Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Manitex International, Inc. | d193502d8k.htm |

| EX-99.1 - EX-99.1 - Manitex International, Inc. | d193502dex991.htm |

“Focused manufacturer of engineered lifting equipment” Manitex International, Inc. (NASDAQ:MNTX) Conference Call First Quarter 2016 May 5th, 2016 Exhibit 99.2

Forward Looking Statements & Non GAAP Measures “Focused manufacturer of engineered lifting equipment” Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Non-GAAP Measures: Manitex International from time to time refers to various non-GAAP (generally accepted accounting principles) financial measures in this presentation. Manitex believes that this information is useful to understanding its operating results without the impact of special items. See Manitex’s First Quarter 2016 Earnings Release on the Investor Relations section of our website www.manitexinternational.com for a description and/or reconciliation of these measures.

Summary “Focused manufacturer of engineered lifting equipment” Our objectives moving into 2016 Cost reduction program to include plant consolidations Continue program of strategic rationalization to drive growth in highest margin products and operating units Cash generation to continue debt reduction by a similar amount as in 2015 Implementation and execution of integration of PM strategy Expand ASV through new distribution

“Focused manufacturer of engineered lifting equipment” Commercial Overview Q1 market conditions little change from Q4-2015 Oil and gas demand very low adversely impacting yoy comparisons for core crane products. North American general construction demand slower in the quarter and increasingly price competitive. Straight mast market maintaining low levels of activity and preference for lower capacity equipment. Knuckle boom crane market in contrast growing in absolute terms and in certain geographies eg North America. European and international markets modest improvement. Strong US dollar impacting translation of sales / profit as well as adversely impacting demand eg in Canada. Significant activity and interest related to our new acquisition products PM sales strength in Q1-2016 in West & Eastern Europe, and N America. ASV controlled distribution channels gaining momentum. Full range of product (skid steer and compact track loaders) in place. “Rental” machines launched in Q1-2016. ASV branded product exceeded 50% of quarterly machine shipments for the first time. New ASV dealer sign-ups at approximately 119 locations, up 19% in the first quarter and first ASV dealers now signed in Canada. 3/31/16 Backlog of $78.6 million (12/31/15, $82.5 million) Broad based order book: ASV 15%, PM 22% All other 63%.

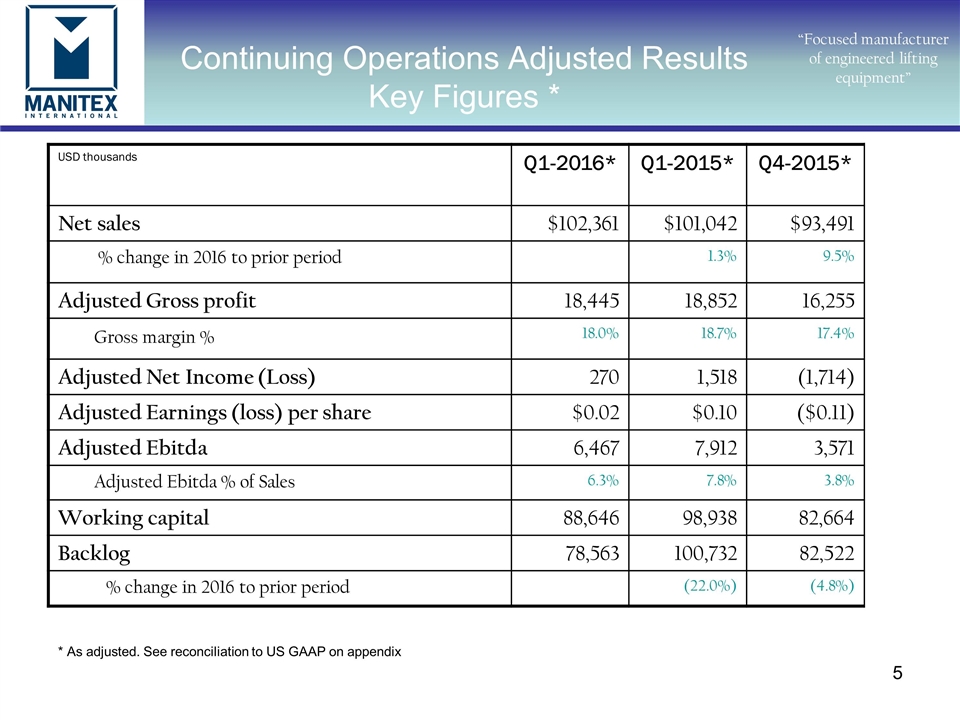

Continuing Operations Adjusted Results Key Figures * “Focused manufacturer of engineered lifting equipment” USD thousands Q1-2016* Q1-2015* Q4-2015* Net sales $102,361 $101,042 $93,491 % change in 2016 to prior period 1.3% 9.5% Adjusted Gross profit 18,445 18,852 16,255 Gross margin % 18.0% 18.7% 17.4% Adjusted Net Income (Loss) 270 1,518 (1,714) Adjusted Earnings (loss) per share $0.02 $0.10 ($0.11) Adjusted Ebitda 6,467 7,912 3,571 Adjusted Ebitda % of Sales 6.3% 7.8% 3.8% Working capital 88,646 98,938 82,664 Backlog 78,563 100,732 82,522 % change in 2016 to prior period (22.0%) (4.8%) * As adjusted. See reconciliation to US GAAP on appendix

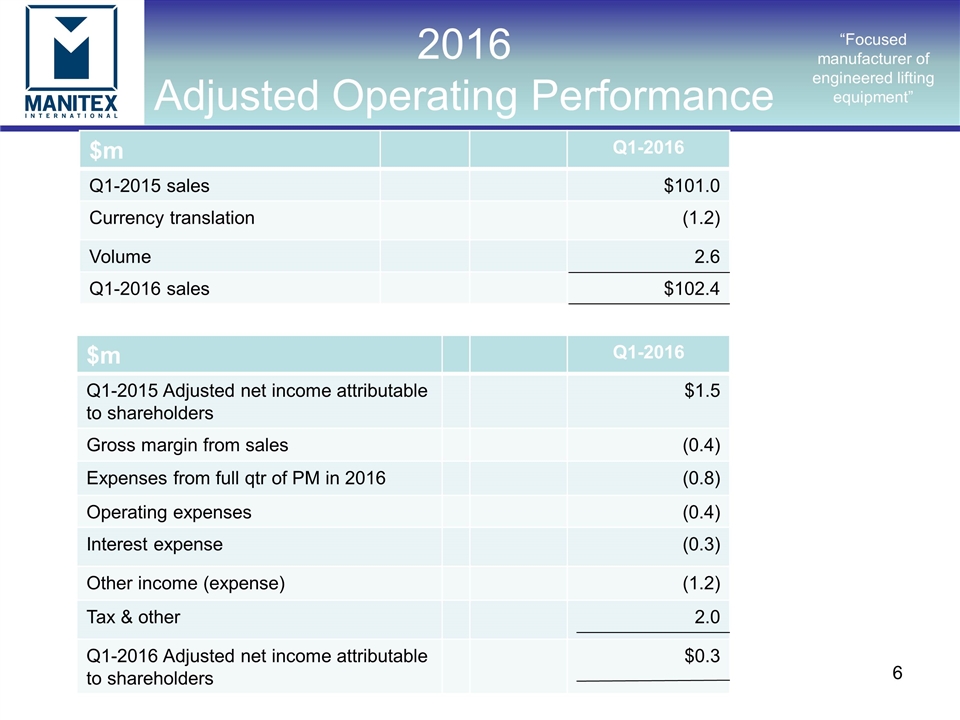

“Focused manufacturer of engineered lifting equipment” 2016 Adjusted Operating Performance $m Q1-2016 Q1-2015 sales $101.0 Currency translation (1.2) Volume 2.6 Q1-2016 sales $102.4 $m Q1-2016 Q1-2015 Adjusted net income attributable to shareholders $1.5 Gross margin from sales (0.4) Expenses from full qtr of PM in 2016 (0.8) Operating expenses (0.4) Interest expense (0.3) Other income (expense) (1.2) Tax & other 2.0 Q1-2016 Adjusted net income attributable to shareholders $0.3

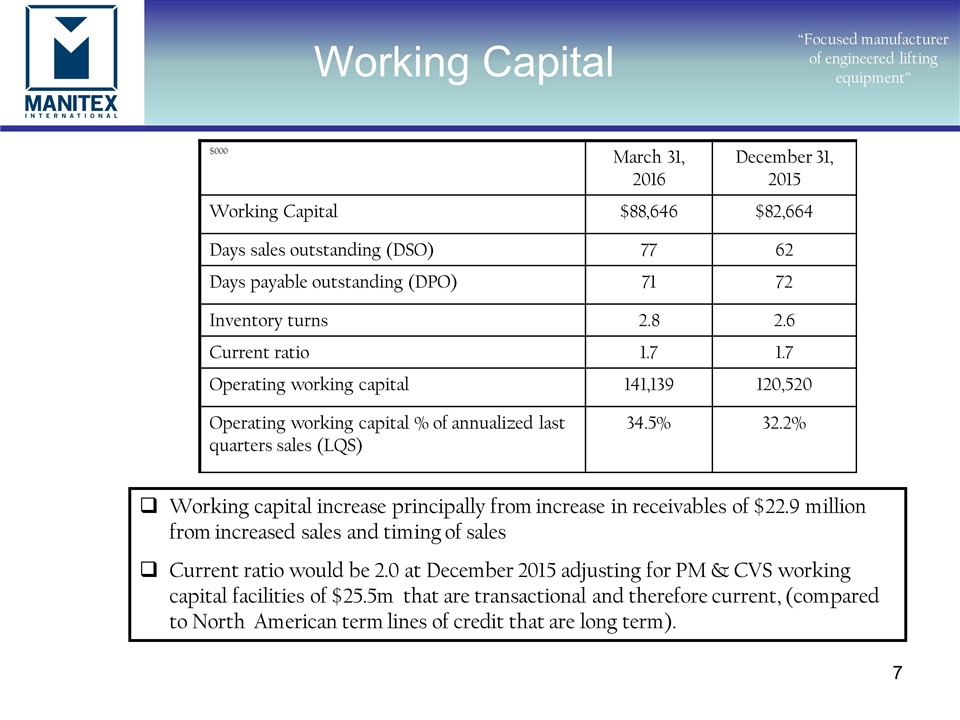

Working Capital “Focused manufacturer of engineered lifting equipment” $000 March 31, 2016 December 31, 2015 Working Capital $88,646 $82,664 Days sales outstanding (DSO) 77 62 Days payable outstanding (DPO) 71 72 Inventory turns 2.8 2.6 Current ratio 1.7 1.7 Operating working capital 141,139 120,520 Operating working capital % of annualized last quarters sales (LQS) 34.5% 32.2% Working capital increase principally from increase in receivables of $22.9 million from increased sales and timing of sales Current ratio would be 2.0 at December 2015 adjusting for PM & CVS working capital facilities of $25.5m that are transactional and therefore current, (compared to North American term lines of credit that are long term).

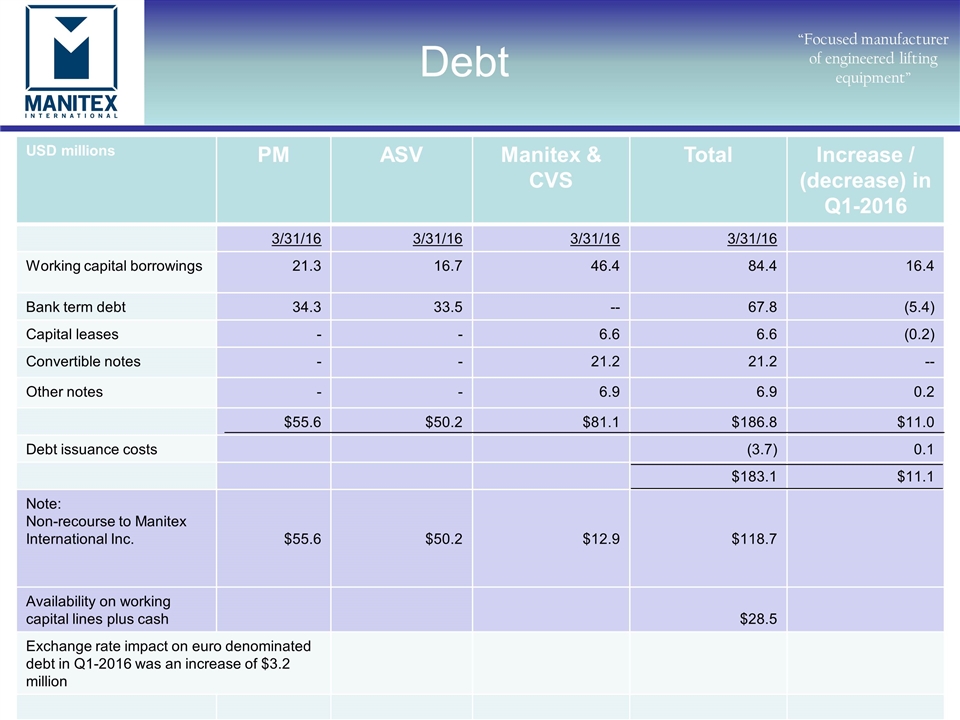

“Focused manufacturer of engineered lifting equipment” Debt USD millions PM ASV Manitex & CVS Total Increase / (decrease) in Q1-2016 3/31/16 3/31/16 3/31/16 3/31/16 Working capital borrowings 21.3 16.7 46.4 84.4 16.4 Bank term debt 34.3 33.5 -- 67.8 (5.4) Capital leases - - 6.6 6.6 (0.2) Convertible notes - - 21.2 21.2 -- Other notes - - 6.9 6.9 0.2 $55.6 $50.2 $81.1 $186.8 $11.0 Debt issuance costs (3.7) 0.1 $183.1 $11.1 Note: Non-recourse to Manitex International Inc. $55.6 $50.2 $12.9 $118.7 Availability on working capital lines plus cash $28.5 Exchange rate impact on euro denominated debt in Q1-2016 was an increase of $3.2 million

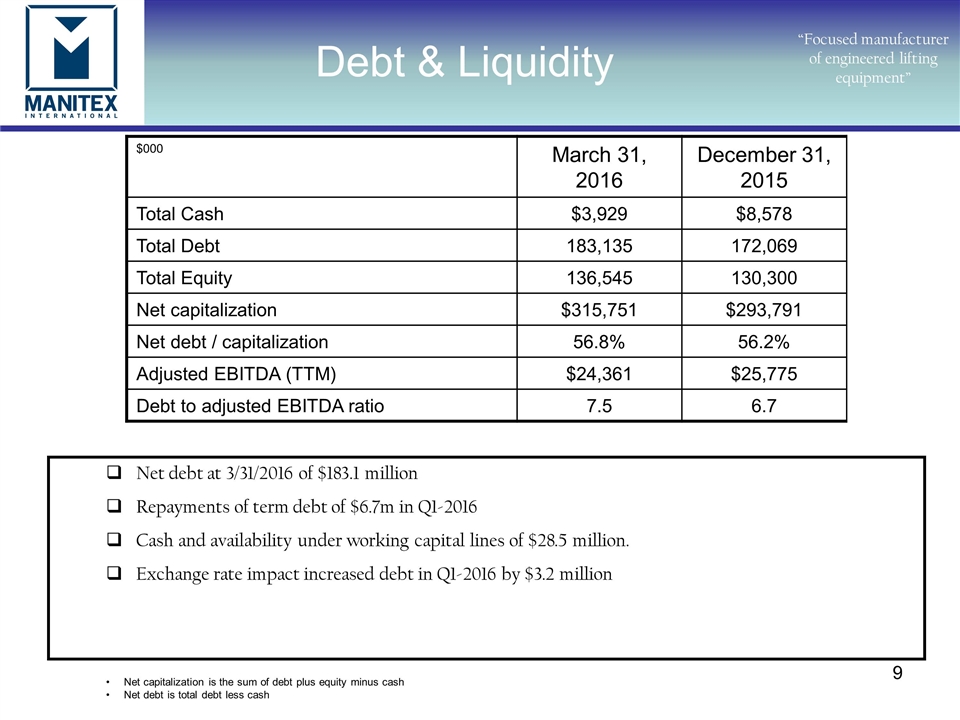

“Focused manufacturer of engineered lifting equipment” $000 March 31, 2016 December 31, 2015 Total Cash $3,929 $8,578 Total Debt 183,135 172,069 Total Equity 136,545 130,300 Net capitalization $315,751 $293,791 Net debt / capitalization 56.8% 56.2% Adjusted EBITDA (TTM) $24,361 $25,775 Debt to adjusted EBITDA ratio 7.5 6.7 Net debt at 3/31/2016 of $183.1 million Repayments of term debt of $6.7m in Q1-2016 Cash and availability under working capital lines of $28.5 million. Exchange rate impact increased debt in Q1-2016 by $3.2 million Debt & Liquidity Net capitalization is the sum of debt plus equity minus cash Net debt is total debt less cash

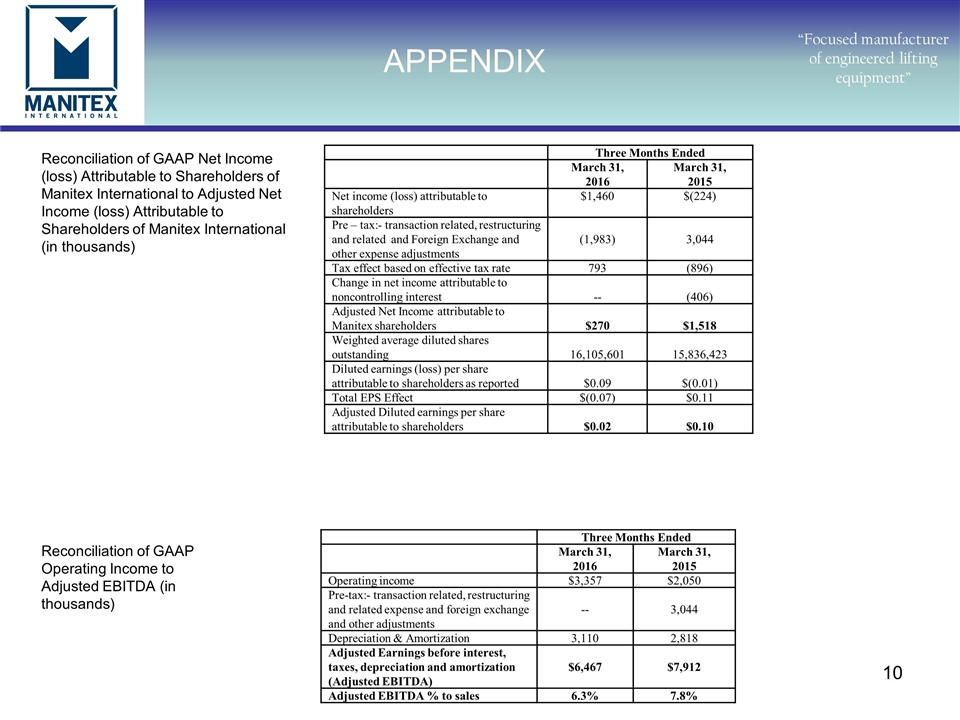

APPENDIX “Focused manufacturer of engineered lifting equipment” Reconciliation of GAAP Net Income (loss) Attributable to Shareholders of Manitex International to Adjusted Net Income (loss) Attributable to Shareholders of Manitex International (in thousands) Reconciliation of GAAP Operating Income to Adjusted EBITDA (in thousands) Three Months Ended March 31, 2016 March 31, 2015 Net income (loss) attributable to shareholders $1,460 $(224) Pre – tax:- transaction related, restructuring and related and Foreign Exchange and other expense adjustments (1,983) 3,044 Tax effect based on effective tax rate 793 (896) Change in net income attributable to noncontrolling interest -- (406) Adjusted Net Income attributable to Manitex shareholders $270 $1,518 Weighted average diluted shares outstanding 16,105,601 15,836,423 Diluted earnings (loss) per share attributable to shareholders as reported $0.09 $(0.01) Total EPS Effect $(0.07) $0.11 Adjusted Diluted earnings per share attributable to shareholders $0.02 $0.10 Three Months Ended March 31, 2016 March 31, 2015 Operating income $3,357 $2,050 Pre-tax:- transaction related, restructuring and related expense and foreign exchange and other adjustments -- 3,044 Depreciation & Amortization 3,110 2,818 Adjusted Earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) $6,467 $7,912 Adjusted EBITDA % to sales 6.3% 7.8%

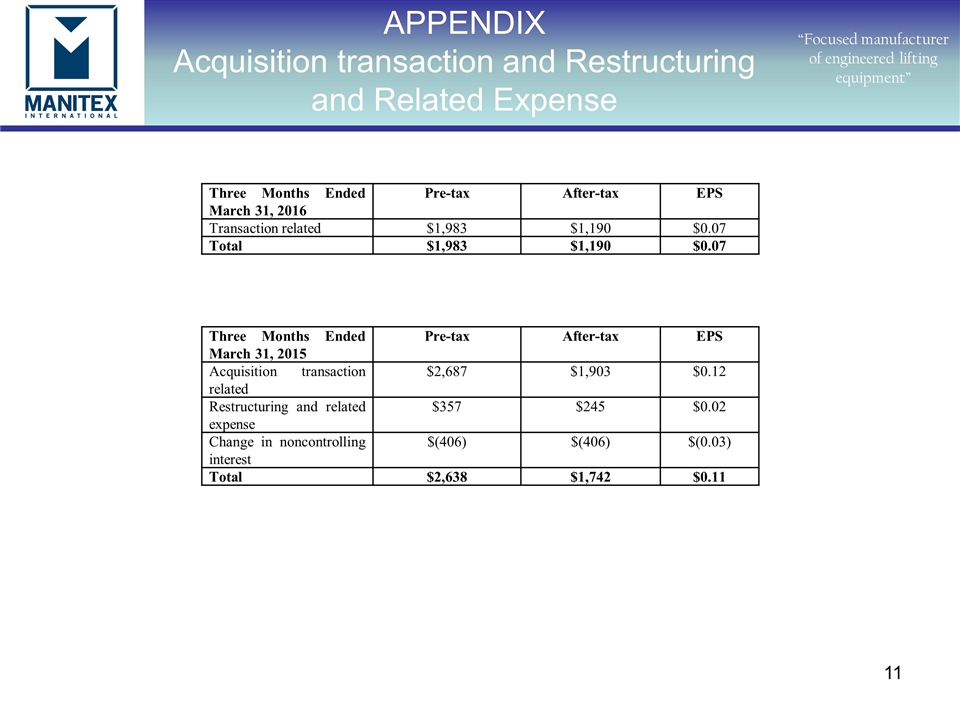

APPENDIX Acquisition transaction and Restructuring and Related Expense “Focused manufacturer of engineered lifting equipment” Three Months Ended March 31, 2016 Pre-tax After-tax EPS Transaction related $1,983 $1,190 $0.07 Total $1,983 $1,190 $0.07 Three Months Ended March 31, 2015 Pre-tax After-tax EPS Acquisition transaction related $2,687 $1,903 $0.12 Restructuring and related expense $357 $245 $0.02 Change in noncontrolling interest $(406) $(406) $(0.03) Total $2,638 $1,742 $0.11