Attached files

| file | filename |

|---|---|

| 8-K - Good Times Restaurants Inc. | d671608k.htm |

Exhibit 99.1

Good Times Restaurants Inc.(Nasdaq Capital Market: GTIM)Investor PresentationJune 2016

Disclaimer Forward-Looking InformationThis presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation may be forward-looking statements. The words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intend,” “targets,” “projects,” “contemplates,” “believes,” “estimates”, “predicts,” “potential” or “continue” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from expectation are disclosed under the “Risk Factors” and ”Cautionary Note Regarding Forward-Looking Statements” sections of the prospectus and the prospectus supplement.All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. You should evaluate all forward-looking statements made in this presentation in the context of these risks and uncertainties. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or qualified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements.Non-GAAP Financial InformationThe non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, Restaurant Operating Profit and Cash on Cash Return on Investment) are not GAAP measures of financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do not reflect tax payments, debt service requirements, capital expenditures, new restaurant openings and certain other cash costs that may recur in the future, including among other things, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using EBITDA and Adjusted EBITDA supplementally. EBITDA, Adjusted EBITDA, Restaurant Operating Profit and Cash on Cash Return on Investment are included in this presentation because they are key metrics used by management and our board of directors to assess our financial performances. EBITDA and Adjusted EBITDA are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Our measures of EBITDA, Adjusted EBITDA, Restaurant Operating Profit and Cash on Cash Return on Investment are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation. Good Times Restaurants Inc. *

Company Highlights 2015 acquisition of high-growth platform companyTwo differentiated and complementary concepts Successful refresh and updating of Good Times yielding improved financial resultsStrong momentum in new Bad Daddy’s stores Excellent cash-on-cash return modelsSubstantial growth potentialExperienced senior leadership team and systems in place Good Times Restaurants Inc. *

Two Complementary & Differentiated Concepts * Good Times Restaurants Inc. Only QSR with steroid-free, hormone-free, vegetarian fed, humanely raised beef, chicken and bacon“Fresh, Handcrafted, All-Natural” positionOperates and franchises 37 restaurants located primarily in the front-range communities of Colorado Full-service, upscale, chef-inspired restaurant conceptFounded by an award-winning entrepreneur founder of numerous successful conceptsOperates, licenses and franchises 18 restaurants in North Carolina (8), South Carolina (1), Tennessee (1) and Colorado (8)

Good Times Restaurants Inc. * “You brought Cool to the suburbs”

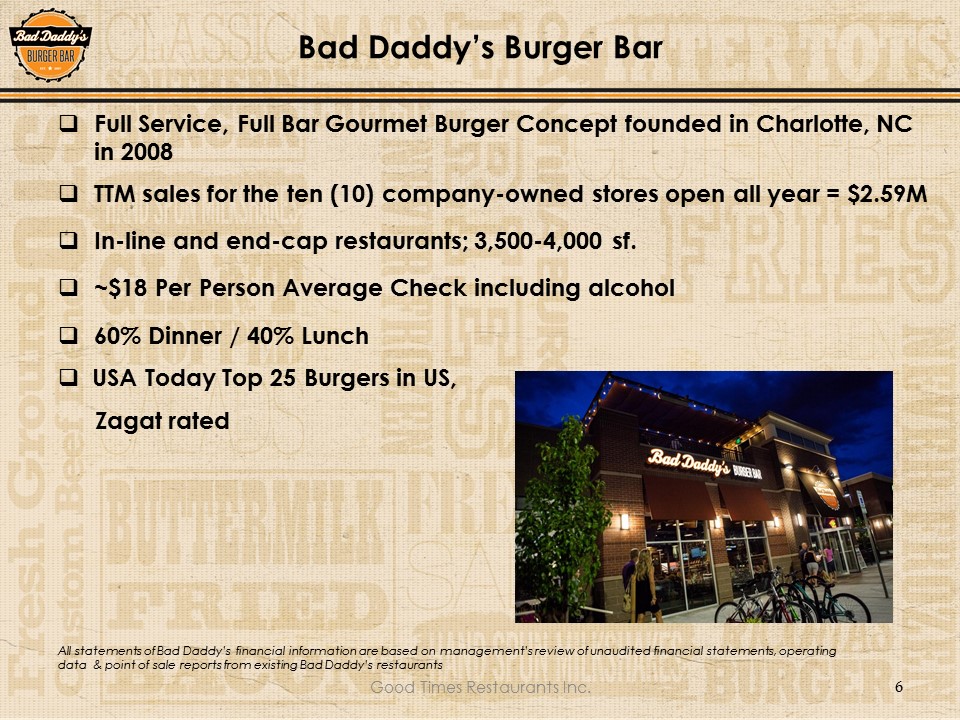

Bad Daddy’s Burger Bar Full Service, Full Bar Gourmet Burger Concept founded in Charlotte, NC in 2008TTM sales for the ten (10) company-owned stores open all year = $2.59MIn-line and end-cap restaurants; 3,500-4,000 sf.~$18 Per Person Average Check including alcohol60% Dinner / 40% Lunch * Good Times Restaurants Inc. All statements of Bad Daddy’s financial information are based on management’s review of unaudited financial statements, operating data & point of sale reports from existing Bad Daddy’s restaurants USA Today Top 25 Burgers in US, Zagat rated

Bad Daddy’s Burger Bar * Good Times Restaurants Inc. Eighteen (18) restaurants currently open in seven metropolitan markets:Denver (7)Colorado Springs (1)Charlotte (5)Raleigh (2)Winston-Salem (1)Greenville (1)Knoxville (1)

The Non-Chain Chain * Good Times Restaurants Inc. Unique look, feel and format to each store

The Non-Chain Chain * Good Times Restaurants Inc. Menu with local ingredients, brand partners and micro local craft beers

Bad Daddy’s Burger Bar – Concept Overview Upscale restaurant concept featuring a chef driven menu of gourmet signature burgers, chopped salads, appetizers and sandwiches Simple, high quality ingredients executed at a high levelHousemade sauces and dressings“Create Your Own” burgers and saladsBi-weekly Chef SpecialsBeef, chicken, turkey, buffalo, tunaBar sales from 15% to 20% mix17 local microbrews on tapFresh-squeezed cocktails, Bad Ass MargaritaAmbience is a high energy, pop culture oriented atmosphere Service is personal, informal and ultra-friendly to support the brand’s irreverent personality * Good Times Restaurants Inc.

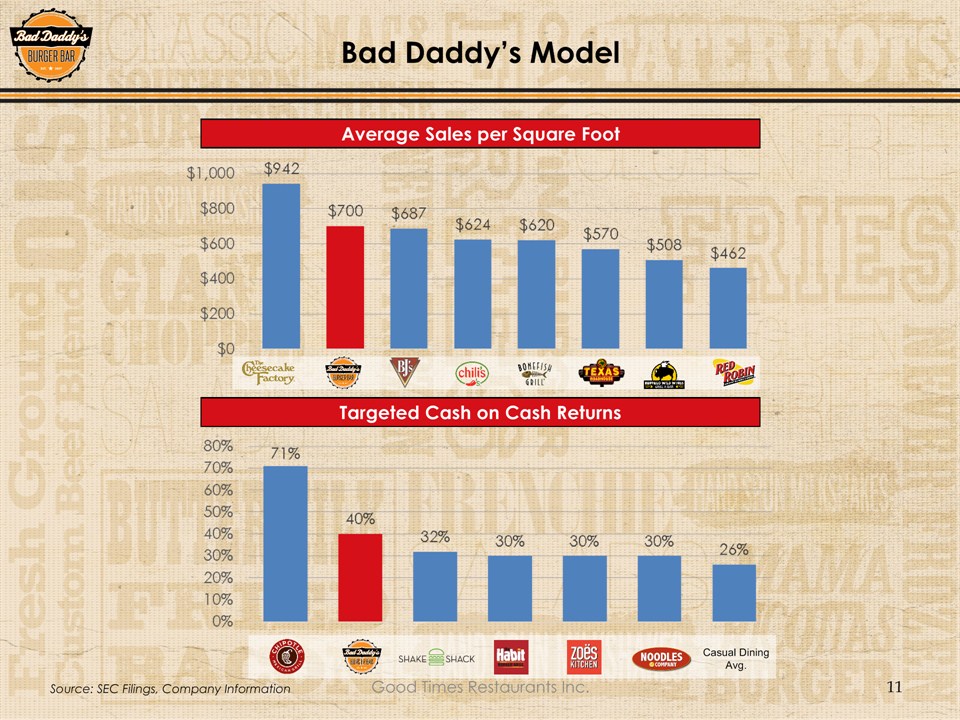

Bad Daddy’s Model * Source: SEC Filings, Company Information Good Times Restaurants Inc. Average Sales per Square Foot Targeted Cash on Cash Returns Casual Dining Avg.

Bad Daddy’s Average Check * Source: SEC Filings, Company Information Good Times Restaurants Inc. Average Check

Bad Daddy’s Strong Momentum Comparable store sales at all units open more than 18 months have averaged +6.2% over the past four quartersAverage volumes of the new units opened in fiscal 2016 are above our $2.5M target 10 - 12 additional restaurants planned through the end of fiscal 2017 including the development of two new markets * Good Times Restaurants Inc.

Bad Daddy’s Projected New Unit Economics Assumptions:3,600 sq. ft. 125 seat designEstimated cash investment = $900K to $1M net of landlord contribution Cash preopening costs = $265K-$280K expensed in Year 1 Year 2 Estimate Sales $2,500,000 Restaurant Operating Profit: 15% (CO min wage) to 18% (Fed min wage) $375,000 - $450,000 Leasehold & FF&E Investment * $950,000 Store Level Cash on Cash ROI @ $950K 40% - 47% * Net of landlord tenant improvement allowance Good Times Restaurants Inc. * Source: All statements of Bad Daddy’s financial information are based on management’s estimates based on its currently operating restaurant. Restaurant Operating Profit is defined as Net Sales less all restaurant-level operating, occupancy and advertising expenses but does not include depreciation, preopening expenses or allocation of any non-restaurant-level expenses. Store Level Cash on Cash ROI is the Restaurant Operating Profit divided by the total cash investment. Our independent accountants have not examined the projections and do not express any assurance with respect thereto.

Good Times Restaurants Inc. * Taking a Better Food Stand

Good Times - Concept Overview QSR Burger chain founded in Boulder, CO in 198727 Company-owned stores, 10 Franchise stores$1.1m AUV; $1.2m -$1.4m new store model; Fiscal 2015 system-wide sales of $39 million$6.50 Average per person check – upper end of national QSR competitorsFree-standing restaurants, 880 to 1,000 square feet for the double drive thru format and a 2,100-2,400 square foot, 50-70 seat dining room format Good Times Restaurants Inc. *

A Highly Differentiated Concept in QSR Multi-dimensional brand refresh initiated 5 years agoThe only “Fresh, All-Natural, Handcrafted” brand story at a QSR price pointMade to order quality with QSR speed of serviceRemodeling and reimaging program to upgrade facilitiesNew store model with upscale, fast casual level finishesCable TV and social media advertising campaign in illustrated, handcrafted styleWe Take a Better Food Stand: Fresh, All-Natural, HandcraftedAll Natural: No hormones, steroids or antibiotics; humanely raisedMeyer all-natural Angus beefHand-breaded Springer Mountain all-natural Chicken TendersFresh, Hand-Crafted: Only at Good TimesFrozen custard made fresh every few hours with all-natural cream & eggsNatural-cut fries cooked to orderHatch Valley New Mexico green chile breakfast burritos Good Times Restaurants Inc. *

Brand Refresh Producing Sales Momentum Good Times Restaurants Inc. * 23 Quarters of Same Store Sales Growth at Good Times

Increasing Sales Has Increased Profits Good Times Restaurants Inc. * Average Unit Sales Volumes (000s) Average Restaurant Level Operating Profit (000s) Note: Restaurant Level Operating Profit is defined as Net Sales less all restaurant level operating, occupancy and advertising expenses but does not include depreciation, preopening expenses or allocation of any non-restaurant level expenses. Our independent accountants have not examined the projections and do not express any assurance with respect thereto. Good Times Restaurant Level Sales and Operating Profit

Strong Growth Platform Good Times growth in Colorado with company-owned storesContinued same store sales growth through menu innovation, remodels and deepening the all-natural positioning at Good TimesBad Daddy’s – 2 markets with infrastructure to support concentric growth:Opening 6 stores in fiscal 2016 off of a base of 10 company-operated storesTargeting 9 – 11 new stores in fiscal 2017 including 2 new markets40+% planned Bad Daddy’s unit growth for each of the next 3 yearsEstimated company revenue of $88M in fiscal 2017 with a run rate of $100M Good Times Restaurants Inc. *

Demonstrated Unit and Sales Growth Good Times Restaurants Inc. * Total Company-Owned Restaurants Total Company Revenue (000s) Note: Fiscal 2016E restaurant count and total company revenue represents the low end of the Company’s guidance, per the most recent earnings release filed May 10, 2016.

Demonstrated Profit Growth Good Times Restaurants Inc. * Restaurant-level EBITDA (000s) Adjusted EBITDA (000s) Note: See appendix for reconciliation to prior years’ Adjusted EBITDA and Restaurant-level EBITDA. Fiscal 2016E represents the low end of the Company’s guidance, per the most recent earnings release filed May 10, 2016.

Highly Experienced Management Team Boyd Hoback – President, CEO40 years in the restaurant business; with Good Times since inceptionImplemented sophisticated operating and management systems across all functional areasScott Lefever – Chief Operating Officer, Good Times35 years in the restaurant businessLed Good Times to top ranking in quality, friendliness, cleanliness (based on Sandelman Quicktrak study)Jim Zielke – Chief Financial OfficerOver 20 years in restaurant financeFormer CFO of public growth companySue Knutson – Controller, Treasurer30 years in restaurant accounting; implemented top notch systems and reportingOversees public accounting, SEC filings, internal controls Good Times Restaurants Inc. * Platform infrastructure with functional expertise Good Times Restaurants Inc.

Highly Experienced Management Team Mike Maloney – Director of Operations, Bad Daddy’s Former VP Ops Paragon Steakhouses, Regional VP Lonestar Steakhouse Executive & operational positions with Jimmy John’sTimothy Kast– Executive Chef, Bad Daddy’sFormer Executive Chef Partner – Seasons 52 (Darden)Culinary Arts graduate Good Times Restaurants Inc. * Bad Daddy’s

The Investment Opportunity Financial Highlights 23 quarters of SSS growth in Good Times3 year compound SSS growth of 28% in Good TimesTwo proven economic models with attractive returnsBad Daddy’s top tier sales per sq. ft., economic model @ $2.5M in salesStrong balance sheet with limited debt & $9M cash as of March 31, 2016Senior debt facility commitment of $9M Long Term Growth Relatively small base of restaurants with large growth platform60+% growth rate in new Bad Daddy’s restaurants in 2016 and 40%+ for the next 3 yearsAttractive valuation vs small cap restaurant growth companies Good Times Restaurants Inc. *

Appendix Good Times Restaurants Inc. * Restaurant-level EBITDA reconciliation (000s)

Appendix Good Times Restaurants Inc. * Adjusted EBITDA reconciliation (000s)