Attached files

| file | filename |

|---|---|

| 8-K - POLARIS INDUSTRIES INC. 8-K - Polaris Inc. | a51355994.htm |

Exhibit 99.1

Investor Presentation June 7, 2016 POLARIS INDUSTRIES INC.

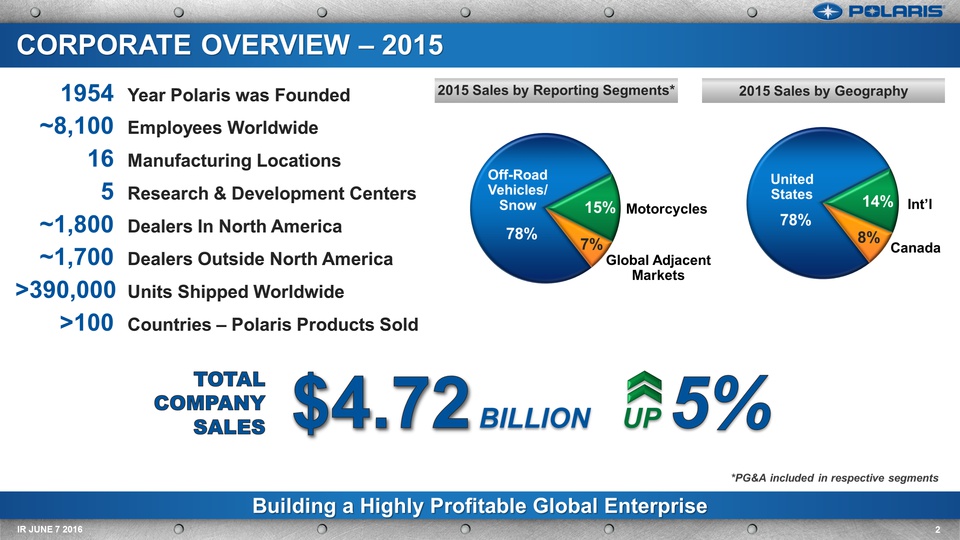

CORPORATE OVERVIEW – 2015 2015 Sales by Reporting Segments* 1954 Year Polaris was Founded ~8,100 Employees Worldwide 16 Manufacturing Locations 5 Research & Development Centers ~1,800 Dealers In North America ~1,700 Dealers Outside North America >390,000 Units Shipped Worldwide >100 Countries – Polaris Products Sold Building a Highly Profitable Global Enterprise IR JUNE 7 2016 2 Int’l Canada United States Global AdjacentMarkets Motorcycles Off-RoadVehicles/Snow *PG&A included in respective segments $4.72 BILLION UP 5% TOTALCOMPANYSALES 2015 Sales by Geography

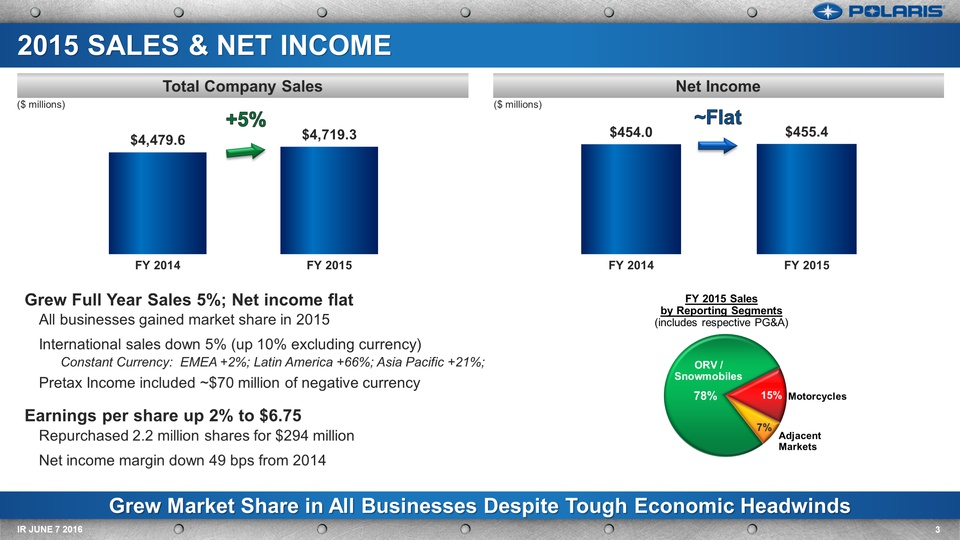

Grew Full Year Sales 5%; Net income flatAll businesses gained market share in 2015International sales down 5% (up 10% excluding currency)Constant Currency: EMEA +2%; Latin America +66%; Asia Pacific +21%; Pretax Income included ~$70 million of negative currencyEarnings per share up 2% to $6.75Repurchased 2.2 million shares for $294 millionNet income margin down 49 bps from 2014 Grew Market Share in All Businesses Despite Tough Economic Headwinds Net Income Total Company Sales 3 IR JUNE 7 2016 2015 SALES & NET INCOME ~Flat +5% Motorcycles Adjacent Markets FY 2015 Sales by Reporting Segments(includes respective PG&A) ORV / Snowmobiles ($ millions) ($ millions)

Company Performance Below Expectations 4 IR JUNE 7 2016 WHAT WENT WELL INTERNAL FACTORS EXTERNAL FACTORS STRENGTHENING DOLLAR US Canda Euro OIL & AG COMMODITIES DOWNSoft retail in oil statesMORE COMPETITIVE OFFERINGSHonda, BRP, John Deere, YamahaMILD WINTERSnowmobile market weak PAINT ISSUESScout / Slingshot delaysINVENTORY TOO HIGHFactory and DealerINCONSISTENT QUALITYRecallsPOOR FORECASTING / EXECUTIONGuidance revision in Q4 INDIAN GROWTHRetail ~80% for 2015SLINGSHOT GROWTH / PROFITABILITYSales well north of $100 million in year onePOWERSPORTS SHARE GAINSGrew for 7th straight yearLEAN / VIP ACCELERATIONOver 900 VIP projects in pipeline 2015 PERFORMANCE – WHAT HAPPENED?

Strategic Objectives Vision & Strategy VISION Fuel the passion of riders, workers and outdoor enthusiasts around the world by delivering innovative, high quality vehicles, products, services and experiences that enrich their lives. STRATEGY Polaris will be a highly profitable, customer centric, $8B global enterprise by 2020. We will make the best off-road and on-road vehicles and products for recreation, transportation and work supporting consumer, commercial and military applications. Our winning advantage is our innovative culture, operational speed and flexibility, and passion to make quality productsthat deliver value to our customers. Best in Powersports PLUS Growth through Adjacencies 5-8% annual organic growth >$2B from acquisitions & new markets Global Market Leadership LEAN Enterprise is Competitive Advantage >33% of Polaris revenue Significant Quality, Delivery & Cost Improvement Strong Financial Performance Sustainable, profitable growthNet Income Margin >10% Guiding Principles Best People, Best Team Safety & Ethics Always Customer Loyalty Performance Priorities Growth Margin Expansion Product & Quality Leadership LEAN Enterprise >$8 Billion by 2020 12% CAGR >10% of Sales by 2020 13% CAGR 5 IR JUNE 7 2016 Strategy and Objectives Remain Valid & Achievable

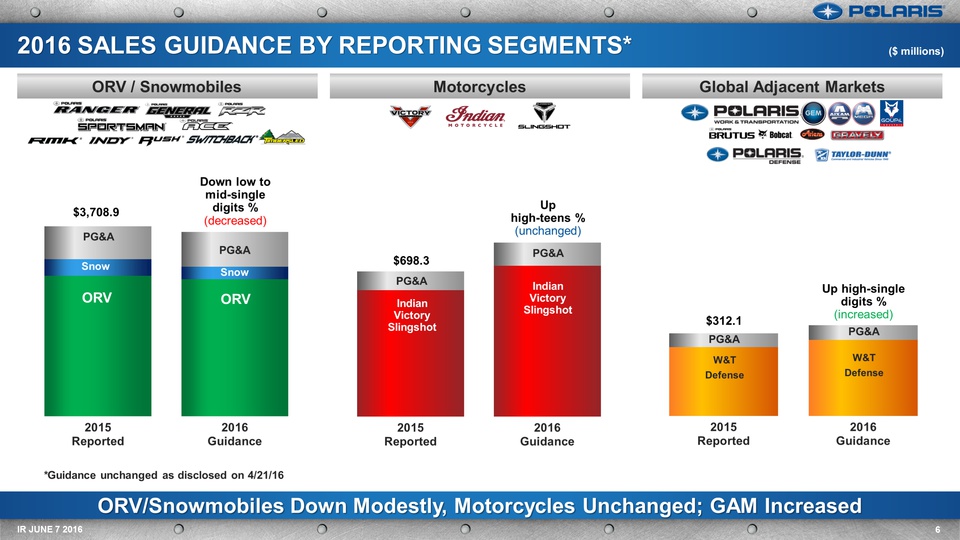

ORV/Snowmobiles Down Modestly, Motorcycles Unchanged; GAM Increased 6 IR JUNE 7 2016 Global Adjacent Markets Motorcycles ORV / Snowmobiles 2016 SALES GUIDANCE BY REPORTING SEGMENTS* $698.3 Uphigh-teens %(unchanged) IndianVictorySlingshot IndianVictorySlingshot PG&A PG&A PG&A PG&A W&TDefense W&TDefense Up high-single digits %(increased) Down low to mid-single digits %(decreased) ORV ORV PG&A PG&A Snow $3,708.9 $312.1 ($ millions) Snow *Guidance unchanged as disclosed on 4/21/16

OFF-ROAD VEHICLES (ORV) 7 IR JUNE 7 2016 2016 Objectives Polaris Off-Road Vehicles Sales* Polaris N.A. ORV Market Share Polaris Off-Road Maintain #1 Market Share Position in More Competitive Environment ($ millions)Excludes PG&A Twice the Nearest Competitor! #1 COMPETITORS (8) Leverage #1 Industry Position – scale Eliminate waste, reduce costs – RFMOn-going innovation for global expansionExpand market to new customersNew leadership: Matt Homan & Craig Scanlon Best in Powersports PLUS 5-Year CAGR +15% NEW MY 16.5 *2013-2015 reclassified to exclude Defense and Commercial Sales to GAM

MOTORCYCLES 8 IR JUNE 7 2016 2016 Objectives Motorcycle Vehicle Sales Indian® “Legendary” / Victory® “American Muscle”Broaden product lineExpand dealer network Accelerate accessories growthSlingshot®Broaden consumer baseBuild upon first mover advantageGrow globallyEnhance dealer engagement Total Motorcycle Market Share 2013 - 2015 Motorcycle Growth Continues; Production Constraints Resolved Acquired2011 Est. 2014 1.8PTS2013 to 2015 Indian Motorcycle Harley-Davidson Japanese Top 4 3.6PTS2013 to 2015 0.5PTS2013 to 2015 Best in Powersports PLUS MY’17 Victory Octane™(Mid-sized) MY 16.5 Slingshot® White Pearl SL LE(Moto-Roadster) MY’16 Indian Springfield™ (Bagger/Touring) 5-Year CAGR +50% ($ millions)Excludes PG&A

SNOWMOBILES 9 IR JUNE 7 2016 2016 Objectives Snowmobile Vehicle Sales Industry-leading qualityGrow Timbersled™ categoryLeverage platform commonalityContinue to grow Market ShareIntroduced 7 new MY’17 snowmobiles in March (+4 Limited Editions) 6-Year Market Share Pts. Growth – N.A. Strong #2 and Gaining Share in N.A. (’15/’16 season vs. ’09/’10) Best in Powersports PLUS 5-Year CAGR +11% 800 Rush® Pro-S2016 Real World Sled of the Year ($ millions)Excludes PG&A

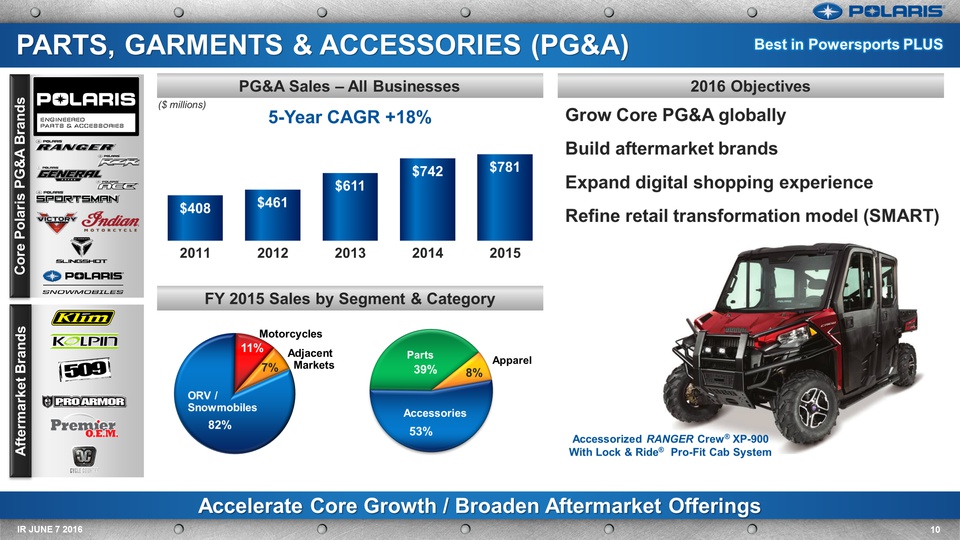

PARTS, GARMENTS & ACCESSORIES (PG&A) 10 IR JUNE 7 2016 2016 Objectives PG&A Sales – All Businesses Grow Core PG&A globallyBuild aftermarket brandsExpand digital shopping experienceRefine retail transformation model (SMART) FY 2015 Sales by Segment & Category Accelerate Core Growth / Broaden Aftermarket Offerings Core Polaris PG&A Brands Aftermarket Brands ($ millions) Motorcycles Adjacent Markets ORV / Snowmobiles Apparel Accessories Parts Best in Powersports PLUS 5-Year CAGR +18% Accessorized RANGER Crew® XP-900 With Lock & Ride® Pro-Fit Cab System

GLOBAL ADJACENT MARKETS 11 IR JUNE 7 2016 2016 Objectives Global Adjacent Markets Vehicle Sales* Aixam grows #1 market share . . . AgainExpand commercial sales / improved executionLeverage installed baseAdd scale / capability through M&AObtain program of record (Military) Work & Transportation / Military ORV Markets Building Businesses for Future Growth / Profitability Growth Through Adjacencies Work & Transportation Military $600+ Million Market Very-light Ultra-light COTS(Commercial off the shelf) $4+ Billion Market 5-Year CAGR +46% Acquired March 2016 *2013-2015 reclassified to include Defense and Commercial Sales ($ millions)Excludes PG&A

Overcome Currency Challenges, Grow Share, Leverage Opole 12 IR JUNE 7 2016 INTERNATIONAL 5%(cc +10%) ($ millions)Includes PG&A 2016 Objectives Drive motorcycle growth – midsize offerings catalystsEffectively leverage Poland operationsContinue to build emerging market foundationImprove execution~1,700 dealers International Sales Opole, Poland Manufacturing Plant Hammerhead Off-Road Polaris/Eicher JV - Multix Global Market Leadership 5-Year CAGR +16%

Lean Delivers Sustainable Profitable Growth and Competitive Advantage 13 IR JUNE 7 2016 LEAN ENTERPRISE Lean drives continuous improvement across the business.Customer Value, Flow, Pull, Standardized Work, Waste Elimination, Built-in Quality and Speed RFM Commercial Model Lean Product Development Lean Business Process Plant Lean Lean Material Flow OUT IN Consumer & Dealer Pull 1 2 3 4 5 SxS to RFM in 2H 2016 Start of ProductionQ2 2016 >$100 Million VIPCost Down Opportunity Lean Business ProcessImprov’t Lean PDP RFM - Order to Delivery Distribution Plant Network Supply Chain Dealers Huntsville Lean LEAN Enterprise is Competitive Advantage

750 experienced engineers Industry-leading technology centersWyoming, MNRoseau, MNSwitzerland France (Goupil, Aixam) R&D Investment Fuels Innovation & Growth Innovation Vitality Index R&D Spend 14 IR JUNE 7 2016 RESEARCH & DEVELOPMENT ($ millions)

725,000 sq. ft. manufacturing plantInitially produce RANGER® SxS; Slingshot® to start in Q3 2016~1,700 employees at capacity~$150 million investmentProvides capacity, flexibility and improved efficienciesIncorporates most advanced lean flow processes and industry-leading technologies Huntsville Production to Start in Q2 2016 as Planned 15 IR JUNE 7 2016 NEW MANUFACTURING FACILITY – HUNTSVILLE, AL LEAN Enterprise is Competitive Advantage

Difficult / Decent Start to YearSales & Earnings down- on guidance; Indian outpacing industry; ORV catching up; RecallVariability too ConsistentMonth-to-month, region-to-region demand shifts challengingLean Enterprise Traction BuildingVIP cost initiatives; Inventory reduction; Standard work & waste elimination Executing RZR Recall Q2 PriorityCustomer safety / back to riding #1 focus; Retail & production plans in placeRegain Momentum in Growing Powersports IndustryAggressively protecting #1 share positionR&D and Growth Investments OngoingProducts / services and acquisition pipeline active All Out Assault on Cost & Working to Make Growth Happen 16 IR JUNE 7 2016 Q1 2016 Comments

ORV sales softer than previously anticipatedPoor weather, RZR recall, slow dealer floor traffic ORV/Snowmobile segment sales now expected in the range of down high-single to low-double digits %Gross margin pressure due to mix, plus potential increased recall costsGross Margin % trending lower than Q1 2016Dealer inventory health remains a top priorityMotorcycle segment growth expected to continue 17 IR JUNE 7 2016 Q2 2016 Update

Laser Focus on Generating Profitable Growth R&D and technology investments at record levels Huntsville production started; plant network optimization complete Lean/Enterprise Costs on target for gross 300-500 bps gross margin expansion Commercial innovation accelerating to augment product innovation ORV team rebuilding competitive advantage

Except for historical information contained herein, the matters set forth in this document, including but not limited to management’s expectations regarding 2016 sales, shipments, margins, currencies, net income and cash flow, the opportunities for expansion and diversification of the Company’s business and the Company’s guidance on earnings per share are forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those forward-looking statements. Potential risks and uncertainties include such factors as product offerings, promotional activities and pricing strategies by competitors; manufacturing operation expansion initiatives; acquisition integration costs; warranty expenses; foreign currency exchange rate fluctuations; environmental and product safety regulatory activity; effects of weather; commodity costs; uninsured product

liability claims; uncertainty in the retail and wholesale credit markets; performance of affiliate partners; changes in tax policy and overall economic conditions, including inflation, consumer confidence and spending and relationships with dealers and suppliers. Investors are also directed to consider other risks and uncertainties discussed in our 2015 annual report and Form 10-K filed by the Company with the Securities and Exchange Commission. The Company does not undertake any duty to any person to provide updates to its forward-looking statements.The data source for retail sales figures included in this presentation is registration information provided by Polaris dealers in North America and compiled by the Company or Company estimates. The Company must rely on information that its dealers supply concerning retail sales, and other retail sales data sources and this information is subject to revision.Non-GAAP Measure - Constant Currency Reporting. This presentation includes information regarding the Company’s 2015 results and 2016 expectations on a constant currency basis, which is a non-GAAP measure, as well as on a GAAP basis. For purpose of comparison, the results on a constant currency basis uses the respective prior year exchange rates for the comparative period to enhance the visibility of the underlying business trends, excluding the impact of translation arising from foreign currency exchange rate fluctuations. 18 IR JUNE 7 2016 SAFE HARBOR

liability claims; uncertainty in the retail and wholesale credit markets; performance of affiliate partners; changes in tax policy and overall economic conditions, including inflation, consumer confidence and spending and relationships with dealers and suppliers. Investors are also directed to consider other risks and uncertainties discussed in our 2015 annual report and Form 10-K filed by the Company with the Securities and Exchange Commission. The Company does not undertake any duty to any person to provide updates to its forward-looking statements.The data source for retail sales figures included in this presentation is registration information provided by Polaris dealers in North America and compiled by the Company or Company estimates. The Company must rely on information that its dealers supply concerning retail sales, and other retail sales data sources and this information is subject to revision.Non-GAAP Measure - Constant Currency Reporting. This presentation includes information regarding the Company’s 2015 results and 2016 expectations on a constant currency basis, which is a non-GAAP measure, as well as on a GAAP basis. For purpose of comparison, the results on a constant currency basis uses the respective prior year exchange rates for the comparative period to enhance the visibility of the underlying business trends, excluding the impact of translation arising from foreign currency exchange rate fluctuations. 18 IR JUNE 7 2016 SAFE HARBOR

CONSISTENT FINANCIAL PERFORMANCE Q1 2016 SALES & NET INCOMEQ1 2016 N.A. RETAIL SALES & DEALER INVENTORY2016 FULL YEAR DETAILED GUIDANCE2016 FULL YEAR GROSS PROFIT MARGIN GUIDANCE FOREIGN CURRENCIES EXPOSURES FOR POLARIS POLARIS FINANCIAL POSITIONFACTORY INVENTORYTAYLOR-DUNN ACQUISITIONPOLARIS CUSTOMER USAGE PROFILESMANUFACTURING LOCATIONS 19 IR JUNE 7 2016 APPENDICES

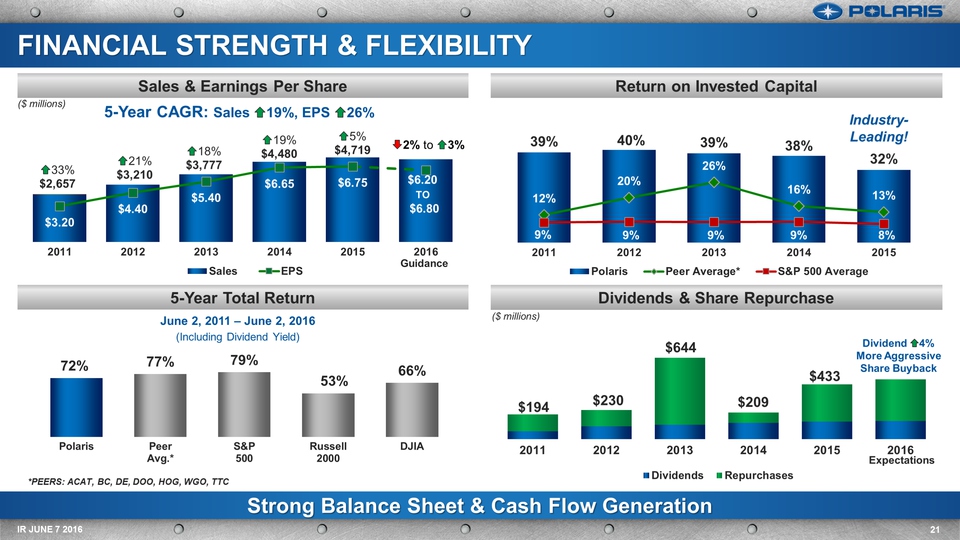

Return on Invested Capital Sales & Earnings Per Share Strong Balance Sheet & Cash Flow Generation Dividends & Share Repurchase 5-Year Total Return 20 IR JUNE 7 2016 FINANCIAL STRENGTH & FLEXIBILITY Dividend 4%More AggressiveShare Buyback Expectations ($ millions) *PEERS: ACAT, BC, DE, DOO, HOG, WGO, TTC Industry-Leading! June 2, 2011 – June 2, 2016(Including Dividend Yield) 5-Year CAGR: Sales 19%, EPS 26% Guidance $6.20 TO $6.80 ($ millions)

Q1 sales and net income in-line with guidanceORV/Snowmobile sales down 9%; Motorcycles up 18%; Global Adjacent Markets down 5%Results include ~$30 million of additional costs: product liability, warranty, acquisition related costs and severance accrualsEarnings per share decreased 45% to $0.71Gross profit margin down 324 bps from negative currency, mix and higher warrantyN.A. dealer inventory levels down 1%ORV down 10 percent Q1 Results In-line with

Expectations Q1 2016 Net Income Q1 2016 Sales 21 IR JUNE 7 2016 Q1 2016 SALES & NET INCOME -5% -47% ($ millions) ($ millions)

Polaris N.A. retail 6% for Q1 2016 vs. Q1 2015Polaris held Powersports share – remains clear #1North American Industry improved sequentially vs. Q4; Q1 similar to PolarisPolaris Q1 2016 N.A. dealer inventory 1% vs. Q1 2015ORV 10% year-over-year; RANGER®, RZR® and ATVs all declinedMotorcycles significantly as expected, near targeted levelsSnowmobiles low-twenties % due to lower snowfall in key regionsRFM business model re-engaged for motorcycles; ATVs working well; SxS to convert in Q4 2016 Retail Improved; Dealer Inventory Down vs. Q1 2015 N.A. Dealer Inventory Polaris Retail Sales 22 IR JUNE 7 2016 N.A. POWERSPORTS RETAIL SALES: Q1 2016 -12% Existing ORV Models 4% New ORV models 2% Snowmobiles 5% Slingshot/Indian 0% New Dealers -1% Total Increase -1%

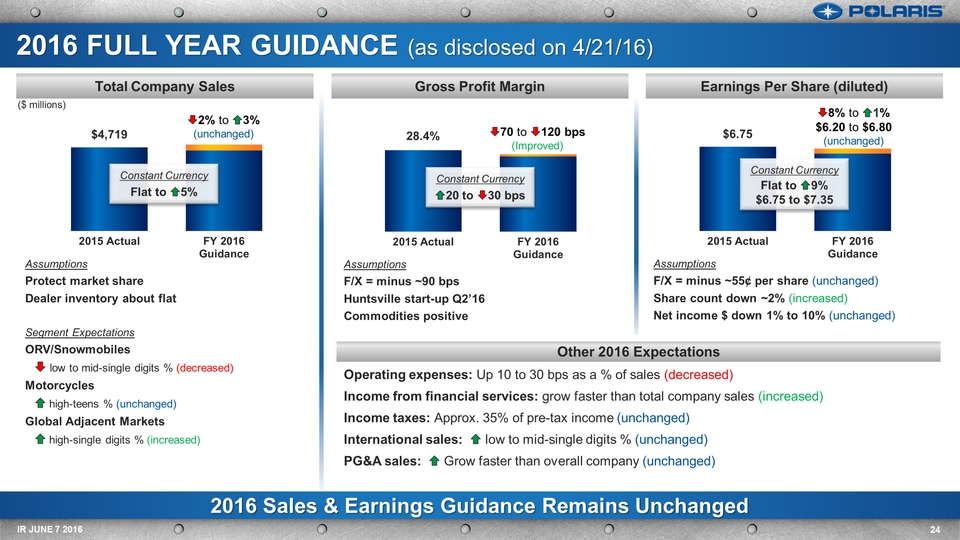

Earnings Per Share (diluted) Gross Profit Margin 23 IR JUNE 7 2016 Total Company Sales 2016 Sales & Earnings Guidance Remains Unchanged Assumptions Protect market shareDealer inventory about flatSegment ExpectationsORV/Snowmobiles low to mid-single digits % (decreased)Motorcycles high-teens % (unchanged)Global Adjacent Markets high-single digits % (increased) Assumptions F/X = minus ~90 bpsHuntsville start-up Q2’16Commodities positive AssumptionsF/X = minus ~55¢ per share (unchanged)Share count down ~2% (increased)Net income $ down 1% to 10% (unchanged) 2016 FULL YEAR GUIDANCE (as disclosed on 4/21/16) 2% to 3%(unchanged) Constant CurrencyFlat to 5% Constant Currency20 to 30 bps Constant CurrencyFlat to 9%$6.75 to $7.35 8% to 1%$6.20 to $6.80(unchanged) 70 to 120 bps(Improved) Other 2016 Expectations Operating expenses: Up 10 to 30 bps as a % of sales (decreased)Income from financial services: grow faster than total company sales (increased)Income taxes: Approx. 35% of pre-tax income (unchanged)International sales: low to mid-single digits % (unchanged)PG&A sales: Grow faster than overall company (unchanged) ($ millions)

By Component Q1 2015 Actual Q1 2016 Actual FY 2016 Guidance Prior period 29.1 28.4% 28.4% Production volume/capacity to Product cost reduction efforts Commodity costs Currency rates Higher selling prices Product mix Motorcycle Production Constraints New plant start-up costs Warranty costs Depreciation/Tooling amortization Sales promotional costs Current period 28.4% 25.2% 27.2% to 27.7% Change -66 bps -324 bps Down 70 to 120 bps By Reporting Segments Q1 2015 Actual Q1 2016 Actual FY 2016 Guidance ORV/Snowmobiles 32.7% 29.0% Motorcycles 12.7% 15.3% Global Adjacent Markets 23.4% 27.5% Gross Profit Margin 28.4% 25.2% 24 IR JUNE 7 2016 2016 GROSS PROFIT MARGIN GUIDANCE Improvement to gross profit margin % Headwind to gross profit margin % Neutral to gross profit margin %

Currency Improved Slightly in Q1; Remains Volatile 25 IR JUNE 7 2016 FOREIGN CURRENCY EXPOSURE FOR POLARIS Foreign Currency Hedging Contracts Currency Impact on Net Income Notional Avg. Exchange Compared to Prior Year Period Foreign Currency CurrencyPosition Cash FlowExposure Hedged Amounts(US $ in Millions) Rate of OpenContracts FY 2016(Expectation) Canadian Dollar (CAD) Long 80% $193 $0.72 to 1 CAD Negative Australian Dollar (AUD) Long 60% $22 $0.71 to 1 AUD Negative Euro (EUR) Long 0% - - Negative Japanese Yen (JPY) Short 40% $6 120 Yen to $1 Positive Mexican Peso (MXN) Short 90% $41 17 Peso to $1 Positive F/X Impacts vs. Prior Year($ in millions) ActualQ1 2015 ActualQ1 2016 ActualFY 2015 FY 2016 Expectations Sales ($32) ($14) ($160) ($75) Gross Profit ($12) ($17) ($70) ($75) Pretax Income ($16) ($8) ($70) ($55) Open F/X Hedging Contracts as of March 31, 2016

POLARIS FINANCIAL POSITION 26 IR JUNE 7 2016 Capital Summary March 2016 Cash Drivers Fav/(Unfav)March 2015 Cash $ 145.8 +32% Debt /Capital Lease Obligations $ 532.4 (63%) Shareholders’ Equity $ 930.9 8% Total Capital $1,463.3 23% Debt to Total Capital 36% (9%) 2015Operating cash flow up significantlyFactory inventory flat sequentially from Q4’15Increased share repurchases given stock priceCap Ex expected to be slightly higher than 2015Reflects Huntsville, Spirit Lake Investments Operating Cash Flow Strong Balance Sheet and Cash Flow Generation ROIC* *Defined as trailing 12 months net income divided by average total assets, minus average current liabilities UpSignificantly ($ millions) ($ millions) ($ millions) Expectations Q1 2016 Summary 2016 Expectations

Inventory Turns Decreasing as Inventory Value Grows at a Faster Rate than Sales Factory Inventory & Turns Sales 27 IR JUNE 7 2016 POLARIS SALES GROWTH & FACTORY INVENTORY ($ millions) Factory inventory historically growing faster than sales – major focus in 2016Inventory reduction closely tied to Retail Flow Management (RFM)Vehicle platforming, localization of suppliers, reduction of supplier lead-times, distribution network reconfigurationTied incentive compensation to factory inventory reduction targets for executives ($ millions) +23% +18% +30% +24% +33% +21% +18% +19% +5% Inventory $ down significantly, Turns Improve Expectations

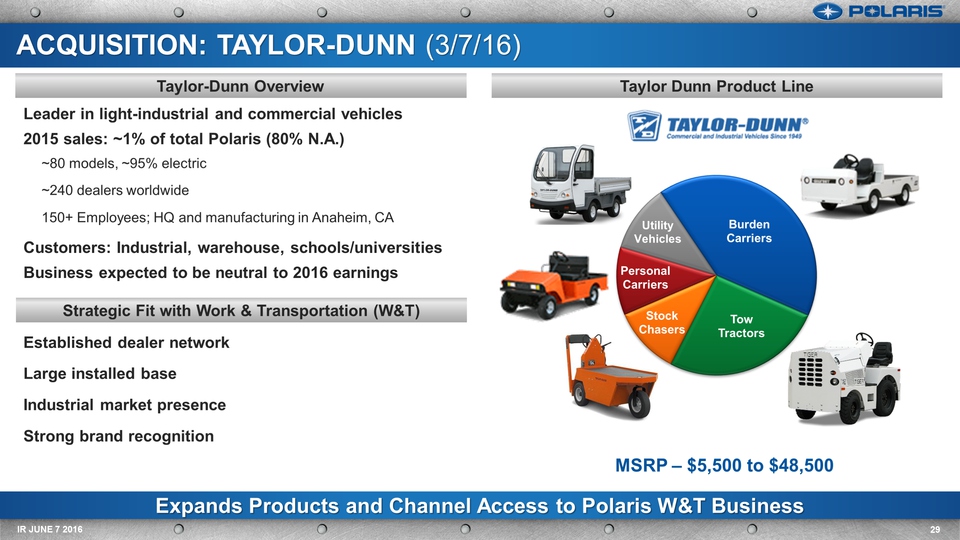

ACQUISITION: TAYLOR-DUNN (3/7/16) 28 IR JUNE 7 2016 Taylor Dunn Product Line Taylor-Dunn Overview Leader in light-industrial and commercial vehicles2015 sales: ~1% of total Polaris (80% N.A.)~80 models, ~95% electric ~240 dealers worldwide150+ Employees; HQ and manufacturing in Anaheim, CACustomers: Industrial, warehouse, schools/universitiesBusiness expected to be neutral to 2016 earnings Established dealer networkLarge installed baseIndustrial market presenceStrong brand recognition Strategic Fit with Work & Transportation (W&T) Expands Products and Channel Access to Polaris W&T Business MSRP – $5,500 to $48,500

Snowmobiles Motorcycles POLARIS CUSTOMER USAGE PROFILES IR JUNE 7 2016 Off-Road Vehicles 29 AVERAGEAGE 50 43 44 43 47 52 56 42 INCOME ~$100k ~$100k -- ~$90k ~$90k ~$100k - $125k $160k ~$90k MALEFEMALE 91% 9% 91% 9% 98% 2% 87%13% 75%25% 90%10% 95%5% 90%10% PRIMARYUSE Work & PlayFarm/RanchProperty Maint.Rec/TrailHunt Mostly PlayRec/TrailDunesProperty Play & Work Rec/TrailPropertyFarm/Ranch Work & PlayRec/TrailProperty Maint.Hunt Rec/TrailHuntUtility Cruising, Day tripsaround townCommute Cruising, Day trips,Commute Recreationon & off trail MY15, except GENERAL (MY16)

17 In-House Manufacturing Facilities Worldwide 30 IR JUNE 7 2016 MANUFACTURING LOCATIONS Monterrey MEXICOSxS, Engines Spirit Lake & MilfordIOWAMotorcycles,SxS, ACE, GEM RoseauMINNESOTASnow, ATV, SxS OsceolaWISCONSINEngines BourranFRANCEGoupil Chanas &Aix-les-BainsFRANCEAixam Mega Cuyahoga FallsOHIO Kolpin Riverside, CALIFORNIA Pro Armor Shanghai, CHINAHammerhead HuntsvilleALABAMA(2016)SxS, Slingshot OpolePOLANDATV, SxS JaipurINDIAEicher JV SandpointIDAHOTimbersled SpearfishSOUTH DAKOTAMotorcycle Paint Anaheim, CALIFORNIA Taylor-Dunn