Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BAR HARBOR BANKSHARES | d180870d8k.htm |

| EX-99.2 - EX-99.2 - BAR HARBOR BANKSHARES | d180870dex992.htm |

May 5, 2016 Bar Harbor Bankshares and Lake Sunapee Bank Group Combine to Create a Leading Northern New England Banking Institution Exhibit 99.1

Safe Harbor Statement SAFE HARBOR This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the proposed merger of Bar Harbor Bankshares (“Bar Harbor”) and Lake Sunapee Bank Group (“Lake Sunapee”). These statements include statements regarding the anticipated closing date of the transaction and anticipated future results. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "would," "should," "could" or "may." Certain factors that could cause actual results to differ materially from expected results include delays in completing the merger, including as a result of delays in obtaining regulatory or shareholder approval, difficulties in achieving cost savings from the merger or in achieving such cost savings within the expected time frame, difficulties in integrating Bar Harbor and Lake Sunapee, increased competitive pressures, changes in the interest rate environment, changes in general economic conditions, legislative and regulatory changes that adversely affect the business in which Bar Harbor and Lake Sunapee are engaged, changes in the securities markets and other risks and uncertainties disclosed from time to time in documents that Bar Harbor and Lake Sunapee file with the Securities and Exchange Commission (“SEC”). ADDITIONAL INFORMATION ABOUT THE MERGER In connection with the proposed merger, Bar Harbor will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Bar Harbor and Lake Sunapee and a Prospectus of Bar Harbor, as well as other relevant documents concerning the proposed merger. Investors and stockholders are urged to read the Registration Statement and the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Registration Statement and Joint Proxy Statement/Prospectus, as well as other filings containing information about Bar Harbor and Lake Sunapee, when they become available, may be obtained free of charge at the SEC’s Internet site (www.sec.gov). Copies of the Registration Statement and Joint Proxy Statement/Prospectus (when they become available) and the filings that will be incorporated by reference therein may also be obtained, free of charge, from Bar Harbor’s website at www.bhbt.com/shareholder-relations or by contacting Bar Harbor Investor Relations at 888-853-7100 or from Lake Sunapee’s website at www.lakesunapeebankgroup.com or by contacting Lake Sunapee Investor Relations at 603-863-0886. PARTICIPANTS IN SOLICITATION Bar Harbor and Lake Sunapee and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Bar Harbor and Lake Sunapee in connection with the proposed merger. Information about the directors and executive officers of Bar Harbor is set forth in the proxy statement for Bar Harbor’s 2016 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on March 23, 2016. Information about the directors and executive officers of Lake Sunapee is set forth in the proxy statement for Lake Sunapee’s 2016 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on March 28, 2016. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the Joint Proxy Statement/Prospectus and other relevant documents regarding the proposed merger to be filed with the SEC (when they become available). Free copies of these documents may be obtained as described in the preceding paragraph.

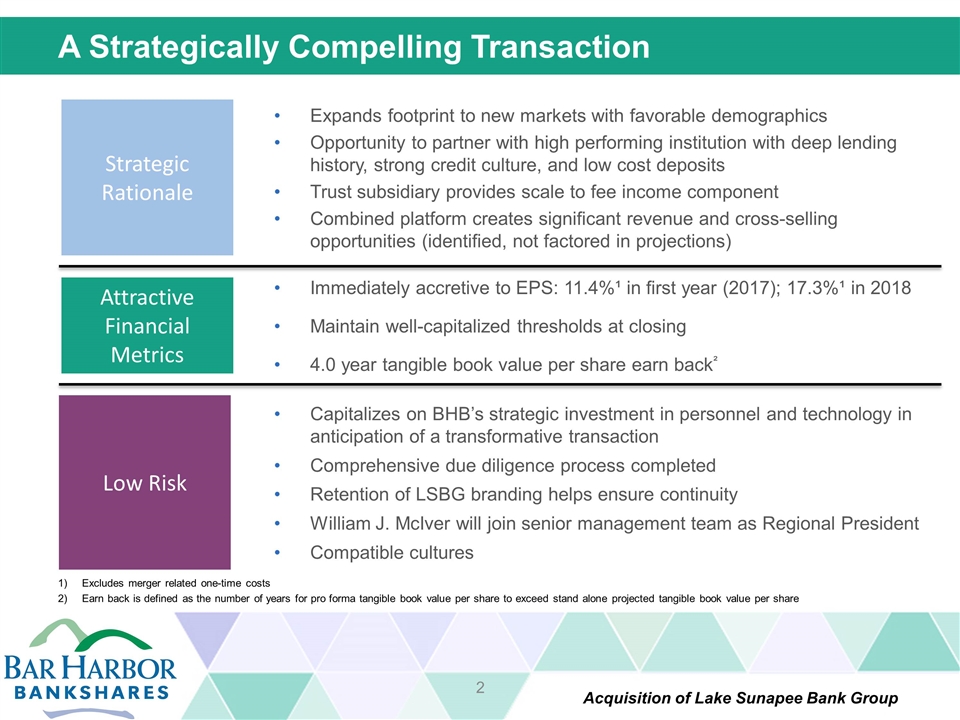

A Strategically Compelling Transaction Expands footprint to new markets with favorable demographics Opportunity to partner with high performing institution with deep lending history, strong credit culture, and low cost deposits Trust subsidiary provides scale to fee income component Combined platform creates significant revenue and cross-selling opportunities (identified, not factored in projections) Excludes merger related one-time costs Earn back is defined as the number of years for pro forma tangible book value per share to exceed stand alone projected tangible book value per share Strategic Rationale Attractive Financial Metrics Low Risk Immediately accretive to EPS: 11.4%¹ in first year (2017); 17.3%¹ in 2018 Maintain well-capitalized thresholds at closing 4.0 year tangible book value per share earn back² Capitalizes on BHB’s strategic investment in personnel and technology in anticipation of a transformative transaction Comprehensive due diligence process completed Retention of LSBG branding helps ensure continuity William J. McIver will join senior management team as Regional President Compatible cultures

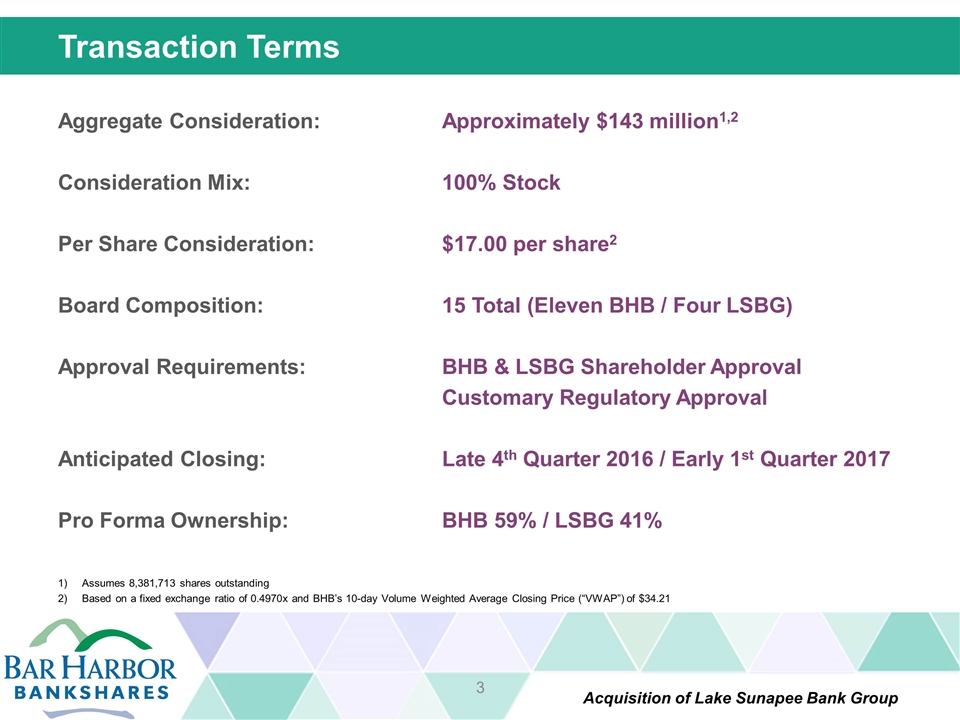

Transaction Terms Aggregate Consideration: Approximately $143 million1,2 Consideration Mix:100% Stock Per Share Consideration:$17.00 per share2 Board Composition:15 Total (Eleven BHB / Four LSBG) Approval Requirements:BHB & LSBG Shareholder Approval Customary Regulatory Approval Anticipated Closing:Late 4th Quarter 2016 / Early 1st Quarter 2017 Pro Forma Ownership:BHB 59% / LSBG 41% Assumes 8,381,713 shares outstanding Based on a fixed exchange ratio of 0.4970x and BHB’s 10-day Volume Weighted Average Closing Price (“VWAP”) of $34.21

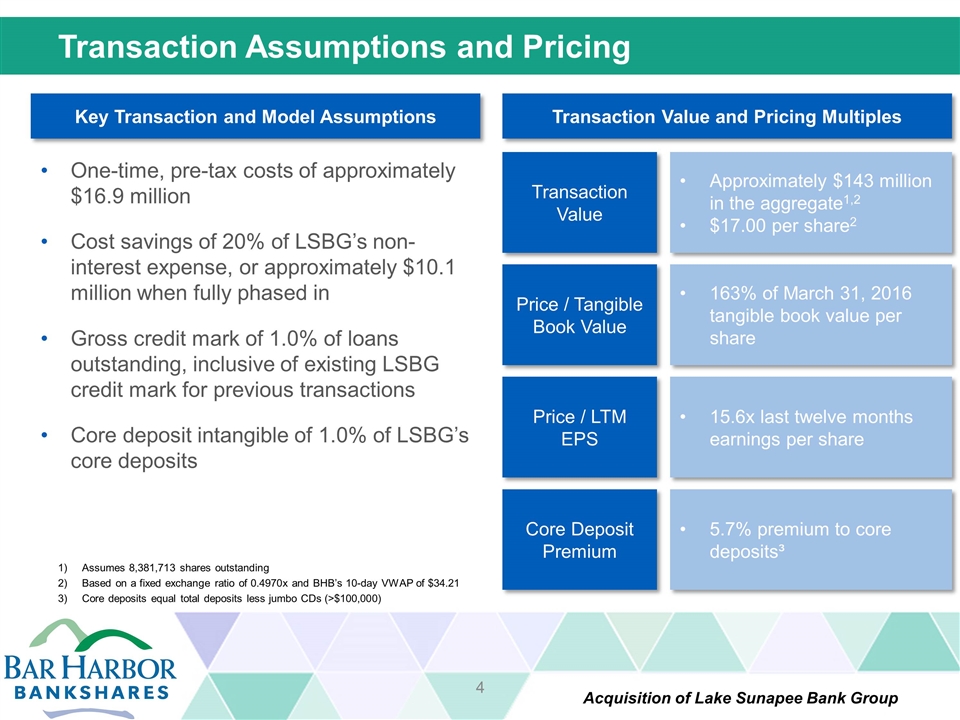

Transaction Assumptions and Pricing Assumes 8,381,713 shares outstanding Based on a fixed exchange ratio of 0.4970x and BHB’s 10-day VWAP of $34.21 Core deposits equal total deposits less jumbo CDs (>$100,000) Key Transaction and Model Assumptions Transaction Value and Pricing Multiples One-time, pre-tax costs of approximately $16.9 million Cost savings of 20% of LSBG’s non-interest expense, or approximately $10.1 million when fully phased in Gross credit mark of 1.0% of loans outstanding, inclusive of existing LSBG credit mark for previous transactions Core deposit intangible of 1.0% of LSBG’s core deposits Transaction Value Approximately $143 million in the aggregate1,2 $17.00 per share2 Price / LTM EPS 15.6x last twelve months earnings per share Price / Tangible Book Value 163% of March 31, 2016 tangible book value per share Core Deposit Premium 5.7% premium to core deposits³

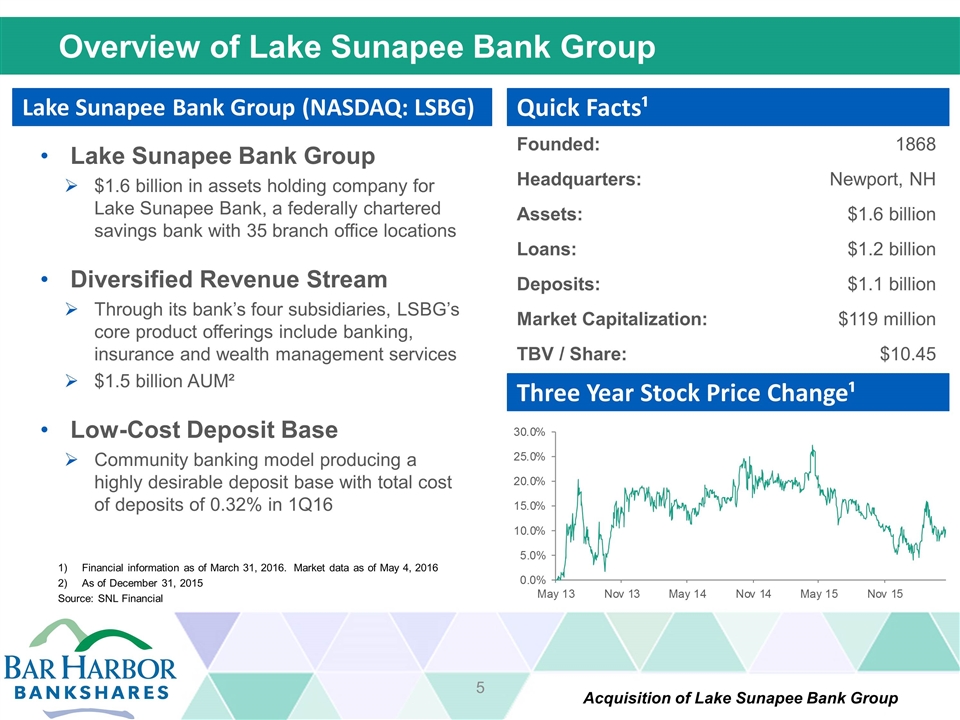

Overview of Lake Sunapee Bank Group Financial information as of March 31, 2016. Market data as of May 4, 2016 As of December 31, 2015 Source: SNL Financial Lake Sunapee Bank Group $1.6 billion in assets holding company for Lake Sunapee Bank, a federally chartered savings bank with 35 branch office locations Diversified Revenue Stream Through its bank’s four subsidiaries, LSBG’s core product offerings include banking, insurance and wealth management services $1.5 billion AUM² Low-Cost Deposit Base Community banking model producing a highly desirable deposit base with total cost of deposits of 0.32% in 1Q16 Three Year Stock Price Change¹ Founded: 1868 Headquarters: Newport, NH Assets: $1.6 billion Loans: $1.2 billion Deposits: $1.1 billion Market Capitalization: $119 million TBV / Share: $10.45 Quick Facts¹ Lake Sunapee Bank Group (NASDAQ: LSBG)

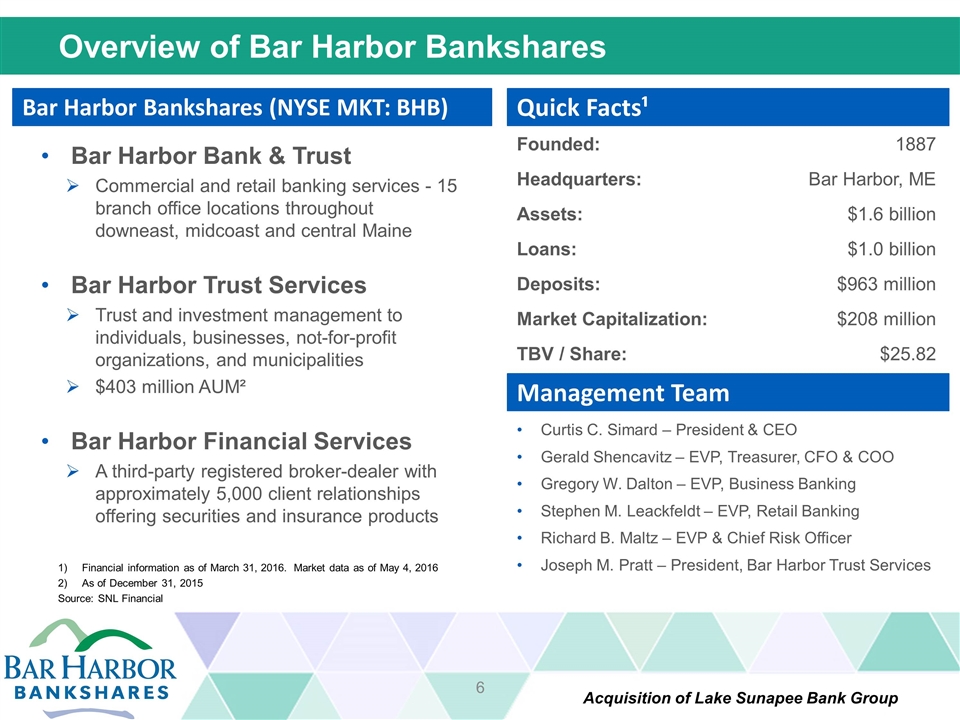

Financial information as of March 31, 2016. Market data as of May 4, 2016 As of December 31, 2015 Source: SNL Financial Overview of Bar Harbor Bankshares Founded: 1887 Headquarters: Bar Harbor, ME Assets: $1.6 billion Loans: $1.0 billion Deposits: $963 million Market Capitalization: $208 million TBV / Share: $25.82 Bar Harbor Bank & Trust Commercial and retail banking services - 15 branch office locations throughout downeast, midcoast and central Maine Bar Harbor Trust Services Trust and investment management to individuals, businesses, not-for-profit organizations, and municipalities $403 million AUM² Bar Harbor Financial Services A third-party registered broker-dealer with approximately 5,000 client relationships offering securities and insurance products Curtis C. Simard – President & CEO Gerald Shencavitz – EVP, Treasurer, CFO & COO Gregory W. Dalton – EVP, Business Banking Stephen M. Leackfeldt – EVP, Retail Banking Richard B. Maltz – EVP & Chief Risk Officer Joseph M. Pratt – President, Bar Harbor Trust Services Management Team Quick Facts¹ Bar Harbor Bankshares (NYSE MKT: BHB)

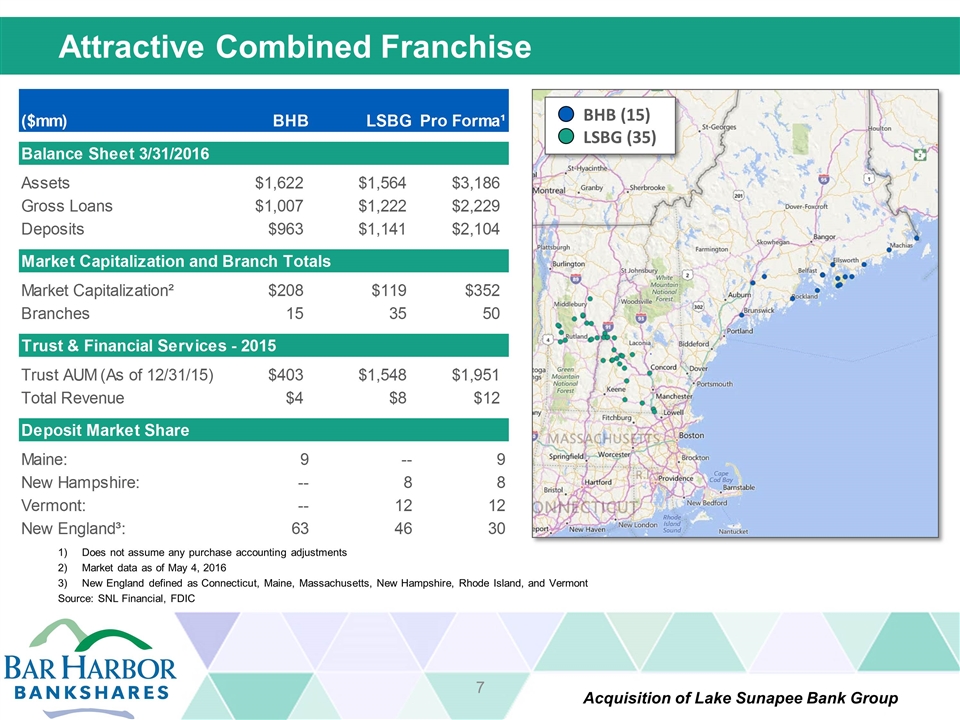

Attractive Combined Franchise Does not assume any purchase accounting adjustments Market data as of May 4, 2016 New England defined as Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont Source: SNL Financial, FDIC BHB (15) LSBG (35)

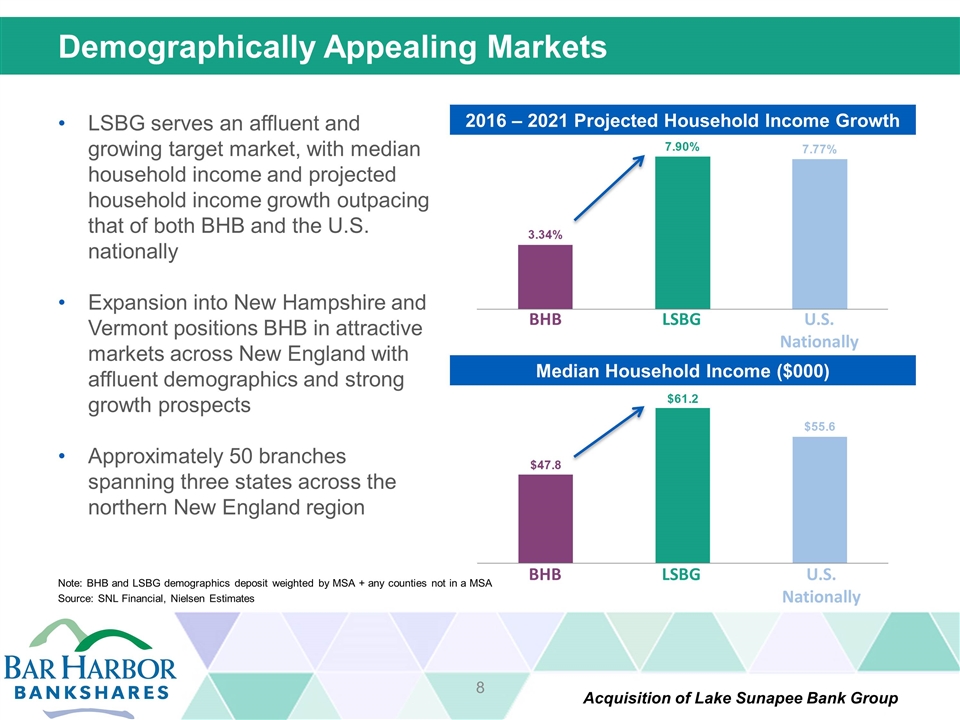

BHB LSBG U.S. Nationally BHB LSBG U.S. Nationally Demographically Appealing Markets Note: BHB and LSBG demographics deposit weighted by MSA + any counties not in a MSA Source: SNL Financial, Nielsen Estimates 2016 – 2021 Projected Household Income Growth Median Household Income ($000) LSBG serves an affluent and growing target market, with median household income and projected household income growth outpacing that of both BHB and the U.S. nationally Expansion into New Hampshire and Vermont positions BHB in attractive markets across New England with affluent demographics and strong growth prospects Approximately 50 branches spanning three states across the northern New England region

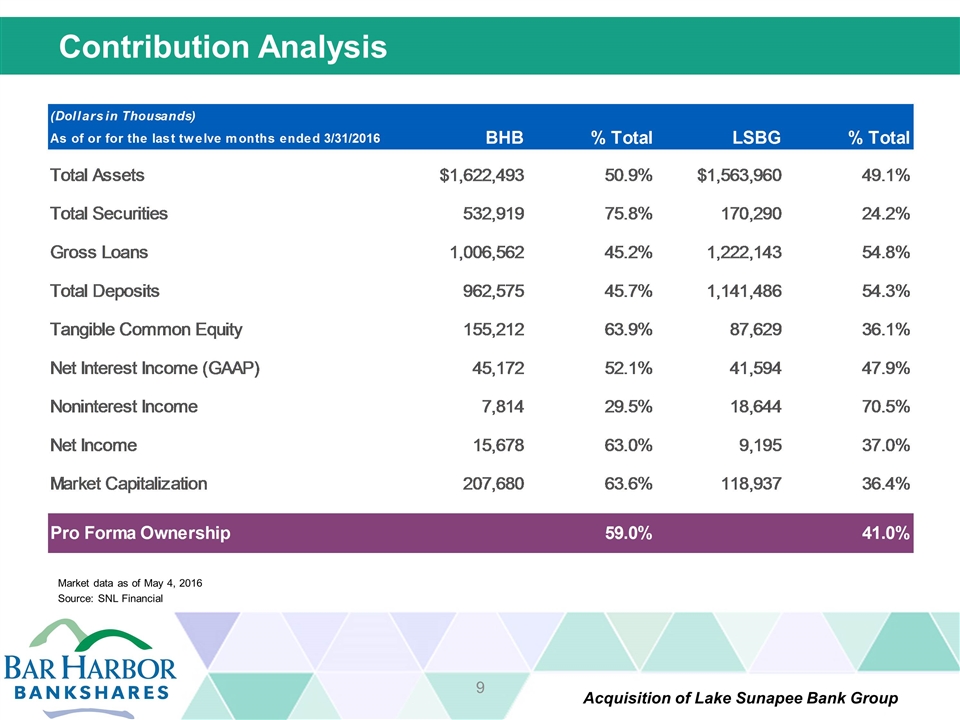

Contribution Analysis Market data as of May 4, 2016 Source: SNL Financial

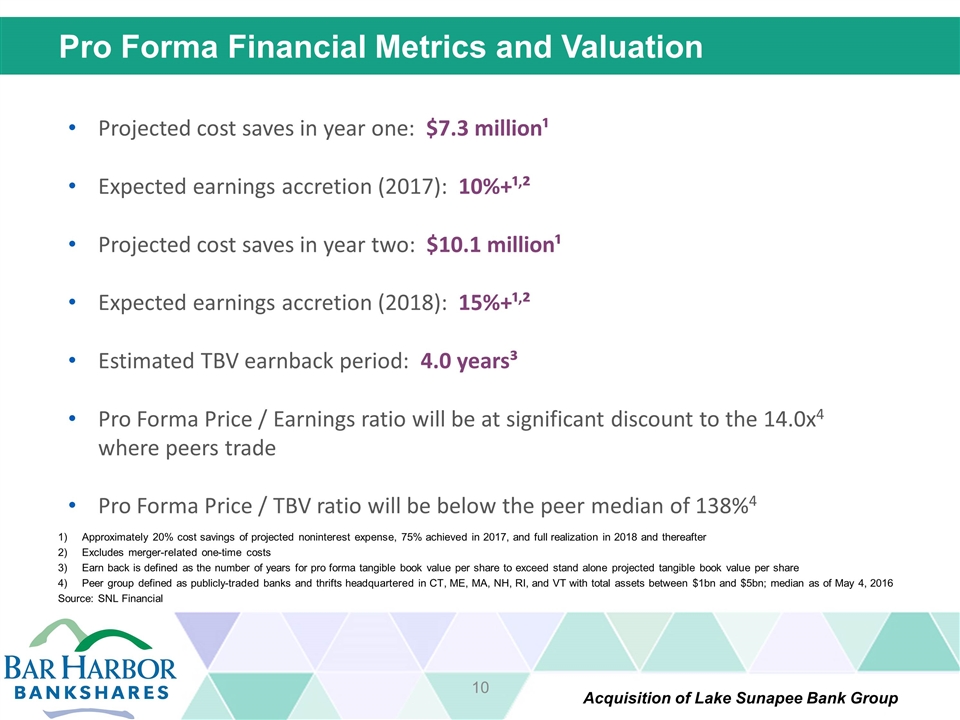

Projected cost saves in year one: $7.3 million¹ Expected earnings accretion (2017): 10%+¹,² Projected cost saves in year two: $10.1 million¹ Expected earnings accretion (2018): 15%+¹,² Estimated TBV earnback period: 4.0 years³ Pro Forma Price / Earnings ratio will be at significant discount to the 14.0x4 where peers trade Pro Forma Price / TBV ratio will be below the peer median of 138%4 Pro Forma Financial Metrics and Valuation Approximately 20% cost savings of projected noninterest expense, 75% achieved in 2017, and full realization in 2018 and thereafter Excludes merger-related one-time costs Earn back is defined as the number of years for pro forma tangible book value per share to exceed stand alone projected tangible book value per share Peer group defined as publicly-traded banks and thrifts headquartered in CT, ME, MA, NH, RI, and VT with total assets between $1bn and $5bn; median as of May 4, 2016 Source: SNL Financial

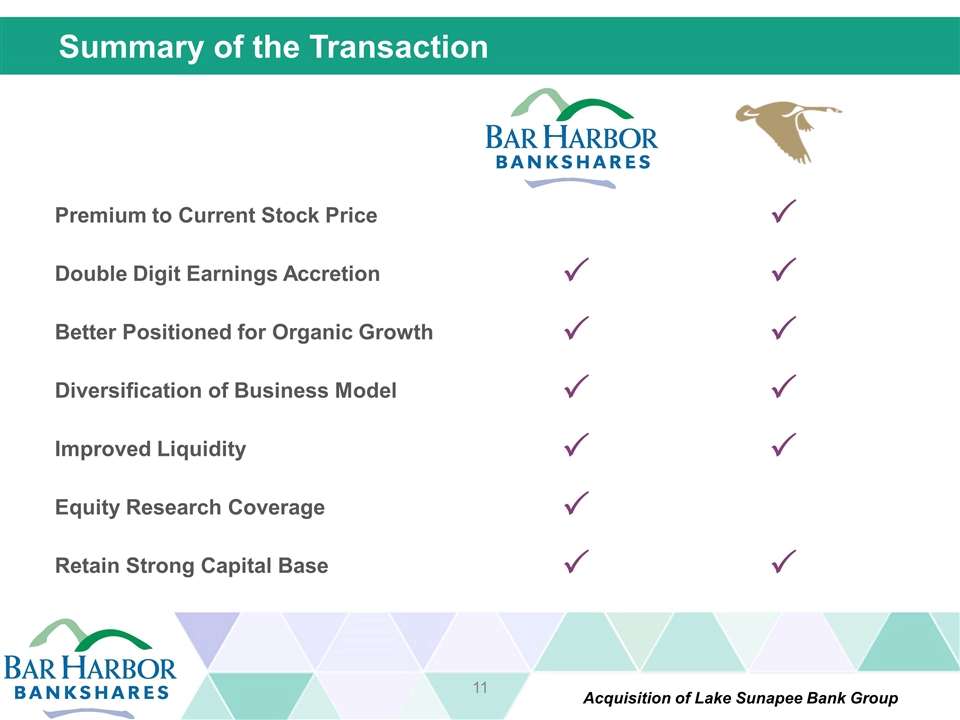

Summary of the Transaction Premium to Current Stock Price P Double Digit Earnings Accretion P P Better Positioned for Organic Growth P P Diversification of Business Model P P Improved Liquidity P P Equity Research Coverage P Retain Strong Capital Base P P

Appendix: Lake Sunapee Bank Group

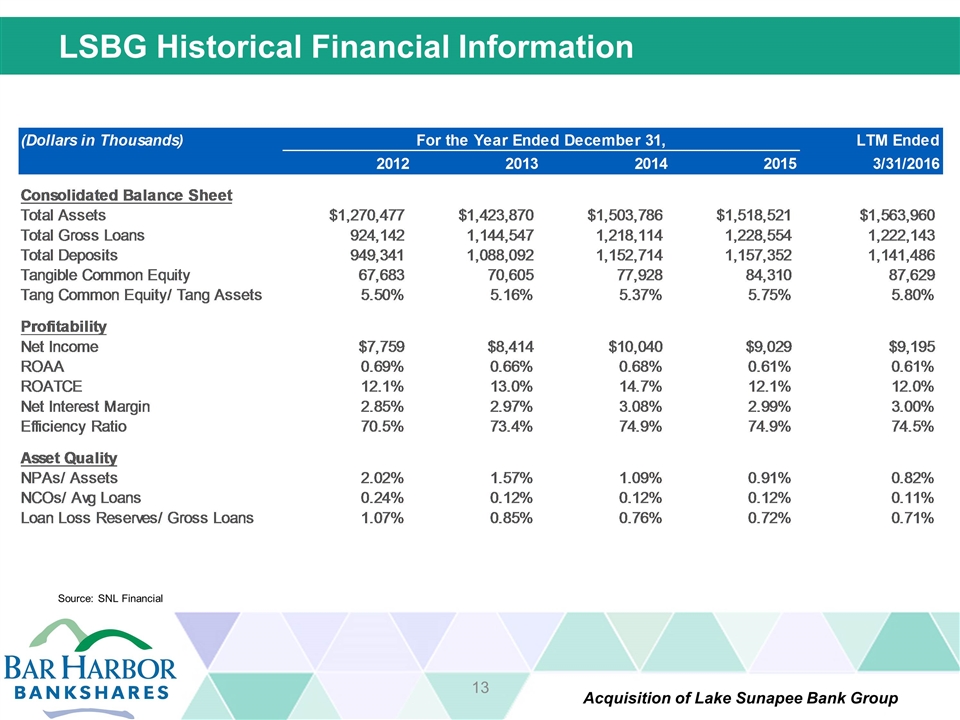

LSBG Historical Financial Information Source: SNL Financial

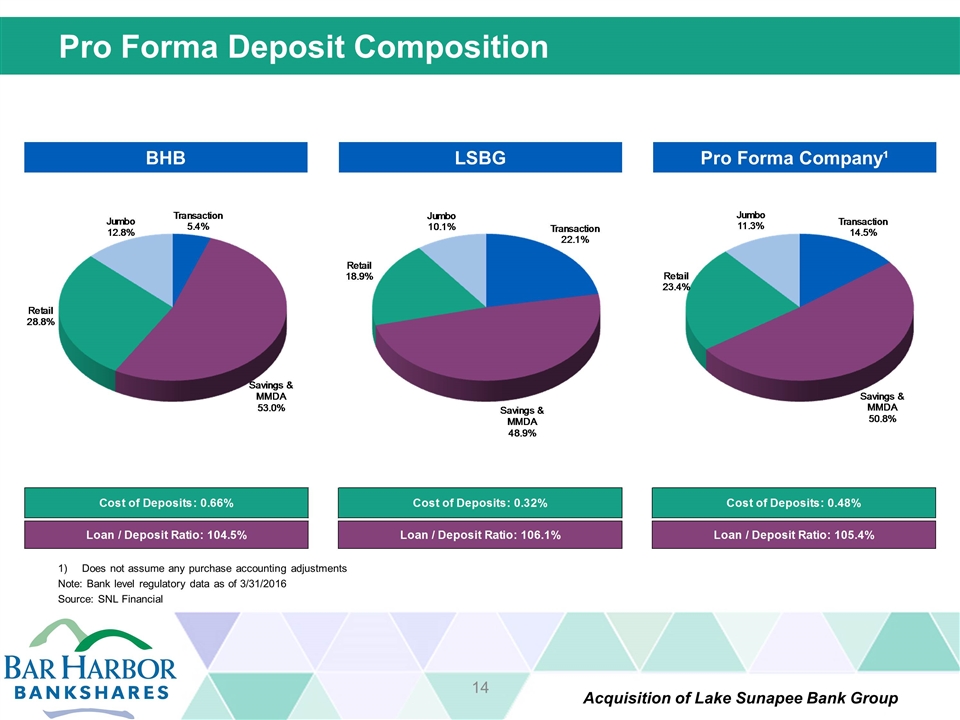

Pro Forma Deposit Composition Does not assume any purchase accounting adjustments Note: Bank level regulatory data as of 3/31/2016 Source: SNL Financial BHB LSBG Pro Forma Company¹

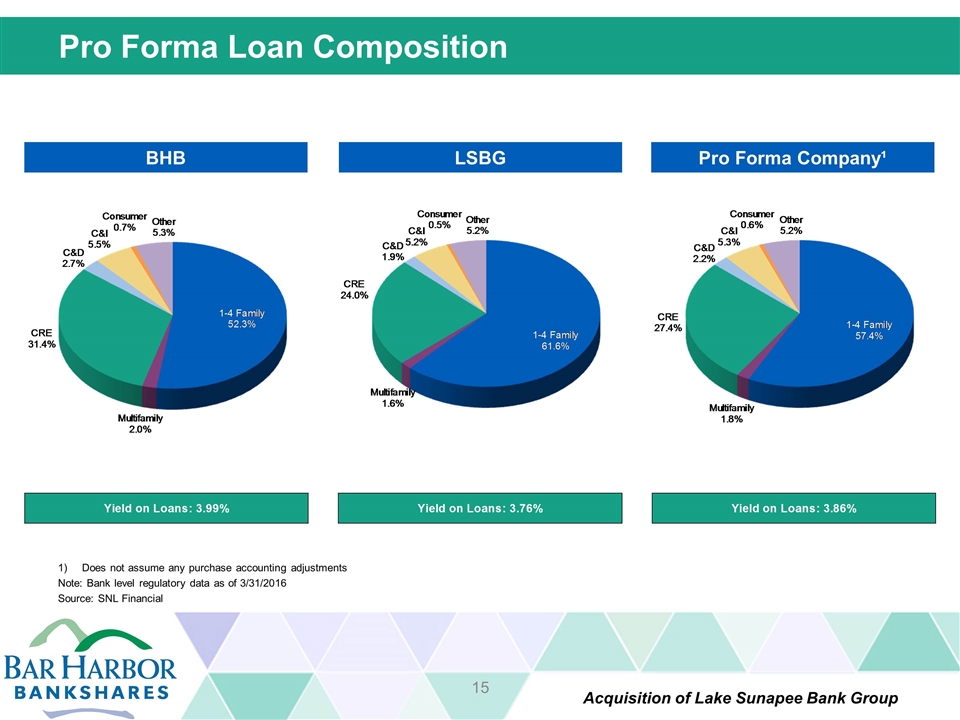

Pro Forma Loan Composition Does not assume any purchase accounting adjustments Note: Bank level regulatory data as of 3/31/2016 Source: SNL Financial BHB LSBG Pro Forma Company¹