Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Seventy Seven Energy Inc. | d137481d8k.htm |

Exhibit 99.1

THIS IS A SOLICITATION OF VOTES TO ACCEPT OR REJECT A JOINT PREPACKAGED CHAPTER 11 PLAN OF REORGANIZATION OF SEVENTY SEVEN FINANCE INC. AND ITS DEBTOR AFFILIATES. SEVENTY SEVEN FINANCE INC. AND THE COMPANIES LISTED BELOW HAVE NOT FILED FOR RELIEF UNDER CHAPTER 11 OF THE BANKRUPTCY CODE, AND THIS DISCLOSURE STATEMENT HAS NOT BEEN FILED WITH OR APPROVED BY THE BANKRUPTCY COURT OR THE SECURITIES AND EXCHANGE COMMISSION. IN THE EVENT THAT THESE COMPANIES FILE PETITIONS FOR RELIEF UNDER CHAPTER 11 OF THE BANKRUPTCY CODE AND SEEK CONFIRMATION OF THE JOINT PREPACKAGED PLAN OF REORGANIZATION DESCRIBED HEREIN, THIS DISCLOSURE STATEMENT WILL BE SUBMITTED TO THE BANKRUPTCY COURT FOR APPROVAL.

SOLICITATION AND DISCLOSURE STATEMENT FOR THE

JOINT PREPACKAGED CHAPTER 11 PLAN OF REORGANIZATION OF

SEVENTY SEVEN FINANCE INC. et al.,1

From holders of:

Term Loans and Related Term Loan Guaranty;

Incremental Term Loans and Related Incremental Term Loan Guaranty;

6.625% Senior Unsecured Notes due 2019 (CUSIP Nos. 165258AB0, U1650HAA8, and 165258AA2) and

Related Guaranty; and

6.5% Notes due 2022 (CUSIP No. 818097AB3)

THE DEADLINE TO ACCEPT OR REJECT THE PLAN IS 5:00 P.M., PREVAILING EASTERN TIME,

ON JUNE 3, 2016, UNLESS EXTENDED.

FOR YOUR VOTE TO BE COUNTED, YOUR BALLOT MUST BE ACTUALLY RECEIVED BY PRIME CLERK, THE VOTING AND CLAIMS AGENT, BEFORE THE VOTING DEADLINE AS DESCRIBED HEREIN. HOLDERS OF CLASS 3 TERM LOAN CLAIMS, CLASS 4 INCREMENTAL TERM LOAN CLAIMS, CLASS 5 OPCO NOTES CLAIMS, CLASS 10 TERM LOAN GUARANTY CLAIMS, CLASS 11 INCREMENTAL TERM LOAN GUARANTY CLAIMS, CLASS 12 OPCO NOTES GUARANTY CLAIMS AND CLASS 13 HOLDCO NOTES CLAIMS SHOULD REFER TO THE BALLOTS ENCLOSED FOR INSTRUCTIONS ON HOW TO VOTE ON THE PLAN OF REORGANIZATION. PLEASE NOTE THAT THE DESCRIPTION OF THE PLAN PROVIDED THROUGHOUT THIS DISCLOSURE STATEMENT IS ONLY A SUMMARY PROVIDED FOR CONVENIENCE. IN THE CASE OF ANY INCONSISTENCY BETWEEN THE SUMMARY OF THE PLAN IN THIS DISCLOSURE STATEMENT AND THE PLAN, THE PLAN WILL GOVERN.2

| 1 | The Debtors in these Chapter 11 Cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable, are: Seventy Seven Energy Inc. (8422); Seventy Seven Finance Inc. (3836); Seventy Seven Operating LLC (8399); Great Plains Oilfield Rental, L.L.C. (4318); Seventy Seven Land Company LLC (4346); Nomac Drilling, L.L.C. (9548); Performance Technologies, L.L.C. (5813); PTL Prop Solutions, L.L.C. (2147); SSE Leasing LLC (5764); Keystone Rock & Excavation, L.L.C. (8771); Western Wisconsin Sand Company, LLC (4510) (collectively, the “Debtors”). The Debtors’ mailing address is 777 NW 63rd Street, Oklahoma City, Oklahoma 73116. |

| 2 | Capitalized terms used but not otherwise defined in this Disclosure Statement will have the meanings set forth in the Plan. |

The Debtors hereby solicit from holders of Class 3 Term Loan Claims, Class 4 Incremental Term Loan Claims, Class 5 OpCo Notes Claims, Class 10 Term Loan Guaranty Claims, Class 11 Incremental Term Loan Guaranty Claims, Class 12 OpCo Notes Guaranty Claims and Class 13 HoldCo Notes Claims votes to accept or reject the Debtors’ Plan under chapter 11 of the Bankruptcy Code. A copy of the Plan is attached hereto as Exhibit A.

| Emanuel C. Grillo (pro hac vice pending) | Robert J. Dehney | |

| Christopher Newcomb (pro hac vice pending) | MORRIS, NICHOLS, ARSHT & TUNNELL LLP | |

| BAKER BOTTS LLP | 1201 N. Market Street, 16th Floor | |

| 30 Rockefeller Plaza | Wilmington, Delaware 19801 | |

| New York, New York 10112 | (302) 658-9200 | |

| (212) 892-4000 | ||

| Proposed Co-Counsel to Debtors and Debtors in Possession | Proposed Co-Counsel to Debtors and Debtors in Possession | |

Dated: May 9, 2016

2

NOTICE TO EMPLOYEES, TRADE CREDITORS

AND OTHER HOLDERS OF GENERAL UNSECURED CLAIMS

THE DEBTORS INTEND TO CONTINUE OPERATING THEIR BUSINESSES IN CHAPTER 11 IN THE ORDINARY COURSE OF BUSINESS AND TO SEEK TO OBTAIN THE NECESSARY RELIEF FROM THE COURT TO HONOR ITS OBLIGATIONS AND PAY ITS EMPLOYEES, TRADE CREDITORS AND OTHER GENERAL UNSECURED CLAIMANTS IN FULL AND IN ACCORDANCE WITH EXISTING BUSINESS TERMS.

DISCLAIMER

IMPORTANT INFORMATION FOR YOU TO READ

THE DEADLINE TO VOTE ON THE JOINT PREPACKAGED CHAPTER 11 PLAN OF SEVENTY SEVEN FINANCE INC., ET AL. IS JUNE 3, 2016 AT 5:00 P.M. PREVAILING EASTERN TIME. THE RECORD DATE FOR DETERMINING WHICH HOLDERS OF CLAIMS OR INTERESTS MAY VOTE ON THE PLAN IS MAY 4, 2016 (THE “VOTING RECORD DATE”).

FOR YOUR VOTE TO BE COUNTED, YOUR BALLOT MUST BE ACTUALLY RECEIVED BY THE VOTING AND CLAIMS AGENT BEFORE THE VOTING DEADLINE AS DESCRIBED HEREIN.

The information contained in this disclosure statement including the Exhibits annexed hereto (collectively, the “Disclosure Statement”) is included herein for purposes of soliciting acceptances of the Joint Prepackaged Chapter 11 Plan of Reorganization of Seventy Seven Finance Inc. and its Debtor Affiliates (the “Plan”) and may not be relied upon for any purpose other than to determine how to vote on the Plan. The Bankruptcy Court has not approved the adequacy of the disclosure contained in this Disclosure Statement or the merits of the Plan. No person is authorized by the Debtors in connection with the Plan or the solicitation of acceptances of the Plan to give any information or to make any representation regarding this Disclosure Statement or the Plan other than as contained in this Disclosure Statement and the Exhibits annexed hereto, incorporated by reference or referred to herein, and if given or made, such information or representation may not be relied upon as having been authorized by the Debtors.

The Disclosure Statement shall not be construed to be advice on the tax, securities, financial, business or other legal effects of the Plan as to holders of Claims against, or Interests in, the Debtors, the Reorganized Debtors or any other person. Each holder should consult with its own legal, business, financial and tax advisors with respect to any matters concerning this Disclosure Statement, the solicitation of votes to accept the Plan, the Plan and the transactions contemplated hereby and thereby.

The Debtors urge the holders of Term Loan Claims in Class 3, Incremental Term Loan Claims in Class 4, OpCo Notes Claims in Class 5, Term Loan Guaranty Claims in Class 10, Incremental Term Loan Guaranty Claims in Class 11, OpCo Notes Guaranty Claims in Class 12 and HoldCo Notes Claims in Class 13, the only Classes of Claims entitled to vote on the Plan, to (1) read the entire Disclosure Statement and Plan carefully; (2) consider all of the information in this Disclosure Statement, including, importantly, the risk factors described in Article XI of this Disclosure Statement; and (3) consult with your own advisors with respect to reviewing this Disclosure Statement, the Plan and all documents that are attached to the Plan and Disclosure Statement before deciding whether to vote to accept or reject the Plan. Plan summaries and statements made in this Disclosure Statement are qualified in their entirety by reference to the Plan and the Exhibits annexed to the Plan and this Disclosure Statement. Please be advised, however, that the statements contained in this Disclosure Statement are made as of the date hereof unless another time is specified herein, and holders of Claims reviewing this Disclosure Statement should not infer at the time of such review that there has not been any change in the information set forth herein since the date hereof unless so specified. In the event of any conflict between the descriptions set forth in this Disclosure Statement and the terms of the Plan, the terms of the Plan shall govern.

i

See the Risk Factors in Article XI of the Disclosure Statement for certain risks that you should carefully consider.

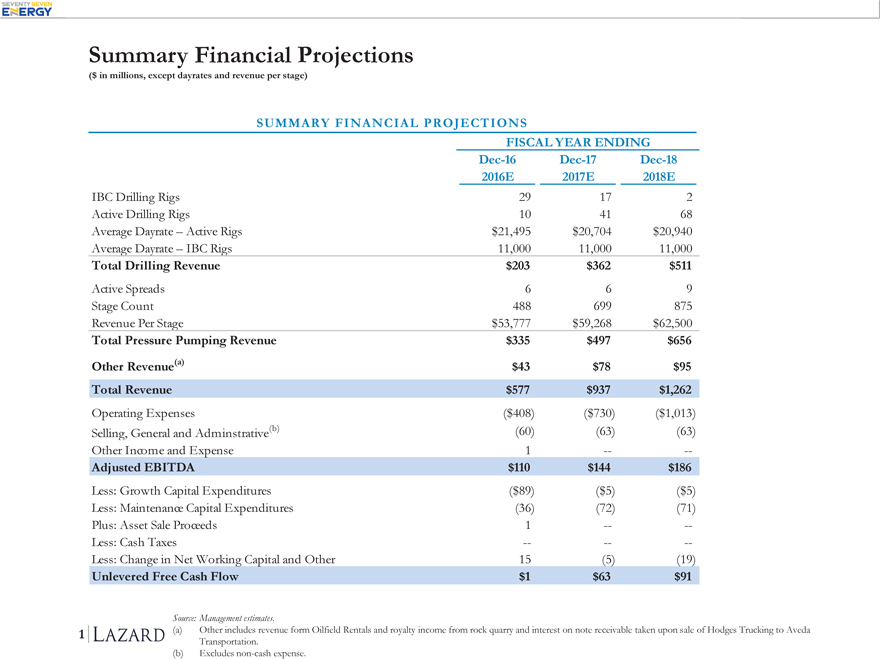

The financial information contained in or incorporated by reference into this Disclosure Statement has not been audited, except as specifically indicated otherwise. The Debtors’ management, in consultation with their advisors, has prepared the Financial Projections (as defined below) attached hereto as Exhibit F and described in this Disclosure Statement. The Debtors’ management did not prepare the Financial Projections in accordance with Generally Accepted Accounting Principles (“GAAP”) or International Financial Reporting Standards (“IFRS”) or to comply with the rules and regulations of the SEC or any foreign regulatory authority. The Financial Projections, while presented with numerical specificity, necessarily were based on a variety of estimates and assumptions that are inherently uncertain and may be beyond the control of the Debtors’ management. Important factors that may affect actual results and cause the management forecasts not to be achieved include, but are not limited to, risks and uncertainties relating to the Debtors’ businesses (including their ability to achieve strategic goals, objectives and targets over applicable periods), industry performance, the regulatory environment, general business and economic conditions and other factors. The Debtors caution that no representations can be made as to the accuracy of these Financial Projections or to their ultimate performance compared to the information contained in the forecasts or that the forecasted results will be achieved. Therefore, the Financial Projections may not be relied upon as a guarantee or other assurance that the actual results will occur.

As to contested matters, existing litigation involving, or possible litigation to be brought by, or against, the Debtors, adversary proceedings and other actions or threatened actions, this Disclosure Statement and Plan shall not constitute, or be construed as, an admission of any fact or liability, a stipulation, or a waiver, but rather as a statement made without prejudice solely for settlement purposes in accordance with Federal Rule of Evidence 408, with full reservation of rights, and is not to be used for any litigation purpose whatsoever by any person, party or entity.

The Board of Directors (or equivalent thereof, as applicable) of each of the Debtors has approved the Plan and recommends that the holders of Term Loan Claims (Class 3), Incremental Term Loan Claims (Class 4), OpCo Notes Claims (Class 5), Term Loan Guaranty Claims (Class 10), Incremental Term Loan Guaranty Claims (Class 11), OpCo Notes Guaranty Claims (Class 12) and HoldCo Notes Claims (Class 13) vote to accept the Plan. The Plan has been negotiated with, and has the support of, the Restructuring Support Parties, which consist of (i) lenders under the Term Loan Credit Agreement that collectively hold approximately 84% of the Term Loan Claims, (ii) lenders under the Incremental Term Supplement that collectively hold approximately 92% of the Incremental Term Loan Claims and (iii) an ad hoc group of holders of the OpCo Notes that collectively hold in excess of 63.2% of the OpCo Notes. This Disclosure Statement, the Plan and the accompanying documents have been extensively negotiated with the legal and/or financial advisors to the Restructuring Support Parties. The votes on the Plan are being solicited in accordance with the Restructuring Support Agreement dated as of May 3, 2016 (as may be amended from time to time), which was executed by the Debtors and each of the Restructuring Support Parties.

The Debtors intend to confirm the Plan and cause the Effective Date to occur promptly after confirmation of the Plan. There can be no assurance, however, as to when and whether confirmation of the Plan and the Effective Date actually will occur. The confirmation and effectiveness of the Plan are subject to material conditions precedent. See Section VIII.B—“Conditions Precedent to Effectiveness.” There is no assurance that these conditions will be satisfied or waived. Procedures for distributions under the Plan are described under Section VII.D—“Distributions.” Distributions will be made only in compliance with these procedures.

If the Plan is confirmed by the Bankruptcy Court and the Effective Date occurs, all holders of Claims against, and Interests in, the Debtors (including, without limitation, those holders of Claims and Interests that do not submit ballots to accept or reject the Plan or that are not entitled to vote on the Plan) will be bound by the terms of the Plan and the transactions contemplated thereby.

If the financial restructuring of the indebtedness contemplated by the Plan is not approved and consummated, there can be no assurance that the Debtors will be able to effectuate an alternative restructuring or successfully emerge from its Chapter 11 Cases, and the Debtors may be forced into a liquidation under chapter 7 of the Bankruptcy Code or under the laws of other countries. As reflected in the Liquidation Analysis (as defined

ii

below), the Debtors believe that if operations are terminated and their assets are liquidated under chapter 7 of the Bankruptcy Code or otherwise, the value of the assets available for payment to creditors and interest holders would be significantly lower than the value of the distributions contemplated by and under the Plan.

SPECIAL NOTICE REGARDING FEDERAL AND STATE SECURITIES LAWS

As of the date of distribution, neither this Disclosure Statement nor the Plan has been filed with or reviewed by the Bankruptcy Court, and neither this Disclosure Statement nor the Plan has been filed with the United States Securities and Exchange Commission (the “SEC”) or any state authority. The Plan has not been approved or disapproved by the SEC or any state securities commission and neither the SEC nor any state securities commission has passed upon the accuracy or adequacy of this Disclosure Statement or the merits of the Plan. Any representation to the contrary is a criminal offense.

This Disclosure Statement has been prepared pursuant to section 1125 of the Bankruptcy Code and Bankruptcy Rule 3016(b) (but has not yet been approved by the Bankruptcy Court as complying with section 1125 of the Bankruptcy Code and Bankruptcy Rule 3016(b)). The securities to be issued under the Plan on or after the Effective Date will not have been the subject of a registration statement filed with the SEC under the Securities Act or any securities regulatory authority of any state under any state securities laws (“Blue Sky Laws”).

Prior to the filing of the Chapter 11 Cases, the Debtors will rely on the exemption provided by section 4(a)(2) of the Securities Act of 1933, as amended, and applicable exemptions from Blue Sky Laws. After the commencement of the Chapter 11 Cases, the Debtors intend to rely on the exemption from the Securities Act and Blue Sky Laws registration requirements provided by section 1145(a)(1) of the Bankruptcy Code to exempt the issuance of securities issued under, or in connection with, the Plan.

Each holder of an OpCo Notes Claim, OpCo Notes Guaranty Claim or HoldCo Notes Claim will be required to certify on its ballot whether it is an Accredited Investor or a Qualified Institutional Buyer. If a holder of an OpCo Notes Claim, OpCo Notes Guaranty Claim or HoldCo Notes Claim is not an Accredited Investor or a Qualified Institutional Buyer, its vote will not be counted.

Neither the Solicitation Package nor this Disclosure Statement constitutes an offer to sell or the solicitation of an offer to buy securities in any state or jurisdiction in which such offer or solicitation is not authorized.

See the Risk Factors in Article XI of the Disclosure Statement for certain risks that you should carefully consider.

This Disclosure Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements consist of any statement other than a recitation of historical fact and can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “could,” “intend,” “consider,” “expect,” “plan,” “anticipate,” “believe,” “predict,” “estimate,” or “continue” or the negative thereof or other variations thereon or comparable terminology. You are cautioned that all forward-looking statements involve risks and uncertainties that could cause actual events or results to differ materially from those referred to in such forward-looking statements. Important factors that could cause or contribute to such differences include those in Article XI: “Certain Risk Factors to be Considered,” generally and in particular “Additional Factors to be Considered—Forward-Looking Statements are not Assured, and Actual Results May Vary.” The Liquidation Analysis set forth in Exhibit D, distribution projections and other information contained herein and annexed hereto are estimates only, and the timing and amount of actual distributions to holders of Allowed Claims and Allowed Interests may be affected by many factors that cannot be predicted. Any analyses, estimates or recovery projections may or may not turn out to be accurate.

iii

QUESTIONS AND ADDITIONAL INFORMATION

If you would like to obtain copies of this Disclosure Statement, the Plan or any of the documents attached hereto or referenced herein, or if you have questions about the solicitation and voting process or these Chapter 11 Cases generally, please contact Prime Clerk, LLC (the “Voting and Claims Agent” or “Prime Clerk”), by (i) calling 844-224-1136 (Toll Free) or 917-962-8386 (International), or (ii) emailing 77nrgballots@primeclerk.com.

Seventy Seven files annual, quarterly and other reports, proxy and information statements and other information with the SEC. You may read and copy any document Seventy Seven files at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for information regarding the Public Reference Room and its copying charges. You can also find Company filings on the SEC’s website at http://www.sec.gov and on Seventy Seven’s website at http://www.77nrg.com. Information contained on Seventy Seven’s website, except for the SEC filings referred to below, is not a part of, and shall not be deemed to be incorporated by reference into, this Disclosure Statement.

By “incorporating by reference” the information Seventy Seven has filed with the SEC, Seventy Seven is disclosing information to you by referring you to those documents without actually including the specific information in this Disclosure Statement. The information incorporated by reference is an important part of this Disclosure Statement, and information that Seventy Seven files later with the SEC will automatically update and may replace this information and information previously filed with the SEC. Any statement contained in the filings (or portions of filings) incorporated by reference into this Disclosure Statement will be deemed to be modified or superseded for purposes of this Disclosure Statement to the extent that a statement contained in this Disclosure Statement or in any filing by Seventy Seven with the SEC prior to the completion of this solicitation modifies, conflicts with, or supersedes such statement.

Seventy Seven also incorporates by reference into this Disclosure Statement any future filings made with the SEC under sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, other than information furnished to the SEC under Items 2.02 or 7.01, or the exhibits related thereto under Item 9.01, of Form 8-K, which information is not deemed filed under the Exchange Act and is not incorporated by reference into this Disclosure Statement.

iv

TABLE OF CONTENTS

| I. |

INTRODUCTION AND EXECUTIVE SUMMARY | 1 | ||||||

| II. |

SUMMARY OF THE CLASSIFICATION AND TREATMENT OF CLAIMS AND EQUITY INTERESTS UNDER THE PLAN | 3 | ||||||

| III. |

VOTING PROCEDURES AND REQUIREMENTS | 8 | ||||||

| A. | Classes Entitled to Vote on the Plan | 8 | ||||||

| B. | Votes Required for Acceptance by a Class | 8 | ||||||

| C. | Certain Factors to Be Considered Prior to Voting | 8 | ||||||

| D. | Classes Not Entitled to Vote on the Plan | 9 | ||||||

| E. | Cramdown | 9 | ||||||

| F. | Allowed Claims | 9 | ||||||

| G. | Impairment Generally | 9 | ||||||

| H. | Solicitation and Voting Process | 10 | ||||||

| The “Solicitation Package” | 10 | |||||||

| Voting Deadlines | 11 | |||||||

| Voting Instructions | 11 | |||||||

| Beneficial Owners of Class 5 OpCo Notes Claims, Class 12 OpCo Notes Guaranty Claims and Class 13 HoldCo Notes Claims | 14 | |||||||

| Brokerage Firms, Banks and Other Nominees | 14 | |||||||

| I. | Confirmation of the Plan and the Combined Hearing | 15 | ||||||

| IV. |

COMPANY BACKGROUND | 15 | ||||||

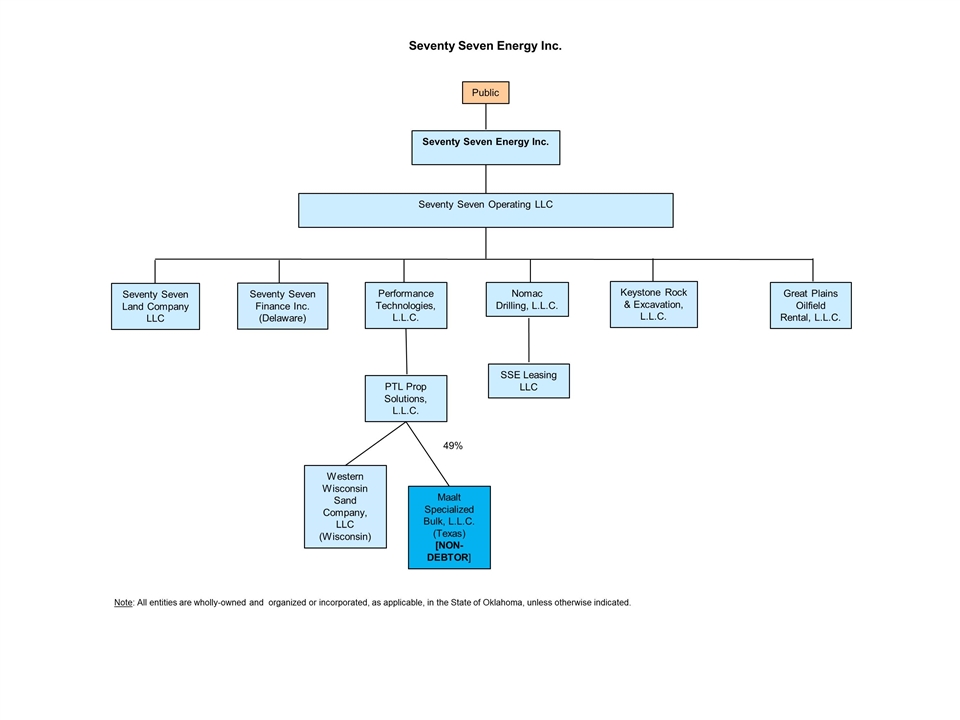

| A. | Company Overview and Organizational Structure | 15 | ||||||

| B. | Relationship with Chesapeake Energy Corporation | 15 | ||||||

| C. | Operations | 18 | ||||||

| D. | Industry and Competition | 20 | ||||||

| E. | Backlog | 20 | ||||||

| F. | Suppliers | 21 | ||||||

| G. | Regulation | 21 | ||||||

| H. | Real Property | 24 | ||||||

| I. | Employees | 24 | ||||||

| J. | The Debtors’ Prepetition Capital Structure | 25 | ||||||

| K. | Prepetition Litigation | 27 | ||||||

| L. | Outlook and Business Strategy | 27 | ||||||

| V. |

EVENTS LEADING TO THE COMMENCEMENT OF THE CHAPTER 11 CASES | 28 | ||||||

| A. | Energy Market Conditions | 28 | ||||||

| B. | Certain Events that Set the Stage for the Restructuring and the Chapter 11 Cases | 29 | ||||||

| C. | Prepetition Restructuring Initiatives | 29 | ||||||

| D. | The Restructuring Support Agreement | 30 | ||||||

| VI. |

THE ANTICIPATED CHAPTER 11 CASES | 32 | ||||||

| A. | Expected Timetable of the Chapter 11 Case | 33 | ||||||

| B. | Significant First Day Motions and Retention of Professionals | 33 | ||||||

| VII. |

SUMMARY OF THE PLAN | 35 | ||||||

| A. | Unclassified Claims | 35 | ||||||

| B. | Treatment of Classified Claims and Interests | 36 | ||||||

| C. | Means for Implementation; Post-Effective Date Governance | 42 | ||||||

| D. | Distributions | 48 | ||||||

v

| E. | Procedures for Resolving Claims | 51 | ||||||

| F. | Executory Contracts and Unexpired Leases | 52 | ||||||

| G. | Effect of Confirmation; Injunctions, Releases and Related Provisions | 54 | ||||||

| H. | Retention of Jurisdiction | 58 | ||||||

| I. | Miscellaneous Provisions | 60 | ||||||

| VIII. |

CONFIRMATION AND EFFECTIVENESS OF THE PLAN | 61 | ||||||

| A. | Conditions Precedent to Confirmation | 61 | ||||||

| B. | Conditions Precedent to Effectiveness | 61 | ||||||

| C. | Waiver of Conditions Precedent | 63 | ||||||

| D. | Effect of Failure of a Condition | 63 | ||||||

| IX. |

CONFIRMATION PROCEDURES | 63 | ||||||

| A. | Combined Disclosure Statement and Confirmation Hearing | 63 | ||||||

| B. | Standards for Confirmation | 64 | ||||||

| Confirmation Without Acceptance by All Impaired Classes | 65 | |||||||

| C. | Alternatives to Confirmation and Consummation of the Plan | 68 | ||||||

| X. |

LIQUIDATION ANALYSIS, VALUATION AND FINANCIAL PROJECTIONS | 68 | ||||||

| A. | Liquidation Analysis | 68 | ||||||

| B. | Valuation Analysis | 69 | ||||||

| C. | Financial Projections | 69 | ||||||

| D. | Other Available Information | 69 | ||||||

| XI. |

CERTAIN RISK FACTORS TO BE CONSIDERED | 70 | ||||||

| A. | General | 70 | ||||||

| B. | Certain Bankruptcy Law Considerations | 70 | ||||||

| C. | Certain Risks Related to the Debtors’ Business and Operations | 73 | ||||||

| D. | Certain Risks Relating to the Shares of New HoldCo Common Shares and the New Warrants Under the Plan | 88 | ||||||

| E. | Additional Factors to Be Considered | 90 | ||||||

| XII. |

SECURITIES LAW MATTERS | 93 | ||||||

| A. | Bankruptcy Code Exemptions from Registration Requirements | 93 | ||||||

| XIII. |

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | 96 | ||||||

| A. | Introduction | 96 | ||||||

| B. | Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors | 97 | ||||||

| C. | Certain U.S. Federal Income Tax Consequences of the Plan to U.S. Holders of Allowed Class 3 Term Loan Claims, Incremental Term Loan/Guaranty Claims, OpCo Notes/Guaranty Claims and Class 13 HoldCo Notes Claims | 99 | ||||||

| D. | Receipt of Interests in the Litigation Trust | 104 | ||||||

| E. | Information Reporting and Backup Withholding | 105 | ||||||

| F. | Importance of Obtaining Professional Tax Assistance | 106 | ||||||

| XIV. |

RECOMMENDATION AND CONCLUSION | 106 | ||||||

vi

TABLE OF EXHIBITS

| Exhibit A: | Debtors’ Joint Prepackaged Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code | |

| Exhibit B: | Restructuring Support Agreement | |

| Exhibit C: | Seventy Seven’s Prepetition Corporate Structure | |

| Exhibit D: | Liquidation Analysis | |

| Exhibit E: | Valuation Analysis | |

| Exhibit F: | Financial Projections | |

| Exhibit G: | Exit Facility Commitment Letter | |

THE DEBTORS HEREBY ADOPT AND INCORPORATE EACH EXHIBIT ANNEXED TO THIS DISCLOSURE STATEMENT BY REFERENCE AS THOUGH FULLY SET FORTH HEREIN.

vii

I. INTRODUCTION AND EXECUTIVE SUMMARY

Seventy Seven Energy Inc., an Oklahoma corporation (“HoldCo”), Seventy Seven Operating LLC (“OpCo”) and certain of their direct and indirect subsidiaries, including Seventy Seven Finance Inc., (the “Debtor Subsidiaries,” and together with HoldCo and OpCo, collectively, the “Company” or “Seventy Seven”), which intend to become chapter 11 debtors and debtors in possession (the “Debtors”) in chapter 11 cases to be filed (the “Chapter 11 Cases”), submit this Disclosure Statement pursuant to section 1126 of title 11 of the United States Code (the “Bankruptcy Code”) for use in the solicitation of votes on the Plan. A copy of the Plan is annexed hereto as Exhibit A. Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Plan.

Seventy Seven provides a wide range of wellsite services and equipment to United States (“U.S.”) land-based exploration and production customers. Its services include drilling, hydraulic fracturing and oilfield rentals. As of March 31, 2016, Seventy Seven’s marketed rig fleet of 92 all-electric rigs consisted of 35 Tier 1 rigs (including 24 proprietary PeakeRigs™) and 57 Tier 2 rigs. Additionally, Seventy Seven had two additional contracted PeakeRigs™ under construction, one of which has been delivered and one of which is scheduled to be delivered during the remainder of 2016. As of March 31, 2016, Seventy Seven also owned 13 hydraulic fracturing fleets with an aggregate of 500,000 horsepower and a diversified oilfield rentals business. Seventy Seven’s operations are geographically diversified across many of the most active oil and natural gas plays in the onshore United States, including the Anadarko and Permian Basins and the Eagle Ford, Haynesville, Marcellus, Niobrara and Utica Shales.

The purpose of this Disclosure Statement is to provide information sufficient to enable creditors of the Debtors that are entitled to vote on the Plan to make informed decisions on whether to vote to accept or reject the Plan. This Disclosure Statement sets forth certain information regarding the Debtors’ prepetition operating and financial history, the Debtors’ need to seek chapter 11 protection, significant events that are expected to occur during the Chapter 11 Cases and the Debtors’ anticipated organization, operations and liquidity upon successful emergence from chapter 11 protection.

The Plan and this Disclosure Statement are the result of extensive and vigorous negotiations among the Debtors and the Restructuring Support Parties, which consist of (i) lenders under the Term Loan Credit Agreement that collectively hold approximately 84% of the Term Loan Claims, (ii) lenders under the Incremental Term Supplement that collectively hold approximately 92% of the Incremental Term Loan Claims and (iii) an ad hoc group of holders of the OpCo Notes that collectively hold in excess of 63% of the OpCo Notes. The culmination of such negotiations was the entry into the Restructuring Support Agreement (as may be amended from time to time, the “Restructuring Support Agreement”), a copy of which is attached hereto as Exhibit B. The Restructuring Support Agreement sets forth the material terms and conditions of the restructuring provided for in the Plan and described herein (the “Restructuring”). As described in more detail below, the Plan substantially deleverages the Debtors’ balance sheet by converting approximately $650 million of debt under the OpCo Notes and $450 million of debt under the HoldCo Notes into 100% equity in Reorganized HoldCo.

As part of the overall settlement embodied in the Restructuring Support Agreement and the Plan, the holders of the OpCo Notes are voluntarily forgoing their right to part of the distributions under the Plan that they are otherwise entitled to receive so that the Debtors can (i) pay in full allowed general unsecured claims, such as the claims of suppliers and vendors, in the ordinary course according to existing business terms (ii), provide a Pro Rata distribution of a portion of the New HoldCo Common Shares, and, if Class 13 (HoldCo Notes Claims) votes to accept the Plan, the New A Warrants to holders of the HoldCo Notes and (iii) if all Voting Classes vote to accept the Plan, provide a Pro Rata distribution of the New B Warrants and the New C Warrants to holders of Existing HoldCo Interests in exchange for the surrender or cancellation of their Interests.

The key components of the Plan are as follows:

| • | Holders of Allowed General Unsecured Claims, including Allowed Claims of trade vendors, suppliers and customers, will not be affected by the filing of the Chapter 11 Cases and, subject to Bankruptcy Court approval, are anticipated to be paid in full in the ordinary course |

1

| of business during the pendency of the Chapter 11 Cases or reinstated and left Unimpaired under the Plan in accordance with their terms as part of the overall compromise embodied in the Plan. |

| • | Holders of Allowed Term Loan Claims will receive (i) their Pro Rata share of the Term Loan Payment; and (ii) continue to hold their Pro Rata share of Term Loans under the Term Loan Credit Agreement (as amended by the Term Loan Credit Agreement Amendment), which Term Loans shall be secured by a valid, perfected and enforceable first-priority lien on and security interest in the Term Loan Collateral and a valid, perfected and enforceable second-priority lien on and security interest in the Exit Facility Priority Collateral. |

| • | Payment in full, in cash, of all Allowed Administrative Claims, Fee Claims, DIP Claims, Priority Tax Claims, statutory fees, Other Priority Claims and Other Secured Claims. |

| • | Holders of Allowed Incremental Term Loan Claims will receive their Pro Rata share of (i) the Incremental Term Loan Payment, and (ii) $15 million of the outstanding Incremental Term Loan balance. The remaining Incremental Term Loan Claims, which shall be secured by a valid, perfected and enforceable second-priority lien on and security interest in the Term Loan Collateral and a valid, perfected and enforceable third-priority lien on and security interest in the Exit Facility Priority Collateral, will be Allowed at $84 million in principal plus all accrued, unpaid interest, fees and any other expenses through and including the Effective Date (including applicable Restructuring Expenses) and will be reinstated with the rights of holders of such Claims unaltered by the Plan (except for certain amendments to the Incremental Term Supplement). |

| • | Holders of Allowed OpCo Notes Claims will receive their Pro Rata share of 96.75%, or if Class 13 (HoldCo Notes Claims) does not vote to accept the Plan, 98.67%, on a fully diluted basis (subject only to the New Warrants and any securities issued under the Management Incentive Plan) of the New HoldCo Common Shares outstanding as of the Effective Date. |

| • | Holders of Allowed HoldCo Notes Claims will receive their Pro Rata share of 3.25% on a fully diluted basis (subject only to the New Warrants and any securities issued under the Management Incentive Plan) of the New HoldCo Common Shares outstanding as of the Effective Date plus warrants exercisable 15% of the New HoldCo Common Shares at a share price based on a total equity value of $524 million, or if Class 13 HoldCo Notes Claims does not vote to accept the Plan, 1.33% on a fully diluted basis (subject only to the New Warrants and any securities issued under the Management Incentive Plan) of the New HoldCo Common Shares outstanding as of the Effective Date. |

| • | Existing HoldCo Interests shall be cancelled and discharged and shall be of no further force or effect, whether surrendered for cancellation or otherwise, and holders of Existing HoldCo Interests shall not receive or retain any property under the Plan on account of such Existing HoldCo Interests; provided, however, that if all classes entitled to vote on the Plan vote to accept the Plan, on the Effective Date, holders of Existing HoldCo Interests shall receive, in exchange for the surrender or cancellation of their Existing HoldCo Interest their Pro Rata share of two series of warrants exercisable for an aggregate of 20% of the New HoldCo Common Shares. |

| • | Entry into the new $100 million asset-based Exit Facility, which will be used (i) to repay debtor-in-possession financing the Debtors anticipate borrowing during the Chapter 11 Cases, (ii) provide additional liquidity and working capital and for general corporate purposes and (iii) to pay all restructuring fees and costs and other payments required under the Plan or arising from the Chapter 11 Cases. |

2

The Debtors and the other parties to the Restructuring Support Agreement believe that the restructuring contemplated by the Plan is in the best interests of all stakeholders because it (i) achieves a substantial deleveraging of the Debtors’ balance sheet through consensus with a significant portion of the Debtors’ debt holders, (ii) provides for a reduction of approximately $65 million of the Debtors’ pre-Restructuring annual interest burden on previously funded debt, (iii) provides $100 million of new financing and (iv) eliminates potential deterioration of value—and disruptions to operations—that could otherwise result from protracted and contentious bankruptcy cases. Importantly, the Debtors would not be able to implement the conversion of debt to equity contemplated by the Plan without the support of the Restructuring Support Parties. In sum, the Plan embodies a global settlement as part of an expeditious and consensual restructuring. This avoids potential litigation that could decrease value for all stakeholders and delay (and possibly derail) the restructuring process. The significant support obtained by the Debtors pursuant to the Restructuring Support Agreement provides a fair and reasonable path for an expeditious consummation of the Plan and the preservation of Seventy Seven’s ordinary course of business.

As of the Effective Date, Reorganized HoldCo anticipates being a reporting company under the Securities Exchange Act of 1934, as amended. As of April 22, 2016, Existing HoldCo Interests were listed for trading on The New York Stock Exchange (“NYSE”). To the extent the New HoldCo Common Shares meet applicable listing requirements immediately after issuance, Reorganized HoldCo will use commercially reasonable efforts to cause the listing of the New HoldCo Common Shares on NYSE or another stock exchange on or as soon as reasonably practicable after the Effective Date.

Additionally, as described in Section VII.E herein, the Plan provides for certain releases of Claims against, among others, the Debtors, the Reorganized Debtors, the parties to the Restructuring Support Agreement, the indenture trustees and agents for Seventy Seven’s existing debt and each of their professionals, employees, officers and directors.

Each holder of a Claim entitled to vote on the Plan should read this Disclosure Statement, the Plan and the instructions accompanying the ballots in their entirety before voting on the Plan. These documents contain, among other things, important information concerning the classification of Claims for voting purposes and the tabulation of votes. The statements contained in this Disclosure Statement are made only as of the date hereof unless otherwise specified, and there can be no assurance that the statements contained herein will be correct at any time hereafter. Because no bankruptcy cases have yet been commenced, this Disclosure Statement has not yet been approved by any court with respect to whether it contains adequate information within the meaning of section 1125(a) of the Bankruptcy Code. Nonetheless, once the Chapter 11 Cases are commenced, the Debtors expect to promptly seek entry of an order of the Bankruptcy Court approving this Disclosure Statement pursuant to section 1125 of the Bankruptcy Code and determining that solicitation of votes on the Plan by means of this Disclosure Statement was in compliance with section 1125(a) of the Bankruptcy Code.

All creditors should also carefully read Article XI of this Disclosure Statement—“Certain Risk Factors to be Considered”—before voting to accept or reject the Plan.

THE DEBTORS BELIEVE THAT IMPLEMENTATION OF THE PLAN IS IN THE BEST INTERESTS OF THE DEBTORS, THEIR ESTATES AND ALL STAKEHOLDERS. FOR ALL OF THE REASONS DESCRIBED IN THIS DISCLOSURE STATEMENT, THE DEBTORS URGE YOU TO RETURN YOUR BALLOT ACCEPTING THE PLAN BY THE VOTING DEADLINE (I.E., THE DATE BY WHICH YOUR BALLOT MUST BE ACTUALLY RECEIVED), WHICH IS JUNE 3, 2016 AT 5:00 P.M. (PREVAILING EASTERN TIME).

II. SUMMARY OF THE CLASSIFICATION AND TREATMENT OF CLAIMS AND EQUITY

INTERESTS UNDER THE PLAN

The Plan establishes a comprehensive classification of Claims and Interests.3 The following table summarizes the classification and treatment of Claims and Interests against each Debtor under the Plan and the

| 3 | In accordance with section 1123(a)(1) of the Bankruptcy Code, the Plan does not classify Administrative Expense Claims, DIP Loan Claims, Priority Tax Claims, U.S. Trustee Fees and Fee Claims. |

3

estimated distributions to be received by the holders of Allowed Claims under the Plan. Amounts assumed for purposes of projected recoveries are estimates only; actual recoveries received under the Plan may differ materially from the projected recoveries.

The summaries in this table are qualified in their entirety by the description of the treatment of such Claims in Article IV of the Plan. All claims and interests against a particular Debtor are placed in classes for each of the Debtors.

| Class |

Claim or Interest |

Treatment of Allowed Claims |

Voting Rights |

Projected Plan | ||||

| 1 |

Other Priority Claims | The legal, equitable and contractual rights of the holders of Allowed Other Priority Claims are unaltered by the Plan. Except to the extent that a holder of an Allowed Other Priority Claim, the Debtors and the Requisite Consenting Creditors agree to different treatment, on the later of the Effective Date and the date that is ten (10) Business Days after the date such Other Priority Claim becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Priority Claim shall receive, in full satisfaction of and in exchange for such Allowed Claim, at the option of the Reorganized Debtors: (i) Cash in an amount equal to the Allowed amount of such Claim or (ii) other treatment consistent with the provisions of section 1129(a)(9) of the Bankruptcy Code. | Unimpaired / Deemed to Accept | 100% | ||||

| 2 |

Other Secured Claims | The legal, equitable and contractual rights of the holders of Allowed Other Secured Claims are unaltered by the Plan. Except to the extent that a holder of an Allowed Other Secured Claim, the Debtor and the Requisite Consenting Creditors agree to different treatment, on the later of the Effective Date and the date that is ten (10) Business Days after the date such Other Secured Claim becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Secured Claim shall receive, in full satisfaction of and in exchange for such Allowed Claim, at the option of the Reorganized Debtors: (i) Cash in an amount equal to the Allowed amount of such Claim, (ii) Reinstatement or such other treatment sufficient to render such holder’s Allowed Other Secured Claim Unimpaired pursuant to section 1124 of the Bankruptcy Code or (iii) return of the applicable Collateral in satisfaction of the Allowed amount of such Other Secured Claim. | Unimpaired / Deemed to Accept | 100% | ||||

| 3 |

Term Loan Claims | The Term Loan Claims shall be allowed in the amount of $393 million plus all accrued, unpaid interest, fees and any other expenses through and including the Effective Date (including applicable Restructuring Expenses). On the Effective Date, (i) each holder of an Allowed Term Loan Claim shall, in full satisfaction of and in exchange for such Allowed Term Loan Claim, (A) receive its Pro Rata share of the Term Loan Payment; and (B) continue to hold its Pro Rata share of Term Loans under the Term Loan Credit Agreement (as amended by the Term Loan Credit Agreement Amendment), which Term Loans shall be secured by a valid, perfected and enforceable first-priority lien on and security interest in the Term Loan Collateral and a valid, perfected and enforceable second-priority lien on and security interest in the Exit Facility Priority Collateral, and (ii) the Debtors shall have used commercially reasonable efforts to obtain the Credit Ratings. For the avoidance of doubt and notwithstanding anything to the contrary in the Plan, the terms of the Term Loan Credit | Impaired / Entitled to Vote | 100% | ||||

4

| Agreement shall control in the event of any inconsistency between any provision of the Plan or the Confirmation Order and the Term Loan Credit Agreement. | ||||||||

| 4 | Incremental Term Loan Claims | On the Effective Date, or as soon as practicable thereafter, each holder of an Allowed Incremental Term Loan Claim shall, in full satisfaction of and in exchange for such Allowed Incremental Term Loan Claim: (a) receive its Pro Rata share of (i) the Incremental Term Loan Payment and (ii) $15 million in Cash, by which the remaining amount of the Incremental Term Loan Claims shall be reduced, provided that the Incremental Term Loan Lenders shall waive the right to any prepayment premium that may be payable in respect of the Incremental Term Loans pursuant to the Incremental Term Supplement in connection with such payment; (b) have the remaining Incremental Term Loan Claims Allowed at $84 million in principal plus all accrued, unpaid interest, fees and any other expenses through and including the Effective Date (including applicable Restructuring Expenses) and secured by a valid, perfected and enforceable second-priority lien on and security interest in the Term Loan Collateral and a valid, perfected and enforceable third-priority lien on and security interest in the Exit Facility Priority Collateral; and (c) have its remaining Allowed Incremental Term Loan Claims Reinstated and its legal, equitable and contractual rights under the Incremental Term Supplement unaltered by the Plan except that the Incremental Term Supplement shall be amended to remove the obligation of the Reorganized Debtors to pay any prepayment premium or penalty on any future payment in respect of the Incremental Term Supplement for a period of 18 months after the Effective Date. | Impaired/Entitled To Vote | 100% | ||||

| 5 | OpCo Notes Claims | On the Effective Date, or as soon as practicable thereafter, all of the OpCo Notes shall be cancelled and discharged and each holder of an Allowed OpCo Notes Claim shall receive, in full satisfaction of and in exchange for such Allowed OpCo Notes Claim, its Pro Rata share of (i) a number of New HoldCo Common Shares which shall in the aggregate comprise 96.75% of the total New HoldCo Common Shares issued on the Effective Date, and (ii) the OpCo Litigation Proceeds. | Impaired/Entitled To Vote | 50% | ||||

| 6 | General Unsecured Claims | The legal, equitable and contractual rights of the holders of General Unsecured Claims are unaltered by the Plan. Except to the extent that a holder of a General Unsecured Claim, the Debtors and the Requisite Consenting Creditors agree on different treatment, on and after the Effective Date, the Debtors or Reorganized Debtors, as applicable, shall continue to pay or dispute each General Unsecured Claim in the ordinary course of business as if the Chapter 11 Cases had never been commenced. | Unimpaired / Deemed to Accept | 100% | ||||

| 7 | Intercompany Claims | On or after the Effective Date, all Intercompany Claims shall be paid, adjusted, continued, settled, reinstated, discharged or eliminated, in each case to the extent determined to be appropriate by the Debtors or Reorganized Debtors, as applicable, in their sole discretion. | Unimpaired / Deemed to Accept | 100% | ||||

| 8 | Intercompany Interests | On the Effective Date and without the need for any further corporate action or approval of any board of directors, management or shareholders of any Debtor or Reorganized Debtor, as applicable, all Intercompany Interests shall be unaffected by the Plan and continue in place following the Effective Date. | Unimpaired / Deemed to Accept | 100% | ||||

5

| 9 | Existing OpCo Interests | On the Effective Date, the Existing OpCo Interests shall remain outstanding and shall be held by Reorganized HoldCo. | Unimpaired / Deemed to Accept | 100% | ||||

| 10 | Term Loan Guaranty Claims | On the Effective Date, holders of Term Loan Guaranty Claims shall on account of their Allowed Term Loan Guaranty Claims receive the treatment set forth in Section 4.3(a) of the Plan for Allowed Term Loan Claims (without duplication of any amount distributed pursuant to Section 4.3(a)), and the Term Loan Guaranty shall be in full force and effect. | Impaired / Entitled to Vote | 100% | ||||

| 11 | Incremental Term Loan Guaranty Claims | On the Effective Date, each holder of an Allowed Incremental Term Loan Guaranty Claim shall be entitled to receive, without duplication of any amounts distributed pursuant to Section 4.4(a) of the Plan, on account of its Allowed Incremental Term Loan Guaranty Claim against HoldCo, its Pro Rata share of the HoldCo Creditor New Common Share Pool, which New HoldCo Common Shares are subject to dilution by any securities issued under the Management Incentive Plan and New HoldCo Common Shares that could be issued upon the exercise of the New Warrants, if any; provided that the holders of the Incremental Term Loan Guaranty Claims shall agree to waive the right to receive any such shares from the New HoldCo Common Share Pool on account of such Incremental Term Loan Guaranty Claims against HoldCo and such shares shall be distributed (i) if holders of at least two-thirds in amount and one-half in number of the Allowed HoldCo Notes Claims (that exercise their right to timely vote on the Plan) vote to accept the Plan, to holders of Allowed HoldCo Notes Claims as set forth in Section 4.13(a) of the Plan or (ii) if holders of at least two-thirds in amount and one-half in number of the Allowed HoldCo Notes Claims (that exercise their right to timely vote on the Plan) do not vote to accept the Plan, to holders of Allowed HoldCo Notes Claims and Allowed OpCo Notes Claims; but, for the avoidance of doubt, such waiver shall not affect the status and validity of the guaranties (by HoldCo and the other Debtors) arising under or related to the Incremental Term Loan Guaranty or any liens arising under or related to the Incremental Term Supplement, which guaranties and liens shall remain in place in accordance with their original terms and conditions.

On the Effective Date, holders of Incremental Term Loan Guaranty Claims shall on account of their Allowed Incremental Term Loan Guaranty Claims against Great Plains, Nomac, PTL, PTL Prop, SSE Leasing and LandCo receive the treatment set forth in Section 4.4(a) of the Plan for Allowed Incremental Term Loan Claims. |

Impaired/Entitled To Vote | 100% | ||||

| 12 | OpCo Notes Guaranty Claims | On the Effective Date, each holder of OpCo Notes Guaranty Claims shall be entitled receive on account of its Allowed OpCo Notes Guaranty Claims against HoldCo its Pro Rata share of (i) after giving effect to the Incremental Term Loan Guaranty Waiver, the HoldCo Creditor New Common Share Pool, which New HoldCo Common Shares are subject to dilution by any securities issued under the Management Incentive Plan and the New HoldCo Common Shares that could be issued upon the exercise of the New Warrants, if any, and the number of which, for the avoidance of doubt, shall in | Impaired/Entitled To Vote | 0%/4.3% | ||||

6

| the aggregate comprise 1.92% of the total number of New HoldCo Common Shares issued on the Effective Date, provided that the OpCo Noteholders agree to waive the right to receive any such shares from the New HoldCo Common Share Pool on account of such OpCo Notes Guaranty Claims against HoldCo and such shares shall be distributed to holders of Allowed HoldCo Notes Claims as set forth in Section 4.13(a) of the Plan if and only if the holders of at least two-thirds in amount and one-half in number of the Allowed HoldCo Notes Claims that timely vote on the Plan vote in favor of the Plan, and (ii) the HoldCo Litigation Proceeds.

On the Effective Date, each holder of an OpCo Notes Guaranty Claim shall on account of its Allowed OpCo Notes Guaranty Claims against Great Plains, Nomac, PTL, PTL Prop, SSE Leasing and LandCo receive the treatment set forth in Section 4.5(a) of the Plan for Allowed OpCo Notes Claims. |

||||||||

| 13 | HoldCo Notes Claims | On the Effective Date, or as soon as practicable thereafter, all HoldCo Notes shall be cancelled and discharged and each holder of an Allowed HoldCo Notes Claim shall receive, in full satisfaction of and in exchange for such Allowed HoldCo Notes Claim, its Pro Rata share of either (i) or (ii) as follows:

(i) if holders of at least two-thirds in amount and one-half in number of the Allowed HoldCo Notes Claims (that exercise their right to timely vote on the Plan) vote to accept the Plan, (A) after giving effect to the Incremental Term Loan Guaranty Waiver and the OpCo Notes Guaranty Waiver, all of the shares in the HoldCo Creditor New Common Share Pool, (B) the New A Warrants and (C) the HoldCo Litigation Proceeds; or

(ii) if holders of at least two-thirds in amount and one-half in number of the Allowed HoldCo Notes Claims (that exercise their right to timely vote on the Plan) do not vote to accept the Plan (or no HoldCo Noteholders vote at all), (A) after giving effect to the Incremental Term Loan Guaranty Waiver, the shares of the HoldCo Creditor New Common Share Pool that are not allocated to holders of Allowed OpCo Notes Guaranty Claims pursuant to Section 4.12(a) of the Plan, the number of which, for the avoidance of doubt, shall in the aggregate comprise 1.33% of the total number of New HoldCo Common Shares issued on the Effective Date, and (B) the HoldCo Litigation Proceeds. |

Impaired/Entitled To Vote | 1.1%/6.2% | ||||

| 14 | Existing HoldCo Interests | On the Effective Date, Existing HoldCo Interests shall be cancelled and discharged and shall be of no further force or effect, whether surrendered for cancellation or otherwise, and holders of Existing HoldCo Interests shall not receive or retain any property under the Plan on account of such Existing HoldCo Interests. Notwithstanding the foregoing, on or as soon as practicable after the Effective Date, if holders of at least two-thirds in amount and one-half in number of the Claims in Classes 3, 4, 5, 10, 11, 12 and 13 vote to accept the Plan, holders of Existing HoldCo Interests shall receive, in exchange for the surrender or cancellation of their Existing HoldCo Interests and for the releases by such holders of the Released Parties, their Pro Rata share of (i) the New B Warrants and (ii) the New C Warrants provided, that any unvested stock-based awards under the Employee Equity Plans shall be cancelled and discharged upon the Effective Date and the holders of such awards shall not be entitled to any distribution pursuant to Section 4.14(a) of the Plan. | Impaired / Deemed to Reject | 0% | ||||

7

III. VOTING PROCEDURES AND REQUIREMENTS

| A. | Classes Entitled to Vote on the Plan |

The following Classes are the only Classes entitled to vote to accept or reject the Plan (the “Voting Classes”):

| Class |

Claim or Interest |

Status | ||

| 3 | Term Loan Claims | Impaired/Entitled to Vote | ||

| 4 | Incremental Term Loan Claims | Impaired/Entitled to Vote | ||

| 5 | OpCo Notes Claims | Impaired/Entitled to Vote | ||

| 10 | Term Loan Guaranty Claims | Impaired/Entitled to Vote | ||

| 11 | Incremental Term Loan Guaranty Claims | Impaired/Entitled to Vote | ||

| 12 | OpCo Notes Guaranty Claims | Impaired/Entitled to Vote | ||

| 13 | HoldCo Notes Claims | Impaired/Entitled to Vote |

If your Claim or Interest is not included in the Voting Classes, you are not entitled to vote. If your Claim is included in the Voting Classes, you should read your ballot and carefully follow the instructions included in the ballot. Please use only the ballot that accompanies the Disclosure Statement or the ballot that the Debtors, or the Voting and Claims Agent on behalf of the Debtors, otherwise provide to you.

| B. | Votes Required for Acceptance by a Class |

Under the Bankruptcy Code, acceptance of a plan of reorganization by a class of claims or interests is determined by calculating the amount and, if a class of claims, the number, of claims and interests voting to accept, as a percentage of the allowed claims or interests, as applicable, that have voted. Acceptance by a class of claims requires an affirmative vote of (i) at least two-thirds in dollar amount of the total allowed claims that have voted and (ii) more than one-half in number of the total allowed claims that have voted. Your vote on the Plan is important. The Bankruptcy Code requires as a condition to confirmation of a plan of reorganization that each class that is impaired and entitled to vote under a plan votes to accept such plan, unless the plan is being confirmed under the “cram down” provisions of section 1129(b) of the Bankruptcy Code.

| C. | Certain Factors to Be Considered Prior to Voting |

There are a variety of factors that all holders of Claims entitled to vote on the Plan should consider prior to voting to accept or reject the Plan. These factors may impact recoveries under the Plan and include:

| • | unless otherwise specifically indicated, the financial information contained in the Disclosure Statement has not been audited and is based on an analysis of data available at the time of the preparation of the Plan and the Disclosure Statement; |

| • | although the Debtors believe that the Plan complies with all applicable provisions of the Bankruptcy Code, the Debtors cannot assure such compliance or that the Bankruptcy Court will confirm the Plan; |

| • | the Debtors may request Confirmation without the acceptance of all Impaired Classes in accordance with section 1129(b) of the Bankruptcy Code; and |

| • | any delays of either Confirmation or Consummation could result in, among other things, increased Administrative Claims and Fee Claims. |

8

While these factors could affect distributions available to holders of Allowed Claims under the Plan, the occurrence or impact of such factors will not necessarily affect the validity of the vote of the Voting Class or necessarily require a re-solicitation of the votes of holders of Claims in such Voting Class.

For a discussion of certain risk factors, please refer to ARTICLE XI, entitled “Certain Risk Factors to Be Considered,” of this Disclosure Statement.

| D. | Classes Not Entitled to Vote on the Plan |

Under the Bankruptcy Code, holders of claims and interests are not entitled to vote if their contractual rights are unimpaired by the proposed plan or if they will receive no property under the proposed plan on account of their claims or interests, as applicable, or are otherwise deemed to reject. As holders of Existing HoldCo Interests are not entitled to receive any distributions on account of the valuation of the Debtors, the votes of holders of Existing HoldCo Interests will not be solicited and such holders will be deemed to reject. Accordingly, the following Classes of Claims and Interests are not entitled to vote to accept or reject the Plan:

| Class |

Claim or Interest |

Status |

Voting Rights | |||

| 1 | Other Priority Claims | Unimpaired | Deemed to Accept | |||

| 2 | Other Secured Claims | Unimpaired | Deemed to Accept | |||

| 6 | General Unsecured Claims | Unimpaired | Deemed to Accept | |||

| 7 | Intercompany Claims | Unimpaired | Deemed to Accept | |||

| 8 | Intercompany Interests | Unimpaired | Deemed to Accept | |||

| 9 | Existing OpCo Interests | Unimpaired | Deemed to Accept | |||

| 14 | Existing HoldCo Interests | Impaired | Deemed to Reject |

| E. | Cramdown |

Section 1129(b) permits confirmation of a plan of reorganization notwithstanding the non-acceptance of the plan by one or more impaired classes of claims or equity interests, so long as at least one impaired class of claims or interests votes to accept a proposed plan. Under that section, a plan may be confirmed by a bankruptcy court if it does not “discriminate unfairly” and is “fair and equitable” with respect to each non-accepting class.

The Debtors intend to pursue a “cram down” of the holders of Existing HoldCo Interests in Class 14, who are deemed to have rejected the Plan for the reasons described in subsection D above, and any of the Voting Classes that do not vote to accept the Plan.

| F. | Allowed Claims |

Only administrative expenses, claims and equity interests that are “allowed” may receive distributions under a chapter 11 plan. An “allowed” administrative expense, claim or equity interest means that a debtor agrees or, in the event of a dispute, that the Bankruptcy Court determines by Final Order that the administrative expense, claim or equity interest, including the amount thereof, is in fact a valid obligation of, or equity interest in, a debtor.

| G. | Impairment Generally |

Under section 1124 of the Bankruptcy Code, a class of claims or equity interests is “impaired” unless, with respect to each claim or interest of such class, the plan of reorganization (i) does not alter the legal, equitable or contractual rights of the holders of such claims or interests or (ii) irrespective of the holders’ right to receive accelerated payment of such claims or interests after the occurrence of a default, cures all defaults (other than those arising from, among other things, the debtor’s insolvency or the commencement of a bankruptcy case), reinstates the maturity of the claims or interests in the class, compensates the holders of such claims or interests for any damages incurred as a result of their reasonable reliance upon any acceleration rights and does not otherwise alter their legal, equitable or contractual rights.

9

Only holders of allowed claims or equity interests in impaired classes of claims or equity interests that receive or retain property under a proposed plan of reorganization, but are not otherwise deemed to reject the plan (such as the Class 14 Existing HoldCo Interests in these Chapter 11 Cases), are entitled to vote on such a plan. Holders of unimpaired claims or equity interests are deemed to accept the plan under section 1126(f) of the Bankruptcy Code and are not entitled to vote. Holders of claims or equity interests that do not receive or retain any property on account of such claims or equity interests are deemed to reject the plan under section 1126(g) of the Bankruptcy Code and are not entitled to vote.

| H. | Solicitation and Voting Process |

Each holder of a Class 3 Term Loan Claim, Class 4 Incremental Term Loan Claim, Class 5 OpCo Notes Claim, Class 10 Term Loan Guaranty Claim, Class 11 Incremental Term Loan Guaranty Claim, Class 12 OpCo Notes Guaranty Claim or Class 13 HoldCo Notes Claim as of May 4, 2016, the Voting Record Date, is entitled to vote to accept or reject the Plan and shall receive the Solicitation Package in accordance with the solicitation procedures. Except as otherwise set forth herein, the Voting Record Date and all of the Debtors’ solicitation and voting procedures shall apply to all holders of Claims or Interests and other parties in interest.

The following summarizes the procedures for voting to accept or reject the Plan (the “Solicitation Procedures”), which the Debtors shall seek approval of in an order of the Bankruptcy Court (the “Solicitation Procedures Order”) through the Plan Scheduling Motion (as defined below). Holders of Class 3 Term Loan Claims, Class 4 Incremental Term Loan Claims, Class 5 OpCo Notes Claims, Class 10 Term Loan Guaranty Claims, Class 11 Incremental Term Loan Guaranty Claims, Class 12 OpCo Notes Guaranty Claims or Class 13 HoldCo Notes Claim, the only Voting Classes under the Plan, are encouraged to review the relevant provisions of the Bankruptcy Code and Bankruptcy Rules and/or to consult their own attorneys.

The “Solicitation Package”

The following materials are provided to each holder of a Class 3 Term Loan Claim, Class 4 Incremental Term Loan Claim, Class 5 OpCo Notes Claim, Class 10 Term Loan Guaranty Claim, Class 11 Incremental Term Loan Guaranty Claim, Class 12 OpCo Notes Guaranty Claim or Class 13 HoldCo Notes Claim that is entitled to vote on the Plan:

| • | the applicable ballot and voting instructions (along with a pre-addressed, prepaid return envelope); |

| • | this Disclosure Statement with all exhibits; and |

| • | the Plan. |

If you (a) did not receive a ballot and believe you are entitled to one; (b) received a damaged ballot; (c) lost your ballot; (d) have any questions concerning this Disclosure Statement, the Plan, or the procedures for voting on the Plan, or the Solicitation Package you received; or (e) wish to obtain a paper copy of the Plan, this Disclosure Statement or any exhibits to such documents, please contact Prime Clerk LLC, the Debtors’ Voting and Claims Agent, at 77 Energy Ballot Processing, c/o Prime Clerk LLC, 830 Third Avenue, 3rd Floor, New York, NY 10022, by calling 844-224-1136 (Toll Free) or 917-962-8386 (International), or by email at 77nrgballots@primeclerk.com.

Before the deadline to object to Confirmation of the Plan, the Debtors intend to file the Plan Supplement. The Debtors will not distribute paper or CD-ROM copies of the Plan Supplement; however, parties may obtain a copy of the Plan Supplement by contracting the Debtors Voting and Claims Agent, Prime Clerk LLC by (i) calling 844-224-1136 (Toll Free) or 917-962-8386 (International) or (ii) emailing 77nrgballots@primeclerk.com. In addition, the Plan Supplement may be examined by accessing the Bankruptcy Court’s website: www.deb.uscourts.gov. Note that a PACER password and login are needed to access documents on the Bankruptcy Court’s website. A PACER password can be obtained at: www.pacer.psc.uscourts.gov.

10

Voting Deadlines.

To be counted, your ballot(s) (or the Master Ballot reflecting your vote) must be actually received by the Voting and Claims Agent no later than June 3, 2016 at 5:00 p.m. (Prevailing Eastern Time) for holders of Class 3 Term Loan Claims, Class 4 Incremental Term Loan Claims, Class 5 OpCo Notes Claims, Class 10 Term Loan Claims, Class 11 Incremental Term Loan Guaranty Claims, Class 12 OpCo Notes Guaranty Claims and Class 13 HoldCo Notes Claims entitled to vote on the Plan. This is the “Voting Deadline.” If you do not return your ballot prior to the Voting Deadline, your vote will not be counted.

In the case of holders of Class 5 OpCo Notes Claims, Class 12 OpCo Notes Guaranty Claims and Class 13 HoldCo Notes Claims, if you received a return envelope addressed to your Nominee (as defined below), you must allow sufficient time for your Nominee to receive your ballot and process your vote on its Master Ballot, which Master Ballot must be received by the Voting and Claims Agent by no later than the Voting Deadline.

Voting Instructions.

If you are a holder of a Class 3 Term Loan Claim, Class 4 Incremental Term Loan Claim, a Class 5 OpCo Notes Claim, a Class 10 Term Loan Guaranty Claim, a Class 11 Incremental Term Loan Guaranty Claim, a Class 12 OpCo Notes Guaranty Claim or a Class 13 HoldCo Notes Claim, a ballot is enclosed for the purpose of voting on the Plan. BALLOTS ARE ONLY BEING SOLICITED FROM HOLDERS OF CLASS 5 OPCO NOTES CLAIMS, CLASS 12 OPCO NOTES GUARANTY CLAIMS AND CLASS 13 HOLDCO NOTES CLAIMS THAT ARE ACCREDITED INVESTORS OR QUALIFIED INSTITUTIONAL BUYERS. THE VOTE OF ANY CLASS 5 OPCO NOTES CLAIMS, CLASS 12 OPCO NOTES GUARANTY CLAIMS AND CLASS 13 HOLDCO NOTES CLAIMS THAT DOES NOT CERTIFY THAT IT IS AN ACCREDITED INVESTOR OR QUALIFIED INSTITUTIONAL BUYER WILL NOT BE COUNTED. IF YOU ARE NOT AN ACCREDITED INVESTOR OR QUALIFIED INSTITUTIONAL BUYER, PLEASE DO NOT COMPLETE THE BALLOT. IF YOU WANT TO ELECT TO OPT OUT OF THE RELEASES IN SECTION 10.6(b) OF THE PLAN, PLEASE CONTACT THE DEBTORS’ VOTING AGENT PRIME CLERK FOR FURTHER INSTRUCTIONS.

Except as provided below, holders of Claims are required to vote all of their Claims within a Class either to accept or reject the Plan and may not split their votes. Any ballot received that does not indicate either an acceptance or rejection of the Plan or that indicates both acceptance and rejection of the Plan will be counted as an acceptance. Any ballot received that is not signed or that contains insufficient information to permit the identification of the holder will be an invalid ballot and will not be counted.

If you are the record holder of Claim(s) that are beneficially owned by another party, you may submit a separate ballot with respect to such portion of Claim(s) that are beneficially owned by such third party, and the vote indicated on such separate ballot may differ from the vote indicated on ballots submitted with respect to Claims that you beneficially own yourself or that are beneficially owned by other parties. In no event may you submit ballots with respect to Claims in excess of the amount of Claims for which you are the record holder as of the Voting Record Date.

Please sign and complete a separate ballot with respect to each Claim and return your ballot(s) in accordance with the instructions on your ballot. In the case of holders of Class 5 OpCo Notes Claims, Class 12 OpCo Notes Guaranty Claims and Class 13 HoldCo Notes Claims, please sign and complete each ballot provided by your Nominee (as defined below), so that your Pre-Validated Ballot (as defined below) or the Master Ballot reflecting your vote is received by Prime Clerk by the Voting Deadline.

Ballots, Pre-Validated Ballots or Master Ballots reflecting your vote should be returned to the Debtors’ voting agent, Prime Clerk, by hand delivery, overnight courier, or first class mail to:

77 Energy Ballot Processing

c/o Prime Clerk LLC

830 Third Avenue, 3rd Floor

New York, NY 10022

11

If you are the beneficial owner of a Class 5 OpCo Notes Claim, Class 12 OpCo Notes Guaranty Claim or Class 13 HoldCo Notes Claim, please follow the directions listed on your ballot (or otherwise follow the directions of your Nominee) and read the Section below titled “Beneficial Owners of Class 5 OpCo Notes Claims, Class 12 OpCo Notes Guaranty Claims and Class 13 HoldCo Notes Claims.”

Only ballots with an original signature will be counted. Email submission of ballots is not permitted.4 Only ballots (including Master Ballots submitted by a Nominee) received by Prime Clerk by the Voting Deadline will be counted.

If delivery of a ballot is by mail, it is recommended that voters use an air courier with guaranteed next-day delivery or registered mail, properly insured, with return receipt requested. In all cases, sufficient time should be allowed to ensure timely delivery. The method of such delivery is at the election and risk of the voter.

A ballot may be withdrawn by delivering a written notice of withdrawal to Prime Clerk, so that Prime Clerk receives the notice before the Voting Deadline. In order to be valid, a notice of withdrawal must (a) specify the name of the creditor who submitted the ballot to be withdrawn, (b) contain a description of the Claim(s) to which it relates and (c) be signed by the creditor in the same manner as on the ballot. The Debtors expressly reserve the right to contest the validity of any withdrawals of votes on the Plan.

After the Voting Deadline, any creditor who casts a timely vote (whether directly to Prime Clerk or through a Nominee, as applicable) may change or withdraw its vote only with the approval of the Bankruptcy Court or the consent of the Debtors (with the consent of the Requisite Consenting Creditors). If more than one timely, properly completed ballot is received with respect to the same Claim and no order of the Bankruptcy Court allowing the creditor to change its vote has been entered before the Voting Deadline, the ballot that will be counted for purposes of determining whether sufficient acceptances required to confirm the Plan have been received will be the timely, properly-completed ballot determined by Prime Clerk to have been received last.

Nominees are required to retain for inspection by the Bankruptcy Court for one year following the Voting Deadline the ballots cast by their beneficial owners.

Nominees may elect to pre-validate the Beneficial Owner Ballot (as defined below) (a “Pre-Validated Ballot”) by (i) signing the applicable Beneficial Owner Ballot and including its DTC Participant Number, (ii) indicating on the Beneficial Owner Ballot the account number of such holder and the principal amount of Notes held by the Nominee for such beneficial owner and (iii) forwarding the Beneficial Owner Ballot (together with the full Solicitation Package, including a prepaid return envelope addressed to the Voting Agent) to the beneficial owner for voting. The beneficial owner must then complete the information requested in the Beneficial Owner Ballot (including indicating a vote to accept or reject the Plan), review the certifications contained therein and return the Beneficial Owner Ballot directly to the Voting Agent in the pre-addressed, postage-paid envelope included with the Solicitation Package so that it is actually received by the Voting Agent on or before the Voting Deadline. A list of beneficial owners to whom the Nominee sent Pre-Validated Ballots should be maintained by the Nominee for inspection for at least one year following the Voting Deadline.

Votes cast by the beneficial owners through a Nominee and transmitted by means of a Master Ballot or a Pre-Validated Ballot will be applied against the positions held by such Nominee as evidenced by the list of record holders of Notes provided by the applicable securities depository. The Debtors further propose that votes submitted by a Nominee on a Master Ballot will not be counted in excess of the position maintained by the respective Nominee on the Voting Record Date.5

| 4 | Notwithstanding the foregoing, only Broadridge Financial Services, as the proxy agent for the majority of Nominees, may return its Master Ballot via electronic mail to 77nrgballots@primeclerk.com. |

| 5 | Each Nominee will distribute the Solicitation Packages, as appropriate, in accordance with their customary practices and obtain votes to accept or reject the Plan also in accordance with their customary practices. If it is the Nominee’s customary and accepted practice to submit a “voting instruction form” to the beneficial holders for the purpose of recording the beneficial holder’s vote, the Nominee is authorized to send the voting information form; provided, however, that the Nominee must also distribute the appropriate ballot form approved by the Solicitation Procedures Order. |

12

To the extent that conflicting, double or over-votes are submitted on Master Ballots, the Voting Agent shall attempt to resolve such votes prior to the vote certification in order to ensure that the votes of beneficial owners of Notes are accurately tabulated.

To the extent that such conflicting, double or over-votes are not reconcilable prior to the vote certification, the Voting Agent is directed to count votes in respect of each Master Ballot in the same proportion as the votes of the beneficial owners or entitlement holders to accept or reject the Plan submitted on such Master Ballot, but only to the extent of the applicable Nominee’s position on the Voting Record Date in the Notes.

For the purposes of tabulating votes, each beneficial owner shall be deemed (regardless of whether such holder includes interest in the amount voted on its ballot) to have voted only the principal amount of its securities; any principal amounts thus voted may be thereafter adjusted by the Voting Agent, on a proportionate basis to reflect the corresponding Claim amount, including any accrued but unpaid prepetition interest, with respect to the securities thus voted.

EACH BALLOT ADVISES HOLDERS OF CLAIMS THAT, IF THEY (1)(A) VOTE TO REJECT THE PLAN OR (B) DO NOT CERTIFY ON THEIR BALLOT THAT THEY ARE AN ACCREDITED INVESTOR OR QUALIFIED INSTITUTIONAL INVESTOR AND (2) DO NOT ELECT TO OPT OUT OF THE RELEASE PROVISIONS CONTAINED IN ARTICLE X OF THE PLAN, THEY SHALL BE DEEMED TO HAVE CONCLUSIVELY, ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY AND FOREVER RELEASED AND DISCHARGED ALL CLAIMS AND CAUSES OF ACTION AGAINST THE RELEASED PARTIES IN ACCORDANCE WITH THE PLAN. ACCORDINGLY, IF YOU (1)(A) VOTE TO REJECT THE PLAN OR (B) DO NOT CERTIFY THAT YOU ARE AN ACCREDITED INVESTOR OR QUALIFIED INSTITUTIONAL BUYER AND (2) DO NOT ELECT TO OPT OUT OF THE RELEASE PROVISIONS CONTAINED IN ARTICLE X OF THE PLAN, YOU WILL BE DEEMED TO HAVE GRANTED THE RELEASES CONTEMPLATED BY SUCH RELEASE PROVISIONS.

HOLDERS OF CLAIMS WHO VOTE TO ACCEPT THE PLAN SHALL BE DEEMED TO HAVE CONCLUSIVELY, ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY AND FOREVER RELEASED AND DISCHARGED ALL CLAIMS AND CAUSES OF ACTION AGAINST THE RELEASED PARTIES IN ACCORDANCE WITH THE PLAN. EACH BALLOT ALSO ADVISES HOLDERS OF CLAIMS THAT, IF THEY FAIL TO RETURN A BALLOT VOTING EITHER TO ACCEPT OR REJECT THE PLAN, THEY SHALL BE DEEMED TO HAVE CONCLUSIVELY, ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY AND FOREVER RELEASED AND DISCHARGED ALL CLAIMS AND CAUSES OF ACTION AGAINST THE RELEASED PARTIES IN ACCORDANCE WITH THE PLAN.

NON-VOTING CLASSES INCLUDE UNIMPAIRED CLAIMS AND INTERESTS AND EXISTING HOLDCO INTERESTS. UNIMPAIRED CLAIMS AND INTERESTS ARE ALSO DEEMED TO HAVE CONCLUSIVELY, ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY AND FOREVER RELEASED AND DISCHARGED ALL CLAIMS AND/OR INTERESTS AND CAUSES OF ACTION AGAINST THE RELEASED PARTIES IN ACCORDANCE WITH THE PLAN TO THE FULLEST EXTENT PERMISSIBLE UNDER APPLICABLE LAW.

13

Beneficial Owners of Class 5 OpCo Notes Claims, Class 12 OpCo Notes Guaranty Claims and Class 13 HoldCo Notes Claims.

If you are a beneficial owner of a Class 5 OpCo Notes Claim, a Class 12 OpCo Notes Guaranty Claim or a Class 13 HoldCo Notes Claim, please use the ballot for beneficial owners (a “Beneficial Owner Ballot”) or the customary means of transmitting your vote to your broker, dealer, commercial bank, trust company or other nominee (“Nominee”) to cast your vote to accept or reject the Plan. You must return your completed Beneficial Owner Ballot or otherwise transmit your vote to your Nominee so that your Nominee will have sufficient time to complete a ballot summarizing votes cast by beneficial owners holding securities (each a “Master Ballot”), which must be forwarded to Prime Clerk by the Voting Deadline. If your Beneficial Owner Ballot or other transmittal of your vote is not received by your Nominee with sufficient time for your Nominee to submit its Master Ballot by the Voting Deadline, your vote will not count.

If you are the Beneficial Owner of a Class 5 OpCo Notes Claim, a Class 12 OpCo Notes Guaranty Claim or a Class 13 HoldCo Notes Claim and hold such Claim(s) in your own name on the records of the applicable indenture trustee or depository, you may vote by completing a Beneficial Owner Ballot or a Master Ballot in your discretion.

Do not return your OpCo Notes, HoldCo Notes or any other instruments or agreements that you may have with your ballot(s).

You may receive multiple mailings of this Disclosure Statement, especially if you own OpCo Notes or HoldCo Notes through more than one brokerage firm, commercial bank, trust company or other nominee. If you submit more than one ballot for a Class because you beneficially own the securities in that Class through more than one broker or bank, you must indicate in the appropriate item of the ballot(s) the names of ALL broker-dealers or other intermediaries who hold securities for you in the same Class.

Authorized signatories voting on behalf of more than one beneficial owner must complete a separate ballot for each such beneficial owner. Any ballot submitted to a brokerage firm or proxy intermediary will not be counted until the brokerage firm or proxy intermediary (a) properly executes the ballot(s) and delivers them to Prime Clerk or (b) properly completes and delivers a corresponding Master Ballot to Prime Clerk.

By voting on the Plan, you are certifying that you are the beneficial owner of OpCo Notes or HoldCo Notes (as of the Voting Record Date) being voted or an authorized signatory for the beneficial owner. Your submission of a ballot will also constitute a request that you (or in the case of an authorized signatory, the beneficial owner) be treated as the record holder of those securities for purposes of voting on the Plan.