Attached files

| file | filename |

|---|---|

| EX-10.1 - EX-10.1 - Primo Water Corp /CN/ | d200371dex101.htm |

| EX-2.1 - EX-2.1 - Primo Water Corp /CN/ | d200371dex21.htm |

| 8-K - FORM 8-K - Primo Water Corp /CN/ | d200371d8k.htm |

Exhibit 99.1

| Press Release |

|

CONTACT:

Jarrod Langhans

Investor Relations

Tel: (813) 313-1732

Investorrelations@cott.com

COTT ANNOUNCES PLANS TO EXPAND ITS HOME AND OFFICE BOTTLED WATER DELIVERY AND OFFICE COFFEE SERVICES PLATFORM THROUGH THE ACQUISITION OF EDEN SPRINGS IN EUROPE

TORONTO, ON and TAMPA, FL – June 7, 2016 – Cott Corporation (NYSE:COT; TSX:BCB) today announced that it has entered into a definitive share purchase agreement to acquire Eden Springs (“Eden”), a leading European direct-to-consumer services provider. Eden specializes in home and office delivery (“HOD”) water, office coffee services (“OCS”) and filtration. The purchase price is approximately €470 million, on a debt and cash free basis, representing a mid 7x Eden’s estimated adjusted 2016 run rate EBITDA of over €60 million (mid 6x multiple including estimated run-rate synergies of approximately €10 million).

The acquisition is consistent with Cott’s stated diversification strategy to expand in HOD water, coffee and tea services as well as filtration services where its platform, operating strength and potential synergies can be leveraged. Eden is a scale business that generated over €360 million in pro forma revenues during 2015. The acquisition broadens the distribution platform of Cott’s existing UK/European business by providing access to a direct-to-consumer route distribution platform in Europe serving over 800,000 homes and offices. In line with Cott’s strategy, the acquisition is expected to be accretive to adjusted free cash flows in its first full year and provide a cash on cash IRR above its cost of equity.

| Press Release |

|

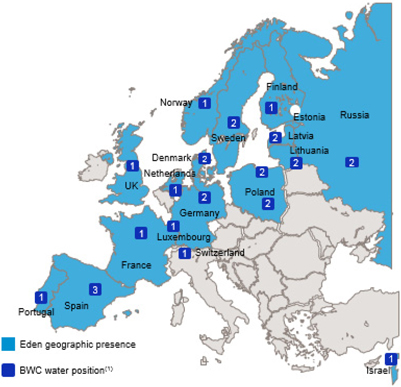

EDEN’S LEADING POSITIONS ACROSS EUROPE (1)

| (1) | BWC represents total bottled water coolers but is not a market in and of itself as the HOD water business consists of coolers, bottled water as well as other products such as case pack water and single serve products |

COMPELLING STRATEGIC RATIONALE

The acquisition of Eden is in line with Cott’s strategy of focusing on acquiring cash accretive businesses with higher margin and/or growth in beverage and beverage adjacencies while continuing Cott’s diversification outside of carbonated soft drinks, shelf stable juices and large format retail. The acquisition is expected to:

| • | Provide market-leading positions and strong platforms in multiple new geographies; |

| • | Be a platform onto which highly accretive tuck-in acquisitions can be completed; |

| • | Improve Cott’s channel mix outside of large format retail and supermarket stores; |

| • | Continue Cott’s shift to higher margin categories; |

| • | Offer cross selling and vertical integration opportunities to leverage DS Services’ and Cott’s products; |

| • | Reduce customer concentration; and |

| • | Provide procurement cost and other synergies over a three year period. |

“The Eden Springs acquisition is another great step in our stated strategy to pursue opportunities in the higher margin home and office water delivery, office coffee and

2

| Press Release |

|

tea services and filtration categories where we believe our platform, operating strength and synergies can be leveraged,” commented Jerry Fowden, Cott’s Chief Executive Officer. “Our Better for You beverage platform will make up over 60%(1) of our EBITDA inclusive of Eden and we will have strong leadership positions in both North America as well as multiple European countries,” continued Mr. Fowden.

| (1) | Better For You beverage categories defined as HOD Water, Sparkling Waters, OCS and Water. |

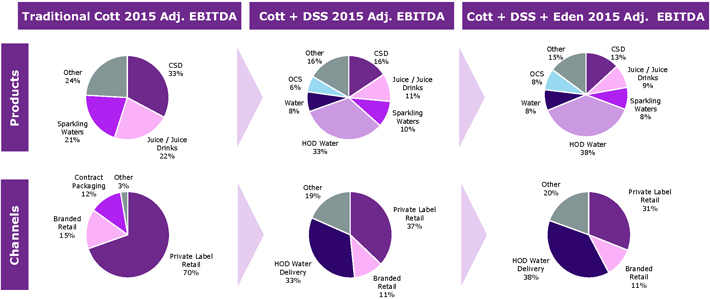

EDEN IMPROVES COTT’S PRODUCT AND CHANNEL MIX(1)

Other product category includes concentrates, Eden’s filtration services and other. Sparkling waters includes mixers.

Other channels include contract packaging, office coffee services and other.

| (1) | 2015 Adjusted EBITDA allocated based upon pro-rata revenues by product category and channel between DS Services (HOD Water, OCS, Water and Other), Traditional Business (CSD, Juice/Juice Drinks, Sparkling Waters and Other) and Eden Springs (HOD Water, OCS, Water and Other). |

FINANCIAL HIGHLIGHTS

The combination is expected to be accretive to adjusted free cash flow (excluding acquisition, integration and transaction costs) in the first full year and accretive to free cash flow in the second full year. Evercore acted as financial advisor to Cott along with Deutsche Bank Securities Inc., JP Morgan and Wells Fargo who also provided unsecured committed financing. Cott ultimately intends to finance the transaction through a combination of incremental borrowings under its ABL facility and a new debt issuance of unsecured notes.

Tom Harrington, CEO of DS Services, commented, “We are very excited about expanding our platform into the European market. We firmly believe that our combined partnerships and home and office water and coffee delivery expertise will create an even stronger, cash generating, growth and service oriented platform across North America and Europe. In addition, these platforms not only provide the opportunities for organic growth but we expect to be able to capitalize on Eden’s and

3

| Press Release |

|

DS Services’ combined expertise in tuck-in acquisitions to pursue further opportunities in the fragmented home and office bottled water, office coffee service and filtration markets across Europe.”

Raanan Zilberman, Eden’s CEO, commented, “Eden is a successful business and a natural fit with the wider Cott family. This transaction is an important step as we strengthen our international capability and develop our market-leading position. We plan to extend the opportunities from commercial and operational synergies of the enlarged group to our over 800,000 customers and 3,200 employees in Europe. This transaction ends our successful partnership with Rhône Capital, who I would like to thank for their support during Eden’s expansion over the past few years.”

The acquisition, which is expected to close in the third quarter of 2016, is subject to certain customary closing conditions (including regulatory approvals) and purchase price adjustments. Additional financial information and a modeling call will be presented post-closing.

TRANSACTION CONFERENCE CALL

Cott Corporation will host a conference call today, June 7, 2016, at 8:30 a.m. ET, to discuss the acquisition, which can be accessed as follows:

North America: (888) 211-7360

International: (913) 312-0665

A copy of the slide presentation that will be used on the call will be available through Cott’s website at http://www.cott.com/en/for-investors/events-and-presentations. The conference call will be a live audio webcast available via the above referenced link and it will be recorded and archived for playback for a period of two weeks following the call.

ABOUT COTT CORPORATION

With the acquisition of DS Services of America, Inc., Cott combined a leading provider in the direct-to-consumer beverage services industry with its traditional business, one of the world’s largest producers of beverages on behalf of retailers, brand owners and distributors. Cott now has the largest volume-based national presence in the U.S. home and office delivery industry for bottled water and one of the five largest national market share positions in the U.S. office coffee services and filtration services industries. Cott reaches over 1.5 million customers (approximately 60% commercial and 40% residential) through over 2,000 routes located across its national network supported by national sales and distribution facilities, as well as a fleet of over 2,000 vehicles. Cott’s broad portfolio allows it to offer, on a direct-to-consumer basis, a variety of bottled water, coffee, brewed tea, water dispensers, coffee and tea brewers and filtration equipment. With the ability to cover approximately 90% of U.S. households, in terms of geography, Cott believes it has the broadest distribution network in the direct-to-consumer beverage services industry in the United States, which enables it to efficiently service residences and small and medium size businesses, as well as national corporations, universities and government agencies.

4

| Press Release |

|

ABOUT EDEN SPRINGS INTERNATIONAL

Eden Springs is a leading provider of water and coffee solutions for offices in Europe. Headquartered in Switzerland, Eden provides a high-level service to over 800,000 offices and homes throughout 18 countries.

Eden Springs offers a variety of integrated water and coffee solutions designed to cater to a wide range of tastes and requirements of a diverse customer base. Solutions include a broad range of bottle-fed water coolers, plumbed-in water coolers and small pack bottles as well as hot beverages solutions including coffee machines, high quality coffee, tea and other accessories.

Eden has more than 3,200 employees and manages a distribution network across Europe, including production facilities, a fleet and local water sources. The scale of operations was achieved through a combination of business entrepreneurship, market expansion, operational excellence, and acquisitions of varying sizes. For more information, see www.edensprings.com.

Non-GAAP Measures

To supplement its reporting of financial measures determined in accordance with GAAP, Cott utilizes certain non-GAAP financial measures, including 2016 estimated Eden Springs adjusted EBITDA, to separate the impact of certain items from the underlying Eden Springs business. Management believes this supplemental information is useful to investors for their independent evaluation and understanding of the transaction with Eden Springs.

Additionally, Cott supplements its reporting of net cash provided by (used in) operating activities determined in accordance with GAAP by excluding capital expenditures to present, free cash flow (on a stand-alone and pro forma basis), and by excluding acquisition, integration and transaction costs to present adjusted free cash flow (on a stand-alone and pro forma basis), which management believes provides useful information to investors about the amount of cash generated by the business that, after the acquisition of property and equipment, can be used for strategic opportunities, including investing in our business, making strategic acquisitions, paying dividends, and strengthening the balance sheet. With respect to our expectations of performance of Eden as it is being integrated, reconciliations of free cash flow accretion and adjusted free cash flow accretion are not available, as we are unable to quantify certain amounts that would be required to be included in the relevant GAAP measures without unreasonable effort. We expect that the unavailable reconciling items, which primarily include foreign exchange impact, interest costs associated with yet to be issued debt and phasing of capex, could significantly affect our financial results. These items depend on highly variable factors and any such reconciliations would imply a degree of precision that would be confusing or misleading to investors. We expect the variability of these factors to have a significant, and potentially unpredictable, impact on our future GAAP financial results.

5

| Press Release |

|

The non-GAAP financial measures described above are in addition to, and not meant to be considered superior to, or a substitute for, Cott’s financial statements prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this earnings announcement reflect management’s judgment of particular items, and may be different from, and therefore may not be comparable to, similarly titled measures reported by other companies.

Safe Harbor Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 conveying management’s expectations as to the future based on plans, estimates and projections at the time Cott makes the statements. Forward-looking statements involve inherent risks and uncertainties and Cott cautions you that a number of important factors could cause actual results to differ materially from those contained in any such forward-looking statement. The forward-looking statements contained in this press release include, but are not limited to, statements related to the completion of the transaction on the terms proposed, the anticipated financing of the transaction on the terms proposed, the anticipated timing of the transaction, expected synergies and contribution to Cott’s performance, and the potential impact the acquisition will have on Cott and related matters. The forward-looking statements are based on assumptions regarding the time necessary to satisfy the conditions to the closing of the transaction and management’s current plans and estimates. Management believes these assumptions to be reasonable but there is no assurance that they will prove to be accurate.

Factors that could cause actual results to differ materially from those described in this press release include, among others: changes in expectations as to the closing of the transaction; changes in estimates of future earnings and cash flows; expected synergies and cost savings are not achieved or achieved at a slower pace than expected; integration problems, delays or other related costs; retention of customers and suppliers; the cost of capital necessary to finance the transaction; and unanticipated changes in laws, regulations, or other industry standards affecting the companies.

The foregoing list of factors is not exhaustive. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. Readers are urged to carefully review and consider the various disclosures, including but not limited to risk factors contained in Cott’s Annual Report on Form 10-K and its quarterly reports on Form 10-Q, as well as other filings with the securities commissions. Cott does not undertake to update or revise any of these statements in light of new information or future events, except as expressly required by applicable law.

Website: www.cott.com

6

| Press Release |

|

| EDEN SPRINGS | SCHEDULE 1 |

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION & AMORTIZATION (EBITDA)

NON-GAAP

(in millions of Euros)

Unaudited

| Fiscal Year 2015 | ||||

| Operating income |

€ | 6.6 | ||

| Depreciation & amortization |

34.7 | |||

|

|

|

|||

| Reported EBITDA (Unadjusted) |

€ | 41.3 | ||

| Acquisition, integration and restructuring costs |

14.1 | |||

| Establishment costs |

4.7 | |||

| Management fees and other expenses |

3.1 | |||

|

|

|

|||

| Reported Adjusted EBITDA |

€ | 63.2 | ||

| Pro forma adjustments(1) |

(0.9 | ) | ||

|

|

|

|||

| Pro forma Adjusted EBITDA(2) |

€ | 62.3 | ||

|

|

|

|||

| (1) | Pro forma adjustments represent pre-synergy pro forma full year revenue and EBITDA adjustments associated with acquired businesses as well as reducing a portion of the establishment costs as Cott intends on reinvesting a portion of these sales and marketing costs on an ongoing basis. |

| (2) | Estimated adjusted 2016 run rate EBITDA expected to be consistent with 2015 pro forma adjusted EBITDA due to foreign exchange impact. Projection excludes acquisition, integration and transaction costs as well as any management stock incentive plans. |

7

| Press Release |

|

| COTT CORPORATION | SCHEDULE 2 |

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION & AMORTIZATION (EBITDA)

NON-GAAP

(in millions of U.S. dollars)

Unaudited

| For the Year Ended January 2, 2016 | ||||||||||||||||||||

| Traditional Cott | DS Services | Total Cott | Eden Springs (1) | Combined | ||||||||||||||||

| Operating income |

$ | 60.4 | $ | 39.0 | $ | 99.4 | ||||||||||||||

| Other income |

(8.3 | ) | (1.2 | ) | (9.5 | ) | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| EBIT |

68.7 | 40.2 | 108.9 | |||||||||||||||||

| Depreciation & amortization |

103.9 | 119.9 | 223.8 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| EBITDA |

$ | 172.6 | $ | 160.1 | $ | 332.7 | $ | 45.8 | $ | 378.5 | ||||||||||

| Facility reorganization costs |

3.0 | — | 3.0 | — | 3.0 | |||||||||||||||

| Acquisition and integration costs, net |

3.9 | 16.7 | 20.6 | — | 20.6 | |||||||||||||||

| Purchase accounting adjustments, net |

— | 4.2 | 4.2 | — | 4.2 | |||||||||||||||

| Unrealized commodity hedging gain, net |

(1.2 | ) | — | (1.2 | ) | — | (1.2 | ) | ||||||||||||

| Unrealized foreign exchange and other gains, net |

(9.7 | ) | (1.2 | ) | (10.9 | ) | — | (10.9 | ) | |||||||||||

| Loss on disposal of property, plant & equipment |

1.6 | 5.3 | 6.9 | — | 6.9 | |||||||||||||||

| Other adjustments |

1.6 | 0.1 | 1.7 | — | 1.7 | |||||||||||||||

| Eden Springs adjustments (1) |

— | — | — | 23.3 | 23.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 171.8 | $ | 185.2 | $ | 357.0 | $ | 69.1 | $ | 426.1 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | See Schedule 1 - Eden Springs pro forma adjusted EBITDA reconciliation (converted at EUR:USD rate of 1.11). |

8

| Press Release |

|

| EDEN SPRINGS | SCHEDULE 3 |

ESTIMATED ADJUSTED EBITDA PURCHASE MULTIPLE

NON-GAAP

(in millions of Euros)

Unaudited

| Estimated 2016 pro forma adjusted EBITDA (1) |

€ | 62.3 | ||

| Approximate purchase price |

470.0 | |||

|

|

|

|||

| 2016 pro forma adjusted EBITDA run rate multiple |

~7.5x | |||

| Expected synergies (three-year capture by 2019) |

€ | 10.0 | ||

| Estimated 2016 pro forma adjusted EBITDA (1) |

62.3 | |||

|

|

|

|||

| Synergized 2016 pro forma adjusted EBITDA |

72.3 | |||

| Approximate purchase price |

470.0 | |||

|

|

|

|||

| 2016 synergized pro forma adjusted EBITDA run rate multiple |

~6.5x | |||

| (1) | See Schedule 1 - Eden Springs pro forma adjusted EBITDA reconciliation. |

9