Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE CAROLINAS MIDLANDS III ACQUISITION - CatchMark Timber Trust, Inc. | pressrelease-midlands3acqu.htm |

| 8-K - CAROLINAS MIDLANDS III ACQUISITION - CatchMark Timber Trust, Inc. | a8-kcttmidlands3acquisition.htm |

CatchMark Timber Trust NYSE: CTT M a y 2 0 1 6 Carol inas Midlands I I I Acquisit ion M A Y 2 0 1 6

F O R WA R D - L O O K I N G S TAT E M E N T S 2 This presentation contains certain forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (as set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) that are subject to risks and uncertainties. Such forward-looking statements can generally be identified by use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. These forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. The Company's ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although the Company believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, the Company's actual results and performance could differ materially from those set forth in, or implied by, the forward-looking statements. You should be aware that there are various factors that could cause actual results to differ materially from any forward-looking statements made in this presentation. Factors that could cause or contribute to such differences include, but are not limited to, (i) the conditions to closing may not be satisfied and, as a result, the acquisition of the Carolinas Midlands III timberlands may not be completed when expected or at all (ii) we may not generate the harvest volumes or the harvest mix from our timberlands that we currently anticipate; (iii) the demand for our timber may not increase at the rate we currently anticipate or at all due to changes in general economic and business conditions in the geographic regions where our timberlands are located; (iv) the cyclical nature of the real estate market generally, including fluctuations in demand and valuations, may adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties; (v) housing starts and timber prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (vi) the supply of timberlands available for acquisition that meet our investment criteria may be less than we currently anticipate; (vii) we may be unsuccessful in winning bids for timberland that are sold through an auction process; (viii) we may not be able to access external sources of capital at attractive rates or at all; (ix) potential increases in interest rates could have a negative impact on our business; (x) our share repurchase program may not be successful in improving shareholder value over the long-term; (x) our cash dividends are not guaranteed and may fluctuate; and (xi) the factors described in Item 1A. of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, under the heading “Risk Factors” and our other filings with Securities and Exchange Commission. You are cautioned not to place undue reliance on any of these forward-looking statements, which reflect the Company's views only as of this date. Furthermore, except as required by law, the Company is under no duty to, and does not intend to, update any of our forward-looking statements after this date, whether as a result of new information, future events or otherwise.

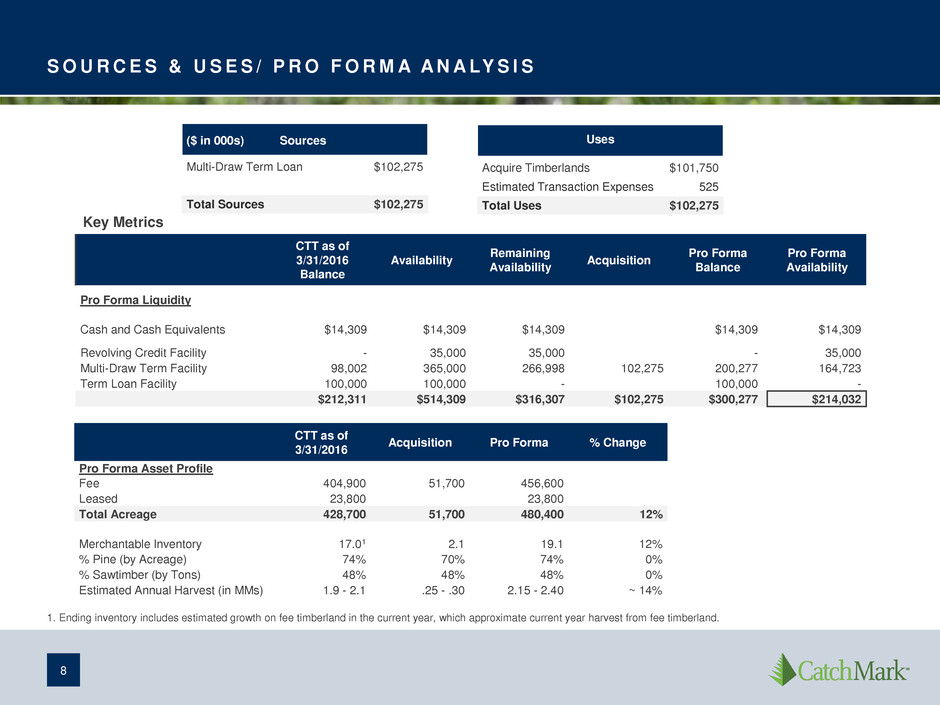

C A R O L I N A S M I D L A N D S I I I : T R A N S A C T I O N S U M M A R Y 3 Transaction/Purchase Price • CatchMark has agreed to acquire approximately 51,700 acres of prime timberlands in South Carolina from funds managed by Forest Investment Associates. • Purchase price of $101.8 million (~$1,969 per acre) Financing Plan • Transaction will be financed through CatchMark's multi-draw term loan. • Over $200 million remaining liquidity post transaction Timing • Closing expected by end of second quarter or early third quarter 2016

C O M P E L L I N G I N V E S T M E N T R AT I O N A L E • Significantly expands CatchMark’s recent entry into North Carolina and South Carolina from 17,600 to 69,300 acres, and will increase the company’s total acreage in the U.S. South to 480,400 acres • Proximity to stable, well managed mills, including one of the most efficient and highest capacity mills in the U.S • Includes assumptions of existing long-term supply agreement • Adds approximately 2.1 million tons1 to CatchMark’s merchantable inventory • Comprises 70% pine acres and a 52%/48% pulpwood to sawtimber mix • Expected to add approximately 250,000 to 300,000 tons per year (4.8 to 5.8 tons per acre per year) to CatchMark’s harvest volumes over the next decade • Average site index of plantations nearing maturity over 80 • Significant diversity in topography, creating seasonal harvest optionality 4 1. Subject to standard final adjustment prior to closing. 2. Site index is the height a tree can grow (in feet) in 25 years. US Southern averages are 60-65.

C O M P L E M E N TA R Y T O P R E V I O U S C A R O L I N A S A C Q U I S I T I O N S 5 Carolinas Midlands III provides synergies in pricing power, haul distances, management and land sales. NC SC Existing timberlands as of 3/31/2016 Carolinas Midlands III acquisition Carolinas Midlands III acquisition in same counties as existing timberland

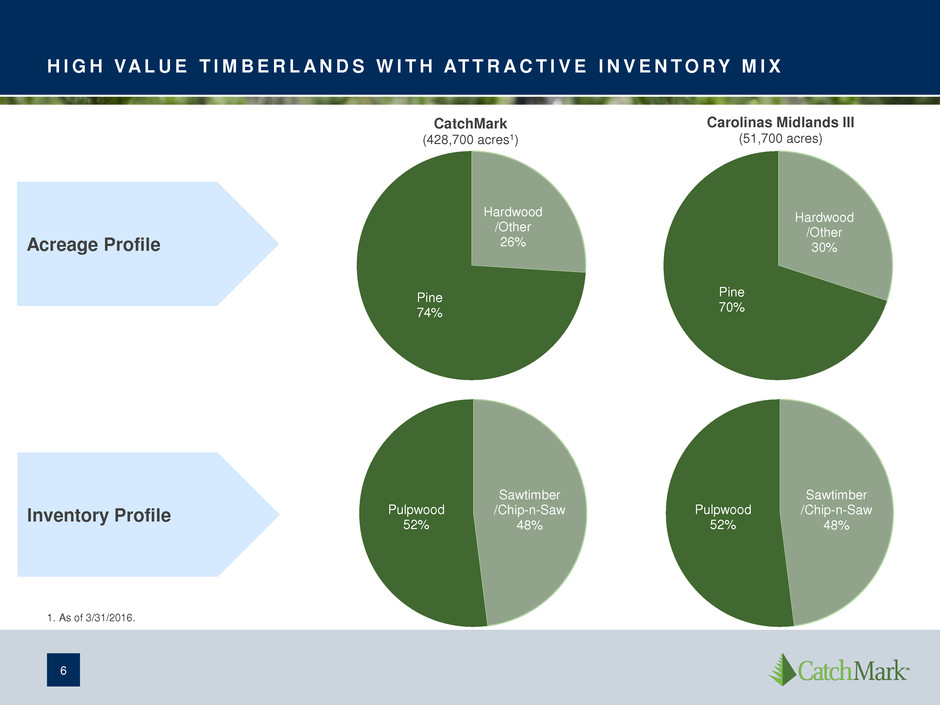

H I G H VA L U E T I M B E R L A N D S W I T H AT T R A C T I V E I N V E N T O R Y M I X 6 Acreage Profile Inventory Profile Hardwood /Other 26% Pine 74% CatchMark (428,700 acres1) Hardwood /Other 30% Pine 70% Carolinas Midlands III (51,700 acres) Sawtimber /Chip-n-Saw 48% Pulpwood 52% Sawtimber /Chip-n-Saw 48% Pulpwood 52% 1. As of 3/31/2016.

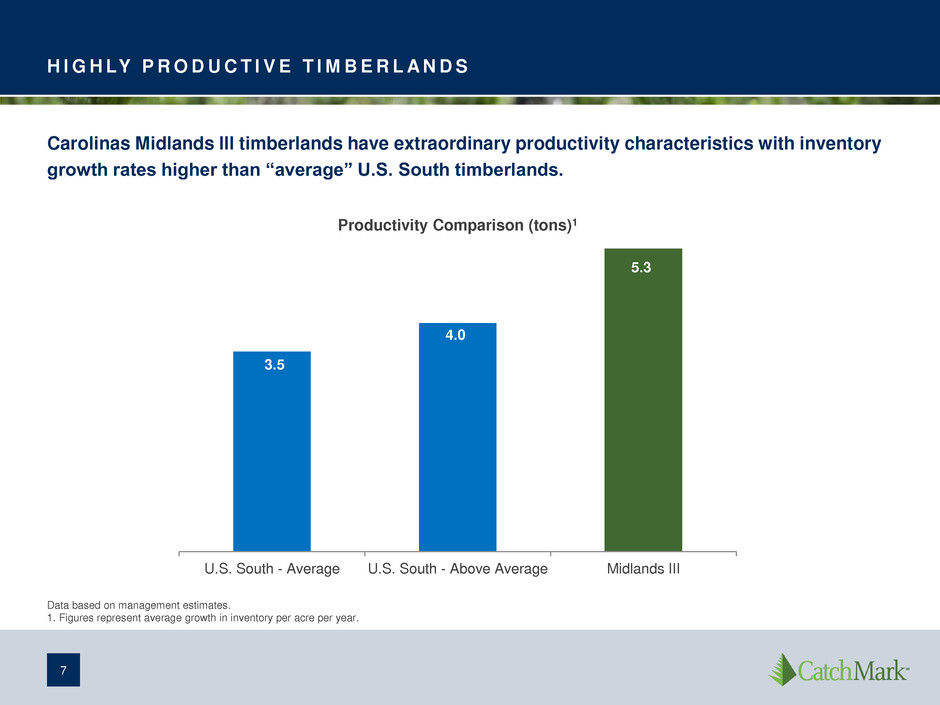

H I G H LY P R O D U C T I V E T I M B E R L A N D S 7 U.S. South - Average U.S. South - Above Average Midlands III 3.5 4.0 5.3 Productivity Comparison (tons)1 Data based on management estimates. 1. Figures represent average growth in inventory per acre per year. Carolinas Midlands III timberlands have extraordinary productivity characteristics with inventory growth rates higher than “average” U.S. South timberlands.

S O U R C E S & U S E S / P R O F O R M A A N A LY S I S 8 ($ in 000s) Sources Multi-Draw Term Loan $102,275 Total Sources $102,275 Uses Acquire Timberlands $101,750 Estimated Transaction Expenses 525 Total Uses $102,275 CTT as of 3/31/2016 Balance Availability Remaining Availability Acquisition Pro Forma Balance Pro Forma Availability Pro Forma Liquidity Cash and Cash Equivalents $14,309 $14,309 $14,309 $14,309 $14,309 Revolving Credit Facility - 35,000 35,000 - 35,000 Multi-Draw Term Facility 98,002 365,000 266,998 102,275 200,277 164,723 Term Loan Facility 100,000 100,000 - 100,000 - $212,311 $514,309 $316,307 $102,275 $300,277 $214,032 Key Metrics CTT as of 3/31/2016 Acquisition Pro Forma % Change Pro Forma Asset Profile Fee 404,900 51,700 456,600 Leased 23,800 23,800 Total Acreage 428,700 51,700 480,400 12% Merchantable Inventory 17.01 2.1 19.1 12% % Pine (by Acreage) 74% 70% 74% 0% % Sawtimber (by Tons) 48% 48% 48% 0% Estimated Annual Harvest (in MMs) 1.9 - 2.1 .25 - .30 2.15 - 2.40 ~ 14% 1. Ending inventory includes estimated growth on fee timberland in the current year, which approximate current year harvest from fee timberland.