Attached files

| file | filename |

|---|---|

| 8-K - AutoWeb, Inc. | abtl8k_may2016.htm |

| EX-99.1 - AutoWeb, Inc. | ex99-1.htm |

EXHIBIT 99.2

Autobytel Inc.

Moderator: Jeff Coats

May 5, 2016

5:00 p.m. ET

CORPORATE PARTICIPANTS

Sean Mansouri Liolios Group, Inc. - IR

Jeff Coats Autobytel Inc. - President and CEO

Kimberly Boren Autobytel Inc. - CFO

CONFERENCE CALL PARTICIPANTS

Sameet Sinha B. Riley & Co. - Analyst

Eric Martinuzzi Lake Street Capital - Analyst

Gary Prestopino Barrington Research - Analyst

Ed Woo Ascendiant Capital Markets - Analyst

John Blackledge Cowen and Company - Analyst

Patrick Lin Primarius Capital - Analyst

PRESENTATION

Operator

Good afternoon everyone, and thank you for participating in today's conference call to discuss Autobytel's financial results for the first quarter ended

March 31, 2016.

Joining us today are Autobytel's President and CEO, Jeff Coats; the Company's CFO, Kimberly Boren, and the Company's outside investor relations advisor,

Sean Mansouri with Liolis Group. Following their remarks we will open the call for our questions.

I would now like to turn the call over to Mr. Mansouri for some introductory comments.

Sean Mansouri - Liolio's Group, Inc - IR

Thank you. Before I introduce Jeff, I remind you that during today's call, including the question-and-answer session, any projections and forward-looking statements made regarding future events or Autobytel's future financial performance are covered by the safe harbor statements contained in today's press release, the slides accompanying this presentation and the Company's public filings with the SEC. Actual events may differ materially from those forward-looking statements.

Specifically, please refer to the Company's Form 10-Q for the quarter ended March 31, 2016, which was filed prior to this call, as well as other filings made by Autobytel with the SEC from time to time. These filings identify factors that could cause results to differ materially from those forward-looking statements.

There are slides included with today's presentation to help illustrate some of the points being made and discussed during the call. The slides can be accessed by visiting Autobytel's website at www.Autobytel.com. When there, go to investor relations and then click on events and presentations.

Please also note that during this call and/or in the accompanying slides, management will be disclosing non-GAAP income and non-GAAP EPS, which are non-GAAP financial measures as defined by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in today's press release and/or in the slides which are posted on the Company's website.

With that, I will now turn the call over to Jeff.

-1-

Jeff Coats - Autobytel Inc. - President and CEO

Thank you, Sean. Good afternoon everyone. Thanks for joining us today to discuss our first-quarter 2016 results.

Q1 marked our third consecutive quarter of record revenues driven by growth in click revenue, lead program expansion and last year's acquisitions of Dealix and AutoWeb.

The first quarter was very exciting and productive as we integrated the AutoWeb acquisition and positioned the Company to capitalize on our strength of leads and clicks from end market, high-intent automotive shoppers. In integrating the AutoWeb business, we worked to establish a more efficient organizational structure that included several management changes. Further, we began migrating our previously outsourced development resources in house to our newly acquired Guatemalan operations and consolidated all of our IT development queues.

We also increased our investment in the clicks business and our sales organization as we expect our growth rate to continue.

We finalized integration of the Dealix lead platform successfully, which has enabled us to leverage our industry-leading SCM practices and lead quality focus, providing us with more flexibility to deliver only the highest quality leads to our partners. These efficiencies allow us to continuously raise our quality standards, ensuring that our dealers receive the highest close rates that we can provide.

As we alluded to in our previous quarterly call, we turned away between $2 million and $3 million in annualized revenue from Dealix during the quarter, with a large portion impacting Q1 and Q2, as we will not deliberately provide our customers with anything less than high-quality leads.

We have already begun to realize several benefits from this approach, including an increase in customer retention and a higher ROI for our lead and click customers, which allows us to successfully obtain price expansion with incoming dealers. We believe that the benefit of maintaining our status as a high-quality leads provider far outweighs the short-term revenue and profitability benefit.

We also believe this commitment to quality will continue to separate us from our competition and serves as an imperative value proposition to our dealer and OEM customers. The demand for leads remains strong and we continue to optimize the Dealix technology platform and convert its data methodologies to mirror our own high-quality lead generation.

We also remain steadfast in our integration of AutoWeb, whose paper click advertising platform propelled Autobytel into the fast-growing digital ad marketplace. We continue to expect the launch of our AutoWeb enhanced product solution by the end of Q3 as well as our brand new usedcars.com site.

But before commenting further, I would like to turn the call over to Kim and have her take us through the important details of our financial results. Kim?

Kimberly Boren - Autobytel Inc. - CFO

Thanks, Jeff, and good afternoon everyone. For those of you following along with our earnings presentation, on slide four you can see our first-quarter revenues increased 38% to a record $36.2 million compared to $26.2 million in the year-ago quarter. The increase was primarily driven by the acquisitions of Dealix and AutoWeb and the expansion of most OEM programs.

Lead revenue from automotive dealers, our retail channel, increased 29% to $14.6 million compared to $11.3 million in the year-ago quarter with the increase driven by Dealix. Lead revenue from automotive manufacturers and wholesale customers, our wholesale channel, increased 39% to $16.3 million compared to $11.7 million in the prior year quarter. The strong lead growth in our wholesale channel was also driven by Dealix as well as higher volumes from nearly all of our OEM customers.

-2-

On a sequential basis, our strong Q1 leads revenue was offset by the optimization of lead gen methodologies and the resulting unmet dealer demand.

Advertising revenues increased 135% to $3.8 million compared to $1.6 million in the year-ago quarter. The increase was due to growth in display advertising as well as a significant increase in click revenue. The increase in click revenue was primarily driven by AutoWeb as well as an increase in traffic from the acquisition of Dealix. On the next quarterly call, we are going to begin breaking out the click revenue from advertising to provide even more transparency in this exciting new part of our business. A summary of our advertising relationships can be found on slide five.

Moving now to slide six, you will see that we delivered approximately 2.3 million automotive leads during the first quarter, a 40% increase over last year. Retail new leads increased 23% compared to the prior year quarter while used leads increased 22%. 72% of leads were delivered to the wholesale channel with the remaining 28% to the retail channel. Dealix contributed to both the increase in our wholesale channel and retail leads; however, our wholesale channel also benefited from the increased demand across nearly all OEM fleet programs. As mentioned earlier, these volumes were offset by some of the scaled back Dealix leads.

Retail new leads invoice per dealer was up 4% year-over-year in the first quarter of 2016 and retail used leads invoice per dealer was up 6%.

We delivered nearly 92,000 specialty finance leads during the quarter, flat from 92,000 in the year ago period. Specialty finance leads revenue was $1.6 million, up 2% from the year-ago period.

On slide seven, you will see dealer count stood at 4726 as of March 31, which is a 17% increase from the year-ago quarter and a slight decrease from December 31--approximately 27 dealers. As we stated earlier, we are making a concerted effort to raise the legacy Dealix lead quality to retain and grow the dealer base. We continue to focus on quality from the Dealix acquisition, paring back where necessary.

As Jeff mentioned earlier, during the first quarter we eliminated between $2 million to $3 million in annualized revenue from Dealix leads that did not pass our quality testing. We remain committed to quality over volume to ensure our dealer and OEM customers can continue to rely on Autobytel for high-value end market consumer leads.

On slide eight, you will see that we continued to experience year-over-year traffic growth during the first quarter with unique visitors up 15% to $7.5 million and total pages up 2% to $85.6 million demonstrating the strength of high-quality content across our site.

Now moving to slide nine, gross profit during the first quarter increased 35% to $13.6 million and gross margin decreased 90 basis points to 37.6% compared to the year-ago quarter. The decline in gross margin was primarily due to a $315,000 increase in the amortization of intangibles resulting from the Dealix and AutoWeb acquisitions. Excluding this amortization, gross margin would have been 38.5%.

Total operating expenses in the first quarter were $14.5 million compared to $8.9 million in the year-ago quarter. As a percentage of revenues, total operating expenses were 40.1% compared to 34% in the first quarter of 2015 with the increase largely driven by one-time severance cost of $839,000 and a related $541,000 from accelerated options for a rounded total of $1.4 million.

We also experienced overlapping costs while transitioning technology work in-house to Guatemala. We expect operating expenses as a percentage of revenues to normalize back to the mid-30s range for the remainder of the year.

On a GAAP basis, net loss was $676,000 or $0.06 per diluted share on 10.5 million shares compared to net income of $773,000 or $0.07 per diluted share on 11.1 million shares in last year's first quarter. The decline was largely driven by the aforementioned one-time severance and related cost. We expect our quarterly diluted share count in 2016 to remain around 13.4 million contingent upon our share price and assuming current outstanding shares, warrants, options and convertible debt remains constant.

-3-

For the first quarter, non-GAAP income, which adds back amortization on acquired intangibles, non-cash stock-based compensation, acquisition costs, severance costs, gain on investment, litigation settlements and income taxes, increased 25% to $2.9 million or $0.22 per diluted share compared to $2.4 million or $0.21 in the year-ago quarter. Cash provided by operations for the 2016 first quarter improved to $1.6 million compared to cash used of $530,000 in the prior year quarter.

On slide 10 you will see that our cash balance remains strong with cash and cash equivalents of $24 million at March 31, 2016, which is essentially flat from December 31, 2015, despite paying down $1.3 million of debt during the quarter and $780,000 in cash severance. Total debt at March 31, 2016 decreased to $25.7 million compared to $27 million at the end of 2015.

With that, I will now turn the call back over to Jeff. Jeff?

Jeff Coats - Autobytel Inc. - President and CEO

Thank you, Kim. As I mentioned earlier, our first quarter was highlighted by continued strong growth in our click revenue, lead program expansion with many of our dealers and essentially all of our OEM customers and the continued benefits from Dealix and AutoWeb. I will spend some time covering each of these topics as well as some updates to our used car and clicks business initiatives.

For the quarter, we expanded our leads program with all but one of our OEM customers. OEMs tend to be very selective in their digital marketing spend and they continue to demonstrate increasing demand for our high-quality leads. With our strong OEM relationships, our industry reach goes far beyond our retail network. In fact, when you account for leads that we deliver to OEMs, we are actually delivering leads to approximately 22,000 dealer franchises, which includes all of our direct retail dealers as well.

These metrics illustrate the breadth of our dealer footprint and our expanding influence in the automotive industry, which is further illustrated on slide 11 but most importantly, we are continuing to provide dealers and OEMs with high intent car buyers regardless of channel in helping their respective businesses grow.

It is based on this reputation that we have established that we drove our decision to turn away from the Dealix leads that did not meet our quality requirements. Initial indications are that we have made the right decision, our churn is down, we are delivering higher ROI to our clicks and leads customers and we are seeing increasing prices for our incoming dealers. We expect these variables to continue to contribute to our growth in the long-term.

Further, we are seeing demand from both dealers and OEMs increasing from what we believe has been our diligent industry facing marketing, which educates dealers on the higher ROI our leads can provide versus some of their other lead-generating sources.

Our consumer acquisition teams continue to work diligently to optimize Dealix's lead-gen methodologies and raise its quality of supply. At the same time, we are in the process of applying Dealix's best practices for re-targeting methodologies to Autobytel's lead generation.

On slide 12, you will see that our estimated average buy rate for internally generated leads in the first quarter was 17%, which for the first time includes the acquired Dealix volume and remains within our targeted range.

On slide 13, as derived from IHS Automotive Reports, these estimated buy rates have remained consistently strong since Q1 2011 with Autobytel.com generating an average buy rate of 24% and all Autobytel internally lead generated leads at about 18%.

Now moving on to the component of our advertising business that is powered by AutoWeb. As a reminder, AutoWeb is our pay per click programmatic advertising marketplace targeting the auto industry whose platform provides dealers and OEMs with access to some of the highest intent car shoppers on the Internet and propels Autobytel into the fast-growing pay per click market.

-4-

As mentioned earlier, we are in the process of finalizing a new AutoWeb enhanced product which we continue to expect launching by the end of Q3. It is worth noting that we have already begun to experience higher demand from dealers as well as Tier 1 and Tier 2 advertisers for AutoWeb's core click product. January, February and March were all record months for click product revenue which we will begin to break out on our next quarterly call.

As noted earlier, we retained key executives from AutoWeb and realigned our management team during the first quarter, which resulted in approximately $1.4 million of severance and related costs comprised of both cash and non-cash stock compensation. We believe this management realignment was necessary to remove duplicative roles within our organization. We also began migrating our previously outsourced development resources in-house to our newly acquired Guatemalan operations and consolidated all of our IT development queues.

Used car lead revenue in the first quarter grew 42% year-over-year to $4.4 million primarily due to Dealix and increased 12% sequentially. Our used car business remains a focal point for growth and we continue to increase the level of resources dedicated to sales and marketing as well as ramping the investment in our used car platform for internal lead generation with special focus on the usedcar.com site which we acquired through Dealix last summer.

As I mentioned earlier, we continue to expect a full relaunch of the brand-new usedcar.com site by the end of Q3. As a reminder, retail used car leads still only represent about 8% of our total leads business today and approximately 12% of revenue, even though used car sales in the United States are two to three times that of new car sales by volume. We continue to believe there is a tremendous opportunity in the used car market. Over 37 million used cars were sold in the United States in 2015, and of those 37 million, only about 11 million occurred at franchise dealers, which is the primary end market we have targeted over the last several years.

In 2015, consumer leads from Autobytel accounted for over 614,000 of those used vehicles, and as you can see on slide 14, our used car leads have consistently increased since 2011 and we have yet to even step on the gas pedal.

Our current used cars initiatives will enable us to go after the vast market that does not include franchise dealers and there is plenty of white space in that market for us to build meaningful relationships going forward.

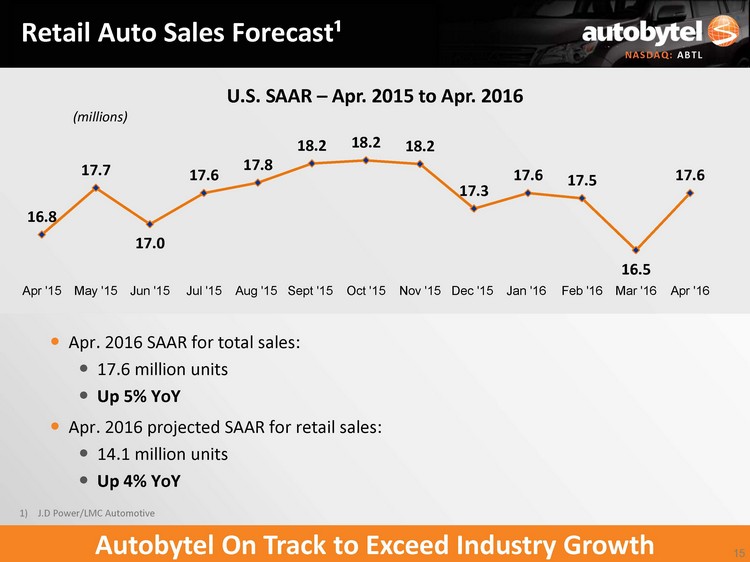

Moving on to the industry outlook as you can see on slide 15, LMC Automotive and J.D. Power have the seasonally adjusted annual run rate or SAAR for total sales at 17.6 million units for April--up 800,000 units from one year ago. This is also up from the 16.5 million unit SAAR in March 2016.

Now moving onto our 2016 business outlook highlighted on slide 16. Despite elimination of revenue from Dealix, as well as our expectation for ongoing investments to further accelerate growth, we continue to expect 2016 revenue to range between $151 million and $155 million, which represents an increase of approximately 13% to 16% from 2015. We also continue to expect non-GAAP diluted EPS to range between $1.39 and $1.43 representing an increase of approximately 14% to 17% from 2015 with the majority of this growth taking place in the second half of 2016.

I would also like to remind listeners about the seasonality in our business and that we have historically seen a step down in Q2 from Q1. For the remainder of 2016, we intend to continue to drive growth and profitability through new and used car lead generation, our click revenues and the continued development of value-added product offerings.

We remain committed to providing value to all of our dealer and OEM customers, which we believe will generate the most advanced value for our stockholders.

At this time we would like to open the call for questions. Operator?

-5-

QUESTION AND ANSWERS

Operator

(Operator Instructions)

Sameet Sinha, B. Riley & Co.

Sameet Sinha - B. Riley & Co. - Analyst

Yes, thank you very much. Jeff, I was wondering if you can talk about the AutoWeb product, the fact that you are breaking it out sounds interesting. What is this leads per click product--if you can give us a sense of exactly how it works that will be helpful.

Secondly, in terms of the finance leads, obviously, press reports are out there about increasing delinquency rates in kind of the auto loan industry and especially on the subprime side. Do you think that is an important piece of the business or can be divested so that you reduce the level of risk and variability that could happen over the next couple of years? And then I have a follow-up.

Jeff Coats - Autobytel Inc. - President and CEO

On the AutoWeb product, it is really the core clicks product that has been scaling up. As you know, we launched a product last summer called Autobytel Direct, which is really the AutoWeb product that we have been selling to dealers. We sold it in a rather limited market so we could really very closely monitor it and understand it before we started rolling it out on a truly national basis and thus far we have had extremely low churn in that product and I mean extremely low churn. It has been extremely positively received by dealers and so we are turning up the flame to begin selling it on a broader basis.

The new product that we will be launching, we are not really talking about publicly yet, Sameet, mostly from a competitive standpoint. We will be providing more information when we do the second quarter call in, I guess it will be the first week of August, and we would expect to get that new product launched by the end of the third quarter so we will be providing more information on it as we get closer to it.

With regards to finance leads, we have seen the same reports of increasing delinquencies. That certainly would, in the long-term, have an impact on us to some extent but it is still pretty early, and as you know, all we are doing are really helping connect consumers that need subprime financing to dealers that provide it or to financial institutions that provide it.

So, we have not historically seen that it has had a really major impact on us from a delinquency standpoint. There is still a lot of people getting into the approval queues for things like that. Long-term, obviously it is a rather small piece of our business so I wouldn't really comment on that one way or the other but it has been a good cash flow business for us historically. And you said you had a follow-up question?

Sameet Sinha - B. Riley & Co. - Analyst

Yes, on the expense side, Kim, if you could talk about how we should think about the expense trends specifically in the second quarter. As Jeff indicated, the leads business is going to go down sequentially. How should we think about the cadence of expenses throughout the year?

-6-

Kimberly Boren - Autobytel Inc. - CFO

Yes, so typically the first quarter, our expenses are the highest, and we have talked about this, because of some of the payroll expenses and other expenses that are front end loaded. NADA is in Q2 this year so that is typically in Q1. It is pushed out into Q2 so the expenses in Q2 should look similar to Q1 with, of course, the severance carved out as well as some of the one-time costs for I should say overlapping costs for the transition of IT resources to Guatemala, although that will be completed this quarter from a cost perspective.

So, I would look at it that way. We are looking at mid-30s as a percentage of revenue going forward for the year.

Sameet Sinha - B. Riley & Co. - Analyst

Thank you.

Operator

Eric Martinuzzi, Lake Street Capital.

Eric Martinuzzi - Lake Street Capital - Analyst

Thanks. I wanted to start with the EPS outlook for the midpoint of the year. That is basically $1.41. Given the $0.22 for Q1 and the expectation for a step down in Q2, I want to make sure I have my back half skewing about right. We could have roughly $0.40 in the front half of the year and $1.00 in the back half. Again, that is just roughly here I'm not asking for specifics but that is the size magnitude skewing?

Kimberly Boren - Autobytel Inc. - CFO

Yes, that is reasonable. Typically, Q3 is our strongest quarter and we would expect to make up quite a bit there, and with the ramp that we are seeing on the clicks business, we would expect Q4 to be a little bit unseasonably strong because of the growth.

Eric Martinuzzi - Lake Street Capital - Analyst

Okay. And then moving up to the margin side, I am having trouble. Obviously I can calculate an adjusted net margin but I can't calculate an adjusted operating margin nor an adjusted gross margin. So, that would be helpful in the future but it sounds like the expense side of the things that weren't one-time and of the things that weren't severance related--it sounds like I was off on my own expense model in Q1. Maybe the things that weren't one-time and severance related would be Guatemala. What else besides that?

Kimberly Boren - Autobytel Inc. - CFO

That would be predominantly it, Eric. Aside again the higher payroll related costs that we see in the first quarter and employee expenses that we see in the first quarter. We have just been investing ahead of the growth as we mentioned in the clicks business with the headcount in Guatemala as well as the sales businesses we are preparing to release the product in the third quarter.

Eric Martinuzzi - Lake Street Capital - Analyst

All right. And then up to the leads business, as I look at it the leads revenue was roughly flat, leads volume was down slightly from Q4 to Q1. What explains that? Is this a question of better pricing or just kind of a mix where there was better pricing on retail even though that seemed like it was relatively flat?

-7-

Kimberly Boren - Autobytel Inc. - CFO

Yes, there is a little bit of mix but we are seeing some pricing in the market, some elasticity in pricing as we mentioned, and as we are raising the quality of the legacy Dealix leads and improving the ROI for the dealers from those leads, we are able to get pricing for incoming dealers.

Eric Martinuzzi - Lake Street Capital - Analyst

Okay. And then Jeff, I know you have covered one of the slides talked about the macro environment for new vehicle sales, retail auto sales forecast but just anecdotally I know you were at the NADA conference fairly recently. Any takeaways that you would care to share as far as separate from the numbers here is what the dealers are saying?

Jeff Coats - Autobytel Inc. - President and CEO

You know, the overall atmosphere at NADA this year was extremely positive. As I have mentioned to a few people, the stock market seems to have decided that the automotive market is not going to have a great year this year. The automotive market has not yet agreed with that. So, things are looking pretty good still. The unit volumes were strong in April. We are not seeing any big pullback thus far. Financing rates are still extremely attractive, financing is widely available. That is a big driver of autos sales.

And incentives, while they are up somewhat, are not nearly where they were at pre-recession levels so there is still some dry powder there from a going forward standpoint. And to my understanding this year is the largest either new vehicle or new model introduction year in many years. I believe there is something like 65 new or upgraded vehicles being launched this year and those also tend to drive overall demand at the consumer level. So, the automotive industry overall is pretty bullish at this point.

Eric Martinuzzi - Lake Street Capital - Analyst

Thank you.

Operator

Gary Prestopino, Barrington Research.

Gary Prestopino - Barrington Research - Analyst

Good afternoon. Most of the number questions have been answered but, Jeff, you mentioned the white space in the used lead business. Are you also contemplating trying to service the independent dealer market for used leads or are you doing that already?

Jeff Coats - Autobytel Inc. - President and CEO

So the answer would be yes and yes. We historically did not really serve the independent market. As part of the Dealix acquisition, we picked up a couple of new customers -- large customers that they were doing business with that are pretty well-known names but they are independent, and we now recognize how interesting and lucrative that independent market can be. So we are gearing up to call on the larger more sophisticated independent dealers out there. And you know, we already do business with some of the rental car companies who have used car operations that are in that business. They are technically independents because they are non-franchise dealers. So, there is actually a lot of pretty well-known names out there that people like us can do business with as we get into that.

Most of the competition in the used car space is on a subscription basis where a dealer pays a flat amount and gets leads and advertising and whatever. We think our pay per lead model will be very well received in a larger portion of that marketplace so we feel pretty good about that.

-8-

Gary Prestopino - Barrington Research - Analyst

Did you have a booth at NADA?

Jeff Coats - Autobytel Inc. - President and CEO

Yes, we did. We always do.

Gary Prestopino - Barrington Research - Analyst

Because I didn't get to go out there this year. What was the general -- not atmosphere but in terms of- another entity in the space this morning said that they had just a high degree of inquiries and leads from NADA this year and I was just wondering if you could comment on as it pertains to your business--what you guys experienced there?

Jeff Coats - Autobytel Inc. - President and CEO

Yes, overall the sentiment was extremely positive there. We probably saw more dealer opportunities from our booth at NADA this year that we have for quite a long time. It was very well trafficked and there are a lot of dealers looking for ways to try to push more metal off the lots so we got a lot of inbound inquiries at NADA this year.

Gary Prestopino - Barrington Research - Analyst

And then just out of curiosity, you mentioned you are abandoning some Dealix leads volume that you think is low-quality. Can you give us,just like maybe, an example of what something like that is?

Jeff Coats - Autobytel Inc. - President and CEO

It could be an implementation where a consumer submits a lead for a certain kind of vehicle and for instance there may be more than one lead generated off of a lead form. There are lots of different things, most of it all we had gone through and found and kind of redirected, rejiggered. But as we were going through the final integrations, there were some other things that came up that we decided we needed to correct. And as you know, we use IHS Automotive to do a sales match against registration data. Dealix historically did a little bit with them but not much and so by the time we had a chance to push the Dealix leads through our IHS screens to really get a good idea of what the quality looked like, it takes several months in arrears to do that.

So, we feel pretty good about where we are now. It is just a question of turning up the flame in our Tampa operation to generate more leads. You just can't do it overnight. You have to do it slowly over a period of time in order to improve your volume so you keep your margin and you keep your quality and we are in the middle of that right now.

Gary Prestopino - Barrington Research - Analyst

Okay, thanks a lot.

Operator

(Operator Instructions). Ed Woo, Ascendiant Capital Markets.

Ed Woo - Ascendiant Capital Markets - Analyst

Congratulations on the quarter. I was wondering, do you notice any change in the competitive landscape particularly with other competitors?

-9-

Jeff Coats - Autobytel Inc. - President and CEO

I wouldn't say that we have seen anything more pronounced than usual. There is a lot of -- there is some consolidation going on in the industry, some of the companies that have done acquisitions are kind of in the midst of integrating them. But I would say it is pretty much the usual strong competitive cadence that we normally see. Haven't really seen anything that looks any particularly different.

Ed Woo - Ascendiant Capital Markets - Analyst

All right, that sounds good. And then following up on the used car initiatives, that is obviously a very big market. You guys obviously seem to have consolidated the new car lead space but how fragmented is the used car lead space and how do think it is going to be different to tackle that versus what you guys have done in a new car space?

Jeff Coats - Autobytel Inc. - President and CEO

We think it will be very straightforward. We have historically done used business with franchise dealers. We are adjusting our programs there to incent our salespeople to be more focused on that but we are also turning up the flame on looking at some of the other independents that are out there. There are some very large operations, some of them we do business with today a little bit that we would like to do more with.

So, it should be pretty straightforward, Ed. And, in an environment where the growth rate of sales is slowing down a little bit on the new side, we think this is going to be extremely well received on the used side as well as the new side in terms of what we are doing now.

Ed Woo - Ascendiant Capital Markets - Analyst

Great. That sounds exciting, especially if the market is two to three times bigger than new car sales. In which case good luck.

Jeff Coats - Autobytel Inc. - President and CEO

Thank you.

Operator

John Blackledge, Cowen and Company.

John Blackledge - Cowen and Company - Analyst

Just a couple of questions. I don't know if you mentioned the kind of click product revenue progression throughout the course of 2016, so just the impact of click revenue? And also, how competitive is the pay per click environment? In other words, are there other alternatives for dealers? And then lastly, just wondering about the Affinity opportunity as we go through the course of year in the next couple of years?

-10-

Jeff Coats - Autobytel Inc. - President and CEO

Sure. The click revenue is scaling up during the quarter. It is AutoWeb's business scale up that during the course of 2015 and was really starting to grow quite nicely as we acquired it. We have continued to reinforce that, reinvest in that side of the business even in the midst of all of the integration and everything that we have been doing. So it is actually -- I have mentioned to some people that we would hope to break out our click revenue at some point this year when it became more meaningful. Just the fact that we are already doing it in Q2 I think is an extremely positive sign for us and for everyone that it is becoming more meaningful.

So, you will be able to see it but it is going to continue to scale during the course of the year. It is not a straight line kind of revenue line.

I'm sorry. I forgot the second one. We are interested in looking at the Affinity opportunities that are out there. It is something that we are spending some time on, but as you can imagine, we have been kind of up to our eyeballs in finishing the integration of the two acquisitions we did last year. But it is something that we view as the future very interesting opportunity.

John Blackledge - Cowen and Company - Analyst

Thank you.

Operator

Patrick Lin, Primarius Capital.

Patrick Lin - Primarius Capital - Analyst

Thanks for taking my call. Jeff, you guys talked about the used car market and alluded to the size of it. Can you just give a little bit more color in terms of why you guys are confident about the growth here because it seems like being fragmented, what gives you the visibility that this thing can be a scalable business? And then, I have a follow-up, please.

Jeff Coats - Autobytel Inc. - President and CEO

It is primarily because the other business models on the digital marketing side that are being pursued in used cars today are predominantly the subscription models by some of the larger players. So a dealer pays a flat fee and for that flat fee they get various services including leads and advertising and they are encouraged to believe that they are getting a lot of walk-in traffic from those listings.

Ours is really more close to a pay for performance approach. It is a per lead approach and as long as we are hitting the kind of close rates overall that our leads are generating whether they be for new or used in our 16% to 25% ranges, we believe that will be extremely well received. It is already thus far from the independent players we are already doing business with. So it is really a function of, if we are helping them sell cars, they will buy our leads.

Patrick Lin - Primarius Capital - Analyst

Great. The second question is real quickly, you talked about reiterating your earnings-per-share guidance for this full-year. And I am wondering, in the past historically, Autobytel has beaten earnings estimates. If you guys were to continue to beat the estimates, where might the upside come from in terms of how you guys see the second half of the year in terms of earnings?

-11-

Jeff Coats - Autobytel Inc. - President and CEO

Patrick, as I'm sure you are aware, that is a pretty tough question to answer. Probably the best I can do for you on that is it is really the halo effect from the growth in the clicks business and continuing to pursue the quality approach on the lead side. So, having the combination of clicks and leads together is really, we think, a very powerful combination out there and we expect to see some nice scale in the business as a result, which will generate a very nice EPS for us.

Patrick Lin - Primarius Capital - Analyst

So, you are not looking at any one particular lever that might have the biggest impact but rather across the board the halo effect for all of the businesses collectively. Is that right?

Jeff Coats - Autobytel Inc. - President and CEO

Absolutely. I mean it is the clicks business, it is scaling up the used car business and it is continuing to pursue our high-quality leads business. The metrics we have been using the last few quarters, the new car leads per dealer and used car leads per dealer are continually increasing and that is important because that is reflective of the fact that dealers are buying more of our leads, including the dealers that are already on our programs. This is not just driven by new sales, this is the dealers on our programs overall are buying more leads from us and it is a function of the quality and return on investment they get.

So, it is an overall halo from the business clicks, leads, used car--big opportunities this year.

Operator

At this time, this concludes our question-and-answer session. I would now like to turn the call back over to Mr. Coates for closing remarks.

Jeff Coats - Autobytel Inc. - President and CEO

Thank you. Thanks to all of you for joining us today. I also want to thank our team of dedicated, very hard-working employees. We look forward to speaking to our investors. Actually the next 30 days is a pretty big period for us. We are attending the Barrington conference, the B. Riley conference, Needham, and Cowen. So we look forward to seeing you at one or more of those conferences. Thank you.

-12-