Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | a8-kx20160510xsecondquarte.htm |

May 2016 Second Quarter 2016 Update

Statements in this presentation that are based on other than historical data or that express the Company’s expectations regarding future events or determinations are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Statements based on historical data are not intended and should not be understood to indicate the Company’s expectations regarding future events. Forward-looking statements provide current expectations or forecasts or intentions regarding future events or determinations. These forward-looking statements are not guarantees of future performance or determinations, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those presented, either expressed or implied, in this presentation. Factors that could cause actual results to differ materially from those expressed in the forward-looking statements include the actual amount and duration of declines in the price of oil and gas, our ability to meet our efficiency and noninterest expense goals, as well as other factors discussed in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”) and available at the SEC’s Internet site (http://www.sec.gov). Except as required by law, the Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments. 2 Forward-Looking Statements

Bank Headquarters Assets % of Total Zions Bank Salt Lake City $20B 33% Amegy Houston $14B 23% CB&T San Diego $12B 20% NB|AZ Phoenix $5B 8% NSB Las Vegas $4B 7% Vectra Denver $3B 6% Commerce Bank - WA/OR Seattle $1B 2% Zions Bancorporation Salt Lake City $60B 100% Strategic local “ownership” of market opportunities and challenges Superior local customer access to bank decision makers relative to big nationals Footprint (by deposit market share) is located in high-growth markets A Collection of Community Banks Local decision-making and top-notch service separate Zions from peers 3 0% 1% 2% 3% 4% 5% 6% ZI O N B O K F B B T EW B C FR C M TB K EY R F ST I FH N SN V C FG C M A A SB PB C T C B SH FI TB H BA N Nominal GDP Footprint Growth Comparison weighted based on deposits Source: SNL Financial, BEA.gov, Zions’ calculations, using simple average of trailing 10 years of annual GDP growth by state multiplied by the percent of deposits in each state

Superior Brand: Nationally Recognized for Excellence • Ranked #1 Nationally by Greenwich Associates (2015) • Thirty-One (31) Greenwich Excellence Awards in small business and middle market banking This year including: Excellence: Overall Satisfaction (seven consecutive years) Excellence: Likelihood to Recommend Excellence: Treasury Management (seven consecutive years) Excellence: Treasury Management Product Capabilities (sole winner in 2015) Zions is one of only four (4) banks that have been consistently awarded more than 10 Excellence awards since 2009, when the first survey was conducted. The biggest four domestic U.S. banks experienced a median of only one (1) award in 2015 • Top team of women bankers – American Banker1 • Amegy Bank named Ex-Im Bank Small Business Lender of the Year2 • California Bank & Trust consistently voted Best Bank in San Diego and Orange Counties3 • National Bank of Arizona voted #1 Bank in Arizona 13 straight years4 4 1. One of five winning teams, 2015, Zions Bank; 2. exim.gov, April 24, 2014; 3.Readers of the San Diego Union- Tribune, August 2015, for 5 years; Orange County Register, for two years in a row; 4.Ranking Arizona, 2015

9% 38% 21% 16% 16% 4% 30% 9% 29% 23% Cash Commercial Loans Commercial Real Estate Loans Consumer Loans Securities Earning Assets 5 Zions Is a Commercially-Oriented Bank 59% of earning assets are commercial loans (vs. 39% for peers), and 38% of earning assets are funded by noninterest bearing deposits (vs. 24% for peers) 38% 48% 2% 12% 1.4% 24% 54% 10% 11% 0.4% 0% 10% 20% 30% 40% 50% 60% Noninterest- Bearing Deposits Interest- Bearing Deposits Total Debt Common Equity + AOCI Pref Equity Liabilities and Equity Source: SNL Financial, data as of 4Q15 for peers, 1Q16 for ZION. Income ratios based on full year results. Noninterest income excludes securities gains / losses. Major categories of assets and liabilities included, and percentages expressed as a sum of the total of the categories; does not include other assets or liabilities, such as property, equipment, accounts payable, etc. Median calculated by major category; as such, the sum of the median ratios does not equal 100%. Average period balances used for ZION. 78% 22% 62% 38% 0% 20% 40% 60% 80% Net Interest Income Noninterest Income Revenue ZION Peer Median

$0 $5,000 $10,000 $15,000 $20,000 $25,000 WF C B A C JP M US B B B T P N C ZIO N M TB R F C ST I H B A N FIT B CM A KE Y U B Commercial Loans Sized $100k - $1M Small Business Lending: Zions Punches Above Its Weight 6 Source: Call report data via SNL Financial, as of 4Q15; peer group shown different than typical peer group in order to show the position of the largest U.S. banks (In millions) 0% 5% 10% 15% 20% 25% ZIO N B B T H B A N M TB R F US B WF C JP M B A C P N C KE Y CM A C ST I FIT B U B Commercial Loans Sized $100k-$1M as a percent of total commercial loans

Top Quartile Balance Sheet: Capital and reserve ratios are among the strongest, debt ratio the lowest of peers Note: Regulatory capital ratios are Basel III. Source: SNL Financial, data as of 4Q15 for peers, 1Q16 for ZION. 7 12.13% 9% 10% 11% 12% 13% ZIO N B O K F CF G C B SH M TB KE Y R F FR C FM ER CM A EWB C FH N SN V B B T ST I FIT B H B A N PB C T A SB Common Equity Tier 1 Capital Ratio 13.9% 9% 10% 11% 12% 13% 14% 15% ZIO N FR C M TB C B SH B O K F CF G B B T FH N R F KE Y FIT B ST I EWB C FM ER CM A H B A N SN V A SB PB C T Tier 1 Risk-Based Capital Ratio 1.64% 0.0% 0.5% 1.0% 1.5% 2.0% ZIO N A SB FIT B R F KE Y B O K F CM A H B A N ST I CF G C B SH FH N EWB C M TB B B T SN V FM ER PB C T FR C Total Allowance for Credit Losses / Loans 18% 0% 50% 100% 150% 200% 250% ZIO N CM A EWB C R F ST I SN V CF G FM ER FR C C B SH KE Y M TB FH N H B A N FIT B B B T PB C T A SB B O K F Debt / Tier 1 Common Capital (CET1)

8 Source: SNL Financial, data as of 1Q16. Note: FRC and PBCT have insufficient history to be included in the 1990-2015 analysis. 0.00% 0.50% 1.00% 1.50% 2.00% B O K F M TB C B SH EW B C A SB ZI O N CM A B B T FM ER C FG ST I R F H B A N FIT B KE Y FH N SN V Average Annual NCOs / Loans 1990-2015 0.00% 0.50% 1.00% 1.50% 2.00% B O K F FR C EWB C PB C T ZIO N SN V FH N M TB H B A N CM A A SB ST I FME R KE Y C B SH CF G R F B B T FIT B Last 12 Months NCOs / Avg Loans FR C C B SH ST I EWB C PB C T B B T KE Y FIT B H B A N CM A FME R ZIO N CF G A SB B O K F SN V M TB FH N R F Last 4 Quarter Average (NPAs + 90DPD) / (Loans + OREO) Credit Quality: Through-the-cycle losses rank in the best quartile of peers; current ratios slightly elevated from normal levels due to energy lending

2016-2017 Objectives: Growth Through Simplification and Focus 9 • Accelerate Positive Operating Leverage • Accelerate loan growth rates • Invest cash into medium duration securities • Maintain mid-single digit growth rates in core fee income • Maintain non-interest expenses below $1.58 billion1 in 2016, increasing somewhat in 2017, made possible through simplification of • Business processes • Legal organization • Compensation: Tighter incentive compensation linked to achievement of articulated efficiency ratio targets • Implement Technology Strategies: Achieve substantial progress on core systems upgrade • Increase the Return on and of Capital • Improvements in operating leverage and loan growth lead to stronger returns on capital • Improved risk profile and risk management should lead to better returns of capital • Execute on our community bank model – doing business on a “local” basis 1 Modified by $20 million lower from the original stated target of less than $1.60 billion due to an accounting adjustment that took place in 1Q16 where Zions moved expense associated with credit and corporate card rewards program expense to net against associated revenue.

First Quarter Highlights 10 Strong 21% pre-provision net revenue growth over year-ago period Strong loan growth (7.6% annualized), building on the prior quarter’s strength Achieving positive operating leverage: solid progress in 1Q16, expect continuation throughout 2016 Tracking on efficiency initiative • Adjusted noninterest expense declined from the prior quarter, despite seasonally elevated payroll tax and accruals for certain incentive compensation plans • Efficiency ratio improved by 106 basis points from 4Q15 to 68.5% Deploying cash to short-to-medium duration securities Credit quality remains healthy despite continued pressure within Oil & Gas portfolio Earnings per share increased slightly vs. year-ago period, substantially restrained due to transitory weakness in energy loan portfolio.

21% -5% 0% 5% 10% 15% 20% 25% FIT B ZIO N CF G EWB C FR C H B A N M TB PB C T FH N SN V A SB KE Y B B T B O K F C B SH CM A ST I R F FM ER Year over Year PPNR Improvement2 Pre-Provision Net Revenue Second best growth of peers over the past year 11 1 Adjusted for items such as severance, provision for unfunded lending commitments, and debt extinguishment costs. See the GAAP to non-GAAP reconciling table on slide 41. FITB’s YoY growth includes gains on Vantiv investment. 2 Source: SNL Financial; data as of 4Q15 for peers, 1Q16 for ZION. 151 160 171 174 182 $100 $125 $150 $175 $200 1Q15 2Q15 3Q15 4Q15 1Q16 Pre-Provision Net Revenue1 In Millions

$36,000 $37,750 $39,500 $41,250 $43,000 1Q15 2Q15 3Q15 4Q15 1Q16 Total Loans Total Loan Growth 12 In Millions • Loan growth has accelerated in the last six months. In 1Q16, normally a seasonally soft growth quarter, it increased at its strongest quarterly rate in nine quarters. • Strong deposit mix, with 44% of total deposits in non-interest bearing accounts 95 100 105 110 1Q15 2Q15 3Q15 4Q15 1Q16 Loan Growth Indexed to 1Q15 (1Q15=100) ZION Peer Median

$0 $2,000 $4,000 $6,000 $8,000 $10,000 1Q15 2Q15 3Q15 4Q15 1Q16 Total Securities (end of period balances) Other Securities Municipal Securities Small Business Administration Loan-Backed Securities Agency Securities Agency Guaranteed MBS Securities Active Management of the Balance Sheet: Securities Portfolio Growth Short-to-medium duration portfolio; limited duration extension risk 13 In Millions Added net $1.2B of securities during 1Q16 • Total growth from year ago period: 84% Securities Portfolio Duration • Current: 2.6 years • 200 bps increase from current interest rates: 3.1 years

Net Interest Income Moving meaningfully higher after a period of stability 14 417 424 425 449 453 $400 $420 $440 $460 $480 1Q15 2Q15 3Q15 4Q15 1Q16 Net Interest Income In Millions • Net interest income growth continued its positive trajectory, increasing nearly 8.5% over the year-ago period • On a linked quarter basis, net interest income grew by $4mm over 4Q15 • Approximately $13 million of the 4Q15 net interest income was from recoveries and elevated income from FDIC-supported loans, which did not persist into 2016 • Net interest income is expected to increase throughout 2016 due primarily to continued loan growth and purchases of securities Modeled Annual Change in a +200 Interest Rate Environment Fast Slow Net Interest Income – 1Q16 1 9% 16% Net Interest Income – 4Q15 9% 15% 1 Preliminary analysis, subject to refinement 12-month simulated impact using a static-sized balance sheet and a parallel shift in the yield curve, and is based on statistical analysis relating pricing and deposit migration to benchmark rates (e.g. Libor, U.S. Treasuries). “Fast” refers to an assumption that deposit rates and volumes will adjust at a faster speed. “Slow” refers to an assumption that deposit rates and volumes will adjust at a more moderate speed.

$90 $100 $110 $120 1Q15 1Q16 Customer-Related Fee Income 15 7% Growth In Millions • Customer-related fee income increased 7% from the year ago period • Key components of fee income: • Loan Fees: up 38% • Bankcard: up 17% • Treasury management: up 3% • Although mortgage origination volume increased by more than 30% in 2015 vs. 2014, mortgage fees decreased from the year ago period principally attributable to portfolio retention. Mortgage origination volume is targeted and is tracking to increase more than 30% in 2016 vs. 2015. Fee Income

Efficiency Ratio: We remain committed to driving the efficiency ratio to less than 66% for 2016 and to the low 60s for 2017 16 71.9% 71.1% 69.1% 69.6% 68.5% <66% low 60s 60% 65% 70% 75% 1Q15 2Q15 3Q15 4Q15 1Q16 FY16 FY17 1 Adjusted for items such as severance, provision for unfunded lending commitments, and debt extinguishment costs. See the GAAP to non-GAAP reconciling table on slide 41. 2 $1.58 billion has been modified lower from the original $1.60 billion, due to an accounting change in 1Q16. 71.9% 68.5% 63.3% 63.4% 1Q15 1Q16 ZION Peer Median Noninterest Expense as a Percentage of Net Revenue1 • Zions is also on track to achieve the commitment to hold adjusted noninterest expenses to less than $1.58 billion2 in 2016.

17 Simplifying & De-Risking How We Do Business Creating a modern core loan and deposit platform Enterprise Loan Operations Consolidating 15 sites into 2 sites Data Governance Corporate-wide stewardship of all elements of data General Ledger Simplification Streamlining the general ledger and enhancing managerial reporting Credit Lead Credit approval workflow system Future Core Replacing 3 loan and 2 deposit systems with 1 modern platform

Upstream 31% Midstream 23% Downstream 5% Other non- service 2% Oilfield Services 30% Energy Service Manufacturing 9% 18 • Oil & Gas (“O&G”) balances represent 6.4% of total loan balances as of 1Q16 • O&G balances decreased 16.3% between 1Q15 and 1Q16 • O&G commitments decreased 16.6% over the same period • Generally consistent with management expectations, criticized and classified balances increased substantially during the past year, to 37.5% and 26.9%, respectively • Cautious approach going into downturn: Zions entered the cycle with slower O&G growth than many of its peers, with no second lien / mezz debt on its balance sheet, and has long graded its loans on total leverage, not just the debt issued by Zions • Many successful resolutions: classified O&G loan favorable resolution rate in last 12 months: $537 million or 181% of the year ago balance of classified O&G loans Energy Lending: At a Glance Note: All current balances and ratios are as of 1Q16, and year over year comparisons are measured from 1Q15 to 1Q16. Favorable resolutions include upgrade (removed from classified status), paid off, or paid down.

$0 $100 $200 $300 $400 $500 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Classifieds by O&G Segment In Millions $0 $300 $600 $900 $1,200 $1,500 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Loan Balances by O&G Segment Upstream Services Other Oil & Gas (O&G) Portfolio Trends Steadily declining balance trend in O&G services balances 19 In Millions $0 $100 $200 $300 $400 $500 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Nonaccruals by O&G Segment Allowance for Credit Losses Upstream Services Other In Millions Total annualized pay downs, payoffs, and upgrades of classified loans in 1Q16: $584 million (112% of beginning balance)

Energy Peer Analysis Although challenges are substantial, Zions’ portfolio compares favorably to many peers 20 37.5% 28.9% 21.6% 39.1% 34.1% 16.3% 0% 10% 20% 30% 40% Criticized % of Total NAL % of Total Reserve % of Criticized ZION Peer Median Source: Company press releases. Data as of 1Q16. Note: Peer group comprised of banks with a high degree of energy exposure, including BOKF, HBHC, TCBI, CMA, ASB, RF, PB, STI, KEY, WFC, FITB, and JPM.

$0 $200 $400 $600 $800 High Pass Mid Pass Low Pass Special Mention Classified Unfunded O&G Commitments by Loan Grade 21 “Criticized” In Millions • Approximately 80% of the unfunded commitments are in the “pass” grade category, while 20% of the loans are graded “criticized” (which includes “special mention” and “classified”) • About one half of unfunded commitments in the Criticized category is unavailable due to covenant violations or borrowing base restrictions $1,000 $1,500 $2,000 $2,500 $3,000 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Total O&G Unfunded Commitments In Millions Understanding Unfunded O&G Commitments

$0 $100 $200 $300 $400 $500 $600 $700 $800 Special Mention Classified Non Accrual Payment Status Current Non current Payment Status: Adversely Graded O&G Loans Most of the adversely graded loans remain current on payments 22 • Virtually all Special Mention balances are current • 96% of Classified balances are current • 91% of Nonaccrual balances are current • Nonaccrual loans are a subset of Classified Loans In Millions Non current: More than 30 days past due on any principal or interest payment.

• O&G Loan Loss Expectation • O&G loan losses are estimated to be in the $100 million area in 2016 • Losses are likely to emerge beyond 2016, but are expected to be manageable • Heading into this cycle, Zions had no second lien or mezzanine debt on its balance sheet that was extended to the O&G industry. This is a significant source of protection against very high loss severity • O&G services loan performance is mixed – both positive and negative surprises, but generally tracking in line with expectations • Strong Reserve Against O&G Loans • Zions’ O&G allowance for credit losses equaled 8.1% of O&G loan balances • Approximately 2 years of loss coverage at trailing six-month charge-off rate O&G Loss Expectation: Moderate increase to reflect lower commodity prices and longer duration 23

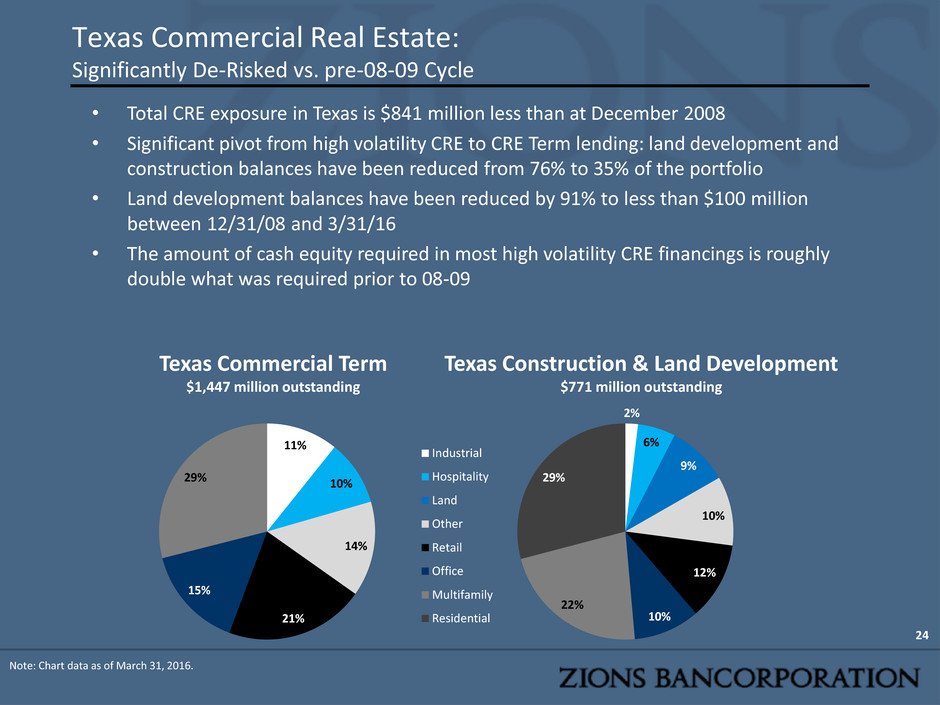

Texas Commercial Real Estate: Significantly De-Risked vs. pre-08-09 Cycle 24 • Total CRE exposure in Texas is $841 million less than at December 2008 • Significant pivot from high volatility CRE to CRE Term lending: land development and construction balances have been reduced from 76% to 35% of the portfolio • Land development balances have been reduced by 91% to less than $100 million between 12/31/08 and 3/31/16 • The amount of cash equity required in most high volatility CRE financings is roughly double what was required prior to 08-09 2% 6% 9% 10% 12% 10% 22% 29% Texas Construction & Land Development $771 million outstanding Industrial Hospitality Land Other Retail Office Multifamily Residential Note: Chart data as of March 31, 2016. 11% 10% 14% 21% 15% 29% Texas Commercial Term $1,447 million outstanding

The Derivative Effect: Commercial Real Estate Limited expected NPAs or losses on Zions’ commercial real estate portfolio in Houston 25 Overview Statement: • Zions expects a moderate adverse migration of loan grades, but does not currently expect substantial loss due to strong collateral and cash flow support (subject to duration of downturn) • Zions exercised caution with Texas CRE lending leading up to the decline in energy prices due primarily to concentration limits and CRE risk hurdles 0% 10% 20% 30% 40% 50% 60% <1.0 1 - 1.25 1.25 - 1.5 1.5 - 1.75 1.75 - 2 >=2 Current Houston Term Debt Service Coverage Ratios 0% 10% 20% 30% 40% 50% 60% Under 50 50-59 60-69 70-79 80-89 90-99 100+ Current Houston Term Loan-To-Values

19.8% 0% 20% 40% 60% 80% 100% PB C T B O K F CM A FM ER A SB M TB B B T FH N H B A N C B SH KE Y FIT B SN V R F ST I EWB C CF G ZIO N FR C Common Payout Ratio 26 Source: SNL Financial; most recent data available. Capital Management Opportunity for Improved Shareholder Payout ZION capital ratios are among the highest while capital return is the lowest among peers Our focus on revenue improvements and risk positioning are designed to improve our return on capital and our return of capital More active capital management has been constrained by stress test results Subject to CCAR Not Subject to CCAR 12.13% 9% 10% 11% 12% 13% ZIO N B O K F CF G C B SH KE Y M TB R F EWB C FM ER FR C CM A B B T FH N SN V ST I FIT B H B A N PB C T A SB Common Equity Tier 1 Ratio

Next 12-Month Outlook Summary Relative to 1Q16 Results Topic Outlook Comment Loan Balances Increasing • Expect strengthening growth in residential mortgage (mostly short duration ARMs) and general C&I, partially offset by continued attrition from National Real Estate and O&G portfolios • QTD growth rate is stronger than 1Q16A Net Interest Income Increasing • Expect continued increases in loans and securities to result in increased net interest income Provisions Stable • On average, quarterly provisions likely to be similar to 1Q16A, reflecting moderate total net charge-offs and loan growth. Noninterest Income Slightly to Moderately Increasing • Target growth of mid-single digit for managed noninterest income (excludes securities gains, dividends, etc.) • Dividends from federal agencies are expected to decline by an annualized $5 million relative to 1Q16 levels due to charter consolidation and FAST Act (transportation, H.R. 22) Noninterest Expense Stable • Targeting NIE of less than $1.58 billion in FY16. Includes the effect of higher FDIC assessment (approved by FDIC in March 2016) • Includes continued elevated spending on technology systems overhaul Tax Rate Increasing • Expected to be in a range of approximately 34% to 35% for FY16 Preferred Dividends Declining1 • Zions launched a tender offer on April 25, 2016 for up to $120 million par amount of certain outstanding shares of preferred stock. 27 1 The expectation for declining preferred dividends is relative to the trailing six month results (not just the 1Q16 results), due to the timing of preferred equity dividends.

2016-2017 Objectives: Growth Through Simplification and Focus 28 • Accelerate Positive Operating Leverage • Accelerate loan growth rates • Invest cash into medium duration securities • Maintain mid-single digit growth rates in core fee income • Maintain non-interest expenses below $1.58 billion1 in 2016, increasing somewhat in 2017, made possible through simplification of • Business processes • Legal organization • Compensation: Tighter incentive compensation linked to achievement of articulated efficiency ratio targets • Implement Technology Strategies: Achieve substantial progress on core systems upgrade • Increase the Return on and of Capital • Improvements in operating leverage and loan growth lead to stronger returns on capital • Improved risk profile and risk management should lead to better returns of capital • Execute on our community bank model – doing business on a “local” basis 1 Modified by $20 million lower from the original stated target of less than $1.60 billion due to an accounting adjustment that took place in 1Q16 where Zions moved expense associated with credit and corporate card rewards program expense to net against associated revenue.

Appendix 29 O&G Portfolio Detail Example of Upstream (Reserve-Based) Underwriting Price Deck Upstream Collateral Coverage Distribution – Overview Upstream Collateral Coverage Distribution – December 31, 2015 Zions’ Commercial Real Estate Portfolio in Texas High Oil & Gas Employment Counties: Consumer credit scores Loan Growth by Type Loan Growth by Bank Brand and Type Deconstructing Interest Rate Sensitivity Strong Liquidity and Superior Deposit Franchise GAAP to Non-GAAP Reconciliation

O&G Portfolio Detail 30 Note: Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a borrower as oil and gas-related, including a particular segment of oil and gas-related activity, e.g., upstream or downstream; typically, 50% of revenues coming from the oil and gas sector is used as a guide. Balances increased modestly in 1Q16, in part due to new originations, but also from some funding of existing loans. Many borrowers continued to delever in 1Q16. Loan downgrades continued, primarily from upstream loans. Zions added to the O&G loan allowance for credit losses during 1Q16. The reserve reflects the downgrading of credits during the same period. Additional downgrades are probable due in part to the Spring 2016 redetermination cycle. Reserve for O&G loans is considered strong at 8.1% of outstanding balances. (In millions) 3/31/16 % of Total 12/31/15 $ Change % Change 3/31/15 Loans and leases: Oil and gas related: Upstream - exploration and production $ 859 32% $ 817 42 5% $ 1078 Midstream – marketing and transportation 649 24% 621 28 5% 654 Downstream – refining 129 5% 127 2 2% 140 Other non-services 43 2% 44 (1) (2)% 57 Oilfield services 734 28% 784 (50) (6)% 959 Energy service manufacturing 229 9% 229 - -% 269 Total loan and lease balances 2,643 100% 2,622 21 1% 3,157 Unfunded lending commitments 2,021 2,151 (130) (6)% 2,432 Total credit exposure $ 4,664 $ 4,773 (109) (2)% $ 5,589 Private equity investments 12 13 (1) (8)% 20 Credit Quality Measures of oil and gas related loans: Criticized loan ratio 37.5 % 30.3 % 15.7 % Classified loan ratio 26.9 % 19.7 % 9.3 % Nonperforming loan ratio 10.8 % 2.5 % 2.1 % Net charge-off ratio, annualized 5.4 % 3.6 % 0.3%

Example of Upstream (Reserve-Based) Underwriting 31 Typical Oil & Gas Reserve-Based Loan $100 - E&P company’s PV of oil & gas reserves using current NYMEX prices, discounted at a 9% rate (“PV9”) $ 90 - Apply “bank price deck” (generally ~90% of NYMEX) to determine collateral value. $ 77 - Zions’ risk-adjusted value of reserves (e.g. Zions applies discounts to non-producing reserves) $ 54 - Loan commitment amount (30% haircut if 25%+ of reserves are hedged) $ 46 - Loan commitment amount (40% haircut if less than 25% hedging) $ 30 - Loan balance outstanding amount (average of 60% in 2015) Note: Initial, unrisked collateral value is based on engineering firm assessment of oil/gas reserves. For lending purposes, no more than 25% of the collateral may be comprised of non-producing reserves. Cash flows from the reserves are calculated by employing engineer’s projected volumes, bank oil/gas price deck and actual operating costs, then converted to present value using a 9% discount rate. In millions

$- $20 $40 $60 $80 $100 $120 $140 $160 M ar -0 0 Oc t- 0 0 M ay -0 1 D e c- 0 1 Ju l- 0 2 Fe b -0 3 Se p -0 3 A p r- 0 4 N o v- 0 4 Ju n -0 5 Ja n -0 6 A u g- 0 6 M ar -0 7 Oc t- 0 7 M ay -0 8 D e c- 0 8 Ju l- 0 9 Fe b -1 0 Se p -1 0 A p r- 1 1 N o v- 1 1 Ju n -1 2 Ja n -1 3 A u g- 1 3 M ar -1 4 Oct -1 4 M ay -1 5 D e c- 1 5 Ju l- 1 6 Fe b -1 7 Se p -1 7 A p r- 1 8 N o v- 1 8 Ju n -1 9 Ja n -2 0 A u g- 2 0 M ar -2 1 Oc t- 2 1 Zions’ Price Deck v. NYMEX Oil 12-mo. Fwd Strip Zions Base Zions Sensitivity NYMEX 32 Price Deck: Consistently conservative vs. 12-month futures strip; strong allowance for credit losses informed by sensitivity case NYMEX Historical 12-Month Oil Futures Strip (Average of next 12 monthly futures contracts) NYMEX Forward 12-Month Oil Futures Strip Dollars per barrel As of April 2016. Due to the average of 12 months of futures, the current price may be above or below the current one-month contract.

Upstream Collateral Coverage Distribution Strong collateral coverage of upstream borrowers; built to withstand further shocks 33 • Upstream commitments reduced approximately 20% during 2015 due largely to the borrowing base redetermination process • Since 12/31/14 there have been six borrowing base deficiencies as a result of the borrowing base redetermination process • Three of these have been cured via company sale, debt reduction from cash flow or the pledge of additional collateral (letter of credit) • We have a high degree of confidence that two of the remaining three will be resolved by mid- 2016 • One of the deficiencies may take longer to resolve; however, the borrower is cooperating and is willing to consider all options to resolve the deficiency • Generally speaking, borrowing bases have decreased less than the market may have expected • Although average oil prices fell ~50% in 2015, the impact has been offset by • Increased reserve additions, • Commodity hedging • Expense reductions (approximately 2/3 from service company price reductions, 1/3 from efficiency gains)

0 200 400 600 800 1,000 1,200 < 60% 60% - 70% 70% - 80% 80% - 90% 90% - 100% > 100% Upstream Commitments As a Percent of Collateral Value Unrisked Reserves, Price-Deck Adjusted Pass Criticized Upstream Collateral Coverage Distribution – December 31, 20151 Strong collateral coverage of upstream borrowers; built to withstand further shocks 34 • We use multiple discounts in our underwriting process. • Unrisked Reserves, Price-Deck Adjusted: Bank Price Deck applied to unrisked, proven oil and gas reserves. • Risked Reserves and Price-Deck Adjusted: Zions’ price deck applied to proven oil and gas reserves which have been adjusted to account for the uncertainty of new production volumes and the uncertainty of converting non-producing and undeveloped reserves to producing status. • While internal underwriting using Risk- Adjusted analysis may cause loans to be internally criticized or classified, on an un- risked basis collateral coverage exists. • Borrowers with satisfactory advance reserve- based loan advance rate may be classified due to higher overall leverage levels due to the presence of second lien or unsecured debt. In Millions 0 200 400 600 800 1,000 1,200 < 60% 60% - 70% 70% - 80% 80% - 90% 90% - 100% > 100% Upstream Commitments As a Percent of Collateral Value Risked Reserves and Price-Deck Adjusted Pass Criticized 1 Zions is currently in the midst of the spring borrowing base redetermination process, which is expected to adversely affect the ratios shown on this page by a moderate degree. An updated version will be published in the July / August 2016 timeframe, after the completion of the redetermination process. In Millions

35 Zions’ Commercial Real Estate Portfolio in Texas Houston is approximately 3/5ths of total Texas exposure; Construction and Land Development loans in Houston have declined more than 80% from the prior credit cycle 14 45 35 15 67 84 $19 $41 $45 $35 $82 $104 $159 $0 $100 $200 $300 $400 $500 Industrial Land Hospitality Other Retail Office Multifamily Commercial Construction ($485 million outstanding) Houston (56%) TX-not Houston (44%) 15 141 $10 $38 $186 $0 $100 $200 $300 $400 $500 Other Land Single Family Housing Residential Construction ($234 million outstanding) Houston (56%) TX-not Houston (44%) 51 89 82 152 119 280 $147 $151 $160 $209 $333 $408 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 Other Industrial Hospitality Office Retail Multifamily Commercial Term ($1,408 million outstanding) Houston (56%) TX-not Houston (44%) Note: Data as of December 31, 2015.

Percentile HOGECs Others HOGECs Others HOGECs Others HOGECs Others HOGECs Others 5% 606 642 600 640 6 2 597 636 9 6 10% 643 677 640 677 3 0 639 674 4 3 50% 753 778 749 781 4 -3 749 780 4 -2 2016 Q1 2015 Q1 1-Year Difference 2014 Q1 2-Year Difference Data includes consumer loans with FICO scores refreshed during the quarter shown. Consumer customers in high oil and gas employment counties (HOGECs) have not experienced substantial credit score deterioration 36 Takeaways: • Consumer loans from high O&G employment counties performing similarly to overall consumer portfolio. Nearly all of these consumer loans are with Amegy (96%) located in Texas, primarily Houston area. • 81% of consumer loans in high-energy counties are Mortgage and HECL • Consumer FICO scores have not deteriorated in counties with high O&G employment, with the 5th, 10th, and 50th percentiles of FICO scores showing slightly favorable movement Credit Score (FICO) Migration in High Oil & Gas Employment Counties

Loan Growth by Type 37 Source: NRE = National Real Estate Group, a division of Zions Bank that focuses on small business loans with low loan-to-value ratios, generally in line with SBA 504 program parameters. Note: Other loans includes municipal and other consumer. C&I (ex-O&G) Owner Occupied (ex-NRE) C&D Term CRE (ex- NRE) 1-4 Family National Real Estate O&G Home Equity Other -20% -10% 0% 10% 20% Year-over-Year Loan Growth • Loan growth in C&I, Term CRE and to a lesser extent Residential Mortgage (1-4 Family) • Declines in in National Real Estate, O&G and Construction and Land Development • Targeting strong growth in C&I and 1-4 family • Expect moderate growth in C&D, mini-perm and stabilized income properties (term CRE) • Expect continued declines in O&G and national real estate

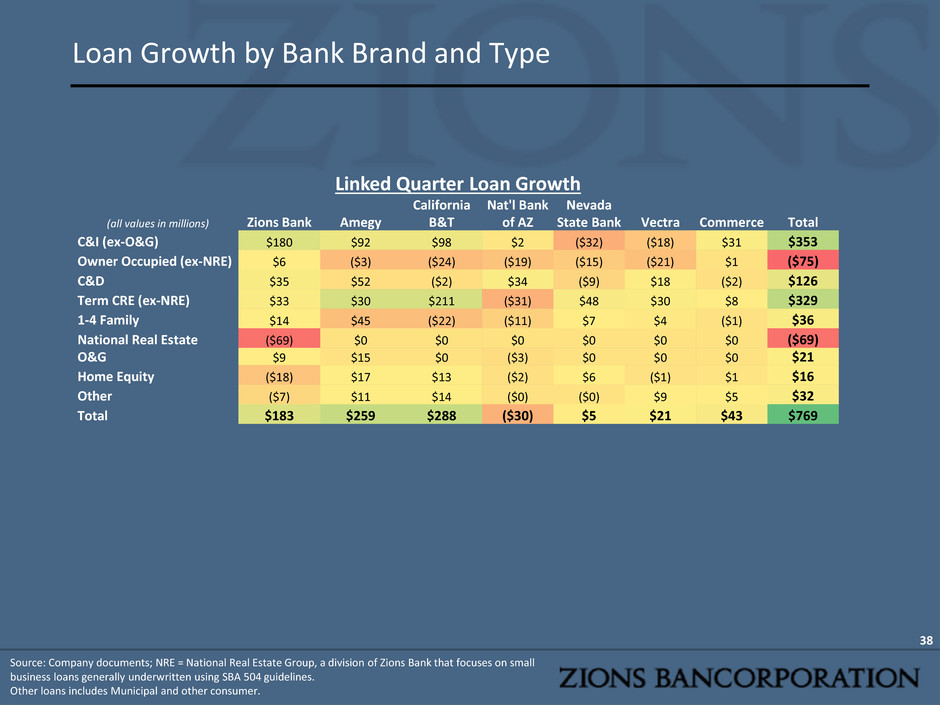

Loan Growth by Bank Brand and Type 38 Source: Company documents; NRE = National Real Estate Group, a division of Zions Bank that focuses on small business loans generally underwritten using SBA 504 guidelines. Other loans includes Municipal and other consumer. Linked Quarter Loan Growth (all values in millions) Zions Bank Amegy California B&T Nat'l Bank of AZ Nevada State Bank Vectra Commerce Total C&I (ex-O&G) $180 $92 $98 $2 ($32) ($18) $31 $353 Owner Occupied (ex-NRE) $6 ($3) ($24) ($19) ($15) ($21) $1 ($75) C&D $35 $52 ($2) $34 ($9) $18 ($2) $126 Term CRE (ex-NRE) $33 $30 $211 ($31) $48 $30 $8 $329 1-4 Family $14 $45 ($22) ($11) $7 $4 ($1) $36 National Real Estate ($69) $0 $0 $0 $0 $0 $0 ($69) O&G $9 $15 $0 ($3) $0 $0 $0 $21 Home Equity ($18) $17 $13 ($2) $6 ($1) $1 $16 Other ($7) $11 $14 ($0) ($0) $9 $5 $32 Total $183 $259 $288 ($30) $5 $21 $43 $769

39 Deconstructing Interest Rate Sensitivity Deposit Repricing • In addition to changes in interest-bearing deposit rates, ZION assumes large movements from noninterest-bearing demand deposit products to interest-bearing deposit products as interest rates change Assumptions regarding the reaction of core deposit behavior to changes in market interest rates significantly impact interest rate risk estimates Effective Deposit Beta +200 bp shock Fast Slow Interest-Bearing 73% 54% Total Deposits 41% 30% • The assumed movement of demand deposits significantly increases the effective beta of interest-bearing deposits, and is the key driver of the difference between the “fast” and “slow” interest rate sensitivity estimates • In the 2004-2005 interest rate cycle, Zions’ total deposit beta was approximately 20% for the first 200 bps Measured from 1Q04 (immediately prior to the increases in the Federal Funds rate by the FOMC) to the average of 1Q05 and 2Q05 when increases in rates averaged 200 bps. If lagged by six months, total deposit beta increased to approximately 40%. “Beta” refers to the increase in the cost of deposits relative to the increase in the FF rate.

40 0% 10% 20% 30% 40% 50% 60% 2000 2005 2010 2015 Noninterest-Bearing Deposits / Total Deposits* ZION Peer Median Source: SNL Financial, data as of 4Q15 for peers, 1Q16 for ZION. Note: FRC and PBCT have insufficient history to be included in the 2000-2015 analysis. 50% 60% 70% 80% 90% 100% CBS H BO K F FME R CM A R F ZI O N EW B C K EY FH N A SB FIT B HB A N ST I B B T FR C MT B CF G SN V P B C T Loans / Deposits CM A ZI O N FR C K EY C B SH R F FIT B MT B EW B C B B T SN V FH N CF G ST I A SB P B C T FME R HB A N BO K F Noninterest-Bearing Deposits / Total Deposits Strong Liquidity, Superior Deposit Franchise Over Time Zions Liquidity Coverage Ratio is comfortably in excess of the regulatory minimum

GAAP to Non-GAAP Reconciliation 41 (Amounts in thousands) 1Q16 4Q15 3Q15 2Q15 1Q15 Efficiency Ratio Noninterest expense (GAAP) 1 (a) $ 395,573 $ 397,353 $ 391,280 $ 398,997 $ 392,977 Adjustments: Severance costs 3,471 3,581 3,464 1,707 2,253 Other real estate expense (1,329) (536) (40) (445) 374 Provision for unfunded lending commitments (5,812) (6,551) 1,428 (2,326) 1,211 Debt extinguishment cost 247 135 — 2,395 — Amortization of core deposit and other intangibles 2,014 2,273 2,298 2,318 2,358 Restructuring costs 996 777 1,630 679 766 Total adjustments (413) (321) 8,780 4,328 6,962 Add-back of adjustments (b) 413 321 (8,780) (4,328) (6,962) Adjusted noninterest expense (a) + (b) = (c) 395,986 397,674 382,500 394,669 386,015 Taxable-equivalent net interest income (GAAP) (d) 458,242 453,780 429,782 428,015 421,581 Noninterest income 1 (e) 116,761 118,641 125,944 (4,682) 117,338 Combined income (d) + (e) = (f) 575,003 572,421 555,726 423,333 538,919 Adjustments: Fair value and nonhedge derivative income (loss) (2,585) 688 (1,555) 1,844 (1,088) Equity securities gains (losses), net (550) 53 3,630 4,839 3,353 Fixed income securities gains (losses), net 28 (7) (53) (138,436) (239) Total adjustments (g) (3,107) 734 2,022 (131,753) 2,026 Add-back of adjustments 3,107 (734) (2,022) 131,753 (2,026) Adjusted taxable-equivalent revenue (Non-GAAP) (f) - (g) = (h) 578,110 571,687 553,704 555,086 536,893 Adjusted pre-provision net revenue (PPNR) (h) - (c) = (i) $ 182,124 $ 174,013 $ 171,204 $ 160,417 $ 150,878 Efficiency Ratio 1 (c) / (h) 68.5 % 69.6 % 69.1 % 71.1 % 71.9 % 1 In the first quarter of 2016, to be consistent with industry practice, the Company reclassified its bankcard rewards expense from “Other” Noninterest expense to “Other service charges, commissions and fees” in Noninterest income to offset this expense against the associated revenue. Prior period amounts have been reclassified to reflect this change.