Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CARMIKE CINEMAS INC | d166124d8k.htm |

| Exhibit 99.1

|

Carmike Cinemas, Inc.

|

|

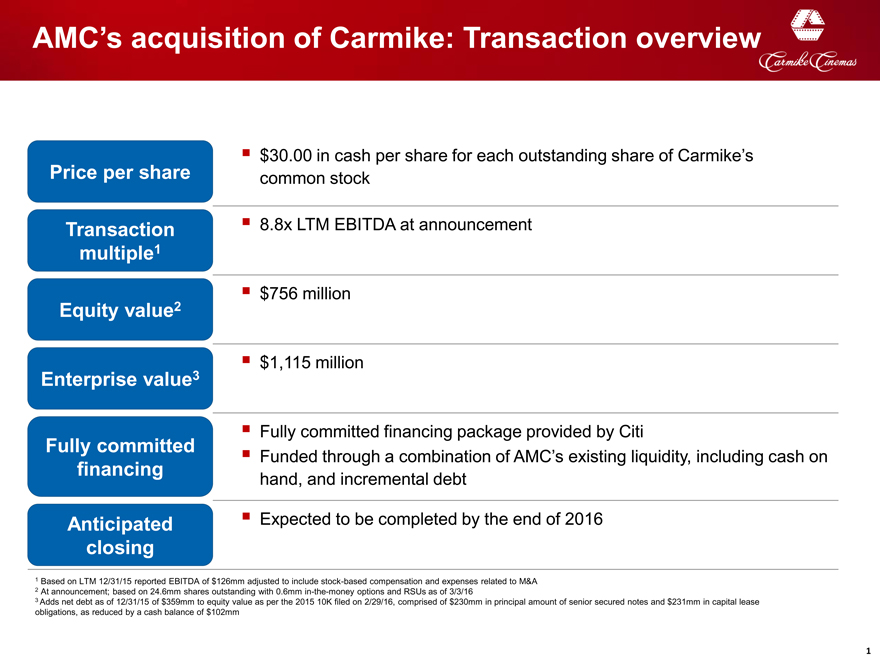

AMC’s acquisition of Carmike: Transaction overview

Price per share

Transaction multiple1

Equity value2

Enterprise value3

Fully committed financing

Anticipated

closing

$30.00 in cash per share for each outstanding share of Carmike’s common stock

8.8x LTM EBITDA at announcement $756 million $1,115 million

Fully committed financing package provided by Citi

Funded through a combination of AMC’s existing liquidity, including cash on hand, and incremental debt Expected to be completed by the end of 2016

1 Based on LTM 12/31/15 reported EBITDA of $126mm adjusted to include stock-based compensation and expenses related to M&A

2 At announcement; based on 24.6mm shares outstanding with 0.6mm in-the-money options and RSUs as of 3/3/16

3 Adds net debt as of 12/31/15 of $359mm to equity value as per the 2015 10K filed on 2/29/16, comprised of $230mm in principal amount of senior secured notes and $231mm in capital lease obligations, as reduced by a cash balance of $102mm

1

|

|

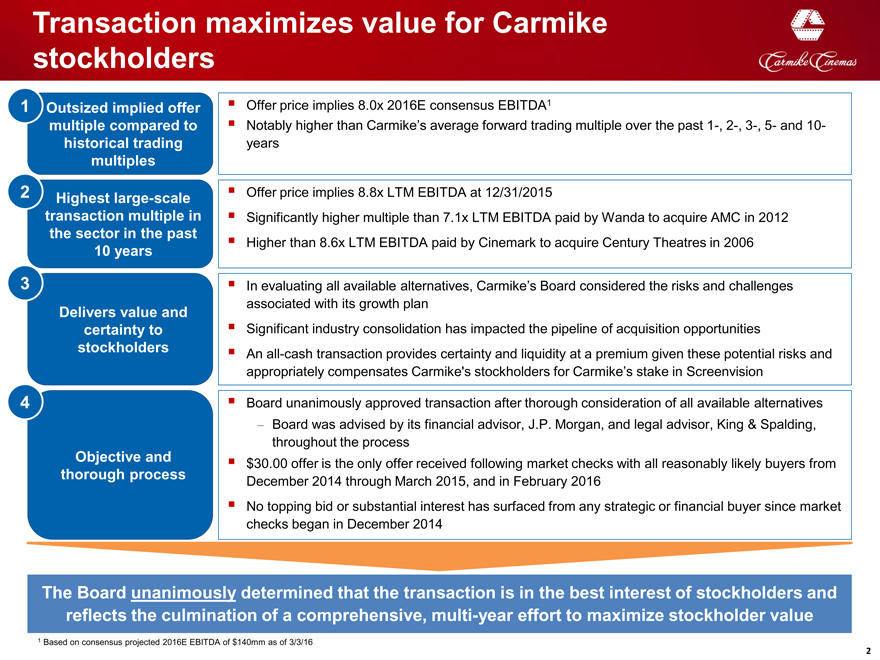

Transaction maximizes value for Carmike

stockholders

1 Outsized implied offer multiple compared to historical trading multiples

Highest large-scale transaction multiple in the sector in the past 10 years

3

Delivers value and certainty to stockholders

4

Objective and thorough process

Offer price implies 8.0x 2016E consensus EBITDA1

Notably higher than Carmike’s average forward trading multiple over the past 1-, 2-, 3-, 5- and 10- years

Offer price implies 8.8x LTM EBITDA at 12/31/2015

Significantly higher multiple than 7.1x LTM EBITDA paid by Wanda to acquire AMC in 2012

Higher than 8.6x LTM EBITDA paid by Cinemark to acquire Century Theatres in 2006

In evaluating all available alternatives, Carmike’s Board considered the risks and challenges associated with its growth plan

Significant industry consolidation has impacted the pipeline of acquisition opportunities

An all-cash transaction provides certainty and liquidity at a premium given these potential risks and appropriately compensates Carmike’s stockholders for Carmike’s stake in Screenvision

Board unanimously approved transaction after thorough consideration of all available alternatives

Board was advised by its financial advisor, J.P. Morgan, and legal advisor, King & Spalding, throughout the process

$30.00 offer is the only offer received following market checks with all reasonably likely buyers from December 2014 through March 2015, and in February 2016

No topping bid or substantial interest has surfaced from any strategic or financial buyer since market checks began in December 2014

The Board unanimously determined that the transaction is in the best interest of stockholders and reflects the culmination of a comprehensive, multi-year effort to maximize stockholder value

1 Based on consensus projected 2016E EBITDA of $140mm as of 3/3/16

2

|

|

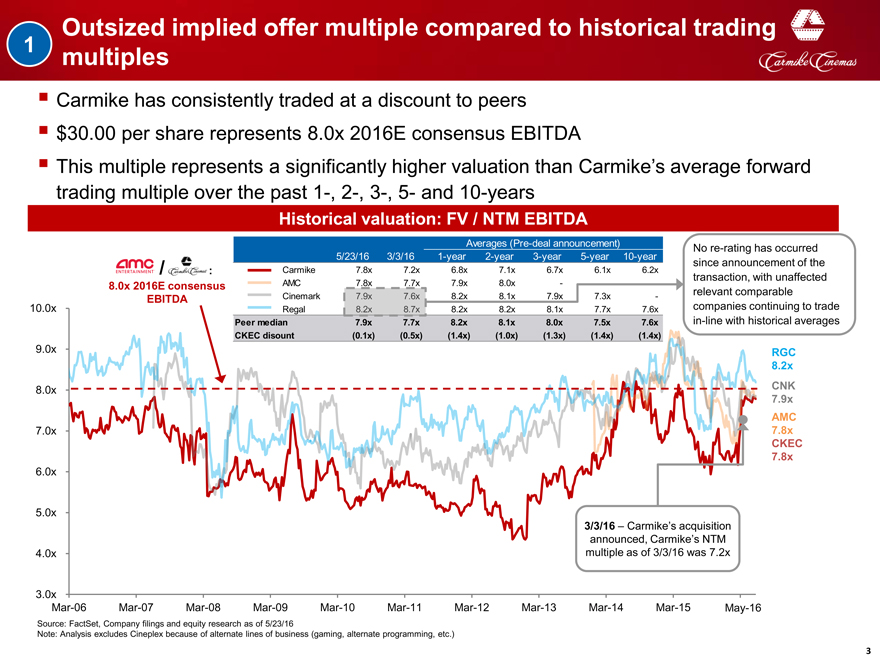

Outsized implied offer multiple compared to historical trading

1

multiples

Carmike has consistently traded at a discount to peers $30.00 per share represents 8.0x 2016E consensus EBITDA

This multiple represents a significantly higher valuation than Carmike’s average forward trading multiple over the past 1-, 2-, 3-, 5- and 10-years

Historical valuation: FV / NTM EBITDA

3

Averages (Pre-deal announcement) No re-rating has occurred

5/23/16 3/3/16 1-year 2-year 3-year 5-year 10-year

/ : Carmike 7.8x 7.2x 6.8x 7.1x 6.7x 6.1x 6.2x since announcement of the

transaction, with unaffected

8.0x 2016E consensus AMC 7.8x 7.7x 7.9x 8.0x ——— relevant comparable

EBITDA Cinemark 8.2x 8.1x 7.9x 7.3x —

10.0x Regal 8.2x 8.2x 8.1x 7.7x 7.6x companies continuing to trade

Peer median 7.9x 7.7x 8.2x 8.1x 8.0x 7.5x 7.6x in-line with historical averages

CKEC disount (0.1x) (0.5x) (1.4x) (1.0x) (1.3x) (1.4x) (1.4x)

9.0x RGC

8.2x

8.0x CNK

7.9x

AMC

7.0x 7.8x

CKEC

7.8x

6.0x

5.0x

3/3/16 – Carmike’s acquisition

announced, Carmike’s NTM

4.0x multiple as of 3/3/16 was 7.2x

3.0x

Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Feb-1May-16

Source: FactSet, Company filings and equity research as of 5/23/16

Note: Analysis excludes Cineplex because of alternate lines of business (gaming, alternate programming, etc.)

|

|

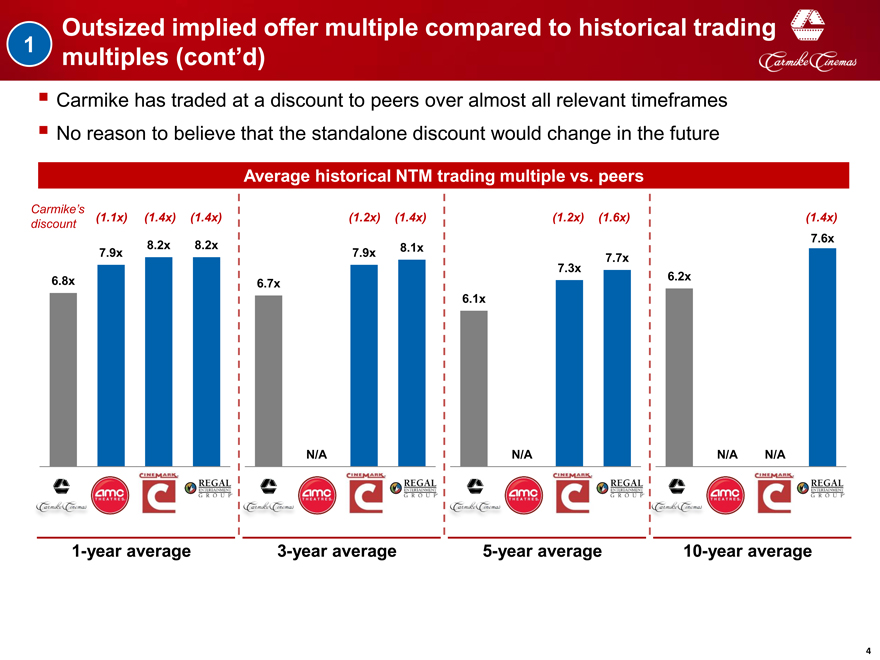

Outsized implied offer multiple compared to historical trading

1 multiples (cont’d)

Carmike has traded at a discount to peers over almost all relevant timeframes

No reason to believe that the standalone discount would change in the future

Average historical NTM trading multiple vs. peers

4

Carmike’s

discount (1.1x) (1.4x) (1.4x) (1.2x) (1.4x) (1.2x) (1.6x) (1.4x)

8.2x 8.2x 8.1x 7.6x

7.9x 7.9x 7.7x

7.3x

6.8x 6.7x 6.2x

6.1x

N/A N/A N/A N/A

1-year average 3-year average 5-year average 10-year average

|

|

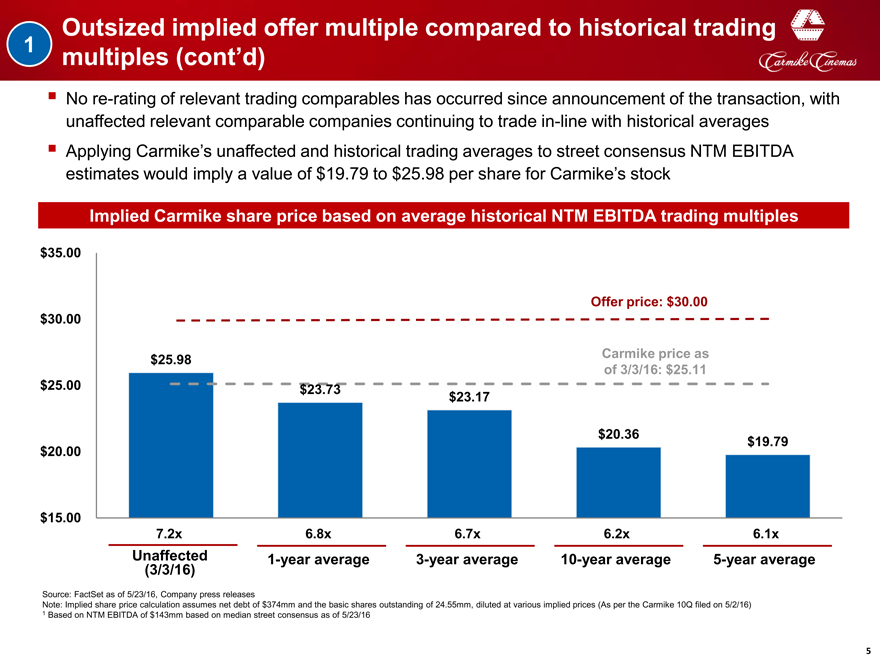

Outsized implied offer multiple compared to historical trading

1

multiples (cont’d)

No re-rating of relevant trading comparables has occurred since announcement of the transaction, with unaffected relevant comparable companies continuing to trade in-line with historical averages Applying Carmike’s unaffected and historical trading averages to street consensus NTM EBITDA estimates would imply a value of $19.79 to $25.98 per share for Carmike’s stock

Implied Carmike share price based on average historical NTM EBITDA trading multiples

$35.00

Offer price: $30.00

$30.00

$ 25.98 Carmike price as

of 3/3/16: $25.11

$25.00 $23.73

$23.17

$20.36 $19.79

$20.00

$15.00

7.2x 6.8x 6.7x 6.2x 6.1x

Unaffected 1-year average 3-year average 10-year average 5-year average

(3/3/16)

Source: FactSet as of 5/23/16, Company press releases

Note: Implied share price calculation assumes net debt of $374mm and the basic shares outstanding of 24.55mm, diluted at various implied prices (As per the Carmike 10Q filed on 5/2/16)

1 Based on NTM EBITDA of $143mm based on median street consensus as of 5/23/16

5

|

|

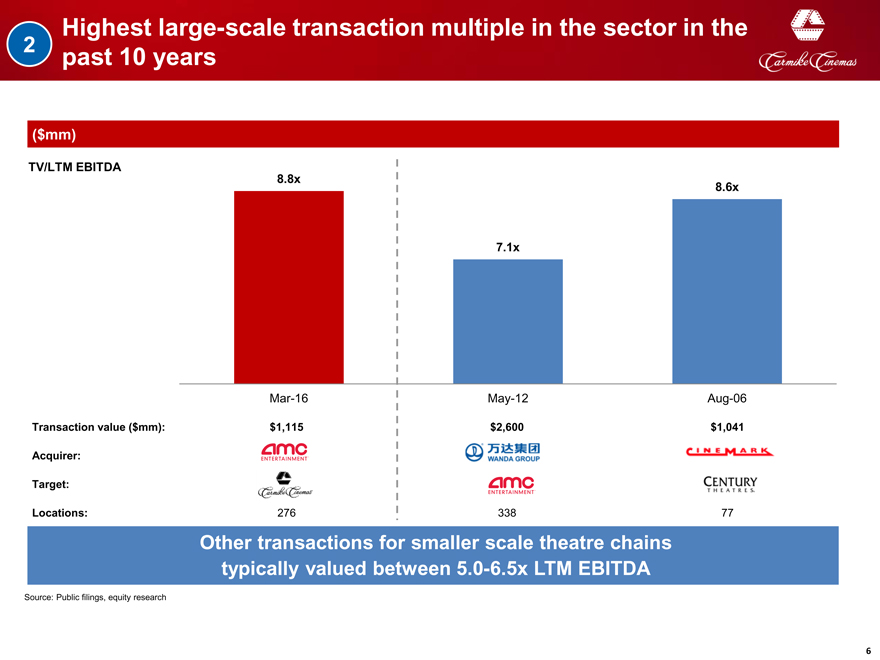

Highest large-scale transaction multiple in the sector in the

2 past 10 years

($mm)

TV/LTM EBITDA

8.8x

8.6x

7.1x

Mar-16 May-12 Aug-06

Transaction value ($mm): $1,115 $2,600 $1,041

Acquirer:

Target:

Locations: 276 338 77

Other transactions for smaller scale theatre chains

typically valued between 5.0-6.5x LTM EBITDA

Source: Public filings, equity research

6

|

|

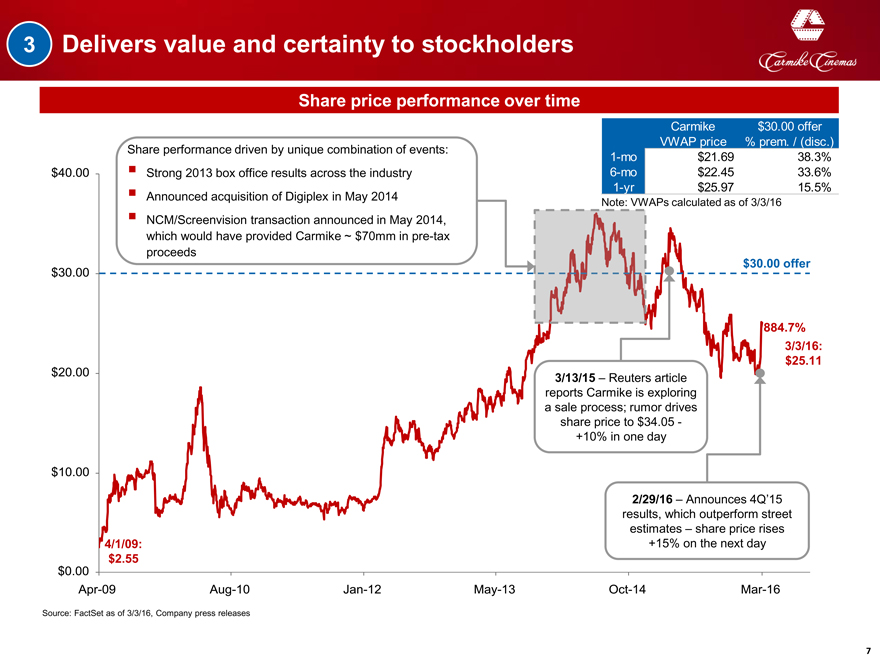

3 Delivers value and certainty to stockholders

Share price performance over time

Carmike $30.00 offer

VWAP price % prem. / (disc.)

Share performance driven by unique combination of events: 1-mo $21.69 38.3%

Strong 2013 box office results across the industry 6-mo $22.45 33.6%

Announced acquisition of Digiplex in May 2014 1-yr $25.97 15.5%

Note: VWAPs calculated as of 3/3/16

NCM/Screenvision transaction announced in May 2014,

which would have provided Carmike ~ $70mm in pre-tax

proceeds

$30.00 offer

3/3/16:

$25.11

3/13/15 – Reuters article

reports Carmike is exploring

a sale process; rumor drives

share price to $34.05—

+10% in one day

2/29/16 – Announces 4Q’15

results, which outperform street

estimates – share price rises

4/1/09: +15% on the next day

$2.55

Source: FactSet as of 3/3/16, Company press releases

7

|

|

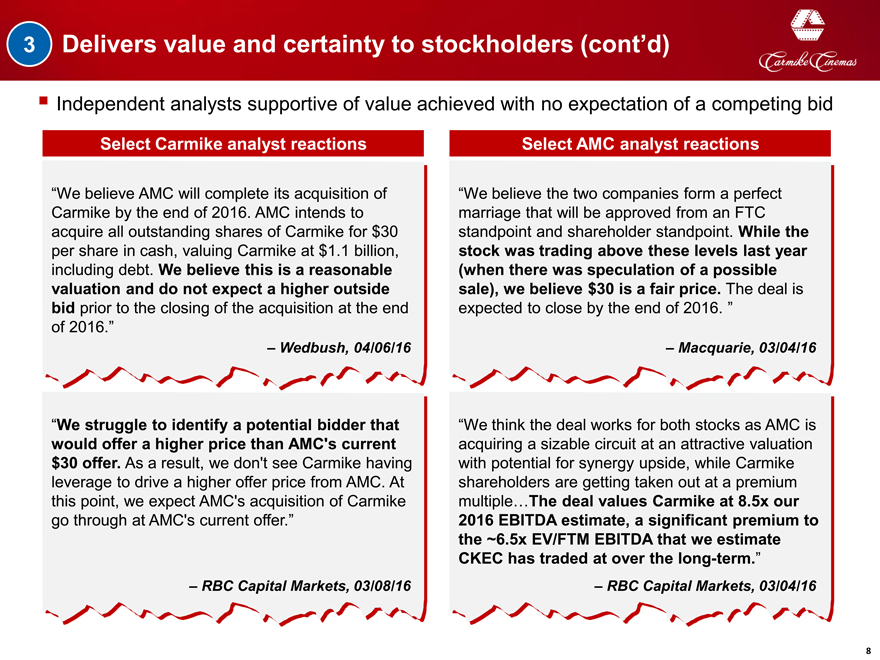

3 Delivers value and certainty to stockholders (cont’d)

Independent analysts supportive of value achieved with no expectation of a competing bid

Select Carmike analyst reactions

“We believe AMC will complete its acquisition of Carmike by the end of 2016. AMC intends to acquire all outstanding shares of Carmike for $30 per share in cash, valuing Carmike at $1.1 billion, including debt. We believe this is a reasonable valuation and do not expect a higher outside bid prior to the closing of the acquisition at the end of 2016.”

– Wedbush, 04/06/16

“We struggle to identify a potential bidder that would offer a higher price than AMC’s current $30 offer. As a result, we don’t see Carmike having leverage to drive a higher offer price from AMC. At this point, we expect AMC’s acquisition of Carmike go through at AMC’s current offer.”

– RBC Capital Markets, 03/08/16

Select AMC analyst reactions

“We believe the two companies form a perfect marriage that will be approved from an FTC standpoint and shareholder standpoint. While the stock was trading above these levels last year (when there was speculation of a possible sale), we believe $30 is a fair price. The deal is expected to close by the end of 2016. “

– Macquarie, 03/04/16

“We think the deal works for both stocks as AMC is acquiring a sizable circuit at an attractive valuation with potential for synergy upside, while Carmike shareholders are getting taken out at a premium multiple…The deal values Carmike at 8.5x our 2016 EBITDA estimate, a significant premium to the ~6.5x EV/FTM EBITDA that we estimate CKEC has traded at over the long-term.”

– RBC Capital Markets, 03/04/16

8

|

|

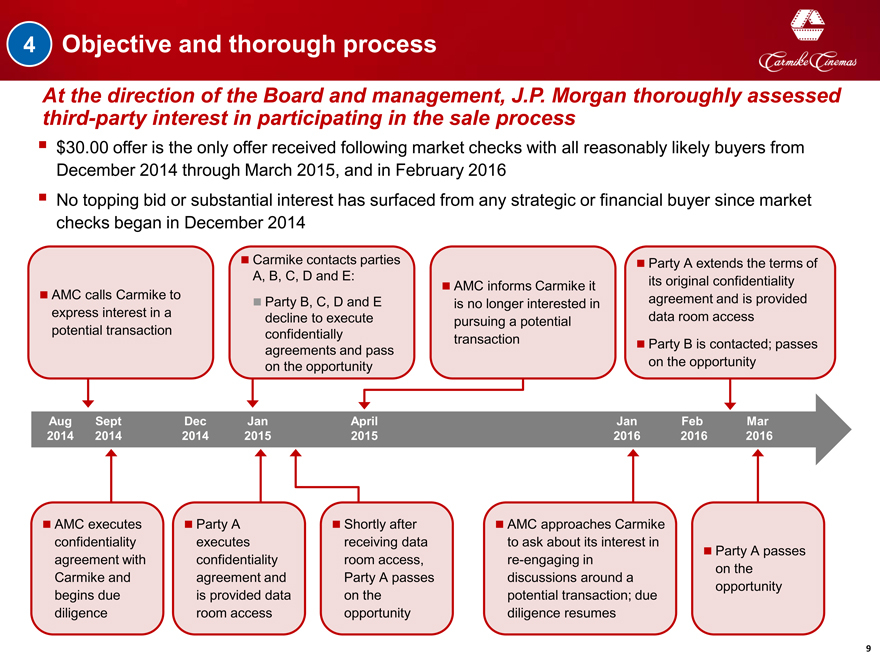

4 Objective and thorough process

At the direction of the Board and management, J.P. Morgan thoroughly assessed third-party interest in participating in the sale process

$30.00 offer is the only offer received following market checks with all reasonably likely buyers from December 2014 through March 2015, and in February 2016

No topping bid or substantial interest has surfaced from any strategic or financial buyer since market checks began in December 2014

Carmike contacts parties Party A extends the terms of

A, B, C, D and E:

AMC informs Carmike it its original confidentiality

AMC calls Carmike to Party B, C, D and E is no longer interested in agreement and is provided

express interest in a decline to execute pursuing a potential data room access

potential transaction confidentially

agreements and pass transaction Party B is contacted; passes

on the opportunity on the opportunity

Aug Sept Dec Jan April Jan

2014 2014 2014 2015 2015 2016

AMC executes confidentiality agreement with Carmike and begins due diligence

Party A executes confidentiality agreement and is provided data room access

Shortly after receiving data room access, Party A passes on the opportunity

AMC approaches Carmike to ask about its interest in re-engaging in discussions around a potential transaction; due diligence resumes

Feb Mar

2016 2016

Party A passes on the opportunity

9

|

|

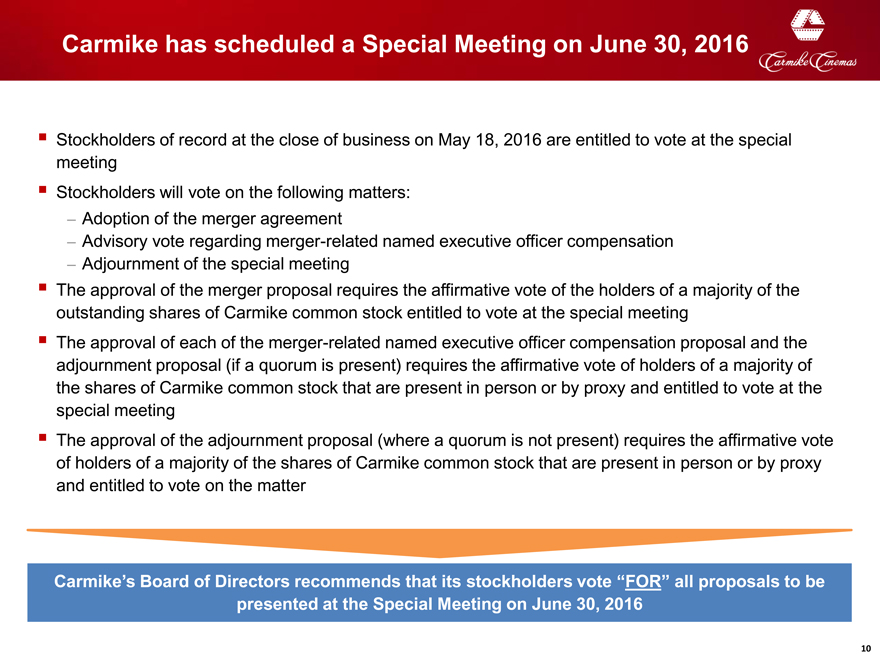

Carmike has scheduled a Special Meeting on June 30, 2016

Stockholders of record at the close of business on May 18, 2016 are entitled to vote at the special meeting

Stockholders will vote on the following matters:

Adoption of the merger agreement

Advisory vote regarding merger-related named executive officer compensation

Adjournment of the special meeting

The approval of the merger proposal requires the affirmative vote of the holders of a majority of the outstanding shares of Carmike common stock entitled to vote at the special meeting

The approval of each of the merger-related named executive officer compensation proposal and the adjournment proposal (if a quorum is present) requires the affirmative vote of holders of a majority of the shares of Carmike common stock that are present in person or by proxy and entitled to vote at the special meeting

The approval of the adjournment proposal (where a quorum is not present) requires the affirmative vote of holders of a majority of the shares of Carmike common stock that are present in person or by proxy and entitled to vote on the matter

Carmike’s Board of Directors recommends that its stockholders vote “FOR” all proposals to be

presented at the Special Meeting on June 30, 2016

10

|

|

Disclosure regarding forward-looking statements

This presentation contains forward-looking statements within the meaning of the federal securities laws. Statements that are not historical facts, including statements about Carmike Cinemas, Inc.’s (“Carmike”) beliefs, expectations and future performance, are forward-looking statements. Forward-looking statements include statements preceded by, followed by or that include the words, “believes,” “expects,” “anticipates,” “plans,” “estimates,” “seeks” or similar expressions. Forward-looking statements are only predictions and are not guarantees of performance. These statements are based on beliefs and assumptions of Carmike’s management, which in turn are based on currently available information. The forward-looking statements also involve risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Many of these factors are beyond Carmike’s ability to control or predict. Important factors that could cause actual results to differ materially from those contained in any forward-looking statement include, but are not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement with AMC

Entertainment Holdings, Inc. (“AMC”); the inability to complete the proposed merger due to the failure to obtain Carmike stockholder or regulatory approval for the proposed merger or the failure to satisfy other conditions of the proposed merger within the proposed timeframe or at all; disruption in key business activities or any impact on Carmike’s relationships with third parties as a result of the announcement of the proposed merger; the failure to obtain the necessary financing arrangements as set forth in the debt commitment letters delivered pursuant to the merger agreement with AMC, or the failure of the proposed merger to close for any other reason; risks related to disruption of management’s attention from Carmike’s ongoing business operations due to the proposed merger; the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted against Carmike and others relating to the merger agreement with AMC; the risk that the pendency of the proposed merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the pendency of the proposed merger; the amount of the costs, fees, expenses and charges related to the proposed merger; adverse regulatory decisions; unanticipated changes in the markets for Carmike’s business segments; general economic conditions in Carmike’s regional and national markets; Carmike’s ability to comply with covenants contained in the agreements governing Carmike’s indebtedness; Carmike’s ability to operate at expected levels of cash flow; financial market conditions including, but not limited to, changes in interest rates and the availability and cost of capital; Carmike’s ability to meet its contractual obligations, including all outstanding financing commitments; the availability of suitable motion pictures for exhibition in Carmike’s markets; competition in Carmike’s markets; competition with other forms of entertainment; the effect of Carmike’s leverage on its financial condition; prices and availability of operating supplies; the impact of continued cost control procedures on operating results; the impact of asset impairments; the impact of terrorist acts; changes in tax laws, regulations and rates; and financial, legal, tax, regulatory, legislative or accounting changes or actions that may affect the overall performance of Carmike’s business.

Consider these factors carefully in evaluating the forward-looking statements. Additional factors that may cause results to differ materially from those described in the forward-looking statements are set forth in Carmike’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016, under the heading “Item 1A. Risk Factors,” and in its subsequently filed reports with the U.S. Securities and Exchange Commission (the “SEC”), including Forms 10-Q and 8-K. Readers are cautioned not to place undue reliance on the forward-looking statements included in this presentation, which speak only as of the date hereof. Carmike does not undertake to update any of these statements in light of new information or future events, except as required by applicable law.

Important Additional Information Regarding the Merger

This presentation may be deemed to be solicitation material in respect of the proposed merger of Carmike with and into a wholly-owned subsidiary of AMC. In connection with the proposed merger, Carmike filed a definitive proxy statement with the SEC on May 23, 2016. Carmike mailed the definitive proxy statement to its stockholders on or about May 25,

2016. BEFORE MAKING ANY VOTING DECISION, CARMIKE’S STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT IN ITS ENTIRETY AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Carmike’s stockholders are able to obtain a free copy of the definitive proxy statement and other relevant documents filed by Carmike with the SEC at the SEC’s website at www.sec.gov. In addition, Carmike’s stockholders may obtain a free copy of the proxy statement and other relevant documents from Carmike’s website at http://www.carmikeinvestors.com/.

Participation in the Solicitation

Carmike and its directors, executive officers and certain other members of management and employees of Carmike may be deemed to be “participants” in the solicitation of proxies from Carmike’s stockholders in connection with the proposed merger. Information regarding the interests of the persons who may, under the rules of the SEC, be considered participants in the solicitation of Carmike’s stockholders in connection with the proposed merger, which may be different than those of Carmike’s stockholders generally, is set forth in the definitive proxy statement filed with the SEC on May 23, 2016. Carmike’s stockholders may obtain a free copy of the definitive proxy statement from Carmike in the manner set forth above.

11