Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atlantic Capital Bancshares, Inc. | acb-form8xkshareholderpres.htm |

1 2016 Annual Shareholders Meeting May 18, 2016

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a future or forward-looking nature. These forward- looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following risks, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the business of Atlantic Capital Bancshares, Inc. (“Atlantic Capital”) may not integrate successfully with the former First Security Group, Inc. (“First Security”) business, or the integration may be more difficult, time-consuming or costly than expected; (2) the expected growth opportunities and cost savings from the transaction with First Security may not be fully realized or may take longer to realize than expected; (3) revenues following the transaction may be lower than expected as a result of losses of customers or other reasons, including issues arising in connection with integration of First Security’s operations and the sale and pending sale of certain branches; (4) deposit attrition, operating costs, customer loss and business disruption following the transaction with First Security, including difficulties in maintaining relationships with employees, may be greater than expected; (5) reputational risks and the reaction of the companies’ customers to the acquisition of First Security; (6) diversion of management time on merger related issues; (7) changes in asset quality and credit risk; (8) the cost and availability of capital; (9) customer acceptance of the combined company’s products and services; (10) customer borrowing, repayment, investment and deposit practices; (11) the introduction, withdrawal, success and timing of business initiatives; (12) the impact, extent, and timing of technological changes; (13) severe catastrophic events in our geographic area; (14) a weakening of the economies in which the combined company will conduct operations may adversely affect its operating results; (15) the U.S. legal and regulatory framework, including those associated with the Dodd-Frank Wall Street Reform and Consumer Protection Act could adversely affect the operating results of the combined company; (16) the interest rate environment may compress margins and adversely affect net interest income; (17) changes in trade, monetary and fiscal policies of various governmental bodies and central banks could affect the economic environment in which we operate; (18) our ability to determine accurate values of certain assets and liabilities; (19) adverse behaviors in securities, public debt, and capital markets, including changes in market liquidity and volatility; (20) our ability to anticipate interest rate changes correctly and manage interest rate risk presented through unanticipated changes in our interest rate risk position and/or short- and long-term interest rates; (21) unanticipated changes in our liquidity position, including but not limited to our ability to enter the financial markets to manage and respond to any changes to our liquidity position; (22) adequacy of our risk management program; (23) increased costs associated with operating as a public company; (24) competition from other financial services companies in the companies’ markets could adversely affect operations; and (25) other factors described in Atlantic Capital’s reports filed with the Securities and Exchange Commission and available on the SEC’s website (www.sec.gov).

Proprietary & Confidential Key Strategic Objectives Since 2007 Provide shareholders with public market liquidity and value Establish a presence in additional southeastern metropolitan markets Diversify our business mix by adding new capabilities

Proprietary & Confidential First Security Merger Accelerated Organic Growth Strategic Expansion Paid $171 million in combination of 8.8 million Atlantic Capital shares and $47 million in cash $50 million subordinated notes $25 million private placement of common shares Listed on NASDAQ under symbol ACBI

Creating a leading middle market commercial bank operating along the I-75 corridor Geographic Expansion Merger expands geographic footprint Access to the Chattanooga and Knoxville metropolitan markets Chattanooga MSA has a diverse manufacturing and service sector economy and above average population and household income growth Knoxville is home to the University of Tennessee and Oak Ridge National Laboratory Georgia Atlanta Tennessee Chattanooga Knoxville Together, the Chattanooga and Knoxville markets have over $23 billion of bank deposits, according to FDIC statistics

Proprietary & Confidential Improved Business Mix Accelerated Organic Growth Strategic Expansion Core relationship banking in Atlanta, Chattanooga, and Knoxville New capabilities in trust and wealth management, residential mortgages, small business banking, and single credit tenant property finance Recent Atlantic Capital initiatives in SBA lending, franchise finance, and payments industry banking Repurposed office network in Eastern Tennessee 7 branches sold in 2nd quarter of 2016

Legacy Atlantic Capital Highlights 2015 Operating Performance Net operating income of $9.7 million, or $0.62 per diluted share Superior credit quality: Net charge-offs of 0.05% Non-performing assets/total assets were 0.40% at year end Net interest income Revenue dollars in millions 2014 2015 Legacy ACB FSG 2014 2015 $1,106 $2,262 $1,338 $1,048 $1,040 2014 2015 $1,315 $2,639 $1,519 Noninterest income Total Loans Assets Deposits $1,886

Proprietary & Confidential Priorities for 2016 Continue the trajectory of growth and profit improvement in legacy Atlantic Capital businesses Reposition legacy First Security businesses for improved performance Consider further geographic expansion, particularly de novo or team lift-out opportunities in other attractive metropolitan markets Complete integration of the acquired First Security businesses including the realization of estimated cost savings

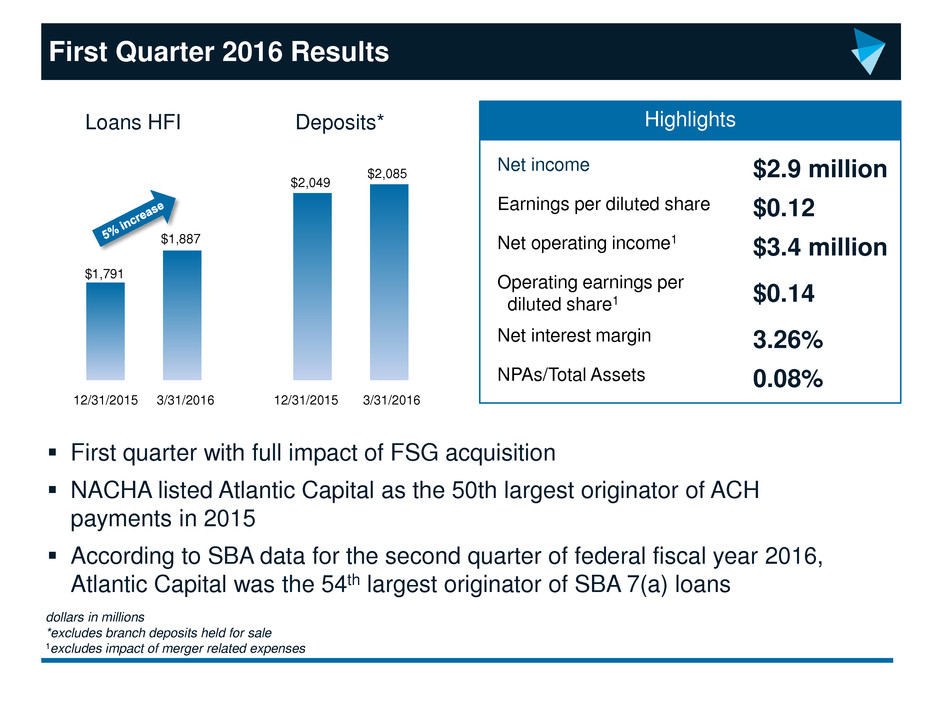

$1,887 Highlights First Quarter 2016 Results First quarter with full impact of FSG acquisition NACHA listed Atlantic Capital as the 50th largest originator of ACH payments in 2015 According to SBA data for the second quarter of federal fiscal year 2016, Atlantic Capital was the 54th largest originator of SBA 7(a) loans Net income $2.9 million Earnings per diluted share $0.12 Net operating income1 $3.4 million Operating earnings per diluted share1 $0.14 Net interest margin 3.26% NPAs/Total Assets 0.08% dollars in millions *excludes branch deposits held for sale 1excludes impact of merger related expenses Loans HFI Deposits* 12/31/2015 3/31/2016 3/31/2016 12/31/2015 $2,049 $2,085 $1,791

10