Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Digital Turbine, Inc. | v440868_8-k.htm |

Exhibit 99.1

B. Riley 17 th Annual Investor Conference May 25, 2016

2 © 2016 Digital Turbine, Inc. Safe Harbor Statements . This presentation includes “forward - looking statements” within the meanings of the U . S . federal securities laws . Statements in this presentation that are not statements of historical fact and that concern future results from operations, financial position, economic conditions, product releases, and any other statement that may be construed as a prediction of future performance or events, including financial projections, new customers and growth in various products, are forward - looking statements that speak only as of the date made and which involve known and unknown risks, uncertainties and other factors which may, should one or more of these risks uncertainties or other factors materialize, cause actual results to differ materially from those expressed or implied by such statements . These factors include risks associated with DT Ignite adoption among existing customers (including the impact of possible delays with major carriers and OEM partners in the roll out for mobile phones deploying DT Ignite) ; actual mobile device sales and sell - through where DT Ignite is deployed is out of our control ; risks associated with the timing of the launch of the Samsung Galaxy S 7 ; new customer adoption and time to revenue with new carrier and OEM partners is subject to delays and factors out of our control ; risks associated with fluctuations in the number of DT Ignite slots across US carrier partners ; required customization and technical integration which may slow down time to revenue notwithstanding the existence of a distribution agreement ; risk that strong Apple iPhone sales could result in a disproportionately low amount of Android sales ; the difficulty of extrapolating monthly demand to quarterly demand ; the challenges, given the Company's comparatively small size, to expand the combined Company's global reach, accelerate growth and create a scalable, low capex business model that drives EBITDA (as well as Adjusted EBITDA) ; challenges to realize anticipated operational efficiencies, revenue (including projected revenue) and cost synergies and resulting revenue growth, EBITDA ( and Adjusted EBITDA) and free cash flow conversion from the Appia merger ; the impact of currency exchange rate fluctuations on our reported GAAP financial statements, particularly in regard to the Australian dollar ; ability as a smaller company to manage international operations ; varying and often unpredictable levels of orders ; the challenges inherent in technology development necessary to maintain the Company’s competitive advantage ; such as adherence to release schedules and the costs and time required for finalization and gaining market acceptance of new products ; changes in economic conditions and market demand ; rapid and complex changes occurring in the mobile marketplace ; pricing and other activities by competitors ; pricing risks associated with potential commoditization of the Appia Core as competition increases and new technologies add pricing pressure ; technology management risk as the company needs to adapt to complex specifications of different carriers and the management of a complex technology platform given the company's relatively limited resources, and other risks including those described from time to time in Digital Turbine’s filings on Forms 10 - K and 10 - Q with the SEC, press releases and other communications . You should not place undue reliance on these forward - looking statements . The Company does not undertake to update forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law .

3 Digital Turbine Investment Thesis • Clear Secular Tailwinds • Robust Demand for Our Comprehensive Suite of Products & Services • Unique/Highly - Defensible Competitive Position • Expanding Addressable Market Opportunity • Imminent Tier - 1 Customer Launches/Rich Customer Pipeline • Attractive Operative Leverage • Experienced/Motivated Management Team

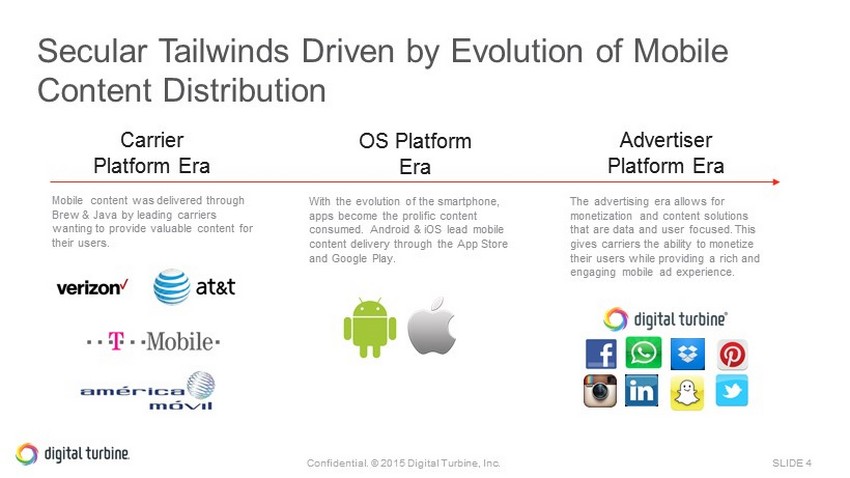

SLIDE 4 Confidential. © 2015 Digital Turbine, Inc. Mobile content was delivered through Brew & Java by leading carriers wanting to provide valuable content for their users. Carrier Platform Era With the evolution of the smartphone, apps become the prolific content consumed. Android & iOS lead mobile content delivery through the App Store and Google Play. OS Platform Era The advertising era allows for monetization and content solutions that are data and user focused. This gives carriers the ability to monetize their users while providing a rich and engaging mobile ad experience. Advertiser Platform Era Secular Tailwinds Driven by Evolution of Mobile Content Distribution

Carriers and OEM’s are actively seeking new sources of revenue to enhance profit margins from both advertising and data Current Market Trends Driving Opportunity Carriers are searching for relevance from a subscriber perspective (shed the “dumb pipe” label) by enhancing/personalizing the user experience The “App Economy” is here to stay – 80%+ of content consumed on smartphones is through apps ; meanwhile, app discovery is a growing challenge Content is king … but distribution is the emperor Mobile advertising is still in it’s infancy, as media spend remains significantly under - indexed on mobile versus traditional formats

6 © 2016 Digital Turbine, Inc. Solving Problems & Creating Opportunities For All Parties in Today’s App Economy Consumer • Assist with App discovery • Enhance/personalize the overall end - user experience by delivering more relevant content via proprietary data analytics engine Advertiser • Target & acquire new customers with unique home screen access • Provide measurable tracking data to maximize campaign ROI Operators and OEMs • Improve profit margins by more effectively monetizing valuable “beachfront” app property • Actively engage with subscribers to deliver a richer user experience (no longer a “dump pipe”) Right App. Right Person. Right Time.

7 © 2016 Digital Turbine, Inc. Five Products Across Our T wo Operating Segments Marketplace White - Labelled Content Stores Pay Simple Mobile Billing Ignite Drive Quality App Installs AdStream New User Acquisition Content Discover App Search & Discovery Advertising

ROI Post Install Event (PIE) Data App Redemption Point App Delivery - Silent - SDK - Wizard - Direct Campaign Management - Filtering, Targeting, Data Science - Recommendations Attribution and Tracking Device Type - Smartphone, Tablets - SIM Card - TV, Wearables , IoT App Provider The Ignite Platform End - to - End Solution

9 © 2016 Digital Turbine, Inc. Signed Contracts with Major Global Players Partnered with 30+ mobile operators and OEM’s Major anchor tenants in key geographies

10 © 2016 Digital Turbine, Inc. Travel Social Real Estate Finance Strong Demand for DT Media Advertising Inventory Digital Turbine works with top tier Advertisers & Advertising Agencies including the top grossing apps on the App Store and Google Play Retail Music Entertainment Gaming Shopping Agency

11 © 2016 Digital Turbine, Inc. Roadmap for Deployment of N ew M ajor Distributors Source: Company websites • Launched • 62M subs • Launched • 5 M subs/Embedded Base Push • Launch in June • 15M annual devices • Launched • 2M annual devices • Live • >100M subs • Netherlands & Czech launching new devices in June; additional market(s) in Sept quarter • >90M subs in Europe • Revenue in June quarter from embedded base pushes • 284M subs • Launch with Ignite Wizard in next 30 - 60 days • >10 New Devices Expected This Summer • 123m subs

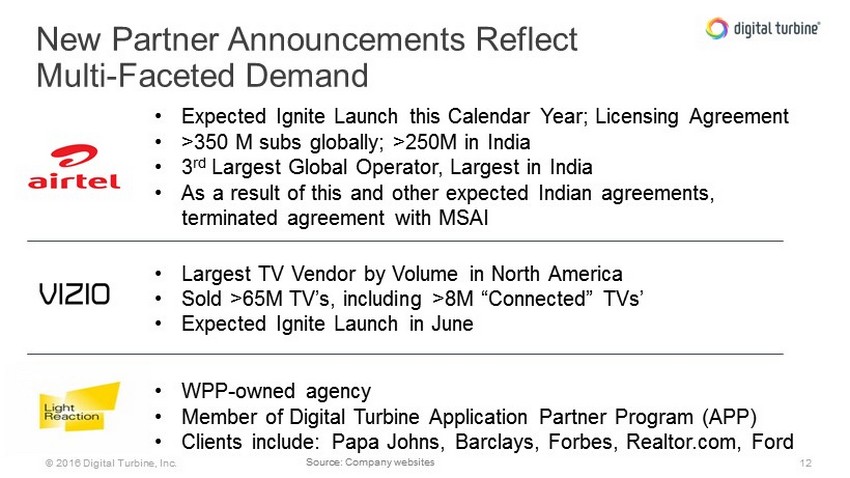

12 © 2016 Digital Turbine, Inc. New Partner Announcements Reflect Multi - Faceted Demand Source: Company websites • Expected Ignite Launch this Calendar Year; Licensing Agreement • >350 M subs globally; >250M in India • 3 rd Largest Global Operator, Largest in India • As a result of this and other expected Indian agreements, terminated agreement with MSAI • Largest TV Vendor by Volume in North America • Sold >65M TV’s, including >8M “Connected” TVs’ • Expected Ignite Launch in June • WPP - owned agency • Member of Digital Turbine Application Partner Program (APP) • Clients include: Papa Johns, Barclays, Forbes, Realtor.com, Ford

13 Operational and Financial Update Digital Turbine Media • Live on the S7 and S7 Edge phones at our largest North American carrier partner • Time to revenue for new customers significantly reduced • Revenues increasingly more diversified • Ignite Demand > Supply. Current pipeline strongest in the history of the Company • Encouraging results from initial embedded base activities; Material new opportunities poised to contribute in both June and September quarter • All - time record of bid rate increases on inventory; demand strong and growing • Expect continued Ignite growth as new partner revenues increase from March quarter A&P and Content • Expect collective growth Balance Sheet • $11.3 M in cash @ 3/31 • No new borrowings under AR SVB facility at FYE

Thank You Digital Turbine @ DigitalTurbine D igitalTurbine