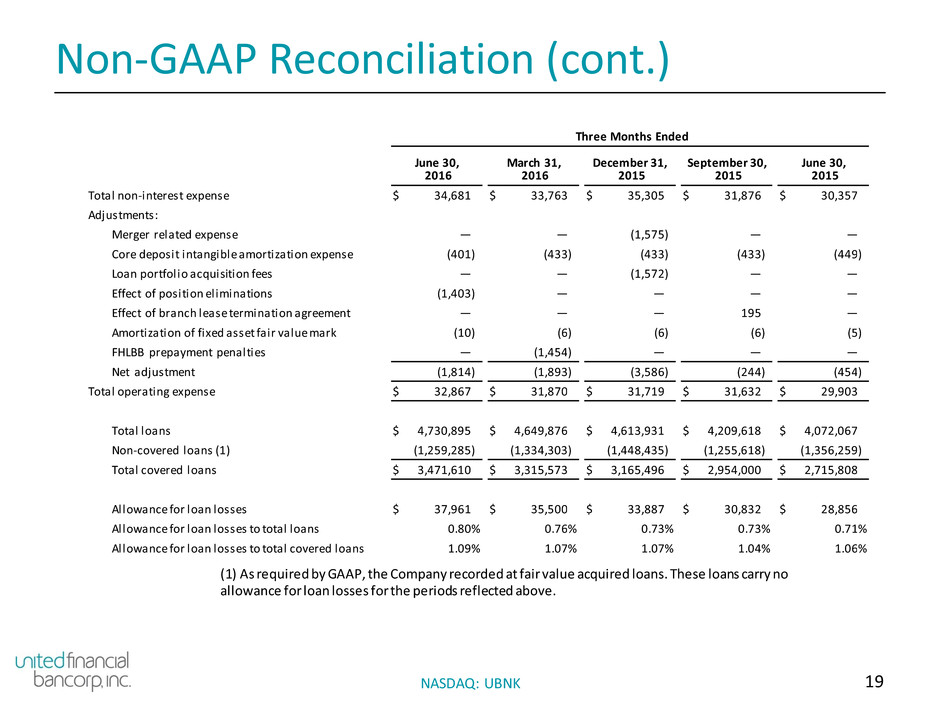

Non-GAAP Reconciliation (cont.)

Three Months Ended

June 30,

2016

March 31,

2016

December 31,

2015

September 30,

2015

June 30,

2015

Total non-interest expense $ 34,681 $ 33,763 $ 35,305 $ 31,876 $ 30,357

Adjustments:

Merger related expense — — (1,575 ) — —

Core deposit intangible amortization expense (401 ) (433 ) (433 ) (433 ) (449 )

Loan portfolio acquisition fees — — (1,572 ) — —

Effect of position eliminations (1,403 ) — — — —

Effect of branch lease termination agreement — — — 195 —

Amortization of fixed asset fair value mark (10 ) (6 ) (6 ) (6 ) (5 )

FHLBB prepayment penalties — (1,454 ) — — —

Net adjustment (1,814 ) (1,893 ) (3,586 ) (244 ) (454 )

Total operating expense $ 32,867 $ 31,870 $ 31,719 $ 31,632 $ 29,903

Total loans $ 4,730,895 $ 4,649,876 $ 4,613,931 $ 4,209,618 $ 4,072,067

Non-covered loans (1) (1,259,285 ) (1,334,303 ) (1,448,435 ) (1,255,618 ) (1,356,259 )

Total covered loans $ 3,471,610 $ 3,315,573 $ 3,165,496 $ 2,954,000 $ 2,715,808

Allowance for loan losses $ 37,961 $ 35,500 $ 33,887 $ 30,832 $ 28,856

Allowance for loan losses to total loans 0.80 % 0.76 % 0.73 % 0.73 % 0.71 %

Allowance for loan losses to total covered loans 1.09 % 1.07 % 1.07 % 1.04 % 1.06 %

(1) As required by GAAP, the Company recorded at fair value acquired loans. These loans carry no

allowance for loan losses for the periods reflected above.