Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HNI CORP | earningsguidance061016ex.htm |

| 8-K - 8-K - HNI CORP | form8kinvestorslides.htm |

Investor Presentation Neocon 2016

This presentation contains "forward-looking" statements based on current expectations regarding future plans, events, outlook, objectives and financial performance, expectations for future sales growth and earnings per diluted share (GAAP and non- GAAP). Forward-looking statements can be identified by words including “expect,” “believe,” “anticipate,” “estimate,” “may,” “will,” “would,” “could,” “confident” or other similar words, phrases or expressions. Forward-looking statements involve known and unknown risks and uncertainties, which may cause the Corporation's actual future results and performance to differ materially from expected results. These risks include but are not limited to: general economic conditions in the United States and internationally; unfavorable changes in the United States housing market; industry and competitive conditions; a decline in corporate spending on office furniture; changes in raw material, component or commodity pricing; future acquisitions, divestitures or investments; the cost of energy; changing legal, regulatory, environmental and healthcare conditions; the Corporation’s ability to successfully complete its business software system implementation; the Corporation’s ability to implement price increases; changes in the sales mix of products; the Corporation’s ability to achieve the anticipated benefits from closures and structural alignment initiatives; and force majeure events outside the Corporation’s control. A description of these risks and additional risks can be found in the Corporation's annual and quarterly reports filed with the Securities and Exchange Commission on Forms 10- K and 10-Q. The Corporation undertakes no obligation to update, amend or clarify forward-looking statements. Forward Looking Statements

2 Leading Market Positions Operational Excellence Investment Considerations 3 Breadth and Depth Financial Strength Long Term Value Creation

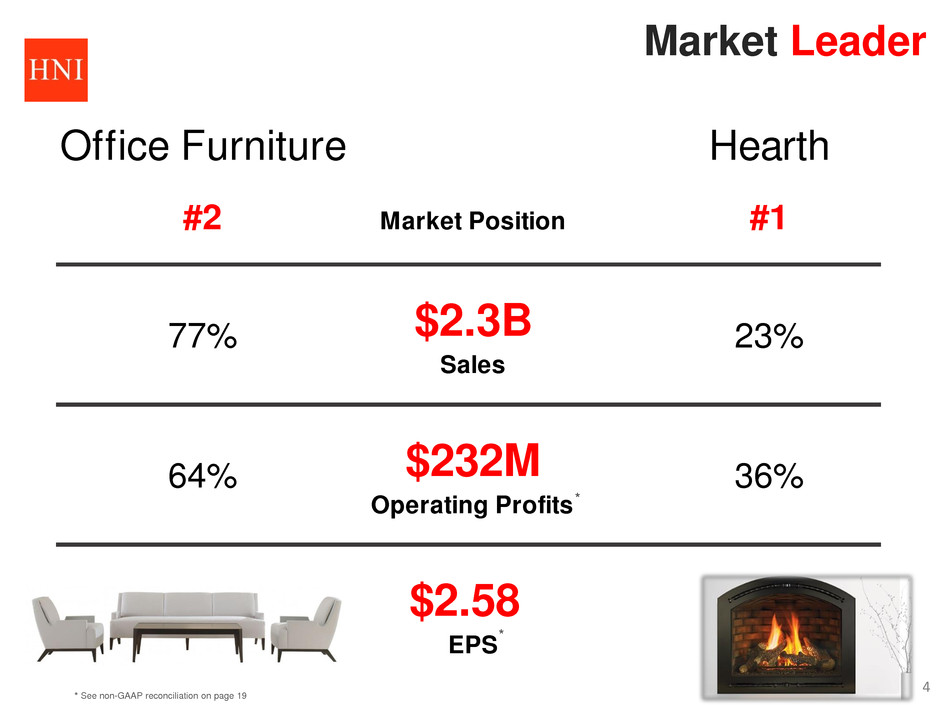

Market Leader Office Furniture Hearth #2 Market Position #1 $2.3B Sales $232M Operating Profits $2.58 EPS 23%77% 36%64% * See non-GAAP reconciliation on page 19 * * 4

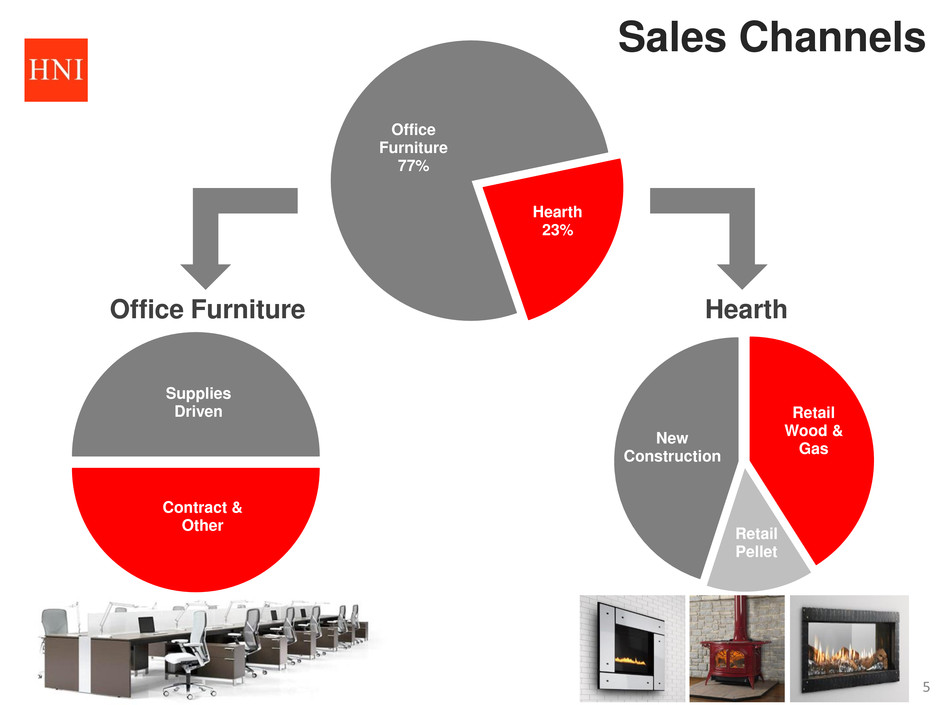

Office Furniture 77% Hearth 23% New Construction Retail Wood & Gas Retail Pellet Supplies Driven Contract & Other Sales Channels HearthOffice Furniture 5

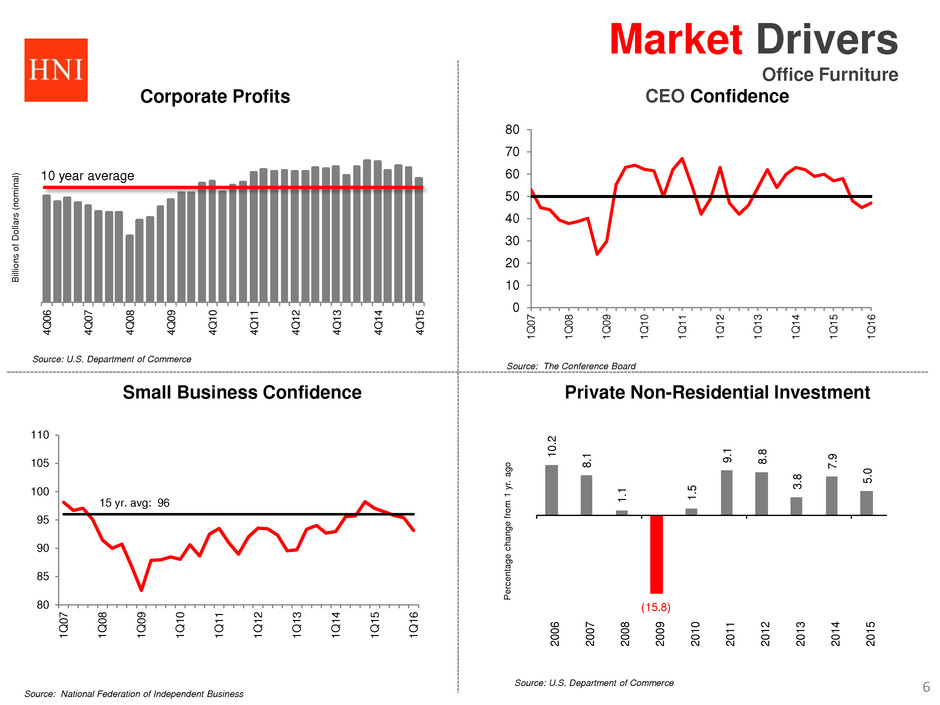

Source: U.S. Department of Commerce B ill io n s o f Dolla rs (n o m in a l) Corporate Profits Market Drivers Office Furniture Source: The Conference Board CEO Confidence Private Non-Residential Investment P e rc e n ta g e c h a n g e f ro m 1 y r. a g o Source: U.S. Department of Commerce Small Business Confidence Source: National Federation of Independent Business 6 4Q 06 4Q 07 4Q 08 4Q 09 4Q 10 4Q 11 4Q 12 4Q 13 4Q 14 4Q 15 10 year average 0 10 20 30 40 50 60 70 80 1Q 07 1Q 08 1Q 09 1Q 10 1Q 11 1Q 12 1Q 13 1Q 14 1Q 15 1Q 16 80 85 90 95 100 105 110 1Q 07 1Q 08 1Q 09 1Q 10 1Q 11 1Q 12 1Q 13 1Q 14 1Q 15 1Q 16 15 yr. avg: 96 10 .2 8. 1 1. 1 (15.8) 1. 5 9. 1 8. 8 3. 8 7. 9 5. 0 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15

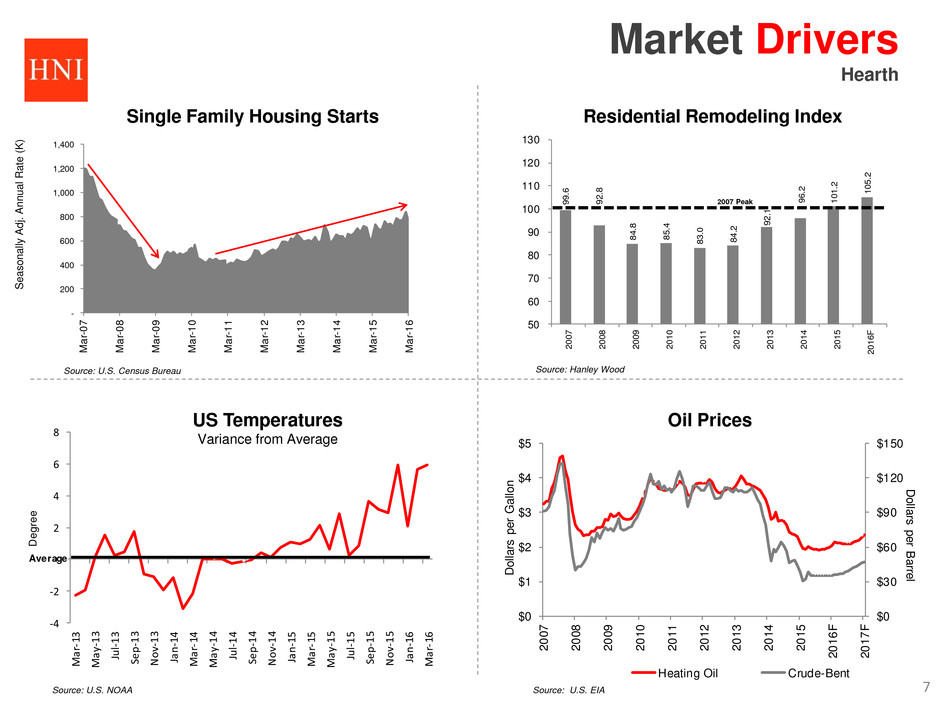

Single Family Housing Starts Source: U.S. Census Bureau S e a s o n a lly A d j. A n n u a l R a te ( K ) Residential Remodeling Index Source: Hanley Wood Oil Prices Source: U.S. EIA Market Drivers Hearth US Temperatures Variance from Average Source: U.S. NOAA 7 -4 -2 0 2 4 6 8 M ar -1 3 M ay -1 3 Ju l-1 3 Se p- 13 No v-1 3 Ja n- 14 M ar -1 4 M ay -1 4 Ju l-1 4 Se p- 14 No v-1 4 Ja n- 15 M ar -1 5 M ay -1 5 Ju l-1 5 Se p- 15 No v-1 5 Ja n- 16 M ar -1 6 De gr ee Average - 200 400 600 800 1,000 1,200 1,400 M ar -0 7 M ar -0 8 M ar -0 9 M ar -1 0 M ar -1 1 M ar -1 2 M ar -1 3 M ar -1 4 M ar -1 5 M ar -1 6 99 .6 92 .8 84 .8 85 .4 83 .0 84 .2 92 .1 96 .2 10 1. 2 10 5. 2 50 60 70 80 90 100 110 120 130 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 F 2007 Peak $0 $30 $60 $90 $120 $150 $0 $1 $2 $3 $4 $5 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 F 20 17 F Dollars per BarrelD oll ar s pe r G all on Heating Oil Crude-Bent

Breadth and Depth DistributionBrands Products Price Points Tuned and tailored Solutions for every need High to low Broadest coverage 8

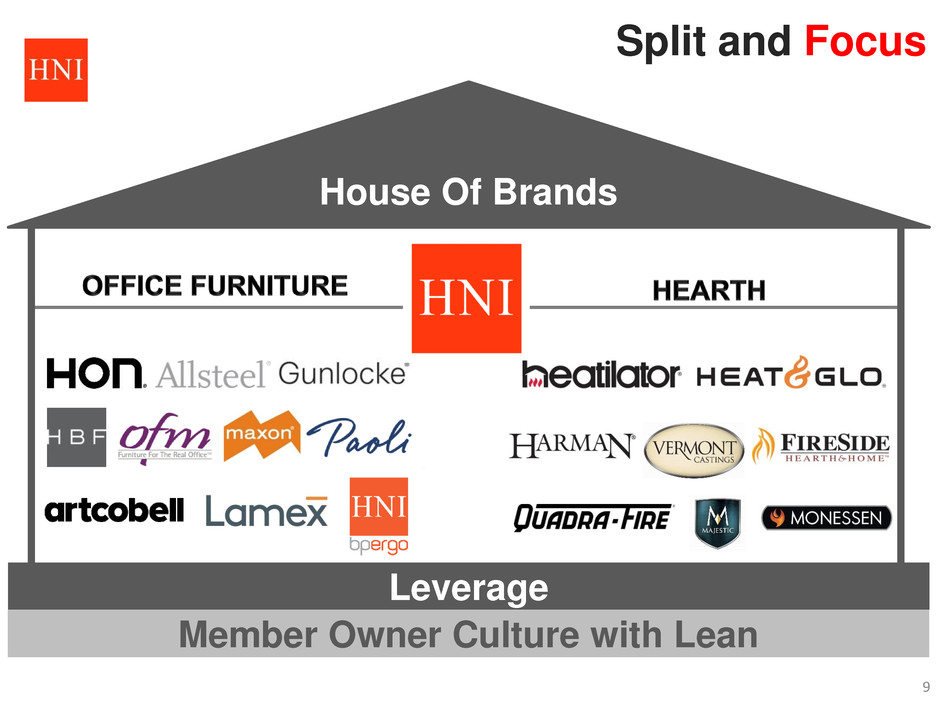

House Of Brands Split and Focus 9 Leverage Member Owner Culture with Lean

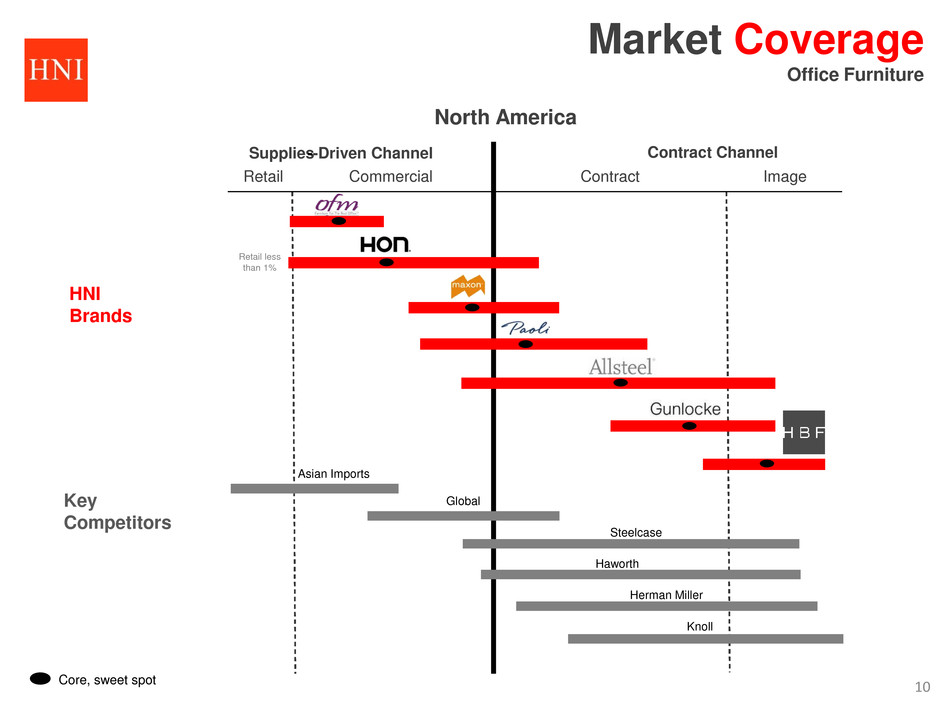

Supplies--Driven Channel Contract Channel ContractRetail Commercial Image Herman Miller Knoll Steelcase Haworth Global Asian Imports Market Coverage Office Furniture North America 10 HNI Brands Key Competitors Core, sweet spot Retail less than 1%

` ` ` 11 New Construction Channel Remodel/Retrofit Channel Specialty Dealer DIY HNI Brands Key Competitors Core, sweet spot ` Niche Competitors Travis Napoleon Installing Distributors International Hearth Products (IHP) Market Coverage Hearth Products

Lean culture drives best total cost Never finished SELECTED EXAMPLES Operational Excellence / Lean Culture Structural Cost Core Productivity Business Process Improvement Announced ongoing structural cost take out, $30 – $40M of annual savings by 2018 Leverage scale, capabilities, and capital to drive rapid continuous improvement 12 Understand Simplify Standardize Flow

Long Term Value Creation 13

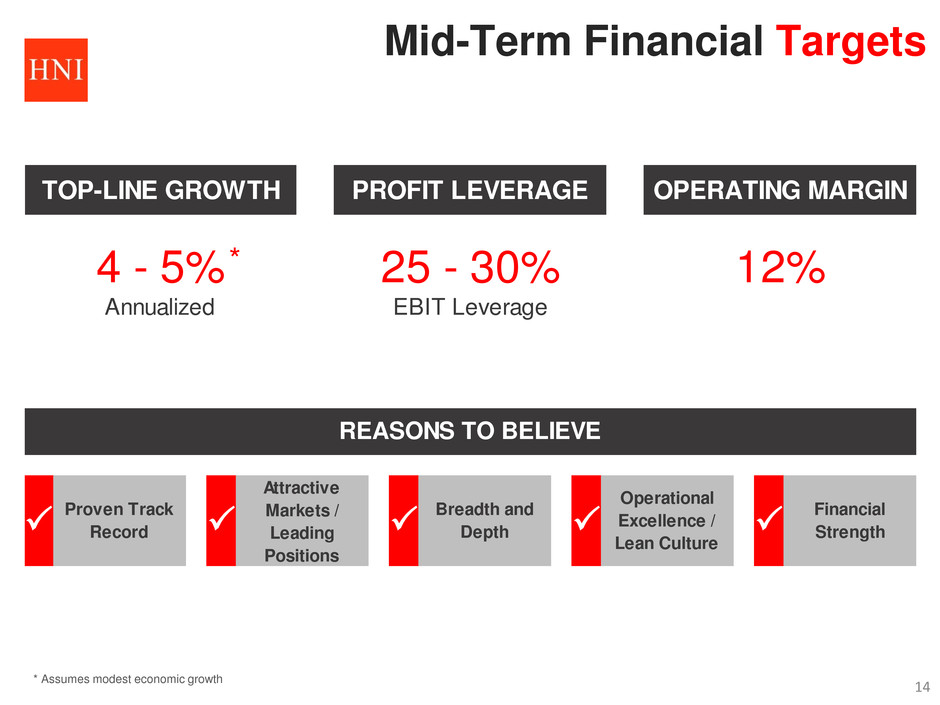

Mid-Term Financial Targets 14 TOP-LINE GROWTH PROFIT LEVERAGE OPERATING MARGIN 4 - 5% 25 - 30% 12% Annualized EBIT Leverage P Proven Track Record P Attractive Markets / Leading Positions P Breadth and Depth P Operational Excellence / Lean Culture P Financial Strength REASONS TO BELIEVE * * Assumes modest economic growth

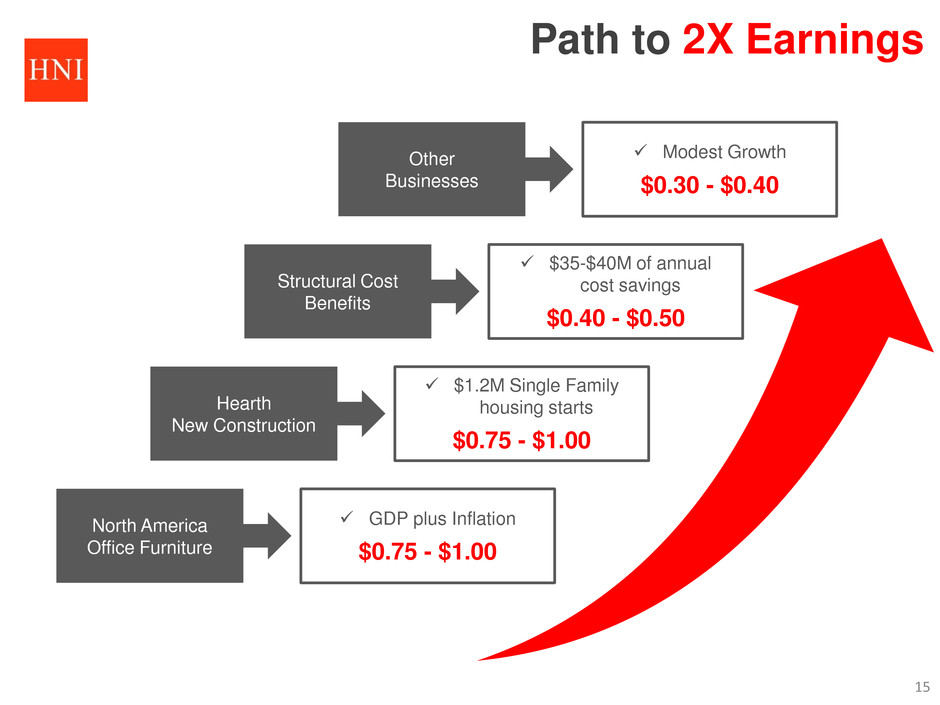

North America Office Furniture Structural Cost Benefits Other Businesses Hearth New Construction Path to 2X Earnings Modest Growth $0.30 - $0.40 $35-$40M of annual cost savings $0.40 - $0.50 $1.2M Single Family housing starts $0.75 - $1.00 GDP plus Inflation $0.75 - $1.00 15

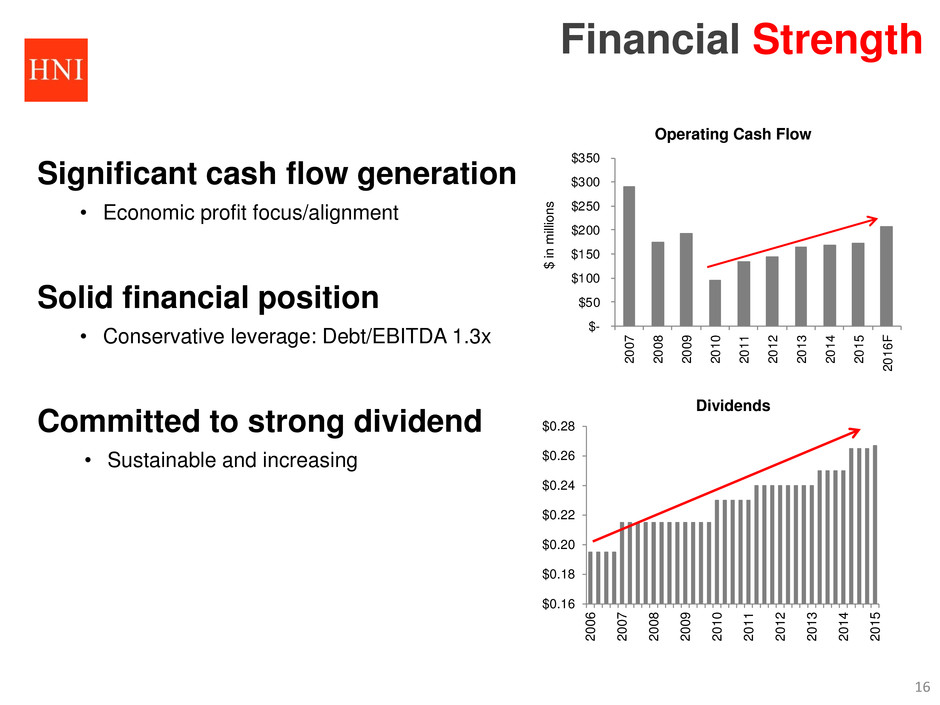

$ in m ill io n s Operating Cash Flow Dividends Significant cash flow generation • Economic profit focus/alignment Solid financial position • Conservative leverage: Debt/EBITDA 1.3x Committed to strong dividend • Sustainable and increasing 16 $- $50 $100 $150 $200 $250 $300 $350 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 F $0.16 $0.18 $0.20 $0.22 $0.24 $0.26 $0.28 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 Financial Strength

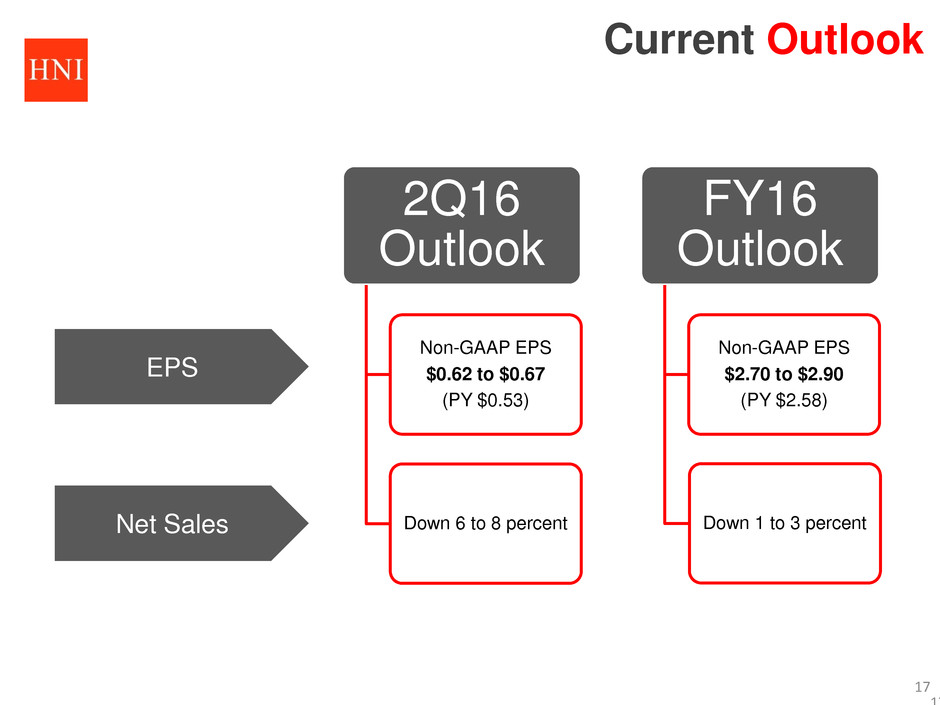

Current Outlook 17 2Q16 Outlook Non-GAAP EPS $0.62 to $0.67 (PY $0.53) Down 6 to 8 percent FY16 Outlook Non-GAAP EPS $2.70 to $2.90 (PY $2.58) Down 1 to 3 percent EPS Net Sales 17

This presentation contains certain non-GAAP financial measures. A "non-GAAP financial measure" is a numerical measure of a company's financial performance that excludes or includes amounts different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of the company. We have provided a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measure. The non-GAAP financial measures used within this presentation are: operating profit, net income per diluted share (i.e., EPS), excluding restructuring and impairment charges and transition costs. Non-GAAP EPS is calculated using the Corporation’s overall effective tax rate for the period. We present these measures because management uses this information to monitor and evaluate financial results and trends. Management believes this information is also useful for investors. This presentation also contains a forward-looking estimates of non-GAAP earnings per diluted share. We provide such non-GAAP measures to investors on a prospective basis for the same reasons we provide them to investors on a historical basis. We are unable to provide a reconciliation of our forward-looking estimate of non-GAAP earnings per diluted share to a forward-looking estimate of GAAP earnings per diluted share because certain information needed to make a reasonable forward-looking estimate of GAAP earnings per diluted share difficult to predict and estimate and is often dependent on future events which may be uncertain or outside of our control. These may include unanticipated charges related to asset impairments (fixed assets, intangibles or goodwill), unanticipated acquisition related costs and other unanticipated non-recurring items not reflective of ongoing operations. 18 Non-GAAP Financial Measures

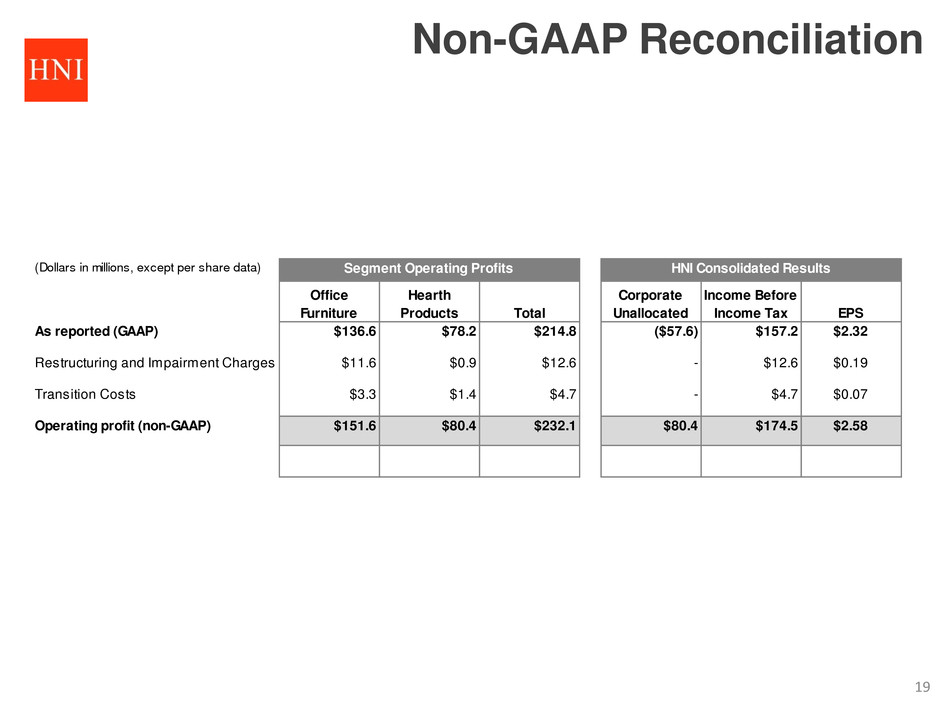

19 Non-GAAP Reconciliation(Dollars in millions, except per share data) Office Furniture Hearth Products Total Corporate Unallocated Income Before Income Tax EPS As reported (GAAP) $136.6 $78.2 $214.8 ($57.6) $157.2 $2.32 Restructuring and Impairment Charges $11.6 $0.9 $12.6 - $12.6 $0.19 Transition Costs $3.3 $1.4 $4.7 - $4.7 $0.07 Operating profit (non-GAAP) $151.6 $80.4 $232.1 $80.4 $174.5 $2.58 Segment Operating Profits HNI Consolidated Results