Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNIVERSAL BIOSENSORS INC | d217090d8k.htm |

Exhibit 99.1

| Universal Biosensors, Inc. |

| |||

| ABN 51 121 559 993 | ||||

|

1 Corporate Avenue |

||||

| Rowville Victoria 3149 | ||||

| Australia | ||||

|

Telephone: |

+61 3 9213 9000 | |||

| Facsimile: | +61 3 9213 6490 | |||

| Email: | info@universalbiosensors.com | |||

| www.universalbiosensors.com | ||||

21 June 2016

Dear Securityholder,

Good morning ladies and gentlemen and welcome to the annual general meeting of Universal Biosensors.

Your company is in the middle of an exciting period of change. In 2016, we have set out on a path that will see UBI become a stronger company and a leader in the global point-of-care diagnostics sector. After this address I will deliver a presentation describing the market and the opportunities in a little more detail.

The importance of innovation and turning ideas into products that make a difference to people’s lives are goals we are striving to achieve. These are themes that are close to my heart and that I have lived by throughout my entire career.

They are themes that UBI is uniquely positioned to capitalise on. The technology behind the test strips we develop and manufacture is world-leading. We have the expertise and drive to turn our technology into the kinds of products that make people’s lives better and easier to manage.

We also have partnerships with world leading healthcare companies, Siemens and Johnson & Johnson, providing valuable support and means for our technology to reach customers.

Entering this time of change, we have undertaken a number of initiatives that will ensure we deliver on our plans.

We have strengthened our balance sheet and reduced recurring costs by putting on hold the development of our own patient self-testing device for monitoring the blood thinning medication warfarin. We took this step after participating in a US Food and Drug Administration workshop that flagged increased scrutiny by the FDA of warfarin point-of-care tests.

The new scrutiny could lead to regulatory changes so it made sense for us to hold off on development until we consider the enhanced features which could address any changes and improve our position.

Our relationship with Siemens continues to strengthen. We recently modified our collaboration agreement to focus our collective resources on enhanced products. The changes to the agreement also saw UBI receive the prepayment of certain milestones, which boosted our cash reserves, while we agreed to reduce the transfer pricing of test strips we make for Siemens’ Xprecia Stride device. It’s an example of UBI and Siemens working together for mutual benefit.

Along with changes to our product pipeline, UBI is also committed to leadership renewal that will help us deliver on our plans for UBI’s continued growth. The company has always attracted and appointed directors with the skills and expertise relevant to UBI’s needs and required to achieve our corporate objectives.

We recently welcomed David Hoey and Judith Smith, who have been invaluable additions to the board. We are pleased to announce that Craig Coleman, Executive Chairman of Viburnum Funds, has agreed to be a director and the Board will be asked to formally approve his appointment at the Board meeting which immediately follows this meeting.

Denis Hanley, who previously indicated his intention to step down from the board, has agreed to remain as his broad range of skills and experience are important to the company. Denis is also chairman of the Audit & Compliance Committee and his financial expertise is welcome.

On leadership, we continue to search for a new Chief Executive Officer to replace Paul Wright. We are taking our time finding the right candidate for the position; it is important to engage someone who has the vision and experience to take UBI to the next stage of our corporate life.

A new CEO will step into a company committed to driving new product development in the point-of-care diagnostics sector in a strong financial position with a sound cash flow from existing products that are already on the market.

Despite this, I’m well aware that the decline in our share price has not reflected the significant opportunities we see in our path to change. While this is disappointing, we believe that the changes that we are delivering at UBI will ultimately deliver returns to shareholders.

As I said at the opening of today’s meeting, UBI is in the middle of an exciting period of change and it’s one I’m personally excited to be part of.

I’d like to thank the Board, our employees and you, our shareholders, for your continued support for the company and look forward to sharing with you our progress into the future.

Andrew Denver

Chairman and Interim CEO

Annual General Meeting: 21 June 2016 Business Update

Important Disclaimer This presentation is intended to provide a general outline only and is not intended to be a definitive statement on the subject matter. This presentation is not financial advice and has been prepared without taking into account the objectives, financial situation or needs of a particular person. Neither the Company, nor its officers or advisors or any other person warrants the accuracy of the analysis herein or guarantees the investment performance of the Company. Investors must make their own independent assessment of the Company and undertake such additional enquiries as they deem necessary or appropriate for their own investment purposes. The statements contained in this presentation that are not purely historical are forward-looking statements within the meaning of the United States Exchange Act. Forward-looking statements in this presentation include statements regarding our expectations, beliefs, hopes, intentions or strategies. All forward-looking statements included in this presentation are based upon information available to us as of the date hereof, and we assume no obligation to update any such forward-looking statement as a result of new information, future events or otherwise. Our actual results could differ materially from our current expectations. The Company is subject to a number of risks. For a summary of key risks, refer to the Company’s most recent Form 10-K filed with the United States Securities and Exchange Commission and the Australian Securities Exchange. Under applicable United States securities laws all of the shares of our common stock are “restricted securities” as that term is defined in Rule 144 under the Securities Act of 1933, as amended. Restricted securities may be resold in the public market to United States persons as defined in Regulation S only if registered for resale or if they qualify for an exemption from registration under the Securities Act. We have not agreed to register any of our common stock for resale by security holders. 2

UBI: Investment Highlights Targeting the large and growing Point-of-Care Diagnostics market Fast growth in revenues based on sale of disposable test strips Validating the technology through partnering deals with LifeScan and Siemens Unique patent-protected technology with low cost manufacturing Driving growth beyond the existing product platform via new product development 3

Progress over last 12 months Strong revenue performance with record Quarterly Service Fees achieved Blood glucose monitoring : QSF generated from OneTouch® Verio® were $4.9m in Q1’FY16 (up 68% compared to pcp) Blood coagulation monitoring : Xprecia Stride™ revenues were $183k in Q1’FY16 (up 154% compared to pcp) Total FY15 revenues improved 76% compared to pcp to $16.8m Trending towards profitability and cash flow generation Net Loss in Q1’FY16 $1.7m (an improvement of $1.2m on pcp) Cash breakeven in sight Implemented a rigorous criteria for R&D to focus on delivering shareholder returns Modified collaboration agreement with Siemens Some product development was put on hold in March 2016 A focussed product development pipeline to drive growth 4

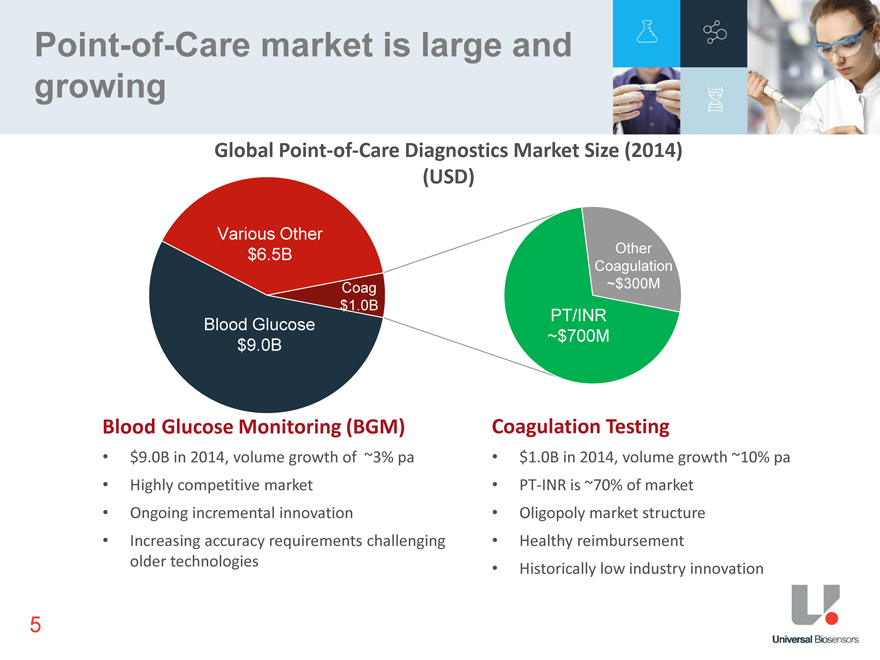

Point-of-Care market is large and growing Global Point-of-Care Diagnostics Market Size (2014) (USD) Various Other $6.5B Other Coagulation Coag ~$300M $1.0B PT/INR Blood Glucose ~$700M $9.0B Blood Glucose Monitoring (BGM) Coagulation Testing $1.0B in 2014, volume growth ~10% pa PT-INR is ~70% of market Oligopoly market structure Healthy reimbursement Historically low industry innovation $9.0B in 2014, volume growth of ~3% pa Highly competitive market Ongoing incremental innovation Increasing accuracy requirements challenging older technologies 5

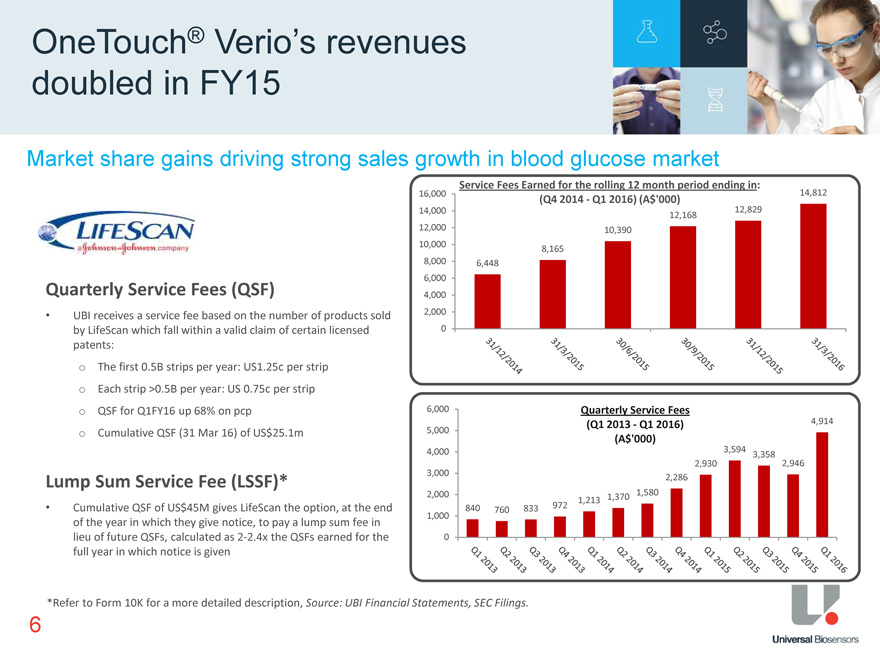

Market share gains driving strong sales growth in blood glucose market OneTouch® Verio’s revenues doubled in FY15 Service Fees Earned for the rolling 12 month period ending in: 16,000 14,812 (Q4 2014—Q1 2016) (A$‘000) 12,829 14,000 12,168 12,000 10,390 10,000 8,165 8,000 6,448 6,000 4,000 2,000 0 UBI receives a service fee based on the number of products sold by LifeScan which fall within a valid claim of certain licensed patents: Quarterly Service Fees (QSF) The first 0.5B strips per year: US1.25c per strip Each strip >0.5B per year: US 0.75c per strip QSF for Q1FY16 up 68% on pcp Cumulative QSF (31 Mar 16) of US$25.1m Lump Sum Service Fee (LSSF)* Cumulative QSF of US$45M gives LifeScan the option, at the end of the year in which they give notice, to pay a lump sum fee in lieu of future QSFs, calculated as 2-2.4x the QSFs earned for the full year in which notice is given 6,000 Quarterly Service Fees 5,000 (Q1 2013—Q1 2016) 4,914 (A$‘000) 3,594 4,000 3,358 3,000 2,930 2,946 2,286 2,000 1,370 1,580 1,213 840 760 833 972 1,000 0 *Refer to Form 10K for a more detailed description, Source: UBI Financial Statements, SEC Filings. 6

Early progress for Xprecia Stride™ Prestigious International Design Awards 2015 Winner: RED DOT design award 2016 Winner: iF DESIGN AWARD in Medicine & Healthcare category Early customer wins Customers previously using competitor system Customers converting from centralised lab testing Customers requiring POC PT-INR as part of a wider bundle of services / products General Physicians, Hospitals and Pharmacy Geographic expansion Selling in Europe, Middle East, Africa, Asia Pacific and Latin America 510k submission to FDA for regulatory clearance to US market in progress 7

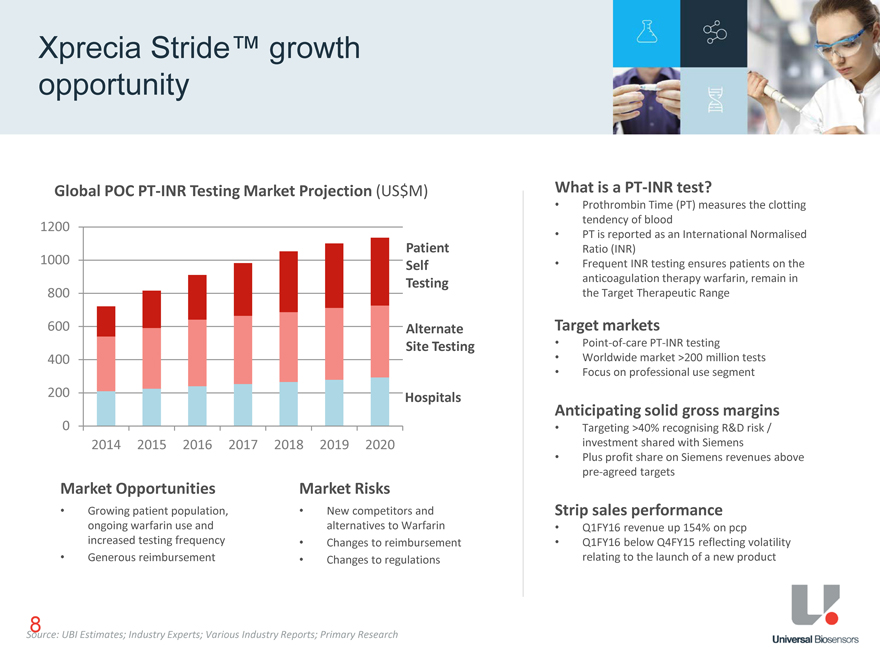

Xprecia Stride™ growth opportunity Global POC PT-INR Testing Market Projection (US$M) 1200 Patient 1000 Self Testing 800 600 Alternate Site Testing 400 200 Hospitals 0 2014 2015 2016 2017 2018 2019 2020 Market Opportunities Market Risks Growing patient population, ongoing warfarin use and increased testing frequency Generous reimbursement New competitors and alternatives to Warfarin Changes to reimbursement Changes to regulations What is a PT-INR test? Prothrombin Time (PT) measures the clotting tendency of blood PT is reported as an International Normalised Ratio (INR) Frequent INR testing ensures patients on the anticoagulation therapy warfarin, remain in the Target Therapeutic Range Target markets Worldwide market >200 million tests Focus on professional use segment Targeting >40% recognising R&D risk / investment shared with Siemens Plus profit share on Siemens revenues above pre-agreed targets Anticipating solid gross margins Q1FY16 revenue up 154% on pcp Q1FY16 below Q4FY15 reflecting volatility relating to the launch of a new product Strip sales performance Source: UBI Estimates; Industry Experts; Various Industry Reports; Primary Research 8

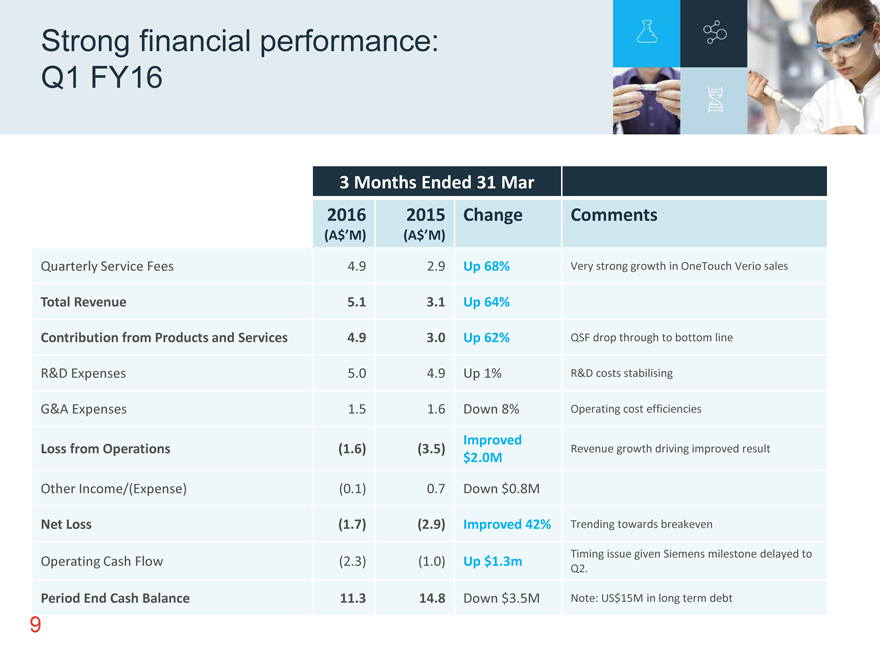

Strong financial performance: Q1 FY16 3 Months Ended 31 Mar 2016 2015 Change Comments (A$’M) (A$’M) Quarterly Service Fees 4.9 2.9 Up 68% Very strong growth in OneTouch Verio sales Total Revenue 5.1 3.1 Up 64% Contribution from Products and Services 4.9 3.0 Up 62% QSF drop through to bottom line R&D Expenses 5.0 4.9 Up 1% R&D costs stabilising G&A Expenses 1.5 1.6 Down 8% Operating cost efficiencies Improved Loss from Operations (1.6) (3.5) Revenue growth driving improved result $2.0M Other Income/(Expense) (0.1) 0.7 Down $0.8M Net Loss (1.7) (2.9) Improved 42% Trending towards breakeven Operating Cash Flow (2.3) (1.0) Up $1.3m Timing issue given Siemens milestone delayed to Q2. Period End Cash Balance 11.3 14.8 Down $3.5M Note: US$15M in long term debt 9

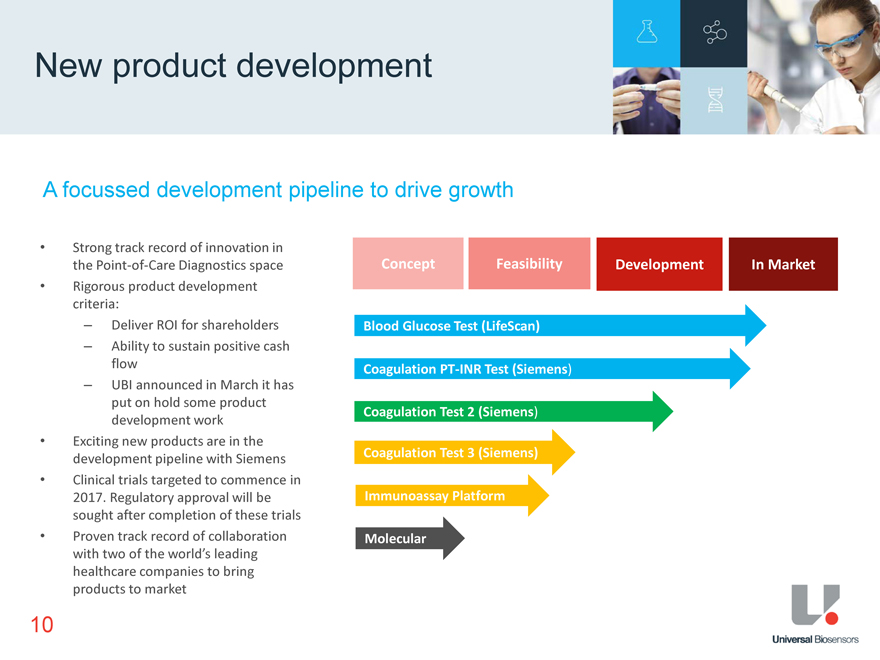

New product development A focussed development pipeline to drive growth Strong track record of innovation in the Point-of-Care Diagnostics space Rigorous product development criteria: Deliver ROI for shareholders Ability to sustain positive cash flow UBI announced in March it has put on hold some product development work Exciting new products are in the development pipeline with Siemens Clinical trials targeted to commence in 2017. Regulatory approval will be sought after completion of these trials Proven track record of collaboration with two of the world’s leading healthcare companies to bring products to market Concept Feasibility Development In Market Blood Glucose Test (LifeScan) Coagulation PT-INR Test (Siemens) Coagulation Test 2 (Siemens) Coagulation Test 3 (Siemens) Immunoassay Platform Molecular 10