Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Sucampo Pharmaceuticals, Inc. | exh_991.htm |

| EX-23.1 - EXHIBIT 23.1 - Sucampo Pharmaceuticals, Inc. | exh_231.htm |

| 8-K/A - FORM 8-K/A - Sucampo Pharmaceuticals, Inc. | f8ka_062816.htm |

Exhibit 99.2

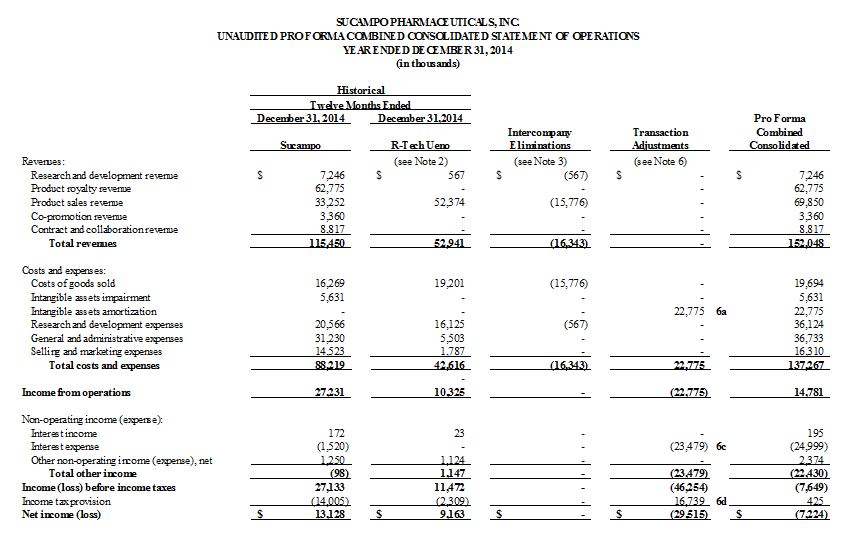

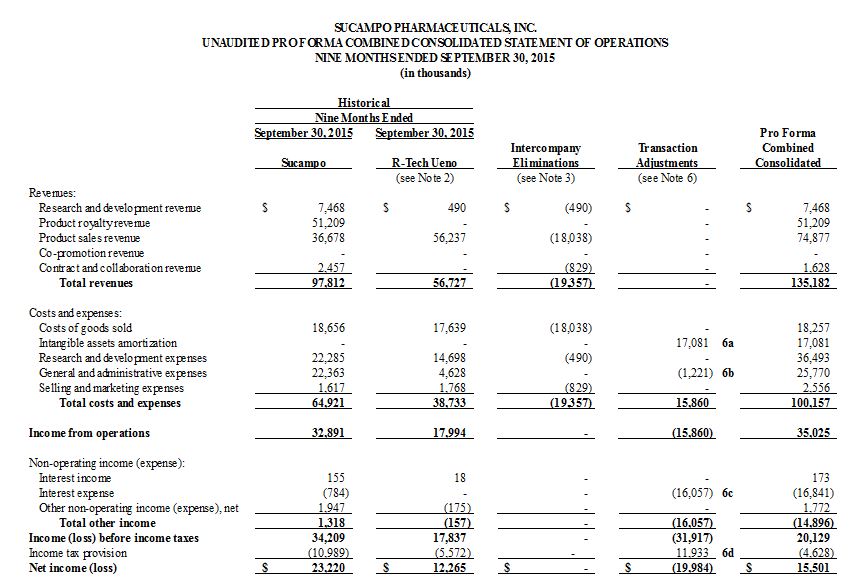

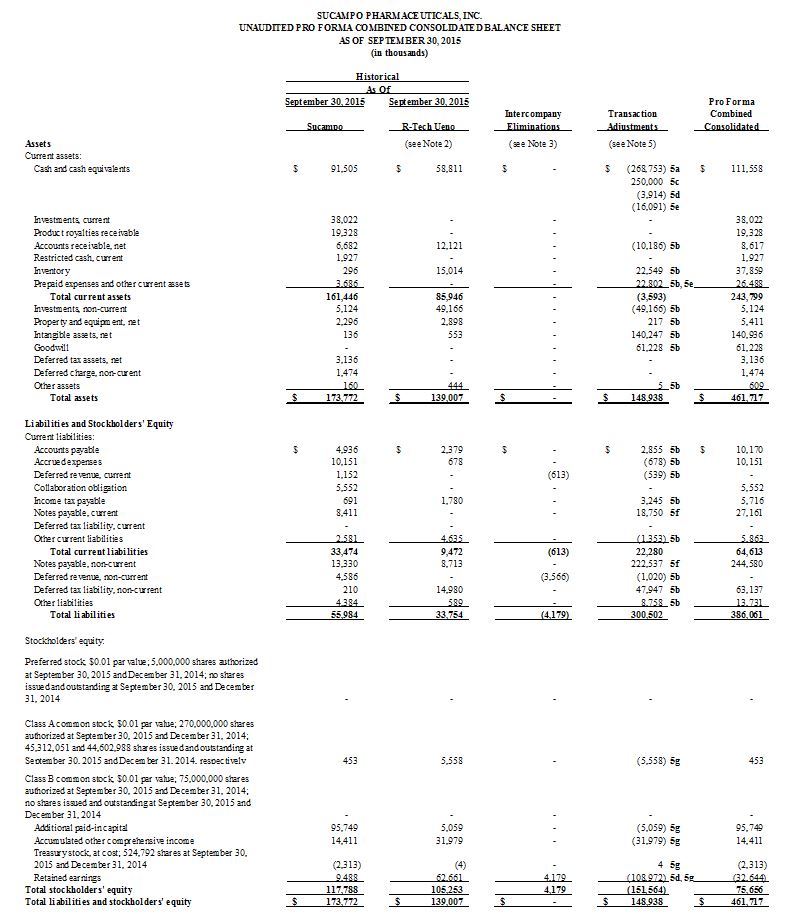

UNAUDITED PRO FORMA COMBINED CONSOLIDATED FINANCIAL INFORMATION

The following unaudited pro forma combined consolidated financial information is presented to illustrate the estimated effects of the proposed acquisition of R-Tech Ueno, Ltd. (“R-Tech”) by Sucampo Pharmaceuticals, Inc. (“Sucampo”) and certain other adjustments listed below, which are collectively referred to as the acquisition adjustments, through the share purchase agreement that was announced on August 26, 2015 under which Sucampo exchanged each issued and outstanding R-Tech share for ¥1,400 in cash.

The unaudited pro forma combined consolidated balance sheet as of September 30, 2015 and the unaudited pro forma combined consolidated statements of operations for the nine months ended September 30, 2015 and the year ended December 31, 2014, respectively, are presented herein. The unaudited pro forma combined consolidated balance sheet combines the unaudited balance sheets of Sucampo and R-Tech as of September 30, 2015 and gives effect to the proposed business combination as if it occurred on September 30, 2015. R-Tech’s assets and liabilities have been measured at fair value as of October 20, 2015, which represents the date R-Tech was acquired by Sucampo. The purchase price has been allocated as of this date since this information was incorporated in our fiscal year 2015 Annual Report filed on Form 10-K and more accurately reflects the fair value of R-Tech’s assets acquired and liabilities assumed.

The unaudited pro forma combined consolidated statements of operations combine the historical results of Sucampo and R-Tech for the nine months ended September 30, 2015 and the year ended December 31, 2014 and give effect to the proposed business combination as if it occurred on January 1, 2014. The historical financial information has been adjusted to give effect to pro forma adjustments that are (i) directly attributable to the proposed business combination, (ii) factually supportable, and (iii) with respect to the unaudited combined consolidated statements of operations, expected to have a continuing impact on the combined entity’s results.

The unaudited pro forma combined consolidated financial information primarily gives effect to the following adjustments:

· Adjustments to reconcile R-Tech’s historical audited and unaudited financial statements prepared in accordance with Japanese GAAP to U.S. GAAP and to convert these statements from Japanese yen to U.S. dollars;

· Application of the acquisition method of accounting in connection with the business combination to reflect total purchase consideration of $275.1 million;

· Adjustments to reflect financing arrangements entered into in connection with the business combination;

· Reclassification of line items on R-Tech’s financial statements to conform to Sucampo’s presentation;

· Elimination of intercompany transactions between Sucampo and R-Tech; and

· Transaction costs in connection with the business combination.

The unaudited pro forma combined consolidated statements of operations also include certain other purchase accounting adjustments, including items expected to have a continuing impact on the combined results, such as increased amortization expense on acquired intangible assets. The unaudited pro forma combined consolidated statements of operations do not include the impact of any revenue, cost or other operating synergies that may result from the business combination or any related restructuring costs.

The unaudited pro forma combined consolidated financial information presented is based on the assumptions and adjustments described in the accompanying notes. The unaudited pro forma combined consolidated financial information is presented for illustrative purposes and does not purport to represent what the financial position or results of operations would actually have been if the business combination occurred as of the dates indicated or what the financial position or results would be for any future periods.

The unaudited pro forma combined consolidated financial information is derived from the historical financial statements of Sucampo and R-Tech, and should be read in conjunction with (1) the accompanying notes to the unaudited pro forma combined consolidated financial information, (2) the unaudited financial statements as of September 30, 2015 and for the nine months ended September 30, 2015 and notes thereto of Sucampo included in Sucampo’s Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2015, which was filed with the SEC on November 4, 2015 and incorporated by reference, (3) the audited financial statements for the fiscal year ended December 31, 2014 and notes thereto of Sucampo included in Sucampo’s Annual Report on Form 10-K, which was filed with the SEC on March 9, 2015 and incorporated by reference, (4) the unaudited financial statements as of September 30, 2015 and for the six months ended September 30, 2015 and notes thereto of R-Tech, which are included in the Form 8-K/A, (5) the audited financial statements for the fiscal years ended March 31, 2014 and 2015 and notes thereto of R-Tech, which are included in the Form 8-K/A.

| 2 |

See accompanying Notes to unaudited pro forma combined consolidated financial information.

| 3 |

See accompanying Notes to unaudited pro forma combined consolidated financial information.

| 4 |

See accompanying Notes to unaudited pro forma combined consolidated financial information.

| 5 |

Note 1 – Description of the Business Combination

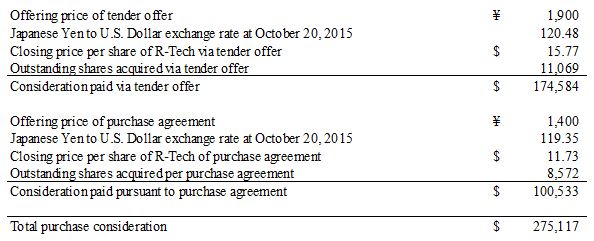

On August 26, 2015, Sucampo and R-Tech entered into the tender offer, whereby Sucampo offered to exchange each issued and outstanding R-Tech ordinary share intended to result in a business combination of R-Tech by Sucampo. On October 20, 2015, Sucampo completed its acquisition of 11,069,000 shares and 328,600 stock acquisition rights of R-Tech pursuant to a previously announced tender offer in Japan (the “Tender Offer”), according to which Sucampo’s wholly owned Japanese subsidiary, Sucampo Pharma LLC (the “Purchaser”), offered to purchase all of the outstanding shares of R-Tech’s common stock (other than the shares acquired pursuant to the Purchase Agreement). In addition, on October 20, 2015, the Registrant acquired 8,571,900 shares of R-Tech in accordance with the terms of the Share Purchase Agreement (“Purchase Agreement”) by and between Sucampo and the founders of R-Tech, who are also the founders of Sucampo, and a related entity. Following these acquisitions, Sucampo directly and indirectly owns approximately 98% of the outstanding shares of R-Tech and acquired the remaining shares of R-Tech through a squeeze-out process under Japanese law.

Subject to the terms and conditions of the business combination agreement, R-Tech shareholders who validly tender their shares in the tender offer will be entitled to receive consideration that is the equivalent of ¥1,400, or $11.73 in cash, for each issued and outstanding share of R-Tech common stock.

The overall tender offer is variable and subject to the U.S. dollar to yen exchange rate on the date of the acquisition.

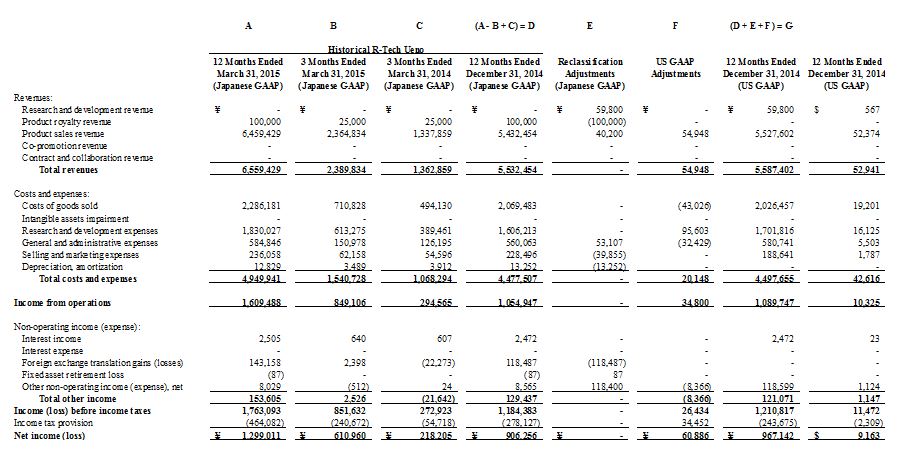

Note 2 — Basis of Presentation

The accompanying unaudited pro forma combined consolidated financial information was prepared in accordance with Article 11 of SEC Regulation S-X. The unaudited pro forma combined consolidated balance sheet was prepared using the historical balance sheets of Sucampo and R-Tech as of September 30, 2015 and assumes the proposed business combination occurred on September 30, 2015. R-Tech’s assets and liabilities have been measured at fair value as of October 20, 2015, which represents the date R-Tech was acquired by Sucampo. R-Tech’s fiscal year ends on March 31 and Sucampo’s fiscal year ends on December 31. The pro forma combined consolidated financial information has been prepared to conform R-Tech’s historical financial information to a year-end of December 31. The unaudited pro forma combined consolidated statements of operations were prepared using:

· the historical unaudited statement of operations of Sucampo for the nine months ended September 30, 2015;

· the historical audited statement of operations of Sucampo for the year ended December 31, 2014;

· the historical unaudited statement of income (loss) of R-Tech for the six months ended September 30, 2015;

· the historical unaudited statement of income (loss) of R-Tech for the three months ended March 31, 2015;

· the historical unaudited statement of income (loss) of R-Tech for the three months ended March 31, 2014; and

· the historical audited statement of income (loss) of R-Tech for the year ended March 31, 2015.

Sucampo’s historical audited and unaudited financial statements were prepared in accordance with U.S. GAAP and presented in thousands of U.S. dollars. R-Tech’s historical audited and unaudited financial statements were prepared in accordance with Japanese GAAP and presented in thousands of yen. The historical R-Tech financial statements included within the unaudited pro forma combined consolidated balance sheet and statements of operations have been adjusted to conform to Sucampo’s year end, and certain reclassifications were made to align R-Tech’s financial statement presentation with that of Sucampo. R-Tech’s historical audited and unaudited financial statements were reconciled to U.S. GAAP, and the Japanese GAAP to U.S. GAAP conversion adjustments have been applied to the historical R-Tech column as presented and discussed in the accompanying notes. A description of the adjustments to convert R-Tech from Japanese GAAP to U.S. GAAP is included in the reconciliation footnote in R-Tech’s historical financial information included in this Form 8-K/A.

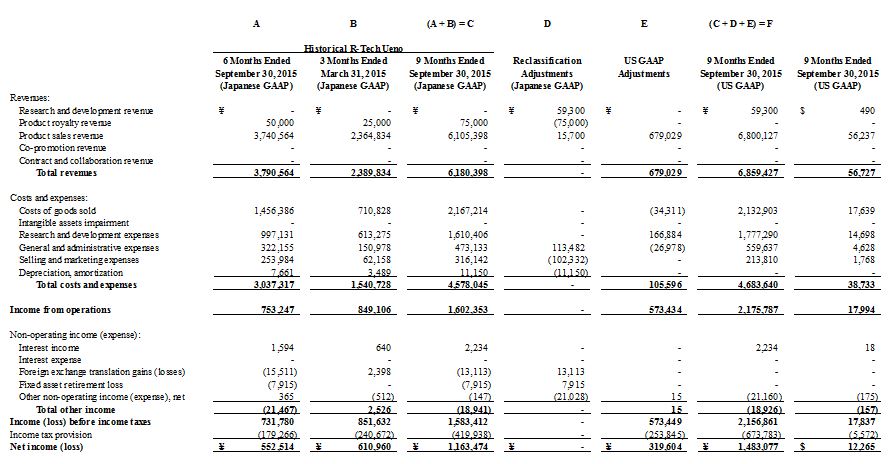

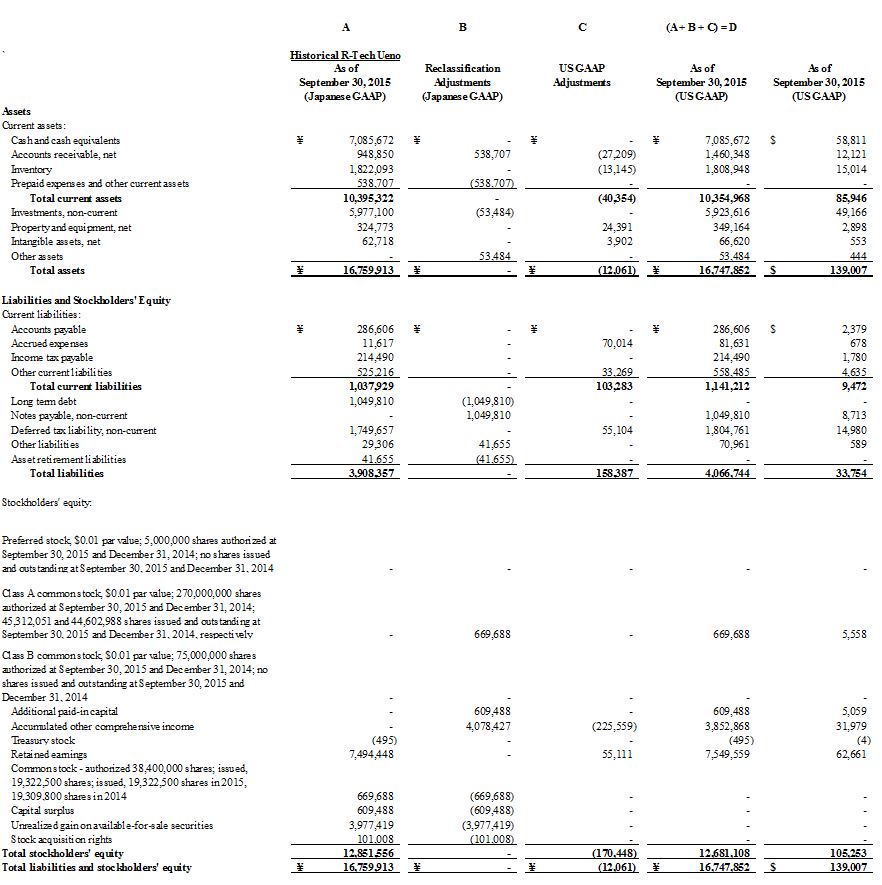

R-Tech’s historical audited and unaudited financial statements, Japanese GAAP to U.S. GAAP adjustments and pro forma adjustments were translated from yen to U.S. dollars using the period-end rate of $0.0083 per yen for the unaudited pro forma combined consolidated balance sheet as of September 30, 2015 and the historical average rates during the nine months ended September 30, 2015 and the year ended December 31, 2014 of $0.0083 and $0.0095 per yen, respectively, for the unaudited pro forma combined consolidated statements of operations. The income statements and balance sheet of R-Tech have been adjusted to conform to the Sucampo periods presented, reclassified to align to Sucampo’s presentation, converted to U.S. GAAP and converted to U.S. dollars as follows:

| 6 |

Conforming schedules of historical statement of income (loss) of R-Tech for the year ended December 31, 2014:

| 7 |

Conforming schedules of historical statement of income (loss) of R-Tech for the nine months ended September 30, 2015:

| 8 |

Conforming schedules of historical balance sheet of R-Tech as of September 30, 2015:

| 9 |

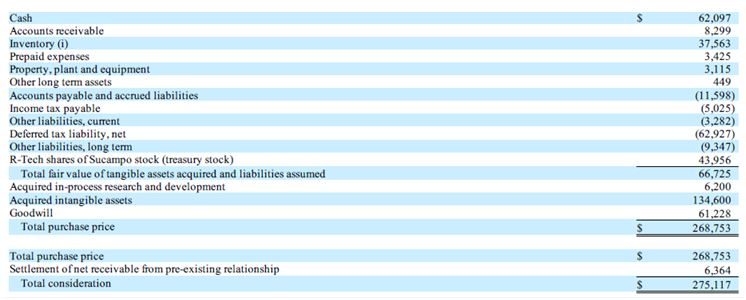

The proposed business combination of Sucampo and R-Tech will be accounted for using the acquisition method of accounting under the provisions of ASC 805, with Sucampo representing the accounting acquirer. Accordingly, the historical financial statements have been adjusted to give effect to the impact of the exchange offer consideration paid in connection with the business combination. In the unaudited pro forma combined consolidated balance sheet, Sucampo’s cost to acquire R-Tech has been allocated to the assets acquired and liabilities assumed based upon management’s preliminary estimate of what their respective fair values would be as of the date of the business combination. The pro forma adjustments are preliminary and are based upon available information and certain assumptions which management believes are reasonable under the circumstances and which are described in the accompanying notes herein. Actual results may differ materially from the assumptions within the accompanying unaudited pro forma combined consolidated financial information. Under ASC 805, generally all assets acquired and liabilities assumed are recorded at their acquisition date fair value. For purposes of the pro forma information presented herein, the fair value of R-Tech’s identifiable tangible and intangible assets acquired and liabilities assumed are based on a preliminary estimate of fair value. Any excess of the purchase price over the fair value of identified tangible and intangible assets acquired and liabilities assumed will be recognized as goodwill. Management believes the estimated fair values utilized for the assets to be acquired and liabilities to be assumed are based on reasonable estimates and assumptions. Preliminary fair value estimates may change as additional information becomes available and such changes could be material, as certain valuations and other studies have yet to commence or progress to a stage where there is sufficient information for definitive measurement.

The unaudited pro forma combined consolidated statements of operations also include certain purchase accounting adjustments, including items expected to have a continuing impact on the combined results, such as increased amortization expense on acquired intangible assets. The unaudited pro forma combined consolidated statements of operations do not include the impacts of any revenue, cost or other operating synergies that may result from the business combination or any related restructuring costs that may be contemplated. Sucampo and R-Tech have just recently begun collecting information in order to formulate detailed integration plans to deliver planned synergies. However, at this time, the status of the integration plans is too uncertain to include in the pro forma financial statements.

Financing Arrangement

On October 16, 2015, Sucampo entered into a credit facility that provides for term loans in the aggregate principal amount of $250.0 million (the “Term Loans”) and allows for the incurrence of incremental loans in an amount up to $25.0 million. The Term Loans bear interest, at Sucampo’s option, at either the Adjusted Eurodollar Rate (as defined in the credit facility) plus 7.25% or the Adjusted Base Rate (as defined in the credit facility) plus 6.25%. The Adjusted Eurodollar Rate is subject to a 1.00% floor and the Adjusted Base Rate is subject to a 2.00% floor. The proceeds of the Term Loans were used a) to finance a portion of the cash consideration of the purchase price to be paid in exchange for R-Tech ordinary shares pursuant to the tender offer, and b) to refinance R-Tech’s outstanding indebtedness at the time of closing. Upon closing of the exchange offer, outstanding borrowings under the Term Loan were approximately $250.0 million.

Note 3 – Intercompany Eliminations

Intercompany elimination adjustments represent the elimination of existing balances included within the balance sheets and statements of operations of Sucampo and R-Tech, which at the close of the acquisition would be considered intercompany transactions:

· R-Tech Product Sales revenue recorded as cost of goods sold by Sucampo.

· R-Tech R&D revenue recorded as R&D expenses by Sucampo.

· Sucampo contract and collaboration revenue recorded as Selling and marketing expenses by R-Tech.

· Sucampo deferred revenue resulting from the deferral of upfront payments relating to the exclusive supply agreements with R-Tech.

· Accounts payable between Sucampo and R-Tech.

Note 4 — Purchase Price

The total purchase consideration to acquire the shares and options of R-Tech was approximately $275.1 million. Under the terms of the tender offer, R-Tech shareholders were entitled to receive the tender offer consideration in cash at the equivalent of ¥1,400 or $11.73 for each issued and outstanding R-Tech ordinary share. Following these acquisitions, Sucampo directly and indirectly owned approximately 98% of the outstanding shares R-Tech. The Company acquired the remaining shares of R-Tech through a squeeze-out process under Japanese law on November 30, 2015. The estimated purchase price reflected in the unaudited pro forma combined consolidated financial information assumes that all issued and outstanding R-Tech ordinary shares were validly tendered in the offer and via the squeeze-out process and received the offer consideration.

| 10 |

For the purpose of preparing the accompanying unaudited pro forma combined consolidated balance sheet as of September 30, 2015, the preliminary estimate of the purchase price was calculated as follows (amounts in thousands, except share data):

The following is a summary of the preliminary allocation of the above purchase price as reflected in the unaudited pro forma combined consolidated balance sheet as of September 30, 2015 (amounts in thousands):

The goodwill balance is primarily attributed to the assembled workforce, expanded market opportunities and cost and other operating synergies anticipated upon the integration of the operations of Sucampo and R-Tech.

Note 5 – Unaudited Pro Forma Combined Consolidated Balance Sheet Adjustments

Purchase Accounting Adjustments:

(a) Reflects $268.8 million, which represents the cash portion of the purchase price paid to R-Tech common shareholders as calculated in Note [4].

(b) Reflects the change in book value for R-Tech’s asset and liability balances to reflect estimated fair value as of the acquisition date, October 20, 2015.

(c) Reflects an adjustment of $250.0 million to record the issuance of debt to finance the acquisition.

| 11 |

(d) Reflects transaction costs attributable to the transaction.

(e) Reflects debt issuance costs related to the new debt.

(f) Reflects the current and long term portions of the new debt.

(g) Reflects adjustments to eliminate R-Tech’s historical shareholders’ equity, which represents the historical book value of R-Tech’s net assets, as a result of the application of purchase accounting.

Note 6 – Unaudited Pro Forma Combined Consolidated Statements of Operations Adjustments

Purchase Accounting Adjustments:

(a) Reflects adjustments for the year ended December 31, 2014 and the nine months ended September 30, 2015 for amortization expense related to the fair value of identified intangible assets with definite lives.

(b) Reflects the removal of transaction costs related to the acquisition for the nine months ended September 30, 2015.

(c) Reflects the adjustments to interest expense and amortization of debt issuance costs resulting from the Term Loans.

(d) Reflects adjustments to income tax expense for the year ended December 31, 2014 and nine months ended September 30, 2015, for the tax effect of the transaction adjustments. Because the tax rate used for these pro forma financial statements is the statutory rate and an estimate, it will likely vary from the effective rate in periods subsequent to the completion of the business combination, and those differences may be material.

12