Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Energy Inc. | a8-kmorganstanleypresentat.htm |

PBF Energy Inc. (NYSE: PBF) Morgan Stanley Refining Corporate Access Day May 12, 2016

2 Safe Harbor Statements This presentation contains forward-looking statements made by PBF Energy Inc. (“PBF Energy”), the indirect parent of PBF Logistics LP (“PBFX” and together with PBF Energy, the “Companies”, or “PBF”), and their management teams. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions (including the pending acquisition of the Torrance Refinery and related logistics assets, the “Torrance Acquisition”) and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; ability to consummate pending acquisitions, the timing for the closing of any such acquisition and our plans for financing any acquisition; unforeseen liabilities associated with any pending acquisition; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date.

3 Fourth largest independent refiner with significantly enhanced asset base 884,000 bpd of crude oil capacity across five refineries(1) Recent acquisition of Chalmette and pending Torrance acquisition demonstrate disciplined growth while maintaining balance sheet flexibility Geographic diversity with presence in PADDs 1, 2, 3 and 5(1) Second most complex refiner in the U.S. with average Nelson Complexity of 12.2(1) Proven Track Record Proven track record of implementing organic projects that drive margin improvement Evaluating projects to reduce demurrage and restart idled units in Chalmette Successful permitting of a new hydrogen plant in Delaware City Increased margin through high-return petrochemical projects in Toledo Financial Flexibility Financial flexibility to execute disciplined growth strategy Conservative balance sheet and robust liquidity position Focused on maintaining capital discipline with >$1.2 billion of liquidity at 3/31/16 Strategic relationship with PBF Logistics Potential to generate cash proceeds from drop-downs to de-lever PBF Energy Experienced Leadership Team Decades of experience operating and managing refining assets Long and successful track record of executing profitable acquisitions and driving growth Focused on growth by acquisition Enhanced Asset Base Investment Highlights ___________________________ 1. Pro forma for the expected Q2 2016 close of the Torrance Acquisition that is located in PADD 5

4 Attractive Asset Diversification Fourth largest independent refiner in United States(1) Currently operates four oil refineries in Ohio, Delaware, New Jersey and Louisiana, and has entered into an agreement to acquire an additional refinery in California(1) PBF's core strategy is to operate safely and responsibly and grow and diversify through acquisitions PBF indirectly owns 100% of the general partner and ~50% of the limited partner interests of PBF Logistics LP (NYSE: PBFX), and 100% of the PBFX incentive distribution rights (“IDRs”) Region Throughput Capacity (bpd) Nelson Complexity Mid-continent 170,000 9.2 East Coast 370,000 12.2 Gulf Coast 189,000 12.7 West Coast(1) 155,000 14.9 Total (1) 884,000 12.2 ___________________________ 1. Pro forma for the expected Q2 2016 close of the Torrance Acquisition that is located in PADD 5 Paulsboro Toledo Chalmette Torrance PADD 2 PADD 3 PADD 5 Delaware City PADD 4 PADD 1

5 Crude cost advantages for complex refineries like Paulsboro, Delaware City and Chalmette translate to increased profitability Coking refineries, such as PBF’s three coastal refineries, have the flexibility to run a wide variety of crudes and can realize improved margins in low flat-price environments Refining dynamics in the Atlantic Basin have dramatically shifted ~2.6 million bpd of refining capacity has been rationalized in the Atlantic Basin since 2009 320 kbpd shut down in Delaware /Pennsylvania Regional Basin Paulsboro and Delaware City have transportation advantage vs. incoming pipelines and waterborne products Chalmette further enhances PBF’s ability to optimize product netbacks in the Atlantic Basin NEW JERSEY PENNSYLVANIA Philadelphia Delaware/Pennsylvania Basin Refining Landscape Refinery Capacity Delaware City 190,000 Paulsboro 180,000 Trainer (Delta) 185,000 Philadelphia (PES) 330,000 Marcus Hook (CLOSED) 175,000 Eagle Point (CLOSED) 145,000 Coastal Refinery Complexity Advantage East Coast Terminals Paulsboro Refinery Delaware City Refinery $9.00 $3.75 $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 PBF Coastal Crude Cost Advantage Lower Clean Product Yield Low-value Products (Sulfur, Pet Coke, CO2) PBF Heavy/Sour COGS Advantage Illustrative Heavy / Sour COGS Advantage 1. Comprised of $5/bbl premium for landed cost of light, sweet crude vs. ($4/bbl) discount for medium and heavy, sour crude to Dated Brent which represents a total crude advantage for refineries that are able to process medium and heavy, sour barrels ($0.75) ($4.50)

6 Commercial Optimization Crude sourcing flexibility and optionality PBF uses its complex crude processing capacity to source lowest cost input slate PBF is benefiting from the over-supply of waterborne crude which is driving increased competition and favorable pricing PBF is leveraging its expanded coastal refining portfolio to capitalize on economies of scale by sharing larger cargoes between assets Pursuing highest netback product distribution channels Actively marketing finished products in local refining markets The East Coast Terminals acquisition by PBFX provides additional capability in the greater Philadelphia market Entering the gasoline and distillate product export markets Increasing asphalt production, with Chalmette and Paulsboro, and becoming a larger supplier on the East Coast Refining Group Crude Slate Breakdown Source: Company reports, JP Morgan Research 0% 20% 40% 60% 80% 100% PBF PSX MPC TSO VLO HFC NTI ALJ DK WNR CVRR Medium / Heavy Light

7 Sector-Leading Capacity Growth Increased refining throughput capacity by over 60% in 12 months(1) Fourth largest and second most complex independent refining system in the U.S.(1) Exposure to West Coast, Gulf Coast, Mid-continent and East Coast markets(1) Increased scale provides commercial opportunities and resilience ___________________________ 1. Pro forma for the expected Q2 2016 close of the Torrance Acquisition that is located in PADD 5 2. Represents PBF prior to Chalmette acquisition US Independent Refiners by Capacity US Independent Refiners by Nelson Complexity Index Source: Company reports, Oil & Gas Journal data Source: Company reports, Oil & Gas Journal data 0 500 1,000 1,500 2,000 2,500 V L O P SX M P C P B F T SO P B F H F C A L J C V I W N R D K N T I 7 8 9 10 11 12 13 V L O P B F HF C M P C A L J N T I P B F P SX TS O C V I W N R D K (1 ) (1 ) (2 ) (2 )

8 Disciplined Growth Strategy(1) $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 R e fi n e ry Co st , $ /Com p le x it y -B a rr e l Denotes PBF Refinery ___________________________ 1. Pro forma for the expected Q2 2016 close of the Torrance Acquisition

9 189,000 bpd high-complexity, high-conversion refinery with Nelson Complexity of 12.7 Expands PBF’s existing commercial footprint Margin improvement opportunities associated with optimization of existing assets and restart of idled units Refined products include gasoline, diesel (ULSD), heating oil, LPG’s, petrochemicals and petroleum coke Strong logistics connectivity for raw material sourcing and product distribution Provides geographic diversification into PADD 3; increased PBF’s refining capacity by 35% Scale and diversification opportunities from potential transactions with PBFX Chalmette Refinery – PADD 3

10 Torrance Acquisition Highlights – PADD 5 $537.5 million purchase price for Torrance Refinery and associated logistics assets and is expected to close in Q2 2016 Assets to be acquired include 155,000 bpd high-complexity Torrance Refinery, multiple crude and product pipelines, two product terminals, and crude oil and product storage facilities; Nelson Complexity of 14.9 Market-based crude supply and product off-take agreements with ExxonMobil Further expands PBF’s existing commercial footprint Provides geographic diversification into PADD 5; increases PBF’s refining capacity by over 20% PBF believes the Torrance acquisition will be immediately accretive to earnings Added scale and diversification increases opportunities for transactions with PBFX Acquired assets include sophisticated Southern California logistics system

11 $120 $1,200 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Q4 2011 Q1 2016 Focus on Balance Sheet Strength Available Liquidity ($mm) PBF maintains a strong balance sheet with significant liquidity Ability to withstand commodity price fluctuations Positioned for growth through disciplined execution of strategic acquisition strategy ~1000% increase, or ~$1.1 billion, in liquidity since 2011 as PBF has executed its strategy Committed ABL Revolver increased by greater than $2 billion, or~425%, over the last 4 years Demonstrated access to capital markets ~$1.3 billion of debt and equity raised since May 2015 ABL Revolver Commitment ($mm) $500 $2,635 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Q4 2011 Q1 2016

12 PBFX is a Strategic and Valuable Partner to PBF Stable cash flows supported predominantly by long- term, take-or-pay Minimum Volume Commitments No direct commodity exposure Hard asset base consisting of crude and product storage, pipelines, and distribution and unloading facilities Vehicle allows PBF to drop-down logistics assets and utilize proceeds to de-lever and improve liquidity PBF's drop-down EBITDA backlog increased significantly with addition of logistics-related assets at Chalmette and Torrance Acquisition (1) PBF believes it has over $280 million(1) of MLP- qualifying EBITDA suitable for drop-downs to PBFX Provides alternative capital source to grow logistics asset base Summary of Executed Drop-Downs Announcement Date Asset Projected Annual EBITDA ($mm) Gross Sale Price ($mm) 9/15/2014 Delaware City Heavy Crude Unloading Rack $15 $150 12/2/2014 Toledo Storage Facility $15 $150 5/15/2015 Delaware City Pipeline / Truck Rack $14 $143 Total $44 $443 ___________________________ 1. Pro forma for the expected Q2 2016 close of the Torrance Acquisition

13 Closed acquisition of East Coast Terminals from Plains All American at a pro forma EBITDA multiple of ~7x Purchase price of $100 million, plus an upfront capital investment of ~$5 million Unaffiliated third-party transaction introduces third- party business to PBFX’s revenue base Diversifies PBFX asset and customer base and creates synergy opportunities with PBF Energy due to proximity of PBF Energy’s East Coast refineries Assets acquired include: 57 product tanks with a total shell capacity of approximately 4.2 million shell barrels Pipeline connections to the Colonial, Buckeye, Sunoco Logistics and other proprietary pipeline systems 26 truck loading lanes Marine facilities capable of handling barges and ships PBF Logistics Delivers Independent Growth

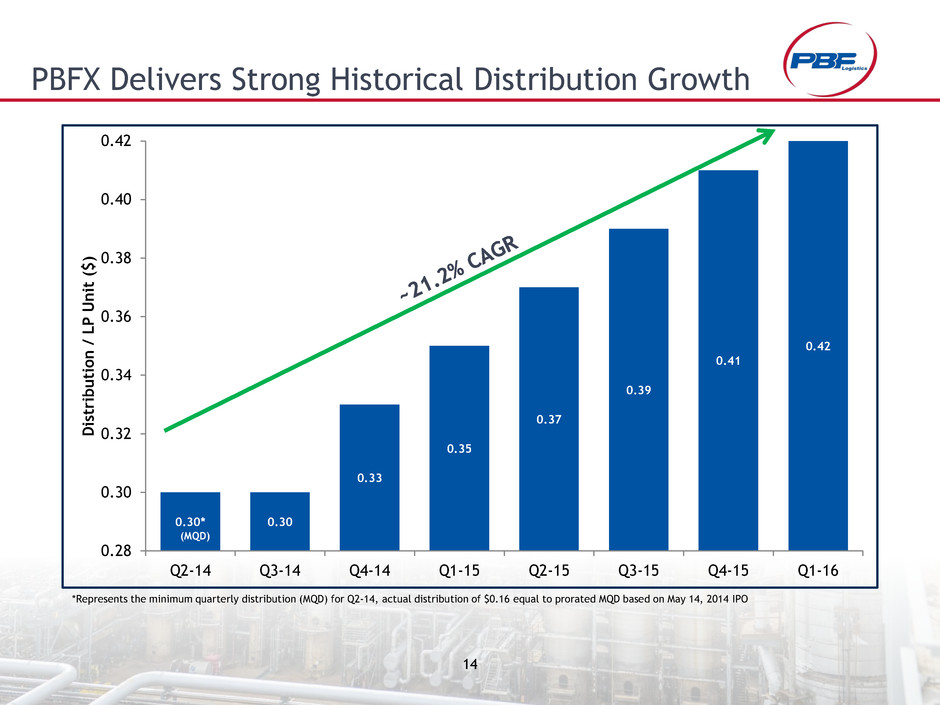

14 0.30* 0.30 0.33 0.35 0.37 0.39 0.41 0.42 0.28 0.30 0.32 0.34 0.36 0.38 0.40 0.42 Q2-14 Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 D is tr ib u ti o n / L P Uni t ( $ ) PBFX Delivers Strong Historical Distribution Growth (MQD) *Represents the minimum quarterly distribution (MQD) for Q2-14, actual distribution of $0.16 equal to prorated MQD based on May 14, 2014 IPO

1 5 Appendix

16 170,000 bpd light, sweet crude refinery located on a 282- acre site near Toledo, Ohio 9.2 Nelson Complexity Refined products include a high percentage of gasoline and diesel (USLD) High-conversion refinery; ~88% distillate and gasoline yield High-value petrochemical slate ~5% of total yield (Nonene, Tetramer, Toluene, Xylene and Benzene) Mid-Continent location and historic transportation rights provide access to major U.S. production basins and Western Canada Active in regional production plays with growth potential, including Utica (transload) and Lower Michigan (truck) Structurally competitive asset; 101% total yield Toledo Refinery – PADD 2

17 190,000 bpd refinery situated on a 5,000-acre site adjacent to the Delaware River 11.3 Nelson Complexity Refined products include gasoline, diesel (ULSD), heating oil, jet fuel, LPG’s, petrochemicals and petroleum coke Connected to major Northeast pipeline systems (Buckeye and Colonial) Medium and heavy sour crude refinery 18,000 bpd hydrocracker 47,000 bpd fluid coker (64% of East Coast coking capacity) Flexible crude sourcing from international and domestic producers utilized to maximize refining margins Export capability through Delaware River terminal complex Delaware City Refinery – PADD 1

18 180,000 bpd refinery located on 950 acres adjacent to the Delaware River Complex refinery; 13.2 Nelson Complexity Refined products include gasoline, jet fuel and heating oil, asphalt, as well as Group I lubricating oil Group I lubricant production of ~7,000 bpd; lubes and light products contract with ExxonMobil Connected to major Northeast pipeline systems (Buckeye and Colonial) Dedicated jet fuel pipeline to the Philadelphia Airport Reconfigured in 2012 to focus on a simplified crude slate Swing between asphalt and pet-coke production Export capability through Delaware River terminal complex Paulsboro Refinery – PADD 1