Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SEACOR HOLDINGS INC /NEW/ | draft8-kinvestorslidesjune.htm |

SUMMARY INVESTOR PRESENTATION June 20, 2016

Forward-Looking Statement This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Certain statements discussed in this presentation as well as in other reports, materials and oral statements that the SEACOR Holdings Inc. (“Company”) releases from time to time constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “believe,” “plan,” “target,” “forecast” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements concern management's expectations, strategic objectives, business prospects, anticipated economic performance and financial condition and other similar matters. These statements are not guarantees of future performance and actual events or results may differ significantly from these statements. Actual events or results are subject to significant known and unknown risks, uncertainties and other important factors, including decreased demand and loss of revenues as a result of a decline in the price of oil and an oversupply of newly built offshore support vessels, additional safety and certification requirements for drilling activities in the U.S. Gulf of Mexico and delayed approval of applications for such activities, the possibility of U.S. government implemented moratoriums directing operators to cease certain drilling activities in the U.S. Gulf of Mexico and any extension of such moratoriums (the “Moratoriums”), weakening demand for the Company’s services as a result of unplanned customer suspensions, cancellations, rate reductions or non-renewals of vessel charters or failures to finalize commitments to charter vessels in response to a decline in the price of oil, an oversupply of newly built offshore support vessels and Moratoriums, increased government legislation and regulation of the Company’s businesses could increase cost of operations, increased competition if the Jones Act is repealed, liability, legal fees and costs in connection with the provision of emergency response services, including the Company’s involvement in response to the oil spill as a result of the sinking of the Deepwater Horizon in April 2010, decreased demand for the Company’s services as a result of declines in the global economy, declines in valuations in the global financial markets and a lack of liquidity in the credit sectors, including, interest rate fluctuations, availability of credit, inflation rates, change in laws, trade barriers, commodity prices and currency exchange fluctuations, the cyclical nature of the oil and gas industry, activity in foreign countries and changes in foreign political, military and economic conditions, changes in foreign and domestic oil and gas exploration and production activity, safety record requirements related to Offshore Marine Services and Shipping Services, decreased demand for Shipping Services due to construction of additional refined petroleum product, natural gas or crude oil pipelines or due to decreased demand for refined petroleum products, crude oil or chemical products or a change in existing methods of delivery, compliance with U.S. and foreign government laws and regulations, including environmental laws and regulations and economic sanctions, the dependence of Offshore Marine Services, Inland River Services, Shipping Services and Illinois Corn Processing on several customers, consolidation of the Company's customer base, the ongoing need to replace aging vessels, industry fleet capacity, restrictions imposed by the Shipping Acts on the amount of foreign ownership of the Company's Common Stock, operational risks of Offshore Marine Services, Inland River Services and Shipping Services, effects of adverse weather conditions and seasonality, the level of grain export volume, the effect of fuel prices on barge towing costs, variability in freight rates for inland river barges, the effect of international economic and political factors on Inland River Services' operations, the effect of the spread between the input costs of corn and natural gas compared with the price of alcohol and distillers grains on Illinois Corn Processing's operations, adequacy of insurance coverage, the potential for a material weakness in the Company's internal controls over financial reporting and the Company's ability to remediate such potential material weakness, the attraction and retention of qualified personnel by the Company, and various other matters and factors, many of which are beyond the Company's control as well as those discussed in Item 1A (Risk Factors) of the Company's Annual report on Form 10-K. In addition, these statements constitute the Company's cautionary statements under the Private Securities Litigation Reform Act of 1995. It should be understood that it is not possible to predict or identify all such factors. Consequently, the preceding should not be considered to be a complete discussion of all potential risks or uncertainties. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which the forward-looking statement is based, except as required by law. The forward- looking statements in this presentation should be evaluated together with the many uncertainties that affect the Company’s businesses, particularly those mentioned under “Forward-Looking Statements” in Item 7 on the Company’s Form 10-K and SEACOR’s periodic reporting on Form 8-K (if any), which are incorporated by reference. 2

Investment Objectives & Strategy 3 OBJECTIVES • Pursue risk adjusted returns on equity • Pursue long-term appreciation (“real growth”) with capital preservation STRATEGY • Adhere to capital and balance sheet discipline: we live within our means • Opportunistically deploy capital into cyclical assets • Maintain flexibility and diversify • Maintain liquidity to buy deep value • Harvest our gains1 • Capitalize on tax efficiency 1 Total gains from asset dispositions and impairments, net was approximately $700 million since 1993. A dollar of gain is as good as rental income.

Offshore Marine 62% Aviation 13% Inland River 23% Other & Corp 2% Offshore Marine 100% Decades of Transformation 4 Offshore Marine 48%Inland River 24% Shipping 25% ICP, Other & Corp 3% Mar. 31, 2016 $1,380 million 1 Net property and equipment was adjusted to exclude the $219.9 million related to our partners’ 49% interest of SEA-Vista. Total net property and equipment as of Mar. 31, 2016 was $1,599.9 million. Net property and equipment excludes cash, investments in joint ventures, and goodwill. Jun. 30, 2005 $934 million Dec. 31, 1990 $98 million Energy Service Energy Service Energy Service Net Property and Equipment Pro Forma Net Property and Equipment1 Net Property and Equipment

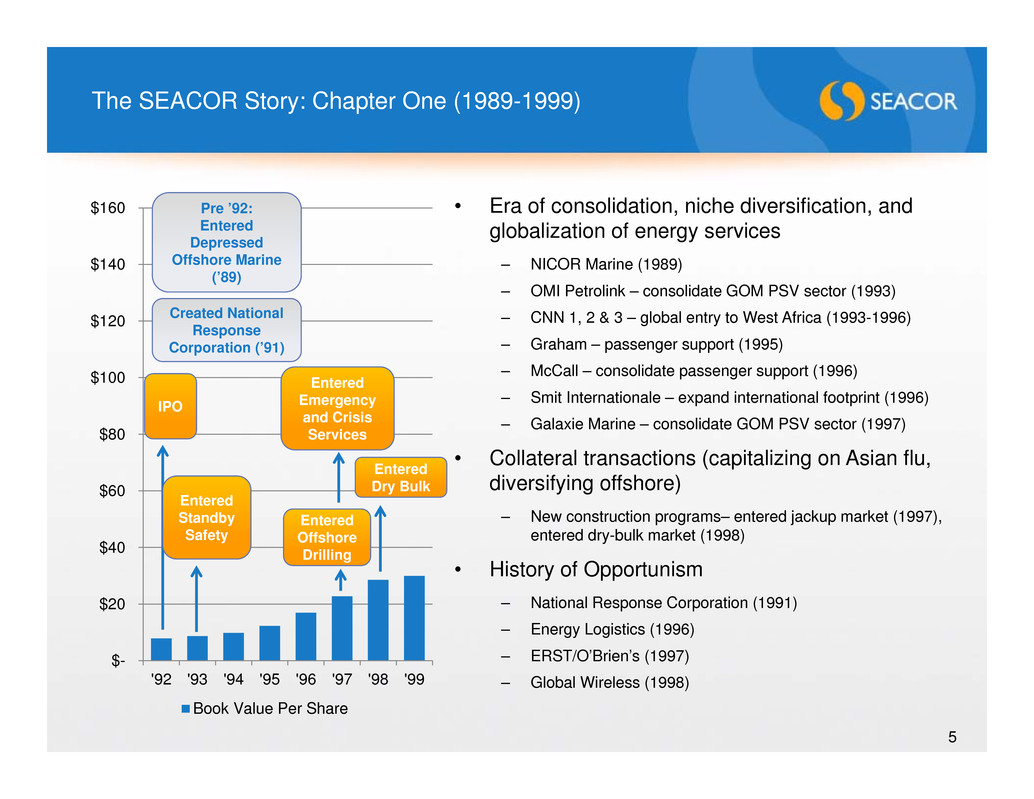

The SEACOR Story: Chapter One (1989-1999) 5 $- $20 $40 $60 $80 $100 $120 $140 $160 '92 '93 '94 '95 '96 '97 '98 '99 Book Value Per Share Pre ’92: Entered Depressed Offshore Marine (’89) IPO Entered Offshore Drilling Entered Dry Bulk Entered Emergency and Crisis Services • Era of consolidation, niche diversification, and globalization of energy services – NICOR Marine (1989) – OMI Petrolink – consolidate GOM PSV sector (1993) – CNN 1, 2 & 3 – global entry to West Africa (1993-1996) – Graham – passenger support (1995) – McCall – consolidate passenger support (1996) – Smit Internationale – expand international footprint (1996) – Galaxie Marine – consolidate GOM PSV sector (1997) • Collateral transactions (capitalizing on Asian flu, diversifying offshore) – New construction programs– entered jackup market (1997), entered dry-bulk market (1998) • History of Opportunism – National Response Corporation (1991) – Energy Logistics (1996) – ERST/O’Brien’s (1997) – Global Wireless (1998) Entered Standby Safety Created National Response Corporation (’91)

The SEACOR Story: Chapter Two (2000-2005) 6 • Era of diversification – Barges: SCF (2000) – Shipping and harbor towing: Seabulk (2005) – Aviation: • TexAir (2002) • Era Aviation (2004) – Environmental: Foss Environ./NRCES (2003) – Financing (i.e. sale leasebacks) – Offshore drilling rigs (exited 2002) • Continued consolidation in energy service: offshore marine – Boston Putford - Standby consolidation (2000) – Plaisance, Rincon, Cheramie, and Stirling – consolidated GOM PSB and utility market, North Sea PSV market (2001) – Seabulk (2005) $- $20 $40 $60 $80 $100 $120 $140 $160 '00 '01 '02 '03 '04 '05 Book Value Per Share Entered Inland River Entered Helicopter Exited Offshore Drilling Entered Petroleum Transport and Harbor Towing and Bunkering: Seabulk Expanded Helicopter: ERA

$- $20 $40 $60 $80 $100 $120 $140 $160 '06 '07 '08 '09 '10 '11 '12 '13 Era Distribution Per Share ($20.88) Special Cash Dividends Per Share (Tot. $20) Book Value Per Share The SEACOR Story: Chapter Three (2006-2013) 7 • Building on diversity and opportunism – Inland river: Waxler (2007), Seaspraie JV (2006) – Inland river terminals/grain elevators: Soylutions (2006), Gateway (2012), Bunge-SCF Grain JV (2010) – Manufacturing: Illinois Corn Processing (2009) – Internationalizing barge business: SCFCo (2008) – Growing shipping liner service: G&G (2011) – Entered general aviation: Avion (2006), Hawker Pacific (2010) – Entered commodity trading : V&A (2009) – Exited commodity trading: SEACOR Energy (2012) – Niche offshore markets: C-Lift (2006), Sea-Cat (2009), Windcat (2011), Superior liftboats - P&A (2012) – Exited international dry bulk: Sea Treasure (2006) – Divested aviation service • Entered EraMed (2007), Dart (2008) • Era Group Inc (spin-off 2013)1 – Harvested environmental business: • RMA (2006); Link, SRI, AC Industrial, Rivers Edge (2007); Trident Port (2008); SES-Chem and PIER Systems (2009); SES-Kazakhstan (2010) • NRC and affiliates (exited 2012) Exited Dry Bulk Entered Inland River Liquids Entered Terminal Business Entered General Aviation Entered Commodity Trading Entered Corn Processing Entered Liner & Short Sea Shipping Spin-off of Helicopter Exited Environmental Response Services 1 Special Cash Dividends of $15 and $5 per common share were paid to stockholders on December 14, 2010, and December 17, 2012, respectively. 2 The spin-off of Era Group Inc. on January 31, 2013 amounted to $20.88 per common share. Book value was $415.2 million. Stock price of ERA from Jan. 31, 2013 to Dec. 31, 2013 ranged from a high of $34.64 and low of $18.55. 1 2 Entered General Aviation: Hawker

The SEACOR Story: Next Chapter (2014-Onward) 8 What goes around comes around When you come to a fork in the road, take it ? ? ? Offshore Marine: Will Phoenix Rise from the Ashes? $- $20 $40 $60 $80 $100 $120 $140 $160 '14 '15 '16 Era Distribution Per Share ($20.88) Special Cash Dividends Per Share (Tot. $20) Book Value Per Share Exited Inland River Liquids Exited Commodity Trading 1 Special Cash Dividends of $15 and $5 per common share were paid to stockholders on December 14, 2010, and December 17, 2012, respectively. 2 The spin-off of Era Group Inc. on January 31, 2013 amounted to $20.88 per common share. Book value was $415.2 million. 1 2

Balance Sheet Highlights: Liquidity, Liquidity, Liquidity 9 (in thousands) 1 SEACOR Marine Holdings Inc. ("SMH") is the offshore marine division. 2 Net property and equipment includes $219.9 million related to our partners’ portion (49% interest) of SEA-Vista. 3 Total debt includes $103.7 million related to our partner’s portion (49% interest) of SEA-Vista and $175 million of Senior Notes funded by the Carlyle Group for the offshore marine division. As Reported Offshore Marine1 Remaining Company Cash: Cash and marketable securities 607,367$ 147,938$ 459,429$ Construction reserve funds 255,350 138,588 116,762 862,717 286,526 576,191 Net Property and Equipment2 1,599,961 658,904 941,057 Investments, at Equity, and Advances to 50% or Less Owned Companies 334,370 135,406 198,964 Goodwill & Intangible Assets, Net 78,126 1,017 77,109 Total Debt3 1,054,019 213,405 840,614 Deferred Income Taxes 374,476 171,216 203,260 SEACOR Holdings Inc. Stockholders' Equity 1,243,221 Shares Outstanding, End of Period 17,294,810 PRO FORMA BALANCE SHEET Mar. 31, 2016

$- $100 $200 $300 $400 $500 $600 $700 $800 $900 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Capital Expenditures OIBDA (ex gains) and Sales Proceeds $- $100 $200 $300 $400 $500 $600 $700 $800 $900 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Capital Expenditures Dividends & Distributions Share Repurchases CFFO and Sales Proceeds Fleet Renewal Funded by Earnings and Fleet Sales 10 SEACOR Offshore Marine 1 2 1 Cash flow from operations plus proceeds from asset dispositions. 2 OIBDA (ex gains) plus proceeds from asset dispositions. OIBDA (ex gains) is calculated as operating income plus depreciation and amortization less gains from asset dispositions and impairments, net. (in millions) (in millions)

Opportunity Drivers 11 • Cyclical recovery: barges and offshore • Industry consolidation: strong balance sheet and cyclical downturn creates opportunities for growth and value purchases • Leverage our in-house operating platform, experience, and knowledge into new niche areas in maritime businesses • Harvest investments • Capitalize on strong relationship with lenders • Maximize value of holding company structure & subsidiary businesses Consolidation: Offshore, Barges, Tank Vessels?

Earnings and Returns (2011-2015) 12 1 OIBDA is a non-GAAP financial measure and calculated as operating income plus depreciation and amortization. 2 Return on average historical cost is calculated as OIBDA divided by average historical cost of equipment. 3 Return on average net book value is calculated as OIBDA divided by average net book value of equipment. 4 Return on average insured value is calculated as OIBDA divided by average insured value of equipment. 5 Return on stockholders’ equity is calculated as net income (loss) attributable to SEACOR divided by stockholders’ equity at the beginning of the year. Average High High (Year) Low Low (Year) 2015 Offshore Marine Services: OIBDA1 102,049$ 153,603$ 2013 22,794$ 2015 22,794$ Return on Average Historical Cost2 9.5% 13.4% 2013 2.1% 2015 2.1% Return on Average Net Book Value3 16.2% 22.0% 2013 4.1% 2015 4.1% Return on Average Insured Value4 11.2% 2013 2.2% 2015 2.2% Inland River Services: OIBDA1 65,488$ 91,952$ 2014 54,231$ 2013 61,768$ Return on Average Historical Cost2 13.8% 18.4% 2014 11.3% 2013 12.7% Return on Average Net Book Value3 19.1% 26.7% 2014 15.8% 2013 19.3% Return on Average Insured Value4 16.7% 2014 9.0% 2013 12.4% Shipping Services: OIBDA1 61,256$ 77,186$ 2014 48,486$ 2012 71,888$ Return on Average Historical Cost2 12.3% 16.4% 2014 9.3% 2012 15.8% Return on Average Net Book Value3 20.9% 31.5% 2014 14.7% 2012 31.5% Return on Average Insured Value4 15.7% 2014 10.4% 2013 15.5% Consolidated: OIBDA (continuing operations)1 208,163$ 297,062$ 2014 147,112$ 2015 147,112$ Return on Avg Historical Cost (continuing operations)2 9.8% 13.6% 2014 7.0% 2015 7.0% Return on Avg Net Book Value (continuing operations)3 15.8% 22.9% 2014 12.8% 2015 12.8% Net Income (Loss) Attributable to SEACOR 34,118$ 100,132$ 2014 (68,782)$ 2015 (68,782)$ Return on Stockholders' Equity5 2.1% 7.1% 2014 (4.9)% 2015 (4.9)% (in thousands, except ratios) 5 Year

Appendix 13

Offshore Marine Services: Operating Leverage – “Stacked Fleet” 14 1 Reflects vessels owned since 2012. 2 Information provided as of April 30, 2016. 3 DVP is calculated as vessel operating revenues less direct operating expenses (running costs) excluding leased-in equipment rental costs. DVP is before the allocation of overhead. DVP does not equate to OIBDA or to profit as additional overhead may be required in order to place vessels back in service and support operations. Year-to-Date2 2015 3 Yr. Avg High Low AHTS 52.1$ (0.5)$ 17.0$ 20.5$ 24.7$ 17.6$ Liftboat 49.3 (0.3) (2.0) 24.6 28.9 19.3 PSV 2.1 - (2.8) 0.8 2.2 - FSV 8.4 - 1.5 2.6 2.9 2.2 Total 111.9$ (0.8)$ 13.7$ 48.5$ 55.4$ 40.9$ Direct Vessel Profit ("DVP")3 U.S.-FLAG VESSELS LAID UP AS OF Jun. 7, 2016 Class1 NBV2 (in millions)

Inland River Services: Freight Rates 15 1 “Barge Fleet Profile Report”. Informa Economics, Inc. (March 2016). 2 Barge earnings per day provided is for the inland river division’s HC Pool, which is made up of 13’ and 14’ covered hopper barges. “The benchmark used to measure rates is the adoption of the expired Bulk Grain and Grain Products Tariff No. 7 as the base tariff rate established for each segment of the river. Barge rates are then traded as a % of this tariff.”1 Barge earnings per day during 2006-2015 has ranged from $96 - $294.2

Earnings (2000 – 2015) 16 (in millions) 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Offshore Marine Services: Operating income (loss) 43.0$ 106.0$ 58.2$ 24.2$ 19.4$ 119.5$ 282.7$ 288.0$ 273.8$ 173.2$ 133.2$ 26.6$ 64.2$ 88.2$ 68.4$ (38.9)$ Depreciation and amortization 41.9 52.9 51.1 46.4 43.3 69.4 81.5 60.5 55.6 54.9 51.8 48.5 61.5 65.4 64.6 61.7 OIBDA1 84.9 158.9 109.3 70.7 62.7 188.9 364.2 348.6 329.4 228.1 184.9 75.0 125.8 153.6 133.0 22.8 Gains (losses) on asset sales2 7.6 9.2 8.6 17.9 10.1 20.4 67.0 82.5 69.2 22.5 29.5 14.7 14.9 28.7 26.5 (17.0) OIBDA (ex. gains/losses)3 77.3$ 149.7$ 100.7$ 52.8$ 52.6$ 168.5$ 297.2$ 266.0$ 260.2$ 205.6$ 155.5$ 60.4$ 110.9$ 124.9$ 106.5$ 39.8$ Inland River Services: Operating income (loss) n/a 2.3$ 3.5$ 5.2$ 16.9$ 41.5$ 59.9$ 71.2$ 47.5$ 42.2$ 65.0$ 36.3$ 31.4$ 25.8$ 62.5$ 33.1$ Depreciation and amortization n/a 1.1 1.9 (3.9) 7.2 12.0 20.0 16.3 16.6 19.4 20.7 23.5 28.3 28.5 29.4 28.6 OIBDA1 n/a 3.4 5.4 1.3 24.1 53.5 79.9 87.5 64.1 61.6 85.8 59.8 59.7 54.2 92.0 61.8 Gains (losses) on asset sales2 n/a - - (0.3) 0.1 0.0 11.1 8.0 10.4 4.7 31.9 3.0 7.7 6.6 29.7 14.9 OIBDA (ex. gains/losses)3 n/a 3.4$ 5.4$ 1.7$ 24.0$ 53.5$ 68.8$ 79.5$ 53.7$ 56.9$ 53.8$ 56.8$ 52.0$ 47.7$ 62.3$ 46.9$ Shipping Services: Operating income (loss) n/a n/a n/a n/a n/a 8.1$ 25.6$ (15.0)$ 16.8$ 13.1$ (3.7)$ 23.4$ 17.9$ 23.8$ 48.8$ 45.6$ Depreciation and amortization n/a n/a n/a n/a n/a 25.8 45.7 43.8 39.8 40.2 37.2 30.2 30.6 31.3 28.4 26.3 OIBDA1 n/a n/a n/a n/a n/a 34.0 71.4 28.8 56.6 53.3 33.5 53.7 48.5 55.1 77.2 71.9 Gains (losses) on asset sales2 n/a n/a n/a n/a n/a - - (0.1) 3.8 0.4 (17.5) 1.4 3.1 0.2 0.2 - OIBDA (ex. gains/losses)3 n/a n/a n/a n/a n/a 34.0$ 71.4$ 28.8$ 52.8$ 52.9$ 51.0$ 52.3$ 45.4$ 54.8$ 77.0$ 71.9$ 1 OIBDA is a non-GAAP financial measure and calculated as operating income plus depreciation and amortization. 2 Gains (losses) on asset dispositions and impairments, net. 3 OIBDA (ex gains) plus proceeds from asset dispositions. OIBDA (ex gains) is calculated as operating income plus depreciation and amortization less gains from asset dispositions and impairments, net.

Funding Capital Expenditures with Proceeds from Asset Sales 17 1 1 Capital expenditures 2005 – 1Q161 (in millions) 1 Represents the capital expenditures and proceeds from asset sales from January 2005 to March 2016 for our offshore marine, inland river and shipping divisions. Total capital expenditures: $2,393 million Total proceeds from asset sales: $2,448 million $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 Offshore Marine Inland River Shipping $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 Offshore Marine Inland River Shipping (in millions) Proceeds from asset sales 2005 – 1Q161

Reconciliations of Certain Non-GAAP Measures 18 Footnotes are found on slide 20. (in thousands, except ratios) 2015 2014 2013 2012 2011 Average Offshore Marine Services: Operating income (loss) (38,935)$ 68,429$ 88,179$ 64,218$ 26,568$ Depreciation and amortization 61,729 64,615 65,424 61,542 48,477 Operating income before depreciation and amortization1 22,794$ 133,044$ 153,603$ 125,760$ 75,045$ 102,049$ Average historical cost2 1,076,068$ 1,133,347$ 1,142,867$ 1,091,592$ 923,714$ 1,073,518$ Return on avg. historical cost3 2.1% 11.7% 13.4% 11.5% 8.1% 9.5% Average net book value4 553,587$ 642,499$ 699,740$ 693,990$ 556,147$ 629,193$ Return on avg. net book value5 4.1% 20.7% 22.0% 18.1% 13.5% 16.2% Average insured value6 1,057,884$ 1,270,120$ 1,368,586$ Return on avg. insured value of owned fleet7 2.2% 10.5% 11.2% Inland River Services: Operating income 33,136$ 62,517$ 25,770$ 31,437$ 36,289$ Depreciation and amortization 28,632 29,435 28,461 28,270 23,494 Operating income before depreciation and amortization1 61,768$ 91,952$ 54,231$ 59,707$ 59,783$ 65,488$ Average historical cost2 485,916$ 500,698$ 479,895$ 481,716$ 432,482$ 476,141$ Return on avg. historical cost3 12.7% 18.4% 11.3% 12.4% 13.8% 13.8% Average net book value4 320,380$ 344,094$ 343,341$ 365,926$ 338,142$ 342,377$ Return on avg. net book value5 19.3% 26.7% 15.8% 16.3% 17.7% 19.1% Average insured value6 499,258$ 550,696$ 602,177$ Return on avg. insured value of owned fleet7 12.4% 16.7% 9.0%

Reconciliations of Certain Non-GAAP Measures Continued 19Footnotes are found on slide 20. (in thousands, except ratios) 2015 2014 2013 2012 2011 Average Shipping Services: Operating income 45,592$ 48,766$ 23,769$ 17,851$ 23,439$ Depreciation and amortization 26,296 28,420 31,299 30,635 30,214 Operating income before depreciation and amortization1 71,888$ 77,186$ 55,068$ 48,486$ 53,653$ 61,256$ Average historical cost2 454,053$ 470,595$ 505,517$ 519,066$ 538,382$ 497,523$ Return on avg. historical cost3 15.8% 16.4% 10.9% 9.3% 10.0% 12.3% Average net book value4 227,937$ 256,085$ 293,379$ 330,425$ 354,305$ 292,426$ Return on avg. net book value5 31.5% 30.1% 18.8% 14.7% 15.1% 20.9% Average insured value of owned fleet6 463,886$ 492,170$ 529,464$ Return on avg. insured value7 15.5% 15.7% 10.4% Consolidated Services (continuing operations): Operating income 21,125$ 165,243$ 100,042$ 56,405$ 67,138$ Depreciation and amortization 125,987 131,819 134,518 131,667 106,873 Operating income before depreciation and amortization1 147,112$ 297,062$ 234,560$ 188,072$ 174,011$ 208,163$ Average historical cost2 2,096,977$ 2,187,605$ 2,206,730$ 2,178,328$ 1,929,866$ 2,119,901$ Return on avg. historical cost3 7.0% 13.6% 10.6% 8.6% 9.0% 9.8% Average net book value4 1,149,563$ 1,298,291$ 1,395,953$ 1,461,071$ 1,287,009$ 1,318,377$ Return on avg. net book value5 12.8% 22.9% 16.8% 12.9% 13.5% 15.8% Consolidated Services (incl. discontinued operations): Net Income (Loss) Attributable to SEACOR (68,782)$ 100,132$ 36,970$ 61,215$ 41,056$ 34,118$ SEACOR Stockholders' Equity (beginning of period) 1,399,494$ 1,400,852$ 1,713,654$ 1,789,607$ 1,787,237$ 1,618,169$ Return on Stockholders' Equity8 (4.9)% 7.1% 2.2% 3.4% 2.3% 2.1%

Reconciliations of Certain Non-GAAP Measures Continued 20 1 Non-GAAP Financial Measure. The Company, from time to time, discloses and discusses OIBDA, a non-GAAP financial measure, for certain of its operating segments in its public releases and other filings with the Securities and Exchange Commission. The Company defines OIBDA as operating income (loss) for the applicable segment plus depreciation and amortization. The Company's measure of OIBDA may not be comparable to similarly titled measures presented by other companies. Other companies may calculate OIBDA differently than the Company, which may limit its usefulness as a comparative measure. In addition, this measurement does not necessarily represent funds available for discretionary use and is not a measure of its ability to fund its cash needs. OIBDA is a financial metric used by management (i) as a supplemental internal measure for planning and forecasting overall expectations and for evaluating actual results against such expectations; (ii) as a criteria for annual incentive bonuses paid to the Company officers and other shore-based employees; and (iii) to compare to the OIBDA of other companies when evaluating potential acquisitions. 2 Average historical cost is computed by averaging the beginning and ending quarterly values during a period. This reflects what we paid at the time the equipment was purchased, not replacement cost, or the fair value for equipment acquired in a corporate transaction. In our businesses, the price for assets, even identical assets, can move up and down over time. 3 Return on average historical cost is calculated as OIBDA divided by average historical cost. 4 Average net book value is computed by averaging the beginning and ending quarterly values during a period. This reflects what we paid at the time the equipment was purchased, net of accumulated depreciation and excludes construction in progress. 5 Return on average net book value is calculated as OIBDA divided by average net book value. 6 Average insured value of the owned fleet is computed by averaging the beginning and ending quarterly values during a period. With the exception of additions (and deletions) within the year, insured values are based on the policy renewals of the respective year. 7 Return on average insured value is calculated as OIBDA divided by average insured value of equipment. 8 Return on stockholders’ equity is calculated as net income (loss) attributable to SEACOR divided by stockholders’ equity at the beginning of the year.