Attached files

| file | filename |

|---|---|

| 8-K - PCS EDVENTURES COM INC | form8-k.htm |

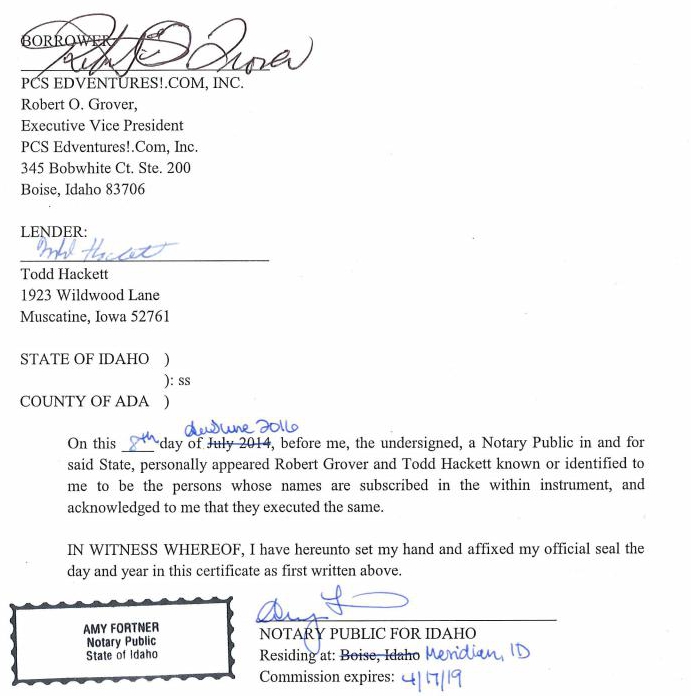

PROMISSORY NOTE

| $1,292,679.45 | Boise, Idaho | June 8, 2016 |

FOR VALUE RECEIVED, PSC Edventuresl.com, Inc., an Idaho corporation located at 345 Bobwhite Ct. Ste. 200, Boise, Idaho 83706 (hereinafter “Borrower”) promises to pay to the order of Todd R. Hackett, or his successors and assigns, if any (hereinafter “Payee”), the principal sum of ONE MILLION TWO HUNDRED NINETY-TWO THOUSAND SIX HUNDRED SEVENTY-NINE and 45/100 DOLLARS ($1,292,679.45), with a current outstanding interest amount of ONE HUNDRED SEVENTY-FOUR THOUSAND TWO HUNDRED FORTY-THREE and 28/100 DOLLARS ($174,243.28) in lawful money of the United States of America, together with interest on the principle thereon at the rate of ten percent (10.0 %) per annum amortized over 24 months, payable in monthly installments until the Maturity Date, at which date the entire amount of any unpaid principal and interest will be due in full. Payment will be as follows:

| (a) | Only the principal first will be payable in consecutive monthly installments in the sum of Fifty Thousand 00/100 Dollars ($50,000.00) per month. |

| (b) | The first such payment will be made on January 15, 2017, and Borrower will thereafter pay a like amount to Payee on the 15th day of each month (the “Due Date”) thereafter throughout the term hereof. The Maturity Date of this “Promissory Note” will be July 15, 2018 at which time the entire remaining balance of principal and interest is due and payable. |

| (c) | Borrower may prepay this “Promissory Note” in whole or in part at any time without penalty. |

| (d) | If any monthly installment under this “Promissory Note” is not paid within fifteen (15) days of the Due Date, a late charge of one percent (1.0%) of the payment(s) due will be assessed. Any monthly installment not paid within 30 days of its Due Date will be deemed a default of this “Promissory Note”. |

| (e) | Upon any default of this “Promissory Note” within the first twenty four (24) months of its term Payee must notify Borrower in writing of default and allow Borrower fourteen (14) days from the date of receipt to remedy the default, including late charges described in section (d). |

| (f) | Notwithstanding section (e), upon failure to remedy a default, default of this “Promissory Note” subsequent to the first twenty four (24) months of its term, the entire principal amount outstanding and accrued interest thereon will at once become due and payable at the option of the holder of this “Promissory Note”. The holder of this “Promissory Note” may exercise this option to accelerate during any default by Borrower regardless of any prior forbearance. |

| (g) | This loan will be secured by the Lender against property as is set forth in the “Security Agreement” on Exhibit A. |

| (h) | If this Note is placed with an attorney for collection or if suit is instituted for its collection, the undersigned non-prevailing party agrees to pay, in either case, reasonable attorney fees incurred by the prevailing party. |

| (i) | This Note may be amended only by a written instrument executed by the Borrower and the Payee. |

| (j) | This Note will be governed by, and will be construed and enforced in accordance with the laws of the State of Idaho. Any legal action to enforce this Note will be brought only in the Fourth Judicial District of Idaho, in the County of Ada. |

PROMISSORY NOTE

| $175,000.00 | Boise, Idaho | June 8, 2016 |

FOR VALUE RECEIVED, PSC Edventuresl.com, Inc., an Idaho coiporation located at 345 Bobwhite Ct. Ste. 200, Boise, Idaho 83706 (hereinafter “Borrower”) promises to pay to the order of Todd R. Hackett, or his successors and assigns, if any (hereinafter “Payee”), the principal sum of ONE HUNDRED SEVENTY-FIVE THOUSAND and 00/100 DOLLARS ($175,000.00), with a current outstanding interest amount of TWENTY SEVEN THOUSAND THREE HUNDRED FIFTY-FOUR and 74/100 DOLLARS ($27,354.74) in lawful money of the United States of America, together with interest on the principle thereon at the rate of ten percent (10.0 %) per annum amortized over 30 months, payable in a one time payment on the Maturity Date, at which date the entire amount of any unpaid principal and interest will be due in full. Payment will be as follows:

| (a) | A one time “balloon” payment will be made by Borrower on January 15, 2019. The Maturity Date of this “Promissory Note” will be January 15, 2019 at which time the entire remaining balance of principal and interest is due and payable. |

| (b) | Borrower may prepay this “Promissory Note” in whole or in part at any time without penalty. |

| (c) | Upon any default of this “Promissory Note,” Payee must notify borrower in writing of default and allow Borrower fourteen (14) days from the date of receipt to remedy the default, including late charges described in section (d). |

| (d) | Notwithstanding section (e), upon failure to remedy a default, default of this “Promissory Note,” the entire principal amount outstanding and accrued interest thereon will at once become due and payable at the option of the holder of this “Promissory Note”. The holder of this “Promissory Note” may exercise this option to accelerate during any default by Borrower regardless of any prior forbearance. |

| (e) | If this Note is placed with an attorney for collection or if suit is instituted for its collection, the undersigned non-prevailing party agrees to pay, in either case, reasonable attorney fees incurred by the prevailing party. |

| (f) | This Note may be amended only by a written instrument executed by the Borrower and the Payee. |

| (g) | This Note will be governed by, and will be construed and enforced in accordance with the laws of the State of Idaho. Any legal action to enforce this Note will be brought only in the Fourth Judicial District of Idaho, in the County of Ada. |

PROMISSORY NOTE

| $340,000.00 | Boise, Idaho | June 8, 2016 |

FOR VALUE RECEIVED, PSC Edventuresl.com, Inc., an Idaho corporation located at 345 Bobwhite Ct. Ste. 200, Boise, Idaho 83706 (hereinafter “Borrower”) promises to pay to the order of Todd R. Hackett, or his successors and assigns, if any (hereinafter “Payee”), the principal sum of THREE HUNDRED FORTY THOUSAND DOLLARS and 00/100 ($340,000.00), with a current outstanding interest amount of TEN THOUSAND THREE HUNDRED TWELVE and 33/100 DOLLARS ($10,312.33) in lawful money of the United States of America, with interest on the principle thereon at the rate of ten percent (10.0 %) per annum amortized over six (6) months, payable in a one time payment on the Maturity Date, at which date the entire amount of any unpaid principal and interest will be due in full. Payment will be as follows:

| (a) | A one time “balloon” payment will be made by Borrower on December 31, 2016. The Maturity Date of this “Promissory Note” will be December 31, 2016 at which time the entire remaining balance of principal and interest is due and payable. |

| (b) | Borrower may prepay this “Promissory Note” in whole or in part at any time without penalty. |

| (c) | If any monthly installment under this “Promissory Note” is not paid within fifteen (15) days of the Due Date, a late charge of one percent (1.0%) of the payment(s) due will be assessed. Any payment not paid within 30 days of its Due Date will be deemed a default of this “Promissory Note”. |

| (d) | Upon any default of this “Promissory Note” the Payee must notify borrower in writing of default and allow Borrower fourteen (14) days from the date of receipt to remedy the default, including late charges described in section (d). |

| (e) | Notwithstanding section (e), upon failure to remedy a default, default of this “Promissory Note” subsequent to its term, the entire principal amount outstanding and accrued interest thereon will at once become due and payable at the option of the holder of this “Promissory Note.” The holder of this “Promissory Note” may exercise this option to accelerate during any default by Borrower regardless of any prior forbearance. |

| (f) | If this Note is placed with an attorney for collection or if suit is instituted for its collection, the undersigned non-prevailing party agrees to pay, in either case, reasonable attorney fees incurred by the prevailing party. |

| (g) | This Note may be amended only by a written instrument executed by the Borrower and the Payee. |

| (h) | This Note will be governed by, and will be construed and enforced in accordance with the laws of the State of Idaho. Any legal action to enforce this Note will be brought only in the Fourth Judicial District of Idaho, in the County of Ada. |