Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Rubicon Technology, Inc. | d202990dex991.htm |

| 8-K - FORM 8-K - Rubicon Technology, Inc. | d202990d8k.htm |

Exhibit 99.2

WHITE PROXY CARD TODAY!

June 13, 2016

Dear Fellow Stockholders:

Rubicon Technology’s Annual Meeting of Stockholders is only weeks away. We are asking you to support Rubicon against Paragon Technologies, Inc. (“Paragon”), which – despite owning less than 0.3% of our stock – is trying to replace two of our directors. We urge you to vote FOR Rubicon’s highly qualified nominees, Don N. Aquilano and Donald R. Caldwell, on the WHITE proxy card.

Rubicon’s Board is comprised of strong and experienced directors who are committed to doing what is best for all stockholders. The Board is actively engaged and has been instrumental in helping guide the Company through difficult industry challenges. The Board and management team also continue to execute a clear plan to strengthen performance and deliver stockholder value.

Moreover, we remain steadfast in our commitment to maintaining a highly qualified Board and giving careful consideration to constructive stockholder feedback. To that end, we recently announced the appointment of a new independent director, Timothy E. Brog, to the Board.

LEADING PROXY ADVISORY FIRM ISS SUPPORTS RUBICON

We are also pleased to report that Institutional Shareholder Services Inc. (“ISS”), a leading independent proxy voting and corporate governance advisory firm, recently recommended that Rubicon stockholders vote “For” both of Rubicon’s nominees on the WHITE proxy card. ISS support is further validation of the actions we are taking and the strength of Rubicon’s incumbent directors and our Board.

In reaching its recommendation, ISS noted the following in its report dated June 11, 2016:

“As the dissident has failed to make a compelling case that additional change at the board level is necessary, no support for the dissident nominees is warranted. Shareholders should vote on the WHITE management card FOR the election of the two management nominees.”

“From a governance perspective, it may be signally important that the dissident holds so little of the company’s equity. The enormity of that disconnect is astonishing…Just to break even on contest expenses, the dissident would have to see shares rise more than 500 percent… This should be seen as a sign of how skeptical other shareholders should be about the alignment of interests between the dissident and themselves.”

ADDING A NEW PERSPECTIVE AND A BIAS FOR CHANGE

With the addition of Mr. Brog, we expanded the Board to six members, five of whom are independent. Mr. Brog, currently President of Locksmith Capital, has worked across a broad spectrum of industries. He has a strong track record driving change as a member of public company boards on slates of both management and activist stockholders. Importantly, initial stockholder feedback regarding Mr. Brog’s appointment has been positive as Rubicon stockholders also welcome additional insights on the Board.

Mr. Brog is an accomplished executive, with extensive investment, legal, management and financial experience. Previously, he served as Chairman of the Board, CEO and a director of Peerless Systems Corporation. Prior to that, he held a variety of positions at investment firms, including as Managing Director and portfolio manager to Locksmith Value Opportunity Fund LP; President of Pembridge Capital Management LLC; and Managing Director of The Edward Andrews Group Inc., a boutique investment bank. He began his career as a corporate finance and mergers & acquisitions attorney at Skadden, Arps, Slate, Meagher & Flom LLP. Mr. Brog is currently a Director of Eco-Bat Technologies Limited and previously served as Chairman of the Board and Chairman of the Audit Committee of Deer Valley Corporation and as a member of the Board of Directors of the Topps Company Inc.

We look forward to benefitting from the new perspectives that Mr. Brog brings to the Rubicon Board. We are confident that his experiences will be invaluable as we continue to pursue the appropriate path forward to drive long-term stockholder value.

A STRONG PLATFORM AND CLEAR PLAN TO DRIVE IMPROVED PERFORMANCE

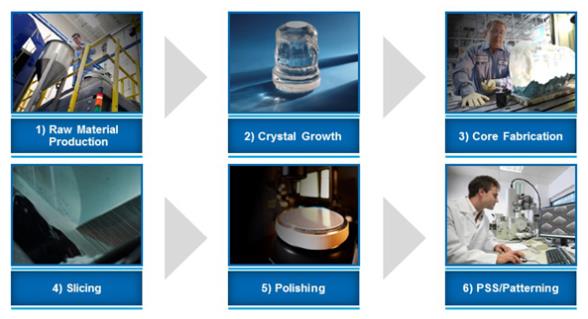

As the industry’s most vertically integrated sapphire supplier, Rubicon has great control over cost and quality enabling it to earn a reputation as one of the most reliable suppliers in the industry.

MOST VERTICALLY INTEGRATED SAPPHIRE SUPPLIER

Leveraging this strong platform and Rubicon’s position as a global leader in sapphire technology, the Board and management team are also taking actions in response to the challenging conditions in the sapphire industry. We are implementing a clear plan to return to profitability and deliver stockholder value focused on:

| • | Improving Financial Performance |

| • Increasing high-margin revenue from new products and new markets where competition is limited – completing development on SapphirEX and LANCE products in the optical space; | ||

| • Expanding product availability and reducing costs in the large diameter Patterned Sapphire Substrate (“PSS”) business – expect significant increase in sales of six-inch PSS wafers in the second half of 2016; and |

Rubicon is the global leader in large-diameter sapphire substrates and has leveraged its unique expertise to create a complete line of PSS in 4” through 8” diameters. | |

| • Reducing operating costs – building on 10% reduction in operating costs achieved in 2015. | ||

| • | Continuing to Examine All Strategic Options. |

PARAGON IS THE WRONG CHOICE

We firmly believe we are taking the right steps to position Rubicon for the future, yet Paragon is intent on disrupting our progress with its attempt to elect two directors, Hesham M. Gad and Jack H. Jacobs, to the Rubicon Board. Despite Paragon’s minimal share ownership, we vetted Messrs. Gad and Jacobs in an effort to reach a constructive resolution. We determined Mr. Gad was unfit to sit on the Rubicon Board due to his personal and professional history.

Despite Mr. Jacobs’ close ties with Mr. Gad, we were willing to consider appointing him to the Board to avoid a costly and distracting proxy contest. However, our efforts were rebuffed. It is also important to note that Mr. Jacobs has been associated with multiple business failures raising further questions about his viability as a nominee. During his short tenure on the SED board, he approved substantial consulting fees paid to Mr. Gad while the company spiraled toward insolvency. In addition, during two stints on the Premier Exhibitions, Inc. board, the company suffered considerable financial losses.

We strongly recommend that Rubicon stockholders reject Paragon’s nominees and vote “FOR” Rubicon’s highly qualified directors – please do not sign or return or vote any proxy card sent to you by Paragon!

VOTE THE WHITE PROXY CARD TODAY – YOUR VOTE IS IMPORTANT

Rubicon’s highly qualified Board and management are focused on executing a plan to deliver value and consistently invite and consider constructive feedback from stockholders. The recent addition of our new independent director demonstrates our Company’s readiness to evaluate our Board and act in all stockholders’ best interests. We urge you to support Messrs. Aquilano and Caldwell – two highly qualified directors who together own 10% of Rubicon stock – at this year’s Annual Meeting, scheduled for Friday, June 24, 2016.

Whether or not you plan to attend Rubicon’s annual meeting, you have the opportunity to support the Company by voting the WHITE proxy card for Rubicon’s nominees TODAY. The Company urges you to vote today by telephone, over the Internet, or by signing, dating and returning the enclosed WHITE proxy card in the postage-paid envelope provided.

Thank you for your continued support.

Sincerely,

The Board of Directors

|

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN.

If you have questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the solicitation of proxies:

INNISFREE M&A INCORPORATED Stockholders Call Toll-Free: (888) 750-5834 Banks and Brokers Call Collect: (212) 750-5833

IMPORTANT We urge you NOT to sign any Blue proxy card sent to you by Paragon, as doing so will revoke your vote on the WHITE proxy card.

|

FORWARD-LOOKING STATEMENTS

Certain of the statements in this release, particularly those preceded by, followed by or including the words “believes,” “expects,” “anticipates,” “intends,” “should,” “estimates,” or similar expressions, or those relating to or anticipating financial results for periods beyond the end of the year 2015, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. For those statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, the statements. These risks and uncertainties include changes in the average selling prices of sapphire products, our successful development and market acceptance of new products, dependence on key customers, potential disruptions in our supply of electricity, changes in our product mix, our ability to protect our intellectual property rights, the competitive environment, the availability and cost of raw materials, the cost of compliance with environmental standards, the ability to make effective acquisitions and successfully integrate newly acquired businesses into existing operations and other risks and uncertainties described in the Company’s most recent Form 10-K and other filings with the SEC. For these reasons, readers are cautioned not to place undue reliance on the Company’s forward-looking statements. Any forward-looking statement that the Company makes speaks only as of the date of such statement, and the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.