Attached files

| file | filename |

|---|---|

| 8-K - HORIZON BANCORP INC /IN/ | hb_8k0505.htm |

Exhibit 99.1

Filed by Horizon Bancorp pursuant to

Rule 425 under the Securities Act of 1933 and deemed filed

pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: LaPorte Bancorp, Inc.

Commission File No. 001-35684

Filed by Horizon Bancorp pursuant to

Rule 425 under the Securities Act of 1933

Subject Company: Horizon Bancorp

Commission File No. 000-10792

A NASDAQ Traded Company - Symbol HBNC

This presentation may contain forward-looking statements regarding the financial performance, business, and future operations of Horizon Bancorp and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future results or performance. As a result, undue reliance should not be placed on these forward-looking statements, which speak only as of the date hereof.We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions, and although management believes that the expectations reflected in such forward-looking statements are accurate and reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause our actual results to differ materially include those set forth in Horizon’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Statements in this presentation should be considered in conjunction with such risk factors and the other information publicly available about Horizon, including the information in the filings we make with the Securities and Exchange Commission.Horizon does not undertake, and specifically disclaims any obligation, to publicly release any updates to any forward-looking statement to reflect events or circumstances occurring or arising after the date on which the forward-looking statement is made, or to reflect the occurrence of unanticipated events, except to the extent required by law. Forward-Looking Statements

Additional Information In connection with the proposed merger with Kosciusko Financial, Inc., holding company for Farmers State Bank (“Farmers”), Horizon has filed with the SEC a Registration Statement on Form S-4 that includes a proxy statement of Farmers and a prospectus of Horizon, as well as other relevant documents concerning the proposed transaction. Horizon and Farmers have mailed the definitive joint proxy statement/prospectus to shareholders of Farmers (which mailings were first made on or about April 13, 2016). In connection with the proposed merger with LaPorte Bancorp, Inc. (“LaPorte”), Horizon will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of LaPorte and a prospectus of Horizon, as well as other relevant documents concerning the proposed transaction. Shareholders of Farmers and LaPorte are urged to read the respective Registration Statements and the joint proxy statement/prospectus regarding each merger and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they contain important information. A free copy of the joint proxy statement/prospectus, as well as other filings containing information about Horizon, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Horizon at www.horizonbank.com under the tab “About Us” and then under the headings “Investor Relations – Documents - SEC Filings.” The information available through Horizon’s website is not and shall not be deemed part of this filing or incorporated by reference into other filings Horizon makes with the SEC.Horizon and Farmers and LaPorte, and certain of their directors and executive officers, may be deemed to be participants in the solicitation of proxies from the shareholders of Farmers and/or LaPorte, respectively, in connection with the proposed mergers. Information about the directors and executive officers of Horizon is set forth in the proxy statement for Horizon’s 2016 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 15, 2016. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the respective joint proxy statement/prospectus regarding the proposed mergers. Free copies of these documents may be obtained as described in the preceding paragraph.

Mark E. SecorExecutive Vice President Chief Financial Officer *

Horizon’s Story *

Indiana and Michigan… The Right Side of Chicago Illinois and Chicago-High Taxes & Living Costs-Lowest Credit Rating of 50 States-Unfriendly Business Environment

* Corporate Profile Financial data as of March 31, 2016 45 Branches Across Indiana and Michigan$2.6 Billion in Assets$1.7 Billion in Loans $1.9 Billion in Deposits$1.4 Billion in Assets Under Mgt.Ownership7% Insiders9% Employee Benefit Plans40% Institutional

Financial Highlights *

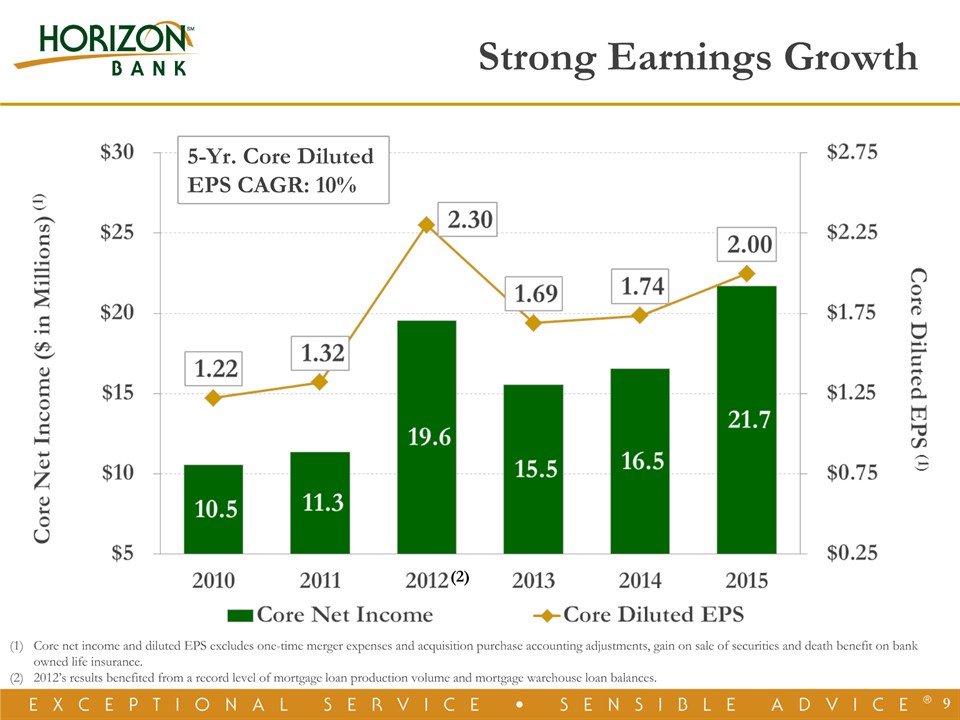

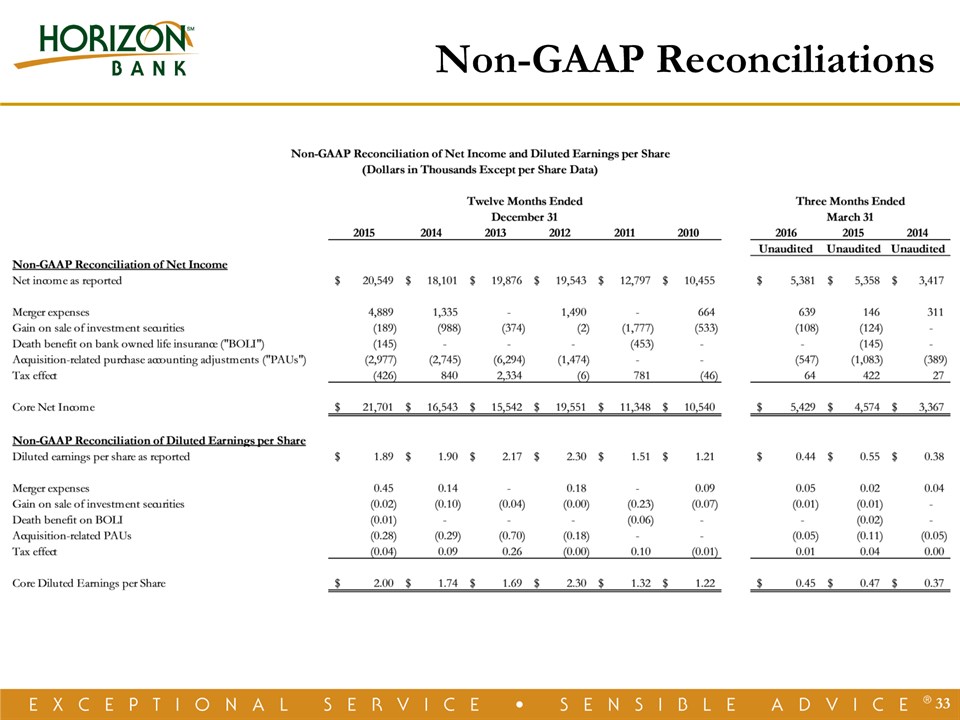

* Core net income and diluted EPS excludes one-time merger expenses and acquisition purchase accounting adjustments, gain on sale of securities and death benefit on bank owned life insurance.2012’s results benefited from a record level of mortgage loan production volume and mortgage warehouse loan balances. 5-Yr. Core Diluted EPS CAGR: 10% Strong Earnings Growth (2)

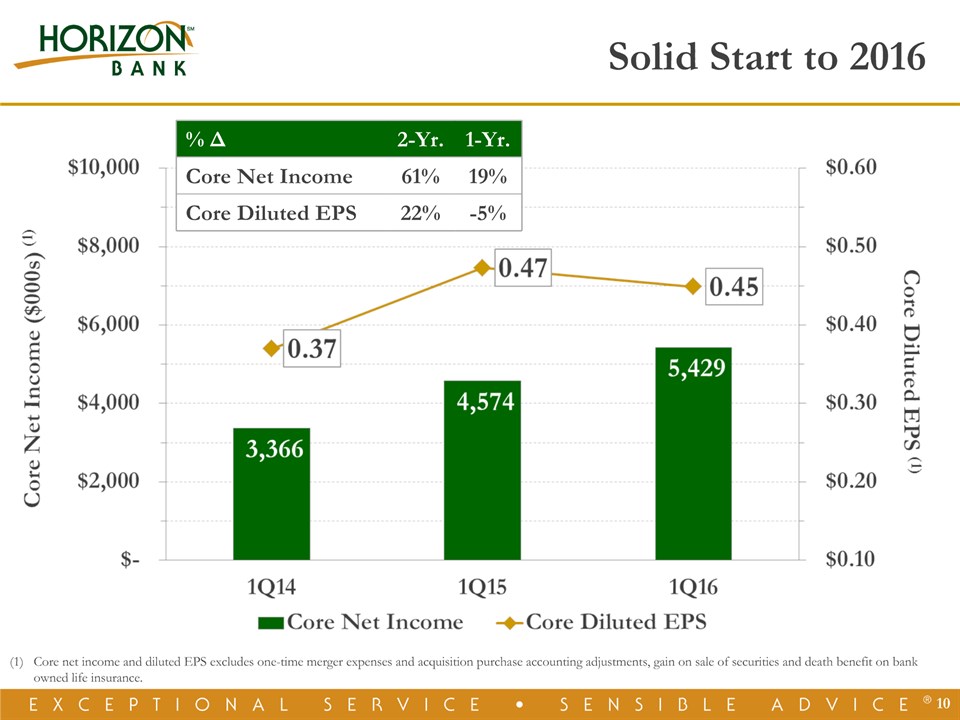

* Solid Start to 2016 % Δ 2-Yr. 1-Yr. Core Net Income 61% 19% Core Diluted EPS 22% -5% Core net income and diluted EPS excludes one-time merger expenses and acquisition purchase accounting adjustments, gain on sale of securities and death benefit on bank owned life insurance.

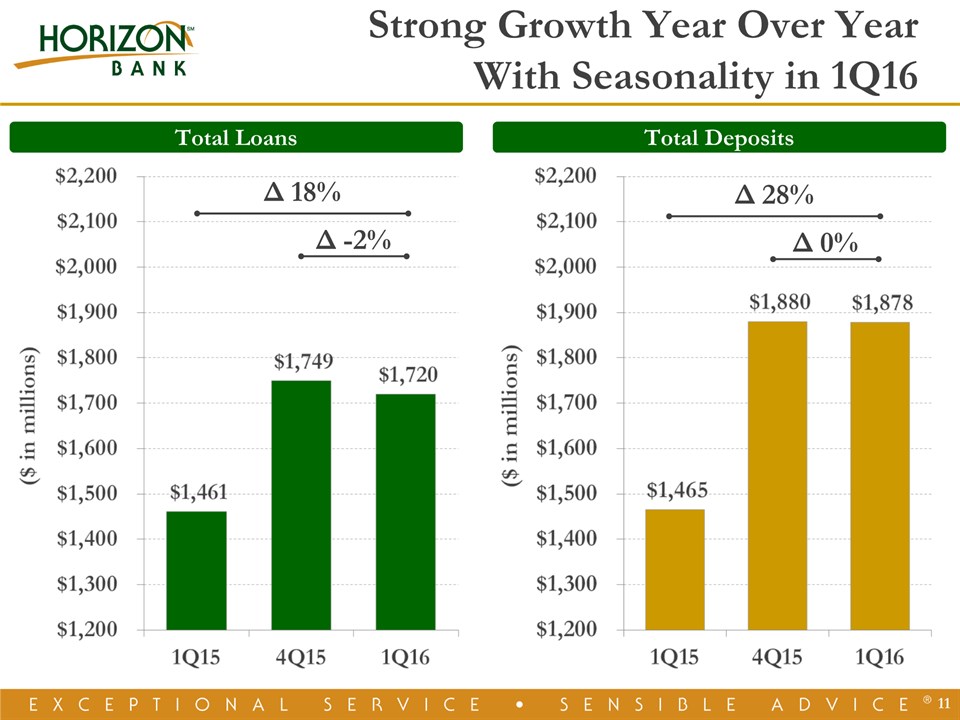

* Total Loans Total Deposits Δ 18% Δ -2% Δ 28% Δ 0% Strong Growth Year Over Year With Seasonality in 1Q16

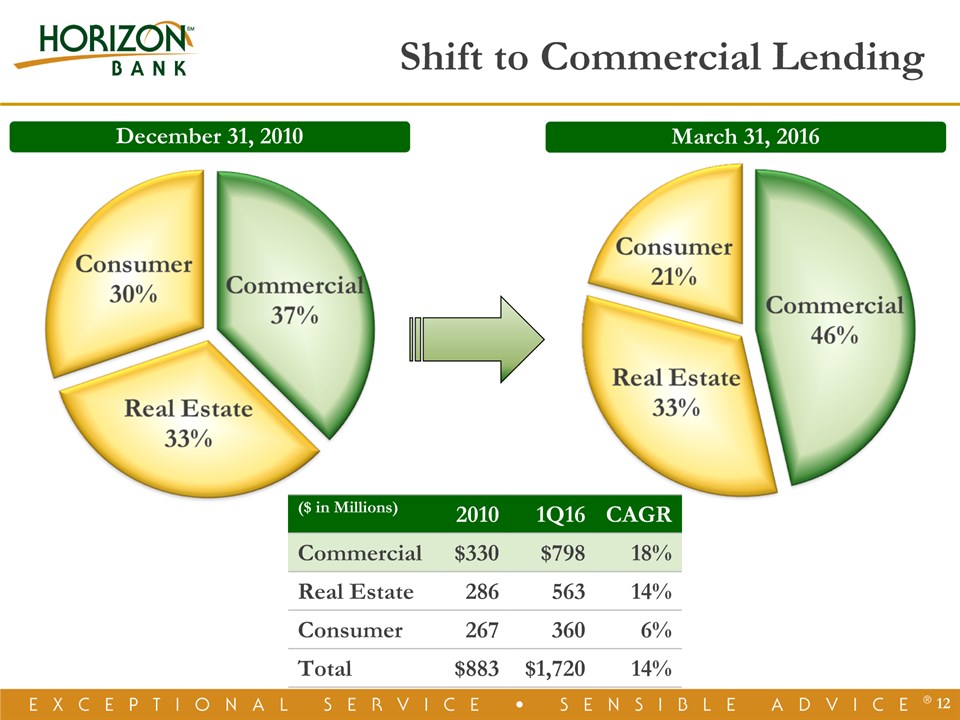

March 31, 2016 December 31, 2010 ($ in Millions) 2010 1Q16 CAGR Commercial $330 $798 18% Real Estate 286 563 14% Consumer 267 360 6% Total $883 $1,720 14% * Shift to Commercial Lending

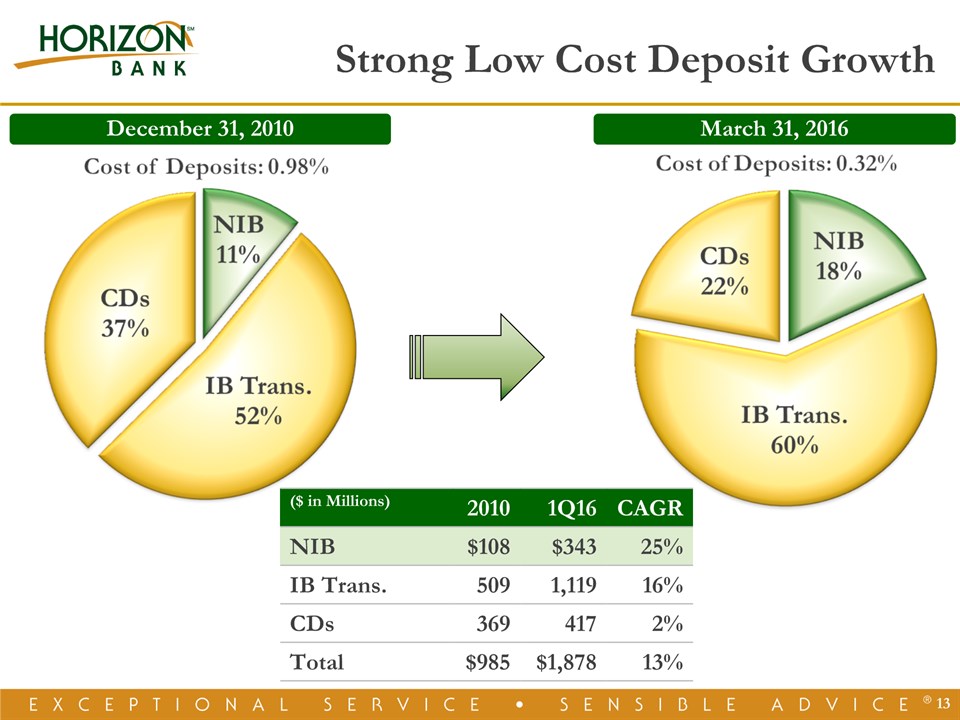

December 31, 2010 March 31, 2016 Strong Low Cost Deposit Growth * ($ in Millions) 2010 1Q16 CAGR NIB $108 $343 25% IB Trans. 509 1,119 16% CDs 369 417 2% Total $985 $1,878 13%

Pending MergersAdds Talent, EPS Accretion & Market Share *

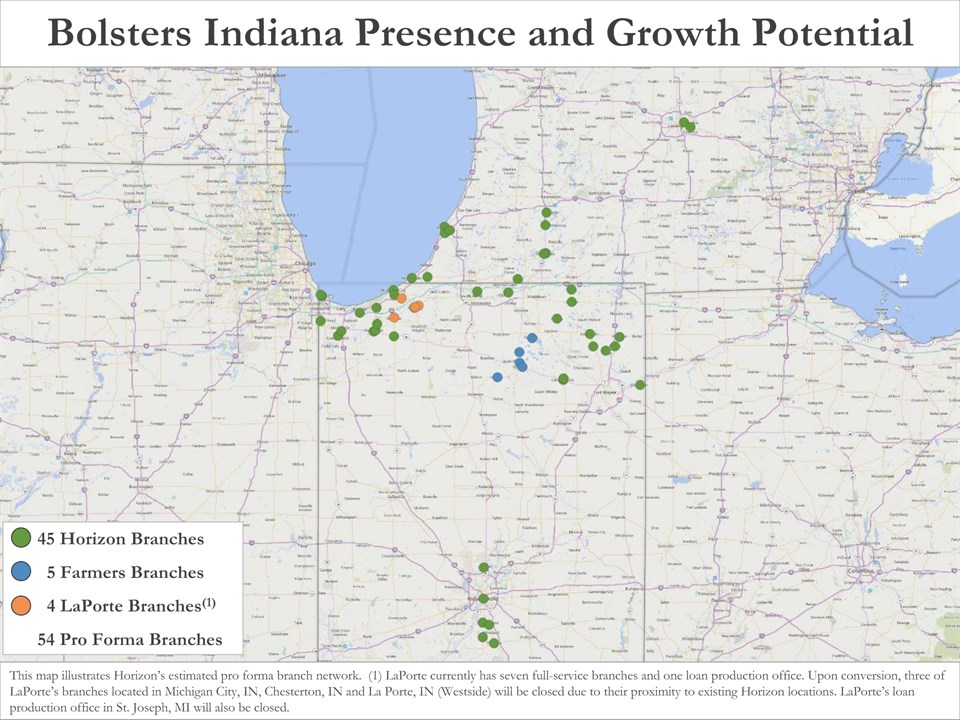

* Bolsters Indiana Presence and Growth Potential This map illustrates Horizon’s estimated pro forma branch network. (1) LaPorte currently has seven full-service branches and one loan production office. Upon conversion, three of LaPorte’s branches located in Michigan City, IN, Chesterton, IN and La Porte, IN (Westside) will be closed due to their proximity to existing Horizon locations. LaPorte’s loan production office in St. Joseph, MI will also be closed. 45 Horizon Branches 5 Farmers Branches 4 LaPorte Branches(1)54 Pro Forma Branches

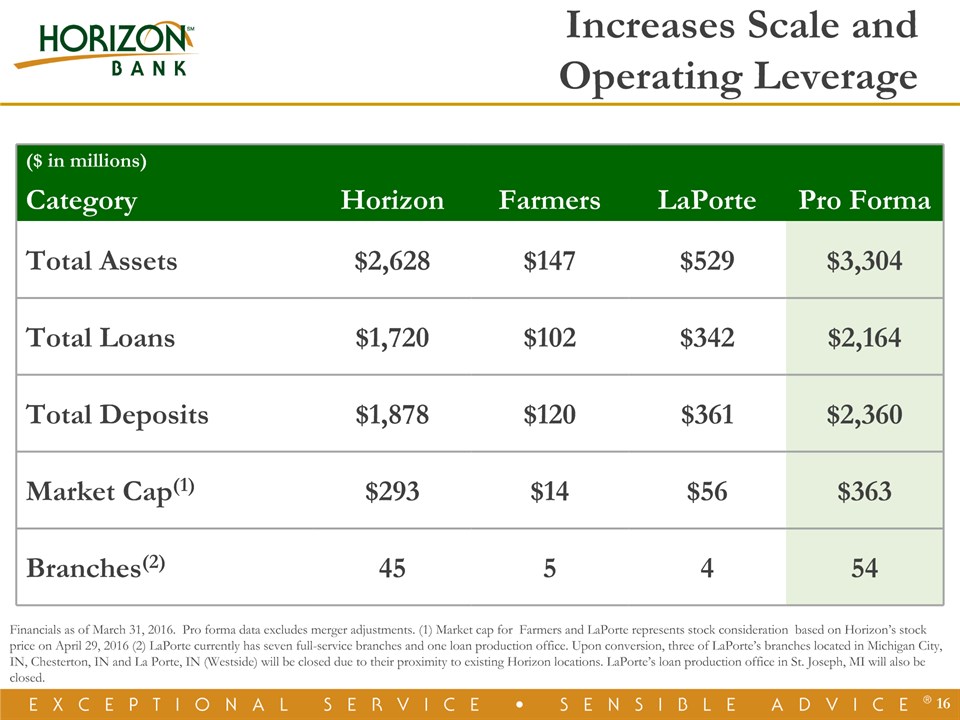

* Increases Scale and Operating Leverage ($ in millions)Category Horizon Farmers LaPorte Pro Forma Total Assets $2,628 $147 $529 $3,304 Total Loans $1,720 $102 $342 $2,164 Total Deposits $1,878 $120 $361 $2,360 Market Cap(1) $293 $14 $56 $363 Branches(2) 45 5 4 54 Financials as of March 31, 2016. Pro forma data excludes merger adjustments. (1) Market cap for Farmers and LaPorte represents stock consideration based on Horizon’s stock price on April 29, 2016 (2) LaPorte currently has seven full-service branches and one loan production office. Upon conversion, three of LaPorte’s branches located in Michigan City, IN, Chesterton, IN and La Porte, IN (Westside) will be closed due to their proximity to existing Horizon locations. LaPorte’s loan production office in St. Joseph, MI will also be closed.

* Strategic Financial Operational Growth opportunity in the vibrant market of Warsaw, INComplements existing presence in northeast IndianaStrong agricultural team and core deposit base Transaction value $22.5 million, 65%/35% stock/cashEPS accretion of ~ 4% in 2017, first full year pro formaInitial TBV dilution of $0.47 with four year earn backInternal rate of return over 20% Fully-phased in cost savings estimated at 45%Retention of key market leadersMinimal credit concerns Farmers Merger Complements NE Indiana & Adds EPS Accretion For further details, see the investor presentation issued on Form 8-K on February 5, 2016

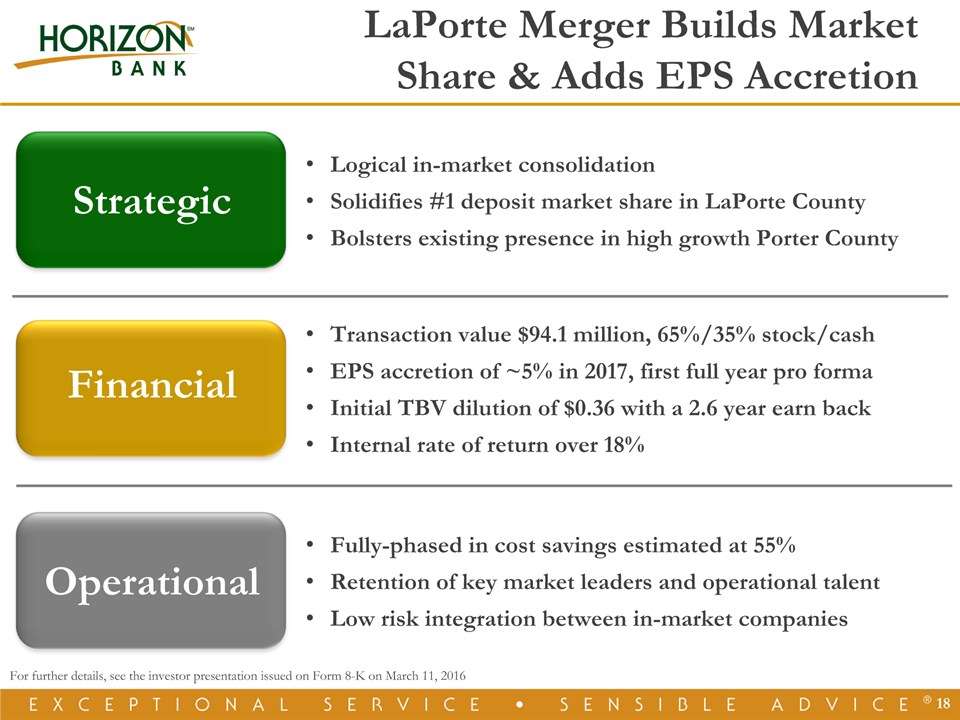

* Strategic Financial Operational Logical in-market consolidationSolidifies #1 deposit market share in LaPorte CountyBolsters existing presence in high growth Porter County Transaction value $94.1 million, 65%/35% stock/cashEPS accretion of ~5% in 2017, first full year pro formaInitial TBV dilution of $0.36 with a 2.6 year earn backInternal rate of return over 18% Fully-phased in cost savings estimated at 55%Retention of key market leaders and operational talentLow risk integration between in-market companies LaPorte Merger Builds MarketShare & Adds EPS Accretion For further details, see the investor presentation issued on Form 8-K on March 11, 2016

Craig M. DwightChairman & Chief Executive Officer *

- Investment Thesis –Building for the FutureTrust, Action, Results *

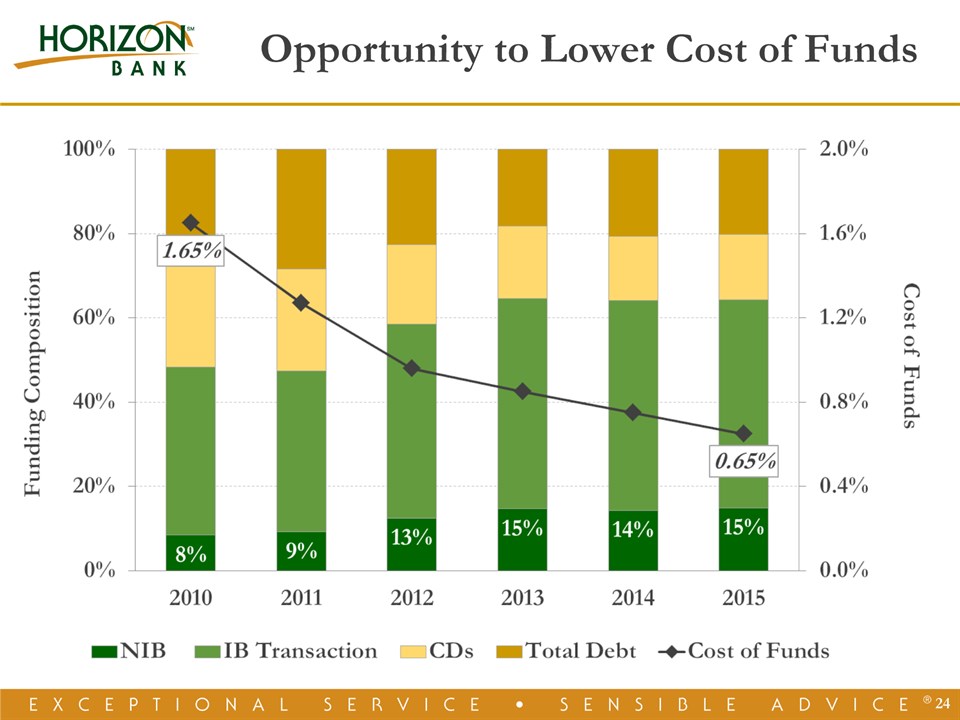

Financial Opportunities * Revenue GrowthIn all directions and in all business linesCustomer satisfaction #1 focusTalent retention, development and recruitmentLower Overall Cost of FundsReduce debt and increase core depositsImproves net interest marginEfficiency ImprovementsMass and scaleLeverage technologyBranch rationalization

* Growth Opportunities In All Directions Current Opportunity Future OpportunityCurrent BranchesFarmers BranchesLaPorte Branches This map illustrates Horizon’s estimated pro forma branch network including the Farmers and LaPorte mergers. Green circles represent Horizon branches, blue circles represent Farmers branches and orange circles represent LaPorte branches, excluding the three branches and loan production office that will be closed on the conversion date. HQ

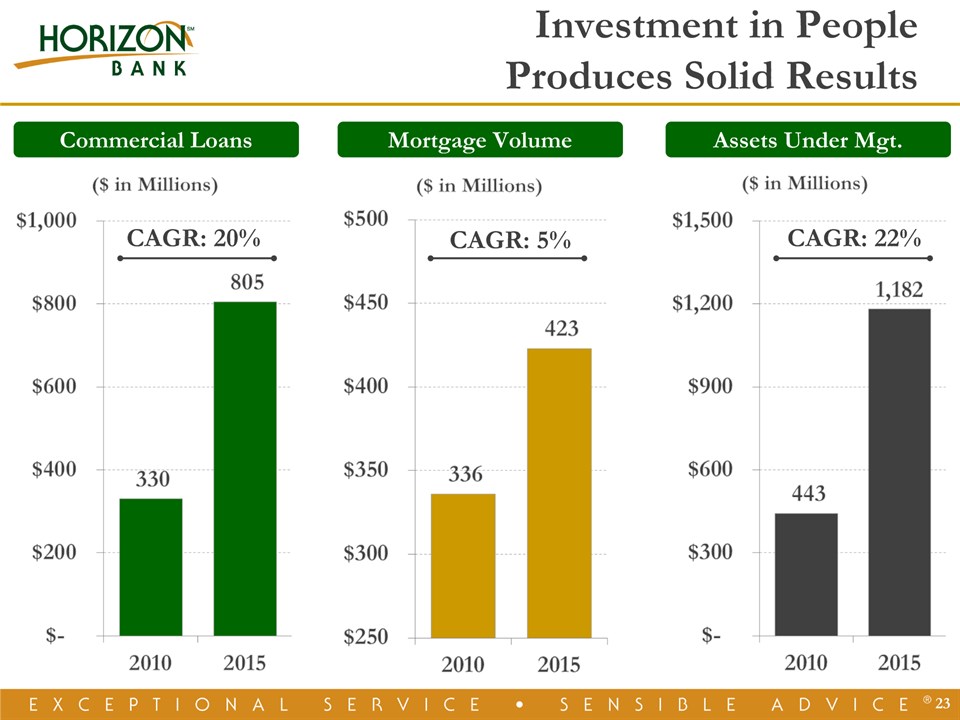

* Commercial Loans Mortgage Volume Assets Under Mgt. CAGR: 20% CAGR: 22% CAGR: 5% Investment in PeopleProduces Solid Results

* Commercial Loan Balances Opportunity to Lower Cost of Funds

* Number of Banks Headquartered in Indiana and Michigan (1) Scarcity Value 37% decline over 10-yearsOn average, 4% decline per year (1) IN and MI commercial banks, savings banks and savings & loan institutions with assets greater than $0 as of December 31st of each respective year. Source: SNL Financial.

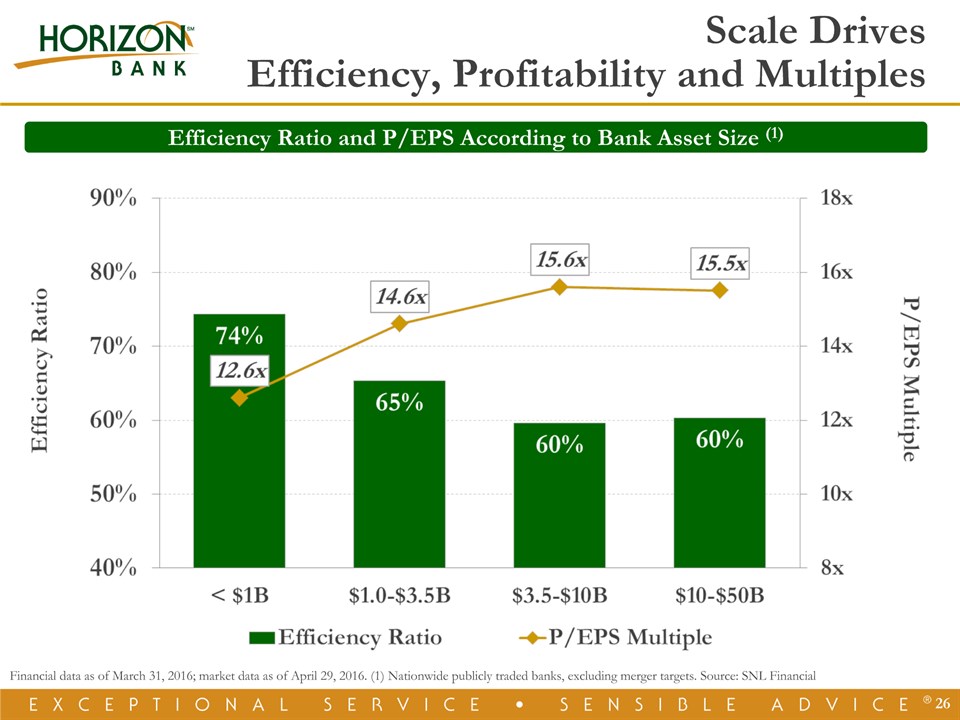

* Efficiency Ratio and P/EPS According to Bank Asset Size (1) Scale Drives Efficiency, Profitability and Multiples Financial data as of March 31, 2016; market data as of April 29, 2016. (1) Nationwide publicly traded banks, excluding merger targets. Source: SNL Financial

Consistent, Well Executed and Disciplined Business Strategy Horizon is a Growth Story10-year Asset CAGR of 9%Nine Acquisitions and Seven Market Expansions Since 2000Capacity to Take Additional Market ShareHistorical Financial Performance Illustrates Ability to Execute * Proven Track Record (Trust)

A Company on the Move (Action) * Assets ($ Mil.) $721 $3,304 Loans($ Mil.) $548 $2,164 Deposits($ Mil.) $489 $2,360 Branches (2) 7 54 OrganicExpans.(7) St. JosephS. BendElkhart Lake County Kalamazoo Indianapolis Carmel --- M&A(9) Anchor Mortgage Alliance American Trust Heartland 1st MortgageSummitPeoples FarmersLaPorte 12% CAGR 11% CAGR 13% CAGR (1) Financials as of 3/31/2016, including pending of Farmers and LaPorte acquisitions, excluding merger adjustments. (2) Reflects anticipated LaPorte branch consolidations.

Horizon Outperforms the MarketFor Total Shareholder Return (Results) As of April 29, 2016SNL U.S. Bank: Includes all Major Exchange Banks in SNL's coverage universe. * Horizon Bancorp: 5-Year Total Return Comparison

Thank Youfor Your Investment inHorizon Bancorp

A NASDAQ Traded Company - Symbol HBNC

Appendix *

* Non-GAAP Reconciliations