Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Homes 4 Rent | form8k-nareitjune2016prese.htm |

Investor Highlights June 2016

2 SINGLE-FAMILY INDUSTRY OVERVIEW Owner Occupied 64% / 74.5M units Apartments & Other Rentals 23% / 26.5M units HOMEOWNERSHIP DECLINE SUPPORTS RENTAL DEMAND TOTAL HOUSING STOCK SUBSTANTIAL GROWTH IN RENTER HOUSEHOLD DEMAND HOUSEHOLD FORMATIONS OUTPACE HOUSING SUPPLY 35% 59% 71% 76% 80% 20% 30% 40% 50% 60% 70% 80% 90% 2000 2002 2004 2006 2008 2010 2012 2014 Under 35 35 - 44 45 - 54 55 - 64 65+ 0.0 0.5 1.0 1.5 2.0 1980 1985 1990 1995 2000 2005 2010 2015 Multi Family Starts Single Family Starts Long Term Average Household Formation Rate ( I n m i l l i o n s ) (1) (2) (2) Single-Family Rentals 14% / 16.0M units (2) (1) Federal Reserve Bank of St. Louis Economic Data and U.S. Census Bureau (2) U.S. Census Bureau 1Q16 R e n t e r H o u s e h o l d s ( i n m i l l i o n s ) 30.0 32.0 34.0 36.0 38.0 40.0 42.0 44.0 2000 2005 2010 2015

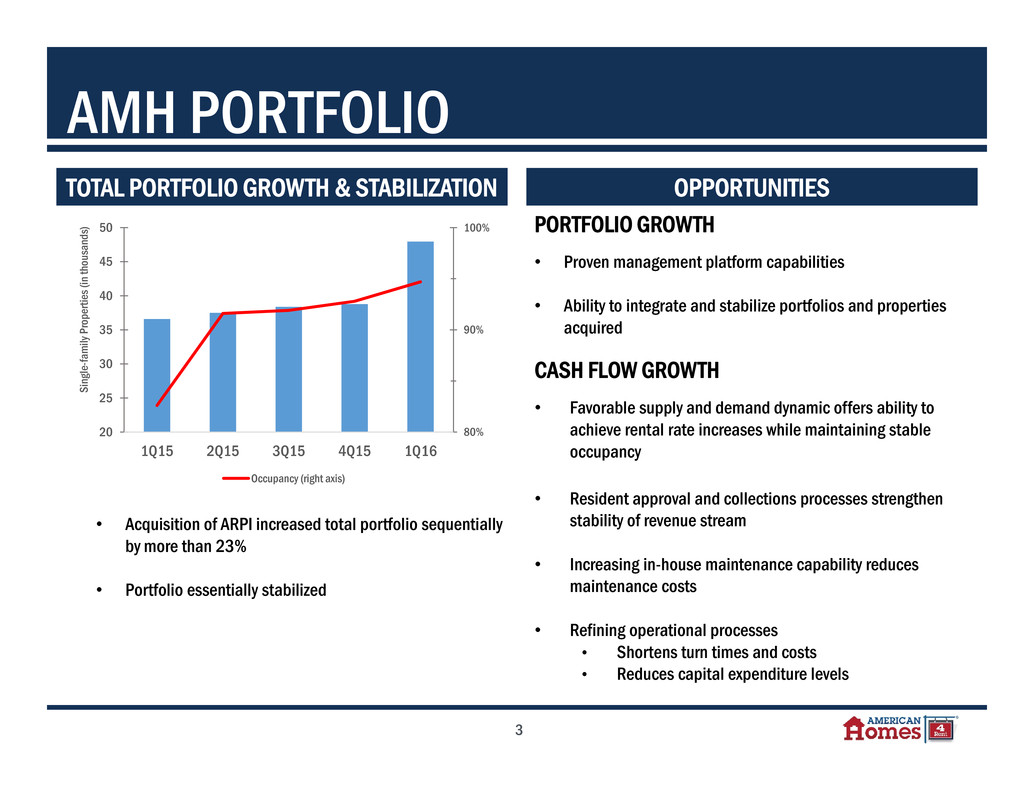

3 AMH PORTFOLIO OPPORTUNITIES • Acquisition of ARPI increased total portfolio sequentially by more than 23% • Portfolio essentially stabilized TOTAL PORTFOLIO GROWTH & STABILIZATION PORTFOLIO GROWTH • Proven management platform capabilities • Ability to integrate and stabilize portfolios and properties acquired CASH FLOW GROWTH • Favorable supply and demand dynamic offers ability to achieve rental rate increases while maintaining stable occupancy • Resident approval and collections processes strengthen stability of revenue stream • Increasing in-house maintenance capability reduces maintenance costs • Refining operational processes • Shortens turn times and costs • Reduces capital expenditure levels 80% 90% 100% 20 25 30 35 40 45 50 1Q15 2Q15 3Q15 4Q15 1Q16 S i n g l e - f a m i l y P r o p e r t i e s ( i n t h o u s a n d s ) Occupancy (right axis)

4 1Q15 2Q15 3Q15 4Q15 1Q16 Number of Same‐Home properties 25,361 25,361 25,361 25,361 25,361 Occupancy percentage 94.4% 94.3% 93.8% 94.3% 95.8% Core revenues $ 99,049 $ 101,650 $ 102,027 $ 103,032 $ 105,549 R&M, turnover and in‐house maintenance, net 6,791 10,139 11,950 8,711 7,980 Property tax, insurance and HOA fees 21,116 21,572 21,896 22,195 22,619 Property management 8,541 8,933 9,114 9,039 9,300 Core property operating expenses 36,448 40,644 42,960 39,945 39,899 Core net operating income (“Core NOI”) 62,601 61,006 59,067 63,087 65,650 63.2% 60.0% 57.9% 61.2% 62.2% Capital expenditures 5,977 7,171 5,834 3,893 3,338 Core NOI after capex $ 56,624 $ 53,835 $ 53,203 $ 59,194 $ 62,312 YOY growth in quarterly Core NOI after capex 4.1% 1.1% 17.0% 14.3% 10.0% Average R&M, turnover and capex per property $ 503 $ 683 $ 701 $ 497 $ 446 SAME-HOME RESULTS HISTORY (Amounts in thousands, except property and per property data) (2) (1) Core NOI is a supplemental non-GAAP financial measure. Refer to “Defined Terms and Non-GAAP Reconciliations” in the attached First Quarter 2016 Supplemental Information Package for definition of this metric and reconciliation to GAAP. (2) Year over year comparisons based on respective quarterly same-home populations Increasing revenues from rental rate and fee increases, improving collections and stabilized occupancy Platform maturation and continued expense controls lead to stable, predictable and growing cash flows Outsized YOY growth in quarterly Core NOI after capex, with past three quarters over 10% Reduction in expenditures resulting from platform maturation (1)

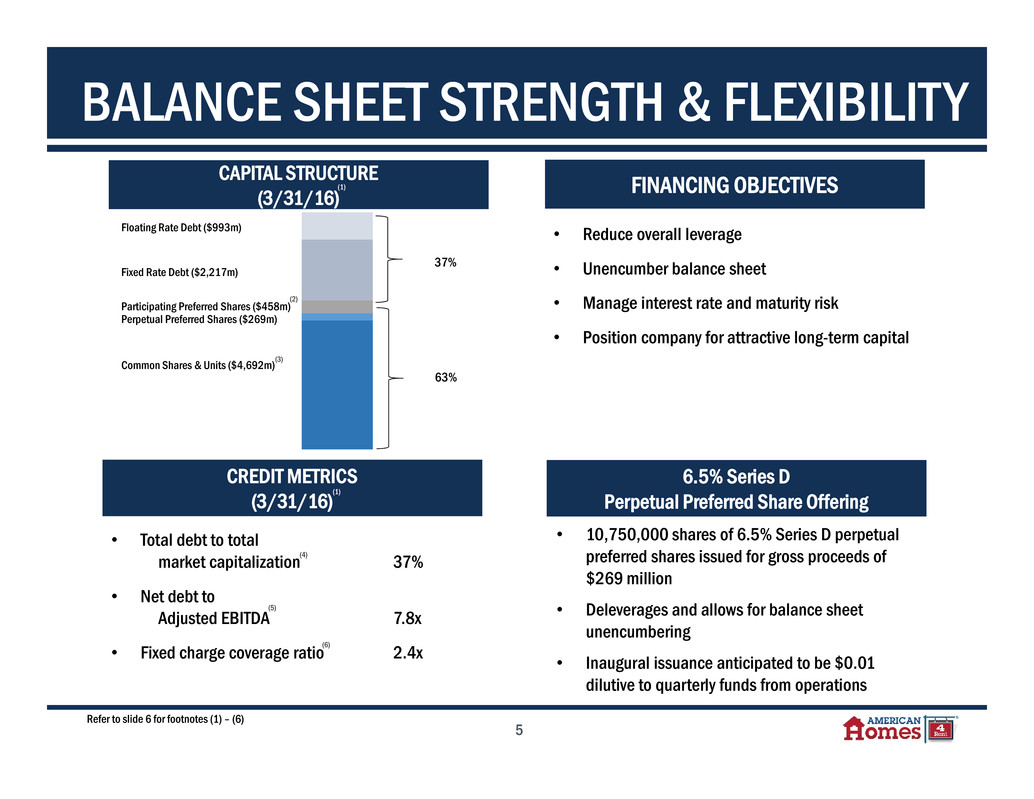

5 BALANCE SHEET STRENGTH & FLEXIBILITY (1) • Reduce overall leverage • Unencumber balance sheet • Manage interest rate and maturity risk • Position company for attractive long-term capital FINANCING OBJECTIVESCAPITAL STRUCTURE (3/31/16) CREDIT METRICS (3/31/16) 6.5% Series D Perpetual Preferred Share Offering • 10,750,000 shares of 6.5% Series D perpetual preferred shares issued for gross proceeds of $269 million • Deleverages and allows for balance sheet unencumbering • Inaugural issuance anticipated to be $0.01 dilutive to quarterly funds from operations • Total debt to total market capitalization 37% • Net debt to Adjusted EBITDA 7.8x • Fixed charge coverage ratio 2.4x Floating Rate Debt ($993m) Fixed Rate Debt ($2,217m) Participating Preferred Shares ($458m) Perpetual Preferred Shares ($269m) Common Shares & Units ($4,692m) 37% 63% (1) (1) (3) (4) (5) (6) Refer to slide 6 for footnotes (1) – (6) (2)

6 FOOTNOTES & FORWARD-LOOKING STATEMENTS Forward-Looking Statements Various statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning the timing and success of our strategies, plans or intentions. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “intend,” “anticipate,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. We have based these forward-looking statements on our current expectations and assumptions about future events. These assumptions include, among others, our projections and expectations regarding: market trends in the single-family home rental industry and in the local markets where we operate, our ability to institutionalize a historically fragmented business model, our business strengths, our ideal tenant profile, the quality and location of our properties in attractive neighborhoods, the scale advantage of our national platform and the superiority of our operational infrastructure, the effectiveness of our investment philosophy and diversified acquisition strategy, our ability to create a cash flow opportunity with attractive current yields and upside from increasing rents and cost efficiencies and our understanding of our competition and general economic, demographic and real estate conditions that may impact our business. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to update any forward-looking statements to conform to actual results or changes in our expectations, unless required by applicable law. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report for the year ended December 31, 2015 and the Company’s subsequent filings with the Securities and Exchange Commission. Slide 5 Footnotes (1) Capital structure and credit metrics have been presented with pro forma adjustment for May 2016 6.5% Series D Perpetual Preferred Share Offering. (2) Participating preferred shares presented at current liquidation value as of March 31, 2016. (3) Common shares and units presented at current market value, using NYSE AMH Class A common share closing price as of March 31, 2016. (4) Total debt to total market capitalization is calculated as total debt, which includes principal balances on asset-backed securitizations, exchangeable senior notes, secured notes payable and borrowing outstanding under our credit facility, divided by total market capitalization, which includes the market value of all outstanding common shares and operating partnership units (based on NYSE AMH Class A common share closing prices), current liquidation value of preferred shares and total debt. (5) Net debt to Adjusted EBITDA is calculated as total debt less unrestricted cash and cash equivalents divided by annualized Adjusted EBITDA. Adjusted EBITDA is a supplemental non-GAAP financial measure defined as earnings before interest, taxes, depreciation and amortization, adjusted to exclude (1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (2) noncash share-based compensation expense, (3) gain or loss on conversion of convertible units and (4) noncash fair value adjustments associated with remeasuring our Series E convertible units liability and preferred shares derivative liability to fair value. Refer to “Defined Terms and Non-GAAP Reconciliations” in the attached First Quarter 2016 Supplemental Information Package for definition of this metric and reconciliation to GAAP. (6) Fixed charge coverage ratio is calculated as Adjusted EBITDA divided by fixed charges, which include cash interest expense incurred, principal payments on total debt and preferred dividends.

American Homes 4 Rent 2 Table of Contents Summary Earnings Press Release 3 Fact Sheet 6 Financial Information Condensed Consolidated Statements of Operations 7 Funds from Operations 8 Core Net Operating Income—Total Portfolio 9 Same-Home Results—Quarterly Comparisons 10 Same-Home Results—Operating Metrics by Market 11 Condensed Consolidated Balance Sheets 12 Debt Summary and Maturity Schedule 13 Capital Structure 14 Property Information Top 20 Markets Summary 15 Leasing Performance 16 Scheduled Lease Expirations 16 Top 20 Markets Home Price Appreciation Trends 16 Other Information Disposition Summary 17 Share Repurchase History 17 Defined Terms and Non-GAAP Reconciliations 18

American Homes 4 Rent Earnings Press Release 3 American Homes 4 Rent Reports First Quarter 2016 Financial and Operating Results AGOURA HILLS, California—American Homes 4 Rent (NYSE: AMH) (the “Company”), a leading provider of high quality single-family homes for rent, today announced its financial and operating results for the quarter ended March 31, 2016. Highlights • On February 29, 2016, the Company completed its previously announced merger with American Residential Properties, Inc. ("ARPI") (see "Merger with American Residential Properties, Inc." later in this press release). • Core Funds from Operations attributable to common share and unit holders (as defined) for the first quarter of 2016 was $63.6 million, or $0.23 per FFO share and unit, compared to $41.9 million, or $0.16 per FFO share and unit, for the same period in 2015, which represents a 47.1% increase on a per share and unit basis. • Core Net Operating Income ("Core NOI") from Same-Home properties increased 4.9% year over year for the quarter ended March 31, 2016. • Maintained solid leasing performance with total and Same-Home portfolio leasing percentages of 95.9% and 96.9%, respectively, as of March 31, 2016. • Core NOI for the quarter ended March 31, 2016, was $106.2 million, a 38.9% increase from $76.5 million for the quarter ended March 31, 2015. • Total portfolio increased by 9,175 homes, including 8,936 homes acquired from ARPI, to 47,955 homes as of March 31, 2016, from 38,780 homes as of December 31, 2015. • During the first quarter of 2016, we repurchased and retired 4.9 million of our Class A common shares at a weighted- average price of $15.40 per share and a total price of $75.9 million. "We are extremely pleased with our first quarter results, during which we made strong progress across our entire platform against our strategic and operational goals,” stated David Singelyn, American Homes 4 Rent’s Chief Executive Officer. “We achieved another quarter of strong leasing performance, with a Same-Home portfolio leasing percentage of 96.9%, and captured a further acceleration in year over year Same-Home quarterly Core NOI growth to 4.9%. In addition, we closed our acquisition of ARPI and increased our total portfolio sequentially by more than 23%, which we believe will provide us with unparalleled opportunities to capture sector leading efficiencies and operating margins. As we move through the remainder of 2016, we are well-positioned with a substantially stabilized portfolio to maintain strong operating growth and drive superior returns for our shareholders.” First Quarter 2016 Financial Results Total revenues increased 48.2% to $195.2 million for the first quarter of 2016 from $131.7 million for the first quarter of 2015. Revenue growth was primarily driven by continued strong leasing activity, as our total leased portfolio grew to 44,455 homes as of March 31, 2016, which includes 7,246 leased homes acquired from ARPI, compared to 31,183 homes as of March 31, 2015. Core NOI from Same-Home properties increased 4.9% to $65.7 million for the first quarter of 2016, compared to $62.6 million for the first quarter of 2015. This increase was primarily due to higher average occupancy levels and rental rate growth. Core NOI increased 38.9% to $106.2 million for the first quarter of 2016, compared to $76.5 million for the first quarter of 2015. This increase was primarily due to substantial growth in rental income resulting from a larger number of leased properties, including those acquired from ARPI. Core Funds from Operations attributable to common share and unit holders ("Core FFO attributable to common share and unit holders") was $63.6 million, or $0.23 per FFO share and unit, for the first quarter of 2016, compared to $41.9 million, or $0.16 per FFO share and unit, for the first quarter of 2015.

American Homes 4 Rent Earnings Press Release (continued) 4 Net loss attributable to common shareholders decreased to $4.4 million for the first quarter of 2016 from $17.8 million for the first quarter of 2015 primarily related to an $11.5 million gain on the conversion of Series E convertible units to Series D convertible units. Core NOI, FFO attributable to common share and unit holders and Core FFO attributable to common share and unit holders are supplemental non-GAAP financial measures. Reconciliations to GAAP measures are provided in a schedule accompanying this press release. Merger with American Residential Properties, Inc. On February 29, 2016, the Company completed its previously announced merger with ARPI, in which ARPI merged with and into a wholly owned subsidiary of us in a stock-for-stock transaction, with our subsidiary continuing as the surviving entity (the "Merger"). Each holder of ARPI common stock received 1.135 of our Class A common shares for each share of ARPI common stock and each holder of limited partnership interests in ARPI's operating partnership received 1.135 Class A units of our operating partnership. We issued 36,546,170 Class A common shares and 1,343,843 Class A units in connection with the Merger, representing 12.7% of the total Class A common shares, Class B common shares and units of our operating partnership, collectively, as of the acquisition date. Portfolio As of March 31, 2016, the Company had 44,455 leased properties, an increase of 8,052 properties from December 31, 2015, which includes 7,246 leased properties acquired from ARPI. As of March 31, 2016, the leased percentage on Same-Home properties was 96.9%, compared to 95.3% as of December 31, 2015. Investments During the first quarter of 2016, the Company’s total portfolio grew by 9,175 homes, including 8,936 homes acquired from ARPI, to 47,955 homes as of March 31, 2016, compared to 38,780 homes as of December 31, 2015. Capital Activities and Balance Sheet During the first quarter of 2016, we repurchased and retired 4.9 million of our Class A common shares at a weighted-average price of $15.40 per share and a total price of $75.9 million. During April 2016, we repurchased and retired 1.3 million of our Class A common shares at a weighted-average price of $15.59 per share and a total price of $20.0 million. As of March 31, 2016, the Company had total outstanding debt of $3.5 billion, excluding unamortized discounts on acquired debt, the value of exchangeable senior notes classified within equity and unamortized deferred loan costs, with a weighted- average interest rate of 3.65% and a weighted-average term to maturity of 12.4 years. The Company’s $800.0 million credit facility, which bears interest at 1-month LIBOR plus 275 basis points, had an outstanding balance of $438.0 million at the end of the quarter. Additional Information A copy of the Company’s First Quarter 2016 Supplemental Information Package and this press release are available on our website at www.americanhomes4rent.com. This information has also been furnished to the SEC in a current report on Form 8-K.

American Homes 4 Rent Earnings Press Release (continued) 5 Conference Call A conference call is scheduled on Friday, May 6, 2016, at 11:00 a.m. Eastern Time to discuss the Company’s financial results for the quarter ended March 31, 2016, and to provide an update on its business. The domestic dial-in number is (877) 705-6003 (for U.S. and Canada) and the international dial-in number is (201) 493-6725 (passcode not required). A simultaneous audio webcast may be accessed by using the link at www.americanhomes4rent.com, under “For Investors.” A replay of the conference call may be accessed through Friday, May 20, 2016, by calling (877) 870-5176 (U.S. and Canada) or (858) 384-5517 (international), replay passcode number 13635850#, or by using the link at www.americanhomes4rent.com, under “For Investors.” About American Homes 4 Rent American Homes 4 Rent (NYSE: AMH) is a leader in the single-family home rental industry and “American Homes 4 Rent” is fast becoming a nationally recognized brand for rental homes, known for high quality, good value and tenant satisfaction. We are an internally managed Maryland real estate investment trust, or REIT, focused on acquiring, renovating, leasing, and operating attractive, single-family homes as rental properties. As of March 31, 2016, we owned 47,955 single-family properties in selected submarkets in 22 states. Forward-Looking Statements This press release contains “forward-looking statements.” These forward-looking statements relate to beliefs, expectations or intentions and similar statements concerning matters that are not of historical fact and are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “intend,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. Examples of forward-looking statements contained in this press release include, among others, our belief that we are well positioned to maintain strong operating growth and continue to drive superior shareholder returns. The Company has based these forward-looking statements on its current expectations and assumptions about future events. While the Company's management considers these expectations to be reasonable, they are inherently subject to risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to update any forward-looking statements to conform to actual results or changes in its expectations, unless required by applicable law. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report on Form 10- K for the year ended December 31, 2015, and in the Company’s subsequent filings with the SEC. Non-GAAP Financial Measures This press release and the First Quarter 2016 Supplemental Information Package include FFO attributable to common share and unit holders, Core FFO attributable to common share and unit holders, Adjusted FFO attributable to common share and unit holders and Core NOI, which are non-GAAP financial measures. We believe these measures are helpful in understanding our financial performance and are widely used in the REIT industry. Because other REITs may not compute these financial measures in the same manner, they may not be comparable among REITs. In addition, these metrics are not substitutes for net income / (loss) or net cash flows from operating activities, as defined by GAAP, as measures of our liquidity, operating performance or ability to pay dividends. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in this press release and in the First Quarter 2016 Supplemental Information Package.

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 6 Fact Sheet (Amounts in thousands, except per share and property data) (Unaudited) For the Three Months Ended Mar 31, 2016 2015 Operating Data Core revenues from single-family properties $ 169,123 $ 120,740 Core net operating income $ 106,207 $ 76,453 Core net operating income margin 62.8 % 63.3 % G&A expense as % of total revenues 4.1 % 4.7 % Annualized G&A expense as % of total assets 0.40 % 0.38 % Adjusted EBITDA $ 100,882 $ 65,715 Per FFO share and unit: FFO attributable to common share and unit holders $ 0.25 $ 0.14 Core FFO attributable to common share and unit holders $ 0.23 $ 0.16 Adjusted FFO attributable to common share and unit holders $ 0.20 $ 0.12 Mar 31, 2016 Dec 31, 2015 Sep 30, 2015 Jun 30, 2015 Mar 31, 2015 Selected Balance Sheet Information - end of period Single-family properties, net $ 7,561,189 $ 6,289,938 $ 6,267,464 $ 6,162,148 $ 6,037,355 Total assets $ 8,097,710 $ 6,751,219 $ 6,907,373 $ 6,638,037 $ 6,526,078 Outstanding borrowings under credit facility $ 438,000 $ — $ — $ 177,000 $ 45,000 Total debt $ 3,469,465 $ 2,580,962 $ 2,587,172 $ 2,291,863 $ 2,164,806 Total equity capitalization $ 5,150,343 $ 4,824,925 $ 4,672,546 $ 4,707,338 $ 4,840,764 Total market capitalization $ 8,619,808 $ 7,405,887 $ 7,259,718 $ 6,999,201 $ 7,005,570 Total debt to total market capitalization 40.2 % 34.9 % 35.6 % 32.7 % 30.9 % NYSE AMH Class A common share closing price $ 15.90 $ 16.66 $ 16.08 $ 16.04 $ 16.55 Portfolio Data - end of period Occupied single-family properties 43,907 35,958 35,232 34,293 30,185 Executed leases for future occupancy 548 445 385 610 998 Total leased single-family properties 44,455 36,403 35,617 34,903 31,183 Single-family properties in acquisition process 109 151 149 184 371 Single-family properties being renovated 211 325 661 502 1,492 Single-family properties being prepared for re-lease 136 178 283 355 838 Vacant single-family properties available for re-lease 1,242 1,432 1,389 1,116 1,008 Vacant single-family properties available for initial lease 221 246 232 387 1,661 Total single-family properties, excluding held for sale 46,374 38,735 38,331 37,447 36,553 Single-family properties held for sale 1,581 45 46 44 35 Total single-family properties 47,955 38,780 38,377 37,491 36,588 Total leased percentage (1) 95.9 % 94.0 % 92.9 % 93.2 % 85.3 % Total occupancy percentage (1) 94.7 % 92.8 % 91.9 % 91.6 % 82.6 % Same-Home leased percentage (25,361 properties) 96.9 % 95.3 % 94.8 % 95.6 % 95.9 % Same-Home occupancy percentage (25,361 properties) 95.8 % 94.3 % 93.8 % 94.3 % 94.4 % Other Data Distributions declared per common share $ 0.05 $ 0.05 $ 0.05 $ 0.05 $ 0.05 Distributions declared per Series A preferred share $ 0.31 $ 0.31 $ 0.31 $ 0.31 $ 0.31 Distributions declared per Series B preferred share $ 0.31 $ 0.31 $ 0.31 $ 0.31 $ 0.31 Distributions declared per Series C preferred share $ 0.34 $ 0.34 $ 0.34 $ 0.34 $ 0.34 (1) Beginning January 1, 2016, leased and occupancy percentages are calculated based on single-family properties, excluding held for sale. Prior period percentages have been restated to conform to the current presentation.

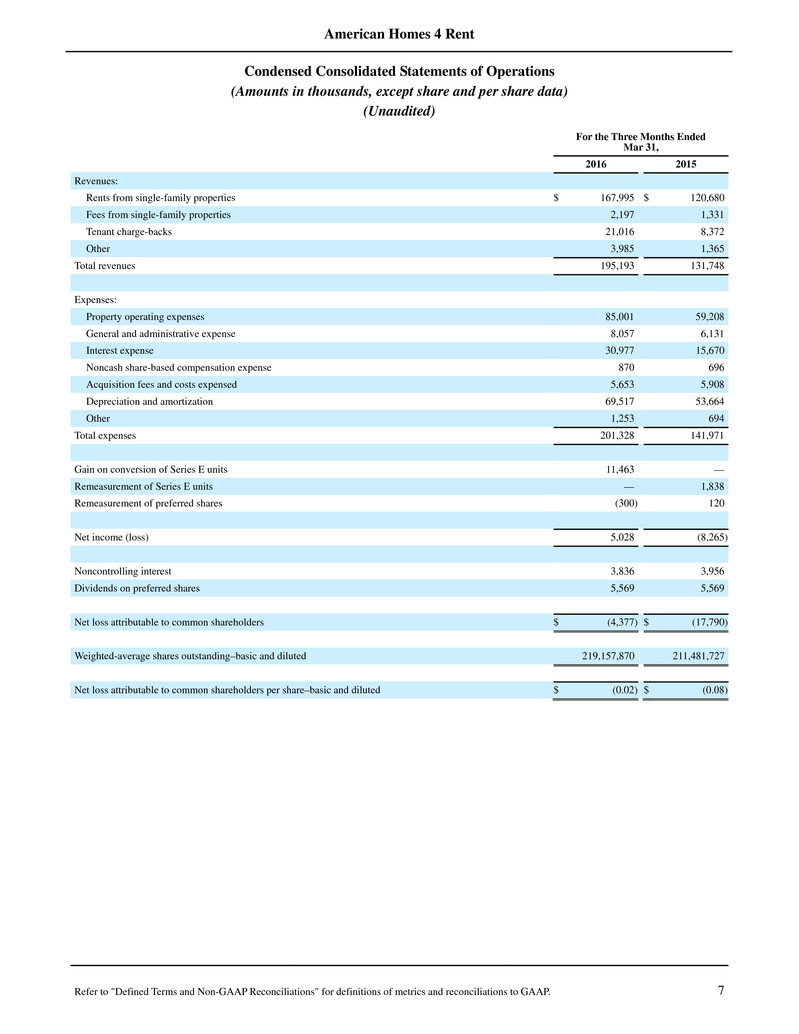

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 7 Condensed Consolidated Statements of Operations (Amounts in thousands, except share and per share data) (Unaudited) For the Three Months Ended Mar 31, 2016 2015 Revenues: Rents from single-family properties $ 167,995 $ 120,680 Fees from single-family properties 2,197 1,331 Tenant charge-backs 21,016 8,372 Other 3,985 1,365 Total revenues 195,193 131,748 Expenses: Property operating expenses 85,001 59,208 General and administrative expense 8,057 6,131 Interest expense 30,977 15,670 Noncash share-based compensation expense 870 696 Acquisition fees and costs expensed 5,653 5,908 Depreciation and amortization 69,517 53,664 Other 1,253 694 Total expenses 201,328 141,971 Gain on conversion of Series E units 11,463 — Remeasurement of Series E units — 1,838 Remeasurement of preferred shares (300 ) 120 Net income (loss) 5,028 (8,265 ) Noncontrolling interest 3,836 3,956 Dividends on preferred shares 5,569 5,569 Net loss attributable to common shareholders $ (4,377 ) $ (17,790 ) Weighted-average shares outstanding–basic and diluted 219,157,870 211,481,727 Net loss attributable to common shareholders per share–basic and diluted $ (0.02 ) $ (0.08 )

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 8 Funds from Operations (Amounts in thousands, except share and per share data) (Unaudited) For the Three Months Ended Mar 31, 2016 2015 Net loss attributable to common shareholders $ (4,377 ) $ (17,790 ) Adjustments: Noncontrolling interests in the Operating Partnership 3,912 3,869 Net (gain) loss on sale / impairment of single-family properties (60 ) — Depreciation and amortization 69,517 53,664 Less: depreciation and amortization of non-real estate assets (1,355 ) (2,154 ) Less: outside interest in depreciation of partially owned properties — (306 ) FFO attributable to common share and unit holders $ 67,637 $ 37,283 Adjustments: Acquisition fees and costs expensed 5,653 5,908 Noncash share-based compensation expense 870 696 Noncash interest expense related to acquired debt 576 — Gain on conversion of Series E units (11,463 ) — Remeasurement of Series E units — (1,838 ) Remeasurement of preferred shares 300 (120 ) Core FFO attributable to common share and unit holders $ 63,573 $ 41,929 Recurring capital expenditures (6,017 ) (7,785 ) Leasing costs (1,929 ) (2,410 ) Adjusted FFO attributable to common share and unit holders $ 55,627 $ 31,734 Per FFO share and unit: FFO attributable to common share and unit holders $ 0.25 $ 0.14 Core FFO attributable to common share and unit holders $ 0.23 $ 0.16 Adjusted FFO attributable to common share and unit holders $ 0.20 $ 0.12 Weighted-average FFO shares and units: Common shares outstanding 219,157,870 211,481,727 Class A units 26,177,307 14,440,670 Series C units 19,813,038 31,085,974 Series D units 5,913,462 4,375,000 Series E units 2,836,538 4,375,000 Total weighted-average FFO shares and units 273,898,215 265,758,371 FFO attributable to common share and unit holders is a non-GAAP financial measure defined as net income or loss calculated in accordance with GAAP, excluding extraordinary items, as defined by GAAP, gains and losses from sales or impairment of real estate, plus real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets), and after adjustment for unconsolidated partnerships and joint ventures. Core FFO attributable to common share and unit holders is a non-GAAP financial measure calculated by adjusting FFO attributable to common share and unit holders for (1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (2) noncash share-based compensation expense, (3) noncash interest expense related to acquired debt, (4) noncash gain or loss on conversion of convertible units and (5) noncash fair value adjustments associated with remeasuring our Series E convertible units liability and preferred shares derivative liability to fair value. Adjusted FFO attributable to common share and unit holders is a non-GAAP financial measure calculated by adjusting Core FFO attributable to common share and unit holders for (1) recurring capital expenditures that are necessary to help preserve the value and maintain functionality of our single-family properties and (2) actual leasing costs incurred during the period. As many of our homes are still recently acquired and / or renovated, we estimate recurring capital expenditures for our entire portfolio by multiplying (a) current period actual capital expenditures per Same-Home property by (b) our total number of properties, excluding non-stabilized and held for sale properties.

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 9 Core Net Operating Income - Total Portfolio (Amounts in thousands) (Unaudited) For the Three Months Ended Mar 31, 2016 2015 Rents from single-family properties $ 167,995 $ 120,680 Fees from single-family properties 2,197 1,331 Bad debt expense (1,069 ) (1,271 ) Core revenues from single-family properties 169,123 120,740 Property operating expenses (1) 85,001 53,930 Expenses reimbursed by tenant charge-backs (21,016 ) (8,372 ) Bad debt expense (1,069 ) (1,271 ) Core property operating expenses 62,916 44,287 Core net operating income $ 106,207 $ 76,453 Core net operating income margin 62.8 % 63.3 % (1) Property operating expenses for the three months ended March 31, 2015, reflect amounts previously presented as leased property operating expenses, which have been combined into property operating expenses to conform to the current presentation. For the Three Months Ended Mar 31, 2016 Same-Home Properties Stabilized, Non-Same-Home Properties Former ARPI Properties (1) Other & Held for Sale Properties (2) Total Single-Family Properties Property count 25,361 10,251 7,583 4,760 47,955 Rents from single-family properties $ 104,863 $ 41,017 $ 9,913 $ 12,202 $ 167,995 Fees from single-family properties 1,313 577 68 239 2,197 Bad debt expense (627 ) (328 ) (20 ) (94 ) (1,069 ) Core revenues from single-family properties 105,549 41,266 9,961 12,347 169,123 Property operating expenses 52,752 22,525 3,921 5,803 85,001 Expenses reimbursed by tenant charge-backs (12,226 ) (7,351 ) (353 ) (1,086 ) (21,016 ) Bad debt expense (627 ) (328 ) (20 ) (94 ) (1,069 ) Core property operating expenses 39,899 14,846 3,548 4,623 62,916 Core net operating income $ 65,650 $ 26,420 $ 6,413 $ 7,724 $ 106,207 (1) Former ARPI properties includes the operating activity of properties acquired through the ARPI merger from the acquisition date of February 29, 2016, through March 31, 2016. (2) Includes 2,387 properties acquired through bulk purchases, 792 non-stabilized properties and 1,581 properties classified as held for sale. Core Net Operating Income ("Core NOI") is a supplemental non-GAAP financial measure defined as rents and fees from single- family properties, net of bad debt expense, less property operating expenses for single-family properties, excluding expenses reimbursed by tenant charge-backs and bad debt expense.

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 10 Same-Home Results – Quarterly Comparisons (Amounts in thousands, except property and per property data) (Unaudited) For the Three Months Ended Mar 31, 2016 2015 % Change Number of Same-Home properties 25,361 25,361 Leased percentage as of period end 96.9 % 95.9 % Occupancy percentage as of period end 95.8 % 94.4 % Average occupancy percentage 95.1 % 93.7 % Economic occupancy percentage 94.8 % 91.7 % Retention rate 67.8 % 70.1 % Turnover rate 33.5 % 33.7 % Average contractual monthly rent (1) $ 1,463 $ 1,420 3.0 % Core Net Operating Income from Same-Home Properties: Rents from single-family properties $ 104,863 $ 99,321 5.6 % Fees from single-family properties 1,313 833 57.6 % Bad debt (627 ) (1,105 ) (43.3 )% Core revenues from Same-Home properties 105,549 99,049 6.6 % Property tax 19,322 17,455 10.7 % HOA fees, net of tenant charge-backs 2,068 2,139 (3.3 )% R&M and turnover costs, net of tenant charge-backs 7,480 6,791 10.1 % In-house maintenance 500 — — % Insurance 1,229 1,522 (19.3 )% Property management 9,300 8,541 8.9 % Core property operating expenses from Same-Home properties 39,899 36,448 9.5 % Core net operating income $ 65,650 $ 62,601 4.9 % Core net operating income margin 62.2 % 63.2 % Capital expenditures $ 3,338 $ 5,977 (44.2 )% Per property: Average capital expenditures $ 132 $ 236 (44.2 )% Average R&M and turnover costs, net of tenant charge-backs, in-house maintenance and capital expenditures $ 446 $ 503 (11.4 )% (1) Average contractual monthly rent as of end of period. Same-Home Results – Sequential Quarterly History For the Three Months Ended Mar 31, 2016 Dec 31, 2015 Sep 30, 2015 Jun 30, 2015 Mar 31, 2015 Core Net Operating Income from Same-Home Properties: Rents from single-family properties $ 104,863 $ 102,335 $ 102,180 $ 101,355 $ 99,321 Fees from single-family properties 1,313 1,266 1,439 1,388 833 Bad debt (627 ) (569 ) (1,592 ) (1,093 ) (1,105 ) Core revenues from Same-Home properties 105,549 103,032 102,027 101,650 99,049 Property tax 19,322 18,683 18,489 18,296 17,455 HOA fees, net of tenant charge-backs 2,068 2,142 2,085 2,090 2,139 R&M and turnover costs, net of tenant charge-backs 7,480 8,711 11,950 10,139 6,791 In-house maintenance 500 — — — — Insurance 1,229 1,370 1,322 1,186 1,522 Property management 9,300 9,039 9,114 8,933 8,541 Core property operating expenses from Same-Home properties 39,899 39,945 42,960 40,644 36,448 Core net operating income $ 65,650 $ 63,087 $ 59,067 $ 61,006 $ 62,601 Core net operating income margin 62.2 % 61.2 % 57.9 % 60.0 % 63.2 % Capital expenditures $ 3,338 $ 3,893 $ 5,834 $ 7,171 $ 5,977 Per property: Average capital expenditures $ 132 $ 154 $ 230 $ 283 $ 236 Average R&M and turnover costs, net of tenant charge-backs, in-house maintenance and capital expenditures $ 446 $ 497 $ 701 $ 683 $ 503

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 11 Same-Home Results – Operating Metrics by Market Average Contractual Monthly Rent (1) Market Number of Properties Gross Book Value per Property % of 1Q16 NOI Mar 31, 2016 Mar 31, 2015 % Change Dallas-Fort Worth, TX 2,351 $ 161,751 9.2 % $ 1,573 $ 1,517 3.7 % Indianapolis, IN 2,208 151,466 7.7 % 1,304 1,279 2.0 % Atlanta, GA 1,544 170,292 6.1 % 1,415 1,361 4.0 % Greater Chicago area, IL and IN 1,500 175,717 5.3 % 1,687 1,651 2.1 % Cincinnati, OH 1,444 174,885 5.8 % 1,463 1,428 2.5 % Houston, TX 1,335 178,650 4.4 % 1,645 1,603 2.6 % Charlotte, NC 1,307 172,399 5.6 % 1,416 1,366 3.6 % Nashville, TN 1,105 207,098 5.8 % 1,600 1,554 2.9 % Jacksonville, FL 1,067 151,405 3.8 % 1,351 1,311 3.0 % Raleigh, NC 967 181,024 4.1 % 1,400 1,356 3.3 % Phoenix, AZ 941 156,323 3.4 % 1,185 1,144 3.5 % Columbus, OH 914 152,659 3.7 % 1,440 1,392 3.5 % Tampa, FL 866 197,287 3.3 % 1,595 1,550 2.9 % Salt Lake City, UT 744 219,954 3.8 % 1,502 1,478 1.6 % Las Vegas, NV 664 174,224 2.7 % 1,373 1,328 3.4 % Orlando, FL 656 169,261 2.4 % 1,464 1,407 4.1 % Austin, TX 439 150,189 1.4 % 1,413 1,348 4.8 % Greensboro, NC 412 170,941 1.6 % 1,358 1,311 3.6 % San Antonio, TX 404 152,827 1.5 % 1,415 1,365 3.7 % Charleston, SC 402 180,136 1.6 % 1,520 1,477 2.9 % All Other (2) 4,091 181,205 16.8 % 1,446 1,408 2.7 % Total / Average 25,361 $ 172,812 100.0 % $ 1,463 $ 1,420 3.0 % Average Occupancy Percentage Market 1Q16 1Q15 Change Dallas-Fort Worth, TX 96.3 % 95.4 % 0.9 % Indianapolis, IN 94.5 % 90.5 % 4.0 % Atlanta, GA 96.2 % 96.6 % (0.4 )% Greater Chicago area, IL and IN 94.7 % 93.8 % 0.9 % Cincinnati, OH 93.7 % 92.5 % 1.2 % Houston, TX 93.8 % 93.6 % 0.2 % Charlotte, NC 95.6 % 95.2 % 0.4 % Nashville, TN 95.0 % 94.1 % 0.9 % Jacksonville, FL 94.8 % 94.6 % 0.2 % Raleigh, NC 95.9 % 94.0 % 1.9 % Phoenix, AZ 96.4 % 94.4 % 2.0 % Columbus, OH 95.9 % 94.6 % 1.3 % Tampa, FL 94.7 % 96.2 % (1.5 )% Salt Lake City, UT 95.9 % 91.7 % 4.2 % Las Vegas, NV 96.0 % 94.6 % 1.4 % Orlando, FL 95.7 % 95.2 % 0.5 % Austin, TX 94.1 % 96.1 % (2.0 )% Greensboro, NC 94.5 % 94.5 % — % San Antonio, TX 96.3 % 95.5 % 0.8 % Charleston, SC 92.9 % 93.2 % (0.3 )% All Other (2) 94.3 % 91.7 % 2.6 % Total / Average 95.1 % 93.7 % 1.4 % (1) Average contractual monthly rent as of end of period. (2) Represents 19 markets in 15 states.

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 12 Condensed Consolidated Balance Sheets (Amounts in thousands) Mar 31, 2016 Dec 31, 2015 (Unaudited) Assets Single-family properties: Land $ 1,474,902 $ 1,229,017 Buildings and improvements 6,434,859 5,469,533 Single-family properties held for sale 123,575 7,432 8,033,336 6,705,982 Less: accumulated depreciation (472,147 ) (416,044 ) Single-family properties, net 7,561,189 6,289,938 Cash and cash equivalents 71,438 57,686 Restricted cash 132,082 111,282 Rent and other receivables, net 16,998 13,936 Escrow deposits, prepaid expenses and other assets 142,828 121,627 Deferred costs and other intangibles, net 26,854 10,429 Asset-backed securitization certificates 25,666 25,666 Goodwill 120,655 120,655 Total assets $ 8,097,710 $ 6,751,219 Liabilities Credit facility $ 438,000 $ — Asset-backed securitizations, net 2,799,267 2,473,643 Exchangeable senior notes, net 105,618 — Secured note payable 50,522 50,752 Accounts payable and accrued expenses 200,946 154,751 Amounts payable to affiliates — 4,093 Contingently convertible Series E units liability — 69,957 Preferred shares derivative liability 63,090 62,790 Total liabilities 3,657,443 2,815,986 Commitments and contingencies Equity Shareholders' equity: Class A common shares 2,389 2,072 Class B common shares 6 6 Preferred shares 171 171 Additional paid-in capital 3,997,747 3,554,063 Accumulated deficit (313,364 ) (296,865 ) Accumulated other comprehensive loss (62 ) (102 ) Total shareholders' equity 3,686,887 3,259,345 Noncontrolling interest 753,380 675,888 Total equity 4,440,267 3,935,233 Total liabilities and equity $ 8,097,710 $ 6,751,219

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 13 Debt Summary and Maturity Schedule as of March 31, 2016 (Amounts in thousands) Balance % of Total Interest Rate (1) Years to Maturity Floating rate debt: Credit facility (2) $ 438,000 12.6 % 3.19 % 2.5 AH4R 2014-SFR1 (3) 472,553 13.6 % 1.98 % 3.2 ARP 2014-SFR1 (4) 342,115 9.9 % 2.55 % 3.4 Total floating rate debt 1,252,668 36.1 % 2.56 % 3.0 Fixed rate debt: AH4R 2014-SFR2 506,022 14.6 % 4.42 % 8.5 AH4R 2014-SFR3 521,788 15.0 % 4.40 % 8.7 AH4R 2015-SFR1 (5) 547,739 15.8 % 4.14 % 29.0 AH4R 2015-SFR2 (5) 475,726 13.7 % 4.36 % 29.5 Exchangeable senior notes 115,000 3.3 % 3.25 % 2.6 Secured note payable 50,522 1.5 % 4.06 % 3.3 Total fixed rate debt 2,216,797 63.9 % 4.26 % 17.7 Total debt $ 3,469,465 100.0 % 3.65 % 12.4 Unamortized discounts and loan costs (76,058 ) Total debt per balance sheet $ 3,393,407 Note: Total interest expense for the three months ended March 31, 2016, includes $2.7 million of loan cost amortization and $0.6 million of noncash interest expense related to acquired debt. Total interest expense capitalized during the three months ended March 31, 2016, was $0.6 million. Year Floating Rate (6) Fixed Rate Total % of Total Remaining 2016 $ 3,608 $ 16,228 $ 19,836 0.6 % 2017 4,810 21,683 26,493 0.8 % 2018 442,810 136,723 579,533 16.7 % 2019 801,440 68,564 870,004 25.1 % 2020 — 20,714 20,714 0.6 % 2021 — 20,714 20,714 0.6 % 2022 — 20,714 20,714 0.6 % 2023 — 20,714 20,714 0.6 % 2024 — 957,420 957,420 27.6 % 2025 — 10,302 10,302 0.3 % Thereafter (5) — 923,021 923,021 26.5 % Total $ 1,252,668 $ 2,216,797 $ 3,469,465 100.0 % (1) Interest rates on floating rate debt reflect stated rates as of end of period. (2) Our credit facility provides for a borrowing capacity of up to $800.0 million through June 2016, with outstanding borrowings due September 2018, and bears interest at 1-month LIBOR plus 2.75% (3.125% beginning in March 2017). Balance reflects borrowings outstanding as of end of period. Years to maturity based on final maturity date in September 2018. (3) AH4R 2014-SFR1 bears interest at a duration-weighted blended interest rate of 1-month LIBOR plus 1.54%, subject to a LIBOR floor of 0.25%, and has an interest rate cap agreement for the initial two-year term with a LIBOR-based strike rate of 3.85%. Years to maturity reflects a fully extended maturity date of June 2019, which is based on an initial two-year loan term and three, 12-month extension options, at the Company’s election, provided there is no event of default and compliance with certain other terms. (4) ARP 2014-SFR1 bears interest at a duration-weighted blended interest rate of 1-month LIBOR plus 2.11% and has an interest rate cap agreement for the initial two-year term with a LIBOR-based strike rate of 3.12%. Years to maturity reflects a fully extended maturity date of September 2019, which is based on an initial two-year loan term and three, 12-month extension options, at the Company’s election, provided there is no event of default and compliance with certain other terms. (5) AH4R 2015-SFR1 and AH4R 2015-SFR2 have maturity dates in April 2045 and October 2045, respectively, with anticipated repayment dates in April 2025 and October 2025, respectively. In the event the loans are not repaid by each respective anticipated repayment date, the interest rate on each component is increased to a rate per annum equal to the sum of 3% plus the greater of: (a) the initial interest rate and (b) a rate equal to the sum of (i) the bid side yield to maturity for the “on the run” United States Treasury note with a 10 year maturity plus the mid-market 10 year swap spread, plus (ii) the component spread for each component. (6) Reflects credit facility based on final maturity date of September 2018, AH4R 2014-SFR1 based on fully extended maturity date of June 2019 and ARP 2014-SFR1 based on fully extended maturity date of September 2019.

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 14 Capital Structure as of March 31, 2016 (Amounts in thousands, except share and per share data) Total Capitalization Floating rate debt $ 1,252,668 Fixed rate debt 2,216,797 Total debt 3,469,465 40.2 % Common shares outstanding (1) 239,554,492 Operating partnership units (1) 55,573,368 Total shares and units 295,127,860 NYSE AMH Class A common share closing price at March 31, 2016 $ 15.90 Market value of common shares and operating partnership units 4,692,533 Participating preferred shares (see below) 457,810 Total equity capitalization 5,150,343 59.8 % Total market capitalization $ 8,619,808 100.0 % (1) Reflects total common shares and operating partnership units outstanding as of end of period. Participating Preferred Shares Initial Redemption Period Outstanding Shares Initial Liquidation Value Current Liquidation Value (1) Annual Dividend Per Share Annual Dividend Amount Series Per Share Total Per Share Total 5.0% Series A 9/30/2017-9/30/2020 5,060,000 $ 25.00 $ 126,500 $ 27.00 $ 136,643 $ 1.250 $ 6,325 5.0% Series B 9/30/2017-9/30/2020 4,400,000 $ 25.00 110,000 $ 27.00 118,820 $ 1.250 5,500 5.5% Series C 3/31/2018-3/31/2021 7,600,000 $ 25.00 190,000 $ 26.62 202,347 $ 1.375 10,450 17,060,000 $ 426,500 $ 457,810 $ 22,275 (1) Current liquidation value reflects initial liquidation value, adjusted by most recent quarterly HPA adjustment calculation, which is made available under the “For Investors” page of the Company’s website.

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 15 Top 20 Markets Summary as of March 31, 2016 Property Information (1) Market Number of Properties Percentage of Total Properties Gross Book Value per Property Avg. Sq. Ft. Avg. Age (years) Dallas-Fort Worth, TX 4,348 9.4 % $ 160,622 2,120 12.4 Atlanta, GA 3,837 8.3 % 162,554 2,110 15.3 Houston, TX 3,154 6.8 % 161,837 2,114 10.4 Indianapolis, IN 2,901 6.3 % 150,684 1,933 13.5 Phoenix, AZ 2,783 6.0 % 160,752 1,814 13.6 Charlotte, NC 2,713 5.9 % 171,667 2,016 12.8 Nashville, TN 2,352 5.1 % 195,979 2,084 11.8 Greater Chicago area, IL and IN 2,062 4.4 % 180,062 1,899 14.7 Cincinnati, OH 1,953 4.2 % 171,549 1,846 13.9 Raleigh, NC 1,824 3.9 % 175,110 1,844 11.5 Tampa, FL 1,678 3.6 % 186,558 1,961 12.5 Jacksonville, FL 1,593 3.4 % 152,439 1,906 12.2 Orlando, FL 1,557 3.4 % 168,859 1,871 14.9 Columbus, OH 1,450 3.1 % 154,624 1,828 14.7 Salt Lake City, UT 1,048 2.3 % 219,892 2,131 14.9 Las Vegas, NV 1,024 2.2 % 173,959 1,841 13.2 San Antonio, TX 1,004 2.2 % 154,069 2,010 13.1 Winston Salem, NC 761 1.6 % 148,605 1,729 12.3 Austin, TX 695 1.5 % 150,733 1,850 11.9 Charleston, SC 681 1.5 % 178,094 1,849 10.3 All Other (3) 6,956 15.0 % 186,159 1,876 13.1 Total / Average 46,374 100.0 % $ 170,565 1,959 13.1 Leasing Information (1) Market Leased Percentage (2) Occupancy Percentage (2) Avg. Contractual Monthly Rent Per Property (2) Avg. Change in Rent for Renewals Avg. Change in Rent for Re-Leases Dallas-Fort Worth, TX 96.4 % 95.2 % $ 1,560 4.8 % 6.1 % Atlanta, GA 93.8 % 92.9 % 1,358 4.9 % 7.9 % Houston, TX 95.5 % 94.2 % 1,567 3.9 % 2.5 % Indianapolis, IN 96.1 % 94.8 % 1,303 1.5 % 2.2 % Phoenix, AZ 97.8 % 97.2 % 1,138 4.1 % 7.6 % Charlotte, NC 95.5 % 94.4 % 1,401 5.0 % 6.1 % Nashville, TN 95.3 % 94.3 % 1,561 3.9 % 3.8 % Greater Chicago area, IL and IN 97.5 % 95.7 % 1,707 3.0 % (0.1 )% Cincinnati, OH 96.2 % 94.8 % 1,455 3.5 % 2.4 % Raleigh, NC 95.2 % 94.4 % 1,370 4.5 % 5.5 % Tampa, FL 95.5 % 94.5 % 1,546 4.6 % 4.6 % Jacksonville, FL 95.4 % 94.1 % 1,348 4.0 % 5.5 % Orlando, FL 95.8 % 94.9 % 1,419 4.7 % 6.4 % Columbus, OH 98.6 % 97.2 % 1,440 4.0 % 4.9 % Salt Lake City, UT 96.9 % 96.0 % 1,494 2.7 % 4.2 % Las Vegas, NV 96.6 % 95.8 % 1,336 4.0 % 6.4 % San Antonio, TX 96.4 % 95.5 % 1,409 4.6 % 5.8 % Winston Salem, NC 95.8 % 94.1 % 1,215 4.0 % 3.7 % Austin, TX 96.7 % 95.7 % 1,395 4.4 % 7.6 % Charleston, SC 93.2 % 91.8 % 1,504 4.7 % 4.4 % All Other (3) 95.3 % 93.8 % 1,483 4.2 % 4.7 % Total / Average 95.9 % 94.7 % $ 1,441 4.1 % 4.7 % (1) Property and leasing information excludes held for sale properties. (2) Leased percentage, occupancy percentage and average contractual monthly rent per property are reflected as of end of period. (3) Represents 22 markets in 16 states.

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 16 Leasing Performance 1Q15 2Q15 3Q15 4Q15 1Q16 Average change in rent for re-leases 1.1 % 4.6 % 5.0 % 2.4 % 4.7 % Average change in rent for renewals 3.6 % 2.4 % 3.3 % 3.7 % 4.1 % Scheduled Lease Expirations MTM 2Q16 3Q16 4Q16 1Q17 Thereafter Lease expirations 2,084 13,564 10,290 7,080 10,687 750 Top 20 Markets Home Price Appreciation Trends The table below summarizes historic changes in the House Price Index of the Federal Housing Finance Agency (“FHFA”), known as the Quarterly Purchase-Only Index, specifically the non-seasonally adjusted “Purchase-Only Index” for the “100 Largest Metropolitan Statistical Areas”, which is used for purposes of computing the “HPA Factor” for our 5% Series A participating preferred shares, 5% Series B participating preferred shares and 5.5% Series C participating preferred shares as described in the prospectuses for those securities. HPA Index (1) Market Dec 31, 2012 Dec 31, 2013 Dec 31, 2014 Mar 31, 2015 Jun 30, 2015 Sep 30, 2015 Dec 31, 2015 HPA Index Change Dallas-Fort Worth, TX (2) 100.0 108.4 115.2 119.8 124.8 126.8 127.6 27.6 % Indianapolis, IN 100.0 106.4 112.3 113.9 116.8 117.4 117.8 17.8 % Atlanta, GA 100.0 114.2 122.3 124.7 131.6 132.6 132.0 32.0 % Charlotte, NC 100.0 113.4 118.8 120.1 126.2 124.9 126.8 26.8 % Greater Chicago area, IL and IN 100.0 111.0 115.1 114.0 119.7 120.9 118.8 18.8 % Houston, TX 100.0 110.8 123.1 123.0 126.8 128.6 130.1 30.1 % Cincinnati, OH 100.0 104.9 111.2 110.3 114.0 116.5 115.7 15.7 % Tampa, FL 100.0 113.0 121.1 123.1 127.5 131.6 132.3 32.3 % Jacksonville, FL 100.0 114.2 121.7 121.3 130.8 132.0 127.7 27.7 % Nashville, TN 100.0 111.0 117.4 120.6 125.8 126.5 131.1 31.1 % Raleigh, NC 100.0 106.7 111.6 114.1 116.9 120.8 120.0 20.0 % Phoenix, AZ 100.0 118.0 123.3 125.9 129.4 133.9 135.9 35.9 % Columbus, OH 100.0 108.9 114.5 117.2 120.8 123.1 120.8 20.8 % Salt Lake City, UT 100.0 109.4 114.5 117.4 120.4 123.7 123.2 23.2 % Orlando, FL 100.0 110.3 123.5 124.4 129.3 131.8 135.4 35.4 % Las Vegas, NV 100.0 125.1 141.3 141.8 142.9 149.4 149.0 49.0 % San Antonio, TX 100.0 101.1 108.0 113.0 117.3 116.0 113.9 13.9 % Denver, CO 100.0 111.0 121.5 128.1 134.2 136.4 136.5 36.5 % Austin, TX 100.0 110.1 122.2 127.3 133.7 134.3 133.9 33.9 % Greenville, SC 100.0 104.1 110.8 114.9 116.7 115.0 117.8 17.8 % Average 27.3 % (1) Updates to the Quarterly Purchase-Only Index are released by the FHFA on approximately the 20th day of the second month following quarter- end. Accordingly, information in the above table has been presented through December 31, 2015. For the illustrative purposes of this table, the HPA Index has been indexed as of December 31, 2012, and, as such, HPA Index values presented are relative measures calculated in relation to the baseline index value of 100.0 as of December 31, 2012. (2) Our Dallas-Fort Worth, TX market is comprised of the Dallas-Plano-Irving and Fort Worth-Arlington Metropolitan Divisions.

American Homes 4 Rent Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. 17 Disposition Summary (Amounts in thousands, except property data) Single-Family Properties Held for Sale (1) Single-Family Properties Sold 1Q16 Market Vacant Leased Total Number of Properties Net Proceeds Greater Chicago area, IL and IN 504 6 510 3 $ 381 Indianapolis, IN 123 289 412 2 210 Phoenix, AZ 16 139 155 3 445 Fort Myers, FL 4 146 150 — — Atlanta, GA 20 56 76 39 3,486 Miami, FL 10 57 67 — — Central Valley, CA — 51 51 — — Denver, CO 1 25 26 1 223 San Antonio, TX 1 21 22 1 154 Memphis, TN 6 11 17 1 47 All Other (2) 31 64 95 16 2,741 Total 716 865 1,581 66 $ 7,687 (1) Reflects single-family properties held for sale as of March 31, 2016. (2) Represents 19 markets in 13 states. Share Repurchase History (Amounts in thousands, except share and per share data) Board authorization announced on 9/21/15: $ 300,000 Quarterly Period Shares Repurchased Purchase Price Avg. Price Paid Per Share 3Q15 3,407,046 $ 53,679 $ 15.76 4Q15 226,556 3,601 15.89 1Q16 4,930,783 75,947 15.40 Total 8,564,385 $ 133,227 $ 15.56 Remaining authorization: $ 166,773

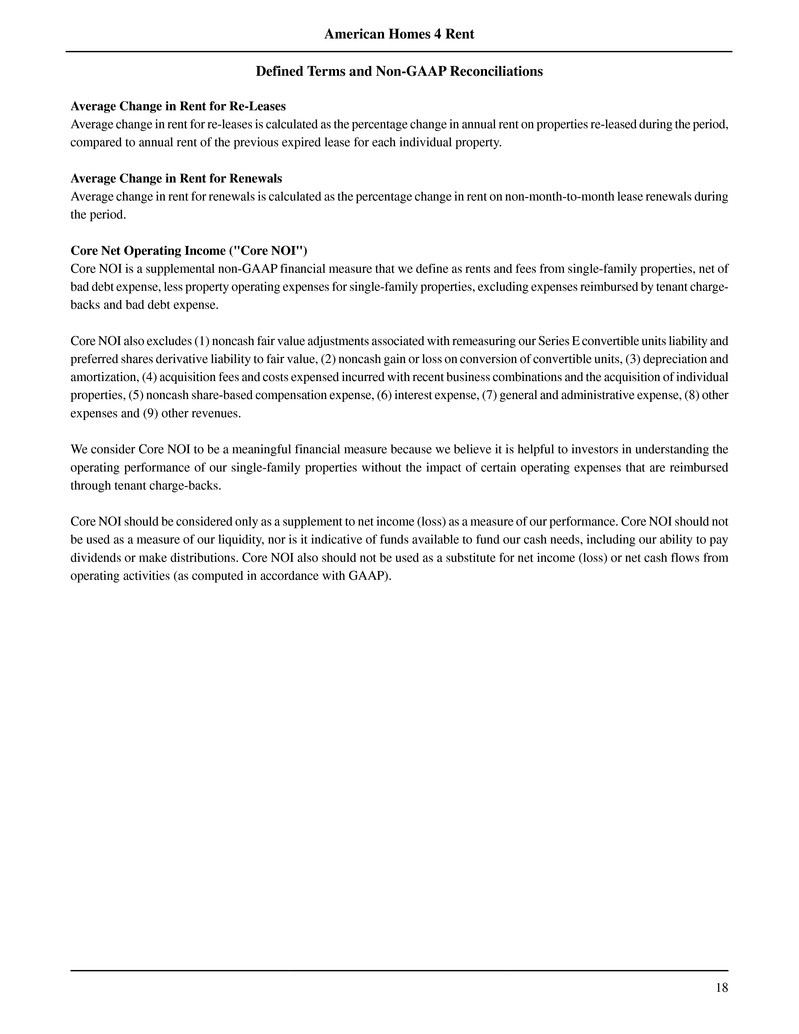

American Homes 4 Rent 18 Defined Terms and Non-GAAP Reconciliations Average Change in Rent for Re-Leases Average change in rent for re-leases is calculated as the percentage change in annual rent on properties re-leased during the period, compared to annual rent of the previous expired lease for each individual property. Average Change in Rent for Renewals Average change in rent for renewals is calculated as the percentage change in rent on non-month-to-month lease renewals during the period. Core Net Operating Income ("Core NOI") Core NOI is a supplemental non-GAAP financial measure that we define as rents and fees from single-family properties, net of bad debt expense, less property operating expenses for single-family properties, excluding expenses reimbursed by tenant charge- backs and bad debt expense. Core NOI also excludes (1) noncash fair value adjustments associated with remeasuring our Series E convertible units liability and preferred shares derivative liability to fair value, (2) noncash gain or loss on conversion of convertible units, (3) depreciation and amortization, (4) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (5) noncash share-based compensation expense, (6) interest expense, (7) general and administrative expense, (8) other expenses and (9) other revenues. We consider Core NOI to be a meaningful financial measure because we believe it is helpful to investors in understanding the operating performance of our single-family properties without the impact of certain operating expenses that are reimbursed through tenant charge-backs. Core NOI should be considered only as a supplement to net income (loss) as a measure of our performance. Core NOI should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Core NOI also should not be used as a substitute for net income (loss) or net cash flows from operating activities (as computed in accordance with GAAP).

American Homes 4 Rent 19 Defined Terms and Non-GAAP Reconciliations (continued) The following is a reconciliation of net income (loss), determined in accordance with GAAP, to Core NOI for the three months ended March 31, 2016 and 2015 (amounts in thousands): For the Three Months Ended Mar 31, 2016 2015 (Unaudited) (Unaudited) Net income (loss) $ 5,028 $ (8,265 ) Remeasurement of preferred shares 300 (120 ) Remeasurement of Series E units — (1,838 ) Gain on conversion of Series E units (11,463 ) — Depreciation and amortization 69,517 53,664 Acquisition fees and costs expensed 5,653 5,908 Noncash share-based compensation expense 870 696 Interest expense 30,977 15,670 General and administrative expense 8,057 6,131 Property operating expenses for vacant single-family properties (1) — 5,278 Other expenses 1,253 694 Other revenues (3,985 ) (1,365 ) Tenant charge-backs 21,016 8,372 Expenses reimbursed by tenant charge-backs (21,016 ) (8,372 ) Bad debt expense excluded from operating expenses 1,069 1,271 Bad debt expense included in revenues (1,069 ) (1,271 ) Core net operating income $ 106,207 $ 76,453 (1) Beginning January 1, 2016, property operating expenses for vacant single-family properties has been included in property operating expenses in the condensed consolidated statements of operations. EBITDA / Adjusted EBITDA EBITDA is defined as earnings before interest, taxes, depreciation and amortization. EBITDA is a non-GAAP financial measure and is used by us and others as a supplemental measure of performance. Adjusted EBITDA is a supplemental non-GAAP financial measure calculated by adjusting EBITDA for (1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (2) noncash share-based compensation expense, (3) gain or loss on conversion of convertible units and (4) noncash fair value adjustments associated with remeasuring our Series E convertible units liability and preferred shares derivative liability to fair value. We consider Adjusted EBITDA to be a meaningful financial measure of operating performance because it excludes the impact of various income and expense items that are not indicative of operating performance.

American Homes 4 Rent 20 Defined Terms and Non-GAAP Reconciliations (continued) The following is a reconciliation of net income (loss), determined in accordance with GAAP, to Adjusted EBITDA for the three months ended March 31, 2016 and 2015 (amounts in thousands): For the Three Months Ended Mar 31, 2016 2015 (Unaudited) (Unaudited) Net income (loss) $ 5,028 $ (8,265 ) Depreciation and amortization 69,517 53,664 Interest expense 30,977 15,670 EBITDA $ 105,522 $ 61,069 Acquisition fees and costs expensed 5,653 5,908 Noncash share-based compensation expense 870 696 Gain on conversion of Series E units (11,463 ) — Remeasurement of preferred shares 300 (120 ) Remeasurement of Series E units — (1,838 ) Adjusted EBITDA $ 100,882 $ 65,715 Economic Occupancy Economic occupancy is calculated as core revenues divided by the product of (1) average contractual monthly rent, (2) total number of properties and (3) number of months in period. FFO / Core FFO / Adjusted FFO attributable to common share and unit holders FFO attributable to common share and unit holders is a non-GAAP financial measure that we calculate in accordance with the White Paper on FFO approved by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”), which defines FFO as net income or loss calculated in accordance with GAAP, excluding extraordinary items, as defined by GAAP, gains and losses from sales or impairment of real estate, plus real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets), and after adjustment for unconsolidated partnerships and joint ventures. Core FFO attributable to common share and unit holders is a non-GAAP financial measure that we use as a supplemental measure of our performance. We compute this metric by adjusting FFO attributable to common share and unit holders for (1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (2) noncash share-based compensation expense, (3) noncash interest expense related to acquired debt, (4) noncash gain or loss on conversion of convertible units and (5) noncash fair value adjustments associated with remeasuring our Series E convertible units liability and preferred shares derivative liability to fair value. Adjusted FFO attributable to common share and unit holders is a non-GAAP financial measure that we use as a supplemental measure of our performance. We compute this metric by adjusting Core FFO attributable to common share and unit holders for (1) recurring capital expenditures that are necessary to help preserve the value and maintain functionality of our properties and (2) actual leasing costs incurred during the period. As many of our homes are still recently acquired and / or renovated, we estimate recurring capital expenditures for our entire portfolio by multiplying (a) current period actual capital expenditures per Same-Home property by (b) our total number of properties, excluding non-stabilized and held for sale properties. We present FFO attributable to common share and unit holders, as well as on a per FFO share and unit basis, because we consider this metric to be an important measure of the performance of real estate companies, as do many analysts in evaluating our Company. We believe that FFO attributable to common share and unit holders is a helpful measure of a REIT’s performance

American Homes 4 Rent 21 Defined Terms and Non-GAAP Reconciliations (continued) since this metric excludes depreciation, which is included in computing net income and assumes the value of real estate diminishes predictably over time. We believe that real estate values fluctuate due to market conditions and in response to inflation. We also believe that Core FFO and Adjusted FFO attributable to common share and unit holders, as well as on a per FFO share and unit basis, are helpful to investors as supplemental measures of the operating performance of our Company as they allow investors to compare our operating performance to prior reporting periods without the effect of certain items that, by nature, are not comparable from period to period. FFO, Core FFO and Adjusted FFO attributable to common share and unit holders are not a substitute for net cash flow provided by operating activities or net income (loss) per share, as determined in accordance with GAAP, as a measure of our liquidity, operating performance or ability to pay dividends. These metrics also are not necessarily indicative of cash available to fund future cash needs. Because other REITs may not compute these measures in the same manner, they may not be comparable among REITs. Refer to Funds from Operations for a reconciliation of these metrics to net loss attributable to common shareholders, determined in accordance with GAAP. FFO Shares and Units FFO shares and units includes weighted-average common shares and operating partnership units outstanding. Leased Property A property is classified as leased upon the execution (i.e., signature) of a lease agreement. Occupied Property A property is classified as occupied upon commencement (i.e., start date) of a lease agreement, which can occur contemporaneously with or subsequent to execution (i.e., signature). Retention Rate Retention rate is calculated as the number of renewed leases in a given period divided by the sum of total lease expirations and early terminations during the same period. Same-Home Property A property is classified as Same-Home if it has been stabilized longer than 90 days prior to the beginning of the earliest period presented under comparison. A property is removed from Same-Home if it has been classified as held for sale. Stabilized Property Single-family properties that we acquire individually (i.e., not through a bulk purchase) are classified as either stabilized or non- stabilized. A property is classified as stabilized once it has been renovated and then initially leased or available for rent for a period greater than 90 days. Total Debt Total Debt includes principal balances on asset-backed securitizations, exchangeable senior notes, secured notes payable and borrowings outstanding under our credit facility as of end of period and excludes unamortized discounts on acquired debt, the value of exchangeable senior notes classified within equity and unamortized deferred loan costs.

American Homes 4 Rent 22 Defined Terms and Non-GAAP Reconciliations (continued) Total Equity Capitalization Total equity capitalization represents the market value of all outstanding common shares and operating partnership units (based on the NYSE AMH Class A common share closing price as of end of period) and the current liquidation value of preferred shares as of end of period. Total Market Capitalization Total market capitalization includes total equity capitalization and total debt. Turnover Rate Turnover rate is calculated as the number of tenant move-outs during the period, divided by total number of properties.

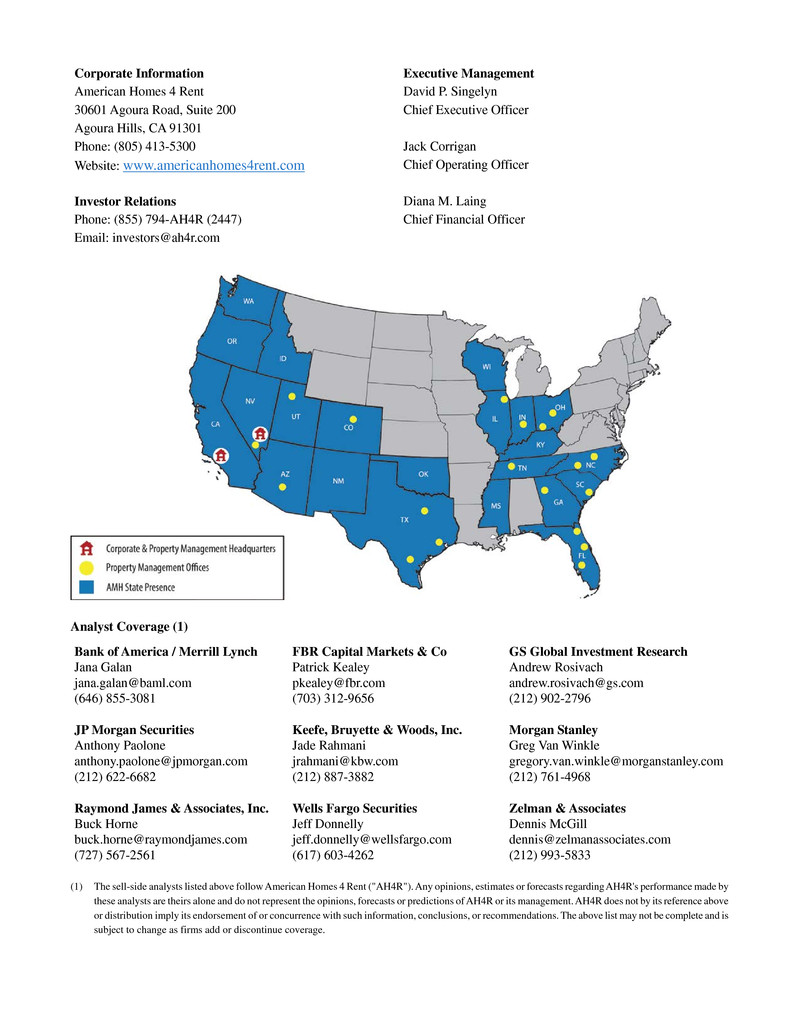

Corporate Information Executive Management American Homes 4 Rent David P. Singelyn 30601 Agoura Road, Suite 200 Chief Executive Officer Agoura Hills, CA 91301 Phone: (805) 413-5300 Jack Corrigan Website: www.americanhomes4rent.com Chief Operating Officer Investor Relations Diana M. Laing Phone: (855) 794-AH4R (2447) Chief Financial Officer Email: investors@ah4r.com Analyst Coverage (1) Bank of America / Merrill Lynch FBR Capital Markets & Co GS Global Investment Research Jana Galan Patrick Kealey Andrew Rosivach jana.galan@baml.com pkealey@fbr.com andrew.rosivach@gs.com (646) 855-3081 (703) 312-9656 (212) 902-2796 JP Morgan Securities Keefe, Bruyette & Woods, Inc. Morgan Stanley Anthony Paolone Jade Rahmani Greg Van Winkle anthony.paolone@jpmorgan.com jrahmani@kbw.com gregory.van.winkle@morganstanley.com (212) 622-6682 (212) 887-3882 (212) 761-4968 Raymond James & Associates, Inc. Wells Fargo Securities Zelman & Associates Buck Horne Jeff Donnelly Dennis McGill buck.horne@raymondjames.com jeff.donnelly@wellsfargo.com dennis@zelmanassociates.com (727) 567-2561 (617) 603-4262 (212) 993-5833 (1) The sell-side analysts listed above follow American Homes 4 Rent ("AH4R"). Any opinions, estimates or forecasts regarding AH4R's performance made by these analysts are theirs alone and do not represent the opinions, forecasts or predictions of AH4R or its management. AH4R does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions, or recommendations. The above list may not be complete and is subject to change as firms add or discontinue coverage.